- Forex, Gold, BTC Market Analysis | Trading Signals

- Sive Morten- Currencies, Gold, Bitcoin Daily Video

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

FOREX PRO WEEKLY July 21-25, 2014

- Thread starter Sive Morten

- Start date

Triantus Shango

Sergeant Major

- Messages

- 1,371

sive

what about Credit Agricole saying that this is not a good time to go short?

EUR/USD technical analysis 23 July 2014 | ForexLive

what about Credit Agricole saying that this is not a good time to go short?

EUR/USD technical analysis 23 July 2014 | ForexLive

sive

what about Credit Agricole saying that this is not a good time to go short?

EUR/USD technical analysis 23 July 2014 | ForexLive

Hi Triantus

this is what Sive and I are talking about..lower PRZ is very close,lets say 1,3380/40, so for longer term position might really not be good/right time..even if we pull back above 1,3575 we could not go very low...

Well I think banks are talking long term positions..

Triantus Shango

Sergeant Major

- Messages

- 1,371

ah ok. i didn't read the other posts yet, sry.

Triantus Shango

Sergeant Major

- Messages

- 1,371

goddam it! don't erase the link... i just got here and didn't have time to read it. but based on the short excerpt, i'd say it doesn't surprise me in the least. psyops today aren't your grandaddy ops of yesteryear, ie they have gotten quite sophisticated and ever more cynical and amoral, but morality never was a consideration in this game, i'm afraid.

furthermore, considering the bigger geopolitical picture as far as Crimea is concerned, and the political weirdness in ukraine in the past few years, i think it should be pretty obvious that some western intelligence agency(ies) have been quite busy. so it isn't black and white in the sense that russia is the bad guy, ukraine and the west the good guys. if anyone believes this, you need to get your head examined or buy this bridge from me for 100M/USD. it is mixed, of course.

it is mixed, of course.

and finally, considering the historical ties between Crimea and Russia and that the Ukraine is in Russia's strategic zone, what gives the West, especially the USA any rights whatsoever to tell Russia what it should and shouldn't do and, the height of all hubris, use international law arguments when the USA didn't give a flying f%*k about international law when they unilaterally decided that 'hey!, wtf, we're the USA and we do as we please, so let's invade Iraq.' and they did it not once, but twice showing no respect for the sovereignty of another nation in contravention of all international law even though Iraq never was a national security threat.

anyway, it's all well documented so you can do your own research on this as i already hear the rising bleats of outrage at my comment from the thundering herd of brainwashed sheep. it's truly amazing how mass media broadcasting can be so adeptly used to continuously reinforce a specific and untrue worldview in the unthinking and uncritical public. propaganda never had it so good.

sive, please PM me the link if you are not going to re-post it. thanks.

furthermore, considering the bigger geopolitical picture as far as Crimea is concerned, and the political weirdness in ukraine in the past few years, i think it should be pretty obvious that some western intelligence agency(ies) have been quite busy. so it isn't black and white in the sense that russia is the bad guy, ukraine and the west the good guys. if anyone believes this, you need to get your head examined or buy this bridge from me for 100M/USD.

and finally, considering the historical ties between Crimea and Russia and that the Ukraine is in Russia's strategic zone, what gives the West, especially the USA any rights whatsoever to tell Russia what it should and shouldn't do and, the height of all hubris, use international law arguments when the USA didn't give a flying f%*k about international law when they unilaterally decided that 'hey!, wtf, we're the USA and we do as we please, so let's invade Iraq.' and they did it not once, but twice showing no respect for the sovereignty of another nation in contravention of all international law even though Iraq never was a national security threat.

anyway, it's all well documented so you can do your own research on this as i already hear the rising bleats of outrage at my comment from the thundering herd of brainwashed sheep. it's truly amazing how mass media broadcasting can be so adeptly used to continuously reinforce a specific and untrue worldview in the unthinking and uncritical public. propaganda never had it so good.

sive, please PM me the link if you are not going to re-post it. thanks.

Triantus Shango

Sergeant Major

- Messages

- 1,371

thank you sive for the great comment.

Sive Morten

Special Consultant to the FPA

- Messages

- 18,676

sive

what about Credit Agricole saying that this is not a good time to go short?

EUR/USD technical analysis 23 July 2014 | ForexLive

Hi Triantus

this is what Sive and I are talking about..lower PRZ is very close,lets say 1,3380/40, so for longer term position might really not be good/right time..even if we pull back above 1,3575 we could not go very low...

Well I think banks are talking long term positions..

Hi, buddy,

yes, Mmax has answered already - 1.3380 is solid support and Fed meeting stands ahead (30th of July), Jackson hole meeting then - they could shake markets.

goddam it! don't erase the link... i just got here and didn't have time to read it.

sive, please PM me the link if you are not going to re-post it. thanks.

Ok, I'll send you by PM, no problem. Article mostly dedicated to secret US military base on Diego Island and biochemic weapon. May be a bullsh**t, but interesting and has some logic.

eurusd insight

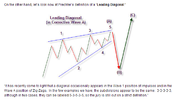

I was thinking where we should be at FOMC that both directions would be possible..

- we could sink for 100 pips and wait there..added in this case that low would be bFlat

- we could stay here somewhere but it is 4 days left...are we ready to stay flat so long? added again only bFlat, we could either drop for 100 pips or go higher

- we could be above 1,3575 and wait there added and to remain in bFlat..

I make a picture if 3rd option is possible at al and I belive it is.

You may see in the picture..from there we could plunge as DZZ into W&R but not too deep because of the angle of channel..whole picture would look bearish but we would bottom 3ED...then we have 2 weeks to climb into 4th to stay in channel and plunge again.. this time limited move..again would look bearish but then we would bottom 5th which would be 4ED on Monthly..then move up could be unlimited long, from 1,3892 to the sky, well not so much, as 5ED on Monthy.....

From 1,3575 we could also go up, attack 50% of 1st weekly swing low and there (or higher) finish Flat 2nd..this scenario would remain long term bullish but deep of 5th could be even double bottom at 1,2040..we could do this also although we drop first as written above in second crossing of 1,3575, well next week candle high..

Maybe closing of short positions before weekend might give a push..

Added: just above 1,3575 is 262 expansion of c=a on H2 (red line!!) and it is not best seen..if we bottomed b already

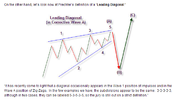

..and for dessert I give a picture about ED from ˝big master˝ Prechter...so, whatever I think, ˝ The biggest Interpreter˝ does not know how market really behaves...

I was thinking where we should be at FOMC that both directions would be possible..

- we could sink for 100 pips and wait there..added in this case that low would be bFlat

- we could stay here somewhere but it is 4 days left...are we ready to stay flat so long? added again only bFlat, we could either drop for 100 pips or go higher

- we could be above 1,3575 and wait there added and to remain in bFlat..

I make a picture if 3rd option is possible at al and I belive it is.

You may see in the picture..from there we could plunge as DZZ into W&R but not too deep because of the angle of channel..whole picture would look bearish but we would bottom 3ED...then we have 2 weeks to climb into 4th to stay in channel and plunge again.. this time limited move..again would look bearish but then we would bottom 5th which would be 4ED on Monthly..then move up could be unlimited long, from 1,3892 to the sky, well not so much, as 5ED on Monthy.....

From 1,3575 we could also go up, attack 50% of 1st weekly swing low and there (or higher) finish Flat 2nd..this scenario would remain long term bullish but deep of 5th could be even double bottom at 1,2040..we could do this also although we drop first as written above in second crossing of 1,3575, well next week candle high..

Maybe closing of short positions before weekend might give a push..

Added: just above 1,3575 is 262 expansion of c=a on H2 (red line!!) and it is not best seen..if we bottomed b already

..and for dessert I give a picture about ED from ˝big master˝ Prechter...so, whatever I think, ˝ The biggest Interpreter˝ does not know how market really behaves...

Last edited:

Similar threads

- Replies

- 7

- Views

- 239

- Replies

- 7

- Views

- 206

- Replies

- 1

- Views

- 35

- Replies

- 8

- Views

- 264

- Replies

- 6

- Views

- 203

- Forex, Gold, BTC Market Analysis | Trading Signals

- Sive Morten- Currencies, Gold, Bitcoin Daily Video