Sive Morten

Special Consultant to the FPA

- Messages

- 18,676

Fundamentals

(Reuters) The U.S. dollar hit a more than one-month low against the safe-haven Swiss franc on Friday on nervousness ahead of next week's U.S. presidential election, despite a solid U.S. jobs report that supported expectations for a Federal Reserve rate hike next month.

Traders largely looked past the U.S. October nonfarm payrolls report, which showed wage growth that reinforced bets of a rate hike in December, choosing to position themselves ahead of an increasingly uncertain race for the White House.

The battle between Democrat Hillary Clinton and Republican Donald Trump has tightened significantly in the past week, as several swing states that were leaning toward Clinton are now considered toss-ups, according to the Reuters/Ipsos States of the Nation project.

Clinton has been viewed as the candidate of the status quo, while many fear that a Trump victory on Tuesday would carry global risks to trade and growth.

The dollar was last down 0.45 percent against the Swiss franc, at 0.9694 franc, near a more than one-month low of 0.9682 touched earlier. The dollar was mostly flat against the yen, at 103.02 yen, not far from a one-month low of 102.54 hit on Thursday.

"The Swiss franc is kind of the darling" given its safety, said Axel Merk, president and chief investment officer of Merk Investments in Palo Alto, California.

The Mexican peso rose as much as 1.2 percent against the dollar, to 18.9348 pesos per dollar, after hitting a more than one-month low of 19.5450 Thursday.

Investors likely bought the peso to neutralise Thursday's selling on election uncertainty, said Sireen Harajli, currency strategist at Mizuho Corporate Bank in New York.

The peso is being used as a proxy on bets on the U.S. election because Mexico is considered to be the most vulnerable to Republican Donald Trump's protectionist policy on trade as the country sends 80 percent of its exports to the United States.

The euro was last up 0.2 percent at $1.1125 , near a more than three-week high of $1.1130 touched earlier, after initially slipping 0.2 percent to a session low of $1.1081.

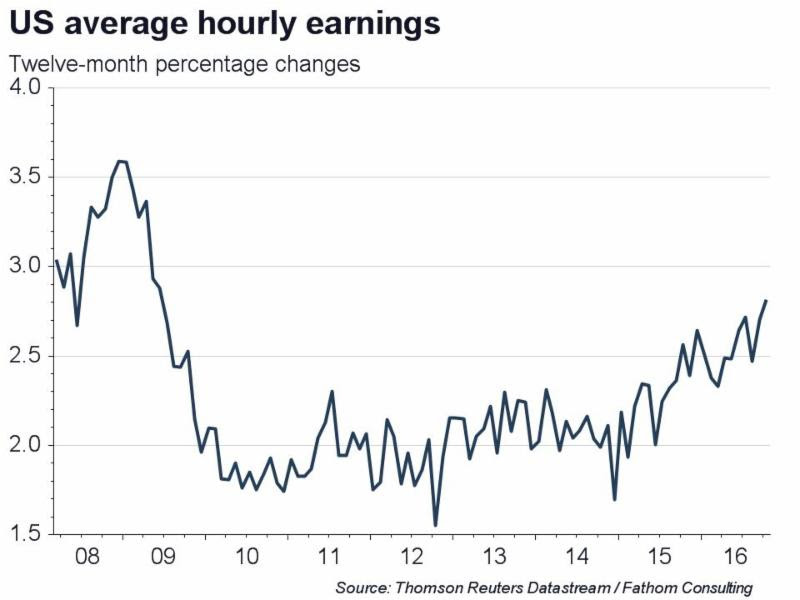

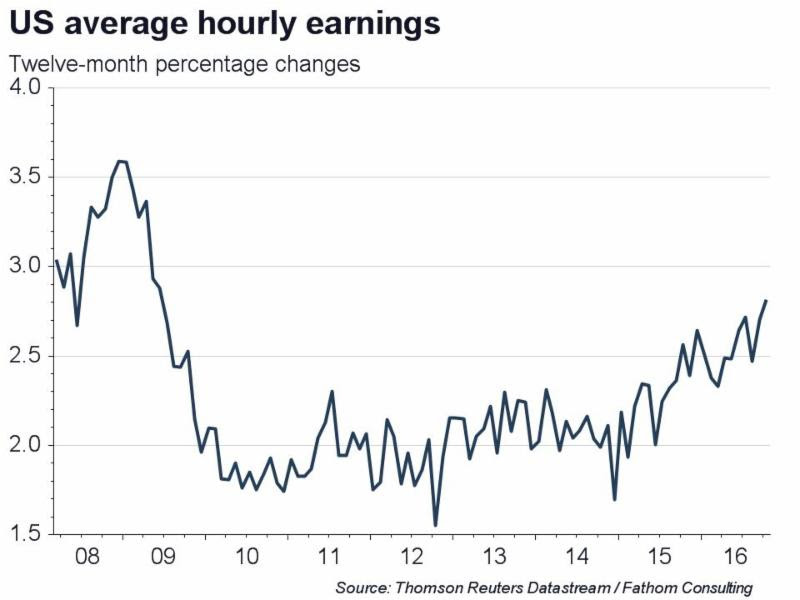

The dollar had gained against the euro after the jobs report showed a year-on-year increase in average hourly earnings of 2.8 percent, the biggest gain since June 2009, before reversing course.

The dollar index, which measures the greenback against a basket of six major currencies, was set to post its biggest weekly percentage drop since late July, of 1.4 percent.

Despite that NFP was slightly less than expected, they show nice wage boost. This enfource hawkish policy and December rate hike:

US wage inflation bolsters case for rate hike next month

by Fathom consulting:

- Today's nonfarm payrolls report showed that the US labour market continues to tighten, with 161,000 jobs added in October.

- Average hourly earnings climbed 0.4% last month, which pushed the annual rate to 2.8%, a post-recession high.

- This acceleration in wages further bolsters the already strong case for a US rate hike next month.

- The average pace of job creation has slowed a little this year, but is still well above the level needed to put upward pressure on wages.

Here is a continuation of very interesting "Donald Dark" article by Fathom consulting. Here they continue to shed light on perspectives of Trump's victory:

Donald Dark: more than just a peso problem

- Our most recent quarterly forecast included a risk scenario that we called ‘Donald Dark’;

- It envisages growing isolationism, and a sharp drop in global trade, hastened by a protectionist Donald Trump presidency in the US;

- Emerging markets have been the greatest beneficiaries of globalisation. They stand to lose the most if it goes into reverse.

Last week, we outlined our central view that GDP growth in emerging markets (EMs) would accelerate away from that in the moribund advanced economies over the next couple of years. That forecast assumed a victory for Hillary Clinton in the US presidential elections or, failing that, a form of ‘Trump Lite’ where Mr Trump

enacts only a small proportion of all that he has promised. This environment yields a ‘business as usual’ outlook of weak but positive growth in the advanced economies.

Our risk scenario, to which we assign a 15% weight, envisages a rise in isolationism globally. The recently observed stagnation in global trade as a share of global GDP turns into a rout. Countries, hastened by a Trump presidency in the US, turn inward. In our view, such a development would deliver a significant

negative blow to global economic growth with EMs particularly affected.

Mr Trump is perhaps the most likely catalyst for a shift towards greater isolationism in the short term. But even if he does not emerge victorious next week, the forces that propelled him over the past 18 months, including an anti-elite sentiment amid rising inequality, are unlikely to go away. Indeed, the same set of grievances help to explain the UK’s vote for Brexit, and the popularity of Marine Le Pen in France.

So while the probability of a sharp decline in world trade in the next year or two may be small, the likelihood that advanced economies will adopt further inward-looking policies in the coming years is high. As a consequence, EMs will remain vulnerable to growing isolationism for some time to come.

Disparate gains from trade

For almost 200 hundred years the fact that trade is beneficial has been a fundamental tenet of economics. Reinforcing this view, rising trade intensity over the past forty years has coincided with increased standards of living. However, the gains from global trade in recent decades have not been equally shared - within

or among countries. Branko Milanovic’s socalled ‘Elephant Chart’ shows that income growth in the 20 years to 2008 was concentrated in the lower and upper-most percentiles of global income distribution. Many

blue collar workers in the advanced economies experienced little or no growth in their incomes, while employees in EMs, together with the very wealthiest, have enjoyed marked growth.

The flipside of stagnant blue collar incomes in the advanced economies has been a substantial increase in average living standards elsewhere in places like Brazil, China and India. EMs have reaped handsome rewards from the world’s more open exchange of goods and services. It has boosted economic growth rates,

and resulted in a rapid improvement in standards of living. A move away from globalisation risks delivering a negative shock to the global economy, with EMs particularly affected.

The politics of envy

The unequal distribution of income growth has not gone unnoticed by voters. When polled, the poorer a country is, the more likely its population is to favour free trade and inward investment. In developing economies, the benefits of both are more tangible. By contrast, only a minority of the public in advanced economies believe that free trade is beneficial. The US public may be the most skeptical of all, with just one in five Americans believing that trade creates jobs or raises wages. Mr Trump has tapped into that sentiment, promising to slap high tariffs on imports into the US and renege on free trade agreements such as NAFTA. The risk is that other countries reciprocate, leading to increased barriers internationally and a downturn in global trade.

Not just a peso problem

To date, currency markets have been a reliable bellwether of Donald Trump’s chances of being elected President. The Mexican peso has risen and fallen with the implied odds of Mr Trump being elected. Nearly 80% of Mexico’s exports go to the US and he has threatened to impose a 35% tariff on them, prompting Mexico’s central bank governor to suggest a Trump presidency would hit Mexico’s economy like a “hurricane” – a sentiment that we share.

However, our risk scenario produces a lot more than just a peso problem. Other tradedependent EMs would also be severely affected. In Vietnam, gross trade as a share of GDP tops 150%, with exports to the US

accounting for almost one fifth of GDP. Economies that are more open generally, and with large exposure to the US specifically, would be most at-risk.

Openness to trade increases an economy’s vulnerability to isolationism, but the alternative does not guarantee immunity. Some countries that have relatively low trade intensities, such as Brazil, would suffer negative consequences via indirect channels. These include lower commodity prices from weaker global demand, as well as increased risk aversion in financial markets with associated declines in investment

and an increased cost of capital. Countries that are relatively closed, have low external debt and are not dependent on commodity exports should be the least affected. On that basis, India stands out as an outperformer.

Crisis point

An isolationist world risks more than just weaker growth for EMs – it threatens crises. We ran key

macroeconomic and financial market outputs from our risk scenario through our Financial Vulnerability Indicator (FVI) to assess the possibility of sovereign default. On the whole, the results showed that those countries already susceptible to a fiscal crunch such as Brazil, Russia and South Africa would remain extremely vulnerable in our isolationist scenario. Mexico and Turkey, who currently exhibit relatively low

probabilities of fiscal vulnerability, rise sharply up the rankings. For both, this reflects a combination of capital outflows, negative shocks to growth and rising borrowing costs.

So, no doubts elections right now is a major driving factor for whole world, not just for financial markets. If you let me, I bring 2 cents of my opinion on global situation. My opinion could seem as a joke that has very small relation to reality. But this is just at first glance, mostly because modern analysists, political experts stands under mind control that they even do not understand. They are wise people but their brains were washed by strong media machine and they can't think differently already. Most EU experts think that if Merkel will demand something or Holland will say "strickly" they could press on Putin and force him to do something. They still think that EU plays very significant role on global policy. Actually this is not the case.

Our opinion is based on Trump victory. He will win. His victory could lead to strong social turmoil inside US first, but in long-term perspective this will bring positive consequences to US nation. Trump will focus on resolving of inner US problems, step-out from policy of global control and dominance. US already can't carry this burden. USA will become strong regional power and keep influence on North and South America, partically on Pacific region.

EU is nothing on political arena. They have no army and they forget what "military superiority" means. Russia keeps visuality of "conversation" but in reality EU leaders look pathetic. They are persons that could do nothing but have huge conceit. Russia just doesn't point on this and lets them feel graciously as they do.

Putin is not a clown. He doesn't joke with world by signing law acts, which tell- "step back NATO to 2000 year borders and compenstate loss from sactions". This is not a joke. The truth stands so that who first will come to him with willingness to do it - will get dominant role. And this person will be Trump. As a result US will get time to resolve debt problems smoothly and other economic and social problems.

He also said about legal affairs on international claims of West countries, starting from Yugoslavia and ending in current claims in Syria and Iraq. Others - who will not come should start preparation to international court affairs. They will pay for all that have been done, because somedody has to pay. This will happen and very soon. The only way how they could escape it is to use military forces as they did starting 1990's and everything were getting over. Now it is not the case.

That's why guys, Trump will will lead to big shifts in Global balance and this is not just light speculations on election process. This is serious stuff. That's why we pay a lot of attention to this moment. Investors are also not stupid, this action on markets across the board that breaks normal laws of price behavior is not an occasion either...

CFTC data

Despite upside rally COT report shows data only on 1st of November, so we do not know yet how recent rally has changed speculation position. On 1st of November sentiment strong bearish as speculative position stands short and increased with open interest:

Technical

Monthly

Monthly has too large scale to be impacted by recent rally, although it looks solid on daily chart. October month still stands as inside one, but I feel that picture will change next week. Technically situation stands the same, but what value it has right now, before elections, is a philosophical question. Still, key levels will have the same meaning, despite the reason of their breakout, right?

Currently EUR stands at rather strong wide support area. This is lower border of downward channel and all-time 5/8 Fib support. Here EUR has formed Butterfly "buy" and it has reached first 1.27 extension here. Probably it needs some time to pass through this level and supportive fundamental background of US strength.

EUR is forming typical reversal candle in May. Price has moved above April top and closed below April's lows. It could not get extended continuation, but usually market shows downward continuation within next 1-3 candles.

Sometimes reversal candles lead to collapse, as it was on EUR around 1.40 area. Thrust down has started particularly by reversal candle in March 2014.

Speaking on big scale bearish signs, we have these ones:

EUR was not able to reach YPR1 and returned right back down to YPP. Following this logic next destination could be YPS1 right around parity and 1.618 butterfly target. This is just another destination point that we have here.

Appearing of reversal candle brings nothing good to bulls. Currently we can't precisely forecast the consequences of its appearing, but even minor results will bring some months of downward action inside current 1.04 -1.15 consolidation... Although potential bearish impact could be even stronger.

Finally we have another bearish sign that looks like bearish dynamic pressure. Take a look that although trend holds bullish - market shows inablitity to move up, even from strong support area. Next strong support stands precisely at parity and will become a culmination of downward action, since this level includes support line, YPS1 and butterfly 1.618 target. Brexit results hardly will bring prosperity to EU and probably will become another bearish driving factor for EUR. We aleardy see consequences of Brexit on GBP, so, some negative impact on EUR also will happen, this is just a question of time.

Also take a look at different behavior near low border of channel. Previously when market has touched it - it shows immediate upside pullback, it was V-shape reversal. Right now behavior is absolutely different, price just hangs on the border and shows no upside action. Any tight consolidation near trendline could become a sign of coming breakout.

Thus, based on monthly chart we could make two major conclusions. First is - real bullish trend will be re-established only when EUR will erase reversal candle and overcome its top above 1.16. Second, if EUR will still keep moderate bearish sentiment, downside potential hardly will be lower than parity, due recent Fed dovish adjustments to its policy for 2017-2018.

Monthly chart is a slow time frame, where we could get fargoing perspectives of some event that already has happened, but we can't catch here real-time changes that are taking place on the market in a moment of this event, which I mean elections. That's why to get some more information we need to dig lower time frames.

(Reuters) The U.S. dollar hit a more than one-month low against the safe-haven Swiss franc on Friday on nervousness ahead of next week's U.S. presidential election, despite a solid U.S. jobs report that supported expectations for a Federal Reserve rate hike next month.

Traders largely looked past the U.S. October nonfarm payrolls report, which showed wage growth that reinforced bets of a rate hike in December, choosing to position themselves ahead of an increasingly uncertain race for the White House.

The battle between Democrat Hillary Clinton and Republican Donald Trump has tightened significantly in the past week, as several swing states that were leaning toward Clinton are now considered toss-ups, according to the Reuters/Ipsos States of the Nation project.

Clinton has been viewed as the candidate of the status quo, while many fear that a Trump victory on Tuesday would carry global risks to trade and growth.

The dollar was last down 0.45 percent against the Swiss franc, at 0.9694 franc, near a more than one-month low of 0.9682 touched earlier. The dollar was mostly flat against the yen, at 103.02 yen, not far from a one-month low of 102.54 hit on Thursday.

"The Swiss franc is kind of the darling" given its safety, said Axel Merk, president and chief investment officer of Merk Investments in Palo Alto, California.

The Mexican peso rose as much as 1.2 percent against the dollar, to 18.9348 pesos per dollar, after hitting a more than one-month low of 19.5450 Thursday.

Investors likely bought the peso to neutralise Thursday's selling on election uncertainty, said Sireen Harajli, currency strategist at Mizuho Corporate Bank in New York.

The peso is being used as a proxy on bets on the U.S. election because Mexico is considered to be the most vulnerable to Republican Donald Trump's protectionist policy on trade as the country sends 80 percent of its exports to the United States.

The euro was last up 0.2 percent at $1.1125 , near a more than three-week high of $1.1130 touched earlier, after initially slipping 0.2 percent to a session low of $1.1081.

The dollar had gained against the euro after the jobs report showed a year-on-year increase in average hourly earnings of 2.8 percent, the biggest gain since June 2009, before reversing course.

The dollar index, which measures the greenback against a basket of six major currencies, was set to post its biggest weekly percentage drop since late July, of 1.4 percent.

Despite that NFP was slightly less than expected, they show nice wage boost. This enfource hawkish policy and December rate hike:

US wage inflation bolsters case for rate hike next month

by Fathom consulting:

- Today's nonfarm payrolls report showed that the US labour market continues to tighten, with 161,000 jobs added in October.

- Average hourly earnings climbed 0.4% last month, which pushed the annual rate to 2.8%, a post-recession high.

- This acceleration in wages further bolsters the already strong case for a US rate hike next month.

- The average pace of job creation has slowed a little this year, but is still well above the level needed to put upward pressure on wages.

Here is a continuation of very interesting "Donald Dark" article by Fathom consulting. Here they continue to shed light on perspectives of Trump's victory:

Donald Dark: more than just a peso problem

- Our most recent quarterly forecast included a risk scenario that we called ‘Donald Dark’;

- It envisages growing isolationism, and a sharp drop in global trade, hastened by a protectionist Donald Trump presidency in the US;

- Emerging markets have been the greatest beneficiaries of globalisation. They stand to lose the most if it goes into reverse.

Last week, we outlined our central view that GDP growth in emerging markets (EMs) would accelerate away from that in the moribund advanced economies over the next couple of years. That forecast assumed a victory for Hillary Clinton in the US presidential elections or, failing that, a form of ‘Trump Lite’ where Mr Trump

enacts only a small proportion of all that he has promised. This environment yields a ‘business as usual’ outlook of weak but positive growth in the advanced economies.

Our risk scenario, to which we assign a 15% weight, envisages a rise in isolationism globally. The recently observed stagnation in global trade as a share of global GDP turns into a rout. Countries, hastened by a Trump presidency in the US, turn inward. In our view, such a development would deliver a significant

negative blow to global economic growth with EMs particularly affected.

Mr Trump is perhaps the most likely catalyst for a shift towards greater isolationism in the short term. But even if he does not emerge victorious next week, the forces that propelled him over the past 18 months, including an anti-elite sentiment amid rising inequality, are unlikely to go away. Indeed, the same set of grievances help to explain the UK’s vote for Brexit, and the popularity of Marine Le Pen in France.

So while the probability of a sharp decline in world trade in the next year or two may be small, the likelihood that advanced economies will adopt further inward-looking policies in the coming years is high. As a consequence, EMs will remain vulnerable to growing isolationism for some time to come.

Disparate gains from trade

For almost 200 hundred years the fact that trade is beneficial has been a fundamental tenet of economics. Reinforcing this view, rising trade intensity over the past forty years has coincided with increased standards of living. However, the gains from global trade in recent decades have not been equally shared - within

or among countries. Branko Milanovic’s socalled ‘Elephant Chart’ shows that income growth in the 20 years to 2008 was concentrated in the lower and upper-most percentiles of global income distribution. Many

blue collar workers in the advanced economies experienced little or no growth in their incomes, while employees in EMs, together with the very wealthiest, have enjoyed marked growth.

The flipside of stagnant blue collar incomes in the advanced economies has been a substantial increase in average living standards elsewhere in places like Brazil, China and India. EMs have reaped handsome rewards from the world’s more open exchange of goods and services. It has boosted economic growth rates,

and resulted in a rapid improvement in standards of living. A move away from globalisation risks delivering a negative shock to the global economy, with EMs particularly affected.

The politics of envy

The unequal distribution of income growth has not gone unnoticed by voters. When polled, the poorer a country is, the more likely its population is to favour free trade and inward investment. In developing economies, the benefits of both are more tangible. By contrast, only a minority of the public in advanced economies believe that free trade is beneficial. The US public may be the most skeptical of all, with just one in five Americans believing that trade creates jobs or raises wages. Mr Trump has tapped into that sentiment, promising to slap high tariffs on imports into the US and renege on free trade agreements such as NAFTA. The risk is that other countries reciprocate, leading to increased barriers internationally and a downturn in global trade.

Not just a peso problem

To date, currency markets have been a reliable bellwether of Donald Trump’s chances of being elected President. The Mexican peso has risen and fallen with the implied odds of Mr Trump being elected. Nearly 80% of Mexico’s exports go to the US and he has threatened to impose a 35% tariff on them, prompting Mexico’s central bank governor to suggest a Trump presidency would hit Mexico’s economy like a “hurricane” – a sentiment that we share.

However, our risk scenario produces a lot more than just a peso problem. Other tradedependent EMs would also be severely affected. In Vietnam, gross trade as a share of GDP tops 150%, with exports to the US

accounting for almost one fifth of GDP. Economies that are more open generally, and with large exposure to the US specifically, would be most at-risk.

Openness to trade increases an economy’s vulnerability to isolationism, but the alternative does not guarantee immunity. Some countries that have relatively low trade intensities, such as Brazil, would suffer negative consequences via indirect channels. These include lower commodity prices from weaker global demand, as well as increased risk aversion in financial markets with associated declines in investment

and an increased cost of capital. Countries that are relatively closed, have low external debt and are not dependent on commodity exports should be the least affected. On that basis, India stands out as an outperformer.

Crisis point

An isolationist world risks more than just weaker growth for EMs – it threatens crises. We ran key

macroeconomic and financial market outputs from our risk scenario through our Financial Vulnerability Indicator (FVI) to assess the possibility of sovereign default. On the whole, the results showed that those countries already susceptible to a fiscal crunch such as Brazil, Russia and South Africa would remain extremely vulnerable in our isolationist scenario. Mexico and Turkey, who currently exhibit relatively low

probabilities of fiscal vulnerability, rise sharply up the rankings. For both, this reflects a combination of capital outflows, negative shocks to growth and rising borrowing costs.

So, no doubts elections right now is a major driving factor for whole world, not just for financial markets. If you let me, I bring 2 cents of my opinion on global situation. My opinion could seem as a joke that has very small relation to reality. But this is just at first glance, mostly because modern analysists, political experts stands under mind control that they even do not understand. They are wise people but their brains were washed by strong media machine and they can't think differently already. Most EU experts think that if Merkel will demand something or Holland will say "strickly" they could press on Putin and force him to do something. They still think that EU plays very significant role on global policy. Actually this is not the case.

Our opinion is based on Trump victory. He will win. His victory could lead to strong social turmoil inside US first, but in long-term perspective this will bring positive consequences to US nation. Trump will focus on resolving of inner US problems, step-out from policy of global control and dominance. US already can't carry this burden. USA will become strong regional power and keep influence on North and South America, partically on Pacific region.

EU is nothing on political arena. They have no army and they forget what "military superiority" means. Russia keeps visuality of "conversation" but in reality EU leaders look pathetic. They are persons that could do nothing but have huge conceit. Russia just doesn't point on this and lets them feel graciously as they do.

Putin is not a clown. He doesn't joke with world by signing law acts, which tell- "step back NATO to 2000 year borders and compenstate loss from sactions". This is not a joke. The truth stands so that who first will come to him with willingness to do it - will get dominant role. And this person will be Trump. As a result US will get time to resolve debt problems smoothly and other economic and social problems.

He also said about legal affairs on international claims of West countries, starting from Yugoslavia and ending in current claims in Syria and Iraq. Others - who will not come should start preparation to international court affairs. They will pay for all that have been done, because somedody has to pay. This will happen and very soon. The only way how they could escape it is to use military forces as they did starting 1990's and everything were getting over. Now it is not the case.

That's why guys, Trump will will lead to big shifts in Global balance and this is not just light speculations on election process. This is serious stuff. That's why we pay a lot of attention to this moment. Investors are also not stupid, this action on markets across the board that breaks normal laws of price behavior is not an occasion either...

CFTC data

Despite upside rally COT report shows data only on 1st of November, so we do not know yet how recent rally has changed speculation position. On 1st of November sentiment strong bearish as speculative position stands short and increased with open interest:

Technical

Monthly

Monthly has too large scale to be impacted by recent rally, although it looks solid on daily chart. October month still stands as inside one, but I feel that picture will change next week. Technically situation stands the same, but what value it has right now, before elections, is a philosophical question. Still, key levels will have the same meaning, despite the reason of their breakout, right?

Currently EUR stands at rather strong wide support area. This is lower border of downward channel and all-time 5/8 Fib support. Here EUR has formed Butterfly "buy" and it has reached first 1.27 extension here. Probably it needs some time to pass through this level and supportive fundamental background of US strength.

EUR is forming typical reversal candle in May. Price has moved above April top and closed below April's lows. It could not get extended continuation, but usually market shows downward continuation within next 1-3 candles.

Sometimes reversal candles lead to collapse, as it was on EUR around 1.40 area. Thrust down has started particularly by reversal candle in March 2014.

Speaking on big scale bearish signs, we have these ones:

EUR was not able to reach YPR1 and returned right back down to YPP. Following this logic next destination could be YPS1 right around parity and 1.618 butterfly target. This is just another destination point that we have here.

Appearing of reversal candle brings nothing good to bulls. Currently we can't precisely forecast the consequences of its appearing, but even minor results will bring some months of downward action inside current 1.04 -1.15 consolidation... Although potential bearish impact could be even stronger.

Finally we have another bearish sign that looks like bearish dynamic pressure. Take a look that although trend holds bullish - market shows inablitity to move up, even from strong support area. Next strong support stands precisely at parity and will become a culmination of downward action, since this level includes support line, YPS1 and butterfly 1.618 target. Brexit results hardly will bring prosperity to EU and probably will become another bearish driving factor for EUR. We aleardy see consequences of Brexit on GBP, so, some negative impact on EUR also will happen, this is just a question of time.

Also take a look at different behavior near low border of channel. Previously when market has touched it - it shows immediate upside pullback, it was V-shape reversal. Right now behavior is absolutely different, price just hangs on the border and shows no upside action. Any tight consolidation near trendline could become a sign of coming breakout.

Thus, based on monthly chart we could make two major conclusions. First is - real bullish trend will be re-established only when EUR will erase reversal candle and overcome its top above 1.16. Second, if EUR will still keep moderate bearish sentiment, downside potential hardly will be lower than parity, due recent Fed dovish adjustments to its policy for 2017-2018.

Monthly chart is a slow time frame, where we could get fargoing perspectives of some event that already has happened, but we can't catch here real-time changes that are taking place on the market in a moment of this event, which I mean elections. That's why to get some more information we need to dig lower time frames.