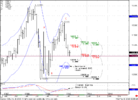

1) Market reached daily confluence level Tuesday, retraced back to OP on Friday (probably a W&R of OP level) and then closed below daily confluence level.

2) Daily, weekly Dema are bearish.

3) No oversold.

Well, Sentinel. Your Confluence area is OK, but your Objective points calculation is not quite valid (From my point of view). First daily trend is bearish and you should calculate targets down. If you want to calculate retracement targets, you should decrease time-frame, to 1-hour for example to find uptrend and then calculate targets. Remember simple rule - Thrust (AB)-retracement (BC) - expansion. But in your daily OP calculation all things are vise versa. The thrust is your correction.

Second, Your "C" point is below A. This is can be applied but not during thrust move of the market. Usually in consolidation or in situation like Double Repo top/bottom. Do you understand the difference?

4) In long term, the context is in favor of Gold decline, since EUR zone is in trouble and USD is improving. China which is an important investor in gold; tightening economic policy measures. All negative, the only risk is inflation, which may create an appetite for gold investment but I think we are much more far from this scenario yet..

It is too sophisticated theme - fundamental Gold analysis. There are too many contradictory factors, and this is realy long-term. For your possition its not very important to my mind. But news can influence.

5) Analysts seems to turn in favor of Gold bearish. (From %73 (19 of 26) to %36 (7 of 19) in one week)

March 5 (Bloomberg)- Nineteen of 26 traders, investors and analysts surveyed by Bloomberg, or 73 percent, said bullion would rise next week. Six forecast lower prices and one was neutral.

March 12 (Bloomberg) - Nine of 19 traders, investors and analysts surveyed by Bloomberg, or 47 percent, said bullion would fall next week. Seven forecast higher prices and three were neutral.

Well, It's just analysis. You do not know their positions. I can tell you, that one really very Big Guy out of Gold, although he gives recomendations every day. The one very important thing had happened - Gold did not confirm bearish expectations month ago (remember our expectations) Retracement was very deep. This fact has pressed on a big guys, and they are entering but very carefull. I'm still aside.

And for me iterest rate futures have much more attractive perspectives right now then gold.

So, what in result?

First - don't mess different analysis time-frames. Use analysis that in a row with your postion.

Second, I also think that Gold can go lower. I already have posted analysis here.