Sive Morten

Special Consultant to the FPA

- Messages

- 18,695

Monthly

Weekly FX Tading Report prepared by Sive Morten exclusively for ForexPeaceArmy.com

According to Reuters news The dollar fell on Friday after a solid but below-expectation October U.S. jobs report as investors took profits on the greenback's months-long rally that has taken it to multi-year highs in anticipation of tighter U.S. monetary policy next year.

U.S. nonfarm payrolls grew at a fairly brisk 214,000 pace, but this was under economists' forecasts for 231,000. The jobless rate dropped to a fresh six-year low of 5.8 percent.

"The reaction to the data is an indication that the market is running tired of the dollar up-move. The market is quite long of dollars and needs perfection to move higher. This data, if we had seen this three months ago, would have the dollar rallying. This is a solid report," said Greg Anderson, global head of FX strategy for BMO Capital Markets in New York.

Tighter monetary policy in the United States would put the dollar at a yield advantage against its counterparts as investors hunt for better returns.

"Today's data is being blamed a little bit more than it should for dollar weakness. It is an excuse to take some profits on a nice rally following Thursday's dovish ECB," said John Doyle, director of markets at Washington, D.C-based Tempus Inc.

The euro is plumbing these lows following Thursday's renewed pledge by European Central Bank President Mario Draghi to take the steps necessary to support the struggling euro zone economy.

"The ECB increased its dovish rhetoric, including a reference to its balance-sheet size in the bank's main statement, which suggests there is general agreement on the Governing Council for this emphasis. That will keep the euro under pressure, we believe," Morgan Stanley said in a note.

The Bank of Japan's renewed vigor at loosening monetary policy in hopes of boosting inflation and economic growth has weighed on the yen. The dollar is up 1.90 percent for the week against the yen.

Both the International Monetary Fund and the United States encouraged the ECB and the BoJ toward greater monetary stimulus during a conference of central bankers in Paris on Friday.

Technical

On previous week we’ve made wide comments on complex situation around EUR. As we’ve said previously EUR right now stands in center of geopolitical and economical turmoil and we have mutual 2-side relations EU-US and EU-Russia. And progress of these relations develops not very positive. Shortly speaking we expect that EUR will continue move down.

We will remind you here major points of our analysis. In EU-US relations there are two topics right now – political and economical. On political side US forces EU to increase pressure on Russia and take disandvantageous steps and measures that primary hurts EU and harmless for US. Here we know about sanctions, Mistrale ships question, etc. Simultaneously US is aiming to replace Russia as important and strategic partner for Europe by enforcing “Zone of free trade agreement”. This falsity of ally becomes possible mostly because Europe de facto is not independent but mostly the colony of US. That’s why US freely can give the law to EU.

Economically US and EU drives on opposite courses. Recently Draghi has given a hint that ECB will increase balance to the level of March 2012 and this assumes QE on approximately 3 Trln EUR. US economy, in turn, now shows signs of improving. The major concern still is lack of inflation. Although Jobs are growing, but wealth of middle class and wages are stagnating.

This makes us think that EUR now stands under double pressure – EU pulls chestnuts out of the fire for US and particularly by this action makes economical pit deeper. What could bit this sorrow?

As a result of blind or coercive following to US policy, EU meets problems with Russia, it’s 3rd largest trading partner. We suggest that situation will become worse, US will demand more and more sanctions from EU upon Russia. But in turn, economical situation EU-Russia stands in relation with geopolicy where US will not accept any compromises. Any ECB efforts on stabilizing of EU economy could be mitigated by new spiral of geopolitical tensions and painful sanctions. That’s why here is our conclusion – hardly real reversal on EUR is possible any time soon.

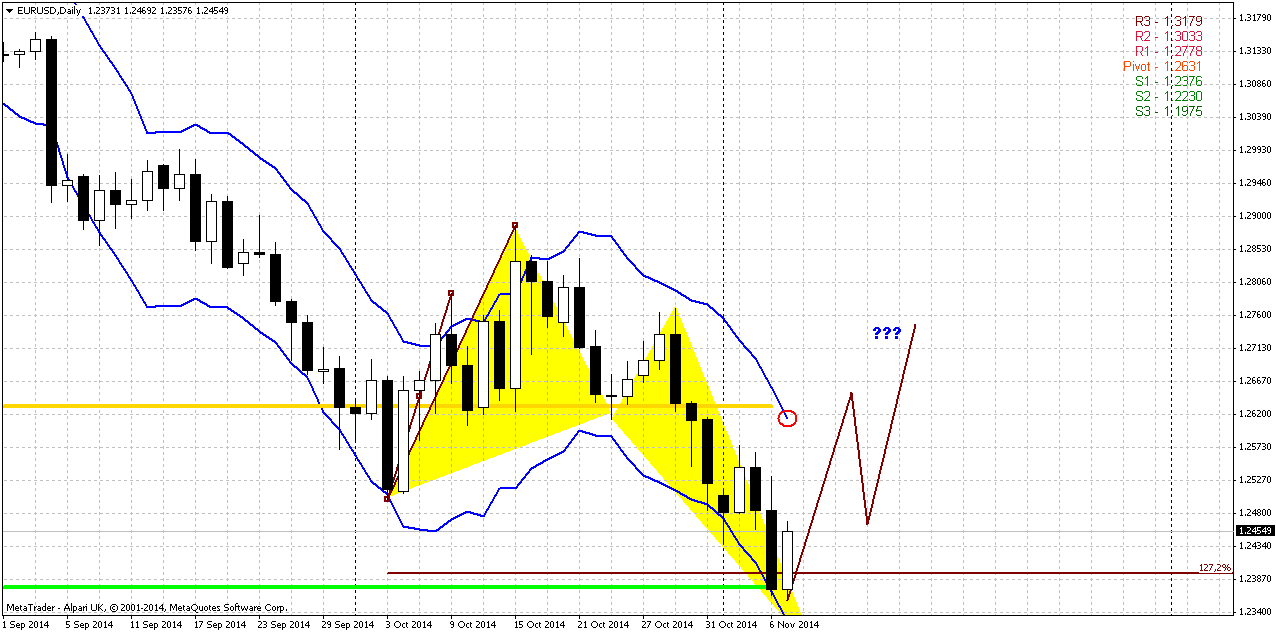

From technical point of view trend holds bearish here, but market is not at oversold. Price has broken through all solid supports and right now stands in “free space” area. As we have large Gartley “222” Sell pattern, it nearest target is 1.22 – 0.618 AB-CD objective point.

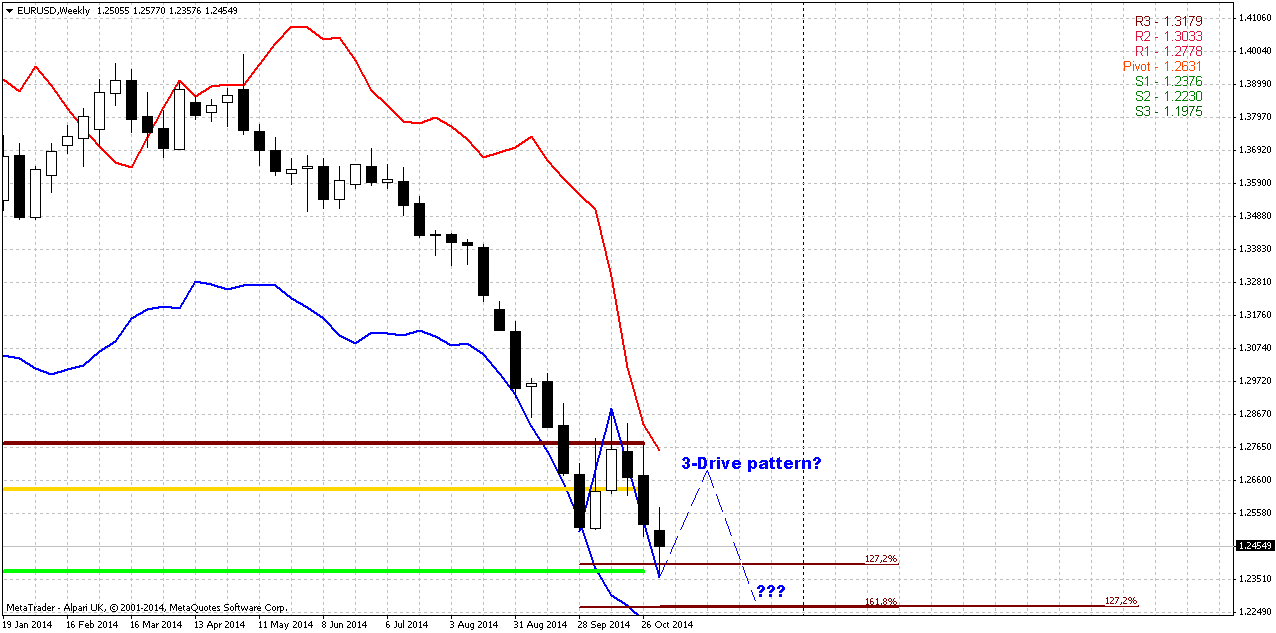

Weekly

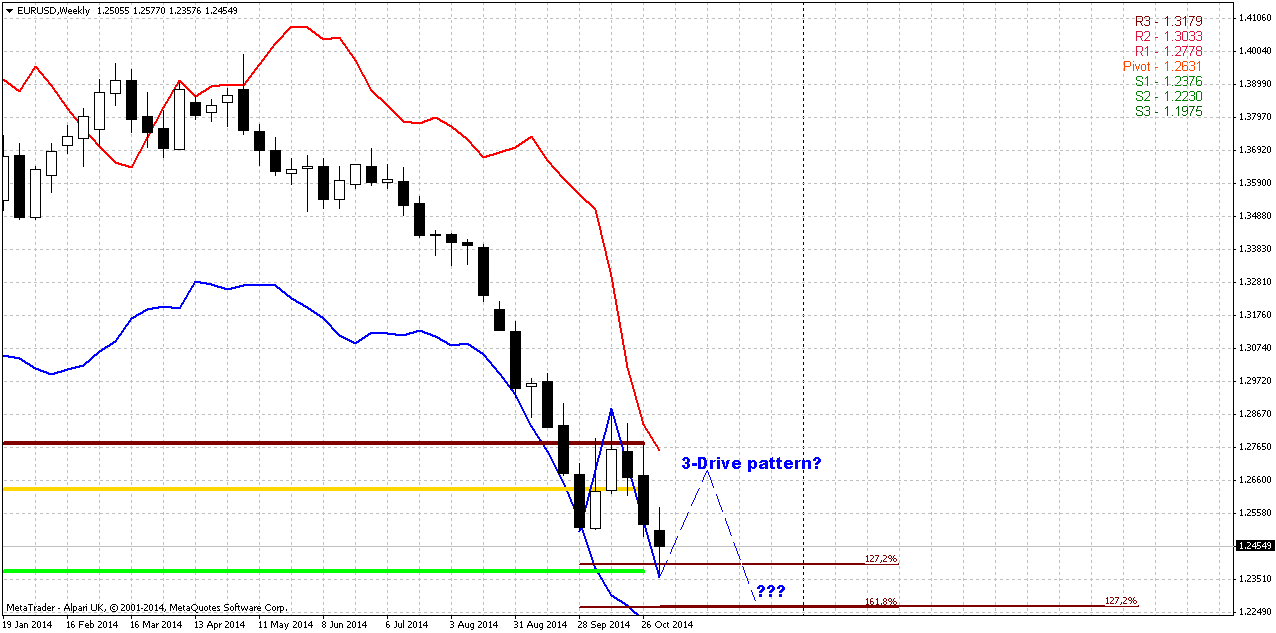

As we’ve said previously that EUR right now stands in “free space” and passed through all major Fib supports, the only support on the way to 1.22 target is MPS1. As previous retracement up was due oversold – market has continued move down and reached our level that we’ve discussed as potential target on previous week.

Although we have nice thrust down, but we do not have any patterns – no grabbers, no DiNapoli directionals or even candlesticks. Let’s see how market will react on MPS1 and wether it will lead to some greater retracement or may be some pattern. Thus, as current low stands at 1.27 of retracement up and our target stands at 1.22 - I’ve drawn 3-Drive pattern here, because it seems logical here and leads particularly to this area. Weekly chart is not at oversold and hardly any reversal will happen prior reaching of monthy 0.618 AB-CD target.

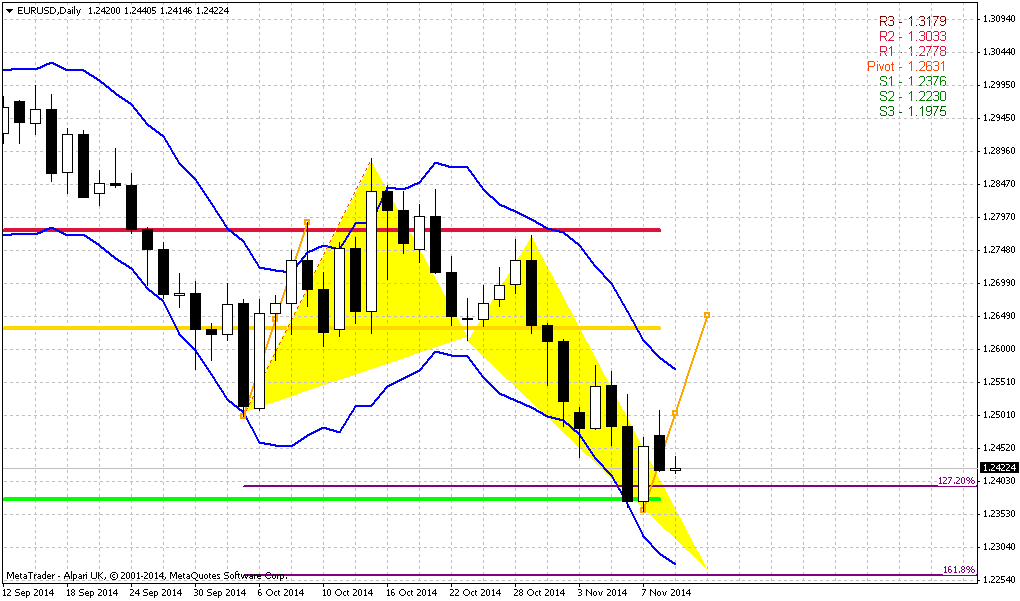

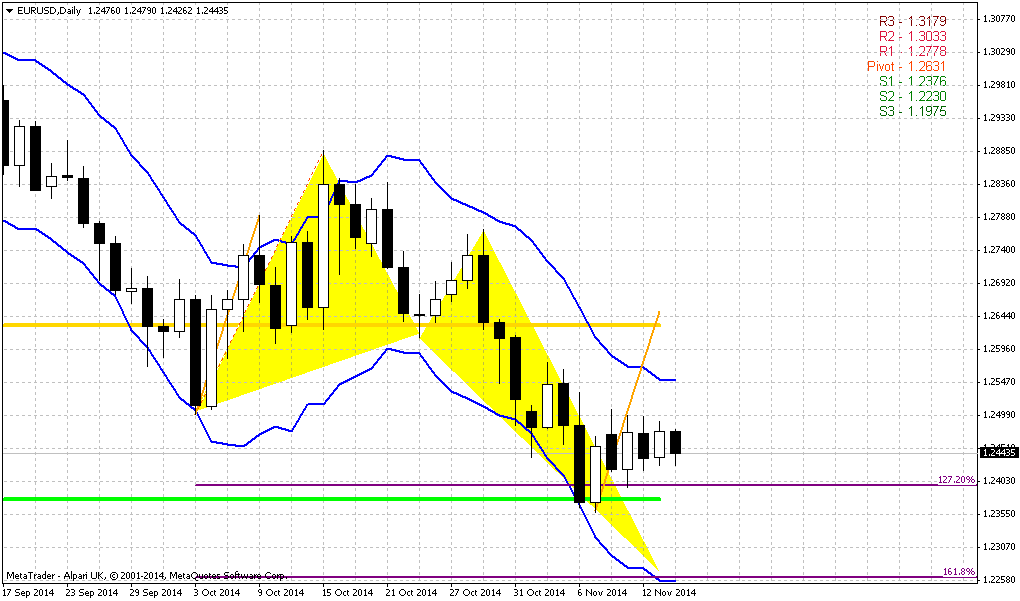

Daily

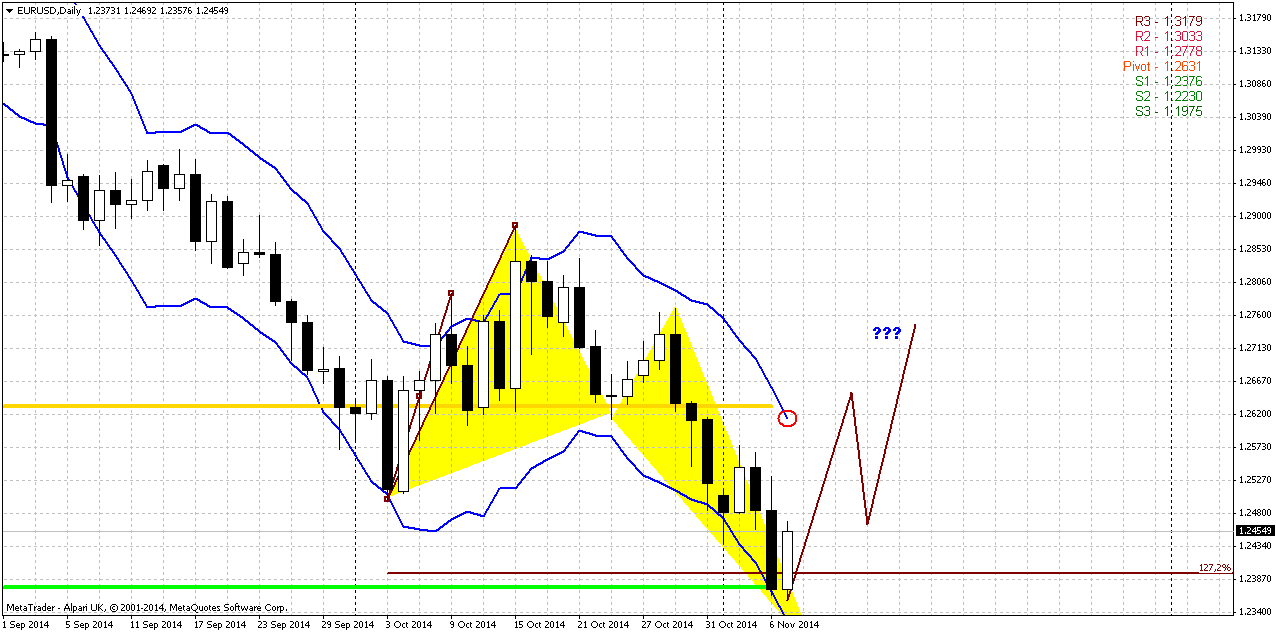

Daily chart gives us riddle on depth of upside retracement. From one point of view we have harmonic swing that suggests action to 1.2760. But this swing is based on situation when market has hit weekly oversold and this has led to strong counter reaction. Right now market is not at weekly oversold, but it stands at MPS1 and butterfly support, daily oversold. Whether upside reaction will be as strong as previously? Or it will be just half of harmonic swing – right to MPP?

At the same time we have to note that if even this will be 1.2760 action – it will be probably compound, 2-leg retracement, because destination point stands above daily overbought. Reaction on flat NFP data was mild that’s why we can’t exclude action only to MPP. Despite whether it will be to 1.2660 or 1.2760 – it will not hurt shape of weekly 3-Drive too much.

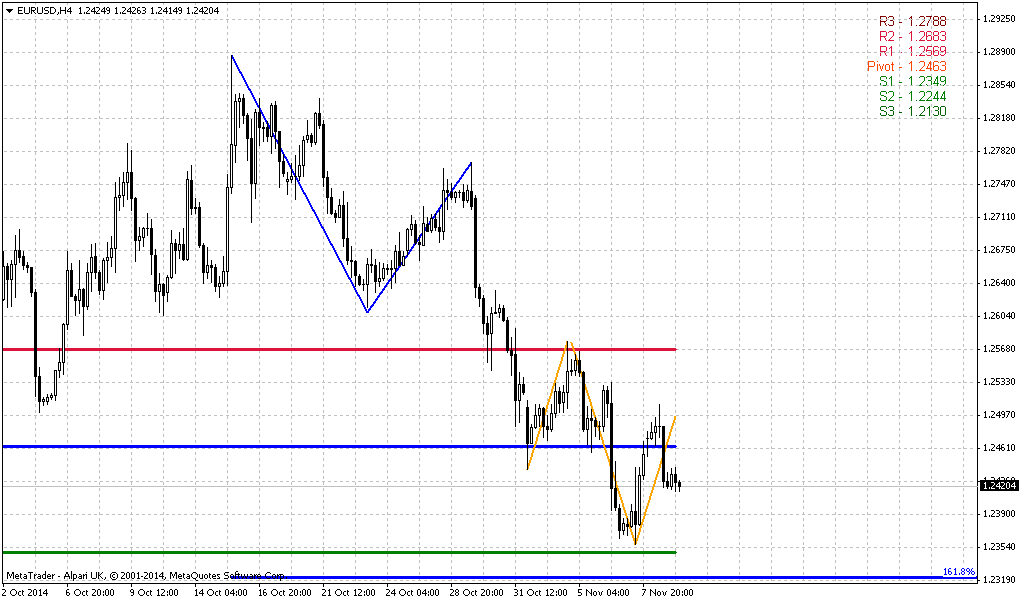

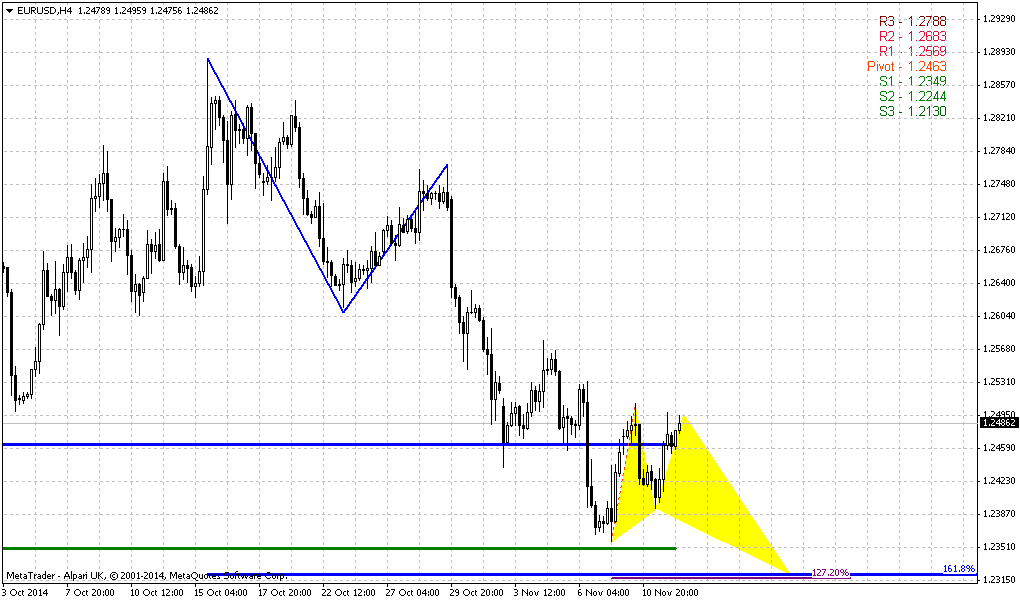

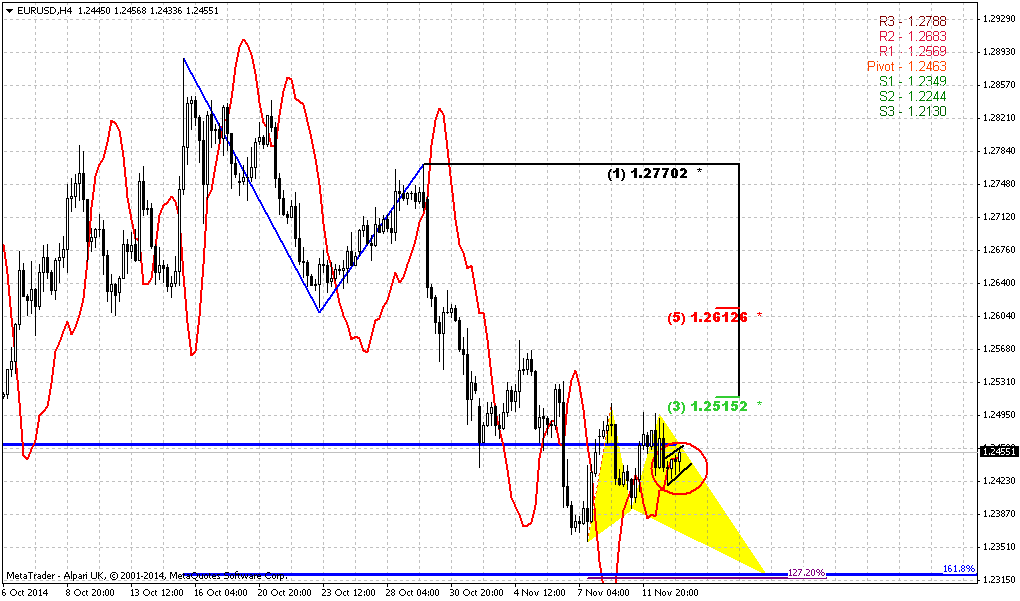

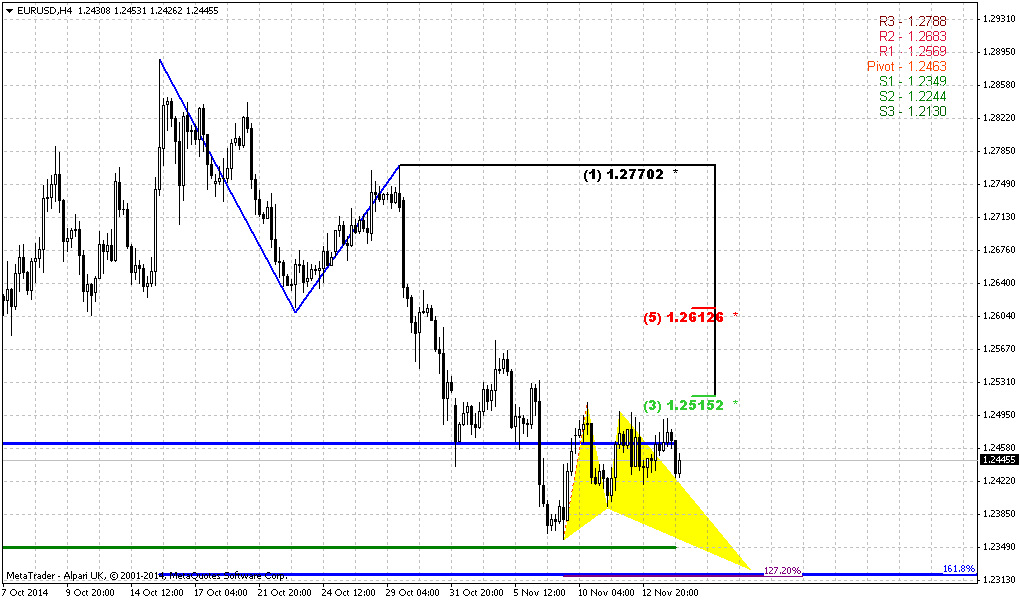

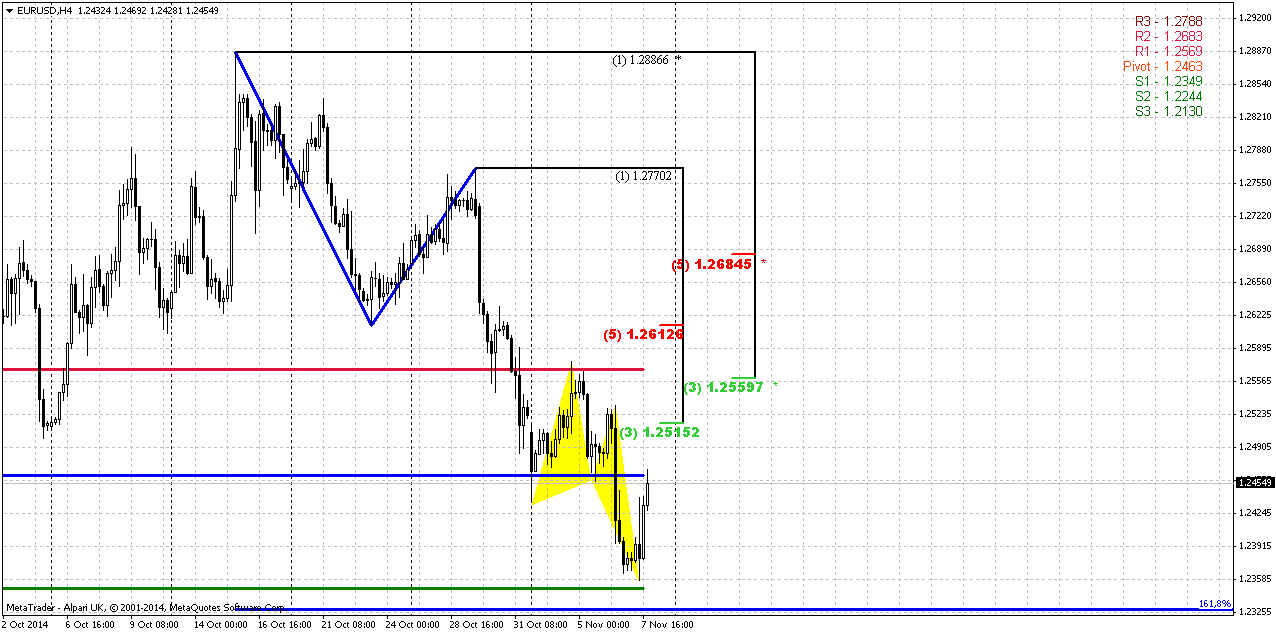

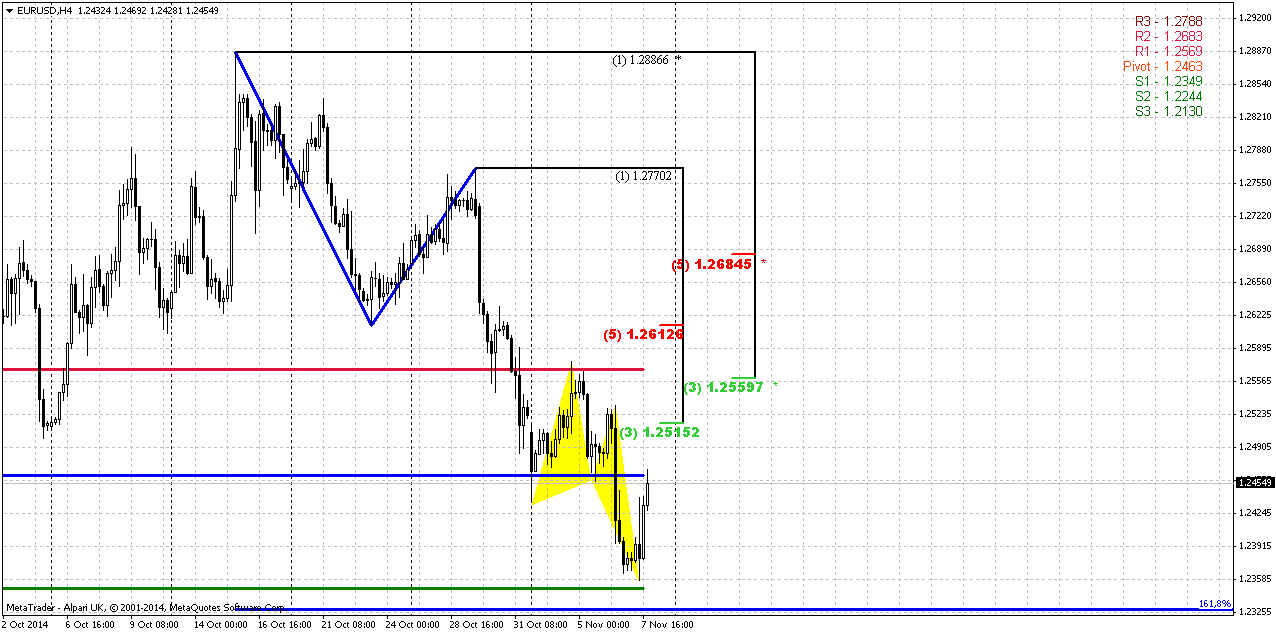

4-hour

We’ve discussed this AB-CD on previous week and come to conclusion that market should continue move down to 1.618 target and MPS1. The one thing that we do not like here is market has not quite reached 1.618 target. This always cares some risk that price could return back to do this. Keep this in mind if you will decide to make stake on upside retracement. In this case place stops somewhere under 1.618 target level.

If market will turn to retracement right from here – it could form later H&S pattern. As butterfly already in place – it could become left part of it.

And could market just continue move down without any retracement? As it is not oversold, and in fact has rather light support, it could, but we will get confirmation of this only if it will move and hold below 1.2325 1.618 AB=CD target. In this case it also will break below MPS1 and WPS1 and this will mean bearish sentiment per se.

Conclusion:

In long-term perspective we expect further EUR depreciation. May be it will not be fast and furious as previously but gradually it should become weaker. Our nearest target stands at 1.22 and probably it will be reached within November.

In short-term perspective market has reached support of MPS1 and some intraday targets. As NFP data was flat some upside retracement could happen, but it will not be very deep. First level is an area of harmonic swing and MPP ~ 1.2630-1.2660. If market will break below 1.2325 then EUR could start moving directly to 1.22 target.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.

Weekly FX Tading Report prepared by Sive Morten exclusively for ForexPeaceArmy.com

According to Reuters news The dollar fell on Friday after a solid but below-expectation October U.S. jobs report as investors took profits on the greenback's months-long rally that has taken it to multi-year highs in anticipation of tighter U.S. monetary policy next year.

U.S. nonfarm payrolls grew at a fairly brisk 214,000 pace, but this was under economists' forecasts for 231,000. The jobless rate dropped to a fresh six-year low of 5.8 percent.

"The reaction to the data is an indication that the market is running tired of the dollar up-move. The market is quite long of dollars and needs perfection to move higher. This data, if we had seen this three months ago, would have the dollar rallying. This is a solid report," said Greg Anderson, global head of FX strategy for BMO Capital Markets in New York.

Tighter monetary policy in the United States would put the dollar at a yield advantage against its counterparts as investors hunt for better returns.

"Today's data is being blamed a little bit more than it should for dollar weakness. It is an excuse to take some profits on a nice rally following Thursday's dovish ECB," said John Doyle, director of markets at Washington, D.C-based Tempus Inc.

The euro is plumbing these lows following Thursday's renewed pledge by European Central Bank President Mario Draghi to take the steps necessary to support the struggling euro zone economy.

"The ECB increased its dovish rhetoric, including a reference to its balance-sheet size in the bank's main statement, which suggests there is general agreement on the Governing Council for this emphasis. That will keep the euro under pressure, we believe," Morgan Stanley said in a note.

The Bank of Japan's renewed vigor at loosening monetary policy in hopes of boosting inflation and economic growth has weighed on the yen. The dollar is up 1.90 percent for the week against the yen.

Both the International Monetary Fund and the United States encouraged the ECB and the BoJ toward greater monetary stimulus during a conference of central bankers in Paris on Friday.

Technical

On previous week we’ve made wide comments on complex situation around EUR. As we’ve said previously EUR right now stands in center of geopolitical and economical turmoil and we have mutual 2-side relations EU-US and EU-Russia. And progress of these relations develops not very positive. Shortly speaking we expect that EUR will continue move down.

We will remind you here major points of our analysis. In EU-US relations there are two topics right now – political and economical. On political side US forces EU to increase pressure on Russia and take disandvantageous steps and measures that primary hurts EU and harmless for US. Here we know about sanctions, Mistrale ships question, etc. Simultaneously US is aiming to replace Russia as important and strategic partner for Europe by enforcing “Zone of free trade agreement”. This falsity of ally becomes possible mostly because Europe de facto is not independent but mostly the colony of US. That’s why US freely can give the law to EU.

Economically US and EU drives on opposite courses. Recently Draghi has given a hint that ECB will increase balance to the level of March 2012 and this assumes QE on approximately 3 Trln EUR. US economy, in turn, now shows signs of improving. The major concern still is lack of inflation. Although Jobs are growing, but wealth of middle class and wages are stagnating.

This makes us think that EUR now stands under double pressure – EU pulls chestnuts out of the fire for US and particularly by this action makes economical pit deeper. What could bit this sorrow?

As a result of blind or coercive following to US policy, EU meets problems with Russia, it’s 3rd largest trading partner. We suggest that situation will become worse, US will demand more and more sanctions from EU upon Russia. But in turn, economical situation EU-Russia stands in relation with geopolicy where US will not accept any compromises. Any ECB efforts on stabilizing of EU economy could be mitigated by new spiral of geopolitical tensions and painful sanctions. That’s why here is our conclusion – hardly real reversal on EUR is possible any time soon.

From technical point of view trend holds bearish here, but market is not at oversold. Price has broken through all solid supports and right now stands in “free space” area. As we have large Gartley “222” Sell pattern, it nearest target is 1.22 – 0.618 AB-CD objective point.

Weekly

As we’ve said previously that EUR right now stands in “free space” and passed through all major Fib supports, the only support on the way to 1.22 target is MPS1. As previous retracement up was due oversold – market has continued move down and reached our level that we’ve discussed as potential target on previous week.

Although we have nice thrust down, but we do not have any patterns – no grabbers, no DiNapoli directionals or even candlesticks. Let’s see how market will react on MPS1 and wether it will lead to some greater retracement or may be some pattern. Thus, as current low stands at 1.27 of retracement up and our target stands at 1.22 - I’ve drawn 3-Drive pattern here, because it seems logical here and leads particularly to this area. Weekly chart is not at oversold and hardly any reversal will happen prior reaching of monthy 0.618 AB-CD target.

Daily

Daily chart gives us riddle on depth of upside retracement. From one point of view we have harmonic swing that suggests action to 1.2760. But this swing is based on situation when market has hit weekly oversold and this has led to strong counter reaction. Right now market is not at weekly oversold, but it stands at MPS1 and butterfly support, daily oversold. Whether upside reaction will be as strong as previously? Or it will be just half of harmonic swing – right to MPP?

At the same time we have to note that if even this will be 1.2760 action – it will be probably compound, 2-leg retracement, because destination point stands above daily overbought. Reaction on flat NFP data was mild that’s why we can’t exclude action only to MPP. Despite whether it will be to 1.2660 or 1.2760 – it will not hurt shape of weekly 3-Drive too much.

4-hour

We’ve discussed this AB-CD on previous week and come to conclusion that market should continue move down to 1.618 target and MPS1. The one thing that we do not like here is market has not quite reached 1.618 target. This always cares some risk that price could return back to do this. Keep this in mind if you will decide to make stake on upside retracement. In this case place stops somewhere under 1.618 target level.

If market will turn to retracement right from here – it could form later H&S pattern. As butterfly already in place – it could become left part of it.

And could market just continue move down without any retracement? As it is not oversold, and in fact has rather light support, it could, but we will get confirmation of this only if it will move and hold below 1.2325 1.618 AB=CD target. In this case it also will break below MPS1 and WPS1 and this will mean bearish sentiment per se.

Conclusion:

In long-term perspective we expect further EUR depreciation. May be it will not be fast and furious as previously but gradually it should become weaker. Our nearest target stands at 1.22 and probably it will be reached within November.

In short-term perspective market has reached support of MPS1 and some intraday targets. As NFP data was flat some upside retracement could happen, but it will not be very deep. First level is an area of harmonic swing and MPP ~ 1.2630-1.2660. If market will break below 1.2325 then EUR could start moving directly to 1.22 target.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.