Sive Morten

Special Consultant to the FPA

- Messages

- 18,754

Monthly

The dollar fell on Friday, hurt by generally weak U.S. economic data this week and heightened tensions in Ukraine that pushed Treasury yields lower. Investors sold the greenback against the safe-haven yen and Swiss franc.

The Japanese and Swiss currencies advanced against most currencies after the government in Kiev said its artillery partially destroyed a Russian column in fighting overnight. Russia denied its forces had crossed into Ukraine, calling the Ukrainian report "some kind of fantasy. The Swiss franc hit a 19-month high against the euro and a three-week peak versus the dollar. The yen, meanwhile, reversed losses against the dollar, turning higher.

"Risk has evaporated from the markets after the Ukraine headlines," said Omer Esiner, chief market analyst at Commonwealth Foreign Exchange in Washington. "We have seen investors use the yen and Swiss franc as safe harbors."

The yen and Swiss franc tend to benefit in times of global tension because of their deep liquidity. The dollar is also a safe haven, but recently investors have bought the greenback against emerging market currencies in periods of financial or geopolitical stress.

U.S. bond yields fell sharply on concerns about the Russia-Ukraine conflict, a negative for the dollar. Benchmark U.S. 10-year note yields fell to their lowest since June 2013. They were last at 2.35 percent, from 2.40 percent in the previous session.

Soft U.S. economic numbers for most of this week - including retail sales, jobless claims and a lower consumer sentiment index - have weighed on the dollar. "The weak numbers were seen keeping the Fed on a low rate path for the foreseeable future," said Joe Manimbo, senior market analyst at Western Union Business Solutions in Washington.

Federal Reserve events should be the focus next week and could drive movements in currencies. Minutes from the Fed's late July meeting are due next Wednesday, followed by Thursday's start of a three-day central bankers' conference hosted by the Fed in Jackson Hole, Wyoming.

Since recent fundamental data was poor and has not shown any significant changes – let’s take a look at CFTC data as well. Especially because recently we’ve estimated that Shorts rate has reached pre-crucial values:

Open interest:

Longs:

Shorts:

This data o 12th of August - and it shows shy contraction of Open Interest and Net shorts. Thus, recent upward action was not due opening new longs, but mostly due closing existing short positions. Currently our ratio of short positions is: 180953/(180953+49818)=78,4%. This ratio has increased significantly. If you remember our calculation couple weeks ago gave us ~72%. When ratio approaches 80-82% this becomes significant, because it means that almost all speculators stand short and nobody can sell more to support trend down. Market turns after that.

Still this is mostly tactical issue. In long term perspective our suggestion that EUR will stay under pressure for long time. First driving factor is US economy improvement. Macroeconomy suggests that when economy comes out from recession into growth – the first stage is “desinflation growth”. Economy shows improvement without jump in inflation. May be right now we are entering in this stage, at least most analysts point on obvious improvements in US economy and there are no doubts about it (as we’ve read above - the dollar's "underlying strengthening trend" was "hardly in question.").

Combining these two moments makes me think that probably this is really first stage. Second stage will be “inflationary growth” – this is a period when Fed’s rate dancing will start. Since we have at least 8-12 months when rate will not change. It means that although USD will keep moderately bullish sentiment and will dominate over EUR, but this domination will not be absolute and fast.

At the same time, it seems that EUR will remain under pressure and we see some reasons for this. Even before Ukranian crisis EU has its own problems that press ECB keeps rate low and even apply clearly dovish rethoric. As EU has intiated sunctions against Russia this will hurt trade balance and negatively impact on EU. This is not a joke - 400 Bln EUR of annual trade turnover. Of cause, currently Russian food embargo is just a small part of mentioned 400 Bln EUR, but this “small part” distributed not equally among different EU countries. Eastern Europe countries, Greece and may be Netherlands will hurt more since they have more agriculture part in GDP. At the same time this is just small part of goods that Russia could forbid potentially and recent data on GDP of Germany, France, Italy shows worse that expected data. Other words, mutual sanctions do not assume improvement in economy.

Reducing of export for EU countries will mean also unemployment growth, reducing of trade balance, GDP and budget income. In current situation this is not good, especially for new members of EU that are more sensible to economic negative situations. Currently we do not see any hope that this sunction program will be lighted or closed soon. This is probably just beginning. Here I’m not saying that this is good for Russia. Russia also will be hurt, but this is quite another question, since Russia has no relation to EUR/USD pair. We suggest that as response on EU sunctions Russia will try to strike back, but will choose an areas and goods that easily could be replaced by inner production or imported from other countries (Asia, LatAM). For example, fruits, vegetables, etc... And it will try to postpone as long as possible impact on strategical areas that couldn’t be replaced fast by domestic production – oil mining technoligies, any other high-tech... But this mutual impact, even in food and utility goods sphere will be sufficient to hold EUR from stable growth or even from just stability.

All these facts make us think that EUR/USD will continue move south with moderate pace during the 8-12 months and even could accelearted when real menace of US rate hiking will appear if any positive shifts in EU economy will not come. Depending on how external political atmospehre will change – we will gradually adjust our view. May be Jackson Hole Meeting in late August will add some clarity on Fed policy.

This is just our view, but of cause we do not pretend on absolute opinion. If you have something to add or to argue – we would like to see you on forum.

Technical

Here we just can repeat what we’ve said previously, since overall globe situation has not changed much. Taking in consideration recent fundamental numbers and events, we can say that it is not even US hawkish policy presses on EUR, especially now, when we didn’t get any “hawkish policy” (looks like old “Ben” was right about Fed – it will keep rates longer than even most conservative analysts think). But EU presses on EUR by itself. Why? Fed statement was relatively dovish (plunge in US bonds yield confirms this as well), data was positive but without surprises (except, may be GDP) and EUR could have all chances to show great upward bounce, but EU starts to dig it’s own pit by sanctions. EU has not climbed out from the pit of 2008 yet and now is falling in another one.

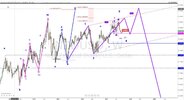

Recent attempt to move higher was shy and not sufficient to break long-term picture. As a result we didn’t get bullish grabber at YPP and now have some really important technical issues.

First one is a trend shifting of cause – monthly trend has turned bearish.

Second – now market is not just piercing YPP but closed below it. If you will track overall action around YPP you will find, that market has tested it first right in January and made an attempt to move higher, but failed to reach YPR1 and now returned right back to it. This looks bearish, since if market pushed out from YPP and if it is really bullish – it should continue move up. If it does not do it, it means that this push was just reaction on support and now is gone. Moveing below YPP could mean its way to YPS1 at 1.3060 area.

Finally, recall our upward AB=CD (inside the wedge) – price has hit just 0.618 extension and CD leg is very flat. As market has hit it – downward retracement already has happened (low in red circle around 1.33). As market returns right back down again – it means that it has no power to continue move up with this AB=CD and probably will fail. The wedge itself has been broken down. Although this breakout still looks under question, but price has closed below it’s lower border. And market is not at oversold...

Still market stands in range since 2014. Thus, 1.33-1.3850 is an area of “indecision”. While market stands inside of it we can talk about neither upward breakout nor downward reversal. At least, reversal identification could be done with yearly pivot – if market will continue to move lower, this could be early sign of changing sentiment. Final confirmation will probably happen when price will move below 1.33 lows.

Weekly

Big picture on weekly chart is also very intriguing. Here our suggestion on possible reversal around 1.3830 resistance is also confirmed by Butterfly “sell” pattern. And it is not done yet. Currently we have 4 closes below YPP. Trend is bearish. Here we do not see any reasons for market to stop except, may be 0.618 target of AB-CD at ~1.34 area (not shown), since EUR is not at support and oversold. Even if minor bounce will happen, price probably will continue action to AB-CD target and Agreement around K-support area as it shown on the chart. Thus our weekly destination point is 1.3225 area. This action really could follow, because market also has formed reversal swing down. Take a look – current swing down is greater than previous swing up. This action usually points on two things – downward action will continue, but first – some retracement up will happen.

Daily

Finally guys, we’ve reached the most interesting moment. Situation here is very tricky. Here are some thoughts. Here we’ve expected to get some bounce up and discuss this moment for a long time already. But the problem is that we have as supportive bullish issues as bearish ones. Thus, we have rather high CFTC ratio that points on possible reversal or at least retracement, we have butterfly “buy” pattern here, we have untouched MPP right at 50% resistance level, that EUR likes most of all, right?

Conversely we have some curious price action. Something prevents market from normal bounce. We clearly will see it on intraday chart. Partially this comes from negative recent data from EU – GDP on major 3 economies, IFO institute data, Draghi speech on possible quantitative easing etc. They are could lead to just flat action. Bullish factors could prevent downward move, but their power could be not enough to trigger normal full-size retracement to MPP. And market could turn to some sideways action. That’s the risk.

Second pattern that we’ve discussed was DPRO “Buy”. But currently guys, I think that we can’t rely on it any more by some reasons. Major fact is market mechanics. DRPO has to show capitulation of bears, but here we mostly see triangle consolidation without brightly visible lows. Price action by itself reminds just consolidation after solid move down. And when we will take a look at 4-hour chart we’ll see that price action absolutely does not represent normal DRPO action.

So, what? Well, although upward action and retracement is still possible, but avoid to trade it via DRPO (some other pattern should appear on intraday chart probably), second – due to recent action it seems probable that market could show just flat sideways action and then continue move down.

4-hour

Well, guys, it is difficult to comment this whipsaw action. Trend is bullish here, but probably just one comment could be made here. Take a look that despite all previous attempts to start rally have failed, but market is forming higher highs. Also we have bullish MACD divergence. A lot of patterns could be formed here – you probably can recognize here as bullish as bearish butterflies, chances on 3-Drive Buy is still possible, may be it will be wide H&S pattern... Anyway guys, until clear pattern will not be formed – better to not take unnessesary risk. Besides, this pattern probably will be formed soon.

Conclusion:

Around our “hot point” – 1.3380 area situation stands not in favor of EUR yet. Although recent data and events were not as strong as they could be – still, they are mostly supportive for USD. Another confirmation could come if market will move below 1.33 area.

In short-term perspective we still could count on possible bounce on daily chart, but recent data makes technical picture very complicated with very nervousness splashes and spikes on intraday charts. Nervous markets are not attractive. Thus, we need to get clear intraday pattern that will point either on retracement, as we think to MPP, or to further downward action to our major weekly target at 1.3220 area.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.

The dollar fell on Friday, hurt by generally weak U.S. economic data this week and heightened tensions in Ukraine that pushed Treasury yields lower. Investors sold the greenback against the safe-haven yen and Swiss franc.

The Japanese and Swiss currencies advanced against most currencies after the government in Kiev said its artillery partially destroyed a Russian column in fighting overnight. Russia denied its forces had crossed into Ukraine, calling the Ukrainian report "some kind of fantasy. The Swiss franc hit a 19-month high against the euro and a three-week peak versus the dollar. The yen, meanwhile, reversed losses against the dollar, turning higher.

"Risk has evaporated from the markets after the Ukraine headlines," said Omer Esiner, chief market analyst at Commonwealth Foreign Exchange in Washington. "We have seen investors use the yen and Swiss franc as safe harbors."

The yen and Swiss franc tend to benefit in times of global tension because of their deep liquidity. The dollar is also a safe haven, but recently investors have bought the greenback against emerging market currencies in periods of financial or geopolitical stress.

U.S. bond yields fell sharply on concerns about the Russia-Ukraine conflict, a negative for the dollar. Benchmark U.S. 10-year note yields fell to their lowest since June 2013. They were last at 2.35 percent, from 2.40 percent in the previous session.

Soft U.S. economic numbers for most of this week - including retail sales, jobless claims and a lower consumer sentiment index - have weighed on the dollar. "The weak numbers were seen keeping the Fed on a low rate path for the foreseeable future," said Joe Manimbo, senior market analyst at Western Union Business Solutions in Washington.

Federal Reserve events should be the focus next week and could drive movements in currencies. Minutes from the Fed's late July meeting are due next Wednesday, followed by Thursday's start of a three-day central bankers' conference hosted by the Fed in Jackson Hole, Wyoming.

Since recent fundamental data was poor and has not shown any significant changes – let’s take a look at CFTC data as well. Especially because recently we’ve estimated that Shorts rate has reached pre-crucial values:

Open interest:

Longs:

Shorts:

This data o 12th of August - and it shows shy contraction of Open Interest and Net shorts. Thus, recent upward action was not due opening new longs, but mostly due closing existing short positions. Currently our ratio of short positions is: 180953/(180953+49818)=78,4%. This ratio has increased significantly. If you remember our calculation couple weeks ago gave us ~72%. When ratio approaches 80-82% this becomes significant, because it means that almost all speculators stand short and nobody can sell more to support trend down. Market turns after that.

Still this is mostly tactical issue. In long term perspective our suggestion that EUR will stay under pressure for long time. First driving factor is US economy improvement. Macroeconomy suggests that when economy comes out from recession into growth – the first stage is “desinflation growth”. Economy shows improvement without jump in inflation. May be right now we are entering in this stage, at least most analysts point on obvious improvements in US economy and there are no doubts about it (as we’ve read above - the dollar's "underlying strengthening trend" was "hardly in question.").

Combining these two moments makes me think that probably this is really first stage. Second stage will be “inflationary growth” – this is a period when Fed’s rate dancing will start. Since we have at least 8-12 months when rate will not change. It means that although USD will keep moderately bullish sentiment and will dominate over EUR, but this domination will not be absolute and fast.

At the same time, it seems that EUR will remain under pressure and we see some reasons for this. Even before Ukranian crisis EU has its own problems that press ECB keeps rate low and even apply clearly dovish rethoric. As EU has intiated sunctions against Russia this will hurt trade balance and negatively impact on EU. This is not a joke - 400 Bln EUR of annual trade turnover. Of cause, currently Russian food embargo is just a small part of mentioned 400 Bln EUR, but this “small part” distributed not equally among different EU countries. Eastern Europe countries, Greece and may be Netherlands will hurt more since they have more agriculture part in GDP. At the same time this is just small part of goods that Russia could forbid potentially and recent data on GDP of Germany, France, Italy shows worse that expected data. Other words, mutual sanctions do not assume improvement in economy.

Reducing of export for EU countries will mean also unemployment growth, reducing of trade balance, GDP and budget income. In current situation this is not good, especially for new members of EU that are more sensible to economic negative situations. Currently we do not see any hope that this sunction program will be lighted or closed soon. This is probably just beginning. Here I’m not saying that this is good for Russia. Russia also will be hurt, but this is quite another question, since Russia has no relation to EUR/USD pair. We suggest that as response on EU sunctions Russia will try to strike back, but will choose an areas and goods that easily could be replaced by inner production or imported from other countries (Asia, LatAM). For example, fruits, vegetables, etc... And it will try to postpone as long as possible impact on strategical areas that couldn’t be replaced fast by domestic production – oil mining technoligies, any other high-tech... But this mutual impact, even in food and utility goods sphere will be sufficient to hold EUR from stable growth or even from just stability.

All these facts make us think that EUR/USD will continue move south with moderate pace during the 8-12 months and even could accelearted when real menace of US rate hiking will appear if any positive shifts in EU economy will not come. Depending on how external political atmospehre will change – we will gradually adjust our view. May be Jackson Hole Meeting in late August will add some clarity on Fed policy.

This is just our view, but of cause we do not pretend on absolute opinion. If you have something to add or to argue – we would like to see you on forum.

Technical

Here we just can repeat what we’ve said previously, since overall globe situation has not changed much. Taking in consideration recent fundamental numbers and events, we can say that it is not even US hawkish policy presses on EUR, especially now, when we didn’t get any “hawkish policy” (looks like old “Ben” was right about Fed – it will keep rates longer than even most conservative analysts think). But EU presses on EUR by itself. Why? Fed statement was relatively dovish (plunge in US bonds yield confirms this as well), data was positive but without surprises (except, may be GDP) and EUR could have all chances to show great upward bounce, but EU starts to dig it’s own pit by sanctions. EU has not climbed out from the pit of 2008 yet and now is falling in another one.

Recent attempt to move higher was shy and not sufficient to break long-term picture. As a result we didn’t get bullish grabber at YPP and now have some really important technical issues.

First one is a trend shifting of cause – monthly trend has turned bearish.

Second – now market is not just piercing YPP but closed below it. If you will track overall action around YPP you will find, that market has tested it first right in January and made an attempt to move higher, but failed to reach YPR1 and now returned right back to it. This looks bearish, since if market pushed out from YPP and if it is really bullish – it should continue move up. If it does not do it, it means that this push was just reaction on support and now is gone. Moveing below YPP could mean its way to YPS1 at 1.3060 area.

Finally, recall our upward AB=CD (inside the wedge) – price has hit just 0.618 extension and CD leg is very flat. As market has hit it – downward retracement already has happened (low in red circle around 1.33). As market returns right back down again – it means that it has no power to continue move up with this AB=CD and probably will fail. The wedge itself has been broken down. Although this breakout still looks under question, but price has closed below it’s lower border. And market is not at oversold...

Still market stands in range since 2014. Thus, 1.33-1.3850 is an area of “indecision”. While market stands inside of it we can talk about neither upward breakout nor downward reversal. At least, reversal identification could be done with yearly pivot – if market will continue to move lower, this could be early sign of changing sentiment. Final confirmation will probably happen when price will move below 1.33 lows.

Weekly

Big picture on weekly chart is also very intriguing. Here our suggestion on possible reversal around 1.3830 resistance is also confirmed by Butterfly “sell” pattern. And it is not done yet. Currently we have 4 closes below YPP. Trend is bearish. Here we do not see any reasons for market to stop except, may be 0.618 target of AB-CD at ~1.34 area (not shown), since EUR is not at support and oversold. Even if minor bounce will happen, price probably will continue action to AB-CD target and Agreement around K-support area as it shown on the chart. Thus our weekly destination point is 1.3225 area. This action really could follow, because market also has formed reversal swing down. Take a look – current swing down is greater than previous swing up. This action usually points on two things – downward action will continue, but first – some retracement up will happen.

Daily

Finally guys, we’ve reached the most interesting moment. Situation here is very tricky. Here are some thoughts. Here we’ve expected to get some bounce up and discuss this moment for a long time already. But the problem is that we have as supportive bullish issues as bearish ones. Thus, we have rather high CFTC ratio that points on possible reversal or at least retracement, we have butterfly “buy” pattern here, we have untouched MPP right at 50% resistance level, that EUR likes most of all, right?

Conversely we have some curious price action. Something prevents market from normal bounce. We clearly will see it on intraday chart. Partially this comes from negative recent data from EU – GDP on major 3 economies, IFO institute data, Draghi speech on possible quantitative easing etc. They are could lead to just flat action. Bullish factors could prevent downward move, but their power could be not enough to trigger normal full-size retracement to MPP. And market could turn to some sideways action. That’s the risk.

Second pattern that we’ve discussed was DPRO “Buy”. But currently guys, I think that we can’t rely on it any more by some reasons. Major fact is market mechanics. DRPO has to show capitulation of bears, but here we mostly see triangle consolidation without brightly visible lows. Price action by itself reminds just consolidation after solid move down. And when we will take a look at 4-hour chart we’ll see that price action absolutely does not represent normal DRPO action.

So, what? Well, although upward action and retracement is still possible, but avoid to trade it via DRPO (some other pattern should appear on intraday chart probably), second – due to recent action it seems probable that market could show just flat sideways action and then continue move down.

4-hour

Well, guys, it is difficult to comment this whipsaw action. Trend is bullish here, but probably just one comment could be made here. Take a look that despite all previous attempts to start rally have failed, but market is forming higher highs. Also we have bullish MACD divergence. A lot of patterns could be formed here – you probably can recognize here as bullish as bearish butterflies, chances on 3-Drive Buy is still possible, may be it will be wide H&S pattern... Anyway guys, until clear pattern will not be formed – better to not take unnessesary risk. Besides, this pattern probably will be formed soon.

Conclusion:

Around our “hot point” – 1.3380 area situation stands not in favor of EUR yet. Although recent data and events were not as strong as they could be – still, they are mostly supportive for USD. Another confirmation could come if market will move below 1.33 area.

In short-term perspective we still could count on possible bounce on daily chart, but recent data makes technical picture very complicated with very nervousness splashes and spikes on intraday charts. Nervous markets are not attractive. Thus, we need to get clear intraday pattern that will point either on retracement, as we think to MPP, or to further downward action to our major weekly target at 1.3220 area.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.