Sive Morten

Special Consultant to the FPA

- Messages

- 18,695

Fundamentals

Reuters reports ongoing Greek debt talks left currency markets in tight ranges on Friday while policymakers traded barbs in Brussels over the latest proposal for working out a debt deal between Athens and its official-sector creditors.

The euro fell below $1.12 after Greek Prime Minister Alexis Tsipras went on the offensive, seemingly pushing back against the latest offer from the International Monetary Fund, European Union and the European Central Bank.

"The immediate kneejerk reaction in the euro seems to be on the back of the Tsipras comments. But I don't want to oversell these moves because broadly I would expect these negotiations to be taking place right up until the 29th or 30th (of June)," said Richard Cochinos, head of Americas G10 FX strategy at Citi in New York.

"It will be going back and forth over the entire weekend and you cannot react too much to any one headline," he said.

Tsipras said the EU's founding principles were not based on blackmail and ultimatums.

Donald Tusk, the former Polish prime minister who chairs the Council of EU leaders, shot back that time creates pressures for Greek talks but not the euro zone, and that it would be easy to lose everything because of bad emotions.

"The comments are taking a little bit more of a contentious tone, which maybe means it is coming to a head," said Bill Samela, co-head of global FX trading at Bank of New York Mellon in New York.

An hour later the euro fell more to a three-week low of $1.1130. It last traded at $1.1163, off 0.37 percent on the day and down 1.65 percent for the week late in the New York session.

"It could be some position squaring ahead of the weekend, but this actual 30 pip drop is not fundamentally based upon anything. There were no headlines driving that move," said John Doyle, director of markets at Washington, D.C.-based Tempus Inc.

The Eurogroup of euro zone finance ministers on Friday rescheduled their talks on Saturday three hours earlier than planned.

"We may see a bit of a relief rally in the euro if there is a compromise at the weekend, but I would prefer to sell into those rallies, as there is still the case of monetary policy divergence between the euro zone and the United States," said Jeremy Stretch, head of currency strategy at CIBC World Markets.

Stretch was referring to expectation U.S. interest rates are poised to move higher while Europe and much of the rest of the world take rates in the opposite direction.

CFTC data mostly shows vast contraction of positions. Open interest has miserably dropped. Hedgers were closing as long as short positions. Speculative long positions have increased 2 weeks ago but last week also was contracted. It means that degree of clarity has decreased. If previously speculators saw some bullish signs, right now situation has become blur.

Open Interest:

Longs:

Longs:

Shorts:

Shorts:

So, Greece stands in first stage. I’m not a professional politician and not the best-class economist, but if you let me I bring my two cents on this question. I would like to share with you my logic that I see in most recent events on Greece problem. Right now Greece stands on crossroad. First way is default on debt, that will lead country to exit from EU, but it will bring it financial freedom. Greece will be able to return back to drachmas, print its own currency and get financial control over the country. This scenario does not suggest that social sphere will not get a crisis and will eliminate negative strike on social sphere. Vice versa – it will, but this impact will be controlled by Greece on its own, there will be no governing and regulating outside.

Second way – is to get temporal relief by injection of liquidity from EU, postpone talks on default for some time, put country in unpopular social reforms and remain financial vassal of EU with no financial freedom and no ability to control Greek financial system. Let’s try to find out in all this mess and foresee what will happen by most recent events.

Definitely Greece stands in some bargain with EU. We do not need to be genius to suggest that bargain mostly stands on reforms. Tsipras probably tries to eliminate and make softer some most radical social reforms. And the core of possible compromise probably will stand in a balance of reforms burden for Greece on one side and financial help on another. We can’t say more, because it is absolutely impossible for us to know what particular reforms EU and IMF demands and what Tsipras is trying to escape or make softer for Greece.

Now is about most recent events. Tsipras said that social reforms that IMF and EU demand will be put on national referendum and people will decide will they accept them or not. This is important, you will understand it below.

Here is my logic. What will happen if Greece will accept IMF/EU conditions and choose second scenario? They will avoid default for some time, till next payment probably. Greece will stay in financial slavery with EU Central Bank. They will bring awful social spending contraction and hit least protected part of citizens – pensioners, unemployed etc. This will be end for Syriza and Tsipras as prime minister. People will not forgive them new spiral of poverty and economy collapse. Besides, this scenario drastically contradicts with promises and pre-election agitation of Syriza party. Besides, these reforms will not bring freedom and prosperity to Greece – not now, not in the future. Because Greece will not be financially independent, remember? It is easy to understand EU here. They need controlled Greece, with loyal government. Syriza does not match this quality and they need to sweep them out from control over the country. This will be fatal strike from EU. Besides, everybody knows that if IMF comes – this is national tragedy and total destruction of economy, social sphere etc. That already has happened in Eastern Europe and many other countries. Besides, this will lead to social turmoil. Greek could ask reasonable question – what for we should suffer this? They will withdraw our debt? No. Why we need these reforms if this will not improve our economy, will not withdraw debt? Why we could decide it by ourselves what expenses to contract and how to do this? I think that this deadlock for Greece.

So, is first scenario of default better? Let’s see. On political sphere Syriza could take the role of such a “Rebel” and struggler for Greece independence from EU oppressors. This will correspond to their election promises and campaign. Demarche probably will lead to some rising of national morale. People will understand that tough times are coming, but they also will understand why they will have to suffer a bit. There will be the hope on better future. Greece will get financial freedom; will be governed by its own government and central bank and totally control financial system. They could take independent external policy. Greece has perspective on external arena, for example “Turkish stream”, gas pipeline to EU. They will not need to keep EU sanctions against Russia for example, they could start mutual relations with Iran that mostly needs food, common consumption goods etc and they could trade it for gas and oil. So a lot of vectors of external policy could be opened that right now are closed.

Both scenarios will keep debt burden on Greece but Greece role could be different. Now, let’s return back to referendum. I think that this confirms the thought that Tsipras has chosen scenario with default. EU and Greece were talking very long time. If Greece would get relief in reforms that it would like to get – they would have accepted EU proposal. As they haven’t done it, and announced referendum, it means that they didn’t get any relief from EU and IMF.

Referendum is a way to debt default. Because People just recently have elected Syriza, people protest against EU reforms and slavery that EU Central bank brings. Referendum also is an attempt to keep Syriza future and get carte-blanche on default demarche. Place yourself instead – what would you prefer, get tough times but control situation by yourself, or get the same tough times but be controlled by somebody else?

So, guys, if I would be a gambler, I would take a bet on Greece default or at least on some significant relief on reforms from EU on Monday negotiations. But I’m not the one, so before taking any trade on EUR, I would probably wait for Monday results.

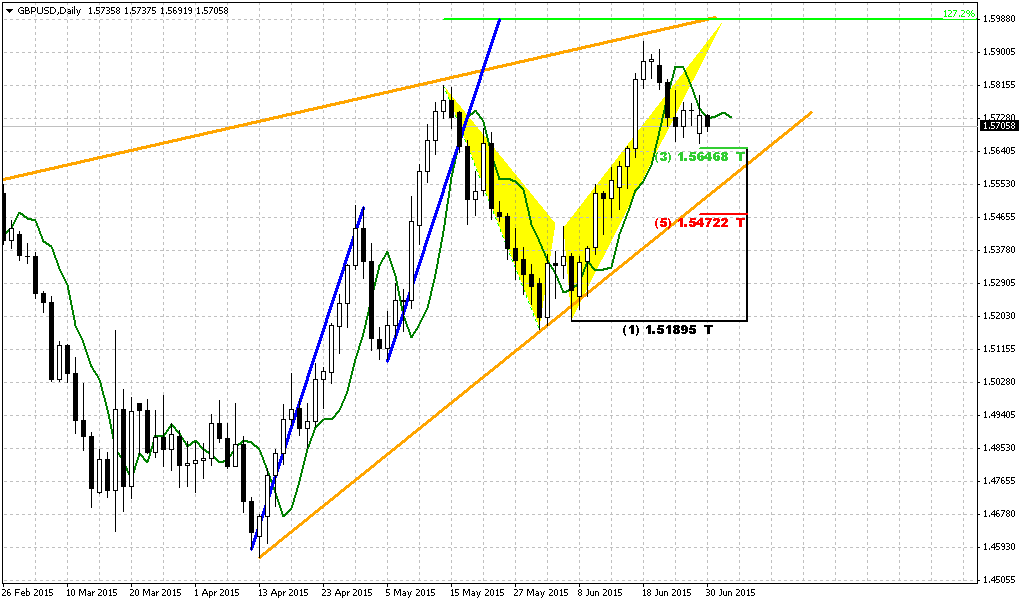

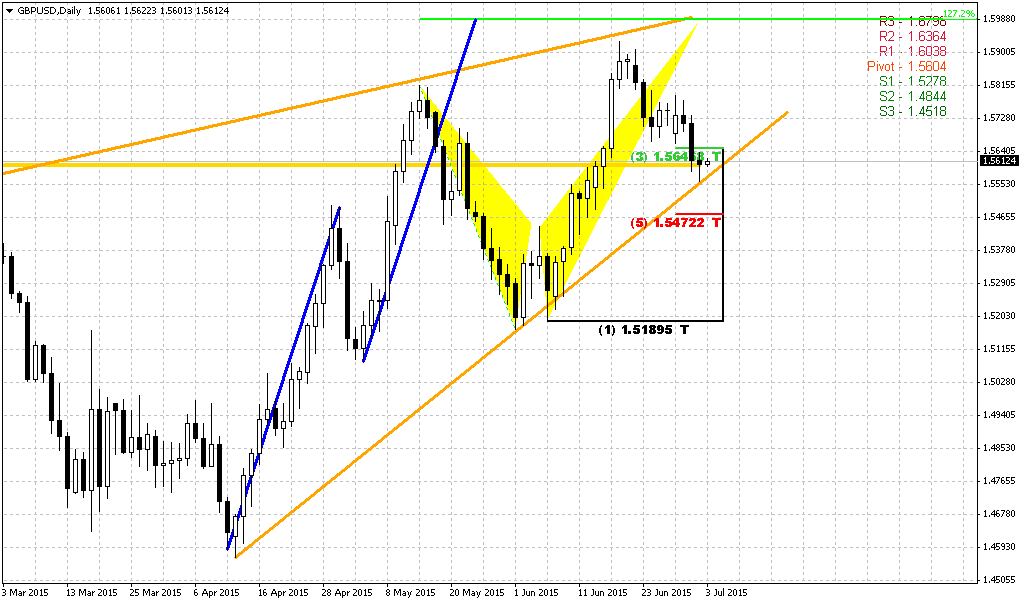

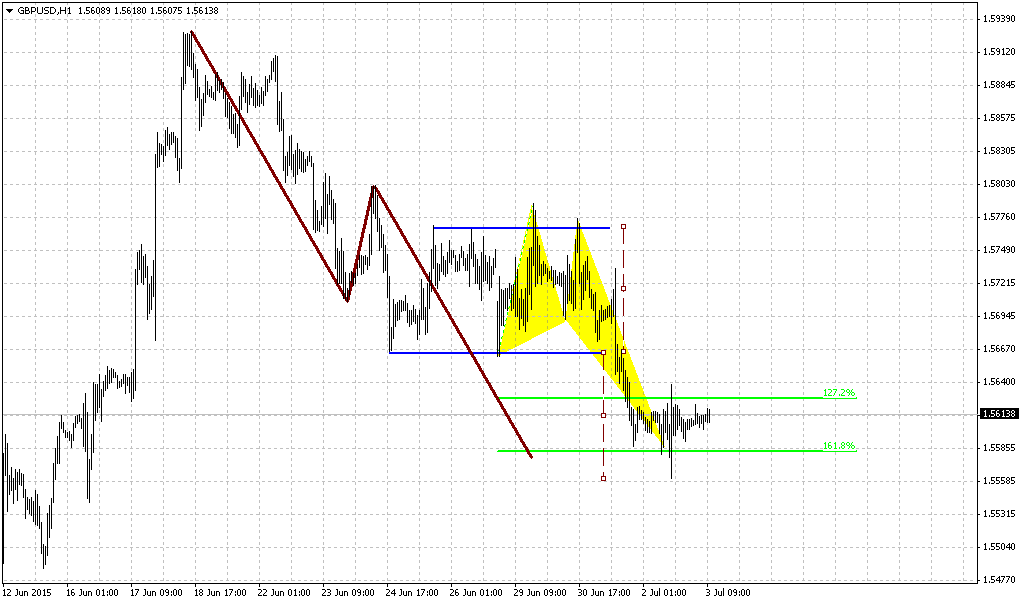

Technicals

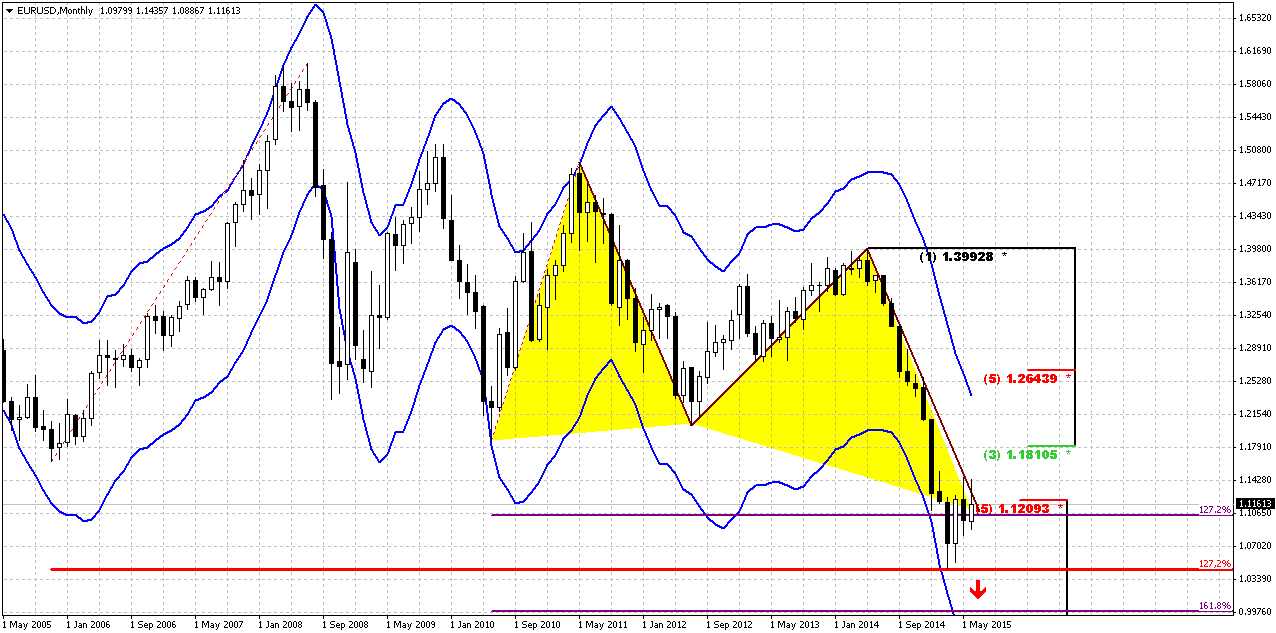

Monthly

Technical picture right now is secondary issue, until situation around Greek debt will be resolved. Still, as we have estimated previously 1.05 is 1.27 extension of huge upside swing in 2005-2008 that also has created large & wide butterfly pattern. Recent action does not quite look like normal butterfly wing, but extension is valid and 1.05 is precisely 1.27 ratio. At the same time we have here another supportive targets, as most recent AB=CD, oversold and 1.27 of recent butterfly.

April has closed and confirmed nicely looking bullish engulfing pattern. We know that most probable target of this pattern is length of the bars counted upside. This will give us approximately 3/8 Fib resistance 1.1810 area. Could we call this situation as “Stretch”? By features probably yes, since market is oversold at support, but by letter not quite, since 1.12 level mostly was broken and the area where market stopped was not a Fib level. Still, applying here Stretch target (middle between OB and OS bands) we will get an area of 50% resistance of most recent swing down around 1.22 area. But most recent action, guys, makes us worry for perspective of upside retracement. After engulfing pattern been formed, EUR can’t turn to upside action within 2 months and can’t pass through 1.1450 area. This is not good sign for bulls. Of cause, we expect downward continuation as we’ve said, but previously we’ve thought that it will happen after upside retracement.

Now about our recent talk on possible B&B or DRPO here. We’ve said that B&B seems more probable. Currently June close price stands above 3x3 DMA, it is a question whether final June close will be above 3x3 DMA and definitely market will not reach 1.18 Fib resistance. So we will keep watching for DiNapoli directional patterns but probably they will appear not as fast as we have expected.

Still, our next long-term target stands the same – parity as 1.618 completion point of recent butterfly. Currently we should treat this bounce up, even to 1.22 area, only as retracement within bear trend. Yes, tactically fundamentals have become weaker in US with dovish recent Fed comments, and open door for pause in bearish trend, but overall picture has not changed drastically yet.

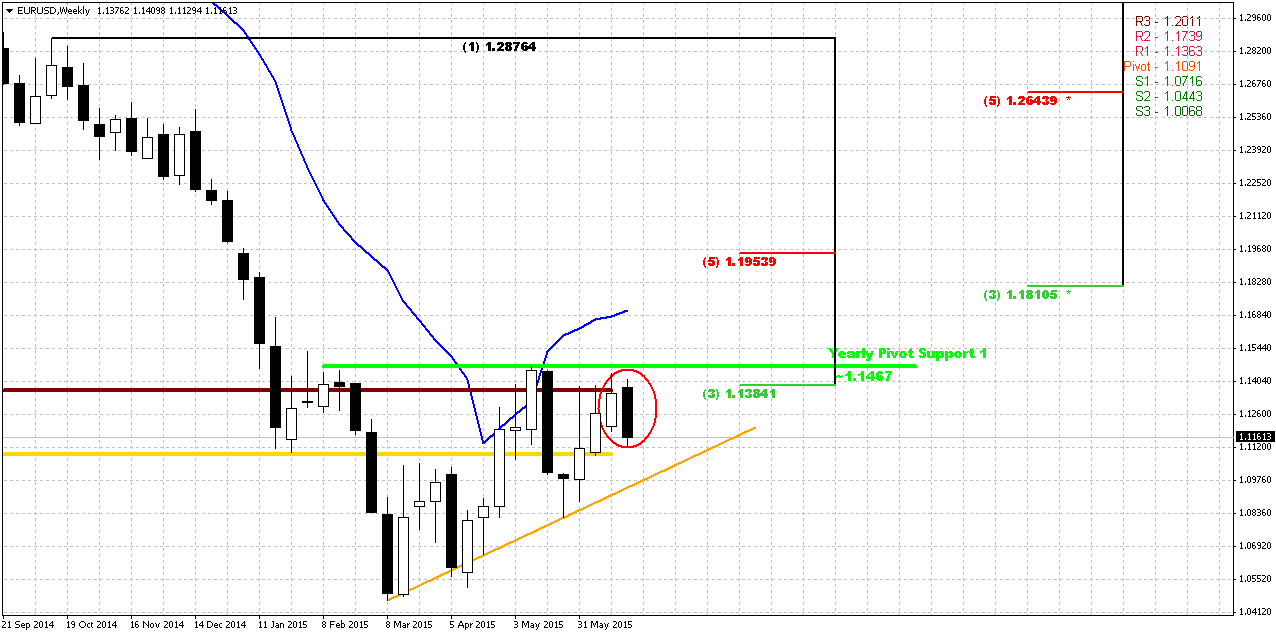

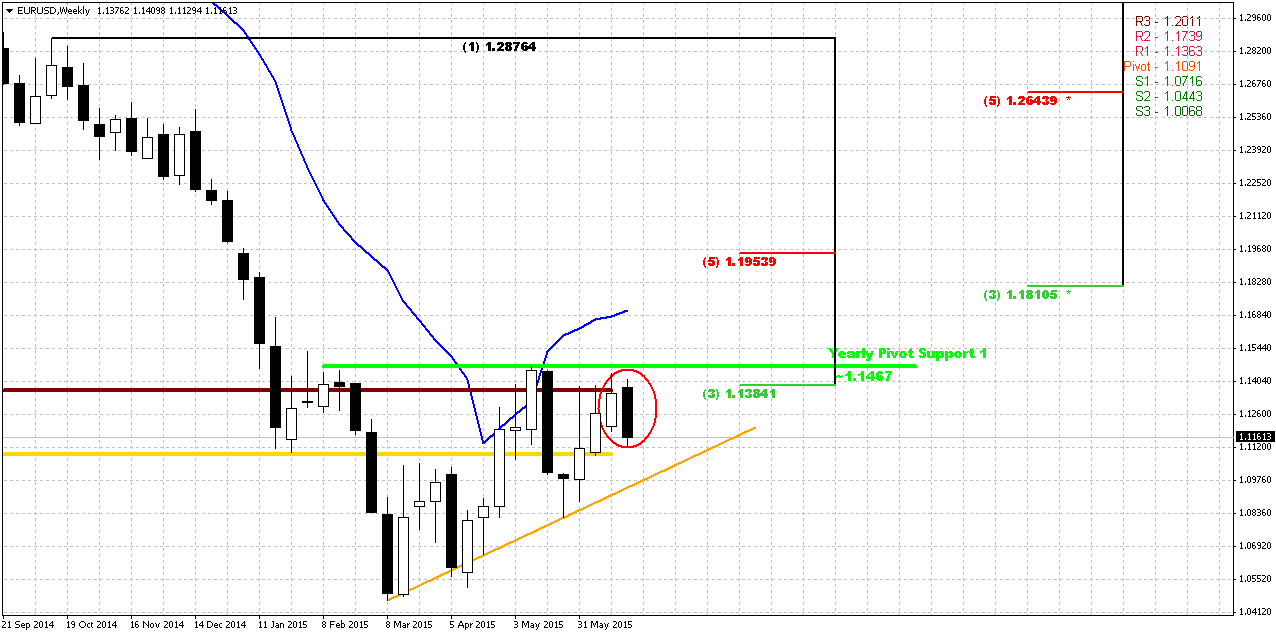

Weekly

Trend is bullish on weekly chart but technical picture significantly has changed here. Previous bounce down was absolutely logical, since EUR has met Fib resistance, MPS1 former YPS1 and overbought. Right now we’ve got another bearish engulfing pattern at the same place, but market is not overbought any more. Previous bearish engulfing is also valid. Since 1.1450 shows itself as strong resistance and our next target is 1.18-1.1950 K-resistance, it would be better to take long position if EUR will break through 1.15 area. For those of you, who would like to trade EUR short – you could try to take position on candlestick patterns. Or, second scenario, wait for downward breakout of 1.08 level. This probably will destroy any potential patterns, such as butterfly “Sell” or may be even H&S and will lead to further weakness of EUR. Market even could shift to butterfly “Buy” pattern with 1.618 extension at the same level – parity. You could draw it by yourself, probably.

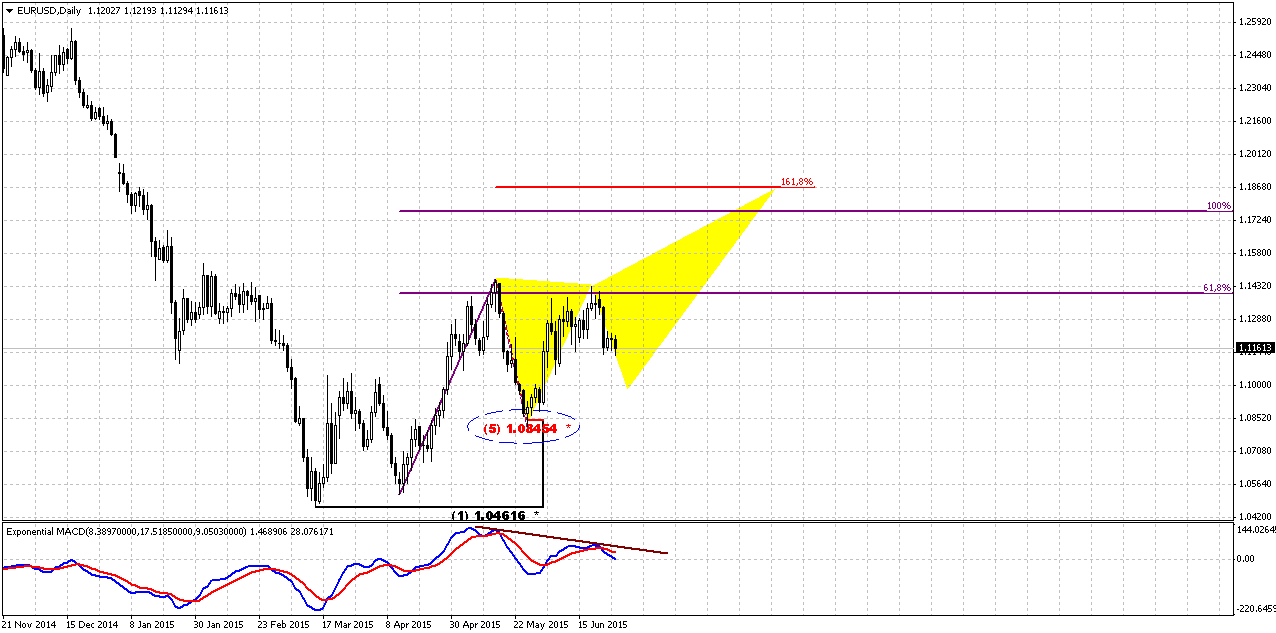

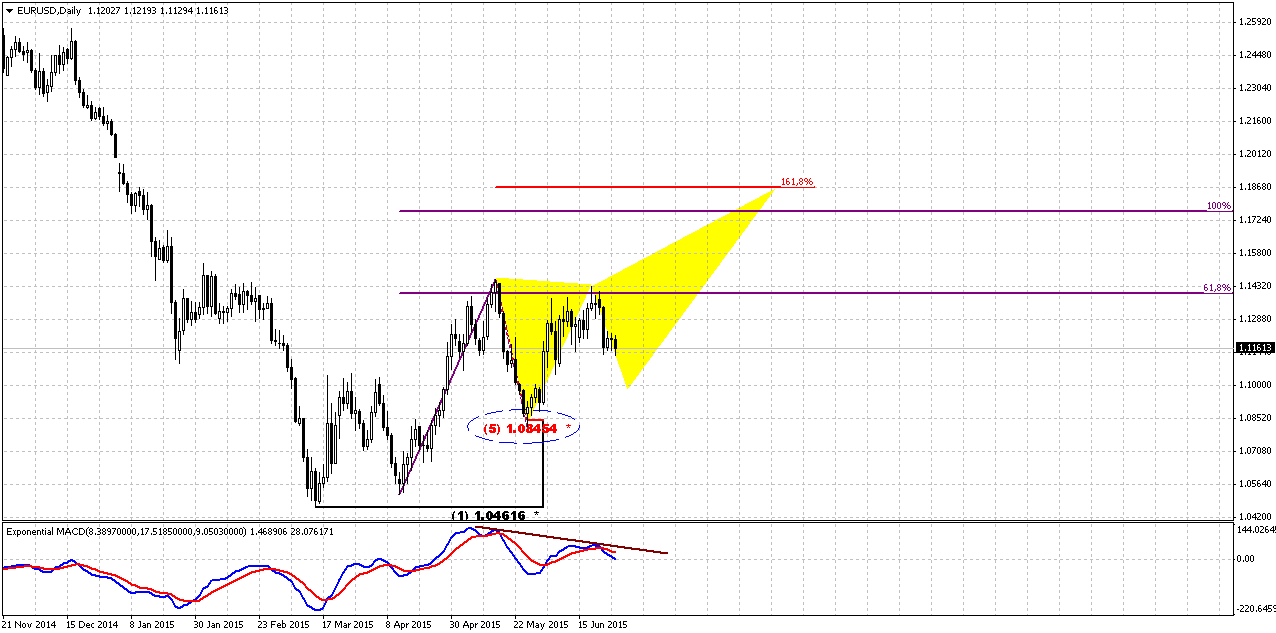

Daily

So, as fundamentally Greece keeps valid both scenarios, technical picture as well corresponds it and also could turn to different directions. There are two major levels on daily chart that we have to monitor on coming week. First one is 1.1450. We see that this is not just strong resistance, but also minor AB-CD target. Current move down technically looks absolutely natural, since this is minor retracement after 0.618 target has been completed. If market will move above 1.1450, it will keep valid AB-CD and could start butterfly “Sell”. Both patterns have the same target around 1.18. We’ve mentioned this level on weekly and monthly chart as well. This scenario could launch monthly B&B “Sell” pattern. But to be honest, guys, I do not believe much in this perspective, mostly because I’m not sure on Greece debt peaceful solution.

Second level is 1.08. Moving below this level will cancel as butterfly as current AB-CD and could put the starting point for long-term move to parity. Currently we also have some kind of bearish divergence with MACD right at strong resistance level. Besides, overall action looks like triangle or pennant on higher time frame charts. Anyway, we call for patience. Do not hurry to take trade here, wait for clarity.

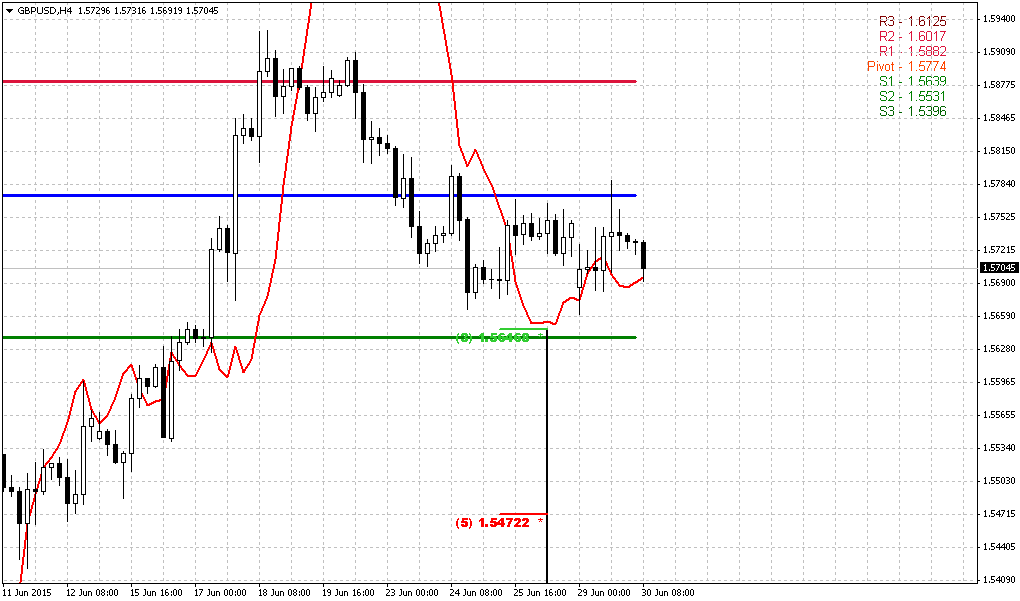

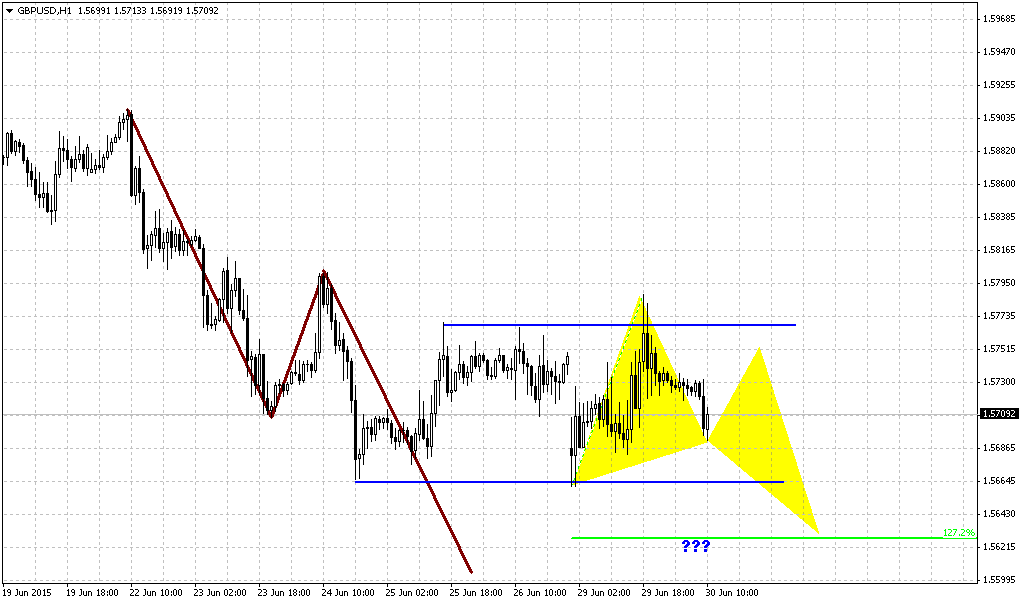

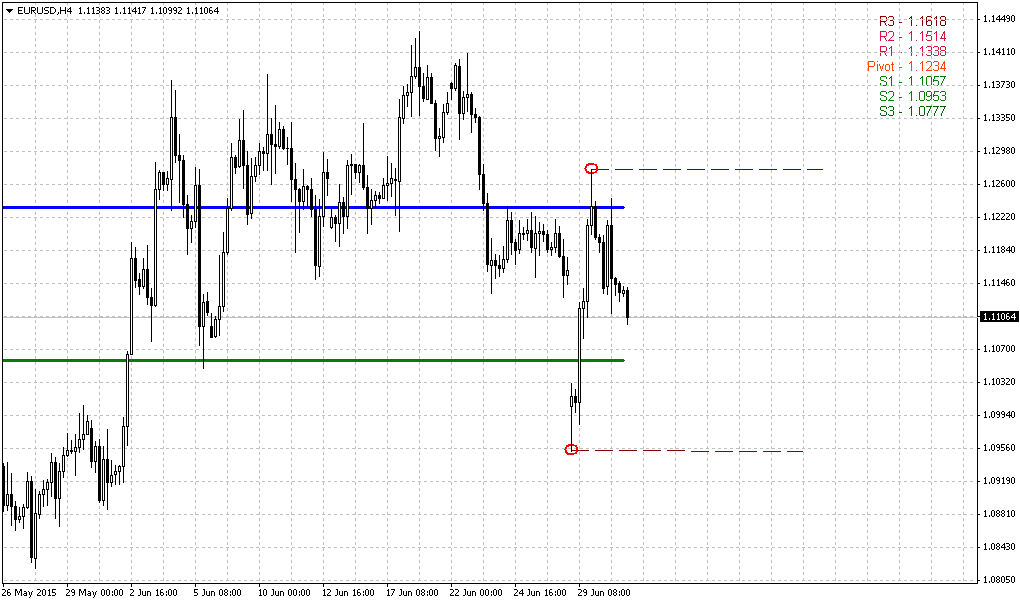

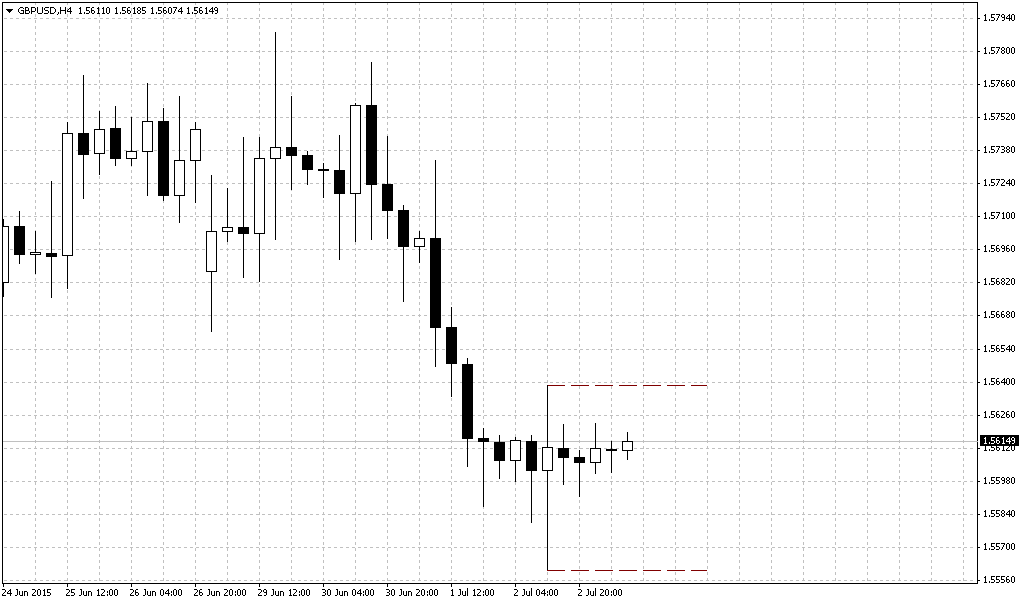

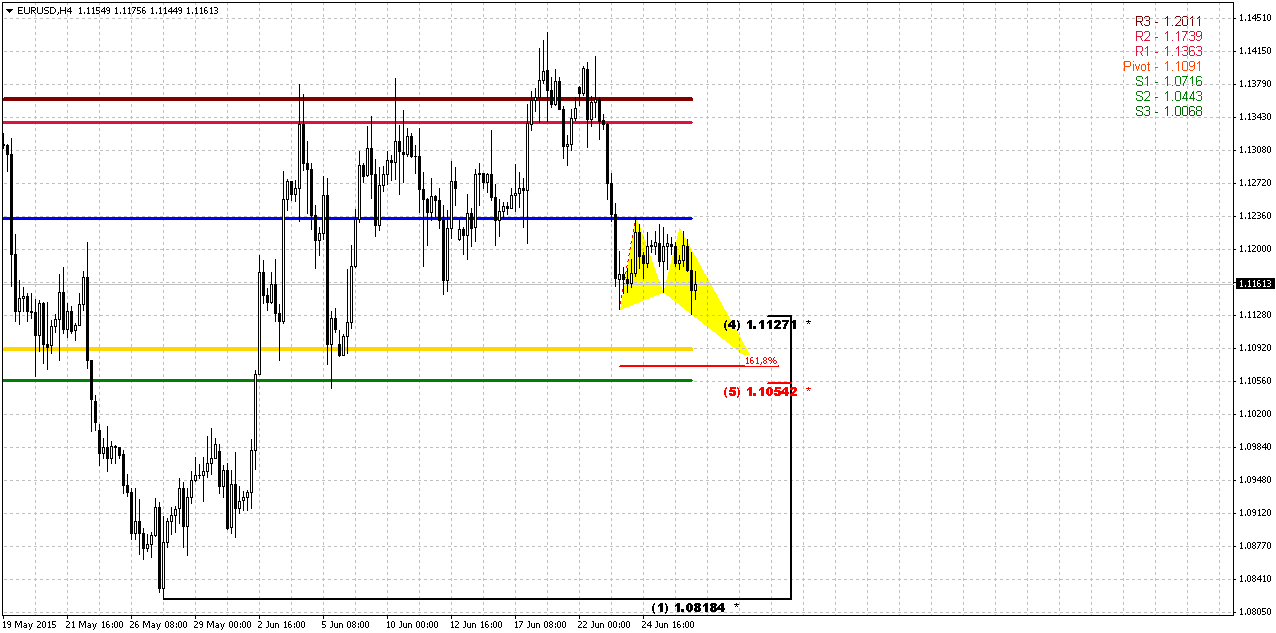

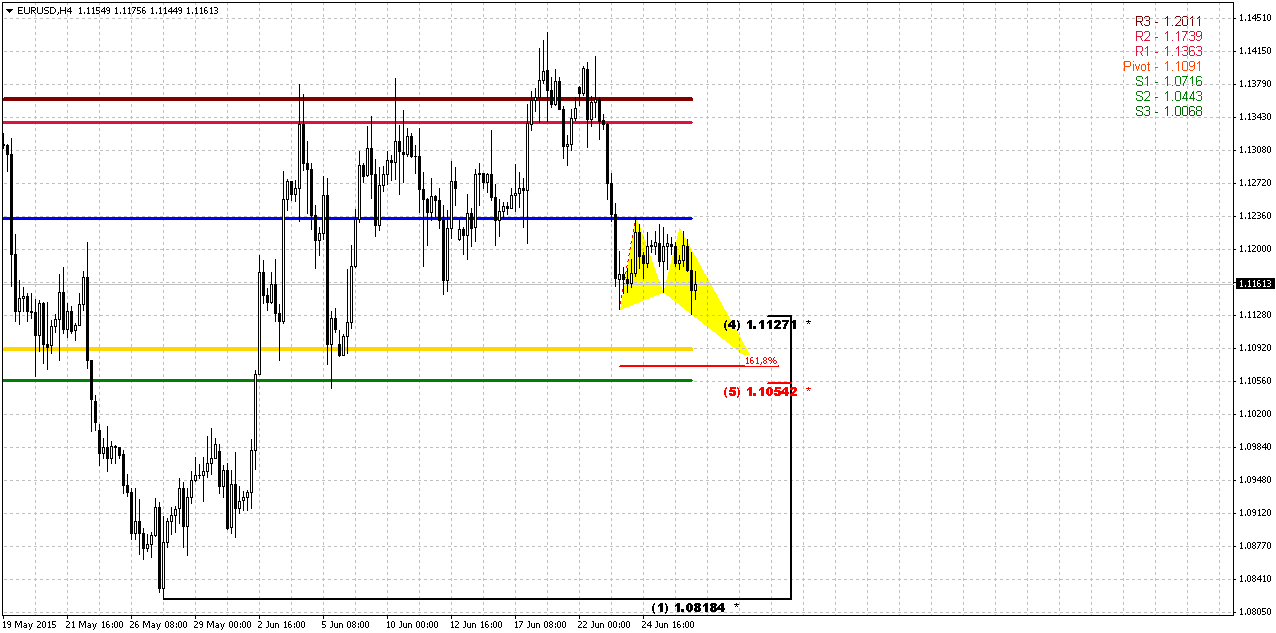

4-Hour

Since till breakout of either 1.1450 or 1.08 will spend considerable period of time, on Monday we could monitor retracement down. There is strong support cluster around 1.1050-1.1130 that includes Fib levels, MPP, WPS1 and potential target of butterfly “Buy”. If EUR really intends to move higher or take another attempt to break through 1.1450, it probably should stop downward action here, at least temporary. If not, and market will pass through it, then there will be minimal chances that 1.08 will survive.

Conclusion:

Currently chances on retracement to 1.18-1.20 area are still exist, but mostly it will depend on political decision on Greek debt. Technically we will be able to estimate further direction by watching for 2 levels – 1.1450 and 1.08.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.

Reuters reports ongoing Greek debt talks left currency markets in tight ranges on Friday while policymakers traded barbs in Brussels over the latest proposal for working out a debt deal between Athens and its official-sector creditors.

The euro fell below $1.12 after Greek Prime Minister Alexis Tsipras went on the offensive, seemingly pushing back against the latest offer from the International Monetary Fund, European Union and the European Central Bank.

"The immediate kneejerk reaction in the euro seems to be on the back of the Tsipras comments. But I don't want to oversell these moves because broadly I would expect these negotiations to be taking place right up until the 29th or 30th (of June)," said Richard Cochinos, head of Americas G10 FX strategy at Citi in New York.

"It will be going back and forth over the entire weekend and you cannot react too much to any one headline," he said.

Tsipras said the EU's founding principles were not based on blackmail and ultimatums.

Donald Tusk, the former Polish prime minister who chairs the Council of EU leaders, shot back that time creates pressures for Greek talks but not the euro zone, and that it would be easy to lose everything because of bad emotions.

"The comments are taking a little bit more of a contentious tone, which maybe means it is coming to a head," said Bill Samela, co-head of global FX trading at Bank of New York Mellon in New York.

An hour later the euro fell more to a three-week low of $1.1130. It last traded at $1.1163, off 0.37 percent on the day and down 1.65 percent for the week late in the New York session.

"It could be some position squaring ahead of the weekend, but this actual 30 pip drop is not fundamentally based upon anything. There were no headlines driving that move," said John Doyle, director of markets at Washington, D.C.-based Tempus Inc.

The Eurogroup of euro zone finance ministers on Friday rescheduled their talks on Saturday three hours earlier than planned.

"We may see a bit of a relief rally in the euro if there is a compromise at the weekend, but I would prefer to sell into those rallies, as there is still the case of monetary policy divergence between the euro zone and the United States," said Jeremy Stretch, head of currency strategy at CIBC World Markets.

Stretch was referring to expectation U.S. interest rates are poised to move higher while Europe and much of the rest of the world take rates in the opposite direction.

CFTC data mostly shows vast contraction of positions. Open interest has miserably dropped. Hedgers were closing as long as short positions. Speculative long positions have increased 2 weeks ago but last week also was contracted. It means that degree of clarity has decreased. If previously speculators saw some bullish signs, right now situation has become blur.

Open Interest:

So, Greece stands in first stage. I’m not a professional politician and not the best-class economist, but if you let me I bring my two cents on this question. I would like to share with you my logic that I see in most recent events on Greece problem. Right now Greece stands on crossroad. First way is default on debt, that will lead country to exit from EU, but it will bring it financial freedom. Greece will be able to return back to drachmas, print its own currency and get financial control over the country. This scenario does not suggest that social sphere will not get a crisis and will eliminate negative strike on social sphere. Vice versa – it will, but this impact will be controlled by Greece on its own, there will be no governing and regulating outside.

Second way – is to get temporal relief by injection of liquidity from EU, postpone talks on default for some time, put country in unpopular social reforms and remain financial vassal of EU with no financial freedom and no ability to control Greek financial system. Let’s try to find out in all this mess and foresee what will happen by most recent events.

Definitely Greece stands in some bargain with EU. We do not need to be genius to suggest that bargain mostly stands on reforms. Tsipras probably tries to eliminate and make softer some most radical social reforms. And the core of possible compromise probably will stand in a balance of reforms burden for Greece on one side and financial help on another. We can’t say more, because it is absolutely impossible for us to know what particular reforms EU and IMF demands and what Tsipras is trying to escape or make softer for Greece.

Now is about most recent events. Tsipras said that social reforms that IMF and EU demand will be put on national referendum and people will decide will they accept them or not. This is important, you will understand it below.

Here is my logic. What will happen if Greece will accept IMF/EU conditions and choose second scenario? They will avoid default for some time, till next payment probably. Greece will stay in financial slavery with EU Central Bank. They will bring awful social spending contraction and hit least protected part of citizens – pensioners, unemployed etc. This will be end for Syriza and Tsipras as prime minister. People will not forgive them new spiral of poverty and economy collapse. Besides, this scenario drastically contradicts with promises and pre-election agitation of Syriza party. Besides, these reforms will not bring freedom and prosperity to Greece – not now, not in the future. Because Greece will not be financially independent, remember? It is easy to understand EU here. They need controlled Greece, with loyal government. Syriza does not match this quality and they need to sweep them out from control over the country. This will be fatal strike from EU. Besides, everybody knows that if IMF comes – this is national tragedy and total destruction of economy, social sphere etc. That already has happened in Eastern Europe and many other countries. Besides, this will lead to social turmoil. Greek could ask reasonable question – what for we should suffer this? They will withdraw our debt? No. Why we need these reforms if this will not improve our economy, will not withdraw debt? Why we could decide it by ourselves what expenses to contract and how to do this? I think that this deadlock for Greece.

So, is first scenario of default better? Let’s see. On political sphere Syriza could take the role of such a “Rebel” and struggler for Greece independence from EU oppressors. This will correspond to their election promises and campaign. Demarche probably will lead to some rising of national morale. People will understand that tough times are coming, but they also will understand why they will have to suffer a bit. There will be the hope on better future. Greece will get financial freedom; will be governed by its own government and central bank and totally control financial system. They could take independent external policy. Greece has perspective on external arena, for example “Turkish stream”, gas pipeline to EU. They will not need to keep EU sanctions against Russia for example, they could start mutual relations with Iran that mostly needs food, common consumption goods etc and they could trade it for gas and oil. So a lot of vectors of external policy could be opened that right now are closed.

Both scenarios will keep debt burden on Greece but Greece role could be different. Now, let’s return back to referendum. I think that this confirms the thought that Tsipras has chosen scenario with default. EU and Greece were talking very long time. If Greece would get relief in reforms that it would like to get – they would have accepted EU proposal. As they haven’t done it, and announced referendum, it means that they didn’t get any relief from EU and IMF.

Referendum is a way to debt default. Because People just recently have elected Syriza, people protest against EU reforms and slavery that EU Central bank brings. Referendum also is an attempt to keep Syriza future and get carte-blanche on default demarche. Place yourself instead – what would you prefer, get tough times but control situation by yourself, or get the same tough times but be controlled by somebody else?

So, guys, if I would be a gambler, I would take a bet on Greece default or at least on some significant relief on reforms from EU on Monday negotiations. But I’m not the one, so before taking any trade on EUR, I would probably wait for Monday results.

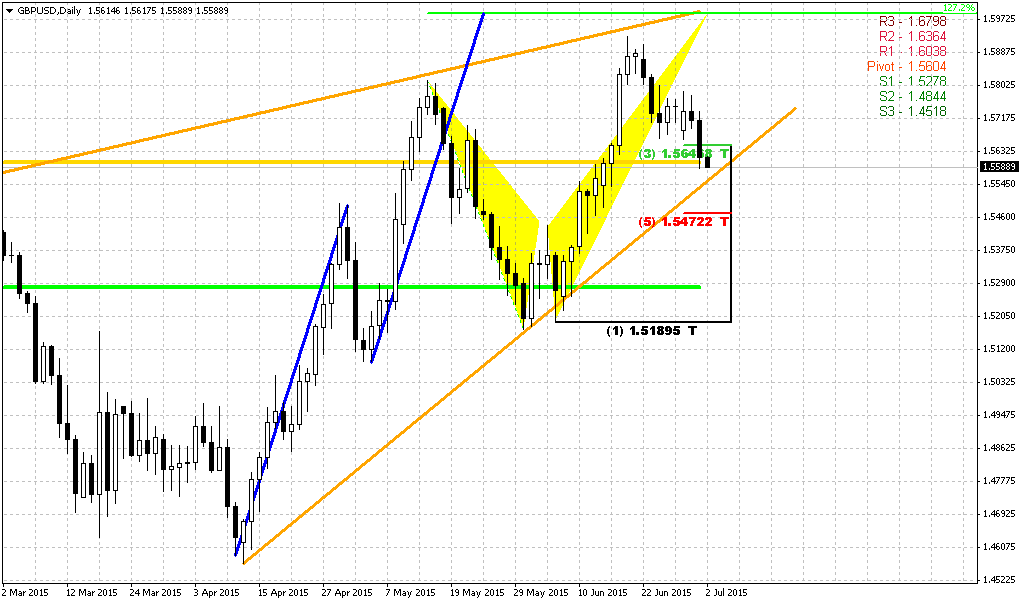

Technicals

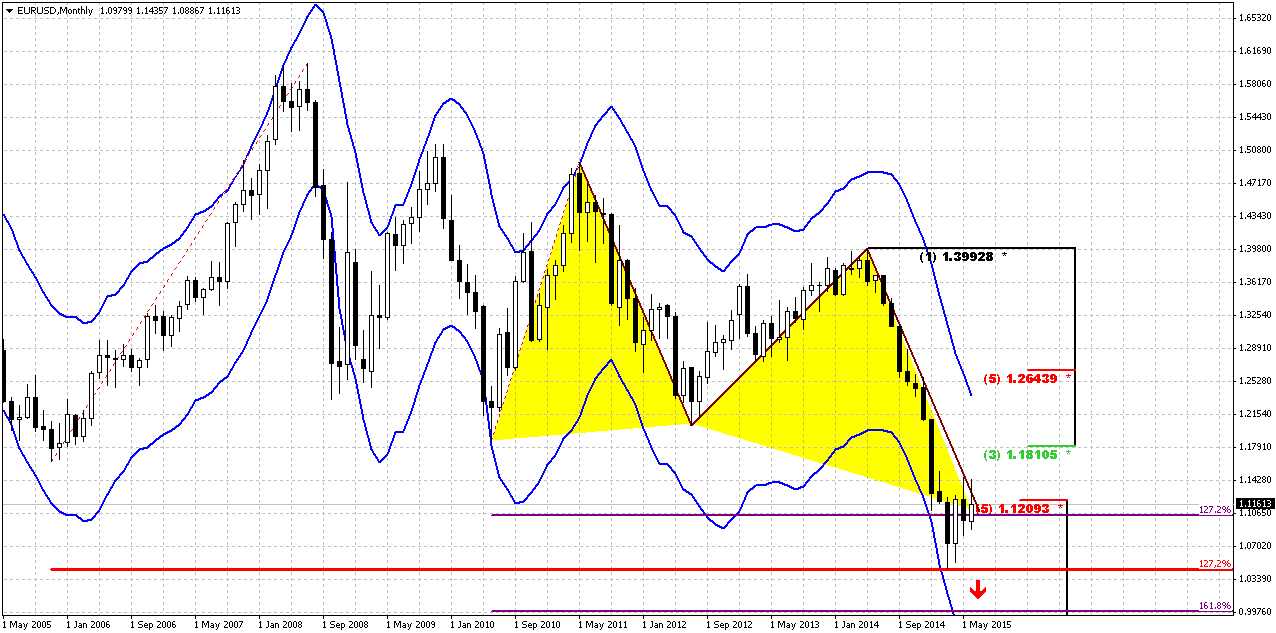

Monthly

Technical picture right now is secondary issue, until situation around Greek debt will be resolved. Still, as we have estimated previously 1.05 is 1.27 extension of huge upside swing in 2005-2008 that also has created large & wide butterfly pattern. Recent action does not quite look like normal butterfly wing, but extension is valid and 1.05 is precisely 1.27 ratio. At the same time we have here another supportive targets, as most recent AB=CD, oversold and 1.27 of recent butterfly.

April has closed and confirmed nicely looking bullish engulfing pattern. We know that most probable target of this pattern is length of the bars counted upside. This will give us approximately 3/8 Fib resistance 1.1810 area. Could we call this situation as “Stretch”? By features probably yes, since market is oversold at support, but by letter not quite, since 1.12 level mostly was broken and the area where market stopped was not a Fib level. Still, applying here Stretch target (middle between OB and OS bands) we will get an area of 50% resistance of most recent swing down around 1.22 area. But most recent action, guys, makes us worry for perspective of upside retracement. After engulfing pattern been formed, EUR can’t turn to upside action within 2 months and can’t pass through 1.1450 area. This is not good sign for bulls. Of cause, we expect downward continuation as we’ve said, but previously we’ve thought that it will happen after upside retracement.

Now about our recent talk on possible B&B or DRPO here. We’ve said that B&B seems more probable. Currently June close price stands above 3x3 DMA, it is a question whether final June close will be above 3x3 DMA and definitely market will not reach 1.18 Fib resistance. So we will keep watching for DiNapoli directional patterns but probably they will appear not as fast as we have expected.

Still, our next long-term target stands the same – parity as 1.618 completion point of recent butterfly. Currently we should treat this bounce up, even to 1.22 area, only as retracement within bear trend. Yes, tactically fundamentals have become weaker in US with dovish recent Fed comments, and open door for pause in bearish trend, but overall picture has not changed drastically yet.

Weekly

Trend is bullish on weekly chart but technical picture significantly has changed here. Previous bounce down was absolutely logical, since EUR has met Fib resistance, MPS1 former YPS1 and overbought. Right now we’ve got another bearish engulfing pattern at the same place, but market is not overbought any more. Previous bearish engulfing is also valid. Since 1.1450 shows itself as strong resistance and our next target is 1.18-1.1950 K-resistance, it would be better to take long position if EUR will break through 1.15 area. For those of you, who would like to trade EUR short – you could try to take position on candlestick patterns. Or, second scenario, wait for downward breakout of 1.08 level. This probably will destroy any potential patterns, such as butterfly “Sell” or may be even H&S and will lead to further weakness of EUR. Market even could shift to butterfly “Buy” pattern with 1.618 extension at the same level – parity. You could draw it by yourself, probably.

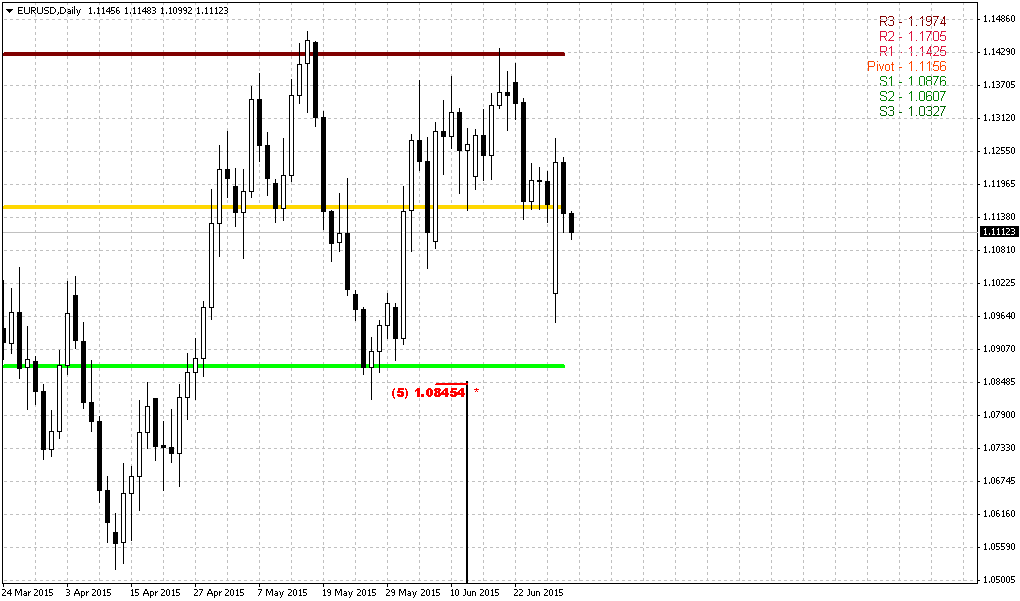

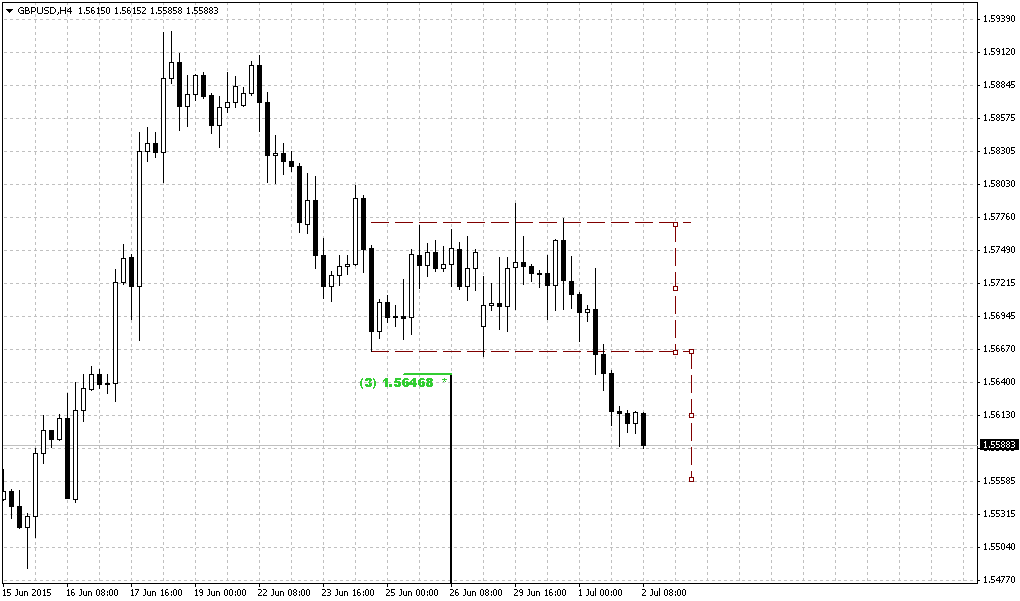

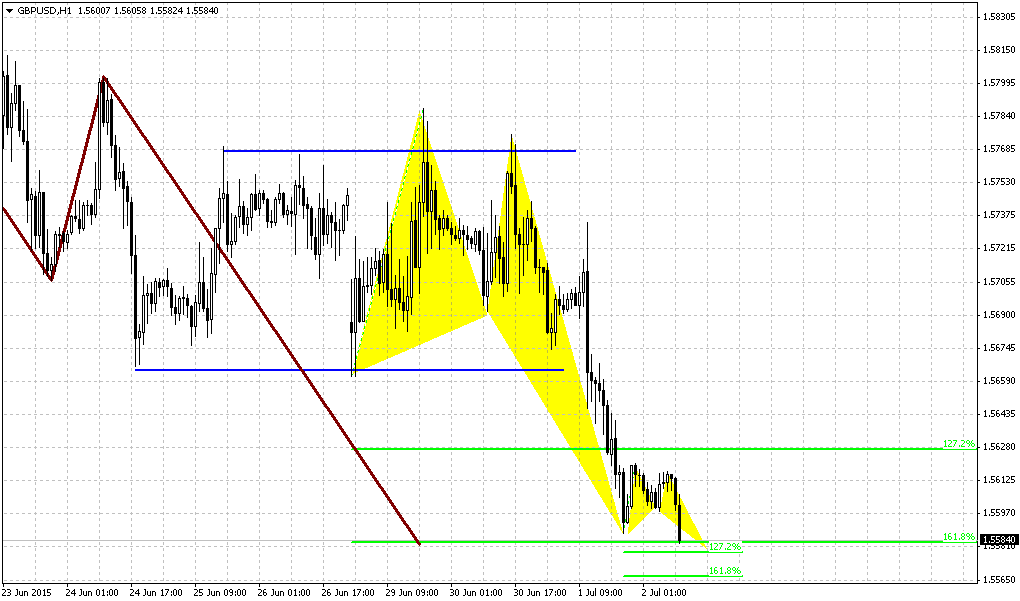

Daily

So, as fundamentally Greece keeps valid both scenarios, technical picture as well corresponds it and also could turn to different directions. There are two major levels on daily chart that we have to monitor on coming week. First one is 1.1450. We see that this is not just strong resistance, but also minor AB-CD target. Current move down technically looks absolutely natural, since this is minor retracement after 0.618 target has been completed. If market will move above 1.1450, it will keep valid AB-CD and could start butterfly “Sell”. Both patterns have the same target around 1.18. We’ve mentioned this level on weekly and monthly chart as well. This scenario could launch monthly B&B “Sell” pattern. But to be honest, guys, I do not believe much in this perspective, mostly because I’m not sure on Greece debt peaceful solution.

Second level is 1.08. Moving below this level will cancel as butterfly as current AB-CD and could put the starting point for long-term move to parity. Currently we also have some kind of bearish divergence with MACD right at strong resistance level. Besides, overall action looks like triangle or pennant on higher time frame charts. Anyway, we call for patience. Do not hurry to take trade here, wait for clarity.

4-Hour

Since till breakout of either 1.1450 or 1.08 will spend considerable period of time, on Monday we could monitor retracement down. There is strong support cluster around 1.1050-1.1130 that includes Fib levels, MPP, WPS1 and potential target of butterfly “Buy”. If EUR really intends to move higher or take another attempt to break through 1.1450, it probably should stop downward action here, at least temporary. If not, and market will pass through it, then there will be minimal chances that 1.08 will survive.

Conclusion:

Currently chances on retracement to 1.18-1.20 area are still exist, but mostly it will depend on political decision on Greek debt. Technically we will be able to estimate further direction by watching for 2 levels – 1.1450 and 1.08.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.