Sive Morten

Special Consultant to the FPA

- Messages

- 18,669

Fundamentals

This week we've got two major drivers - BoE meeting and US GDP release, although on Friday the new wave of coronavirus panic started and by the end of the day we see strong acceleration against the USD across the board, stock markets collapsed. Today we have big bulk of fundamental factors to discuss that supposedly make impact on Forex market next week.

As we've suggested last time, real activity indeed has come only on Wednesday. The Federal Reserve held interest rates steady at its first policy meeting of the year, with officials pointing to continued moderate U.S. economic growth and a “strong” job market. he Fed’s policy-setting committee announced its unanimous decision to maintain the key overnight lending rate in a range of between 1.50% and 1.75%.

The Fed’s statement was little changed from the one issued after its December meeting, saying that the current federal funds rate was “appropriate to support sustained expansion of economic activity,” including ongoing job growth and a rise in inflation to the central bank’s 2% target.

At the same time, Federal Reserve Chair Jay Powell expressed concerns about the economic fallout of the coronavirus at a news conference following the central bank’s announcement it would leave interest rates unchanged. While the sell-off of risk assets in financial markets has moderated in recent days, Powell’s remarks about the virus bid up the dollar after it had briefly dipped into negative territory.

“He’s bringing up the coronavirus. We knew he was going to, but it’s one of those things - it’s a nagging news story where there’s a ton of uncertainty surrounding it,” said John Doyle, vice president of dealing and trading at Tempus, Inc.

“We are very carefully monitoring the situation,” Powell said, adding that while the implications of the outbreak for China’s output are clear, it is “too early” to determine its global effect or impact on the U.S. economic outlook. “A lot of the uncertainties that we were worried about in 2019 are gone - we have the phase one trade deal, it looks like impeachment is not going to be much of anything - and so the Fed is on hold,” said Doyle. “What’s going to get in the way?” “Potentially that’s this coronavirus.”

The U.S. dollar fell Thursday on news that the American economy in 2019 posted its slowest annual growth in three years and that personal consumption weakened dramatically, ending the currency’s rally on safe-haven demand from worries about economic fallout of the coronavirus outbreak in China.

The American economy missed the Trump administration’s 3% growth target for a second straight year as the slump in business investment deepened amid damaging trade tensions, the Commerce Department reported.

Growth in consumer spending, which accounts for more than two-thirds of U.S. economic activity, slowed to a 1.8% pace after rising at a brisk 3.2% rate in the third quarter. Personal consumption expenditures (PCE) factor into the Federal Reserve’s policymaking, and expectations of an interest rate cut in March rose from 7.2% yesterday to 17.7% today, according to CME Group’s FedWatch tool.

“The Fed message yesterday was consistent with tolerance for higher inflation - that depresses U.S. real rates and that’s not great news for the dollar. The soft components of GDP, particularly core PCE deflator would point you in the direction of lower Fed policy,” said Daniel Katzive, head of foreign exchange strategy for North America at BNP Paribas.

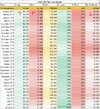

The odds that interest rates will still be at 150-175 basis points in July fell from 44.3% yesterday to 37.2% today. This is how market sentiment of July meeting changes week by week. Indeed market prices-in rate drop by 25 b.p. in July. Now probability of this event stands above 50%.

View attachment 50495

Source: cmegroup.com

“The only reason that GDP perhaps looked relatively healthy was because of something that’s actually quite poisonous for the U.S. economy: a slump in domestic demand and a sharp but unsustainable rise in exports. That’s not something that is attractive to the forward-looking participants that make up the foreign exchange market,” said Karl Schamotta, chief market strategist at Cambridge Global Payments.

By our side we have to mention that overall GDP data was not bad, in a row with expectations, except inflation numbers. GDP Price Index and Core PCE Prices fell below expectations and significantly contracted compares to previous data.

Sterling gained on Thursday after the Bank of England held interest rates at 0.75%, defying money markets that had seen a 50% probability of a cut to help the economy. The meeting, the last under Governor Mark Carney, was one of the least predictable for years. Money markets had factored in a 50% probability of a 25-basis-point rate cut.

Britain’s economy struggled at the end of 2019, prompting several policymakers to say this month they would vote for a rate cut unless data improved. Carney said earlier this month a case could be made for a precautionary cut. But economic momentum has shown signs of picking up since December’s general election, the BOE said, adding that signs of global stabilisation also meant stimulus was not needed yet. The Monetary Policy Committee remained split 7-2 as before, with external members Michael Saunders and Jonathan Haskel again voting to lower rates.

Analysts expect sterling’s strength to be limited. More positive data on an economic rebound is needed before the currency could move much higher, they said.

Investors are also wary as Britain officially leaves the European Union on Friday, setting the clock ticking on an 11-month deadline to reach a trade agreement with the EU.The BoE decision prompted money markets to slash their expectations for a rate cut in March, the month its new governor, Andrew Bailey, takes over. They now see just a 16% probability of a 25 bps cut, versus 80% before the announcement.

Dean Turner, UK economist at UBS Wealth Management, said recent flash PMIs signalled a post-election economic recovery but added that the economy was likely to hit more obstacles. “Therefore we still expect the BoE to cut rates at some point in the next six months to give the economy additional support,” Turner said.

The British pound extended its rally on Friday and was on track for its biggest weekly gain in a month after the Bank of England’s decision to keep interest rates steady on signs of a post-election pick-up in growth. But analysts said the rally may be short lived. The United Kingdom exits the European Union at 2300 GMT and faces negotiations on reaching a new trade and future relationship deal with the bloc by the end of 2020 - something the EU has said will not be easy.

“Looking ahead, there are more downside risks to the pound as investors gauge the progress of the Brexit negotiations,” said Morten Lund, a strategist at Danske Bank who expects euro/pound to rise to 86 pence over the coming months.

At the stroke of midnight in Brussels, the EU will lose 15% of its economy, its biggest military spender and the world’s international financial capital - London. Britain must begin charting a course for generations to come.

But in the final countdown to Brexit, the pound was still basking in the after glow of the Bank of England’s decision to hold interest rates on Thursday at Governor Mark Carney’s final policy meeting.

Brexit at last: Britain leaves the EU as champagne corks fly

The safe-haven yen and Swiss franc jumped to multiweek highs on Friday as worries about the global economic impact of the latest coronavirus outbreak in China intensified. The World Health Organization said late Thursday that the coronavirus outbreak was a global emergency, prompting the United States and other countries to tighten travel curbs on Friday.

All three major U.S. airlines -- United Airlines Holdings Inc, Delta Air Lines Inc, and American Airlines Group Inc -- announced the cancellation of flights to mainland China on Friday after the U.S. State Department elevated a travel advisory over concerns about the coronavirus.

"When we take a look at the overall picture heading into the week, there was some optimism that we could still see strong earnings. There's anticipation that eventually we're going to see a trickle-down effect of the Phase 1 trade deal with China," said Edward Moya, senior market strategist at OANDA in New York. "Right now, none of that matters. It's all about the virus and its impact on the Chinese economy and its trading partners," he added.

Investors remained transfixed on the casualties from the virus and feared its impact on the global economy, including businesses such as airlines and hotels.

The death toll rose to 213 on Friday, all in China. The number of confirmed cases in China has risen beyond 9,800, Beijing's envoy to the United Nations in Vienna said, while some 131 cases have been reported in 23 other countries and regions.

Markets on Friday were under sign of risk aversion - as safe-haven currencies as gold has jumped, dollar weakened while stocks have shown big collapse. We do not exclude that coronavirus precedent could trigger global shift in market cycles that we've discussed last year, when we said that expect reversal on stock market soon and pointed on long-term bullish trend on gold market. It could happen that this process just has started...

CFTC Report

CFTC data shows increasing of net short position on EUR. Despite technical rally on Friday that we also were waiting for, it doesn't change longer-term fundamental balance and keeps EUR at weaker position to USD in long-term perspective. Brexit process will add problems as now EU also will have to decide cross border problems of mutual business functioning with UK.

View attachment 50497

Now we have to take a look in the future - coming US NFP report, Coronavirus impact and other moments.

Virus recent information

Financial markets have gone swiftly from nonchalance to awe in reacting to the fast-spreading 2019-nCoV or new coronavirus here

Global stocks have been shaken in the past week by headlines of cases and deaths, countries telling citizens not to travel or businesses shutting in China - but all this has happened while Chinese markets have been on holiday. So there is some trepidation about how mainland traders will respond to the dramatic growth downgrades and business disruptions.

A 5% plunge in share prices in neighboring Taiwan and Hong Kong as soon as they opened after the Lunar New Year break has given markets a taste of what to expect from Shanghai on Monday. Eyes will also be on the People’s Bank of China to see what monetary support it might stump up.

The virus’s progression has been likened to a schlock science fiction movie, replete with conspiracy theories around symptomless transmission and super-spreaders. Some 60 million people at the center of the outbreak are living under virtual lockdown. A shock to China’s economy this quarter, which then reverberates through global supply chains, is a foregone conclusion. It’s just that no one can yet say how deep.

View attachment 50498

The coronavirus’s repercussions are being felt far and wide, well beyond its starting point in China’s Hubei province. Countries reliant on Chinese demand have seen steep drops in their currencies, with the Australian dollar down around 5% in January, its worst month since 2016. The Thai and Korean currencies, exposed to China via tourism and goods exports respectively, are also taking a battering.

Growth forecast downgrades for China, the world’s No. 2 economy, are coming thick and fast, meaning estimates for other countries are being reworked too. Tellingly, ‘Dr’ Copper, the best-known gauge of economic health, is down 10% in little more than a week, and oil is headed for a fourth week of losses. World stocks have lost $1.2 trillion over the past two weeks and, depending on how the virus spreads from now, expect more to come. Selling may focus in particular on travel and leisure, with a European index of these sectors skidding to the lowest since October. The beneficiaries? The usual safe-haven plays: gold, for instance, has enjoyed its best month in five.

EU Banks

Blowout performances by Wall Street banks, and bumper Q4 earnings from the Spanish lender Santander, have fed hopes of a strong season for euro zone banks, a raft of which will post results in coming days. How heavyweights such as BNP Paribas, Intesa and ING fared in the last quarter of 2019 will shed more light on how they are riding the wave of negative rates.

Troubled Deutsche Bank reported a major loss due to one-offs, but shares rose nonetheless as investors turned their focus on the bank’s turnaround potential. With higher interest rates still far off, banks are finding it challenging to grow. But after 20 straight months of downgrades, earnings estimates have started to stabilize.

The coronavirus scare, however, threatens to strangle Europe’s economic recovery and therefore any banking revival. An index of bank shares has fallen 4% so far this year, underperforming the broader euro benchmark.

View attachment 50499

US NFP Report

Friday’s non-farm payroll data will show how the U.S. economy fared in the first month of the new decade. The report is expected to show a pickup from December, with a Reuters poll forecasting 156,000 were added, from 145,000 the month before. The previous decade hit a number of milestones. December’s report was the 111th monthly scorecard in a row to show employment gains, while the 3.5% unemployment rate matched a low from half a century ago and is roughly a third of the level at the start of the decade. Worries of a trade-war-induced slowdown have faded since the Federal Reserve delivered three rate cuts in 2019. Recent data has largely shown the U.S. economy continuing to expand at a moderate pace, and the Fed has signaled that its monetary policy stance is unlikely to change this year. -U.S. employment growth slows; labor market tightening.-GRAPHIC-U.S. employment in the 2010s in 5 charts.

EUR Volatility keeps lowest levels

When a slight U.S. inflation uptick pushed stock markets lower on Feb. 5 two years ago, few expected it to turn into one of the biggest Wall Street shake-ups in recent years. That episode — “Volmageddon” — saw the VIX equity volatility gauge triple overnight to 50%, wiping out hordes of small punters who had piled into so-called inverse-vol investments.

These strategies, peddled via exchange-traded products and designed to profit from extended spells of market calm, yielded rich pickings as long as volatility stayed low. But as the VIX exploded higher, vehicles such as the ProShares Short VIX ETF tumbled over 80 percent in a day.

As we were reminded two years ago, volatility can spike spectacularly in quiet markets. As it happens, the coronavirus has sent the VIX to three-month highs and ProShares ETF, which had climbed back to the highest level reached since Volmageddon, has fallen again. But volatility gauges for bonds and currencies remain well below historic averages. Investors might be wise to brace for reversals.

View attachment 50500

That's being said - all "expected" drivers have worked properly as they should and as we've expected in our recent report. Fundamental balance of US and EU economies have not changed, long-term perspective of UK economy on a background of Brexit (as well as EU, though) still stands blur, promising real difficulties. The only factor that is out of our control is virus spreading, or better to say - the potential impact on global economy and mutual trading. This impact is yet to be calculated. Currently we see only panic that spreading like a fire in the wood. Without no real chances to assess real impact of virus, news agencies distribute articles and scaring commentaries one worse than another.

As always this situation leads to only one thing - rising volatility and nervousness on the market when strong pullbacks will be mixed with strong collapses. Definitely we could say that whatever impact virus will be - it will be equal to all mature economies, as US as EU. This suggestion should keep status quo of EUR and USD relation.

At the same time I would like encourage you, guys to not scare. Within just few years we've passed through bird flue, pig flue, SARS (severe acute respiratory syndrome) and I'm sure that with God's help we could overcome new coronavirus too. We should understand that coronavirus is "comfortable topic" for owners of big money. They use it to re-shape global markets.

Technicals

Monthly

Hopefully, in last session of January EUR was able to hold above YPS1 and recent lows and escape appearing of another bearish grabber. But at the same time it is nothing to be happy about, because recent rally was mostly against the dollar, or better to say in favor of gold, CHF and JPY, rather than in favor of EUR. EUR growth is mostly by-product of overall situation on the market, as EUR itself has no fundamental reasons to show appreciation by far.

Anyway, thanks to the bounce - situation on the monthly chart has not changed. From pivot points frame work EUR has tested YPP but failed to break it up, which is bearish sign. Second, as grabber suggests drop below 1.08 level - this is also Yearly Pivot Support 1, and breaking YPS1 means downside trend on monthly chart, back to 1.03 lows because EUR has no additional stoppers below 1.08 - no valuable targets, oversold, no significant Fib levels.

Currently market also is just completed upside harmonic pullback (pink lines on the chart) and retreats, suggesting that existed downside tendency is still valid. That's being said, monthly picture looks bearish now and tells us to stay aside from any long-term bullish positions on EUR. Also we have to keep an eye on coming events as they will have major impact on situation (although somehow I suggest that they will confirm status quo).

To break this, EUR has to climb at least above 1.1220, or better to reach 1.1450 area, to set some background for further upside action.

Weekly

Previously we've mentioned few times that EUR stands at crucial area. This makes overall situation simple and vital simultaneously. Vital is because drop below 1.10 will destroy bullish context and open road to 1.08 lows. Simple - because EUR has not room to retreat more and already stands at crucial point. New detail that we've got this week on weekly chart makes our task more simple. This is bullish grabber. Pattern suggests upside action above 1.1235 area. Conversely, lows of the pattern cemented existed major support and agrees with it. Thus, downside breakout is vital not only for the grabber but for the whole bullish scenario. It means that our task is to try taking long position based on grabber against recent lows. Or, at least do not take short positions by far if bullish context seems not sufficient to you.

Daily

Actually, somebody of you could already have long positions, as we talked about upside reversal on EUR as on Thu as on Fri. Anyway, EUR shows strong pullback from major daily support Agreement, as well as Dollar Index. On daily chart it is important that now market stands at resistance - K-area and trend line which was broken down previously.

Odds suggest some respect of this area, in a way of retracement. And this is what we particularly need.

Intraday

Here we see that EUR has completed XOP target as well, which creates Agreement with daily level as well. As EUR is not at overbought - it seems that most probable target of retracement is K-support around 1.1050:

Conclusion:

Despite good rally on Friday, and promising technical picture - we do not see any shifts in fundamental background of EUR that remains relatively weak. It means that rally is by product of massive run in safe haven assets and dollar sell-off. We do not want to gamble whether technical setup will be completed and what reasons could push EUR above 1.1250, but just follow short-term trading plan. Friday's momentum should be strong enough to let us extract some profit on its continuation.

This week we've got two major drivers - BoE meeting and US GDP release, although on Friday the new wave of coronavirus panic started and by the end of the day we see strong acceleration against the USD across the board, stock markets collapsed. Today we have big bulk of fundamental factors to discuss that supposedly make impact on Forex market next week.

As we've suggested last time, real activity indeed has come only on Wednesday. The Federal Reserve held interest rates steady at its first policy meeting of the year, with officials pointing to continued moderate U.S. economic growth and a “strong” job market. he Fed’s policy-setting committee announced its unanimous decision to maintain the key overnight lending rate in a range of between 1.50% and 1.75%.

The Fed’s statement was little changed from the one issued after its December meeting, saying that the current federal funds rate was “appropriate to support sustained expansion of economic activity,” including ongoing job growth and a rise in inflation to the central bank’s 2% target.

At the same time, Federal Reserve Chair Jay Powell expressed concerns about the economic fallout of the coronavirus at a news conference following the central bank’s announcement it would leave interest rates unchanged. While the sell-off of risk assets in financial markets has moderated in recent days, Powell’s remarks about the virus bid up the dollar after it had briefly dipped into negative territory.

“He’s bringing up the coronavirus. We knew he was going to, but it’s one of those things - it’s a nagging news story where there’s a ton of uncertainty surrounding it,” said John Doyle, vice president of dealing and trading at Tempus, Inc.

“We are very carefully monitoring the situation,” Powell said, adding that while the implications of the outbreak for China’s output are clear, it is “too early” to determine its global effect or impact on the U.S. economic outlook. “A lot of the uncertainties that we were worried about in 2019 are gone - we have the phase one trade deal, it looks like impeachment is not going to be much of anything - and so the Fed is on hold,” said Doyle. “What’s going to get in the way?” “Potentially that’s this coronavirus.”

The U.S. dollar fell Thursday on news that the American economy in 2019 posted its slowest annual growth in three years and that personal consumption weakened dramatically, ending the currency’s rally on safe-haven demand from worries about economic fallout of the coronavirus outbreak in China.

The American economy missed the Trump administration’s 3% growth target for a second straight year as the slump in business investment deepened amid damaging trade tensions, the Commerce Department reported.

Growth in consumer spending, which accounts for more than two-thirds of U.S. economic activity, slowed to a 1.8% pace after rising at a brisk 3.2% rate in the third quarter. Personal consumption expenditures (PCE) factor into the Federal Reserve’s policymaking, and expectations of an interest rate cut in March rose from 7.2% yesterday to 17.7% today, according to CME Group’s FedWatch tool.

“The Fed message yesterday was consistent with tolerance for higher inflation - that depresses U.S. real rates and that’s not great news for the dollar. The soft components of GDP, particularly core PCE deflator would point you in the direction of lower Fed policy,” said Daniel Katzive, head of foreign exchange strategy for North America at BNP Paribas.

The odds that interest rates will still be at 150-175 basis points in July fell from 44.3% yesterday to 37.2% today. This is how market sentiment of July meeting changes week by week. Indeed market prices-in rate drop by 25 b.p. in July. Now probability of this event stands above 50%.

View attachment 50495

Source: cmegroup.com

“The only reason that GDP perhaps looked relatively healthy was because of something that’s actually quite poisonous for the U.S. economy: a slump in domestic demand and a sharp but unsustainable rise in exports. That’s not something that is attractive to the forward-looking participants that make up the foreign exchange market,” said Karl Schamotta, chief market strategist at Cambridge Global Payments.

By our side we have to mention that overall GDP data was not bad, in a row with expectations, except inflation numbers. GDP Price Index and Core PCE Prices fell below expectations and significantly contracted compares to previous data.

Sterling gained on Thursday after the Bank of England held interest rates at 0.75%, defying money markets that had seen a 50% probability of a cut to help the economy. The meeting, the last under Governor Mark Carney, was one of the least predictable for years. Money markets had factored in a 50% probability of a 25-basis-point rate cut.

Britain’s economy struggled at the end of 2019, prompting several policymakers to say this month they would vote for a rate cut unless data improved. Carney said earlier this month a case could be made for a precautionary cut. But economic momentum has shown signs of picking up since December’s general election, the BOE said, adding that signs of global stabilisation also meant stimulus was not needed yet. The Monetary Policy Committee remained split 7-2 as before, with external members Michael Saunders and Jonathan Haskel again voting to lower rates.

Analysts expect sterling’s strength to be limited. More positive data on an economic rebound is needed before the currency could move much higher, they said.

Investors are also wary as Britain officially leaves the European Union on Friday, setting the clock ticking on an 11-month deadline to reach a trade agreement with the EU.The BoE decision prompted money markets to slash their expectations for a rate cut in March, the month its new governor, Andrew Bailey, takes over. They now see just a 16% probability of a 25 bps cut, versus 80% before the announcement.

Dean Turner, UK economist at UBS Wealth Management, said recent flash PMIs signalled a post-election economic recovery but added that the economy was likely to hit more obstacles. “Therefore we still expect the BoE to cut rates at some point in the next six months to give the economy additional support,” Turner said.

The British pound extended its rally on Friday and was on track for its biggest weekly gain in a month after the Bank of England’s decision to keep interest rates steady on signs of a post-election pick-up in growth. But analysts said the rally may be short lived. The United Kingdom exits the European Union at 2300 GMT and faces negotiations on reaching a new trade and future relationship deal with the bloc by the end of 2020 - something the EU has said will not be easy.

“Looking ahead, there are more downside risks to the pound as investors gauge the progress of the Brexit negotiations,” said Morten Lund, a strategist at Danske Bank who expects euro/pound to rise to 86 pence over the coming months.

At the stroke of midnight in Brussels, the EU will lose 15% of its economy, its biggest military spender and the world’s international financial capital - London. Britain must begin charting a course for generations to come.

But in the final countdown to Brexit, the pound was still basking in the after glow of the Bank of England’s decision to hold interest rates on Thursday at Governor Mark Carney’s final policy meeting.

Brexit at last: Britain leaves the EU as champagne corks fly

The safe-haven yen and Swiss franc jumped to multiweek highs on Friday as worries about the global economic impact of the latest coronavirus outbreak in China intensified. The World Health Organization said late Thursday that the coronavirus outbreak was a global emergency, prompting the United States and other countries to tighten travel curbs on Friday.

All three major U.S. airlines -- United Airlines Holdings Inc, Delta Air Lines Inc, and American Airlines Group Inc -- announced the cancellation of flights to mainland China on Friday after the U.S. State Department elevated a travel advisory over concerns about the coronavirus.

"When we take a look at the overall picture heading into the week, there was some optimism that we could still see strong earnings. There's anticipation that eventually we're going to see a trickle-down effect of the Phase 1 trade deal with China," said Edward Moya, senior market strategist at OANDA in New York. "Right now, none of that matters. It's all about the virus and its impact on the Chinese economy and its trading partners," he added.

Investors remained transfixed on the casualties from the virus and feared its impact on the global economy, including businesses such as airlines and hotels.

The death toll rose to 213 on Friday, all in China. The number of confirmed cases in China has risen beyond 9,800, Beijing's envoy to the United Nations in Vienna said, while some 131 cases have been reported in 23 other countries and regions.

Markets on Friday were under sign of risk aversion - as safe-haven currencies as gold has jumped, dollar weakened while stocks have shown big collapse. We do not exclude that coronavirus precedent could trigger global shift in market cycles that we've discussed last year, when we said that expect reversal on stock market soon and pointed on long-term bullish trend on gold market. It could happen that this process just has started...

CFTC Report

CFTC data shows increasing of net short position on EUR. Despite technical rally on Friday that we also were waiting for, it doesn't change longer-term fundamental balance and keeps EUR at weaker position to USD in long-term perspective. Brexit process will add problems as now EU also will have to decide cross border problems of mutual business functioning with UK.

View attachment 50497

Now we have to take a look in the future - coming US NFP report, Coronavirus impact and other moments.

Virus recent information

Financial markets have gone swiftly from nonchalance to awe in reacting to the fast-spreading 2019-nCoV or new coronavirus here

Global stocks have been shaken in the past week by headlines of cases and deaths, countries telling citizens not to travel or businesses shutting in China - but all this has happened while Chinese markets have been on holiday. So there is some trepidation about how mainland traders will respond to the dramatic growth downgrades and business disruptions.

A 5% plunge in share prices in neighboring Taiwan and Hong Kong as soon as they opened after the Lunar New Year break has given markets a taste of what to expect from Shanghai on Monday. Eyes will also be on the People’s Bank of China to see what monetary support it might stump up.

The virus’s progression has been likened to a schlock science fiction movie, replete with conspiracy theories around symptomless transmission and super-spreaders. Some 60 million people at the center of the outbreak are living under virtual lockdown. A shock to China’s economy this quarter, which then reverberates through global supply chains, is a foregone conclusion. It’s just that no one can yet say how deep.

View attachment 50498

The coronavirus’s repercussions are being felt far and wide, well beyond its starting point in China’s Hubei province. Countries reliant on Chinese demand have seen steep drops in their currencies, with the Australian dollar down around 5% in January, its worst month since 2016. The Thai and Korean currencies, exposed to China via tourism and goods exports respectively, are also taking a battering.

Growth forecast downgrades for China, the world’s No. 2 economy, are coming thick and fast, meaning estimates for other countries are being reworked too. Tellingly, ‘Dr’ Copper, the best-known gauge of economic health, is down 10% in little more than a week, and oil is headed for a fourth week of losses. World stocks have lost $1.2 trillion over the past two weeks and, depending on how the virus spreads from now, expect more to come. Selling may focus in particular on travel and leisure, with a European index of these sectors skidding to the lowest since October. The beneficiaries? The usual safe-haven plays: gold, for instance, has enjoyed its best month in five.

EU Banks

Blowout performances by Wall Street banks, and bumper Q4 earnings from the Spanish lender Santander, have fed hopes of a strong season for euro zone banks, a raft of which will post results in coming days. How heavyweights such as BNP Paribas, Intesa and ING fared in the last quarter of 2019 will shed more light on how they are riding the wave of negative rates.

Troubled Deutsche Bank reported a major loss due to one-offs, but shares rose nonetheless as investors turned their focus on the bank’s turnaround potential. With higher interest rates still far off, banks are finding it challenging to grow. But after 20 straight months of downgrades, earnings estimates have started to stabilize.

The coronavirus scare, however, threatens to strangle Europe’s economic recovery and therefore any banking revival. An index of bank shares has fallen 4% so far this year, underperforming the broader euro benchmark.

View attachment 50499

US NFP Report

Friday’s non-farm payroll data will show how the U.S. economy fared in the first month of the new decade. The report is expected to show a pickup from December, with a Reuters poll forecasting 156,000 were added, from 145,000 the month before. The previous decade hit a number of milestones. December’s report was the 111th monthly scorecard in a row to show employment gains, while the 3.5% unemployment rate matched a low from half a century ago and is roughly a third of the level at the start of the decade. Worries of a trade-war-induced slowdown have faded since the Federal Reserve delivered three rate cuts in 2019. Recent data has largely shown the U.S. economy continuing to expand at a moderate pace, and the Fed has signaled that its monetary policy stance is unlikely to change this year. -U.S. employment growth slows; labor market tightening.-GRAPHIC-U.S. employment in the 2010s in 5 charts.

EUR Volatility keeps lowest levels

When a slight U.S. inflation uptick pushed stock markets lower on Feb. 5 two years ago, few expected it to turn into one of the biggest Wall Street shake-ups in recent years. That episode — “Volmageddon” — saw the VIX equity volatility gauge triple overnight to 50%, wiping out hordes of small punters who had piled into so-called inverse-vol investments.

These strategies, peddled via exchange-traded products and designed to profit from extended spells of market calm, yielded rich pickings as long as volatility stayed low. But as the VIX exploded higher, vehicles such as the ProShares Short VIX ETF tumbled over 80 percent in a day.

As we were reminded two years ago, volatility can spike spectacularly in quiet markets. As it happens, the coronavirus has sent the VIX to three-month highs and ProShares ETF, which had climbed back to the highest level reached since Volmageddon, has fallen again. But volatility gauges for bonds and currencies remain well below historic averages. Investors might be wise to brace for reversals.

View attachment 50500

That's being said - all "expected" drivers have worked properly as they should and as we've expected in our recent report. Fundamental balance of US and EU economies have not changed, long-term perspective of UK economy on a background of Brexit (as well as EU, though) still stands blur, promising real difficulties. The only factor that is out of our control is virus spreading, or better to say - the potential impact on global economy and mutual trading. This impact is yet to be calculated. Currently we see only panic that spreading like a fire in the wood. Without no real chances to assess real impact of virus, news agencies distribute articles and scaring commentaries one worse than another.

As always this situation leads to only one thing - rising volatility and nervousness on the market when strong pullbacks will be mixed with strong collapses. Definitely we could say that whatever impact virus will be - it will be equal to all mature economies, as US as EU. This suggestion should keep status quo of EUR and USD relation.

At the same time I would like encourage you, guys to not scare. Within just few years we've passed through bird flue, pig flue, SARS (severe acute respiratory syndrome) and I'm sure that with God's help we could overcome new coronavirus too. We should understand that coronavirus is "comfortable topic" for owners of big money. They use it to re-shape global markets.

Technicals

Monthly

Hopefully, in last session of January EUR was able to hold above YPS1 and recent lows and escape appearing of another bearish grabber. But at the same time it is nothing to be happy about, because recent rally was mostly against the dollar, or better to say in favor of gold, CHF and JPY, rather than in favor of EUR. EUR growth is mostly by-product of overall situation on the market, as EUR itself has no fundamental reasons to show appreciation by far.

Anyway, thanks to the bounce - situation on the monthly chart has not changed. From pivot points frame work EUR has tested YPP but failed to break it up, which is bearish sign. Second, as grabber suggests drop below 1.08 level - this is also Yearly Pivot Support 1, and breaking YPS1 means downside trend on monthly chart, back to 1.03 lows because EUR has no additional stoppers below 1.08 - no valuable targets, oversold, no significant Fib levels.

Currently market also is just completed upside harmonic pullback (pink lines on the chart) and retreats, suggesting that existed downside tendency is still valid. That's being said, monthly picture looks bearish now and tells us to stay aside from any long-term bullish positions on EUR. Also we have to keep an eye on coming events as they will have major impact on situation (although somehow I suggest that they will confirm status quo).

To break this, EUR has to climb at least above 1.1220, or better to reach 1.1450 area, to set some background for further upside action.

Weekly

Previously we've mentioned few times that EUR stands at crucial area. This makes overall situation simple and vital simultaneously. Vital is because drop below 1.10 will destroy bullish context and open road to 1.08 lows. Simple - because EUR has not room to retreat more and already stands at crucial point. New detail that we've got this week on weekly chart makes our task more simple. This is bullish grabber. Pattern suggests upside action above 1.1235 area. Conversely, lows of the pattern cemented existed major support and agrees with it. Thus, downside breakout is vital not only for the grabber but for the whole bullish scenario. It means that our task is to try taking long position based on grabber against recent lows. Or, at least do not take short positions by far if bullish context seems not sufficient to you.

Daily

Actually, somebody of you could already have long positions, as we talked about upside reversal on EUR as on Thu as on Fri. Anyway, EUR shows strong pullback from major daily support Agreement, as well as Dollar Index. On daily chart it is important that now market stands at resistance - K-area and trend line which was broken down previously.

Odds suggest some respect of this area, in a way of retracement. And this is what we particularly need.

Intraday

Here we see that EUR has completed XOP target as well, which creates Agreement with daily level as well. As EUR is not at overbought - it seems that most probable target of retracement is K-support around 1.1050:

Conclusion:

Despite good rally on Friday, and promising technical picture - we do not see any shifts in fundamental background of EUR that remains relatively weak. It means that rally is by product of massive run in safe haven assets and dollar sell-off. We do not want to gamble whether technical setup will be completed and what reasons could push EUR above 1.1250, but just follow short-term trading plan. Friday's momentum should be strong enough to let us extract some profit on its continuation.