Sive Morten

Special Consultant to the FPA

- Messages

- 18,776

Monthly

The dollar fell to a two-month low against the euro on Friday, posting its worst monthly performance since April after data showed steady euro zone inflation and a downward revision to fourth-quarter U.S. economic growth. The European Union's statistics office Eurostat estimated that consumer prices in the 18 countries sharing the euro rose 0.8 percent year on year this month, a sign of stability that cooled expectations the European Central Bank might ease monetary policy as early as next week. "Everyone's probably re-adjusting their expectations as to how aggressive the ECB will be with respect to its monetary accommodation," said Mark Frey, chief market strategist at Cambridge Mercantile Group in Victoria, British Columbia.

The U.S. Commerce Department, meanwhile, said on Friday gross domestic product expanded at a 2.4 percent annual rate in the fourth quarter, down sharply from the 3.2 percent pace of growth reported last month and the 4.1 percent expansion logged in the third quarter. The data stoked fears the Federal Reserve could pause cuts to its monthly bond-buying program, which analysts said would hurt the dollar since it would help keep interest rates low and drive capital flows into higher-yielding assets outside the United States. "If we saw further weakness in the data such as what we've seen today, the Fed could slow the pace of removing their monetary accommodation," Frey of Cambridge Mercantile said.

The dollar index, which tracks the U.S. currency's performance against a basket of major currencies, was last down 0.7 percent at 79.763. The index posted its worst monthly performance since September amid uncertainty surrounding the pace of the Fed's withdrawal of its asset purchases. Data from the Commodity Futures Trading Commission on Friday showed speculators reduced bets on the U.S. dollar in the latest week, with net longs falling to their lowest in nearly four months.

The yen was seen as investors' best choice for a safe haven on concerns over a weakening Chinese yuan and tensions in Ukraine.

Technical

Trend holds bullish on monthly time frame and price has played back all January decline. Recent price action confirms our suggestion that until market stands above 1.33 and coiling around current levels – nothing clear about possible direction. As upward breakout as downward reversal could happen. Fundamental data of previous week does not suggest drastical changing of long-term sentiment and does not clarify absolutely possible direction. Even analysts’ opinion are not unique on recent US data. Although it was worse than expected, but there was low-key negative reaction. This happens mostly because many investors suggest that poor data comes from tough winter and as spring is coming, situation should improve significantly. This could put some limitation on market activity at least till April.

As we’ve noted in our previous EUR research, YPP will play it’s role sooner or later, and that has happened. Take a look, that upward bounce has started precisely from 1.3475 level. Now the major question stands as follows – whether this upward action is a confirmation of long-term bullish sentiment or just a respect of YPP first touch.

If we will follow to market mechanics, we’ll see that currently market should not show any solid retracement down. Any move of this kind should be treated as market weakness and it will increase probability of reversal down. Take a look that as market has hit minor 0.618 AB-CD extension target right at rock hard resistance – Fib level and Agreement and former yearly PR1, it has shown reasonable bounce down to 1.33. As retracement after 0.618 target already has happened, it is unlogical and unreasonable to see another deep bounce and if it will happen - it will look suspicious. Right now market still stands on the edge here. From one point of view price has failed to break up in 2013, but from another one – it still stands very close to previous highs. Now we have additional detail here – market is forming flag consolidation right under significant resistance and February action was positive. In most cases this suggests attempt of upper breakout and EUR just accumulates energy for it. Second moment – if this was true revresal down from AB-CD 0.618 target market should not return right back up to it and particularly should not form any bullish consolidation right below it. Thus, coiling around resistance could mean that market is preparing for challenging it. Another sign is that price has held above YPP. This tells that sentiment is still bullish here and currently overall situation on monthly chart has more bullish spirit rather than bearish.

Weekly

Weekly chart now shows greater odds in favor of upward continuation, depsite how extended it will be. We will focus on nearest butterfly target – 1.27 around 1.3960 area. Although situation remains tricky and here is enough different issues that make overall context difficult.

Here what we have – Butterfly “Sell” is forming right around major monthly resistance, price still can’t pass through it. Current AB-CD pattern has reached minor 0.618 target, but CD leg is much flatter than AB and this is the sign of weakness. Usually this leads to reversal at final AB=CD point. We’ve got bearish divergence here right at monthly resistance, but on passed week trend has turned bullish and bearish stop grabber that we’ve worried about has not appeared here. This adds points to bulls.

Speaking about bearish reversal criteria ideal peformance is to see butterfly completion and then – move below 1.33 lows. In this case we will get reversal swing on weekly chart that could become at least something that could confirm downward ambitions.

Speaking about bullish signs, we can point on some moments. Although we’ve got bearish patterns, say, engulfing, divergence, but market does not follow it as usual. Yes, price has shown minor retracement down, but this also could be due AB=CD 1.618 inner butterfly extension and monthly resistance. Here former MPR1 stand as well. Second – recall what we’ve said in Dec-Jan:

“To speak about upward continuation o big scale, we need to get fulfilling of two conditions as well – market should coil around previous tops without significant retracement...”

And this is what we have right now. Market has bounced up from YPP, moved above MPP. Now trend has turned bullish again, vanishing potential bearish grabber and we see tight consolidation that takes the shape of flag right below resistance area. In January price has held above MPS1 and this also could be an indication that long-term bullish trend is still valid. That’s being said, although we have some contradictive moments here, I would suggest that bullish signs have more value right now, mostly because they prevent further development of bearish patterns. They are not just opposite patterns that have been formed side-by-side. It looks like most recent bullish signs a kind of vanishing and preventing normal development of earlier bearish patterns. And now we also see upward breakout of flag consolidation. Actually price shows upward action at bearish MACD trend and this could be a bullish dynamic pressure that suggests at least reaching of previous highs.

Speaking about more extended action, if upward continuation will be long term – we need to see move above 1.3980 – butterfly 1.27 target first. In this case next target will be right around 1.43-1.44 – weekly AB-CD, Yearly PR1 and butterfly 1.618.

Also, guys, here you see new pivots for March 2014.

Daily

As market has stand with retracement on previous week, it is very probable that the first half of coming week will be dedicated to upward continuation right to 1.3850 target and within second half market will show retracement, because right now we have untouched WPP and new MPP. Around 1.3850 area stands in fact multiple targets. The major one is large AB=CD 0.618 extension, while also we have minor most recent AB=CD pattern. Slightly higher we see new WPR1. Additional question for coming week is whether market will do attempt to challenge current highs around 1.3885. Overbought condition lets to do this. Besides, if you will draw an extension of initial AB=CD right from YPP (that we’ve traded recently), we will see that 1.618 extension stands precisely around recent highs. So, theoretically this is possible. Alternative scenario – market could try to form here butterfly “Sell” with BC leg of big AB=CD as initial swing of left shoulder. And try to reach weekly targets by this butterfly.

But anyway, current context is bullish and if market will show minor retracement down in the beginning of the week, we will try to use it for scalp bullish trade with target around 1.3850 area.

4-hour

Here we have following technical issues. Trend is bullish here, as well as price action. We have AB-CD action in progress. As market already has shown compounding retracement down (we’ve tracked it on previous week) as respect of AB=CD target and is continuing upward action further – we should not get deep retracement here again, since there are no reasons for that right now, at least from technical point of view. Thus for trading we’re interested in most recent swing only. As market is not at overbought on daily, retracement probably should be shy. 1.3750 level looks very nice for this purpose – Fib support, natural support/resistance and WPP. So, preliminary trading plan is as follows – looking for this area for possible long entry with target at 1.3850.

1-hour

Hourly chart is not, may be, as important as others, but it points that downward action could be started by DRPO “Sell” may be. Target of DRPO (that is 50% of DRPO swing up) stands precisely at the same area as other levels on 4-hour chart...

Conclusion:

On long-term charts price still coiling around edge point and currently chances exist as for upward breakout as for downward reversal. To rely on direction whatever it will be, we need to get clear patterns that could confirm it and point extended targets for us. But we do not have them yet, although recent weeks show some action that could inspire bulls a bit.

In shorter-term, EUR shows not bad upward action that has nearest target around 1.3850. Major retracement we’ve got on previous week according to our analysis. On coming week we will mostly deal with minor retracements at least until price will hit 1.3850 target. Thus, currently 1.3750-1.3755 area looks suitable for this purpose.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.

The dollar fell to a two-month low against the euro on Friday, posting its worst monthly performance since April after data showed steady euro zone inflation and a downward revision to fourth-quarter U.S. economic growth. The European Union's statistics office Eurostat estimated that consumer prices in the 18 countries sharing the euro rose 0.8 percent year on year this month, a sign of stability that cooled expectations the European Central Bank might ease monetary policy as early as next week. "Everyone's probably re-adjusting their expectations as to how aggressive the ECB will be with respect to its monetary accommodation," said Mark Frey, chief market strategist at Cambridge Mercantile Group in Victoria, British Columbia.

The U.S. Commerce Department, meanwhile, said on Friday gross domestic product expanded at a 2.4 percent annual rate in the fourth quarter, down sharply from the 3.2 percent pace of growth reported last month and the 4.1 percent expansion logged in the third quarter. The data stoked fears the Federal Reserve could pause cuts to its monthly bond-buying program, which analysts said would hurt the dollar since it would help keep interest rates low and drive capital flows into higher-yielding assets outside the United States. "If we saw further weakness in the data such as what we've seen today, the Fed could slow the pace of removing their monetary accommodation," Frey of Cambridge Mercantile said.

The dollar index, which tracks the U.S. currency's performance against a basket of major currencies, was last down 0.7 percent at 79.763. The index posted its worst monthly performance since September amid uncertainty surrounding the pace of the Fed's withdrawal of its asset purchases. Data from the Commodity Futures Trading Commission on Friday showed speculators reduced bets on the U.S. dollar in the latest week, with net longs falling to their lowest in nearly four months.

The yen was seen as investors' best choice for a safe haven on concerns over a weakening Chinese yuan and tensions in Ukraine.

Technical

Trend holds bullish on monthly time frame and price has played back all January decline. Recent price action confirms our suggestion that until market stands above 1.33 and coiling around current levels – nothing clear about possible direction. As upward breakout as downward reversal could happen. Fundamental data of previous week does not suggest drastical changing of long-term sentiment and does not clarify absolutely possible direction. Even analysts’ opinion are not unique on recent US data. Although it was worse than expected, but there was low-key negative reaction. This happens mostly because many investors suggest that poor data comes from tough winter and as spring is coming, situation should improve significantly. This could put some limitation on market activity at least till April.

As we’ve noted in our previous EUR research, YPP will play it’s role sooner or later, and that has happened. Take a look, that upward bounce has started precisely from 1.3475 level. Now the major question stands as follows – whether this upward action is a confirmation of long-term bullish sentiment or just a respect of YPP first touch.

If we will follow to market mechanics, we’ll see that currently market should not show any solid retracement down. Any move of this kind should be treated as market weakness and it will increase probability of reversal down. Take a look that as market has hit minor 0.618 AB-CD extension target right at rock hard resistance – Fib level and Agreement and former yearly PR1, it has shown reasonable bounce down to 1.33. As retracement after 0.618 target already has happened, it is unlogical and unreasonable to see another deep bounce and if it will happen - it will look suspicious. Right now market still stands on the edge here. From one point of view price has failed to break up in 2013, but from another one – it still stands very close to previous highs. Now we have additional detail here – market is forming flag consolidation right under significant resistance and February action was positive. In most cases this suggests attempt of upper breakout and EUR just accumulates energy for it. Second moment – if this was true revresal down from AB-CD 0.618 target market should not return right back up to it and particularly should not form any bullish consolidation right below it. Thus, coiling around resistance could mean that market is preparing for challenging it. Another sign is that price has held above YPP. This tells that sentiment is still bullish here and currently overall situation on monthly chart has more bullish spirit rather than bearish.

Weekly

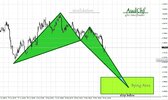

Weekly chart now shows greater odds in favor of upward continuation, depsite how extended it will be. We will focus on nearest butterfly target – 1.27 around 1.3960 area. Although situation remains tricky and here is enough different issues that make overall context difficult.

Here what we have – Butterfly “Sell” is forming right around major monthly resistance, price still can’t pass through it. Current AB-CD pattern has reached minor 0.618 target, but CD leg is much flatter than AB and this is the sign of weakness. Usually this leads to reversal at final AB=CD point. We’ve got bearish divergence here right at monthly resistance, but on passed week trend has turned bullish and bearish stop grabber that we’ve worried about has not appeared here. This adds points to bulls.

Speaking about bearish reversal criteria ideal peformance is to see butterfly completion and then – move below 1.33 lows. In this case we will get reversal swing on weekly chart that could become at least something that could confirm downward ambitions.

Speaking about bullish signs, we can point on some moments. Although we’ve got bearish patterns, say, engulfing, divergence, but market does not follow it as usual. Yes, price has shown minor retracement down, but this also could be due AB=CD 1.618 inner butterfly extension and monthly resistance. Here former MPR1 stand as well. Second – recall what we’ve said in Dec-Jan:

“To speak about upward continuation o big scale, we need to get fulfilling of two conditions as well – market should coil around previous tops without significant retracement...”

And this is what we have right now. Market has bounced up from YPP, moved above MPP. Now trend has turned bullish again, vanishing potential bearish grabber and we see tight consolidation that takes the shape of flag right below resistance area. In January price has held above MPS1 and this also could be an indication that long-term bullish trend is still valid. That’s being said, although we have some contradictive moments here, I would suggest that bullish signs have more value right now, mostly because they prevent further development of bearish patterns. They are not just opposite patterns that have been formed side-by-side. It looks like most recent bullish signs a kind of vanishing and preventing normal development of earlier bearish patterns. And now we also see upward breakout of flag consolidation. Actually price shows upward action at bearish MACD trend and this could be a bullish dynamic pressure that suggests at least reaching of previous highs.

Speaking about more extended action, if upward continuation will be long term – we need to see move above 1.3980 – butterfly 1.27 target first. In this case next target will be right around 1.43-1.44 – weekly AB-CD, Yearly PR1 and butterfly 1.618.

Also, guys, here you see new pivots for March 2014.

Daily

As market has stand with retracement on previous week, it is very probable that the first half of coming week will be dedicated to upward continuation right to 1.3850 target and within second half market will show retracement, because right now we have untouched WPP and new MPP. Around 1.3850 area stands in fact multiple targets. The major one is large AB=CD 0.618 extension, while also we have minor most recent AB=CD pattern. Slightly higher we see new WPR1. Additional question for coming week is whether market will do attempt to challenge current highs around 1.3885. Overbought condition lets to do this. Besides, if you will draw an extension of initial AB=CD right from YPP (that we’ve traded recently), we will see that 1.618 extension stands precisely around recent highs. So, theoretically this is possible. Alternative scenario – market could try to form here butterfly “Sell” with BC leg of big AB=CD as initial swing of left shoulder. And try to reach weekly targets by this butterfly.

But anyway, current context is bullish and if market will show minor retracement down in the beginning of the week, we will try to use it for scalp bullish trade with target around 1.3850 area.

4-hour

Here we have following technical issues. Trend is bullish here, as well as price action. We have AB-CD action in progress. As market already has shown compounding retracement down (we’ve tracked it on previous week) as respect of AB=CD target and is continuing upward action further – we should not get deep retracement here again, since there are no reasons for that right now, at least from technical point of view. Thus for trading we’re interested in most recent swing only. As market is not at overbought on daily, retracement probably should be shy. 1.3750 level looks very nice for this purpose – Fib support, natural support/resistance and WPP. So, preliminary trading plan is as follows – looking for this area for possible long entry with target at 1.3850.

1-hour

Hourly chart is not, may be, as important as others, but it points that downward action could be started by DRPO “Sell” may be. Target of DRPO (that is 50% of DRPO swing up) stands precisely at the same area as other levels on 4-hour chart...

Conclusion:

On long-term charts price still coiling around edge point and currently chances exist as for upward breakout as for downward reversal. To rely on direction whatever it will be, we need to get clear patterns that could confirm it and point extended targets for us. But we do not have them yet, although recent weeks show some action that could inspire bulls a bit.

In shorter-term, EUR shows not bad upward action that has nearest target around 1.3850. Major retracement we’ve got on previous week according to our analysis. On coming week we will mostly deal with minor retracements at least until price will hit 1.3850 target. Thus, currently 1.3750-1.3755 area looks suitable for this purpose.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.