Sive Morten

Special Consultant to the FPA

- Messages

- 18,699

Fundamentals

Reuters reports U.S. dollar hit its highest level against major currencies in over 8-1/2 years on Friday on diverging monetary policy between the Federal Reserve and other major central banks, and bullish dollar positions heading into the end of the year.

The euro hit a 28-month low against the greenback, while the dollar hovered near a 28-month high against the Swiss franc and hit a more than one-week high against the Japanese yen on the back of the Fed signaling on Wednesday that it would likely hike rates in 2015 and looser policies in Europe, Japan and Switzerland.

"The dollar's rise is a continuation of the broad dollar strength that we've been seeing, which was further supported by the Fed announcement," said Eric Viloria, currency strategist at Wells Fargo Securities in New York.

The dollar has gained against other major currencies on the view that expected Fed interest rate increases will boost the greenback by driving investment flows into the United States.

Strategists also said traders favored the dollar, which has risen about 12 percent against major currencies this year, on the view that the greenback is the safest position to take ahead of year-end volatility.

"These are markets that are very finicky, that can be driven by anything right now," said Axel Merk, president and chief investment officer of Palo Alto, California-based Merk Investments. "Many people want to be with the winning position."

Last week Recent CFTC data showed drastical drop in speculative short positions. Recent data shows that this tendency has continued, although pace is a bit shyer. Longs also have contracted slightly. It could mean just decreasing of investors’ activity at Xmas eve. Still, here we should take into consideration the date of recent data – 16th of December, although recent drop mostly has happened on 18-19th. So, it is interesting what CFTC data will show on 23rd of December…

Open interest:

Shorts:

Shorts:

Longs:

Longs:

Recently we’ve made wide comments on complex situation around EUR. As we’ve said previously EUR right now stands in center of geopolitical and economical turmoil and we have mutual 2-side relations EU-US and EU-Russia. And progress of these relations develops not very positive. Shortly speaking US freely gives the law to EU because de facto EU is not totally independent.

Economically US and EU drives on opposite courses. While US is tending to starting rate hiking cycle in mid 2015, ECB gives comments on QE and increasing of balance to the level of March 2012 and this assumes QE on approximately 3 Trln EUR.

This makes us think that EUR now stands under double pressure – EU pulls chestnuts out of the fire for US (in relation with Russia) and particularly due this action makes economical pit deeper. What could bit this sorrow?

As a result of blind or coercive following to US policy, EU meets problems with Russia, it’s 3rd largest trading partner. We suggest that situation will become worse, US will demand more and more sanctions from EU upon Russia. But in turn, economical situation EU-Russia stands in relation with geopolicy where US will not accept any compromises. Any ECB efforts on stabilizing of EU economy could be mitigated by new spiral of geopolitical tensions and painful sanctions. That’s why here is our conclusion – hardly real reversal on EUR is possible any time soon.

But the only one thing exists that could put short-term situation from top to bottom. And this thing is European QE. We already gave some hints on our daily updates on this subject. Here we operate such terms as “short-term” and “long-term”. As we have a habit to treat “short-term” as within a week, here we have to apply absolutely different scale, since right now we touch the sphere of economical policy and there is everything is “long-term”. That’s why I will give you example how correctly understand this.

Recent 2 years we saw QE in US. As result we’ve got huge bubble on stock market and other US assets. This we should treat as “short-term technical impact”. Why it is technical? Because recent huge growth of financial markets were driven not by real growth of economy and wealth of nation, but mostly due re-distribution of money flows. Thus Fed has injected trillions of dollars in financial system and have expected that banks and financial companies will put them in real sector as long-term loans that should support economy, increase job creating and wealth of people. May be some part of money really was applied as it should be, but most part was put in stock market. As a result, while QE functions, we’ve saw “technical short-term” impact as rally on stock market. Now about long-term… In long-term period we should get impact of real economical laws. QE somehow should impact US economy and not necessary that this impact will be positive. In reality nobody knows what will happen. Right now, as QE was closed, we stand just at the eve of new period.

Now, let’s back to EU. Why we think that drastical changes could happen on EUR? Probably you’ve got it already. As financial world already has seen the QE, how it works – investors understand that something of this kind will happen right now in EUR-zone. And this is “easy money”. Just put them in EU assets and wait while ECB will push market higher and higher with its liquidity. Why should QE fail in EU while it has worked in US? And this could change the picture for couple of years on EUR, at least till ECB will keep with QE. That’s why now we keep close eye on CFTC data. We already have first signs that relatively confirm our suspicions. But in the long-term perspective EUR really will remain under pressure. As soon as QE will be over, difference in rate policy between EU and US will start to dominate again and EUR could return back to decreasing. And again, guys, right now hardly somebody could imagine what result will follow from such huge QE programs, as in EU as in US. Short-term effect could be positive, but what will be with inflation? Who knows that it will remain at 2-3%?

Technicals

Monthly

From technical point of view we have large Gartley “222” Sell pattern, it nearest target is 1.22 – 0.618 AB-CD objective point. Last week market has not reached target just for 46 pips. Legs of the pattern very harmonic, speed of CD and AB legs are almost equal. EUR looks really heavy; month by month it opens at the high close at the low. On previous week we stand with concern how possible QE in EU could change situation with EUR currency. As market has started to form some reversal patterns on lower time frames, we have some doubts on timing of reaching 1.22 target. But right now this attempt was cancelled, and market again has turned to 1.22 destination probably it should be reached – just 25 pips rest.

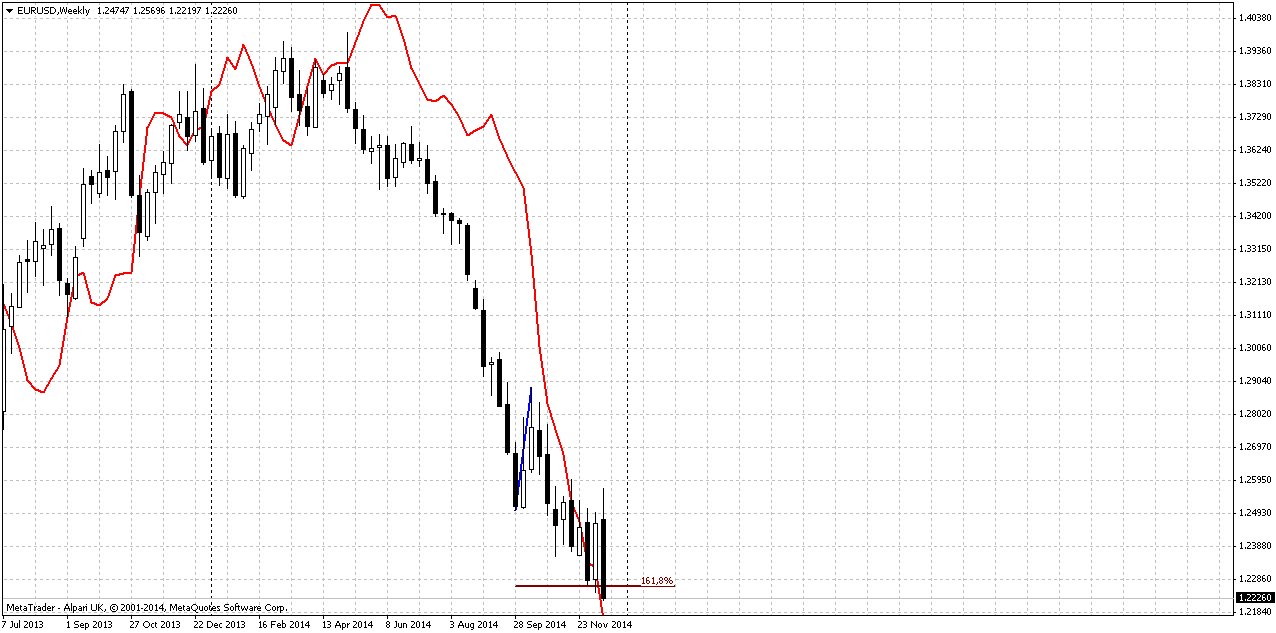

Weekly

Recent action o weekly chart shows that sentiment is changing or investors stand nervous a bit. In December week by week we see opposite action… Some shed is put by recent contradictive information. Thus, CFTC shows contraction of the shorts while market is coming to major monthly target. At the same time recent reversal patterns that have appeared here, such as 3-Drive “Buy”, bullish engulfing, grabber have been erased by recent plunge down. Besides, recent move down has solid range that engulfs previous consolidation.

So, we could make only two conclusions – either patterns were erased due existence of 1.22 target and upside action could finally start from there, or upside retracement totally has been cancelled. It seems that we will get answer when monthly target will be hit.

At the same time here exist some other scenarios. Thus, thrust down is perfect and any DiNapoli pattern either B&B or DRPO will have solid potential, since this is weekly chart. Another pattern is H&S still. Take a look that current bottom stands around 1.618 extension of previous retracement. This might become shoulder. Again, solution probably should come soon.

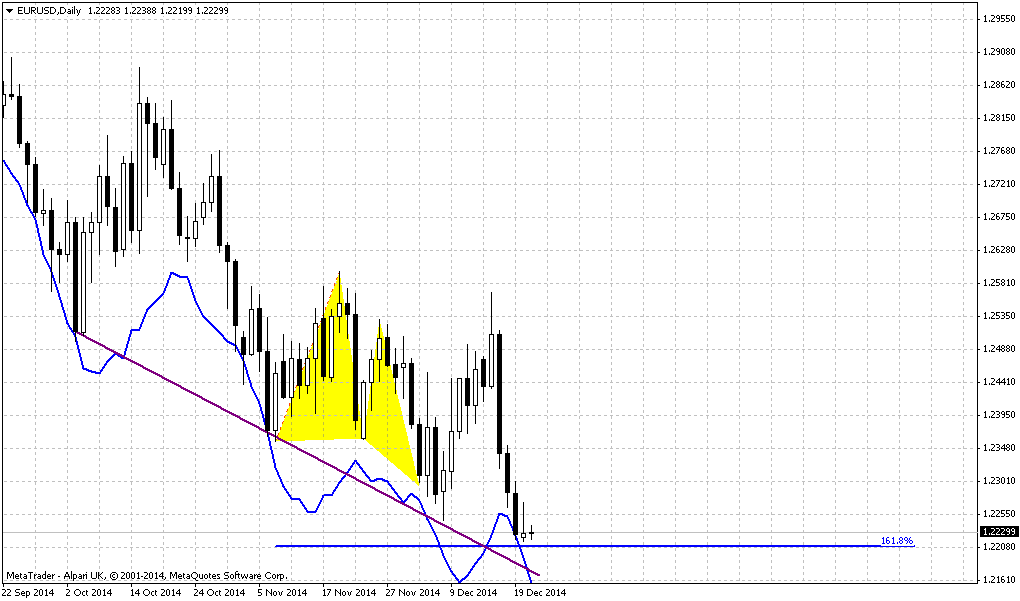

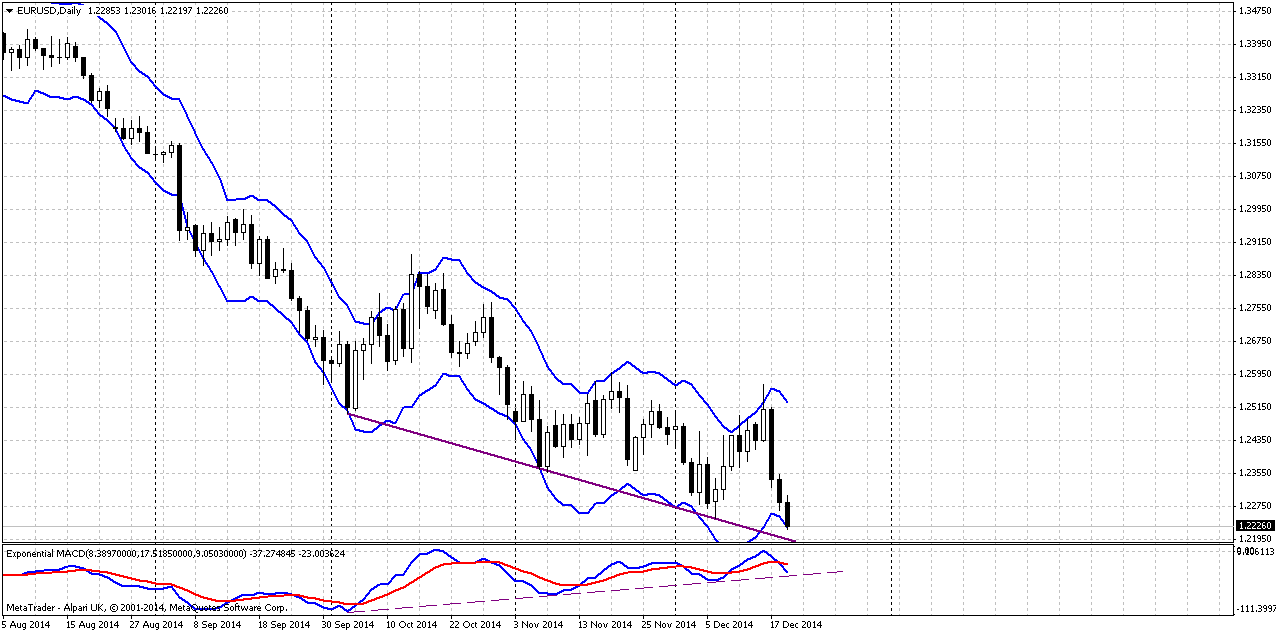

Daily

Major conclusion here we’ve made on previous week – 3-Drive “buy” pattern has not reached its target and failed. Market has returned right back down below MPS1. Of cause, we know that some fundamental events stand at the back of this motion but from pure technical point of view market just gravitates to major monthly target.

The only bullish sign here is divergence of MACD. Marker probably has not reached 1.22 target on Friday due oversold. It means that it will try to do it in the beginning of the next week.

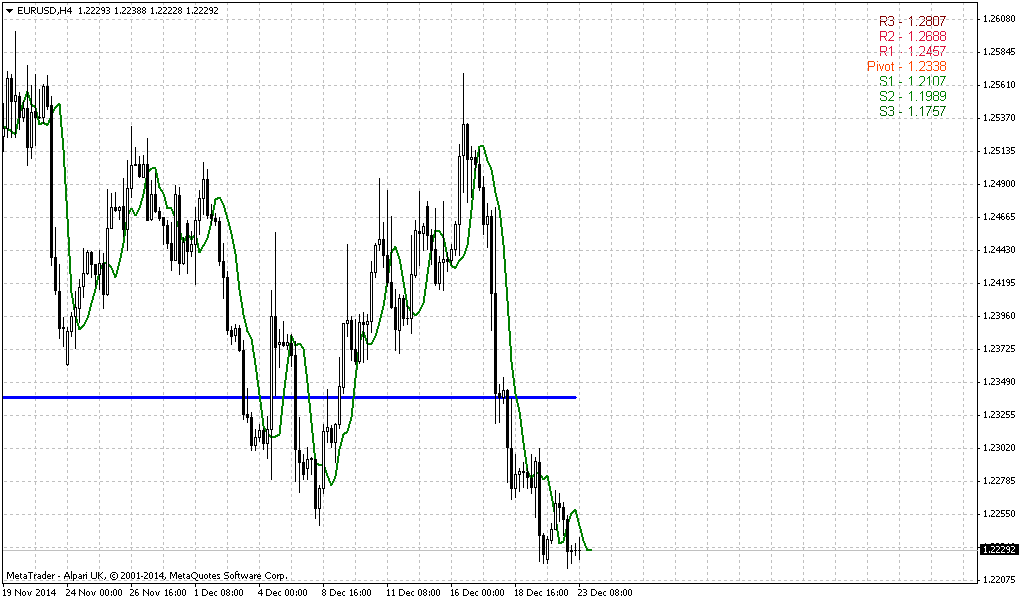

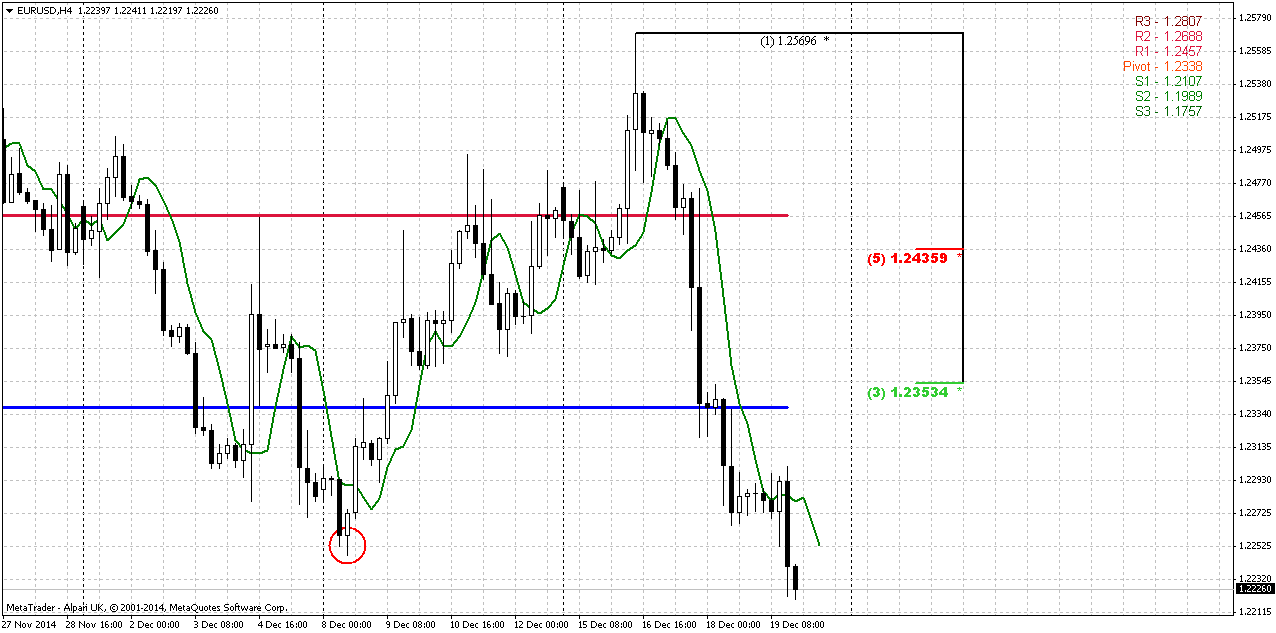

4-hour

On Friday we’ve expected to get some bounce that could give us B&B “Sell” pattern as recent thrust is absolutely suitable for DiNapoli pattern. Although market has done this attempt but bounce was too small to create any pattern. As a result market has passed through former lows and stay there. Now market has reached oversold on daily chart and bounce up is possible again, but whether setup will be attractive for taking short position, since 1.22 target stands just 25 pips lower.

Thus, all that we could say right now – if market will still form B&B “sell” – it will be separate scalp trade with no relation to big picture. While daily setup probably will be formed only when EUR will reach 1.22 target.

Conclusion:

Currently we have no doubts that market will reach major 1.22 target. Since we have some bullish signs on different time frames and CFTC data also looks not purely bearish, we do not exclude some retracement that could happen after. But as market has not touched it yet we have no clear patterns that could confirm this. The major hint here is possible H&S on weekly chart.

In short-term perspective market stands at oversold and here is possible B&B “Sell” scalp trade on 4-hour chart. But this will be separate self-sufficient short-term trade.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.

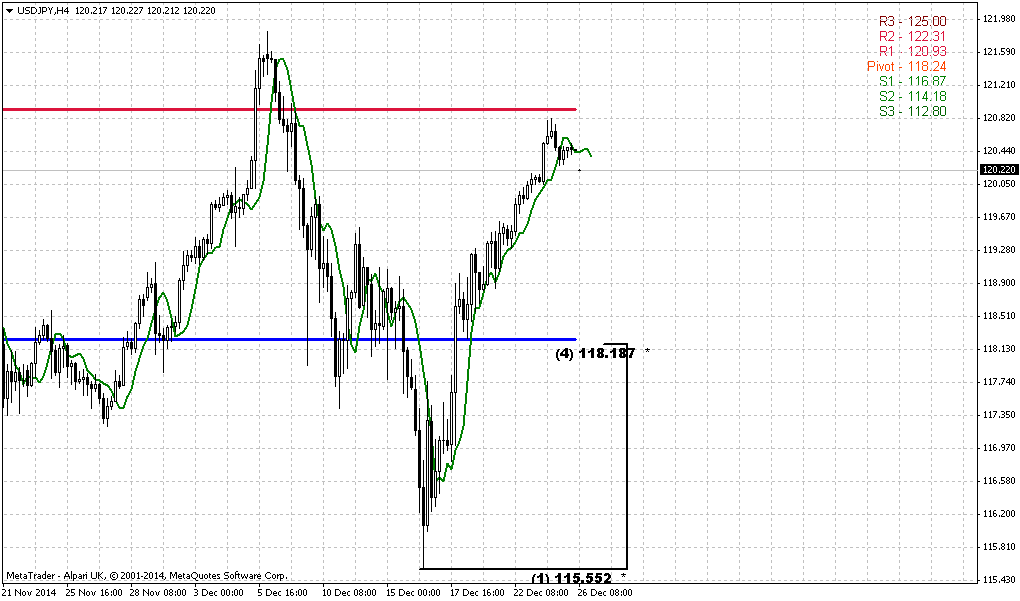

Reuters reports U.S. dollar hit its highest level against major currencies in over 8-1/2 years on Friday on diverging monetary policy between the Federal Reserve and other major central banks, and bullish dollar positions heading into the end of the year.

The euro hit a 28-month low against the greenback, while the dollar hovered near a 28-month high against the Swiss franc and hit a more than one-week high against the Japanese yen on the back of the Fed signaling on Wednesday that it would likely hike rates in 2015 and looser policies in Europe, Japan and Switzerland.

"The dollar's rise is a continuation of the broad dollar strength that we've been seeing, which was further supported by the Fed announcement," said Eric Viloria, currency strategist at Wells Fargo Securities in New York.

The dollar has gained against other major currencies on the view that expected Fed interest rate increases will boost the greenback by driving investment flows into the United States.

Strategists also said traders favored the dollar, which has risen about 12 percent against major currencies this year, on the view that the greenback is the safest position to take ahead of year-end volatility.

"These are markets that are very finicky, that can be driven by anything right now," said Axel Merk, president and chief investment officer of Palo Alto, California-based Merk Investments. "Many people want to be with the winning position."

Last week Recent CFTC data showed drastical drop in speculative short positions. Recent data shows that this tendency has continued, although pace is a bit shyer. Longs also have contracted slightly. It could mean just decreasing of investors’ activity at Xmas eve. Still, here we should take into consideration the date of recent data – 16th of December, although recent drop mostly has happened on 18-19th. So, it is interesting what CFTC data will show on 23rd of December…

Open interest:

Recently we’ve made wide comments on complex situation around EUR. As we’ve said previously EUR right now stands in center of geopolitical and economical turmoil and we have mutual 2-side relations EU-US and EU-Russia. And progress of these relations develops not very positive. Shortly speaking US freely gives the law to EU because de facto EU is not totally independent.

Economically US and EU drives on opposite courses. While US is tending to starting rate hiking cycle in mid 2015, ECB gives comments on QE and increasing of balance to the level of March 2012 and this assumes QE on approximately 3 Trln EUR.

This makes us think that EUR now stands under double pressure – EU pulls chestnuts out of the fire for US (in relation with Russia) and particularly due this action makes economical pit deeper. What could bit this sorrow?

As a result of blind or coercive following to US policy, EU meets problems with Russia, it’s 3rd largest trading partner. We suggest that situation will become worse, US will demand more and more sanctions from EU upon Russia. But in turn, economical situation EU-Russia stands in relation with geopolicy where US will not accept any compromises. Any ECB efforts on stabilizing of EU economy could be mitigated by new spiral of geopolitical tensions and painful sanctions. That’s why here is our conclusion – hardly real reversal on EUR is possible any time soon.

But the only one thing exists that could put short-term situation from top to bottom. And this thing is European QE. We already gave some hints on our daily updates on this subject. Here we operate such terms as “short-term” and “long-term”. As we have a habit to treat “short-term” as within a week, here we have to apply absolutely different scale, since right now we touch the sphere of economical policy and there is everything is “long-term”. That’s why I will give you example how correctly understand this.

Recent 2 years we saw QE in US. As result we’ve got huge bubble on stock market and other US assets. This we should treat as “short-term technical impact”. Why it is technical? Because recent huge growth of financial markets were driven not by real growth of economy and wealth of nation, but mostly due re-distribution of money flows. Thus Fed has injected trillions of dollars in financial system and have expected that banks and financial companies will put them in real sector as long-term loans that should support economy, increase job creating and wealth of people. May be some part of money really was applied as it should be, but most part was put in stock market. As a result, while QE functions, we’ve saw “technical short-term” impact as rally on stock market. Now about long-term… In long-term period we should get impact of real economical laws. QE somehow should impact US economy and not necessary that this impact will be positive. In reality nobody knows what will happen. Right now, as QE was closed, we stand just at the eve of new period.

Now, let’s back to EU. Why we think that drastical changes could happen on EUR? Probably you’ve got it already. As financial world already has seen the QE, how it works – investors understand that something of this kind will happen right now in EUR-zone. And this is “easy money”. Just put them in EU assets and wait while ECB will push market higher and higher with its liquidity. Why should QE fail in EU while it has worked in US? And this could change the picture for couple of years on EUR, at least till ECB will keep with QE. That’s why now we keep close eye on CFTC data. We already have first signs that relatively confirm our suspicions. But in the long-term perspective EUR really will remain under pressure. As soon as QE will be over, difference in rate policy between EU and US will start to dominate again and EUR could return back to decreasing. And again, guys, right now hardly somebody could imagine what result will follow from such huge QE programs, as in EU as in US. Short-term effect could be positive, but what will be with inflation? Who knows that it will remain at 2-3%?

Technicals

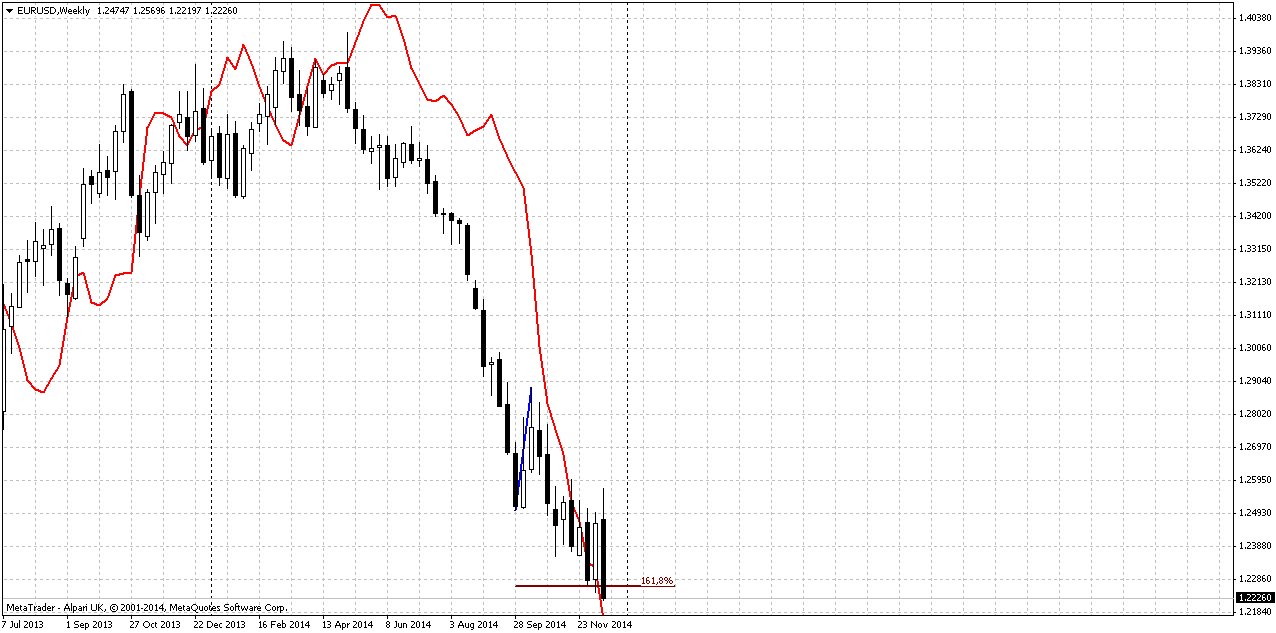

Monthly

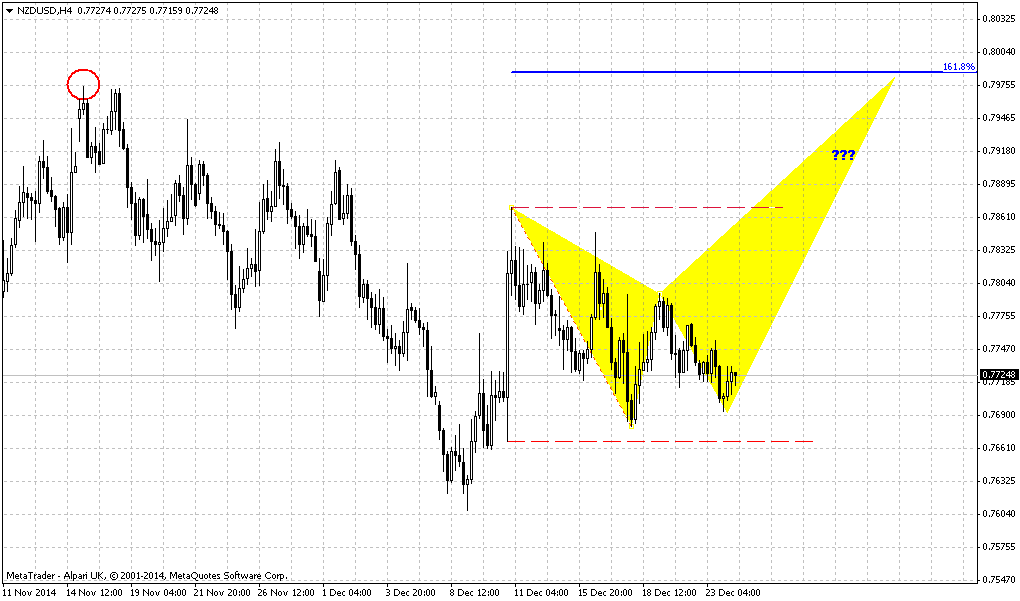

From technical point of view we have large Gartley “222” Sell pattern, it nearest target is 1.22 – 0.618 AB-CD objective point. Last week market has not reached target just for 46 pips. Legs of the pattern very harmonic, speed of CD and AB legs are almost equal. EUR looks really heavy; month by month it opens at the high close at the low. On previous week we stand with concern how possible QE in EU could change situation with EUR currency. As market has started to form some reversal patterns on lower time frames, we have some doubts on timing of reaching 1.22 target. But right now this attempt was cancelled, and market again has turned to 1.22 destination probably it should be reached – just 25 pips rest.

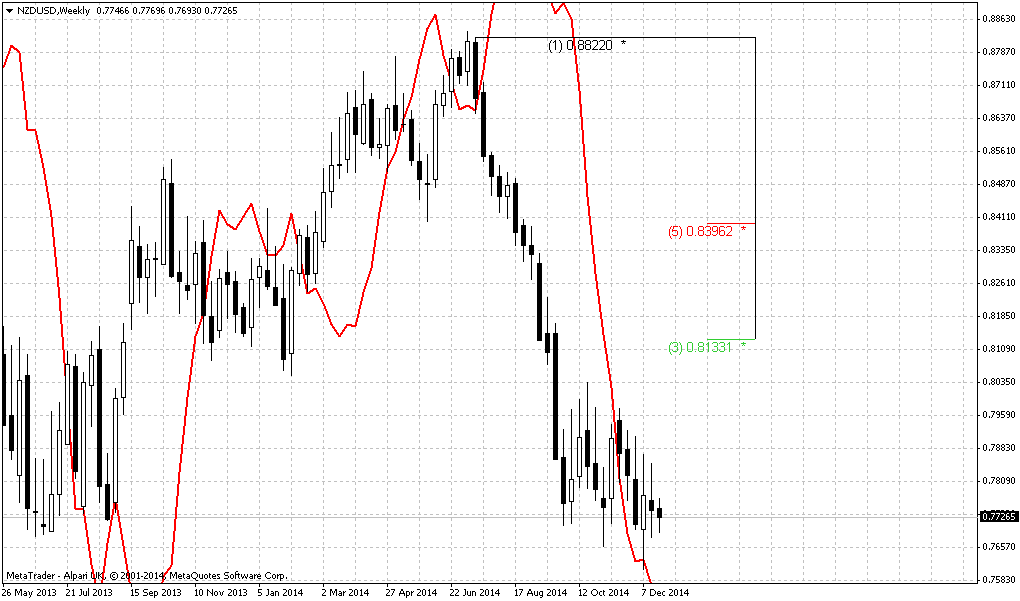

Weekly

Recent action o weekly chart shows that sentiment is changing or investors stand nervous a bit. In December week by week we see opposite action… Some shed is put by recent contradictive information. Thus, CFTC shows contraction of the shorts while market is coming to major monthly target. At the same time recent reversal patterns that have appeared here, such as 3-Drive “Buy”, bullish engulfing, grabber have been erased by recent plunge down. Besides, recent move down has solid range that engulfs previous consolidation.

So, we could make only two conclusions – either patterns were erased due existence of 1.22 target and upside action could finally start from there, or upside retracement totally has been cancelled. It seems that we will get answer when monthly target will be hit.

At the same time here exist some other scenarios. Thus, thrust down is perfect and any DiNapoli pattern either B&B or DRPO will have solid potential, since this is weekly chart. Another pattern is H&S still. Take a look that current bottom stands around 1.618 extension of previous retracement. This might become shoulder. Again, solution probably should come soon.

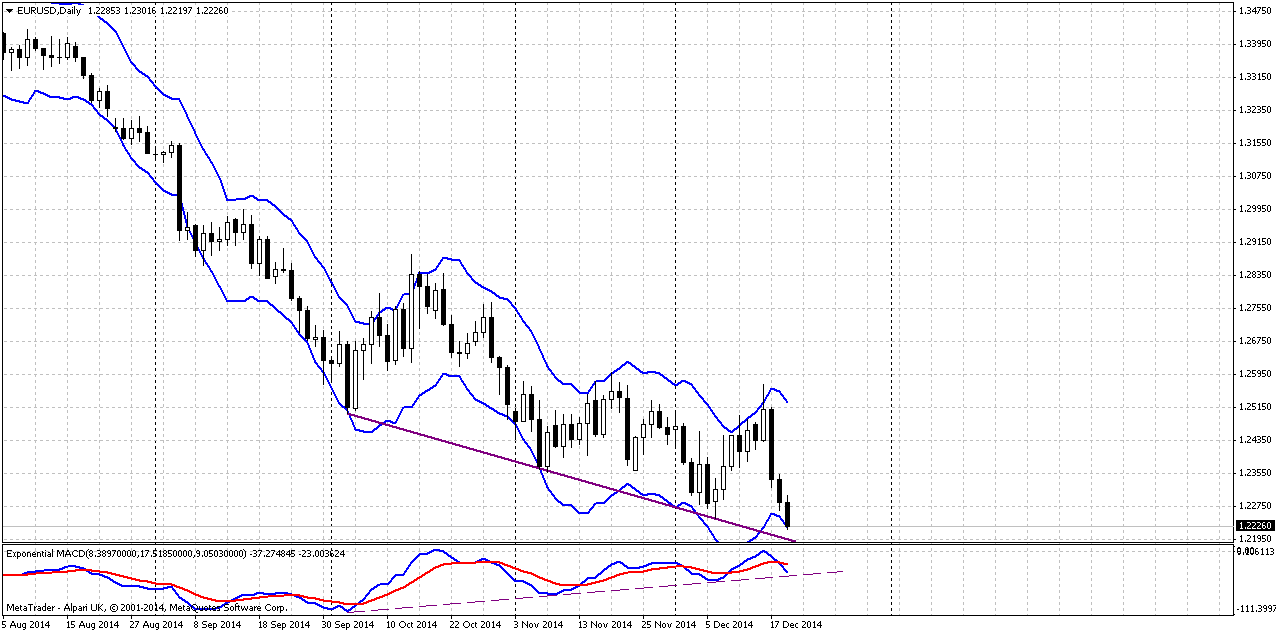

Daily

Major conclusion here we’ve made on previous week – 3-Drive “buy” pattern has not reached its target and failed. Market has returned right back down below MPS1. Of cause, we know that some fundamental events stand at the back of this motion but from pure technical point of view market just gravitates to major monthly target.

The only bullish sign here is divergence of MACD. Marker probably has not reached 1.22 target on Friday due oversold. It means that it will try to do it in the beginning of the next week.

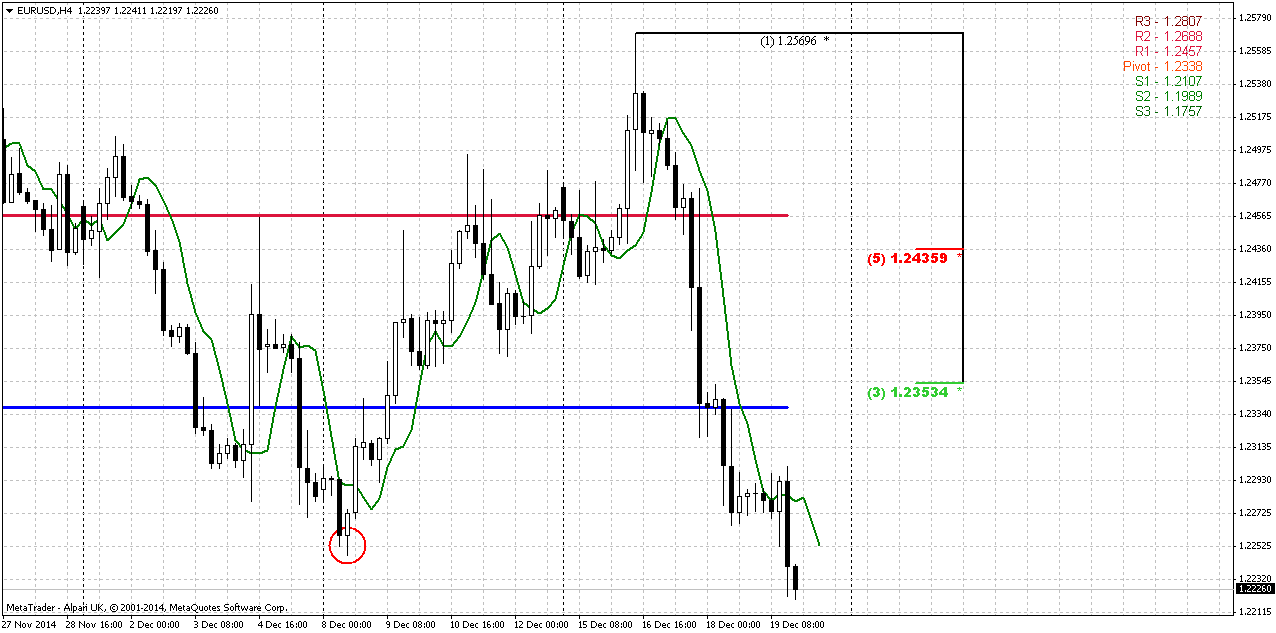

4-hour

On Friday we’ve expected to get some bounce that could give us B&B “Sell” pattern as recent thrust is absolutely suitable for DiNapoli pattern. Although market has done this attempt but bounce was too small to create any pattern. As a result market has passed through former lows and stay there. Now market has reached oversold on daily chart and bounce up is possible again, but whether setup will be attractive for taking short position, since 1.22 target stands just 25 pips lower.

Thus, all that we could say right now – if market will still form B&B “sell” – it will be separate scalp trade with no relation to big picture. While daily setup probably will be formed only when EUR will reach 1.22 target.

Conclusion:

Currently we have no doubts that market will reach major 1.22 target. Since we have some bullish signs on different time frames and CFTC data also looks not purely bearish, we do not exclude some retracement that could happen after. But as market has not touched it yet we have no clear patterns that could confirm this. The major hint here is possible H&S on weekly chart.

In short-term perspective market stands at oversold and here is possible B&B “Sell” scalp trade on 4-hour chart. But this will be separate self-sufficient short-term trade.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.