Sive Morten

Special Consultant to the FPA

- Messages

- 18,673

Fundamentals

Yesterday, in our FX report we've taken detailed look at Fitch Agency decision and come to conclusion that this is not just an economical factor, reflecting deterioration of US credit rating but also the signal, which has political background as well. Now we see a lot f geopolitical processes around the World that unavoidably will lead to effect in the economy as well. And gold market always absorbs such event and reflect them in price action.

Market overview

Gold was near a more than three-week low on Thursday, dragged by a robust dollar and elevated bond yields. The dollar rose to a four-week high, making gold more expensive for other currency holders. U.S. 10-year Treasury yields rose to their highest since November.

World Gold Council suggests that gold hardly hold for long time above $2000, if rally will happen. The price of gold tends to do well in times of elevated uncertainty about economies and financial systems—something the world has seen a lot of in the past few years. Yet each time the precious metal rallies above $2,000 an ounce, it quickly falls back below that threshold.

Why is that? Joe Cavatoni, strategist at the World Gold Council, joined the What Goes Up podcast to explain what drives the price of gold, what buyers need to know and why that magic number has served as a ceiling. One main reason, he says, is that when prices go that high, they tend to reduce the real-world demand for gold—including from buyers of jewelry in China and India.

In a turnaround that’s already taken it from one of the world’s biggest gold buyers to a top seller this year, Kazakhstan’s central bank is looking to cut the metal’s share to as low as half of its $34.5 billion reserves. The Kazakh sales abroad of about 67 tons in the first six months are part of a plan to lower the metal’s share in reserves to an “optimal” level of 50%-55% — equivalent to around 300 tons — at end-2023, from the current 314 tons. The proportion was near 56% at the end of June, the central bank said in an emailed reply to questions.

Central banks’ gold demand fell for a third straight quarter as massive sales by Turkey outshone buying elsewhere. Net purchases by the institutions declined 64% to 103 tons in the second quarter, according to a report by the World Gold Council. That took demand to the lowest in more than a year.

The main cause was massive sales by the Central Bank of Turkey, which released 132 tons of gold into its local market after imports were constrained. Consumer demand has soared this year because of high inflation and concerns about political instability following the country’s election.

Russia, in turn, to restart buying currency, gold as energy Income Revives. The Finance Ministry said Thursday it will purchase 40.5 billion rubles ($433 million) during the Aug. 7-Sept. 6 period under a budgetary mechanism designed to insulate the economy from the volatility of commodity markets.

The WGC expects central bank demand this year to be roughly half that of a record 2022. That still would equal more than 500 tons of purchases, according to the report.

According to Bloomberg Intelligence and Mike McGlone, this year, silver shows weaker dynamics than gold. The main reason for this is the decline in industrial demand for silver, while the world's central banks continue to buy gold. In this sense, silver today behaves more like an industrial metal like copper than like a precious metal like gold. The average gold/silver price ratio over the past 50 years is around 60, versus today's 82. In other words, gold looks expensive relative to silver historically. However, with recessionary risks indicated by an extreme inversion of the US Treasury yield curve, gold may continue to outperform silver. We believe that additional monetary tightening in the US will make the imminent recession even more severe, and the gold-to-silver ratio could reach a new all-time high.

NEXT CPI REPORT

Here is some support of our long-term view from Pieter Schiff analytics, additional factors to look on inflation perspectives:

Is price inflation really heading back toward the Federal Reserve’s 2% target? Most people in the mainstream seem to think so, and the recent drop in the consumer price index (CPI) appears to support this belief. Price inflation has trended downward over the last several months, with the annual CPI falling from a high of 9% last year to just 3% in July. But there is an another opinion, which we also support - that the Fed has not won the inflation fight and central bank’s sanguine inflation outlook hardly is correct. Easing price inflation is transitory.

The Fed’s rate hikes and modest balance sheet reduction have succeeded in tightening credit and cooling the economy. This has taken some of the upward pressure off prices. If the Fed could stay this course indefinitely, it might be able to eventually beat price inflation down. But 5.5% interest rates and a small reduction in the balance sheet aren’t enough to counteract nearly 15 years of artificially low-interest rates and a more than $7 trillion expansion of the balance sheet since 2008.

In other words, inflation — an expansion in the money supply — hasn’t gone anywhere. The Fed has just done enough to paper over one symptom of inflation – rising prices. And the moment it goes back to artificially low-interest rates and quantitative easing prices will return to the upward trajectory we saw last year.

And it’s just a matter of time before the Fed goes right back to loose monetary policy. The moment something else breaks in the economy, the Fed will respond predictably with rate cuts and money printing.

Federal Reserve Chairman Jerome Powell has already opened that door. During his post-FOMC meeting press conference in July, he conceded that the central bank would likely start cutting rates before the CPI reaches the 2% target.

Powell is getting some help with easing prices. One of the main reasons we’ve seen the big drop in CPI is due to a 50% drop in the price of oil between the summer of 2022 and April 2023. But over the last three months, oil prices have gone up about 25%. We've taken a detailed look on this problem last week. If oil prices continue this trajectory, it will put significant upward pressure on CPI in the closing months of this year. It will also put another drag on the economy. And we think it will, just because of fundamental reasons - demand is rising but supply is lagging and it is no way to increase it fast.

And the economy isn’t nearly as strong as a lot of people seem to think.

With much stronger-than-expected second-quarter GDP growth and continued labor market strength, a growing number of people in the mainstream now think the US has escaped the clutches of a recession despite the Fed driving interest rates to the highest level in 16 years. Powell said staff economists at the central bank still project a noticeable slowdown in growth starting later this year, “But given the resilience of the economy recently, they are no longer forecasting a recession.”

But it seems unlikely the US economy can avoid a significant downturn given the fact that the Fed has taken away its lifeblood – easy money. And there are plenty of signs that the economy is getting increasingly shaky. We’ve seen 15 consecutive drops in the Index of Leading Economic Indicators (the most consecutive negative prints since 2007-2008), an inverted yield curve, and a rising number of corporate defaults. Meanwhile, non-traditional metrics such as the cardboard box barometer are flashing recession.

The mainstream is over-optimistic about the trajectory of the economy because they are relying on sketchy government numbers. Not only is there going to be a recession, it will likely be deep and protracted. That will force the Fed to reopen the inflation spigot. It’s important to wrap your head around just how much the Fed’s easy monetary policy over the last decade-plus has distorted the economy. Here’s some perspective.

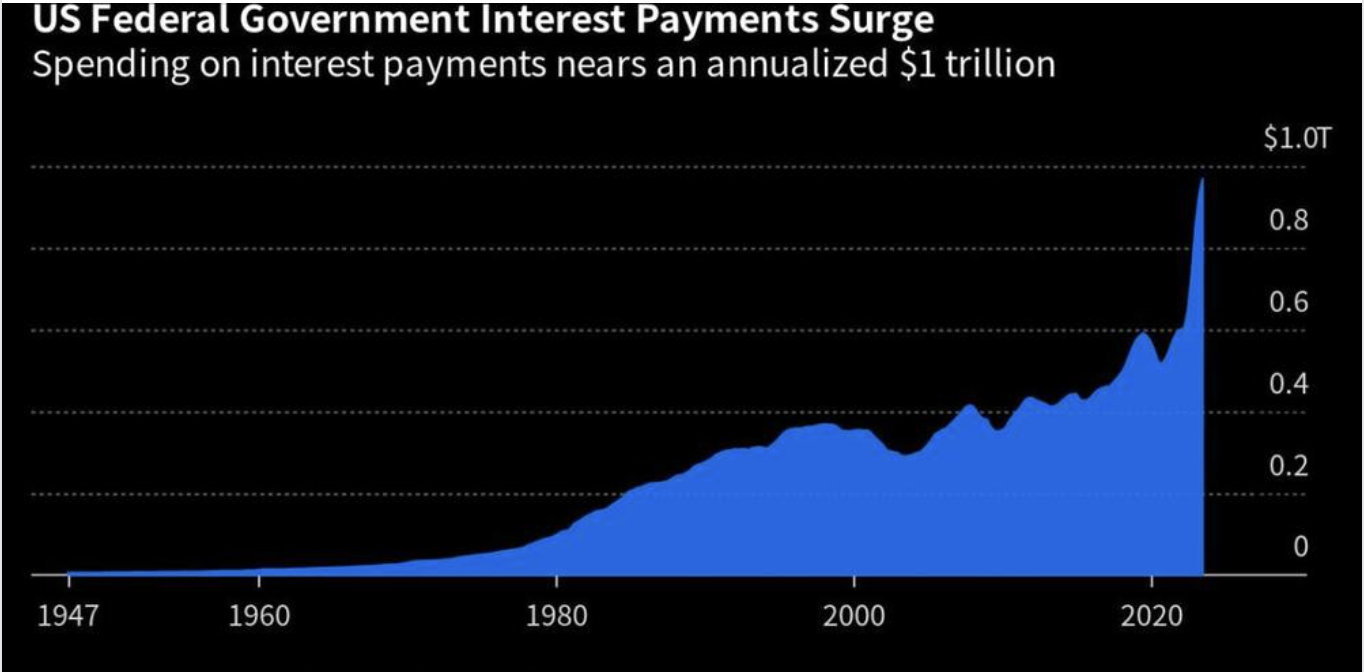

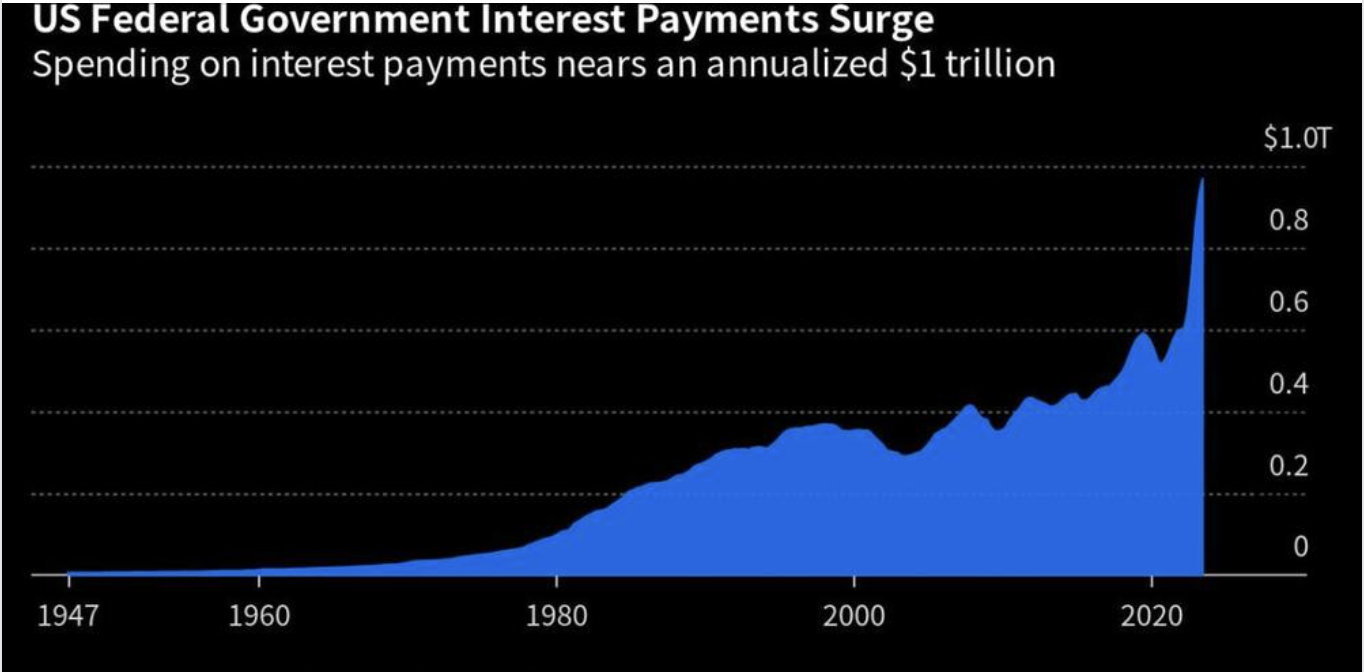

The last time interest rates were this high, the national debt was $5.6 trillion. Today, the national debt stands at $32.7 trillion. A 5.5% interest rate on a $5.6 trillion debt meant interest payments were around $300 billion annually. Today, interest payments are approaching $1 trillion on an annual basis, and there are still a lot of low-interest bonds out there that haven’t matured. As those roll off and are replaced by higher interest Treasuries, interest payments will continue to climb.

When you apply a 5.5% interest rate to a $32 trillion debt, the interest payments rise to $1.8 trillion annually. The US government appears to be on the verge of a solvency crisis. This is yet another reason the Fed cannot possibly maintain this “high” interest rate environment. This is indicative of what the Fed has done to the economy. Corporations and individuals are also buried in debt, thanks to a Federal Reserve monetary policy that incentivized borrowing to the hilt. Thanks to the Fed, we’re sitting on a powder keg of debt just waiting to explode.

The bottom line is that the economy needs inflation (money creation) to keep limping along. When the Fed has to start easing again in the face of already high inflation, it will be throwing gasoline on an inflation fire. Now we're living in environment when the average US debt rate is still around 3%. But it is already The US Treasury announced $1.85 trillion in loans in the second half of this year. Yes, you heard right - almost two trillion in six months.

The US is facing a fiscal wall: 14% of tax revenue is paid in interest payments.

OTHER PROBLEMS

Another obstacle to a strong recovery of US GDP growth after the end of the current cycle of rate cuts. Everything is simple to the banal - there is a shortage of labor. That is, it will not even be the same as it was after 2008, when there was still a couple of percent of the working-age population left in reserve, which could be included with the activation of growth. Yes, and re-industrialization can be a problem. With such a cost of education, there is nowhere to quickly take on new qualified personnel. Unless they move from Europe, but it should be very difficult for this there.

The Fed's rate hike continues to slow down recruitment for both small firms and the economy as a whole. The labor market is softening in terms of the number of hours worked, the number of vacancies and the rate of layoffs. The impact of the rate increase is obvious - higher capital costs slow down investment and hiring. Since it is assumed that rates will remain at this level for several years, enemy analysts believe that this process will continue further.

This is one of the reasons why the consensus assumes that the change in the number of jobs in the non-agricultural sector will be negative for the six months from October 2023 to March 2024. In general, the beginning of 2024 is most likely a bifurcation point, unless it breaks somewhere earlier.

The world economy should have collapsed in 2008 were it not for a massive Hocus Pocus exercise by Western central banks. At that time, global debt was $125 trillion plus derivatives. Today debt is $325 trillion plus quasi-debt or derivatives of probably $2+ quadrillion. The US is today running bigger deficits than ever at a time when:

The interest rate cycle is strongly up;

There is only one buyer of US debt – the Fed and controlled primary dealers banks;

De-dollarization will lead to a rapid decline of the dollar.

The financial system should have been allowed to collapse 15 years ago when the problem was 1/3 of today. But governments and central bankers prefer to postpone the inevitable and thus passing the batten to their successors thereby exacerbating the problem. In the West, the last major depression was in the 1930s followed by WWII. Repetition is obvious. The world and in particular the Western economies are facing a wealth destruction never before seen in history and very few people are prepared for it.

When In 1971, global debt was a “mere” $4 trillion. In 2023 global debt is $325T excluding derivatives. By 2030, debt could be as high as $3 quadrillion. This assumes that the quasi debt of global derivatives of $2 – $2.5 quadrillion has been “rescued” by central banks in order to stop the financial system from imploding.

First we will obviously see major pressures in the on balance sheet credit market. Corporate bankruptcy filings are increasing in most countries. In the US it is on a 13 year high for example, up 53% from 2022. Moody expects global corporate defaults to keep surging as financial conditions tighten.

The US banks are grappling with deposit flight, higher rates and major risks in the property sector. The pressures in the commercial property market and in housing will lead to a wave of defaults necessitating further money printing. S&P reports that 576 banks are at risk of overexposure to commercial property loans and surpassing regulatory guidelines.

The bank failures in mid-March starting with Silicon Valley Bank were just a warning shot. Banks need high rates and a reduction in the loan portfolio to survive. But borrowers, both commercial and private, need lower rates and more credit to survive. This is a dilemma without solution. It will end up with both sides losing. Borrowers will default and banks will go bankrupt.

So, as Gold Switzerland tells, we now have a perfect setup for the coming wealth destruction scenario:

Yes, the West led by a bankrupt USA will try all tricks in the books. That will include CBDCs (Central Bank Digital Currencies), much higher taxes especially for the wealthy, bank bail-ins (forcing depositors to buy 10-30 year government bonds), martial law and many more measures to restrict people’s everyday lives.

These government bonds will have zero value since there will be no buyers. CBDCs will also soon become worthless as they are just another form of unlimited paper or finger-snapping money. I doubt ordinary people will accept these draconian measures. Thus there will be civil unrest which governments will be unable to control. Neither police nor the military will accept to turn against suffering fellow citizens.

Gold Switzerland calls to change the mind - Forget about gluttony or greed. Forget about trying to get out of stocks at the top. Forget about the old axioms that stocks and property always go up. Forget about the notion that sovereign debt is always safe. Just remember one thing the next however many years is all about economic survival. If you haven’t made your money from ordinary investments in the last 20+ years, you are very unlikely to make it now.

And if you hang on to your portfolio of conventional investments like stocks, bonds and investment properties, you are standing the risk of a severe decline of 50-90% of your portfolio for a very, very long period. More safe investments in the current climate are commodities. Look at the chart below showing Commodities versus Stocks (S&P) years. We are looking at a 50+ year low.

Few Non-obvious political issues

First of all, we suggest that big change is coming for Ukraine. Western position is changing. First is, Politico released interesting article, where they ask question what EU would do if Zelensky will be assassinated by Russia. Of course everybody understands that Russia is not going to do it, especially now. But this is an attempt to prepare background for public opinion. It is no necessary to explain that such kind of headlines never appear just occasionally, and especially in Politico. It means that decision over Zelensky probably is made already. Second indirect sign - Joe Biden to ask Congress to fund Taiwan arms via Ukraine budget. Ukraine is near exhausting of its people resources and will be thrown away on junk.

Military experts tell that China can't make landing operation against Taiwan, due to very sophisticated landscape. So the only way to put it under control is sea blockade. This explains recent China-Russia sea manoeuvres in the region and US military help activization to Taiwan. So the battle mostly will be on the sea rather than on the land.

West is loosing Africa. The major victim is France, as they loose not only largest Uranian ore supply but also Trans-Sahara gas pipe with 30 Bln cbm of natural gas supply. This put French energy sector at the edge of surviving. This is not mentioning what is going on in other countries - Mali, Burkina Faso, Central African Republic etc. Control could be returned only by force, because Africa is taking straight course on independence from neo-colonization. And first steps are already made. Another, global importance of Africa for western and Chinese economy we've considered yesterday. Its not only about the France. Situation is mor serious.

Finally, about D. Trump and all rush around him in recent few weeks. It seems that inter-clan fight barely comes on surface. Experts suggest that on the back of Trump probes, stands strong shifts in political elites. By far he is not imprisoned. At the same time his rating in the Republican party is actively growing, eliminating all possible opponents. And the question is - could it be more complex game on behind?

First scenario is - Democrats and bankers of "Global Western project" who are behind Biden and hist team now recognized that they loose power and elections in 2024 and will be off-power until 2028. Yes D. Trump has spoiled and will spoil a lot of blood for specific officials, maybe he will jail H. Biden or H. Clinton (as he promised) but hardly he will clean out Washington from liberal deep state totally. And Globalists will return back to power in 2028 with good chances, because D. Trump will be compromised by ongoing crisis, taking whole burden of it. Now it is Biden, who bears the brunt of the blow, but after election it will be D. Trump. But he is not Nixon, and J. Powell is not Volcker.

But second option seems more interesting. What if conflict among elites worries them very much and they will have to come on compromises. It is problem now that the US is too depended on western global project. They could try to shake off this colonial dependence and make national "silence" Revolution, accusing bankers in all sins.

The core of idea is to create "National rescue government" free of transnational bankers elites, their control and participation. To do this, they could accept mixed-party government, such as D. Trump - F. Kennedy jnr. Of course, Republicans, in euphoria of 2024 victory hardly accept this. Thus, recent pressure on D. Trump, might be just a tool to assure him in perspectives of this initiative. But this is direct way to industrialization, shaking off Bretton Wood system, globalization and dollar-based global financial system. This is the way to AUKUS.

Well, this is just few ideas, but they seem reasonable.

Conclusion

All these points mentioned today are positive for the gold in long-term. We suggest that gold should start shining very soon, and every time call to buy physical gold on the deeps. Best stocks to hold would be in precious metals, oil, and uranium.

The king of wealth preservation is gold. Silver is very undervalued and thus has more upside potential than gold but is much more volatile.

For the best protection, gold and silver should be held in physical form directly by the investor and stored in the safest private vaults in the safest jurisdictions.

After having organised our financial affairs, we must think about the people that need our help in whatever form.

Then enjoy life with family, friends as well as nature, books, music etc which are all free pleasures.

Yesterday, in our FX report we've taken detailed look at Fitch Agency decision and come to conclusion that this is not just an economical factor, reflecting deterioration of US credit rating but also the signal, which has political background as well. Now we see a lot f geopolitical processes around the World that unavoidably will lead to effect in the economy as well. And gold market always absorbs such event and reflect them in price action.

Market overview

Gold was near a more than three-week low on Thursday, dragged by a robust dollar and elevated bond yields. The dollar rose to a four-week high, making gold more expensive for other currency holders. U.S. 10-year Treasury yields rose to their highest since November.

"Gold prices could drift down towards the $1,900 level, but there is probably strong support there as well, just because we are certainly getting towards the end of the hiking cycle," said Ryan McKay, commodity strategist at TD Securities.

World Gold Council suggests that gold hardly hold for long time above $2000, if rally will happen. The price of gold tends to do well in times of elevated uncertainty about economies and financial systems—something the world has seen a lot of in the past few years. Yet each time the precious metal rallies above $2,000 an ounce, it quickly falls back below that threshold.

Why is that? Joe Cavatoni, strategist at the World Gold Council, joined the What Goes Up podcast to explain what drives the price of gold, what buyers need to know and why that magic number has served as a ceiling. One main reason, he says, is that when prices go that high, they tend to reduce the real-world demand for gold—including from buyers of jewelry in China and India.

“These are price-sensitive businesses and price-sensitive consumers,” Cavatoni says. “So when you start seeing those types of price levels develop, that’s when you see those types of consumers back away from buying—and investors aren’t ready to step back in in the long-term.”

In a turnaround that’s already taken it from one of the world’s biggest gold buyers to a top seller this year, Kazakhstan’s central bank is looking to cut the metal’s share to as low as half of its $34.5 billion reserves. The Kazakh sales abroad of about 67 tons in the first six months are part of a plan to lower the metal’s share in reserves to an “optimal” level of 50%-55% — equivalent to around 300 tons — at end-2023, from the current 314 tons. The proportion was near 56% at the end of June, the central bank said in an emailed reply to questions.

Central banks’ gold demand fell for a third straight quarter as massive sales by Turkey outshone buying elsewhere. Net purchases by the institutions declined 64% to 103 tons in the second quarter, according to a report by the World Gold Council. That took demand to the lowest in more than a year.

The main cause was massive sales by the Central Bank of Turkey, which released 132 tons of gold into its local market after imports were constrained. Consumer demand has soared this year because of high inflation and concerns about political instability following the country’s election.

Russia, in turn, to restart buying currency, gold as energy Income Revives. The Finance Ministry said Thursday it will purchase 40.5 billion rubles ($433 million) during the Aug. 7-Sept. 6 period under a budgetary mechanism designed to insulate the economy from the volatility of commodity markets.

The WGC expects central bank demand this year to be roughly half that of a record 2022. That still would equal more than 500 tons of purchases, according to the report.

“I don’t think we will see a repeat of Turkey’s central bank selling off gold to provide liquidity to commercial banks,” said John Reade, chief market strategist at the WGC. “By implication, we would expect to see a better third quarter number.”

According to Bloomberg Intelligence and Mike McGlone, this year, silver shows weaker dynamics than gold. The main reason for this is the decline in industrial demand for silver, while the world's central banks continue to buy gold. In this sense, silver today behaves more like an industrial metal like copper than like a precious metal like gold. The average gold/silver price ratio over the past 50 years is around 60, versus today's 82. In other words, gold looks expensive relative to silver historically. However, with recessionary risks indicated by an extreme inversion of the US Treasury yield curve, gold may continue to outperform silver. We believe that additional monetary tightening in the US will make the imminent recession even more severe, and the gold-to-silver ratio could reach a new all-time high.

NEXT CPI REPORT

Here is some support of our long-term view from Pieter Schiff analytics, additional factors to look on inflation perspectives:

Is price inflation really heading back toward the Federal Reserve’s 2% target? Most people in the mainstream seem to think so, and the recent drop in the consumer price index (CPI) appears to support this belief. Price inflation has trended downward over the last several months, with the annual CPI falling from a high of 9% last year to just 3% in July. But there is an another opinion, which we also support - that the Fed has not won the inflation fight and central bank’s sanguine inflation outlook hardly is correct. Easing price inflation is transitory.

The Fed’s rate hikes and modest balance sheet reduction have succeeded in tightening credit and cooling the economy. This has taken some of the upward pressure off prices. If the Fed could stay this course indefinitely, it might be able to eventually beat price inflation down. But 5.5% interest rates and a small reduction in the balance sheet aren’t enough to counteract nearly 15 years of artificially low-interest rates and a more than $7 trillion expansion of the balance sheet since 2008.

In other words, inflation — an expansion in the money supply — hasn’t gone anywhere. The Fed has just done enough to paper over one symptom of inflation – rising prices. And the moment it goes back to artificially low-interest rates and quantitative easing prices will return to the upward trajectory we saw last year.

And it’s just a matter of time before the Fed goes right back to loose monetary policy. The moment something else breaks in the economy, the Fed will respond predictably with rate cuts and money printing.

Federal Reserve Chairman Jerome Powell has already opened that door. During his post-FOMC meeting press conference in July, he conceded that the central bank would likely start cutting rates before the CPI reaches the 2% target.

In fact, Fed monetary policy isn’t really restrictive. During a recent interview on CNBC, Jim Grant pointed out that the Chicago Fed Financial Conditions Index still indicates that the current financial environment is still “easy” even after all of the talk and rate lifting.The Federal Funds Rate is at a restrictive level now, so if we see inflation coming down, credibly, sustainably, then we don’t need to be at a restrictive level anymore… You’d stop raising [rates] long before you got to 2% inflation and you’d start cutting before you got to 2% inflation, too.”

So, what we’re seeing today is not the beginning of the end of price inflation, but a temporary reprieve. In other words, easing price inflation is transitory.So, there’s a difference, as someone said recently, between tightening and tight. And by the standards of the Volker era, monetary policy is not yet tight. And yet, there are undeniable signs of stringency throughout finance.”

Powell is getting some help with easing prices. One of the main reasons we’ve seen the big drop in CPI is due to a 50% drop in the price of oil between the summer of 2022 and April 2023. But over the last three months, oil prices have gone up about 25%. We've taken a detailed look on this problem last week. If oil prices continue this trajectory, it will put significant upward pressure on CPI in the closing months of this year. It will also put another drag on the economy. And we think it will, just because of fundamental reasons - demand is rising but supply is lagging and it is no way to increase it fast.

And the economy isn’t nearly as strong as a lot of people seem to think.

With much stronger-than-expected second-quarter GDP growth and continued labor market strength, a growing number of people in the mainstream now think the US has escaped the clutches of a recession despite the Fed driving interest rates to the highest level in 16 years. Powell said staff economists at the central bank still project a noticeable slowdown in growth starting later this year, “But given the resilience of the economy recently, they are no longer forecasting a recession.”

But it seems unlikely the US economy can avoid a significant downturn given the fact that the Fed has taken away its lifeblood – easy money. And there are plenty of signs that the economy is getting increasingly shaky. We’ve seen 15 consecutive drops in the Index of Leading Economic Indicators (the most consecutive negative prints since 2007-2008), an inverted yield curve, and a rising number of corporate defaults. Meanwhile, non-traditional metrics such as the cardboard box barometer are flashing recession.

The mainstream is over-optimistic about the trajectory of the economy because they are relying on sketchy government numbers. Not only is there going to be a recession, it will likely be deep and protracted. That will force the Fed to reopen the inflation spigot. It’s important to wrap your head around just how much the Fed’s easy monetary policy over the last decade-plus has distorted the economy. Here’s some perspective.

The last time interest rates were this high, the national debt was $5.6 trillion. Today, the national debt stands at $32.7 trillion. A 5.5% interest rate on a $5.6 trillion debt meant interest payments were around $300 billion annually. Today, interest payments are approaching $1 trillion on an annual basis, and there are still a lot of low-interest bonds out there that haven’t matured. As those roll off and are replaced by higher interest Treasuries, interest payments will continue to climb.

When you apply a 5.5% interest rate to a $32 trillion debt, the interest payments rise to $1.8 trillion annually. The US government appears to be on the verge of a solvency crisis. This is yet another reason the Fed cannot possibly maintain this “high” interest rate environment. This is indicative of what the Fed has done to the economy. Corporations and individuals are also buried in debt, thanks to a Federal Reserve monetary policy that incentivized borrowing to the hilt. Thanks to the Fed, we’re sitting on a powder keg of debt just waiting to explode.

The bottom line is that the economy needs inflation (money creation) to keep limping along. When the Fed has to start easing again in the face of already high inflation, it will be throwing gasoline on an inflation fire. Now we're living in environment when the average US debt rate is still around 3%. But it is already The US Treasury announced $1.85 trillion in loans in the second half of this year. Yes, you heard right - almost two trillion in six months.

The US is facing a fiscal wall: 14% of tax revenue is paid in interest payments.

OTHER PROBLEMS

Another obstacle to a strong recovery of US GDP growth after the end of the current cycle of rate cuts. Everything is simple to the banal - there is a shortage of labor. That is, it will not even be the same as it was after 2008, when there was still a couple of percent of the working-age population left in reserve, which could be included with the activation of growth. Yes, and re-industrialization can be a problem. With such a cost of education, there is nowhere to quickly take on new qualified personnel. Unless they move from Europe, but it should be very difficult for this there.

The Fed's rate hike continues to slow down recruitment for both small firms and the economy as a whole. The labor market is softening in terms of the number of hours worked, the number of vacancies and the rate of layoffs. The impact of the rate increase is obvious - higher capital costs slow down investment and hiring. Since it is assumed that rates will remain at this level for several years, enemy analysts believe that this process will continue further.

This is one of the reasons why the consensus assumes that the change in the number of jobs in the non-agricultural sector will be negative for the six months from October 2023 to March 2024. In general, the beginning of 2024 is most likely a bifurcation point, unless it breaks somewhere earlier.

The world economy should have collapsed in 2008 were it not for a massive Hocus Pocus exercise by Western central banks. At that time, global debt was $125 trillion plus derivatives. Today debt is $325 trillion plus quasi-debt or derivatives of probably $2+ quadrillion. The US is today running bigger deficits than ever at a time when:

The interest rate cycle is strongly up;

There is only one buyer of US debt – the Fed and controlled primary dealers banks;

De-dollarization will lead to a rapid decline of the dollar.

The financial system should have been allowed to collapse 15 years ago when the problem was 1/3 of today. But governments and central bankers prefer to postpone the inevitable and thus passing the batten to their successors thereby exacerbating the problem. In the West, the last major depression was in the 1930s followed by WWII. Repetition is obvious. The world and in particular the Western economies are facing a wealth destruction never before seen in history and very few people are prepared for it.

When In 1971, global debt was a “mere” $4 trillion. In 2023 global debt is $325T excluding derivatives. By 2030, debt could be as high as $3 quadrillion. This assumes that the quasi debt of global derivatives of $2 – $2.5 quadrillion has been “rescued” by central banks in order to stop the financial system from imploding.

First we will obviously see major pressures in the on balance sheet credit market. Corporate bankruptcy filings are increasing in most countries. In the US it is on a 13 year high for example, up 53% from 2022. Moody expects global corporate defaults to keep surging as financial conditions tighten.

The US banks are grappling with deposit flight, higher rates and major risks in the property sector. The pressures in the commercial property market and in housing will lead to a wave of defaults necessitating further money printing. S&P reports that 576 banks are at risk of overexposure to commercial property loans and surpassing regulatory guidelines.

The bank failures in mid-March starting with Silicon Valley Bank were just a warning shot. Banks need high rates and a reduction in the loan portfolio to survive. But borrowers, both commercial and private, need lower rates and more credit to survive. This is a dilemma without solution. It will end up with both sides losing. Borrowers will default and banks will go bankrupt.

So, as Gold Switzerland tells, we now have a perfect setup for the coming wealth destruction scenario:

- Global debt has gone up 80X between $4T in 1971 to $325 trillion in 2023

- Bursting of the derivatives bubble could push debt to $3+ quadrillion

- High interest rates and high inflation lead to sovereign and private defaults

- Bubble assets like stocks, bonds and property will fall dramatically in real terms

- Major debasement of USD and most currencies

- Real assets – commodities, metals, oil, gas, uranium etc will rise strongly

- Higher taxes, bail-ins, failure of pension and social security system

- Central banks will fail to save the system leading to debt implosion and defaults

- A deflationary depression will hit the West worst in a long term decline

- The East and South (BRICS, SCO etc) will also suffer but emerge much stronger

Yes, the West led by a bankrupt USA will try all tricks in the books. That will include CBDCs (Central Bank Digital Currencies), much higher taxes especially for the wealthy, bank bail-ins (forcing depositors to buy 10-30 year government bonds), martial law and many more measures to restrict people’s everyday lives.

These government bonds will have zero value since there will be no buyers. CBDCs will also soon become worthless as they are just another form of unlimited paper or finger-snapping money. I doubt ordinary people will accept these draconian measures. Thus there will be civil unrest which governments will be unable to control. Neither police nor the military will accept to turn against suffering fellow citizens.

Gold Switzerland calls to change the mind - Forget about gluttony or greed. Forget about trying to get out of stocks at the top. Forget about the old axioms that stocks and property always go up. Forget about the notion that sovereign debt is always safe. Just remember one thing the next however many years is all about economic survival. If you haven’t made your money from ordinary investments in the last 20+ years, you are very unlikely to make it now.

And if you hang on to your portfolio of conventional investments like stocks, bonds and investment properties, you are standing the risk of a severe decline of 50-90% of your portfolio for a very, very long period. More safe investments in the current climate are commodities. Look at the chart below showing Commodities versus Stocks (S&P) years. We are looking at a 50+ year low.

Few Non-obvious political issues

First of all, we suggest that big change is coming for Ukraine. Western position is changing. First is, Politico released interesting article, where they ask question what EU would do if Zelensky will be assassinated by Russia. Of course everybody understands that Russia is not going to do it, especially now. But this is an attempt to prepare background for public opinion. It is no necessary to explain that such kind of headlines never appear just occasionally, and especially in Politico. It means that decision over Zelensky probably is made already. Second indirect sign - Joe Biden to ask Congress to fund Taiwan arms via Ukraine budget. Ukraine is near exhausting of its people resources and will be thrown away on junk.

Military experts tell that China can't make landing operation against Taiwan, due to very sophisticated landscape. So the only way to put it under control is sea blockade. This explains recent China-Russia sea manoeuvres in the region and US military help activization to Taiwan. So the battle mostly will be on the sea rather than on the land.

West is loosing Africa. The major victim is France, as they loose not only largest Uranian ore supply but also Trans-Sahara gas pipe with 30 Bln cbm of natural gas supply. This put French energy sector at the edge of surviving. This is not mentioning what is going on in other countries - Mali, Burkina Faso, Central African Republic etc. Control could be returned only by force, because Africa is taking straight course on independence from neo-colonization. And first steps are already made. Another, global importance of Africa for western and Chinese economy we've considered yesterday. Its not only about the France. Situation is mor serious.

Finally, about D. Trump and all rush around him in recent few weeks. It seems that inter-clan fight barely comes on surface. Experts suggest that on the back of Trump probes, stands strong shifts in political elites. By far he is not imprisoned. At the same time his rating in the Republican party is actively growing, eliminating all possible opponents. And the question is - could it be more complex game on behind?

First scenario is - Democrats and bankers of "Global Western project" who are behind Biden and hist team now recognized that they loose power and elections in 2024 and will be off-power until 2028. Yes D. Trump has spoiled and will spoil a lot of blood for specific officials, maybe he will jail H. Biden or H. Clinton (as he promised) but hardly he will clean out Washington from liberal deep state totally. And Globalists will return back to power in 2028 with good chances, because D. Trump will be compromised by ongoing crisis, taking whole burden of it. Now it is Biden, who bears the brunt of the blow, but after election it will be D. Trump. But he is not Nixon, and J. Powell is not Volcker.

But second option seems more interesting. What if conflict among elites worries them very much and they will have to come on compromises. It is problem now that the US is too depended on western global project. They could try to shake off this colonial dependence and make national "silence" Revolution, accusing bankers in all sins.

The core of idea is to create "National rescue government" free of transnational bankers elites, their control and participation. To do this, they could accept mixed-party government, such as D. Trump - F. Kennedy jnr. Of course, Republicans, in euphoria of 2024 victory hardly accept this. Thus, recent pressure on D. Trump, might be just a tool to assure him in perspectives of this initiative. But this is direct way to industrialization, shaking off Bretton Wood system, globalization and dollar-based global financial system. This is the way to AUKUS.

Well, this is just few ideas, but they seem reasonable.

Conclusion

All these points mentioned today are positive for the gold in long-term. We suggest that gold should start shining very soon, and every time call to buy physical gold on the deeps. Best stocks to hold would be in precious metals, oil, and uranium.

The king of wealth preservation is gold. Silver is very undervalued and thus has more upside potential than gold but is much more volatile.

For the best protection, gold and silver should be held in physical form directly by the investor and stored in the safest private vaults in the safest jurisdictions.

After having organised our financial affairs, we must think about the people that need our help in whatever form.

Then enjoy life with family, friends as well as nature, books, music etc which are all free pleasures.