Sive Morten

Special Consultant to the FPA

- Messages

- 18,776

Monthly

The dollar held a slim gain against a basket of major currencies on Friday as benchmark U.S. Treasury yields edged up from their lowest levels in six months, although the greenback faces further weakness if yields resume their decline. The dollar pared earlier modest losses against the Japanese yen and euro after a stronger-than-expected report on U.S. housing construction. "Falling yields have been problematic for the dollar," said Richard Franulovich, senior currency strategist at Westpac Banking Corp in New York. "Bond yields look too low here against this economic backdrop." The decline in the dollar and U.S. Treasuries yields came in the face of encouraging domestic economic data in recent weeks. On Friday, the government said housing starts rose 13.2 percent to 1.07 million annualized units in April, the strongest level since November 2013. The bond market's rally has confounded analysts and traders who reckoned it will eventually peter out and the dollar will rebound from current levels. Benchmark U.S. 10-year Treasury yields were last at 2.518 percent, up from the six-month low of 2.473 percent on Thursday. The 10-year yield is set to fall nearly 11 basis points this week.

The dollar traded at 101.45 yen above a two-month low of 101.31 yen set on Thursday and its 200-day moving average of 101.20 yen which analysts peg as a key support.

Thursday's disappointing euro zone growth data raised expectations the European Central Bank will embark on more stimulus at its June policy meeting, and some investors are betting that the euro could grind lower in coming weeks. Traders also pointed to funds moving to safety after a sell-off in Greek bonds halted a rally in debt of weaker euro zone members. The sell-off in peripheral bonds, if it gathered pace, was likely to hurt the euro, traders said. The yield on 10-year Greek bonds edged up 2 basis points to 6.851 percent, its highest since late March. "We have a lot of volatility in Europe especially the last two days. I find it hard for the euro to rally from here," Franulovich said. The implied one-month euro/dollar volatility, the expected price swings over the coming month, has risen this week from 7-year lows to 5.8 percent on Friday.

Under Curtain

In a series of quarter-million-dollar dinners with wealthy private investors, Ben Bernanke has been clearer than he ever was as chairman of the Federal Reserve on his expectations that easy-money policies and below-normal interest rates are here for a long time to come, according to some of those in attendance. Bernanke, who retired from the U.S. central bank in January, has predicted the Fed will only very slowly move to raise rates, and probably do so later than many forecast because the labor market still has a lot more room to recover from the financial crisis and recession.

The accounts of the discussions come from attendees as well as those who heard second-hand what was said at the dinners, where hedge fund managers and others willing to foot the roughly $250,000 bill for each event asked the former Fed chairman questions in a free-flowing round-table fashion over recent weeks. Bernanke has no constraints on expressing his views in public or private, providing he does not talk about confidential Fed matters. He declined to comment on any of his remarks at the private events.

The demand for Bernanke's time shows that many of Wall Street's highest-profile brokers and investors see him as holding rare insight on how the Fed will react in the months and years ahead - and are prepared to pay big bucks to get private access to those views. At least one guest left a New York restaurant with the impression Bernanke, 60, does not expect the federal funds rate, the Fed's main benchmark interest rate, to rise back to its long-term average of around 4 percent in Bernanke's lifetime, one source who had spoken to the guest said.

Another dinner guest was moved when Bernanke said the Fed aims to hit its 2 percent inflation target at all times, and that it is not necessarily a ceiling. "Shocking when he said this," the guest scribbled in his notes. "Is that really true?" he scribbled at another point, according to the notes reviewed by Reuters.

Bernanke's last major act as Fed chairman was to announce, in December, plans for the winding down of the central bank's huge stimulus, a bond-buying program called "quantitative easing," which should end by this fall. That was greeted by a sell-off in the bond market, where expectations for future interest rate levels are particularly important, because many investors believed the Fed would move on to raising interest rates in fairly short order. The yield on the benchmark 10-year Treasury note ended the year just above 3 percent, the highest since the summer of 2011. To the surprise of many, however, bonds have rallied back hard this year, driving the 10-year yield down by half a percentage point. The shift comes as more and more investors come to embrace a view Bernanke has been sharing with his dinner guests: There is just too much slack remaining in the economy to support a rise in interest rates.

Still, not every guest believes they came away from a Bernanke dinner with an exclusive insight. "People can try all they want to feel that they got him to say something extra to them, but he never does," said one person who attended one of the dinners.

In one dinner-table exchange with investors, Bernanke argued that fiscal tightening, constrained financial markets and lower U.S. productivity all point to lower real rates than would be considered normal for a long time to come. Based on trading in the massive Eurodollar futures market, investors have in recent months tempered expectations of rate rises in the years ahead; as it stands, they don't expect the fed funds rate to return to 4 percent until 2022. As recently as last September, futures markets signaled they thought this would happen by the end of 2018.

At the dinners, Bernanke has also argued the Fed would want to delay raising rates if the tighter financial conditions created could threaten to harm the economy. He has also stressed that financial stability concerns would more formally be considered in policy-making, according to the sources.

Technical

Although April was upward month, but overall action mostly should be classified as “inside” one to March range. Almost whole April price has spent in the same range. At the same time May action is starting to show its power. Although this has happened not quite independently but having ECB hand in EUR dynamic, still, technically we see attempt of reversal on monthly chart. We saw something cognate on February action, but it didn’t lead to any downward continuation. At the same time, currently situation is slightly different because there was no solid upward action in April, and now we have a month candle that has moved above April high. If May will close below April low – we will get monthly reversal bar and this could lead at least to some downward continuation. Part of this work has been done already and is continued on recent week. As May stands close to an end – this could become a reality very soon.

By looking at bigger picture, market stands in tight range since 2014. Thus, 1.33-1.3850 is an area of “indecision”. While market stands inside of it we can talk about neither upward breakout nor downward reversal. At least, reversal identification could be done with yearly pivot – if market will move below it, this could be early sign of changing sentiment. But, as you can see, nothing among this issues have happened yet.

Speaking about upward continuation, market mechanics does not allow price to show any deep retracement any more. Any move of this kind should be treated as market weakness and it will increase probability of reversal down. Take a look that as market has hit minor 0.618 AB-CD extension target right at former rock hard resistance – Fib level and Agreement and former yearly PR1, it has shown reasonable bounce down to 1.33. As retracement after 0.618 target already has happened, it is unlogical and unreasonable to see another deep bounce and if it will happen - it will look suspicious.

So, speaking about monthly upside targets... If we will get finally real break through resistance, we have two major targets – AB=CD one around 1.44 and Yearly PR1 = 1.4205.

That’s being said, to change really big picture and long-term sentiment market will have to leave 1.3350-1.3850 area in one or other direction. While appearing of reversal May bar will give us confidence to suggest further downward action inside of 1.3350-1.3850 range by far.

Weekly

On weekly chart we have full pack of bearish signs. It’s a bit uncomfortable that they are too obvious, but they are facts that we can’t ingore still. Besides, fundamentally EUR/USD pair also has reasons to move lower. Although Lutz Karpowitz, a currency strategist with Commerzbank in Frankfurt said: “As long as quantitative easing continues in the U.S., we expect the dollar to remain under pressure”, - but currently it’s not quite the same QE. It was contracted twice and dollar supply has decreased. At the same time ECB stands near stopping of its liquidity sterilization action and this should increase the supply of EUR, or, at least it should stop contracting it. These opposite measures play in favor of EUR/USD downward action probably.

By looking at technical issues, we have a lot of bearish signs: butterfly “Sell” at MPR1, accompanied by bearish wedge and divergence with MACD. On recent week EUR has continued action that it has started on week before. Two weeks ago market has moved below MPP and has formed bearish stop grabber pattern that suggests taking out of 1.3670 lows. And on recent week, as we se eon the chart – price has moved below MPS1 and grabber has reached its target. At the same time grabber bar is a reversal week – market has created new high and close below bottom of previous week. And, finally, this week was W&R of previous highs. I will not dare to speak about long-term reversal, but at least minor continuation should follow. Nearest support stands around 1.35-1.3520 area and includes two major points – Fib support and YPP at 1.3475. This is also minimum butterfly target and right now we do not see reasons on weekly chart, why this area couldn’t be reached.

Daily

So, our trading plan on recent week was achieved, but now, despite how attractive and promising weekly bearish context stands – it could take pause due situation on daily chart. Take a look that market has reached Fib support at daily oversold, which creates DiNapoli bullish “Stretch” pattern. Stretch is not “impulse” pattern, it is mostly has retrace quality. That’s why, although weekly chart stands bearish – it could get downward continuation only in second part of coming week, or even in 2 weeks. Meantime, as we’re mostly focused on daily chart – we will deal with Stretch pattern. Trend is strongly bearish here, but Direction overrules trend, right? As minimum upside target of this retracement we, probably will use 1.3760-1.3780 – Fib level and WPR1. Besides, WPR1 will show us – whether current bearish trend is still valid, or not. If this is true then WPR1 should hold upward retracement. Also take a look – approximately in the same area we have former bottom as well. And finally – bullish hammer could become the starting point of upward bounce – let’s take closer look at it.

1-hour

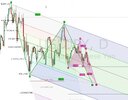

4-hour chart also contains some important issues – trend has turned bullish there and price has formed bullish divergence with MACD. Still major picture stands here, on hourly chart. As you can see upward action could start with reverse H&S pattern and butterfly “Buy” as left part of this pattern. The target of this pattern as AB-CD, based on head and right shoulder stands right at daily Fib resistance and WPR1 and creates an Agreement. Right now market stands with downward retracement. Last level that could be used for long entry is 1.3680 Agreement. Not just because this is Agremement, but mostly because this is last level that will keep the harmony of H&S. If price will break it – it will not neccesary mean that upward bounce impossible, may be price will turn to double bottom or something else, but this will be quite another story and we will have to prepare another trading plan for it, if it will happen. While now we have another pattern and we do not have any reasons to suggest that it will fail yet. Besides, daily hammer... Normal market reaction does not suggest taking out of it’s lows before upward action. Anyway, we’ll see... Let’s cross that bridge when one comes to it...

Conclusion:

While price stands in 1.33-1.38 area we can’t speak either on upward or downward breakout. To change really big picture market should have to show breakout out of it.

In May we will be watching for possible reversal months appearing. Price already has created new high and now the question is whether it will close below April’s lows. If this will happen – this will encourage us on expectation of more solid downward action inside 1.33-1.38 range.

In short-term perspective despite how cloudless situation on weekly chart looks – market probably will take the pause in downward action and show upside retracement with minimum target ~1.3780 in the beginning of the coming week.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.

The dollar held a slim gain against a basket of major currencies on Friday as benchmark U.S. Treasury yields edged up from their lowest levels in six months, although the greenback faces further weakness if yields resume their decline. The dollar pared earlier modest losses against the Japanese yen and euro after a stronger-than-expected report on U.S. housing construction. "Falling yields have been problematic for the dollar," said Richard Franulovich, senior currency strategist at Westpac Banking Corp in New York. "Bond yields look too low here against this economic backdrop." The decline in the dollar and U.S. Treasuries yields came in the face of encouraging domestic economic data in recent weeks. On Friday, the government said housing starts rose 13.2 percent to 1.07 million annualized units in April, the strongest level since November 2013. The bond market's rally has confounded analysts and traders who reckoned it will eventually peter out and the dollar will rebound from current levels. Benchmark U.S. 10-year Treasury yields were last at 2.518 percent, up from the six-month low of 2.473 percent on Thursday. The 10-year yield is set to fall nearly 11 basis points this week.

The dollar traded at 101.45 yen above a two-month low of 101.31 yen set on Thursday and its 200-day moving average of 101.20 yen which analysts peg as a key support.

Thursday's disappointing euro zone growth data raised expectations the European Central Bank will embark on more stimulus at its June policy meeting, and some investors are betting that the euro could grind lower in coming weeks. Traders also pointed to funds moving to safety after a sell-off in Greek bonds halted a rally in debt of weaker euro zone members. The sell-off in peripheral bonds, if it gathered pace, was likely to hurt the euro, traders said. The yield on 10-year Greek bonds edged up 2 basis points to 6.851 percent, its highest since late March. "We have a lot of volatility in Europe especially the last two days. I find it hard for the euro to rally from here," Franulovich said. The implied one-month euro/dollar volatility, the expected price swings over the coming month, has risen this week from 7-year lows to 5.8 percent on Friday.

Under Curtain

In a series of quarter-million-dollar dinners with wealthy private investors, Ben Bernanke has been clearer than he ever was as chairman of the Federal Reserve on his expectations that easy-money policies and below-normal interest rates are here for a long time to come, according to some of those in attendance. Bernanke, who retired from the U.S. central bank in January, has predicted the Fed will only very slowly move to raise rates, and probably do so later than many forecast because the labor market still has a lot more room to recover from the financial crisis and recession.

The accounts of the discussions come from attendees as well as those who heard second-hand what was said at the dinners, where hedge fund managers and others willing to foot the roughly $250,000 bill for each event asked the former Fed chairman questions in a free-flowing round-table fashion over recent weeks. Bernanke has no constraints on expressing his views in public or private, providing he does not talk about confidential Fed matters. He declined to comment on any of his remarks at the private events.

The demand for Bernanke's time shows that many of Wall Street's highest-profile brokers and investors see him as holding rare insight on how the Fed will react in the months and years ahead - and are prepared to pay big bucks to get private access to those views. At least one guest left a New York restaurant with the impression Bernanke, 60, does not expect the federal funds rate, the Fed's main benchmark interest rate, to rise back to its long-term average of around 4 percent in Bernanke's lifetime, one source who had spoken to the guest said.

Another dinner guest was moved when Bernanke said the Fed aims to hit its 2 percent inflation target at all times, and that it is not necessarily a ceiling. "Shocking when he said this," the guest scribbled in his notes. "Is that really true?" he scribbled at another point, according to the notes reviewed by Reuters.

Bernanke's last major act as Fed chairman was to announce, in December, plans for the winding down of the central bank's huge stimulus, a bond-buying program called "quantitative easing," which should end by this fall. That was greeted by a sell-off in the bond market, where expectations for future interest rate levels are particularly important, because many investors believed the Fed would move on to raising interest rates in fairly short order. The yield on the benchmark 10-year Treasury note ended the year just above 3 percent, the highest since the summer of 2011. To the surprise of many, however, bonds have rallied back hard this year, driving the 10-year yield down by half a percentage point. The shift comes as more and more investors come to embrace a view Bernanke has been sharing with his dinner guests: There is just too much slack remaining in the economy to support a rise in interest rates.

Still, not every guest believes they came away from a Bernanke dinner with an exclusive insight. "People can try all they want to feel that they got him to say something extra to them, but he never does," said one person who attended one of the dinners.

In one dinner-table exchange with investors, Bernanke argued that fiscal tightening, constrained financial markets and lower U.S. productivity all point to lower real rates than would be considered normal for a long time to come. Based on trading in the massive Eurodollar futures market, investors have in recent months tempered expectations of rate rises in the years ahead; as it stands, they don't expect the fed funds rate to return to 4 percent until 2022. As recently as last September, futures markets signaled they thought this would happen by the end of 2018.

At the dinners, Bernanke has also argued the Fed would want to delay raising rates if the tighter financial conditions created could threaten to harm the economy. He has also stressed that financial stability concerns would more formally be considered in policy-making, according to the sources.

Technical

Although April was upward month, but overall action mostly should be classified as “inside” one to March range. Almost whole April price has spent in the same range. At the same time May action is starting to show its power. Although this has happened not quite independently but having ECB hand in EUR dynamic, still, technically we see attempt of reversal on monthly chart. We saw something cognate on February action, but it didn’t lead to any downward continuation. At the same time, currently situation is slightly different because there was no solid upward action in April, and now we have a month candle that has moved above April high. If May will close below April low – we will get monthly reversal bar and this could lead at least to some downward continuation. Part of this work has been done already and is continued on recent week. As May stands close to an end – this could become a reality very soon.

By looking at bigger picture, market stands in tight range since 2014. Thus, 1.33-1.3850 is an area of “indecision”. While market stands inside of it we can talk about neither upward breakout nor downward reversal. At least, reversal identification could be done with yearly pivot – if market will move below it, this could be early sign of changing sentiment. But, as you can see, nothing among this issues have happened yet.

Speaking about upward continuation, market mechanics does not allow price to show any deep retracement any more. Any move of this kind should be treated as market weakness and it will increase probability of reversal down. Take a look that as market has hit minor 0.618 AB-CD extension target right at former rock hard resistance – Fib level and Agreement and former yearly PR1, it has shown reasonable bounce down to 1.33. As retracement after 0.618 target already has happened, it is unlogical and unreasonable to see another deep bounce and if it will happen - it will look suspicious.

So, speaking about monthly upside targets... If we will get finally real break through resistance, we have two major targets – AB=CD one around 1.44 and Yearly PR1 = 1.4205.

That’s being said, to change really big picture and long-term sentiment market will have to leave 1.3350-1.3850 area in one or other direction. While appearing of reversal May bar will give us confidence to suggest further downward action inside of 1.3350-1.3850 range by far.

Weekly

On weekly chart we have full pack of bearish signs. It’s a bit uncomfortable that they are too obvious, but they are facts that we can’t ingore still. Besides, fundamentally EUR/USD pair also has reasons to move lower. Although Lutz Karpowitz, a currency strategist with Commerzbank in Frankfurt said: “As long as quantitative easing continues in the U.S., we expect the dollar to remain under pressure”, - but currently it’s not quite the same QE. It was contracted twice and dollar supply has decreased. At the same time ECB stands near stopping of its liquidity sterilization action and this should increase the supply of EUR, or, at least it should stop contracting it. These opposite measures play in favor of EUR/USD downward action probably.

By looking at technical issues, we have a lot of bearish signs: butterfly “Sell” at MPR1, accompanied by bearish wedge and divergence with MACD. On recent week EUR has continued action that it has started on week before. Two weeks ago market has moved below MPP and has formed bearish stop grabber pattern that suggests taking out of 1.3670 lows. And on recent week, as we se eon the chart – price has moved below MPS1 and grabber has reached its target. At the same time grabber bar is a reversal week – market has created new high and close below bottom of previous week. And, finally, this week was W&R of previous highs. I will not dare to speak about long-term reversal, but at least minor continuation should follow. Nearest support stands around 1.35-1.3520 area and includes two major points – Fib support and YPP at 1.3475. This is also minimum butterfly target and right now we do not see reasons on weekly chart, why this area couldn’t be reached.

Daily

So, our trading plan on recent week was achieved, but now, despite how attractive and promising weekly bearish context stands – it could take pause due situation on daily chart. Take a look that market has reached Fib support at daily oversold, which creates DiNapoli bullish “Stretch” pattern. Stretch is not “impulse” pattern, it is mostly has retrace quality. That’s why, although weekly chart stands bearish – it could get downward continuation only in second part of coming week, or even in 2 weeks. Meantime, as we’re mostly focused on daily chart – we will deal with Stretch pattern. Trend is strongly bearish here, but Direction overrules trend, right? As minimum upside target of this retracement we, probably will use 1.3760-1.3780 – Fib level and WPR1. Besides, WPR1 will show us – whether current bearish trend is still valid, or not. If this is true then WPR1 should hold upward retracement. Also take a look – approximately in the same area we have former bottom as well. And finally – bullish hammer could become the starting point of upward bounce – let’s take closer look at it.

1-hour

4-hour chart also contains some important issues – trend has turned bullish there and price has formed bullish divergence with MACD. Still major picture stands here, on hourly chart. As you can see upward action could start with reverse H&S pattern and butterfly “Buy” as left part of this pattern. The target of this pattern as AB-CD, based on head and right shoulder stands right at daily Fib resistance and WPR1 and creates an Agreement. Right now market stands with downward retracement. Last level that could be used for long entry is 1.3680 Agreement. Not just because this is Agremement, but mostly because this is last level that will keep the harmony of H&S. If price will break it – it will not neccesary mean that upward bounce impossible, may be price will turn to double bottom or something else, but this will be quite another story and we will have to prepare another trading plan for it, if it will happen. While now we have another pattern and we do not have any reasons to suggest that it will fail yet. Besides, daily hammer... Normal market reaction does not suggest taking out of it’s lows before upward action. Anyway, we’ll see... Let’s cross that bridge when one comes to it...

Conclusion:

While price stands in 1.33-1.38 area we can’t speak either on upward or downward breakout. To change really big picture market should have to show breakout out of it.

In May we will be watching for possible reversal months appearing. Price already has created new high and now the question is whether it will close below April’s lows. If this will happen – this will encourage us on expectation of more solid downward action inside 1.33-1.38 range.

In short-term perspective despite how cloudless situation on weekly chart looks – market probably will take the pause in downward action and show upside retracement with minimum target ~1.3780 in the beginning of the coming week.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.