Sive Morten

Special Consultant to the FPA

- Messages

- 18,695

Monthly

Weekly FX Tading Report prepared by Sive Morten exclusively for ForexPeaceArmy.com

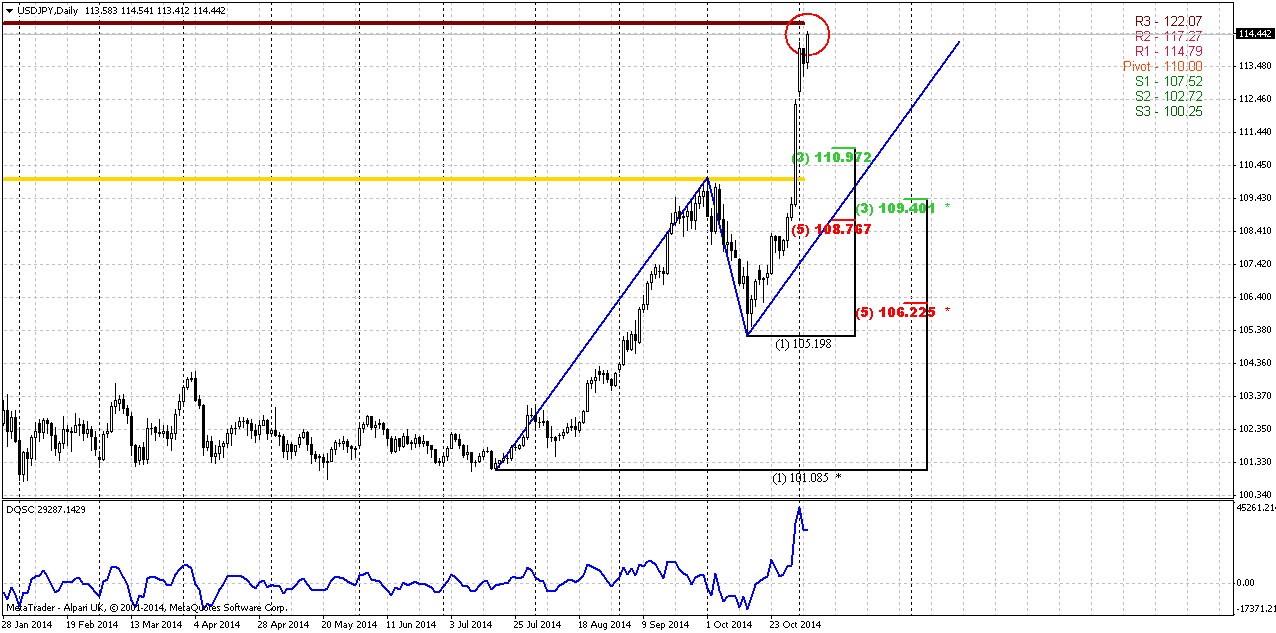

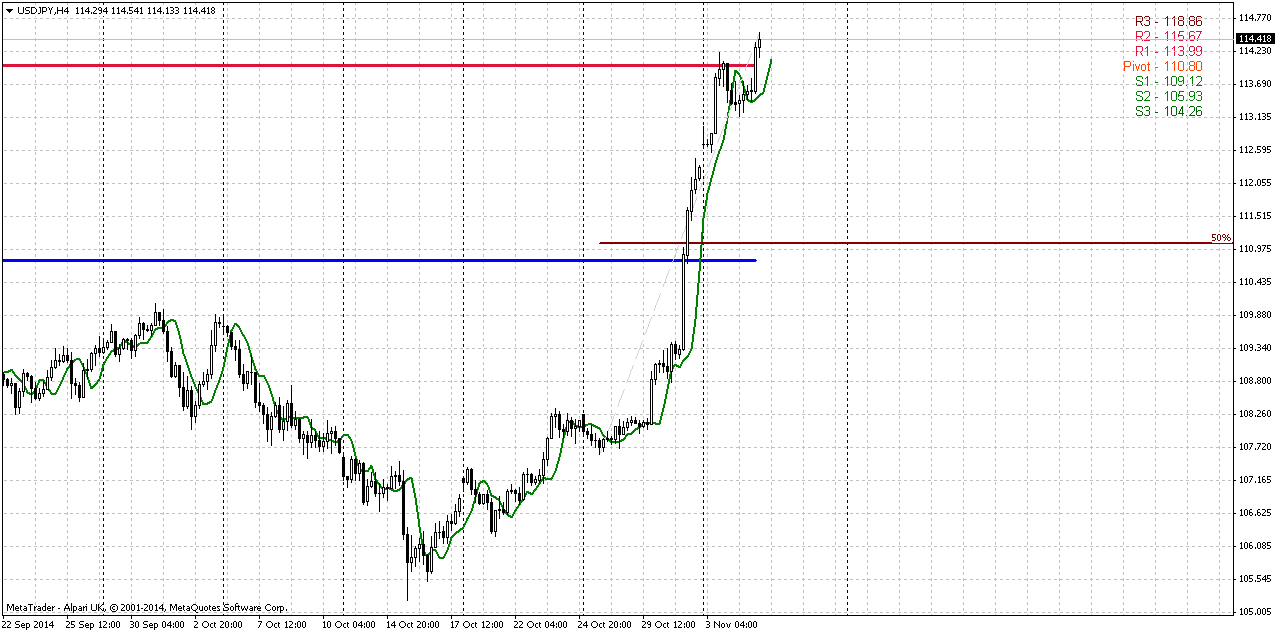

According to Reuters news The yen plunged to a near seven-year low against the U.S. dollar on Friday, putting it on track for its worst day in 18 months, after the Bank of Japan shocked financial markets with an aggressive easing of its monetary policy.

In addition to the BoJ's decision to expand its already massive monetary stimulus plan, an announcement by the country's government pension fund that it would increase its holdings of foreign and domestic shares added to yen selling. Japan is aiming to reverse decades of deflation and subpar growth.

While some easing by Japan's central bank had been expected, most investors thought any action was months away as Governor Haruhiko Kuroda had voiced optimism over the Japanese economic outlook even after soft economic data.

"If the yen keeps weakening, watch for formal political appeals to stabilize the yen's value from non-exporting, small and medium-sized enterprises and from power utilities whose nuclear capacity is still offline," analysts at Eurasia Group wrote clients on Friday.

"If yen depreciation accelerates rapidly and looks to falls below 120/dollar, the Japanese government would likely intervene to put a floor under it," they said.

DOLLAR GETS SUPPORT FROM ALL SIDES

Japan's monetary policies are moving in the opposite direction indicated by the hawkish policy tone adopted this week by the U.S. Federal Reserve. The Fed's comment on the economy as it ended its bond-buying program raised expectations that the U.S. central bank will increase interest rates sooner than previously forecast.

There are two elements working in favor of a stronger dollar, said Win Thin, currency strategist at Brown Brothers Harriman in New York.

"On one side you have firm U.S. data and the Fed on track to hike next year." he said. "On the other side you have the BoJ's aggressive dovish move and the expectations that the ECB is going to have to do more in light of the weak data. That's driving euro/dollar down."

The European Central Bank has been more hesitant to throw open the monetary spigots in the face of deteriorating euro zone economic data. And the 0.4 percent rise in consumer prices in October announced on Friday lowered expectations the ECB will ease policy at its meeting next week.

Recent CFTC data does not show something special. Open interest shows slow growth, as well as short speculating positions. In general this combination looks supportive for further downward action.

Our ratio of shorts-to-OI shows 79.78% value. This number is significant but not extreme. So, it lets shorts to grow a bit more.

Non-Commercial Shorts:

Non-Commercial Longs:

Open Interest:

Technical

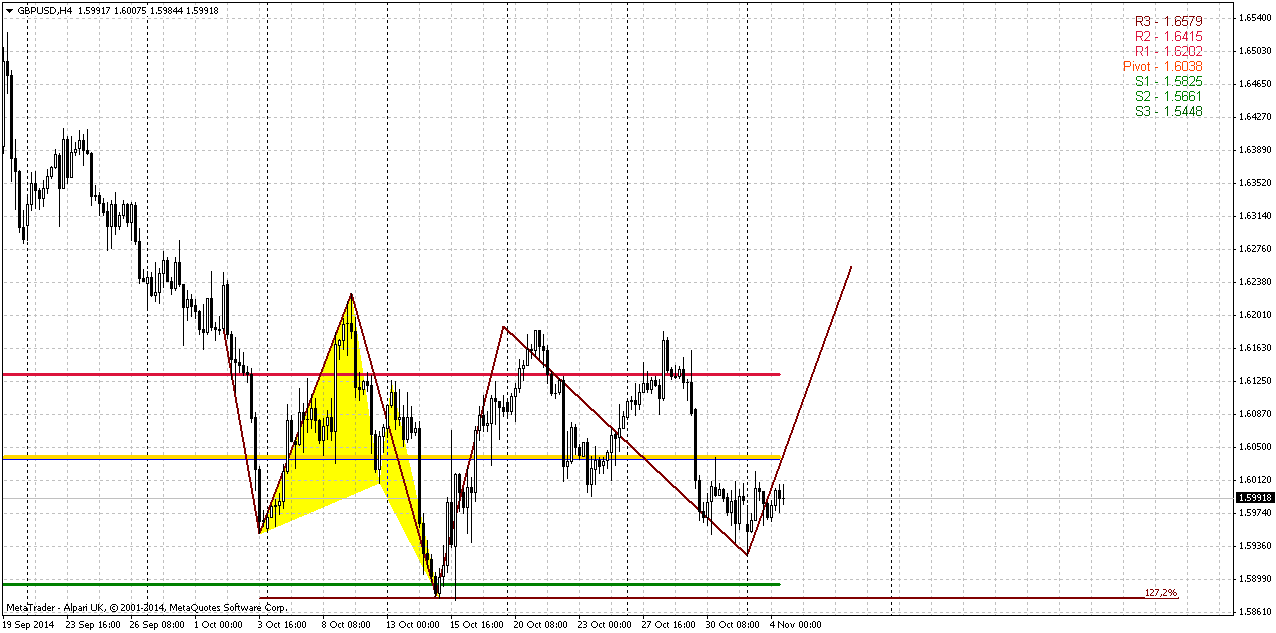

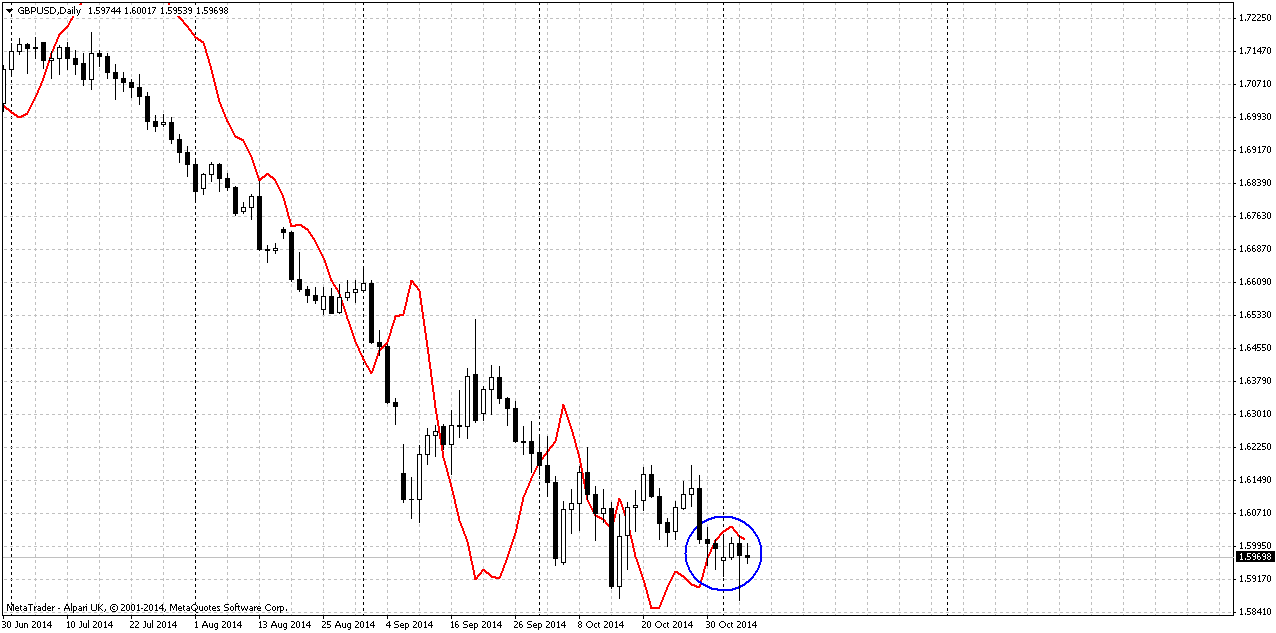

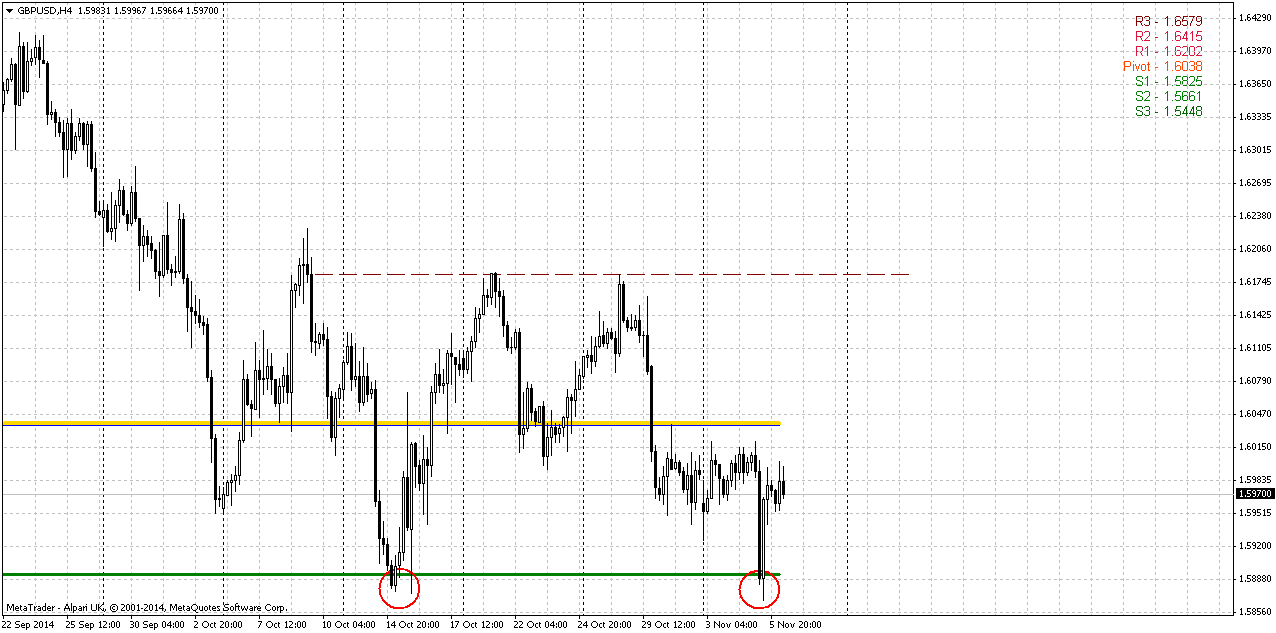

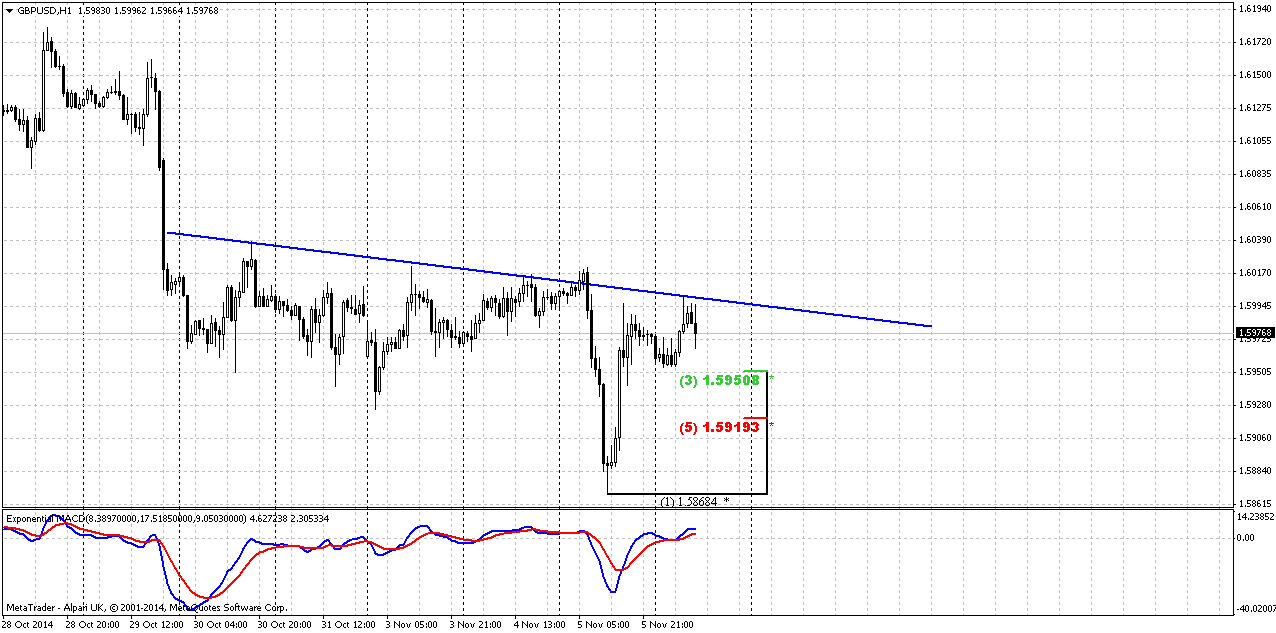

Finally we will talk on EUR currency again. On GBP situation does not need an update yet. Market still holds in our level of “right shoulder bottom”, so let’s see what will happen next.

As we’ve mentioned ones in our daily video, EUR right now stands in center of geopolitical and economical turmoil, thus it needs special discussion. Here we have mutual 2-side relations EU-US and EU-Russia. And progress of these relations develops not very positive. Shortly speaking we expect that EUR will continue move down. Below, guys, we will point our logic and opinion and may be will touch some geopolitical topics. I will do my best to avoid hurting of anybody’s patriotic feelings and some moments may become not very pleasant for somebody and even not obvious, but we will try to touch these moments as light as possible and only when they have relation to economy and way of our discussion. Besides, if we will close eyes on everything “uncomfortable” then we never will know truth. Our discussion of some geopolitical moments will stay in relation to economy and will not shift in sphere of personal political tastes and opinions.

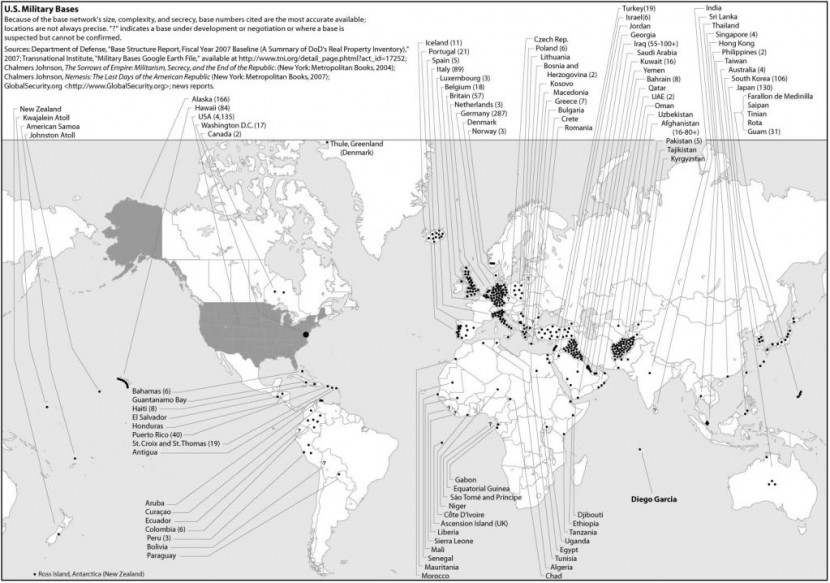

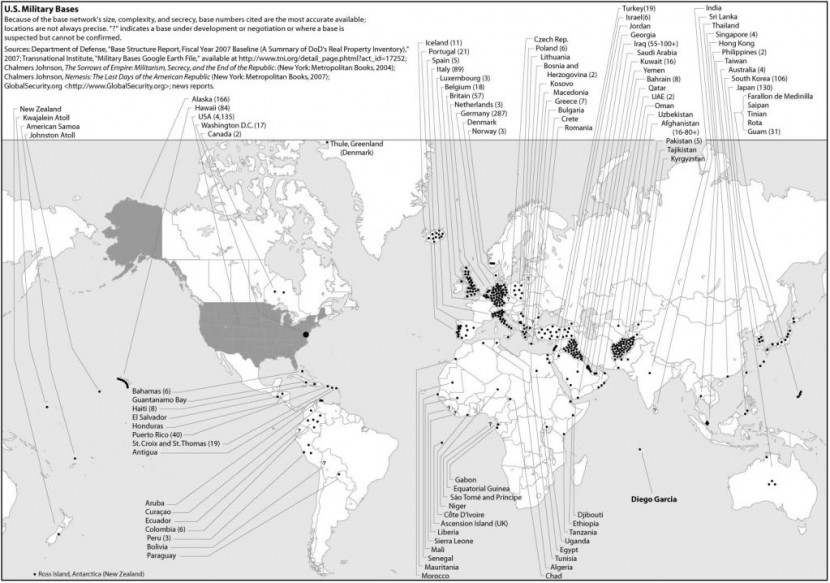

So, let’s start from EU-US. Here we have as geopolitcal moments as economical. In economy US would like to cut EU off from Russia and other countries and become primary trade partner. That’s why US works hard or “Zone of free trade agreement” and Europe just as strong as it could struggle with it and does not give any progress to this document. If it will be signed then it could lead to serious problems for EU domestic producers. Good quality european goods as food, clothes, textile, cars, machines etc will be replaced by cheap and not necessary US-made analogs that negatively impact on EU economy. If it could lead to some other positive moments – EU would probably has signed this document long time ago. Another part of this economic game stands in relation to geopolicy. Among different points with Ukranian compaign US has the point to cut EU off from Russia, particularly from purchasing of oil and gas and replace it by selling them US shale gas. US here has a lot of political ammunition. As you can see EU can’t follow its own policy (at least does not do this) and take the course that it forced to by US. We can call about anything here, but roughly speaking EU is US colony. US has huge amount of military objects across the Europe. We can call it as allies until this is comfortable for us, but in reality this is also control tool.

US Military Bases across the World

But why we’re talking about it? Because this explains why EU will follow to US external policy if even this course will bring just looses to Europe. This is the first factor that is pressing on EU – EU will accept solutions and make decisions that even will be negative for it, but positive for US. All impact of worsening mutual relations between EU and Russia will hurt EU but not US, and, hence, will be negative for EUR. Here are come sanctions, blocking of South Stream Gas project etc. Is it really EU politicians so stupid to hurt their own country? Either somebody forces it to take this. Ok, if even we suggest that this is own EU policy – this will change nothing. Anyway this will hurt EU and result for EUR will be the same.

Thus, as US is concerned and would like further escalation situation – this will impact EU in first turn and this is first factor of EUR weakness.

Now let’s shift to economy moments. Here they move on opposite directions. As US shows improving in economy that is confirmed from all sides – companies earnings, GDP, Consumer Confidence, NFP etc., EU has real problems with economy growth and stands under risk of new deflation spiral and ECB thinks on starting of QE analog in 2015 for 1 Trln EUR. This fact also does not fascinate on soon EUR improving. Thus, US-EU picture is clear...

Now, EU-Russia. Russia is one of the largest (3rd largest) EU partner with 400 Bln Eur annual turnover. Russia is not only goods’ consumer but also provider of commodities. And EU right now is taking confrontation policy with it. We have said a lot already about sanctions and other moments, but here I would like to touch most recent events. First is Milan meeting and recent agreement on Ukraine gas delivery. It shows that Russia will not go on any other concessions. It already has done much to for Ukraine – loan for 3Bln, 100$ price discount, postponing of payments etc. Thus recent Brusell gas meeting has finished with very simple result – Europe will pay for Ukraine till April for gas. From broader view, due taking strong position by Russia – this will increase pressure from US and will lead to new spiral of sanctions, results will be very hurting for EU either. To trigger new contradiction US pushes puppet Ukranian government on new war confrontation with South-East. You’ll see that war will continue very soon. And US again will press on EU, itemize Russia and tells that this is unreliable partner.

Here we do not want to dive into political debates. The major thing here is definite steps itself but not reasons why they were made. Your asessement of reasons of these steps could be different and we do not argue. This does not change the core, that is negative impact for EU economy.

This just explains why we think that EUR will remain under pressure for the long time. Because mostly situation in EU economy depends on Russia mutual relations. May be if situation would be stable, even at least negatively but stable, we could suggest some improvement. But we suggest that situation will become worse, US will demand more and more sanctions from EU upon Russia. But in turn, economical situation EU-Russia stands in relation with geopolicy where US will not accept any compromises because they loose and risk nothing. Any ECB efforts on stabilizing of EU economy will be mitigated by new spiral of geopolitical tensions and painful sanctions. That’s why here is our conclusion – hardly real reversal on EUR is possible any time soon.

From technical point of view trend holds bearish here, but market is not at oversold. Price has broken through all solid supports and right now stands in “free space” area. As we have large Gartley “222” Sell pattern, it nearest target is 1.22 – 0.618 AB-CD objective point.

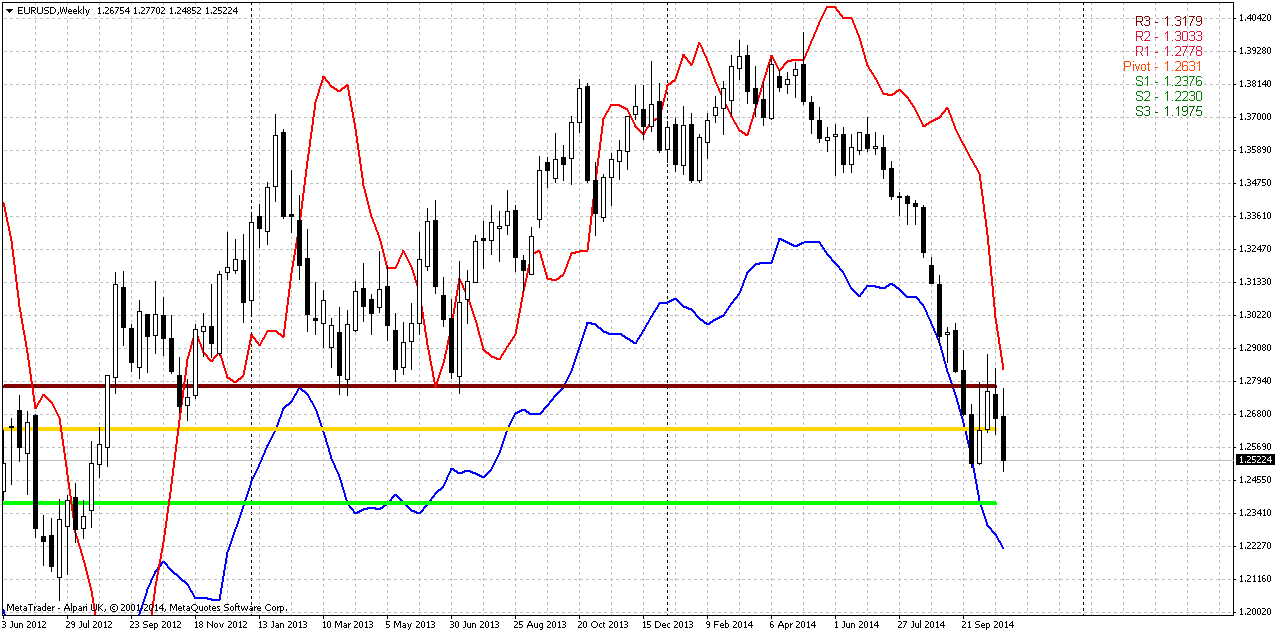

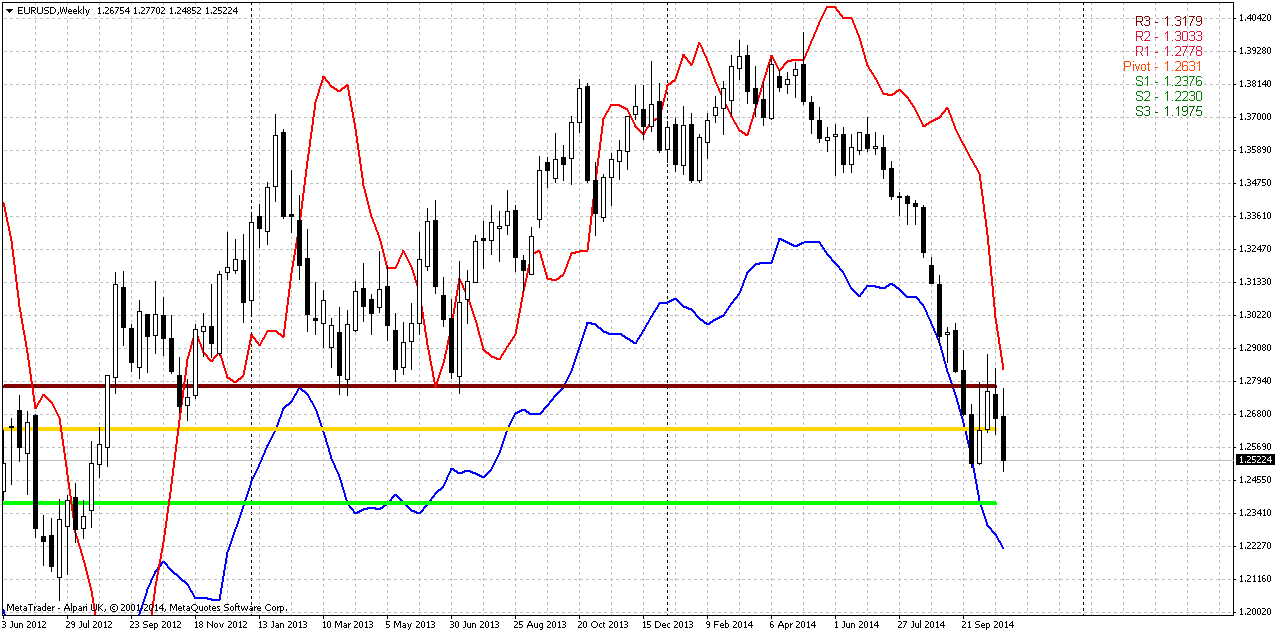

Weekly

This chart, guys does not give us a lot topics for discussion. Trend holds bearish, but we do not have any patterns – no grabbers, no DiNapoli directionals, although thrust down looks pretty nice. Recent retracement mostly was triggered by oversold condition. Right now market has abandoned it and is ready for downward continuation. The fact that price has shown very small retracement after solid plunge down tells that this retracement is not based on some sentiment changing but mostly technical. It has not even reached 3/8 Fib resistance. That’s why by the way, we didn’t get B&B “Sell” here.

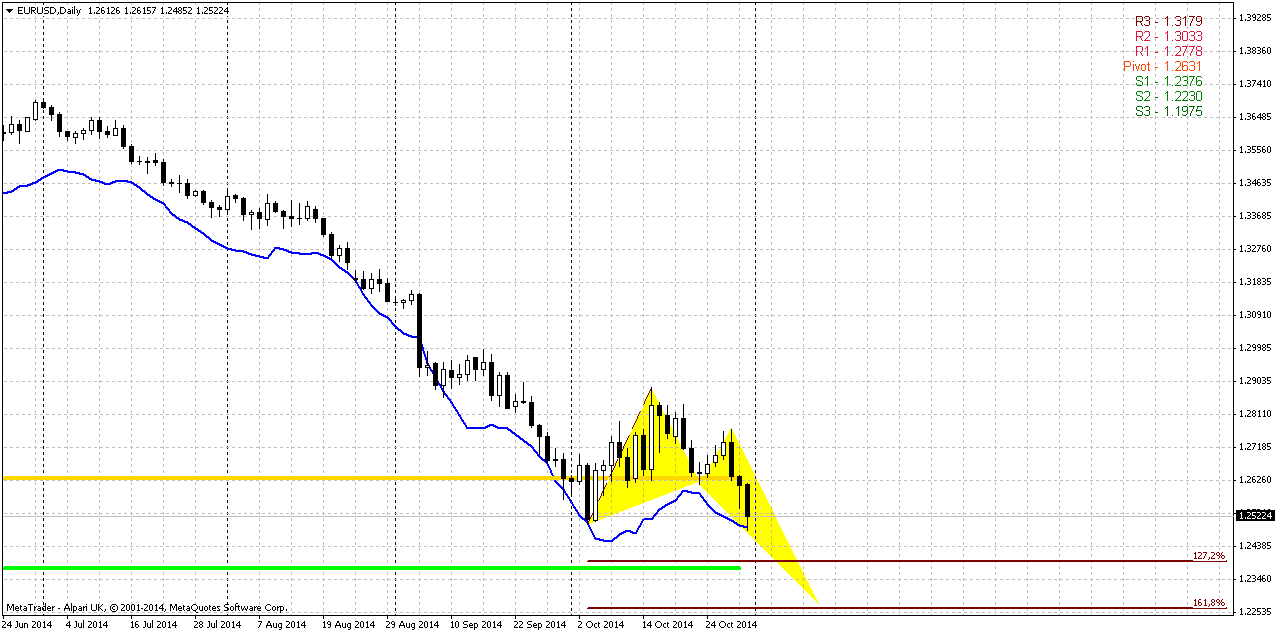

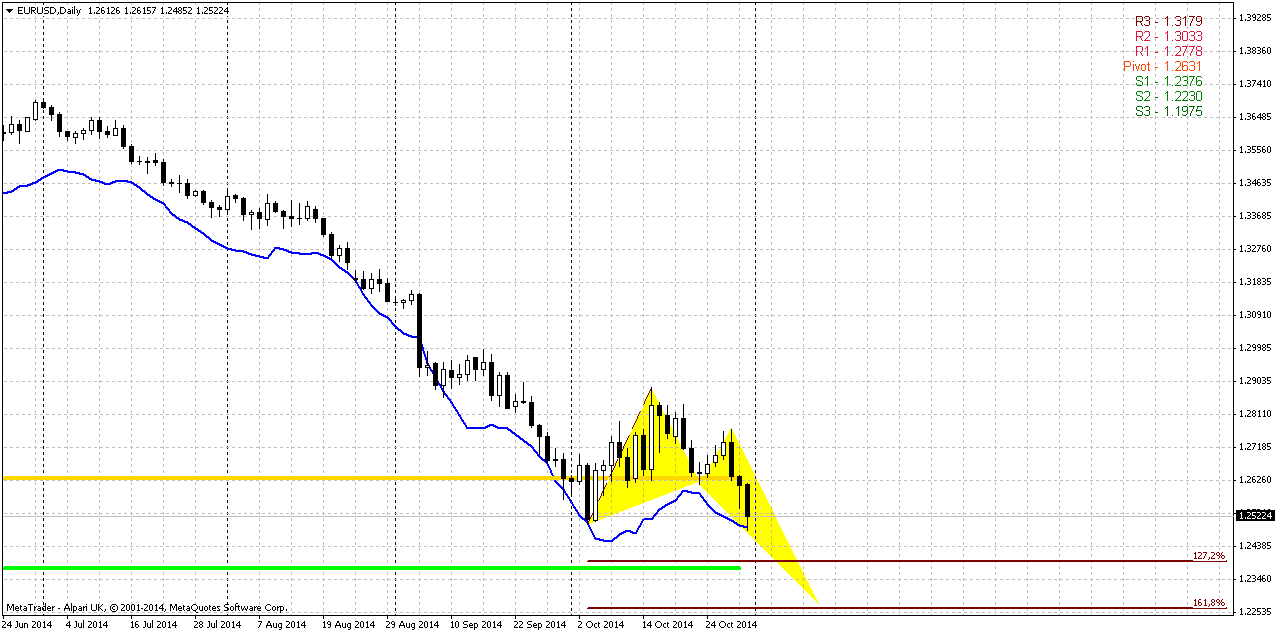

Daily

As upside AB=CD pattern has failed market has turned to Butterfly pattern. 1.618 extension stands almost in agreement with monthly target – 1.2250 vs 1.2200. But this is not perspective of coming week, probably. As market has stopped move down due daily oversold, the most probable next week objective point is 1.27 butterfly extension @ 1.2380 and MPS1.

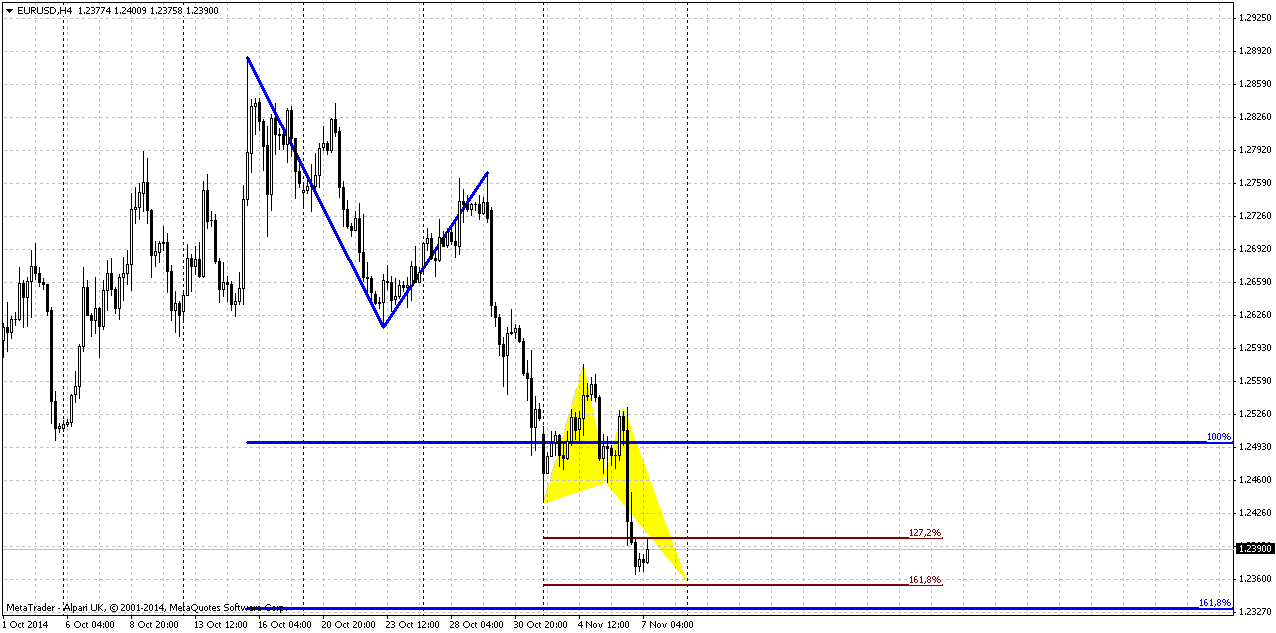

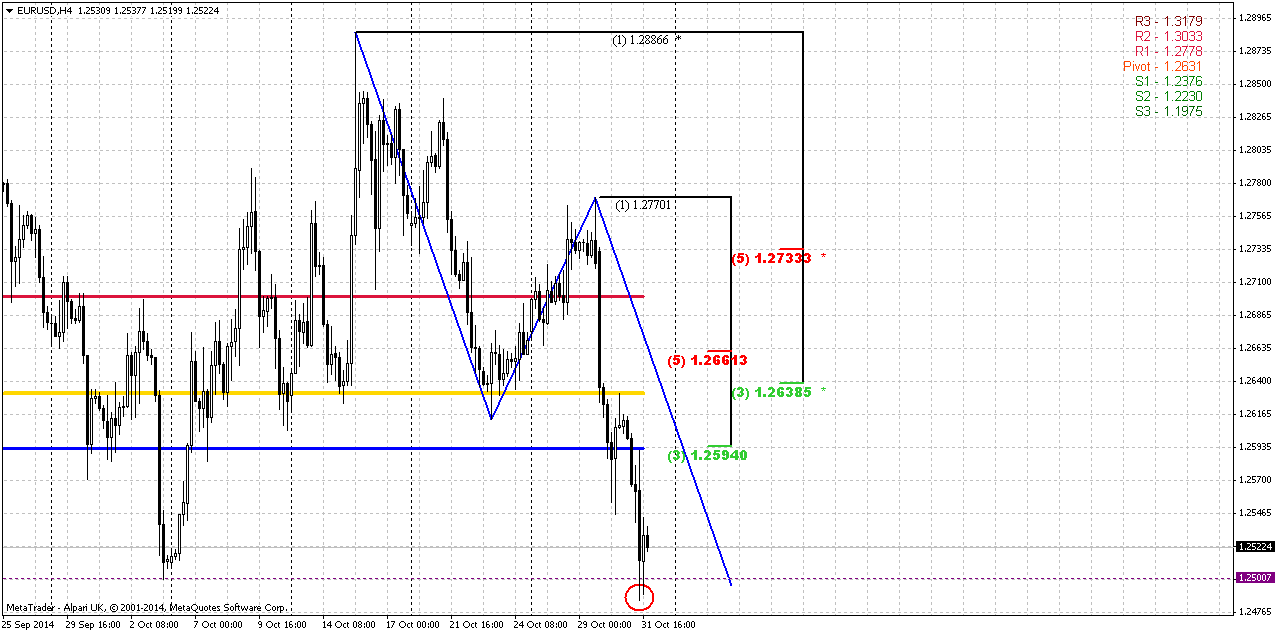

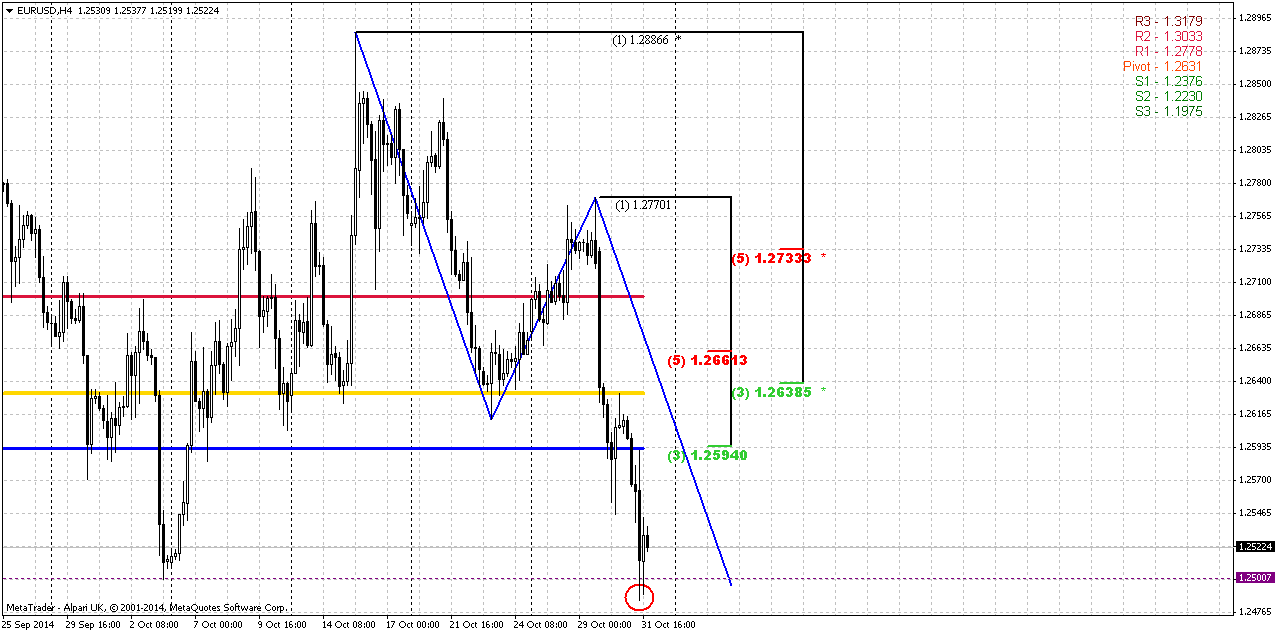

4-hour

This chart gives us picture for Mon-Tue. Market has completed our AB=CD right at daily oversold (so, this setup is called as “Kibby trade” by DiNapoli and has some features of Stretch pattern). At the same time we can say that CD leg was really fast and much faster than AB. This combination tells that although some retracement up probably will happen, but hardly it will be very deep and after it downward action will continue to next AB-CD objective point.

By taking a look at Fib levels and Pivots 1.2630-1.2660 seems as strong resistance, where rally could bog down. This rally also will give market oportunity to test as WPP as MPP. So, if you’re scalp trader on Monday keep an eye on hourly chart for any reversal patterns. Currently they have not been formed yet.

Conclusion:

In long-term perspective we expect further EUR depreciation. May be it will not be fast and furious as previously but gradually it should become weaker. Our nearest target stands at 1.22 and probably it will be reached within November.

In short-term perspective market has reached daily oversold and completed intraday AB=CD. This could become a background for short-term rally back to 1.2630-1.2660 strong resistance area that also will let market to test WPP and MPP.

Thus, for scalp traders – watch for bullish patterns on hourly chart that could let you to take long position. For positional traders – wait for 1.2630-1.2660 if rally will end there, we can sell it on a journey to 1.2375 target.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.

Weekly FX Tading Report prepared by Sive Morten exclusively for ForexPeaceArmy.com

According to Reuters news The yen plunged to a near seven-year low against the U.S. dollar on Friday, putting it on track for its worst day in 18 months, after the Bank of Japan shocked financial markets with an aggressive easing of its monetary policy.

In addition to the BoJ's decision to expand its already massive monetary stimulus plan, an announcement by the country's government pension fund that it would increase its holdings of foreign and domestic shares added to yen selling. Japan is aiming to reverse decades of deflation and subpar growth.

While some easing by Japan's central bank had been expected, most investors thought any action was months away as Governor Haruhiko Kuroda had voiced optimism over the Japanese economic outlook even after soft economic data.

"If the yen keeps weakening, watch for formal political appeals to stabilize the yen's value from non-exporting, small and medium-sized enterprises and from power utilities whose nuclear capacity is still offline," analysts at Eurasia Group wrote clients on Friday.

"If yen depreciation accelerates rapidly and looks to falls below 120/dollar, the Japanese government would likely intervene to put a floor under it," they said.

DOLLAR GETS SUPPORT FROM ALL SIDES

Japan's monetary policies are moving in the opposite direction indicated by the hawkish policy tone adopted this week by the U.S. Federal Reserve. The Fed's comment on the economy as it ended its bond-buying program raised expectations that the U.S. central bank will increase interest rates sooner than previously forecast.

There are two elements working in favor of a stronger dollar, said Win Thin, currency strategist at Brown Brothers Harriman in New York.

"On one side you have firm U.S. data and the Fed on track to hike next year." he said. "On the other side you have the BoJ's aggressive dovish move and the expectations that the ECB is going to have to do more in light of the weak data. That's driving euro/dollar down."

The European Central Bank has been more hesitant to throw open the monetary spigots in the face of deteriorating euro zone economic data. And the 0.4 percent rise in consumer prices in October announced on Friday lowered expectations the ECB will ease policy at its meeting next week.

Recent CFTC data does not show something special. Open interest shows slow growth, as well as short speculating positions. In general this combination looks supportive for further downward action.

Our ratio of shorts-to-OI shows 79.78% value. This number is significant but not extreme. So, it lets shorts to grow a bit more.

Non-Commercial Shorts:

Non-Commercial Longs:

Open Interest:

Technical

Finally we will talk on EUR currency again. On GBP situation does not need an update yet. Market still holds in our level of “right shoulder bottom”, so let’s see what will happen next.

As we’ve mentioned ones in our daily video, EUR right now stands in center of geopolitical and economical turmoil, thus it needs special discussion. Here we have mutual 2-side relations EU-US and EU-Russia. And progress of these relations develops not very positive. Shortly speaking we expect that EUR will continue move down. Below, guys, we will point our logic and opinion and may be will touch some geopolitical topics. I will do my best to avoid hurting of anybody’s patriotic feelings and some moments may become not very pleasant for somebody and even not obvious, but we will try to touch these moments as light as possible and only when they have relation to economy and way of our discussion. Besides, if we will close eyes on everything “uncomfortable” then we never will know truth. Our discussion of some geopolitical moments will stay in relation to economy and will not shift in sphere of personal political tastes and opinions.

So, let’s start from EU-US. Here we have as geopolitcal moments as economical. In economy US would like to cut EU off from Russia and other countries and become primary trade partner. That’s why US works hard or “Zone of free trade agreement” and Europe just as strong as it could struggle with it and does not give any progress to this document. If it will be signed then it could lead to serious problems for EU domestic producers. Good quality european goods as food, clothes, textile, cars, machines etc will be replaced by cheap and not necessary US-made analogs that negatively impact on EU economy. If it could lead to some other positive moments – EU would probably has signed this document long time ago. Another part of this economic game stands in relation to geopolicy. Among different points with Ukranian compaign US has the point to cut EU off from Russia, particularly from purchasing of oil and gas and replace it by selling them US shale gas. US here has a lot of political ammunition. As you can see EU can’t follow its own policy (at least does not do this) and take the course that it forced to by US. We can call about anything here, but roughly speaking EU is US colony. US has huge amount of military objects across the Europe. We can call it as allies until this is comfortable for us, but in reality this is also control tool.

US Military Bases across the World

But why we’re talking about it? Because this explains why EU will follow to US external policy if even this course will bring just looses to Europe. This is the first factor that is pressing on EU – EU will accept solutions and make decisions that even will be negative for it, but positive for US. All impact of worsening mutual relations between EU and Russia will hurt EU but not US, and, hence, will be negative for EUR. Here are come sanctions, blocking of South Stream Gas project etc. Is it really EU politicians so stupid to hurt their own country? Either somebody forces it to take this. Ok, if even we suggest that this is own EU policy – this will change nothing. Anyway this will hurt EU and result for EUR will be the same.

Thus, as US is concerned and would like further escalation situation – this will impact EU in first turn and this is first factor of EUR weakness.

Now let’s shift to economy moments. Here they move on opposite directions. As US shows improving in economy that is confirmed from all sides – companies earnings, GDP, Consumer Confidence, NFP etc., EU has real problems with economy growth and stands under risk of new deflation spiral and ECB thinks on starting of QE analog in 2015 for 1 Trln EUR. This fact also does not fascinate on soon EUR improving. Thus, US-EU picture is clear...

Now, EU-Russia. Russia is one of the largest (3rd largest) EU partner with 400 Bln Eur annual turnover. Russia is not only goods’ consumer but also provider of commodities. And EU right now is taking confrontation policy with it. We have said a lot already about sanctions and other moments, but here I would like to touch most recent events. First is Milan meeting and recent agreement on Ukraine gas delivery. It shows that Russia will not go on any other concessions. It already has done much to for Ukraine – loan for 3Bln, 100$ price discount, postponing of payments etc. Thus recent Brusell gas meeting has finished with very simple result – Europe will pay for Ukraine till April for gas. From broader view, due taking strong position by Russia – this will increase pressure from US and will lead to new spiral of sanctions, results will be very hurting for EU either. To trigger new contradiction US pushes puppet Ukranian government on new war confrontation with South-East. You’ll see that war will continue very soon. And US again will press on EU, itemize Russia and tells that this is unreliable partner.

Here we do not want to dive into political debates. The major thing here is definite steps itself but not reasons why they were made. Your asessement of reasons of these steps could be different and we do not argue. This does not change the core, that is negative impact for EU economy.

This just explains why we think that EUR will remain under pressure for the long time. Because mostly situation in EU economy depends on Russia mutual relations. May be if situation would be stable, even at least negatively but stable, we could suggest some improvement. But we suggest that situation will become worse, US will demand more and more sanctions from EU upon Russia. But in turn, economical situation EU-Russia stands in relation with geopolicy where US will not accept any compromises because they loose and risk nothing. Any ECB efforts on stabilizing of EU economy will be mitigated by new spiral of geopolitical tensions and painful sanctions. That’s why here is our conclusion – hardly real reversal on EUR is possible any time soon.

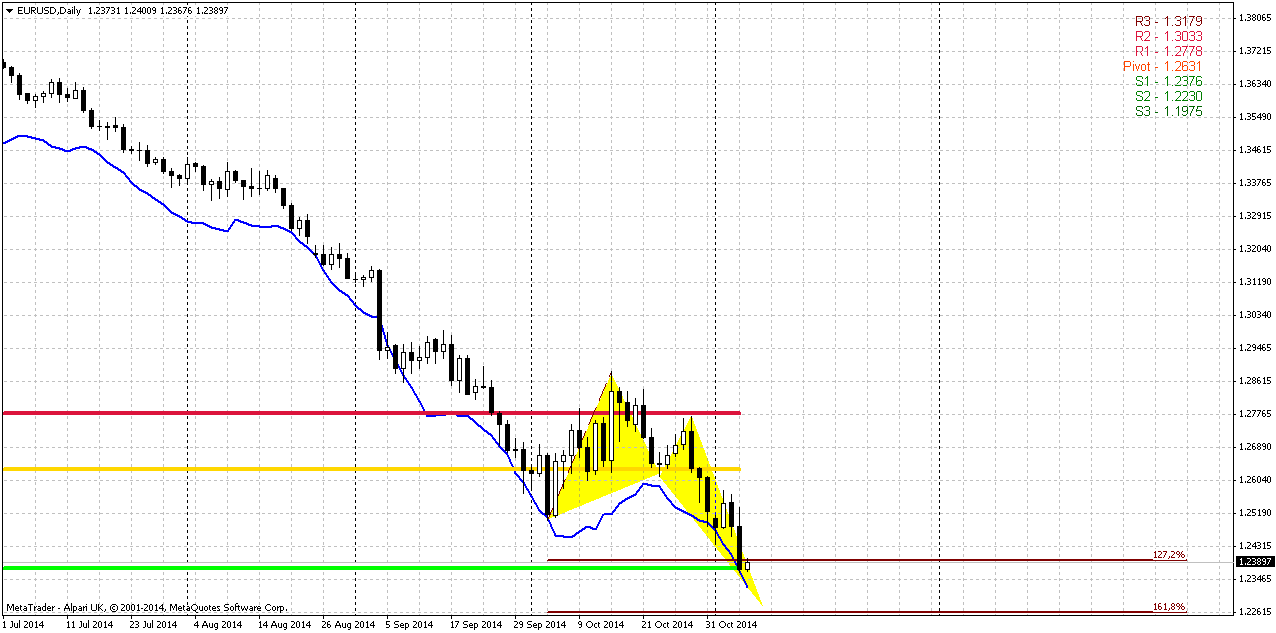

From technical point of view trend holds bearish here, but market is not at oversold. Price has broken through all solid supports and right now stands in “free space” area. As we have large Gartley “222” Sell pattern, it nearest target is 1.22 – 0.618 AB-CD objective point.

Weekly

This chart, guys does not give us a lot topics for discussion. Trend holds bearish, but we do not have any patterns – no grabbers, no DiNapoli directionals, although thrust down looks pretty nice. Recent retracement mostly was triggered by oversold condition. Right now market has abandoned it and is ready for downward continuation. The fact that price has shown very small retracement after solid plunge down tells that this retracement is not based on some sentiment changing but mostly technical. It has not even reached 3/8 Fib resistance. That’s why by the way, we didn’t get B&B “Sell” here.

Daily

As upside AB=CD pattern has failed market has turned to Butterfly pattern. 1.618 extension stands almost in agreement with monthly target – 1.2250 vs 1.2200. But this is not perspective of coming week, probably. As market has stopped move down due daily oversold, the most probable next week objective point is 1.27 butterfly extension @ 1.2380 and MPS1.

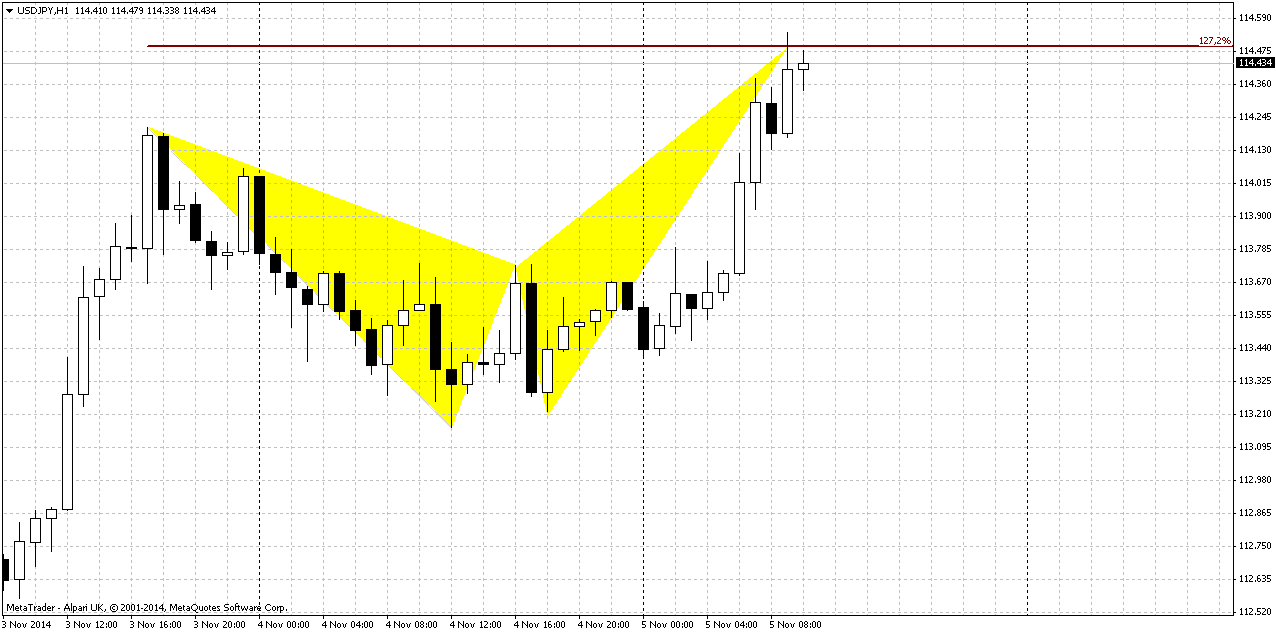

4-hour

This chart gives us picture for Mon-Tue. Market has completed our AB=CD right at daily oversold (so, this setup is called as “Kibby trade” by DiNapoli and has some features of Stretch pattern). At the same time we can say that CD leg was really fast and much faster than AB. This combination tells that although some retracement up probably will happen, but hardly it will be very deep and after it downward action will continue to next AB-CD objective point.

By taking a look at Fib levels and Pivots 1.2630-1.2660 seems as strong resistance, where rally could bog down. This rally also will give market oportunity to test as WPP as MPP. So, if you’re scalp trader on Monday keep an eye on hourly chart for any reversal patterns. Currently they have not been formed yet.

Conclusion:

In long-term perspective we expect further EUR depreciation. May be it will not be fast and furious as previously but gradually it should become weaker. Our nearest target stands at 1.22 and probably it will be reached within November.

In short-term perspective market has reached daily oversold and completed intraday AB=CD. This could become a background for short-term rally back to 1.2630-1.2660 strong resistance area that also will let market to test WPP and MPP.

Thus, for scalp traders – watch for bullish patterns on hourly chart that could let you to take long position. For positional traders – wait for 1.2630-1.2660 if rally will end there, we can sell it on a journey to 1.2375 target.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.