Brett Reynolds

2nd Lieutenant

- Messages

- 1,127

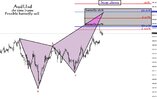

Any change on overall situation with GBP & NZD with this sentiment change recently on USD!? GBP Butterfly to 1.75 & Kiwi to .0.92 is bigger picture right.!? But at what point do these patterns become 'invalid'!? Yea..my olde Russian friend!?