Sive Morten

Special Consultant to the FPA

- Messages

- 18,699

Fundamentals

Weekly Gold Tading Report prepared by Sive Morten exclusively for ForexPeaceArmy.com

Reuters reports, Gold edged lower on Friday, struggling with the $1,200 an ounce mark as the dollar firmed and investor appetite for risk increased on expectations of rising U.S. interest rates.

The Fed, after wrapping up a two-day meeting on Wednesday, signaled it was on track to increase rates next year but said it was taking a patient stance, keeping gold's losses in check.

Higher interest rates would hurt non-interest-bearing bullion, which was boosted by central bank liquidity and a low interest rate environment in the years following the 2008 financial crisis.

"It was surprising to see that gold didn't fall sharply after the Fed's meeting, given the strength in the dollar," Commerzbank analyst Carsten Fritsch said.

"We expect some pressure on the gold price in the first half of the year, with prices around $1,100 an ounce due to the effect of higher U.S. interest rates, possibly in the second quarter, falling inflation expectations, lower oil prices and weak economic conditions outside the U.S.," he added.

U.S. traders said some funds opted to sit on the sidelines of the quiet session ahead of year-end, while others did some light "bargain hunting".

The Fed's no-rush stance to withdraw stimulus from the U.S. economy sent European and U.S. shares up, after Asian stocks enjoyed their best day in 15 months.

In India, gold importers are offering a discount of $2 an ounce versus London prices for the first time in almost five months due to excess market supply.

Importers generally charge a premium over London prices but demand in the world's second-biggest gold consumer is expected to fall sharply this month after shipments surged in the past three months.

SPDR fund has shown now positive progress on recent week, storages even fell for ~ 1 tonne to 724.55. So actives of the funds stagnates for 2 weeks.

CFTC data gives absolutely flat data on 16th of December. As longs as shorts were contracted a bit. Thus, major sentiment shifting has happened 2 weeks ago. We’ve seen mass short covering, and then CFTC showed increasing in speculative long positions and shy growth of open interest.

Here is detailed breakdown of speculative positions:

Open interest:

Shorts:

Shorts:

Longs:

Longs:

So, guys, recent chill out in upside rally looks worrying. It has started rather well, but faded out rather fast. Currently it is not quite clear whether the reason is Xmas and end of financial year or indeed it was just retracement. It is difficult to argue with the facts – SDPR is stagnating, CFTC also does not support yet big shift that have happened 2 weeks ago and finally - spot market in Asia gives discounts to London quotes. This is not typical situation at all. Big players still expect that gold will remain under pressure. That’s being said it looks like our major target is to not overestimate recent events. It could happen so that bearish positions will be re-established in January, but if they not – this indeed will be sign of shifting sentiment on gold market. Also we do not expect any solid activity till the end of the year. Probably market will remain thin, quiet and lazy a bit.

Technicals

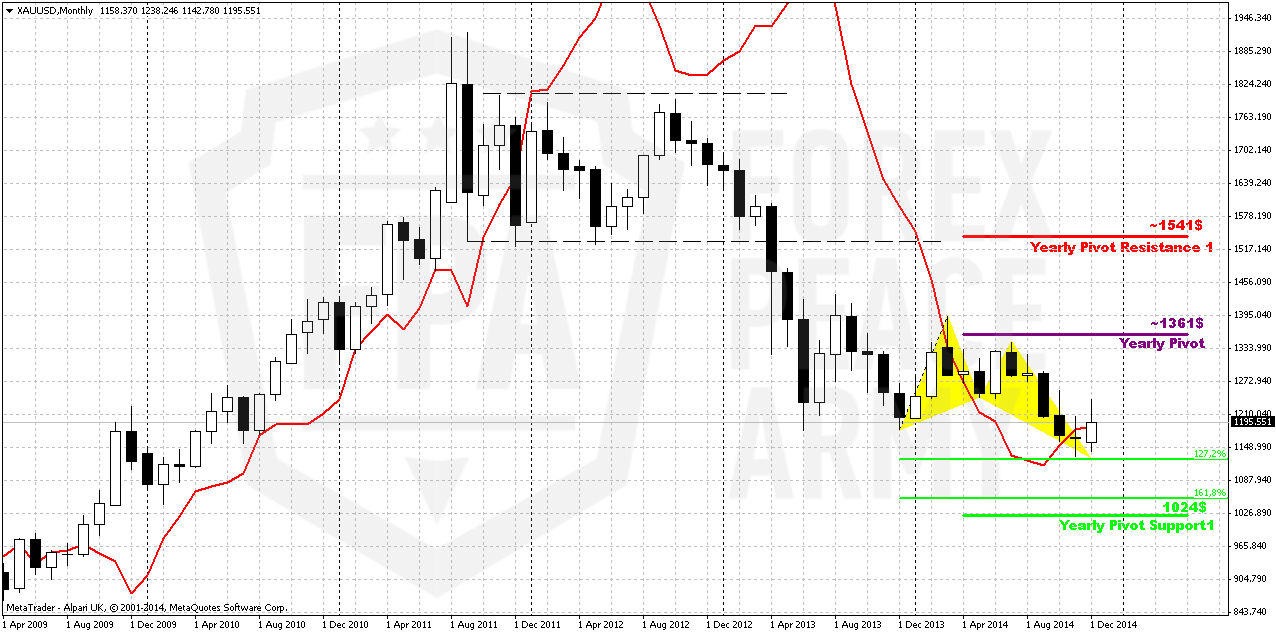

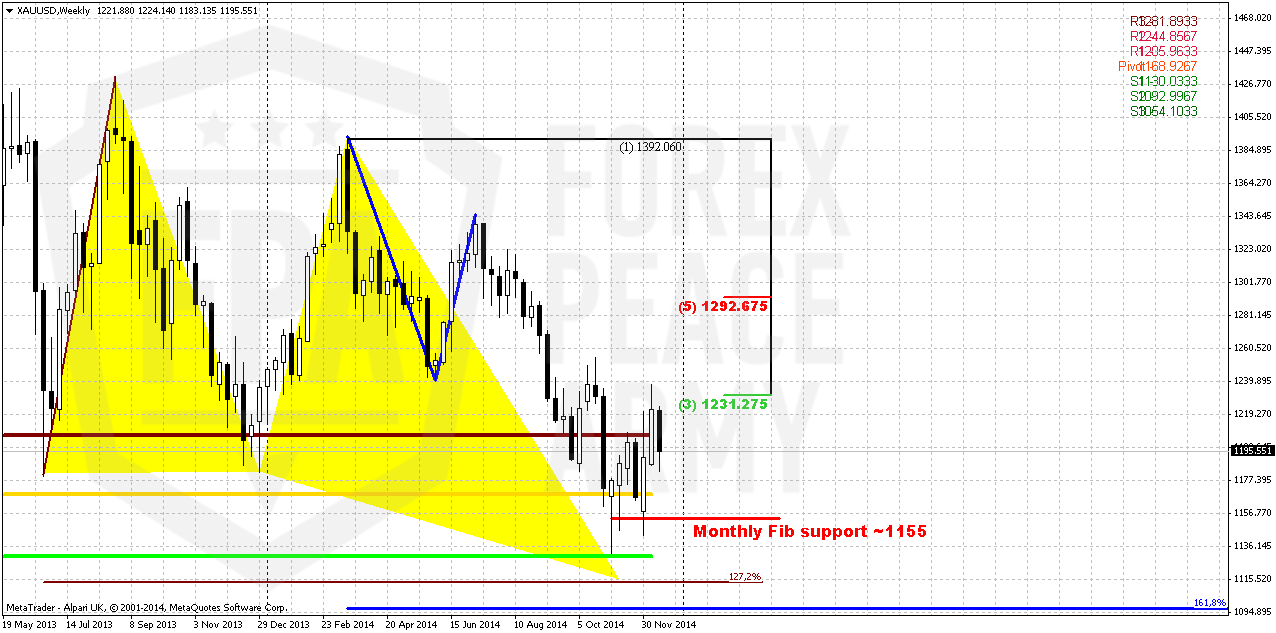

Monthly

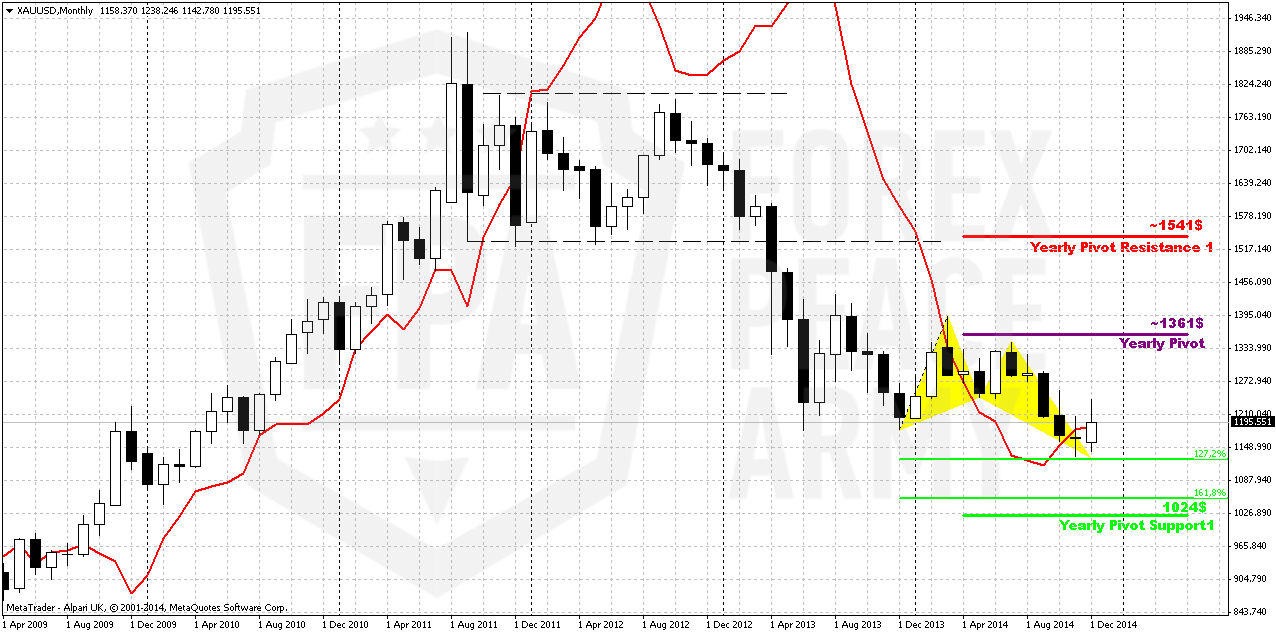

As we’ve said two of our patterns have been completed - bearish grabber @ 1400 and recent dynamic pressure that have led market to 1180 lows and clear them out. Still we have another pattern in progress that is Volatility breakout (VOB). It suggests at least 0.618 AB-CD down. And this target is 1050$.

On previous week we’ve said monthly chart has lost its piquancy. Bullish grabber has not been formed. In December we could get either just trend shifting back to bullish, or bearish grabber that will suggest further downward action. Massive closing of short positions could mean that December might become quiet month. Investors have contracted their positions significantly, pointing that they do not believe in soon downward breakout but also do not fascinating with upside perspectives. Most probable explanation is reducing positions before year end, bonuses calculation and long holidays.

The major driving factor for Gold is inflation and particularly here US economy has problem. Although recent report has shown shy increase in wages, but inflation still stands flat. Accompanied by positive NFP numbers increasing chances on sooner rate hiking will be negative combination for gold. That’s why currently we do not see reasons yet to cancel our 1050$ target. Commerzbank analyst also think that gold will remain under pressure in the first half of 2015 with 1100$ target.

At the same time guys we see some structural shifts in market sentiment and just can’t ignore it. Hardly could we call mass short covering, increasing longs and SDPR storage just occasional. That’s why although we probably keep our long-term target at 1050$ for awhile, but in short-term perspective we do not exclude deeper retracement to 1265$ area. Recently this tendency has paused a bit, but January will give the answer – either it will continue or short positions will be re-established and market indeed will continue move down. Right now situation is too contradictive to say definitely what direction will be chosen.

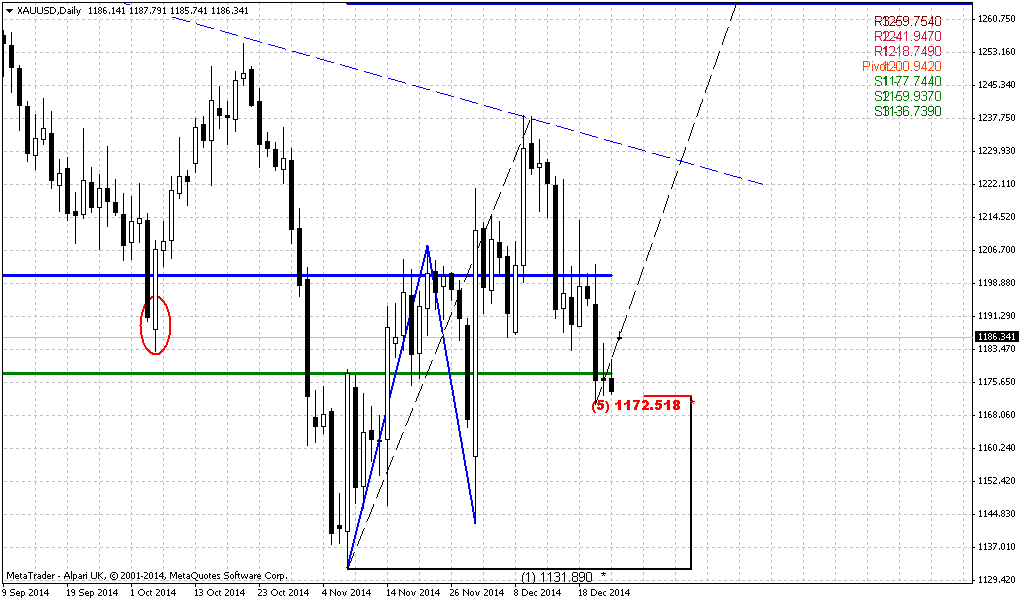

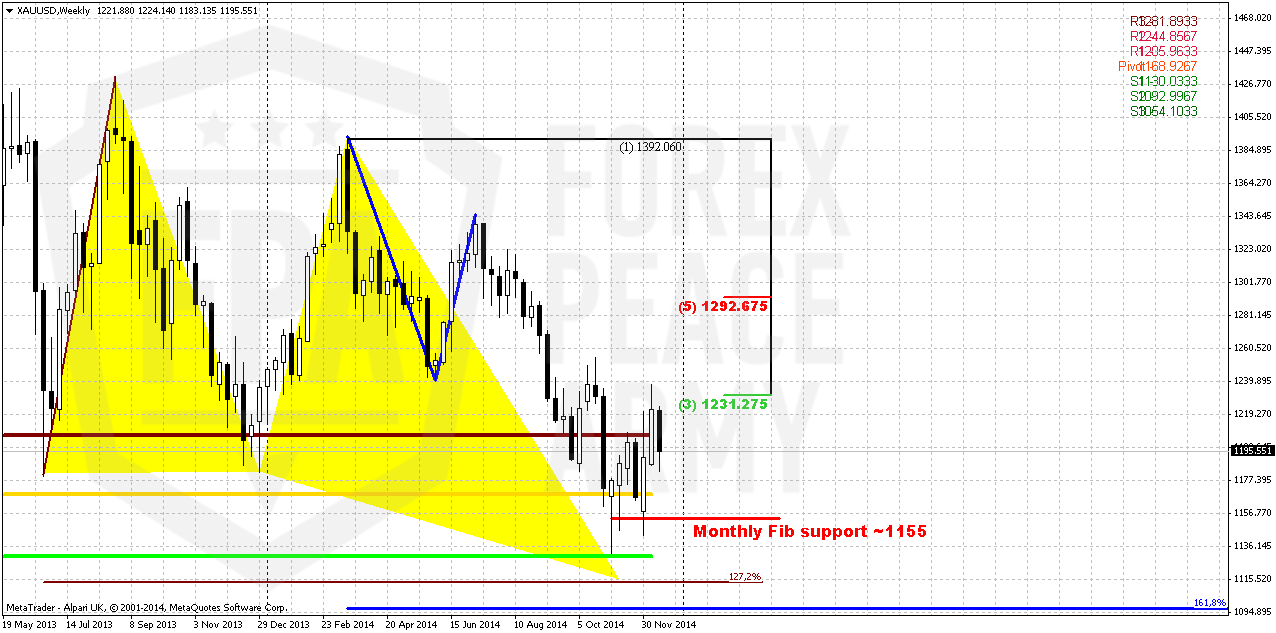

Weekly

Trend holds bullish here, although recent action is mostly inside trading session. Initial reaction of AB=CD completion point and monthly Agreement now looks not as impressive as previously. It is slowed and become more choppy with long shadows as to upside as to downside. Market has returned right back down below MPR1. Now it does not look really as upside impulse action and reversal, right? Taking into consideration recent fundamental data and existence of untouched butterfly and 1.618 AB-CD targets, downward continuation seems not impossible.

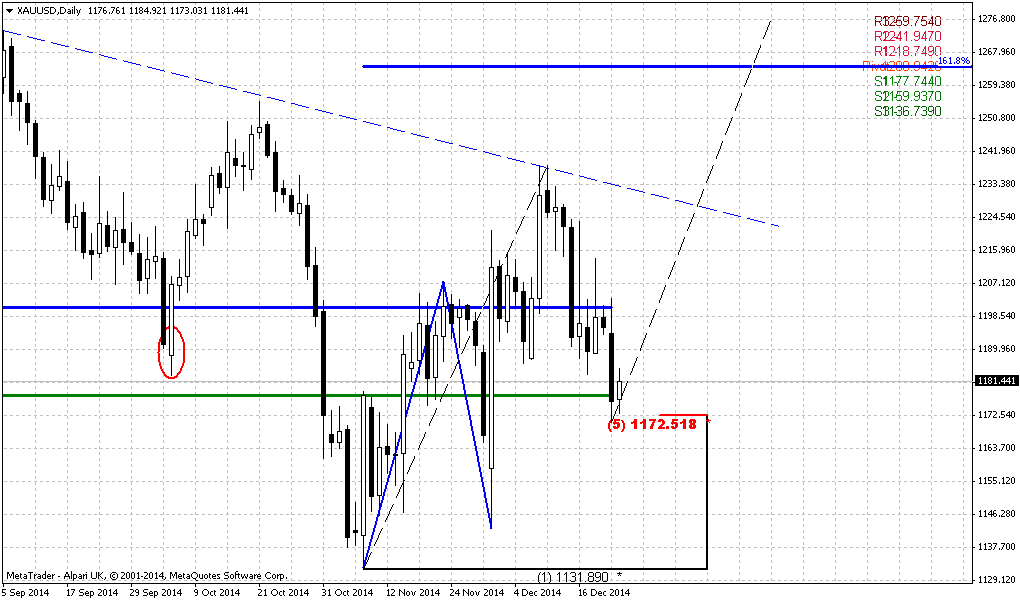

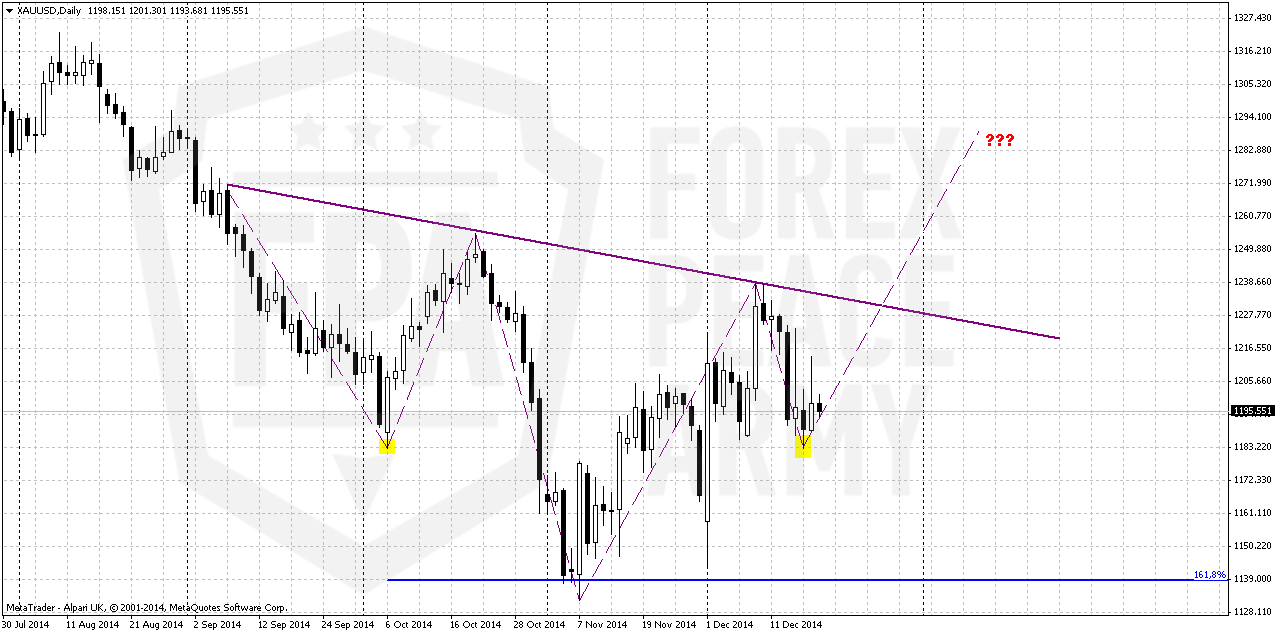

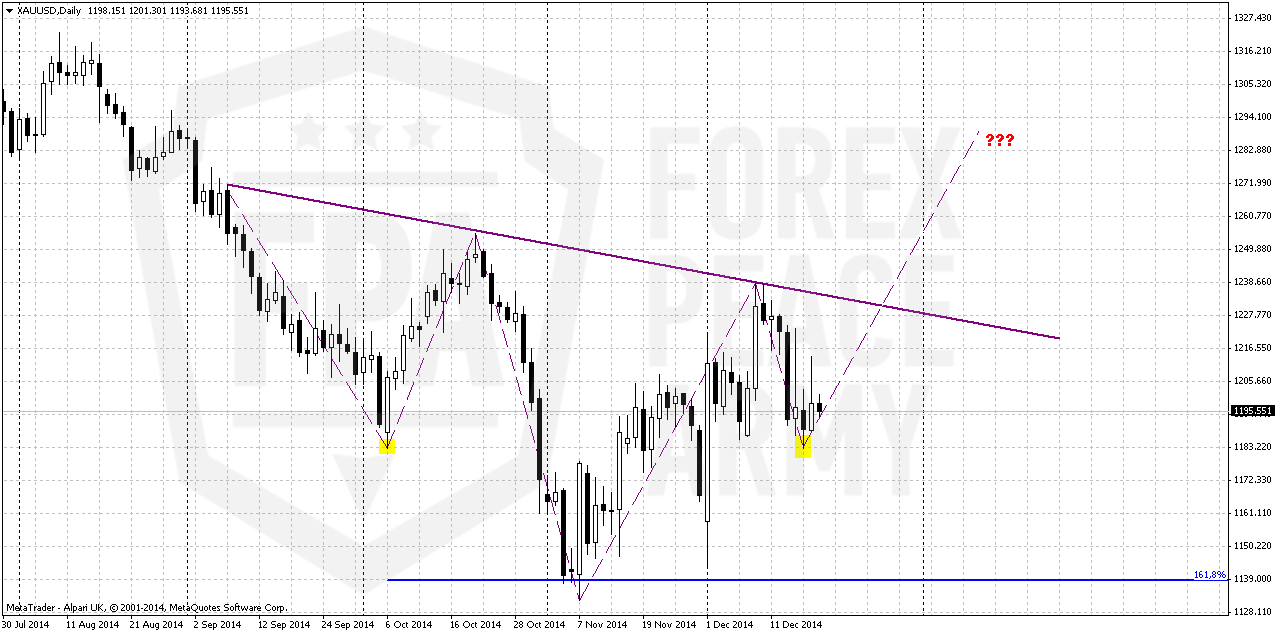

Daily

As you can see recent week was relatively flat. Here I just have drawn pattern that could become starting moment for any upside action. On daily chart there are some important issues exist. Although we do not have clear patterns for immediate trading, some moments seems important. Market mechanics of H&S pattern suggests that bears make its final strong impact on the way to the bottom of the head, while action on left shoulder should become a capitulation mostly and upside rally where bulls take market should start soon after that. Here we see a bit another picture. Sell-off was fast on right shoulder and all market’s attempts to start upside action have been failed. Although gold still stands above crucial 1180 area and theoretically keeps chances on H&S – the longer market will stand here the worse chances it will get to move upside. Even more, too long standing there will be bearish. This leads us to second important moment – 1180 will answer on any questions. Hope it will happen soon.

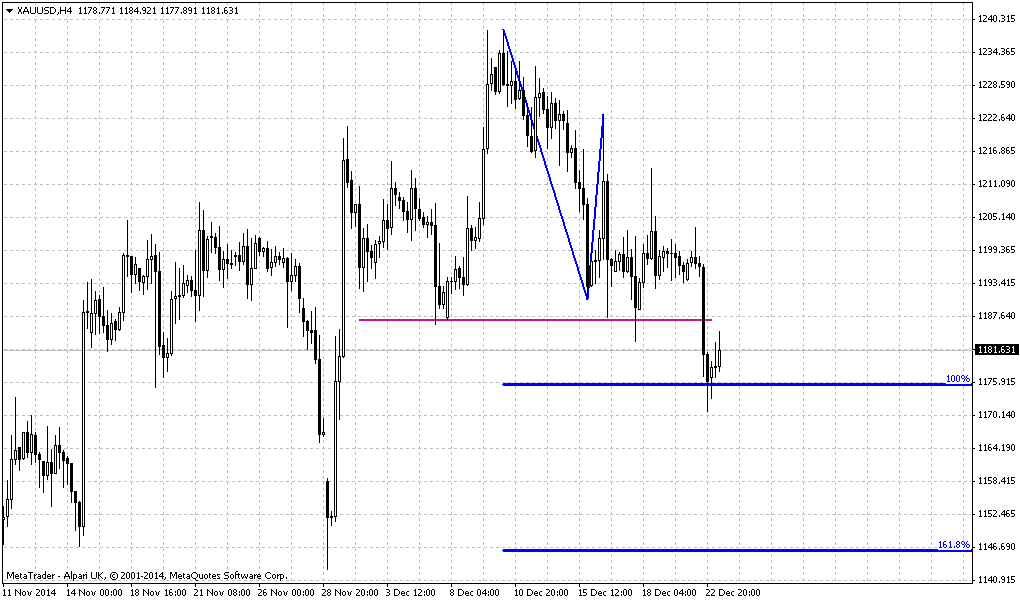

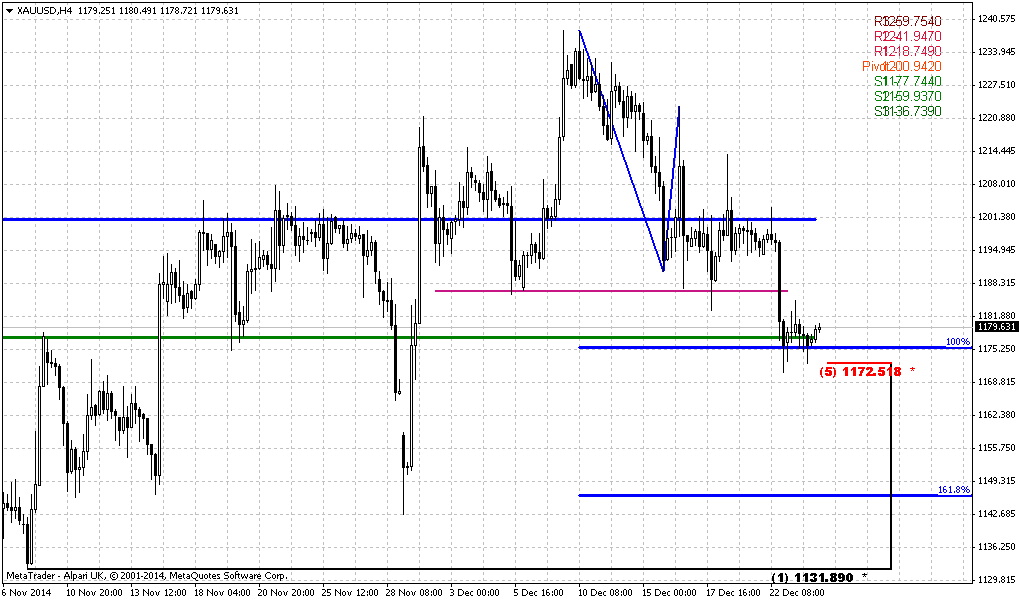

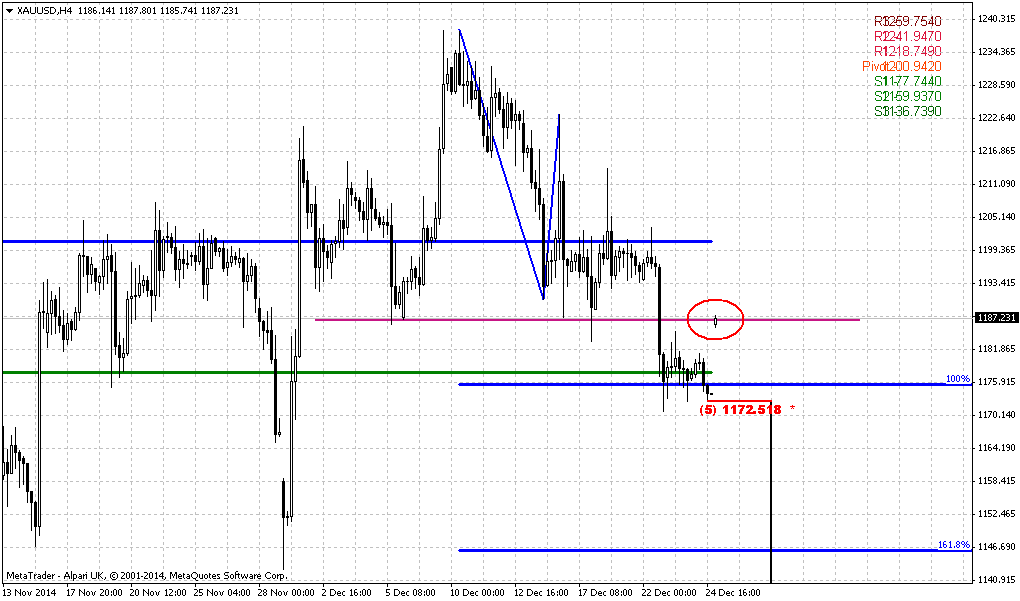

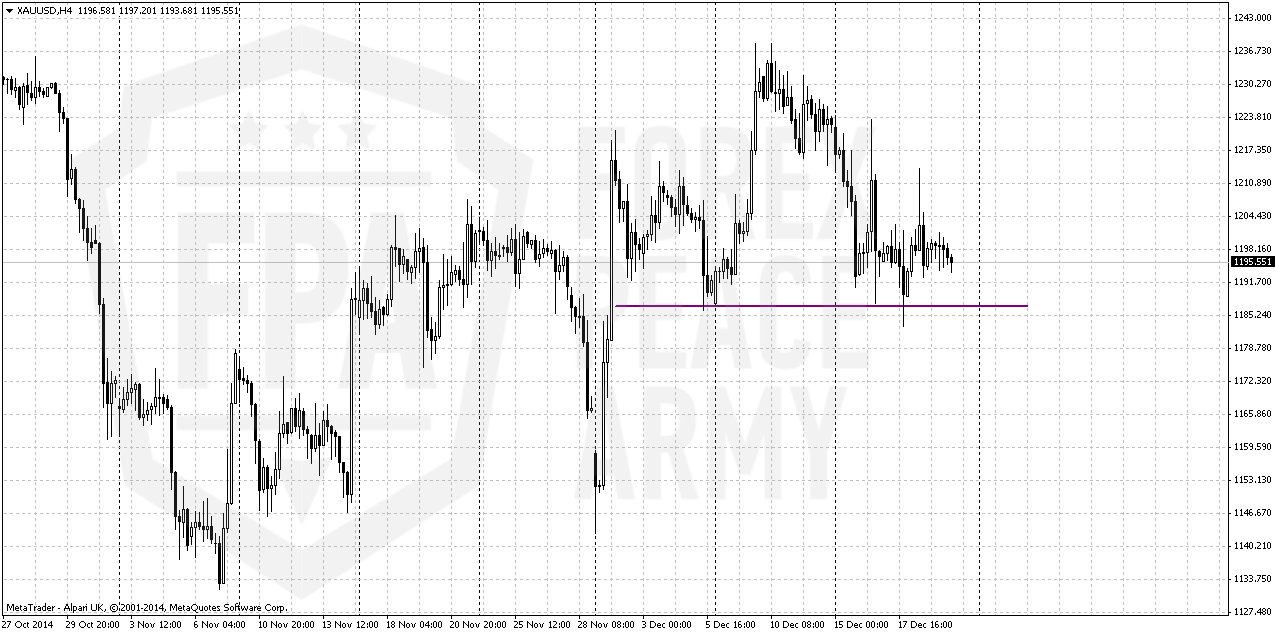

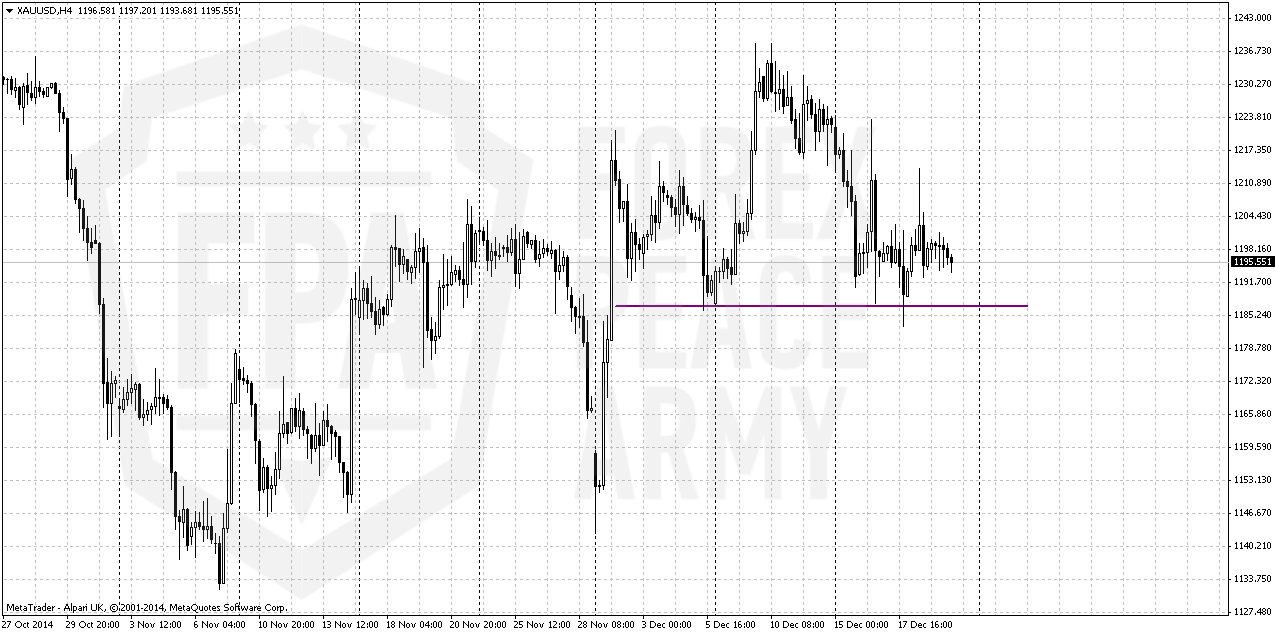

4-hour

Here guys we see only one pattern and it hardly will encourage bulls, especially since it stands at very important level. This H&S looks a bit ugly but if it will work – daily pattern will probably fail. Market could pass down a bit lower, say, to 1175 level, this will not break harmony on daily chart. But any deeper action will look suspicious.

Conclusion:

Since market still keeps normal bearish tendency we should not refuse our 1050 target yet. Recent data shows some chill out in further upside sentiment. Currently it is not quite clear whether the reason is just end of the year and Xmas or really something is changing in big sentiment. Recent data suggests that first variant is more probable by far. Technical picture also does not look rock hard bullish. January will probably clarify some moments.

In short-term perspective market still stands at crucial 1175-1180$ area and theoretically keeps chances on upside action. But appearing of potential H&S on 4-hour chart and price behavior per se looks not very fascinating. Taking in consideration all aspects - at my opinion chances on downward continuation looks preferable right now.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.

Weekly Gold Tading Report prepared by Sive Morten exclusively for ForexPeaceArmy.com

Reuters reports, Gold edged lower on Friday, struggling with the $1,200 an ounce mark as the dollar firmed and investor appetite for risk increased on expectations of rising U.S. interest rates.

The Fed, after wrapping up a two-day meeting on Wednesday, signaled it was on track to increase rates next year but said it was taking a patient stance, keeping gold's losses in check.

Higher interest rates would hurt non-interest-bearing bullion, which was boosted by central bank liquidity and a low interest rate environment in the years following the 2008 financial crisis.

"It was surprising to see that gold didn't fall sharply after the Fed's meeting, given the strength in the dollar," Commerzbank analyst Carsten Fritsch said.

"We expect some pressure on the gold price in the first half of the year, with prices around $1,100 an ounce due to the effect of higher U.S. interest rates, possibly in the second quarter, falling inflation expectations, lower oil prices and weak economic conditions outside the U.S.," he added.

U.S. traders said some funds opted to sit on the sidelines of the quiet session ahead of year-end, while others did some light "bargain hunting".

The Fed's no-rush stance to withdraw stimulus from the U.S. economy sent European and U.S. shares up, after Asian stocks enjoyed their best day in 15 months.

In India, gold importers are offering a discount of $2 an ounce versus London prices for the first time in almost five months due to excess market supply.

Importers generally charge a premium over London prices but demand in the world's second-biggest gold consumer is expected to fall sharply this month after shipments surged in the past three months.

SPDR fund has shown now positive progress on recent week, storages even fell for ~ 1 tonne to 724.55. So actives of the funds stagnates for 2 weeks.

CFTC data gives absolutely flat data on 16th of December. As longs as shorts were contracted a bit. Thus, major sentiment shifting has happened 2 weeks ago. We’ve seen mass short covering, and then CFTC showed increasing in speculative long positions and shy growth of open interest.

Here is detailed breakdown of speculative positions:

Open interest:

So, guys, recent chill out in upside rally looks worrying. It has started rather well, but faded out rather fast. Currently it is not quite clear whether the reason is Xmas and end of financial year or indeed it was just retracement. It is difficult to argue with the facts – SDPR is stagnating, CFTC also does not support yet big shift that have happened 2 weeks ago and finally - spot market in Asia gives discounts to London quotes. This is not typical situation at all. Big players still expect that gold will remain under pressure. That’s being said it looks like our major target is to not overestimate recent events. It could happen so that bearish positions will be re-established in January, but if they not – this indeed will be sign of shifting sentiment on gold market. Also we do not expect any solid activity till the end of the year. Probably market will remain thin, quiet and lazy a bit.

Technicals

Monthly

As we’ve said two of our patterns have been completed - bearish grabber @ 1400 and recent dynamic pressure that have led market to 1180 lows and clear them out. Still we have another pattern in progress that is Volatility breakout (VOB). It suggests at least 0.618 AB-CD down. And this target is 1050$.

On previous week we’ve said monthly chart has lost its piquancy. Bullish grabber has not been formed. In December we could get either just trend shifting back to bullish, or bearish grabber that will suggest further downward action. Massive closing of short positions could mean that December might become quiet month. Investors have contracted their positions significantly, pointing that they do not believe in soon downward breakout but also do not fascinating with upside perspectives. Most probable explanation is reducing positions before year end, bonuses calculation and long holidays.

The major driving factor for Gold is inflation and particularly here US economy has problem. Although recent report has shown shy increase in wages, but inflation still stands flat. Accompanied by positive NFP numbers increasing chances on sooner rate hiking will be negative combination for gold. That’s why currently we do not see reasons yet to cancel our 1050$ target. Commerzbank analyst also think that gold will remain under pressure in the first half of 2015 with 1100$ target.

At the same time guys we see some structural shifts in market sentiment and just can’t ignore it. Hardly could we call mass short covering, increasing longs and SDPR storage just occasional. That’s why although we probably keep our long-term target at 1050$ for awhile, but in short-term perspective we do not exclude deeper retracement to 1265$ area. Recently this tendency has paused a bit, but January will give the answer – either it will continue or short positions will be re-established and market indeed will continue move down. Right now situation is too contradictive to say definitely what direction will be chosen.

Weekly

Trend holds bullish here, although recent action is mostly inside trading session. Initial reaction of AB=CD completion point and monthly Agreement now looks not as impressive as previously. It is slowed and become more choppy with long shadows as to upside as to downside. Market has returned right back down below MPR1. Now it does not look really as upside impulse action and reversal, right? Taking into consideration recent fundamental data and existence of untouched butterfly and 1.618 AB-CD targets, downward continuation seems not impossible.

Daily

As you can see recent week was relatively flat. Here I just have drawn pattern that could become starting moment for any upside action. On daily chart there are some important issues exist. Although we do not have clear patterns for immediate trading, some moments seems important. Market mechanics of H&S pattern suggests that bears make its final strong impact on the way to the bottom of the head, while action on left shoulder should become a capitulation mostly and upside rally where bulls take market should start soon after that. Here we see a bit another picture. Sell-off was fast on right shoulder and all market’s attempts to start upside action have been failed. Although gold still stands above crucial 1180 area and theoretically keeps chances on H&S – the longer market will stand here the worse chances it will get to move upside. Even more, too long standing there will be bearish. This leads us to second important moment – 1180 will answer on any questions. Hope it will happen soon.

4-hour

Here guys we see only one pattern and it hardly will encourage bulls, especially since it stands at very important level. This H&S looks a bit ugly but if it will work – daily pattern will probably fail. Market could pass down a bit lower, say, to 1175 level, this will not break harmony on daily chart. But any deeper action will look suspicious.

Conclusion:

Since market still keeps normal bearish tendency we should not refuse our 1050 target yet. Recent data shows some chill out in further upside sentiment. Currently it is not quite clear whether the reason is just end of the year and Xmas or really something is changing in big sentiment. Recent data suggests that first variant is more probable by far. Technical picture also does not look rock hard bullish. January will probably clarify some moments.

In short-term perspective market still stands at crucial 1175-1180$ area and theoretically keeps chances on upside action. But appearing of potential H&S on 4-hour chart and price behavior per se looks not very fascinating. Taking in consideration all aspects - at my opinion chances on downward continuation looks preferable right now.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.