Sive Morten

Special Consultant to the FPA

- Messages

- 18,760

Fundamentals

Gold rose on Friday as the dollar declined but made its biggest monthly drop in five months on signs that recovery in the U.S. economy could lead to the curbing of easy central bank money. Gold has shed more than 5 percent in November and has lost around a quarter of its value so far this year, which puts it on track to post its first annual loss in 13 years. “One reason for this, besides the still ongoing ETF (Exchange Traded Fund) outflows, is the weakness of Indian imports, a weakness which could well continue for some time yet," said Eugen Weinberg, head of Commodity Research for Commerzbank, referring to the weak monthly performance. "After all, much higher physical premiums are prompting Indian households increasingly to fall back on gold scrap for the wedding season, which is now in full swing." Gold has stayed below $1,300 an ounce for the past three weeks and has been largely rangebound in the last few sessions due to thin trading around the U.S. Thanksgiving holiday on Thursday. "We are probably going to see gold coming back off again, as we have real yields in the U.S. moving up a little bit ... and equity markets stronger," Deutsche Bank analyst Michael Lewis said. "A strong payrolls number is also expected to lock much of a move higher in gold." Traders see the next resistance levels at $1,255 and $1,290, while support stands in the $1,220 area.

"Given recent development in key explanatory variables, our gold fair-value model suggests that prices are marginally overvalued in November and that the average price will approach $1,243/oz in December 2013," Barclay's said in a research note.

Gold buying by China, set to become the world's biggest consumer of gold this year, picked up this week. On Thursday, traded volumes of 99.99 percent purity gold on the Shanghai Gold Exchange hit their highest in seven weeks. Volumes for the week at the Friday close were the highest since the last week of September. ANZ cut its precious metal price forecasts for 2014, and it expected gold to average $1,269 per ounce, compared with $1,436 previously, citing softer-than-expected demand and negative market sentiment.

Monthly

Whether we will get upward retracement and possible BC leg of larger AB=CD down move or not – that was our question for previous months and not much has changed here by far. And looks like bullish sunshine was not as long as it could. Market has moved and closed below October lows. Fundamental situation and CFTC data stand not in favor of possible appreciation. Seasonal trend is still bullish, but it is not always lead to growth. Sometimes, it could just hold depreciation and now we see something of this kind, since market stands in some range since August.

Our previous analysis (recall volatility breakout - VOB) suggests upward retracement. As market has significantly hit oversold we’ve suggested that retracement up should be solid, may be not right to overbought, but still significant. Take a look at previous bounces out from oversold – everytime retracement was significant. Thus, we’ve made an assumption of possible deeper upward retracement that could take a shape of AB=CD, and invalidation for this setup is previous lows around 1170s. If market will pass through it, then, obviously we will not see any AB=CD up. And now, as market has broken through 1250, next target is precisely previous lows around 1180. In fact this will be the last chance for possible upward bounce, if, say, market will shows something like double bottom. Price is not at oversold right now and not at major support, so really bearish market should reach previous lows level.

Weekly

Overall context here is bearish as well. As we’ve said previously, price has broken through major 5/8 Fib support and MPS1. Also, currently market stably holds below 1250 lows and minor 0.618 AB-CD target. As market has not shown any failure breakout or W&R, although it could, this tells that bearish intentions probably rather solid. Here we have two possible scenarios. First one is completion of AB-CD pattern right around 1180 lows and second one is butterfly – it has target around 1110 area. On the road to 1180 there is new WPS1=1210. Thus as monthly as weekly charts point on possible continuation, so any bounce should be used probably for short entry.

Daily

So, guys we didn’t get the stop grabber here and trend has turned bullish. Almost whole previous week market has looked heavy and we’ve started to doubt with possible retracement up. But right on Friday market has become alive and even has shown something like rally. Thus, may be some retracement up is still possible. If we will get it, then first area where it could finish is 1263-1278 that includes MPP, WPR1 and Fib resistance level. Also this will be re-testing of broken 1250’s lows and previously broken 1275 major Fib support on weekly chart. Hardly market will proceed to K-resistance at 1306-1310, since it stands beyond overbought on current week. But theoretically K-resistance is ultimate level after reaching just minor AB-CD extension. Any higher move should be treated as a hazard for downward continuation.

4-hour

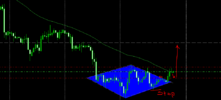

Looks like old trader’s wisdom “take first AB-CD after reverse swing and go” has worked again. We almost have begun to doubt possible rebound here, but suddenly it has started at the end of Friday, when market even has reached minor 0.618 target of our “222” Buy pattern. Next target stands in a Agreement with WPR1 and this is lower border of our resistance cluster. Any move below WPS1 will mean that retracement probably is over and price is ready for downward continuation.

1-hour

On Monday we have to focus on hourly chart. As we’ve mentioned that market has hit minor 0.618 AB=CD target – it has formed bearish engulfing on hourly chart as a respect of this target. Thus, some at least minor bounce down probably should follow. The level that we will monitor is 1246-1247 K-support +WPP. This is some kind of indicator. Since price has hit minor target – it should not show deep retracement if it still intends move higher. That’s why if it will break through it – that will be a first bell of possible downward continuation. Besides, market simultaneously will move below WPP and shift sentiment to bearish. Here I do not call you to take long position, because this is not suggested by daily analysis. But if you a scalp trader, may be this will be useful for your trading plan. For daily traders - we need just to get signs of weakness whatever they will be – breakout here, through WPP, or continuation to next target and appearing some reversal pattern there or any other, since our current context is bearish.

Conclusion:

In short-term perspective market stands with retracement up. As signs of weakness or retracement’ ending will appear – we should start search possibility to enter short. Next target down will be 1180 lows.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.

Gold rose on Friday as the dollar declined but made its biggest monthly drop in five months on signs that recovery in the U.S. economy could lead to the curbing of easy central bank money. Gold has shed more than 5 percent in November and has lost around a quarter of its value so far this year, which puts it on track to post its first annual loss in 13 years. “One reason for this, besides the still ongoing ETF (Exchange Traded Fund) outflows, is the weakness of Indian imports, a weakness which could well continue for some time yet," said Eugen Weinberg, head of Commodity Research for Commerzbank, referring to the weak monthly performance. "After all, much higher physical premiums are prompting Indian households increasingly to fall back on gold scrap for the wedding season, which is now in full swing." Gold has stayed below $1,300 an ounce for the past three weeks and has been largely rangebound in the last few sessions due to thin trading around the U.S. Thanksgiving holiday on Thursday. "We are probably going to see gold coming back off again, as we have real yields in the U.S. moving up a little bit ... and equity markets stronger," Deutsche Bank analyst Michael Lewis said. "A strong payrolls number is also expected to lock much of a move higher in gold." Traders see the next resistance levels at $1,255 and $1,290, while support stands in the $1,220 area.

"Given recent development in key explanatory variables, our gold fair-value model suggests that prices are marginally overvalued in November and that the average price will approach $1,243/oz in December 2013," Barclay's said in a research note.

Gold buying by China, set to become the world's biggest consumer of gold this year, picked up this week. On Thursday, traded volumes of 99.99 percent purity gold on the Shanghai Gold Exchange hit their highest in seven weeks. Volumes for the week at the Friday close were the highest since the last week of September. ANZ cut its precious metal price forecasts for 2014, and it expected gold to average $1,269 per ounce, compared with $1,436 previously, citing softer-than-expected demand and negative market sentiment.

Monthly

Whether we will get upward retracement and possible BC leg of larger AB=CD down move or not – that was our question for previous months and not much has changed here by far. And looks like bullish sunshine was not as long as it could. Market has moved and closed below October lows. Fundamental situation and CFTC data stand not in favor of possible appreciation. Seasonal trend is still bullish, but it is not always lead to growth. Sometimes, it could just hold depreciation and now we see something of this kind, since market stands in some range since August.

Our previous analysis (recall volatility breakout - VOB) suggests upward retracement. As market has significantly hit oversold we’ve suggested that retracement up should be solid, may be not right to overbought, but still significant. Take a look at previous bounces out from oversold – everytime retracement was significant. Thus, we’ve made an assumption of possible deeper upward retracement that could take a shape of AB=CD, and invalidation for this setup is previous lows around 1170s. If market will pass through it, then, obviously we will not see any AB=CD up. And now, as market has broken through 1250, next target is precisely previous lows around 1180. In fact this will be the last chance for possible upward bounce, if, say, market will shows something like double bottom. Price is not at oversold right now and not at major support, so really bearish market should reach previous lows level.

Weekly

Overall context here is bearish as well. As we’ve said previously, price has broken through major 5/8 Fib support and MPS1. Also, currently market stably holds below 1250 lows and minor 0.618 AB-CD target. As market has not shown any failure breakout or W&R, although it could, this tells that bearish intentions probably rather solid. Here we have two possible scenarios. First one is completion of AB-CD pattern right around 1180 lows and second one is butterfly – it has target around 1110 area. On the road to 1180 there is new WPS1=1210. Thus as monthly as weekly charts point on possible continuation, so any bounce should be used probably for short entry.

Daily

So, guys we didn’t get the stop grabber here and trend has turned bullish. Almost whole previous week market has looked heavy and we’ve started to doubt with possible retracement up. But right on Friday market has become alive and even has shown something like rally. Thus, may be some retracement up is still possible. If we will get it, then first area where it could finish is 1263-1278 that includes MPP, WPR1 and Fib resistance level. Also this will be re-testing of broken 1250’s lows and previously broken 1275 major Fib support on weekly chart. Hardly market will proceed to K-resistance at 1306-1310, since it stands beyond overbought on current week. But theoretically K-resistance is ultimate level after reaching just minor AB-CD extension. Any higher move should be treated as a hazard for downward continuation.

4-hour

Looks like old trader’s wisdom “take first AB-CD after reverse swing and go” has worked again. We almost have begun to doubt possible rebound here, but suddenly it has started at the end of Friday, when market even has reached minor 0.618 target of our “222” Buy pattern. Next target stands in a Agreement with WPR1 and this is lower border of our resistance cluster. Any move below WPS1 will mean that retracement probably is over and price is ready for downward continuation.

1-hour

On Monday we have to focus on hourly chart. As we’ve mentioned that market has hit minor 0.618 AB=CD target – it has formed bearish engulfing on hourly chart as a respect of this target. Thus, some at least minor bounce down probably should follow. The level that we will monitor is 1246-1247 K-support +WPP. This is some kind of indicator. Since price has hit minor target – it should not show deep retracement if it still intends move higher. That’s why if it will break through it – that will be a first bell of possible downward continuation. Besides, market simultaneously will move below WPP and shift sentiment to bearish. Here I do not call you to take long position, because this is not suggested by daily analysis. But if you a scalp trader, may be this will be useful for your trading plan. For daily traders - we need just to get signs of weakness whatever they will be – breakout here, through WPP, or continuation to next target and appearing some reversal pattern there or any other, since our current context is bearish.

Conclusion:

In short-term perspective market stands with retracement up. As signs of weakness or retracement’ ending will appear – we should start search possibility to enter short. Next target down will be 1180 lows.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.