Sive Morten

Special Consultant to the FPA

- Messages

- 18,690

Fundamentals

Reuters reports euro declined against other major currencies on Friday, weighed down by anxieties Greece may soon default on debts that also drove safe-haven buying of the dollar.

Greece is days away from potentially missing debt repayments of 1.6 billion euros to the International Monetary Fund, and investors are looking to an emergency meeting next week where euro zone leaders will try to find a way to unlock aid for Athens.

Germany, the biggest European contributor to bailout programs that have kept Greece afloat for five years, insisted it still was not too late for Athens to come to terms with its creditors at the EU and IMF.

The European Central Bank on Friday raised the ceiling on emergency liquidity that Greek banks can draw from the country's central bank for the second time this week, a banking source told Reuters.

Bankers told Reuters that about 4.2 billion euros had flooded out of Greek bank accounts this week despite central bank efforts to restore calm.

Versus sterling, which strategists say is something of a safe-haven, the euro fell as low as 71.22 pence , its weakest since May 28. It was last down 0.11 percent to 71.48 pence.

The euro was also lower against the Swiss franc and yen, both traditionally safe plays .

The dollar had been trading weakly since Wednesday, when Federal Reserve policymakers dulled expectations of imminent hikes in U.S. interest rates, but rose modestly on Friday.

"Greece remains highly combustible, and that's a recipe for dollar strength and risk aversion," said Richard Franulovich, senior currency strategist at Westpac in New York.

The dollar gave up early gains against the yen, hurt by a price rally in Treasuries debt that lowered U.S. bond yields. It last stood at 122.62 yen , off 0.28 percent.

The dollar has been rallying for nearly a year but this week was on track for a third consecutive week of losses. Some analysts still see the dollar climbing.

"When we get to where we can see the white of the eyes of the Fed rate hike, we will have a second wave of the dollar rally," said Greg Anderson, global head of FX strategy at BMO Capital Markets in New York.

We will not talk on EUR today because Greece and EU will take emergency meeting on 22nd of June, on Monday and will try to resolve difficult situation with Greece debt burden. Even banks in Greece could be closed in this day. As EUR right now is a hostage of solution on Greek debt and we can’t foresee the result, our analysis will have minor value. So let’s better take a look at GBP.

CFTC report shows significant changes compares to last week. Open interest has dropped but this decrease mostly was driven by hedgers’ position. Speculative positions mostly have not changed, while hedgers have decreased as longs as shorts. Currently it is difficult to find correct explanation why this is happening. The only conclusion that we could do here is the same – current action is retracement as it is accompanied by decreasing open interest. Probably sooner rather than later cable should turn down again.

Open interest:

Shorts:

Shorts:

Longs:

Longs:

Technicals

Monthly

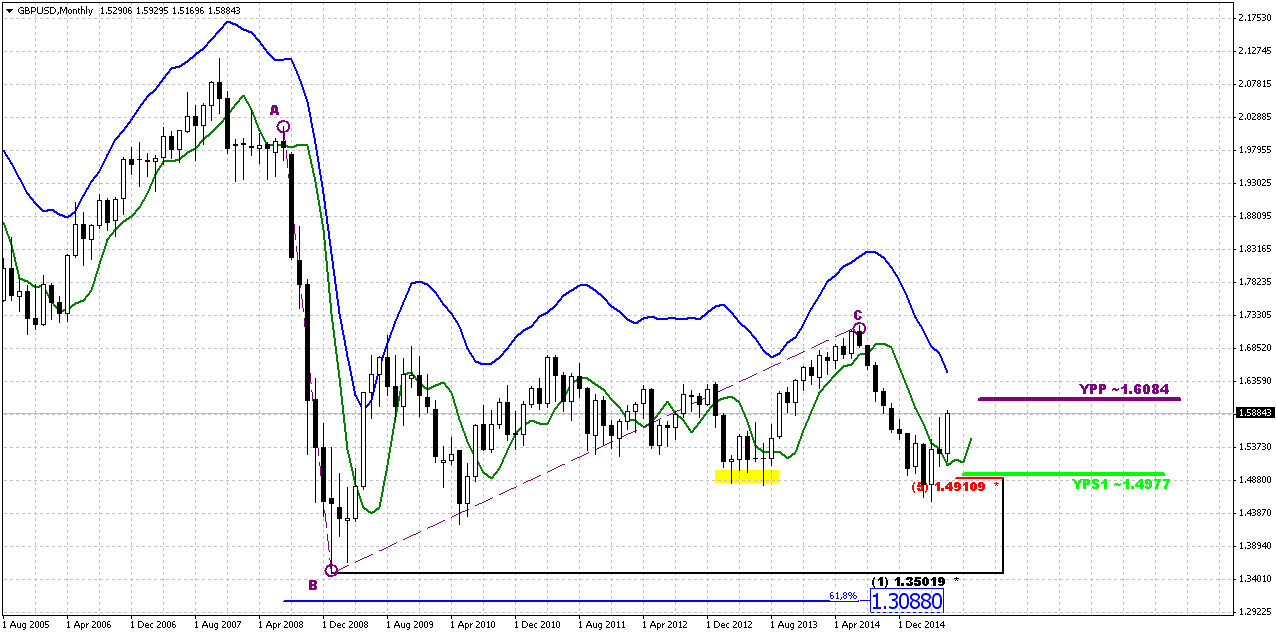

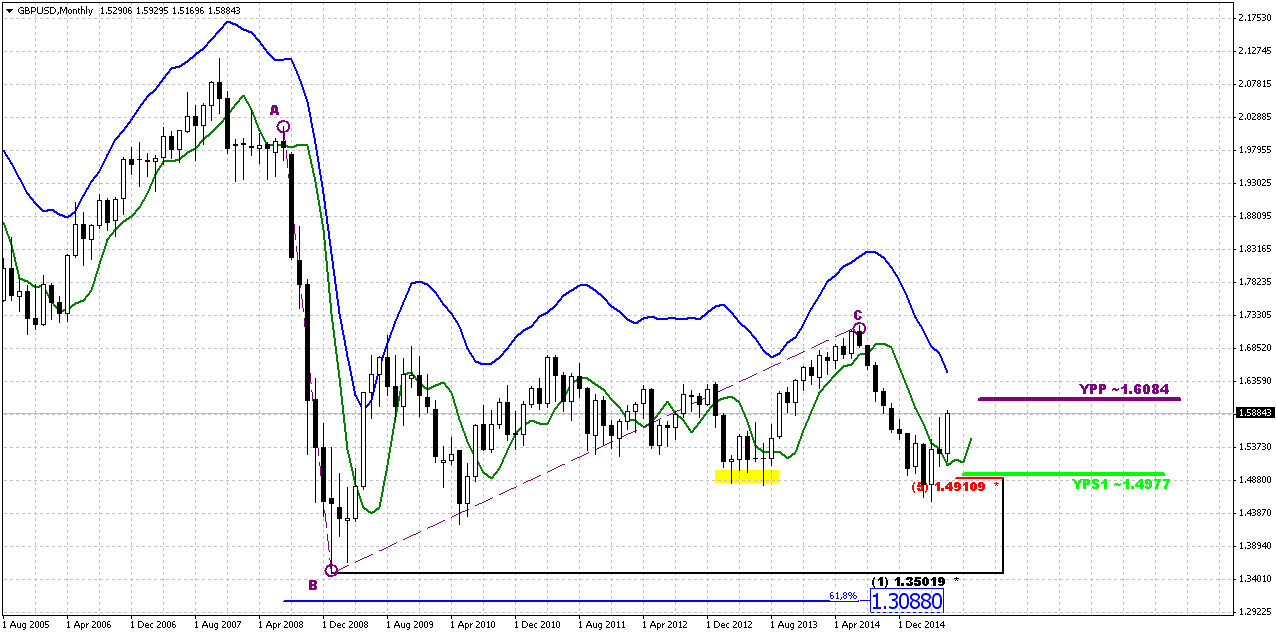

Since our recent discussion GBP shows some important changes. In the beginning we continue to keep our long-term analysis that we’ve made in December 2013 in our Forex Military School Course, where we were learning Elliot Waves technique.

https://www.forexpeacearmy.com/forex-forum/forex-military-school-complete-forex-education-pro-banker/30110-chapter-16-part-v-trading-elliot-waves-page-7-a.html

Our long term analysis suggests first appearing of new high on 4th wave at ~1.76 level and then starting of last 5th wave down. First condition was accomplished and we’ve got new high, but it was a bit lower – not 1.76 but 1.72. This was and is all time support/resistance area. Now we stand in final part of our journey. According to our 2013 analysis market should reach lows at 1.35 area. Let’s see what additional information we have right now.

Trend is bearish here, but GBP is not at oversold. Couple of months ago market has reached strong support area – Yearly Pivot support 1 and 5/8 major monthly Fib level. Market gradually struggling through YPS1 but it seems that first attempt to pass through it has failed. It means that we could meet meaningful pullback and already see it. Although in long term it will not mean the capitulation of the bears. This will be probably just temporal pullback, respect of support and correction after unsuccessful attempt to pass through support right on first challenge. CFTC data also tells on the same as we’ve discussed above.

New information here is downward thrust. Occasionally I’ve counted the number of bars there, and guys, it has 8 black candles. Theoretically this thrust is suitable for B&B “Sell” pattern. We do not mention DRPO, since we come to conclusion that current upside action is retracement and it can’t lead to appearing of DRPO on monthly chart. I’m not sure about B&B, it looks a bit shy on overall picture, but this pattern is definitely the one that we should monitor. Some of you were hurry to treat May candle as B&B, but right now we see that market has closed below 3x3 DMA and uncompleted B&B condition, since we didn’t get 3x3 DMA penetration. Right now, June month could fix it. Appearing of B&B harmonically build in our overall view of possible downward continuation.

Beyond B&B we have also bullish engulfing pattern that usually suggests upside development in the shape of AB-CD pattern on lower time frames.

In fact here we have just one major downward destination point. Monthly chart give us just single AB-CD pattern with nearest target at 0.618 extension – 1.3088.

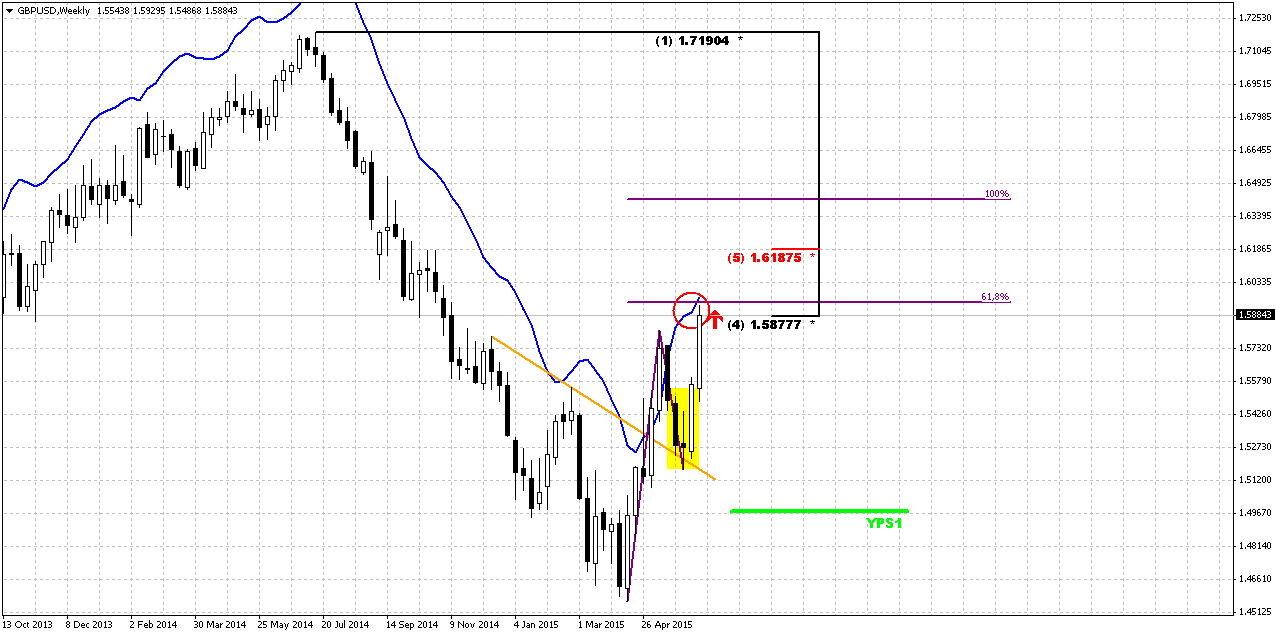

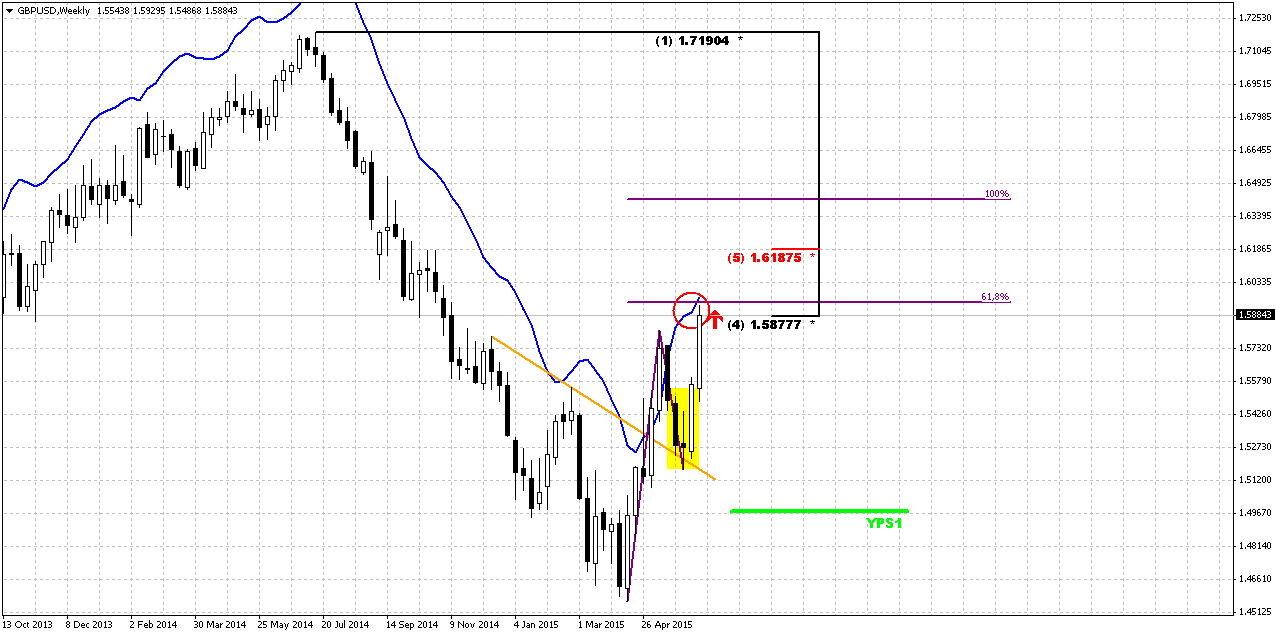

Weekly

Weekly chart right now is interesting as add-on of monthly B&B pattern. Last week cable has completed our analysis and reached predefined target, that is 1.60 area - minor 0.618 AB-CD target, weekly overbought and 50% Fib level. Morning star pattern that has confirmed support on re-tested trend line also has done well.

What important conditions B&B have? It suggests reaching of major Fib level within 3 closes above 3x3 DMA. June candle with high probability will close above 3x3 and market already has reached 50% level. At the same time B&B rules do not forbid market continue action, say, to 5/8 Fib resistance, because cable theoretically has 2 months in reserve to start B&B action down. So, it means that we do not know definitely whether market will re-establish bear trend right now or it will take 1-2 months more of upside action and B&B will start from higher level. Both scenarios are valid from B&B trading rules point of view. The difficulty also comes from reversal patterns that we have on daily chart. They point on possible downward action, but whether it will be reversal or temporal retracement?

Thus, our thought here is that we should try to take short position from 1.60 area. As cable stands at strong resistance – this is not just Fib resistance, this is also Agreement and weekly oversold. Odds suggest that market should show some respect of this area. If even this will not turn to B&B action – we should have enough time to protect our position with breakeven stops. Later, if market will continue upside action – we will be watching for next level, etc.

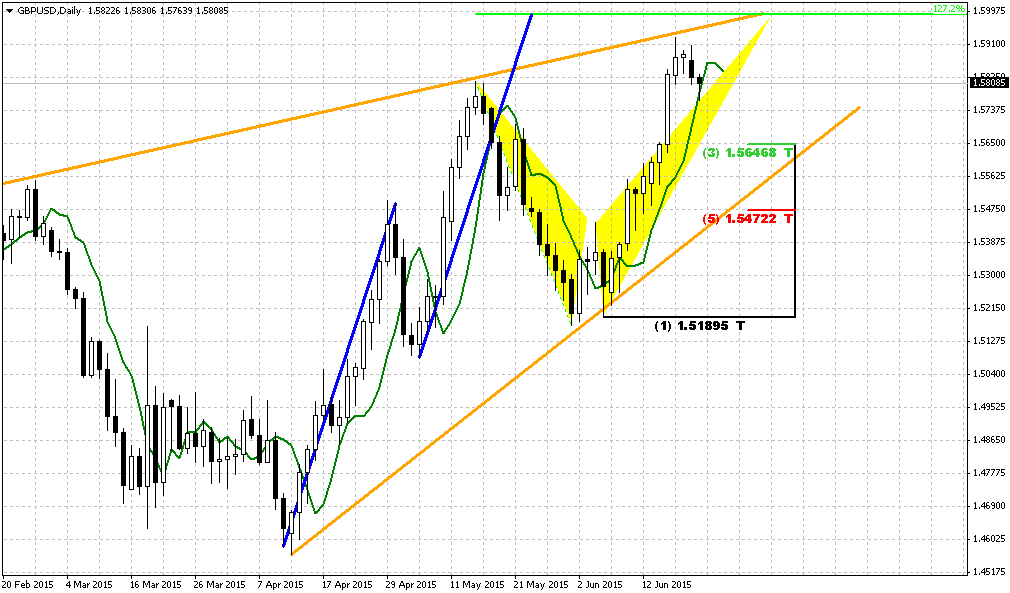

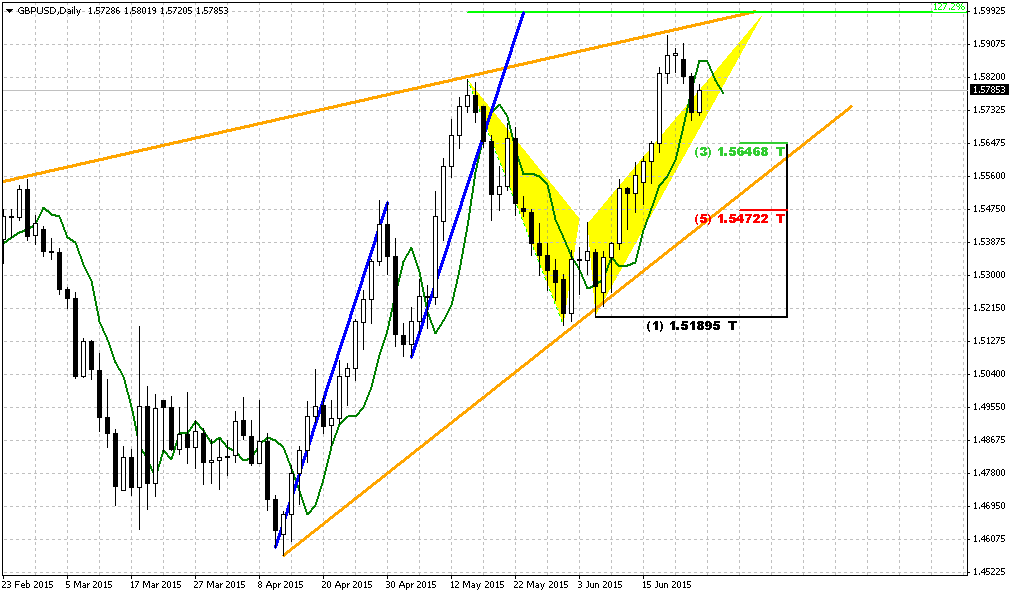

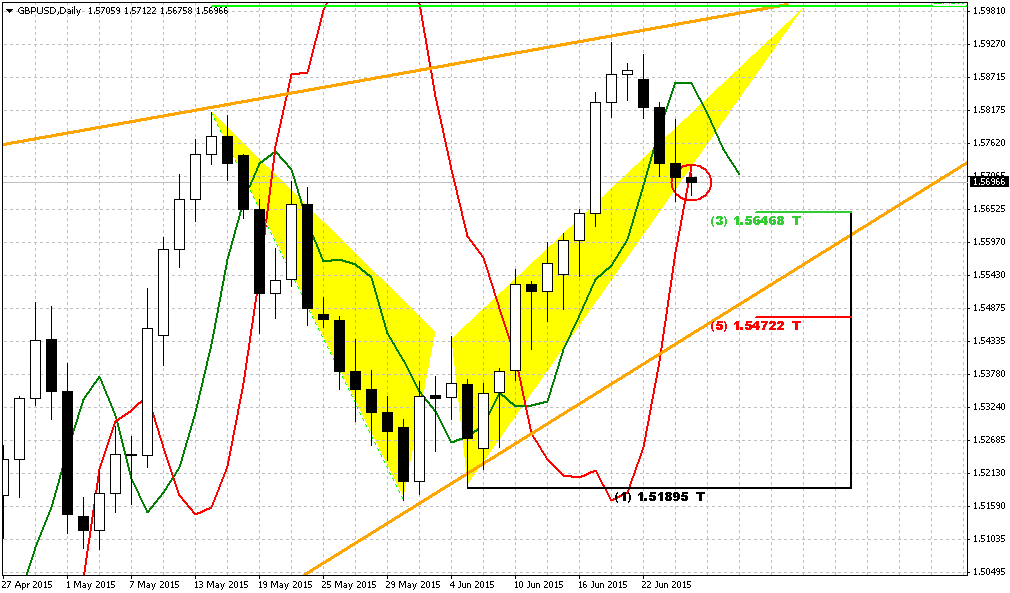

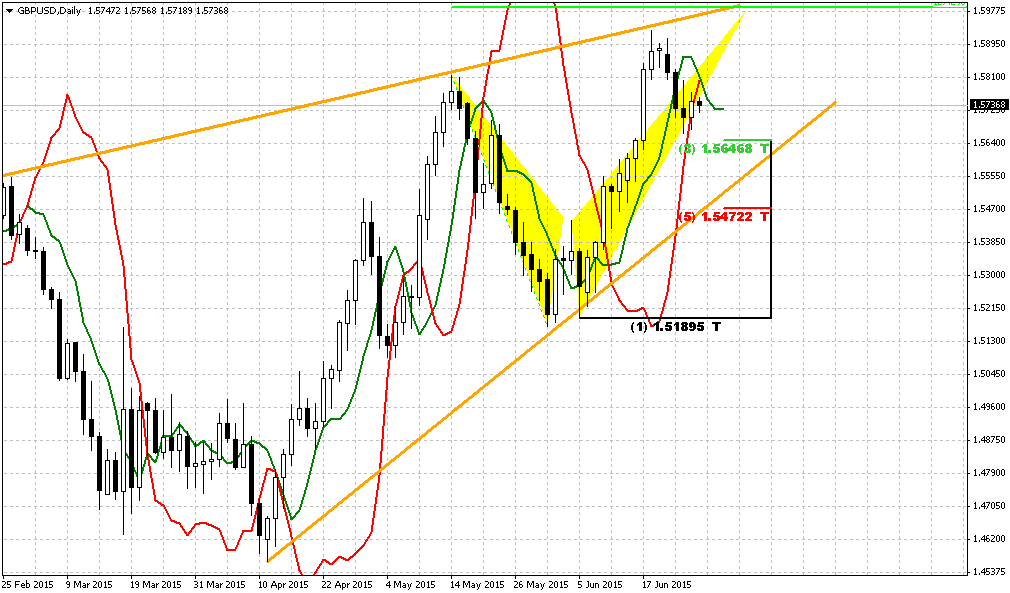

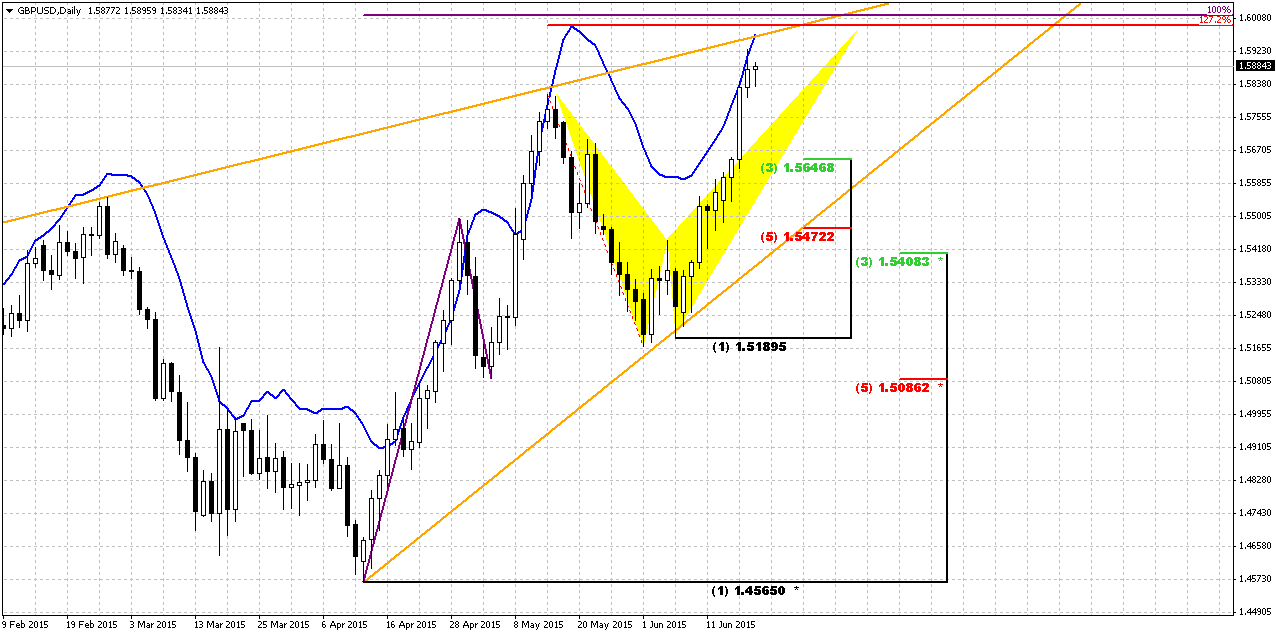

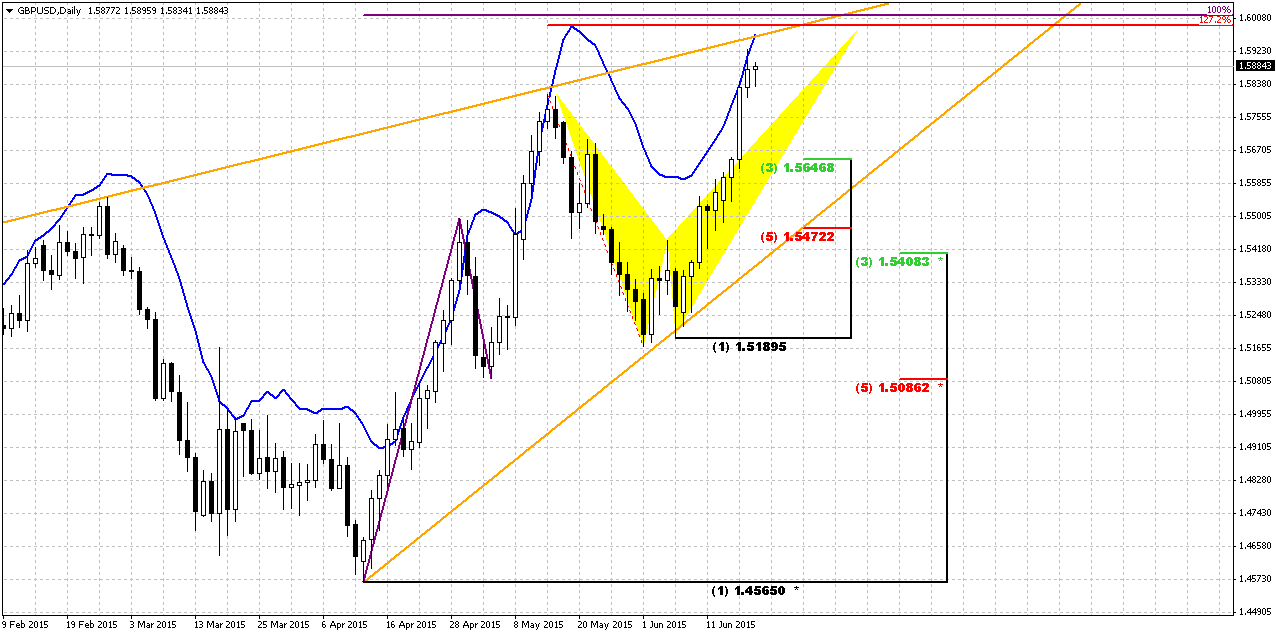

Daily

Daily chart has twofold meaning for us. First is, it points on how we could take short position and how will be better to do this. As you can see recently upside action mostly has stopped due meeting overbought. It has not completed major targets. It means that in the beginning of the week somehow it should continue upside action and reach as AB=CD target as complete Butterfly “Sell” 1.27 level. This should happen right around 1.60 area and this will be our signal for taking short position.

Second – take a look most recent upside thrust has 9 candles and is suitable for separate minor B&B “Buy” by itself. So, if market will show minor downward retracement on Monday, scalp traders could think about taking short-term long position with 1.60 target.

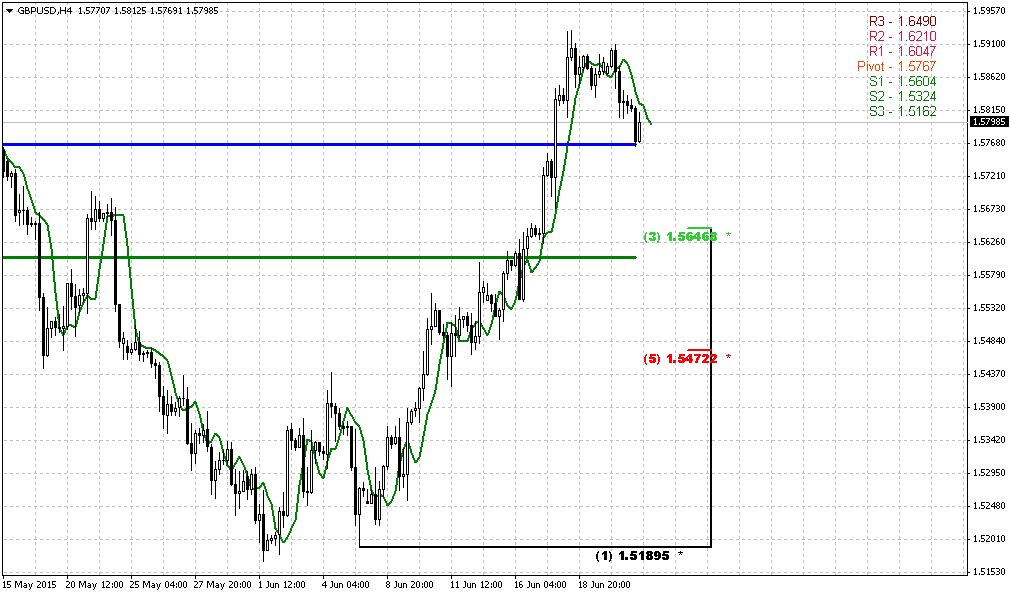

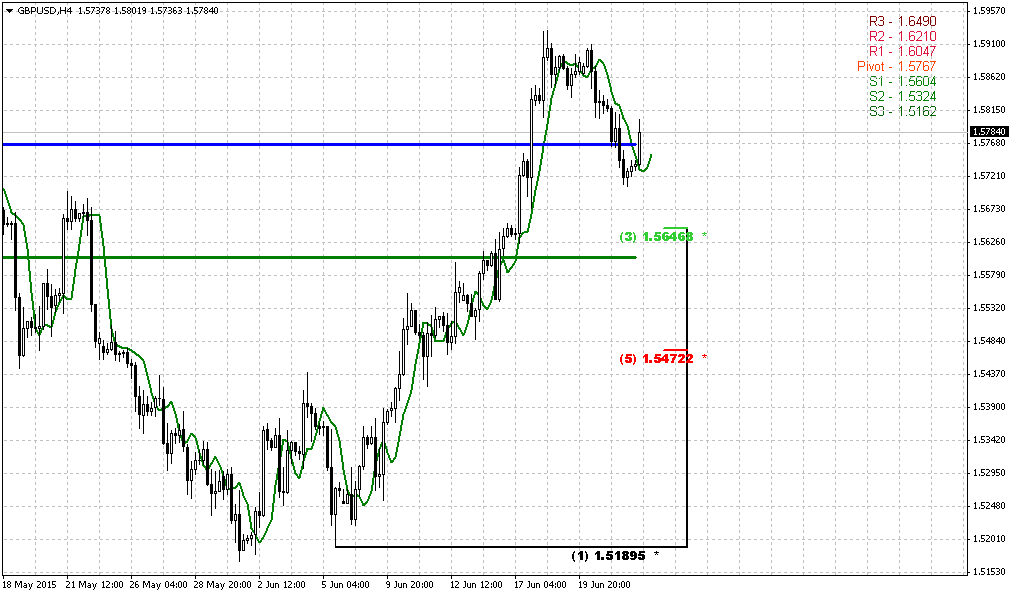

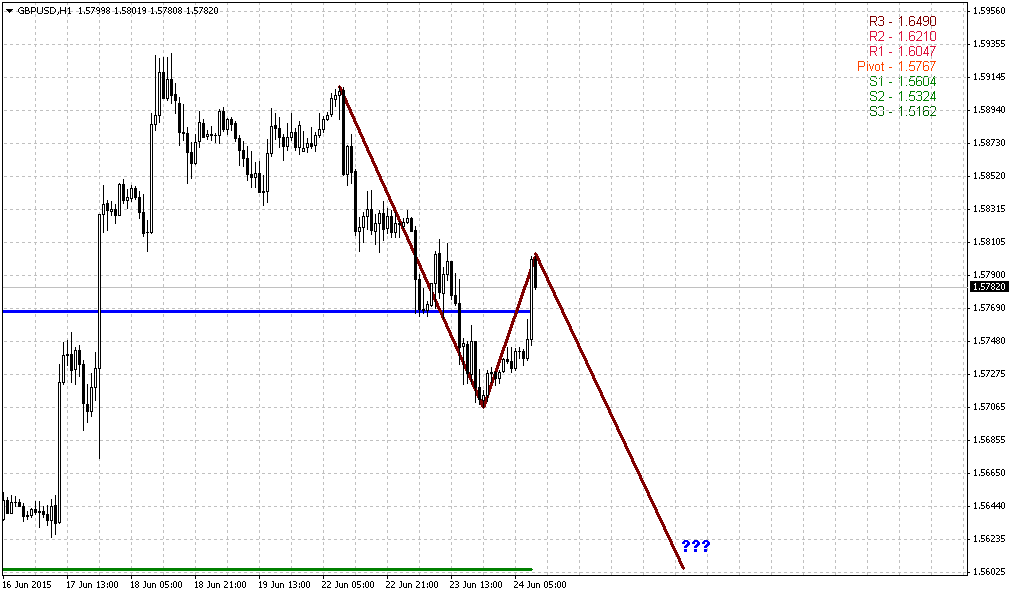

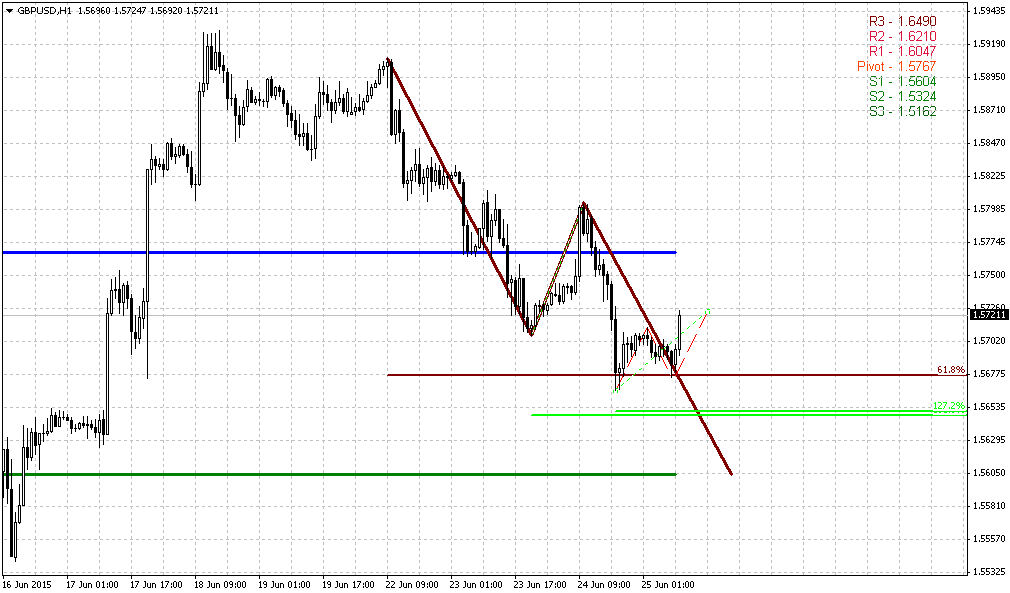

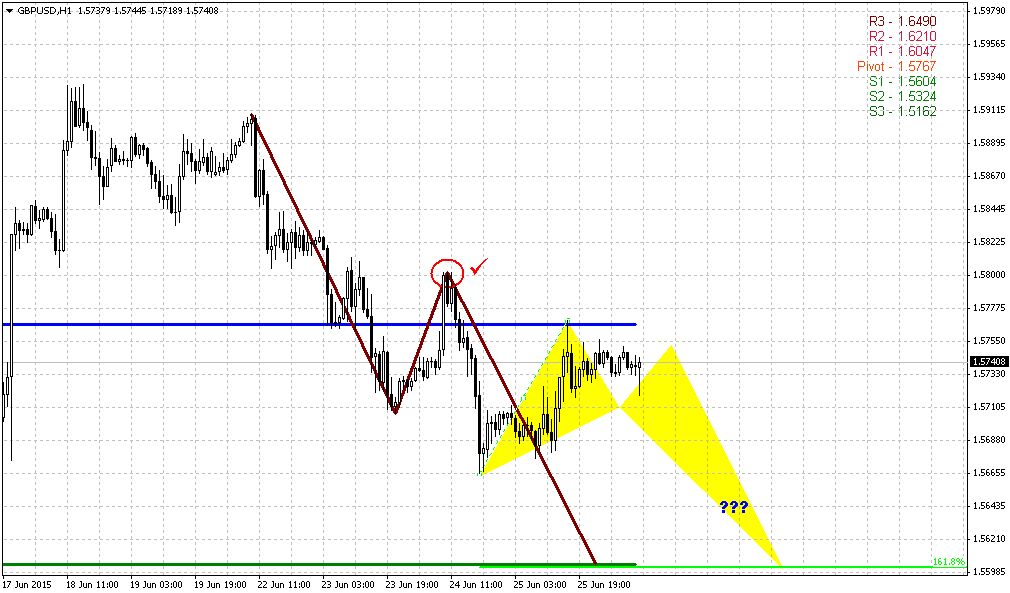

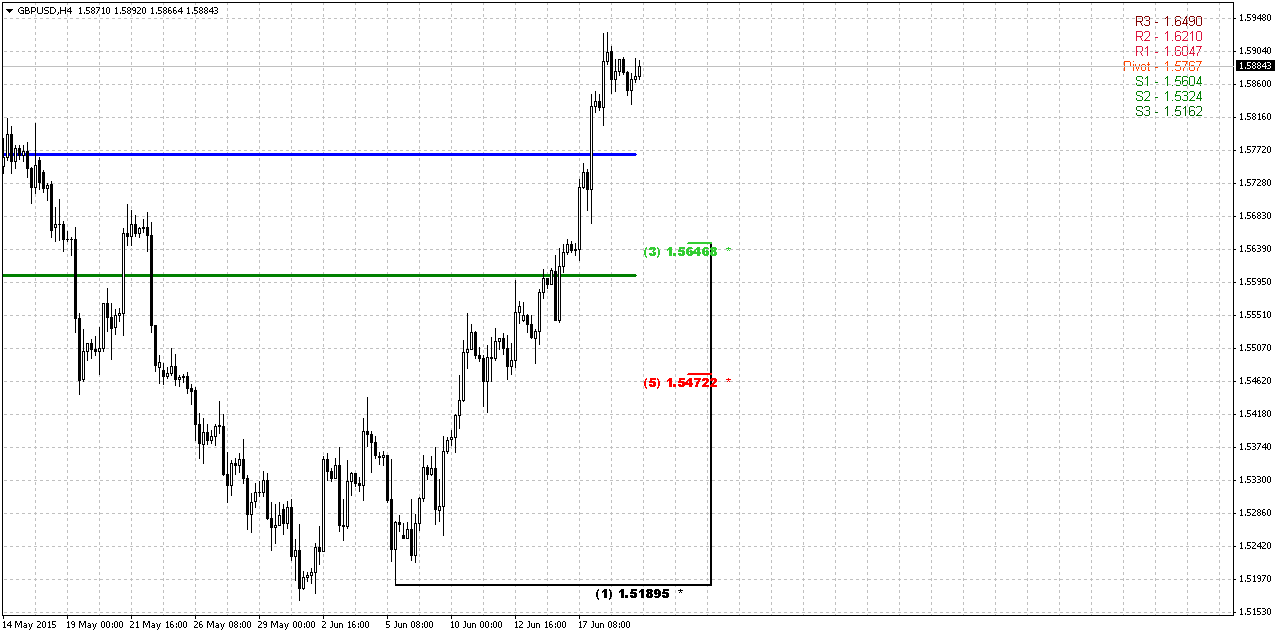

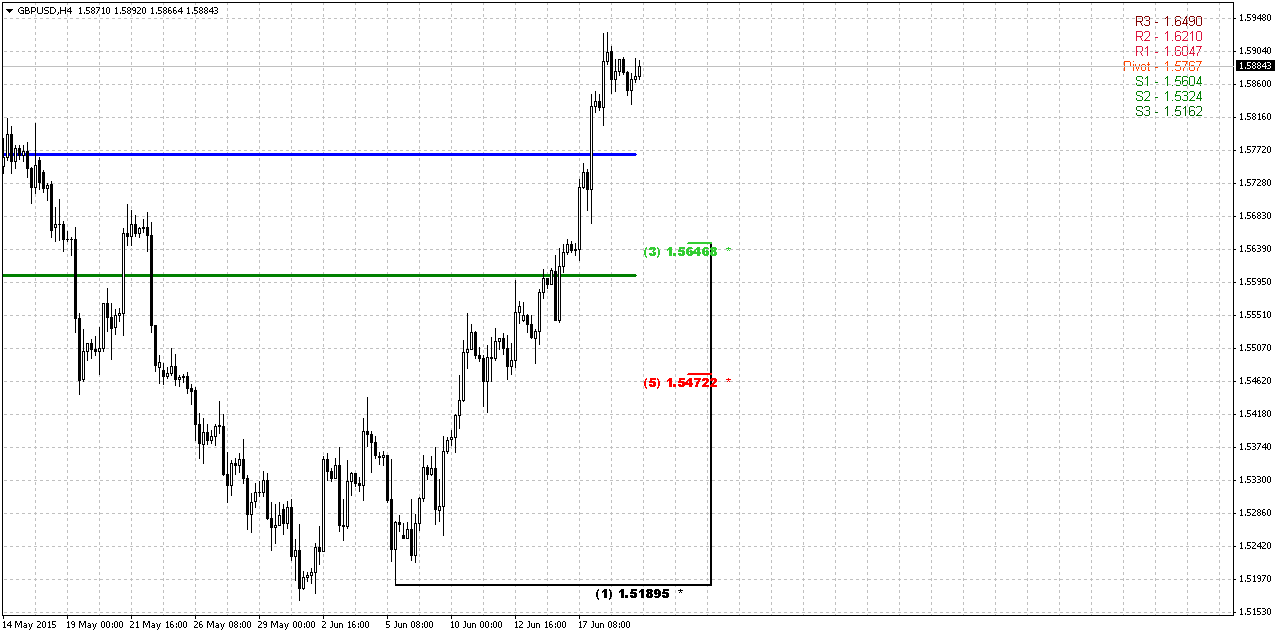

4-Hour

Now let’s talk on possible B&B. First of all – we can’t guarantee that it definitely will be formed. Market could stay for some time flat and then continue action to daily targets. But conditions that we have right now make possible its appearing – overbought and upside thrust suggest retracement. To get B&B we need rather deep retracement, since B&B rules suggest reaching of major Fib level of B&B thrust. First level stands at 1.5650 area and is accompanied by WPS1.

Theoretically reaching of this level agrees with bullish trend. Market is at overbought, hence, retracement should be deeper. At the same time, 3/8 Fib support is just 30% retracement. Also we know that WPS1 holds retracement on bullish trend. From that standpoint cable could reach 1.5650 and keep bullish trend intact. All that we need is just wait whether this will happen or not. If not – we will be watching for taking short position from 1.60 area, after daily targets will be hit.

Conclusion:

Long term picture and CFTC data suggest that current upside action is retracement. Currently we do not know where it will finish. This could happen as from 1.60 level as from higher one – major 5/8 Fib resistance.

At the same time GBP right now stands at strong weekly resistance area that includes AB-CD minor target, Fib level and overbought. Market also is forming reversal patterns on daily chart that agree with the same 1.60 area. This significantly increases chances if not on reversal but at least on meaningful bounce down. That’s why our analysis suggests taking short position around 1.60 level as soon as daily targets will be hit.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.

Reuters reports euro declined against other major currencies on Friday, weighed down by anxieties Greece may soon default on debts that also drove safe-haven buying of the dollar.

Greece is days away from potentially missing debt repayments of 1.6 billion euros to the International Monetary Fund, and investors are looking to an emergency meeting next week where euro zone leaders will try to find a way to unlock aid for Athens.

Germany, the biggest European contributor to bailout programs that have kept Greece afloat for five years, insisted it still was not too late for Athens to come to terms with its creditors at the EU and IMF.

The European Central Bank on Friday raised the ceiling on emergency liquidity that Greek banks can draw from the country's central bank for the second time this week, a banking source told Reuters.

Bankers told Reuters that about 4.2 billion euros had flooded out of Greek bank accounts this week despite central bank efforts to restore calm.

Versus sterling, which strategists say is something of a safe-haven, the euro fell as low as 71.22 pence , its weakest since May 28. It was last down 0.11 percent to 71.48 pence.

The euro was also lower against the Swiss franc and yen, both traditionally safe plays .

The dollar had been trading weakly since Wednesday, when Federal Reserve policymakers dulled expectations of imminent hikes in U.S. interest rates, but rose modestly on Friday.

"Greece remains highly combustible, and that's a recipe for dollar strength and risk aversion," said Richard Franulovich, senior currency strategist at Westpac in New York.

The dollar gave up early gains against the yen, hurt by a price rally in Treasuries debt that lowered U.S. bond yields. It last stood at 122.62 yen , off 0.28 percent.

The dollar has been rallying for nearly a year but this week was on track for a third consecutive week of losses. Some analysts still see the dollar climbing.

"When we get to where we can see the white of the eyes of the Fed rate hike, we will have a second wave of the dollar rally," said Greg Anderson, global head of FX strategy at BMO Capital Markets in New York.

We will not talk on EUR today because Greece and EU will take emergency meeting on 22nd of June, on Monday and will try to resolve difficult situation with Greece debt burden. Even banks in Greece could be closed in this day. As EUR right now is a hostage of solution on Greek debt and we can’t foresee the result, our analysis will have minor value. So let’s better take a look at GBP.

CFTC report shows significant changes compares to last week. Open interest has dropped but this decrease mostly was driven by hedgers’ position. Speculative positions mostly have not changed, while hedgers have decreased as longs as shorts. Currently it is difficult to find correct explanation why this is happening. The only conclusion that we could do here is the same – current action is retracement as it is accompanied by decreasing open interest. Probably sooner rather than later cable should turn down again.

Open interest:

Technicals

Monthly

Since our recent discussion GBP shows some important changes. In the beginning we continue to keep our long-term analysis that we’ve made in December 2013 in our Forex Military School Course, where we were learning Elliot Waves technique.

https://www.forexpeacearmy.com/forex-forum/forex-military-school-complete-forex-education-pro-banker/30110-chapter-16-part-v-trading-elliot-waves-page-7-a.html

Our long term analysis suggests first appearing of new high on 4th wave at ~1.76 level and then starting of last 5th wave down. First condition was accomplished and we’ve got new high, but it was a bit lower – not 1.76 but 1.72. This was and is all time support/resistance area. Now we stand in final part of our journey. According to our 2013 analysis market should reach lows at 1.35 area. Let’s see what additional information we have right now.

Trend is bearish here, but GBP is not at oversold. Couple of months ago market has reached strong support area – Yearly Pivot support 1 and 5/8 major monthly Fib level. Market gradually struggling through YPS1 but it seems that first attempt to pass through it has failed. It means that we could meet meaningful pullback and already see it. Although in long term it will not mean the capitulation of the bears. This will be probably just temporal pullback, respect of support and correction after unsuccessful attempt to pass through support right on first challenge. CFTC data also tells on the same as we’ve discussed above.

New information here is downward thrust. Occasionally I’ve counted the number of bars there, and guys, it has 8 black candles. Theoretically this thrust is suitable for B&B “Sell” pattern. We do not mention DRPO, since we come to conclusion that current upside action is retracement and it can’t lead to appearing of DRPO on monthly chart. I’m not sure about B&B, it looks a bit shy on overall picture, but this pattern is definitely the one that we should monitor. Some of you were hurry to treat May candle as B&B, but right now we see that market has closed below 3x3 DMA and uncompleted B&B condition, since we didn’t get 3x3 DMA penetration. Right now, June month could fix it. Appearing of B&B harmonically build in our overall view of possible downward continuation.

Beyond B&B we have also bullish engulfing pattern that usually suggests upside development in the shape of AB-CD pattern on lower time frames.

In fact here we have just one major downward destination point. Monthly chart give us just single AB-CD pattern with nearest target at 0.618 extension – 1.3088.

Weekly

Weekly chart right now is interesting as add-on of monthly B&B pattern. Last week cable has completed our analysis and reached predefined target, that is 1.60 area - minor 0.618 AB-CD target, weekly overbought and 50% Fib level. Morning star pattern that has confirmed support on re-tested trend line also has done well.

What important conditions B&B have? It suggests reaching of major Fib level within 3 closes above 3x3 DMA. June candle with high probability will close above 3x3 and market already has reached 50% level. At the same time B&B rules do not forbid market continue action, say, to 5/8 Fib resistance, because cable theoretically has 2 months in reserve to start B&B action down. So, it means that we do not know definitely whether market will re-establish bear trend right now or it will take 1-2 months more of upside action and B&B will start from higher level. Both scenarios are valid from B&B trading rules point of view. The difficulty also comes from reversal patterns that we have on daily chart. They point on possible downward action, but whether it will be reversal or temporal retracement?

Thus, our thought here is that we should try to take short position from 1.60 area. As cable stands at strong resistance – this is not just Fib resistance, this is also Agreement and weekly oversold. Odds suggest that market should show some respect of this area. If even this will not turn to B&B action – we should have enough time to protect our position with breakeven stops. Later, if market will continue upside action – we will be watching for next level, etc.

Daily

Daily chart has twofold meaning for us. First is, it points on how we could take short position and how will be better to do this. As you can see recently upside action mostly has stopped due meeting overbought. It has not completed major targets. It means that in the beginning of the week somehow it should continue upside action and reach as AB=CD target as complete Butterfly “Sell” 1.27 level. This should happen right around 1.60 area and this will be our signal for taking short position.

Second – take a look most recent upside thrust has 9 candles and is suitable for separate minor B&B “Buy” by itself. So, if market will show minor downward retracement on Monday, scalp traders could think about taking short-term long position with 1.60 target.

4-Hour

Now let’s talk on possible B&B. First of all – we can’t guarantee that it definitely will be formed. Market could stay for some time flat and then continue action to daily targets. But conditions that we have right now make possible its appearing – overbought and upside thrust suggest retracement. To get B&B we need rather deep retracement, since B&B rules suggest reaching of major Fib level of B&B thrust. First level stands at 1.5650 area and is accompanied by WPS1.

Theoretically reaching of this level agrees with bullish trend. Market is at overbought, hence, retracement should be deeper. At the same time, 3/8 Fib support is just 30% retracement. Also we know that WPS1 holds retracement on bullish trend. From that standpoint cable could reach 1.5650 and keep bullish trend intact. All that we need is just wait whether this will happen or not. If not – we will be watching for taking short position from 1.60 area, after daily targets will be hit.

Conclusion:

Long term picture and CFTC data suggest that current upside action is retracement. Currently we do not know where it will finish. This could happen as from 1.60 level as from higher one – major 5/8 Fib resistance.

At the same time GBP right now stands at strong weekly resistance area that includes AB-CD minor target, Fib level and overbought. Market also is forming reversal patterns on daily chart that agree with the same 1.60 area. This significantly increases chances if not on reversal but at least on meaningful bounce down. That’s why our analysis suggests taking short position around 1.60 level as soon as daily targets will be hit.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.