Sive Morten

Special Consultant to the FPA

- Messages

- 18,651

Fundamentals

At first glance, this week we do not have any gold-specific news. But this is only on a first glance. In fact, J. Biden speech in Congress and geopolitical consequences of earthquake in Turkey might become decisive for the gold performance in a long run. Another important conclusion that we could make, based on recent headlines in Twitter, news agencies - more and more analysts start speaking about issues that we've covered last year. They are pitfall in the US debt market, inability of the Fed to keep rates high for a long-term, manipulation of statistics data, especially employment and CPI and many others. This also could make effect soon as common sense based view is becoming more popular.

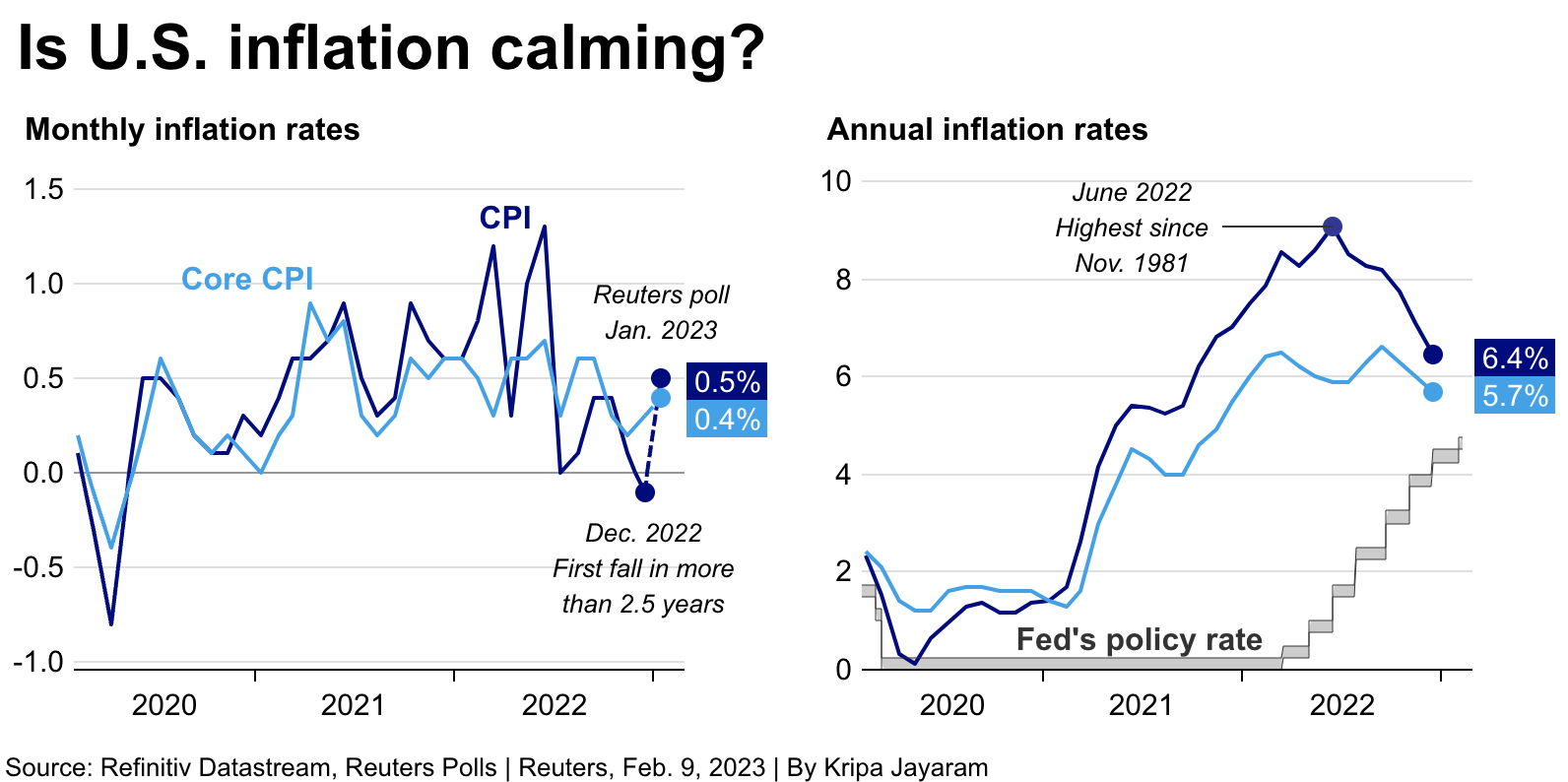

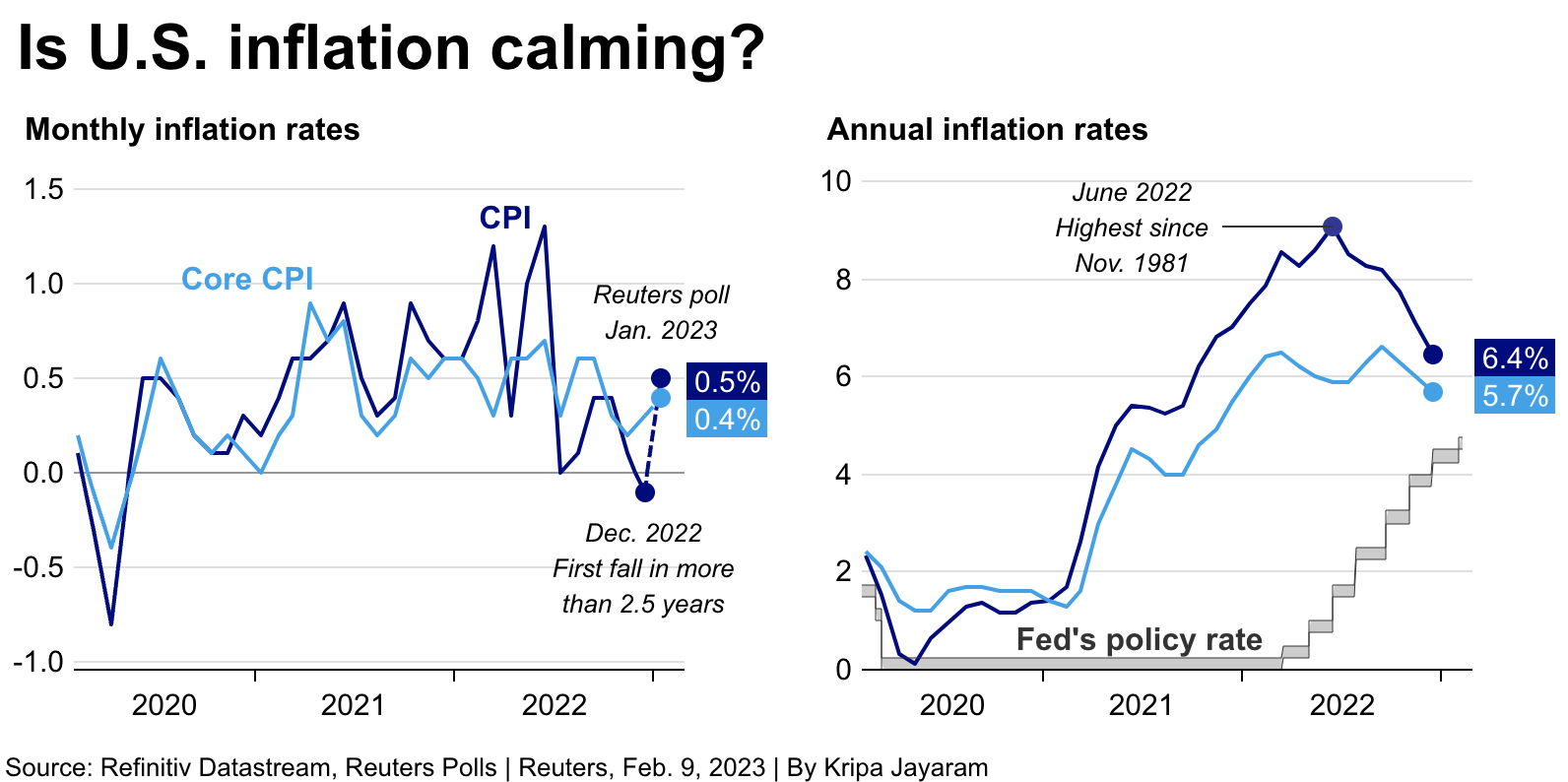

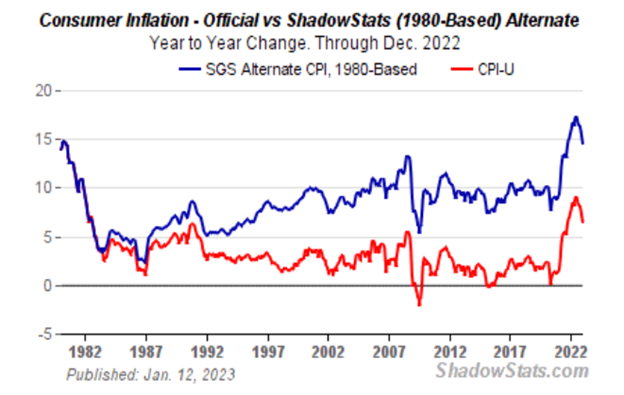

For example, CPI data. Last week we've said that due to regularly changing algorithm of CPI calculation skews the real inflation numbers down. Economists who have studied this phenomenon, tells that conservative US Inflation now should be around 10% on average, with more realistic level is around 12-15%. ZeroHedge even has released article on this subject, but it is only for Primary subscribers. Now, it is "super core" CPI numbers appeared that excludes everything - energy, food, shelter, old cars etc, which shows inflation below 2%. Obviously if we exclude everything then inflation will be zero. Great solution. Next week, on Tue we will be watching for CPI again, and Reuters poll suggests some uptick, even with this "adjusted" CPI.

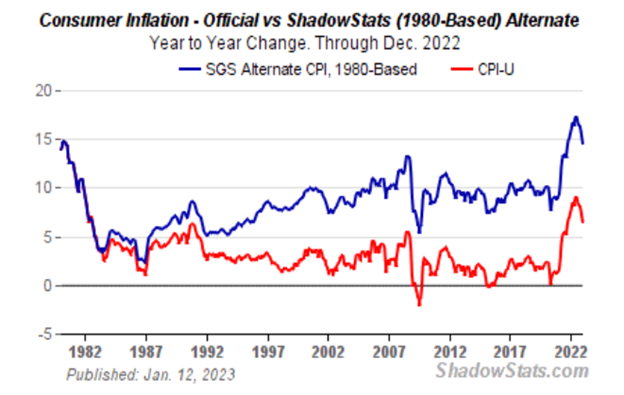

Among other tricks, the aim of the Office of BS is to now use neighborhood level information on housing structure types for a calendar year to effectively manipulate a lower than honest CPI inflation rate. This is rich coming from a CPI scale (red line below) that is already notorious for under-reporting genuine inflation by 50% when compared to the old inflation scale (blue line below) used in the Volcker era. Here is our 15% by the way:

Effectively, such lies may never be right, but as the official data point of the US Government, they are also never wrong. Such tricks open the door for Powell to even return to more inflationary money printing without risking inflationary headlines simply because the CPI scale is telling us the inflation “data” is improving—despite the fact that consumer expenses are literally burning with a 103-degree fever, night sweats and aching muscles… Just ask yourselves: Does your cost of living seem to be rising by 6.5%, or does that “fever” feel a bit higher than what you’re being told?

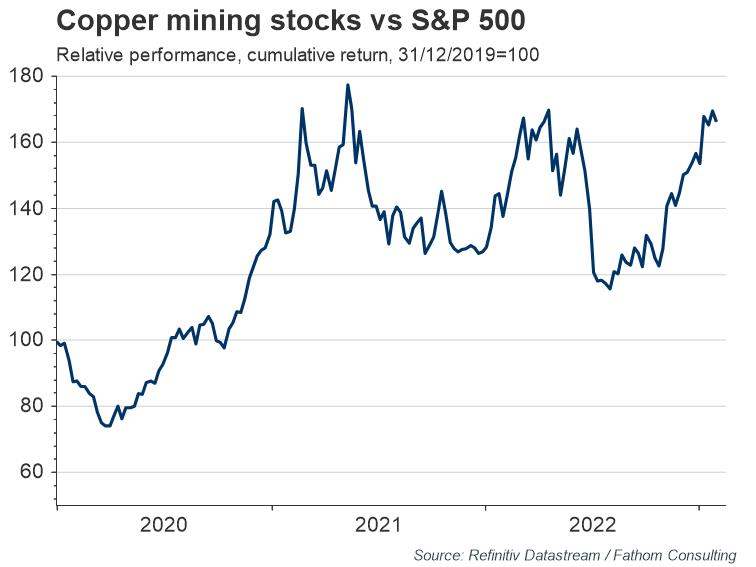

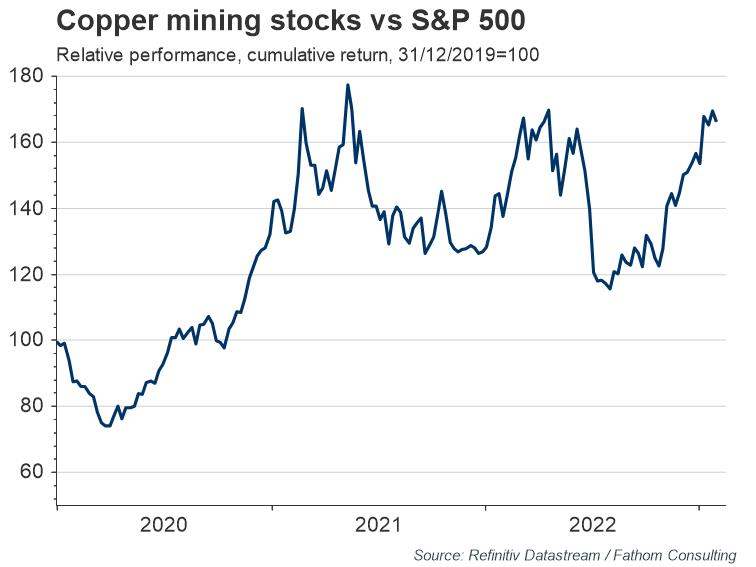

Concerning inflation in general, many investors additionally are watching for some commodities, especially Copper. Copper is an industrial metal and always rising in a period of economy growth. Moderate inflation in a period of economy boom is a normal and a positive sign. Indeed, if we take a look at copper market is shows upside action. Also, notoriously macro-sensitive stocks such as copper miners have gained about 40% more than the broader S&P500 index since the start of September 2022, including a 10% relative rise in 2023 alone. All this could indicate that the market believes that the worst of the macro news may be behind us:

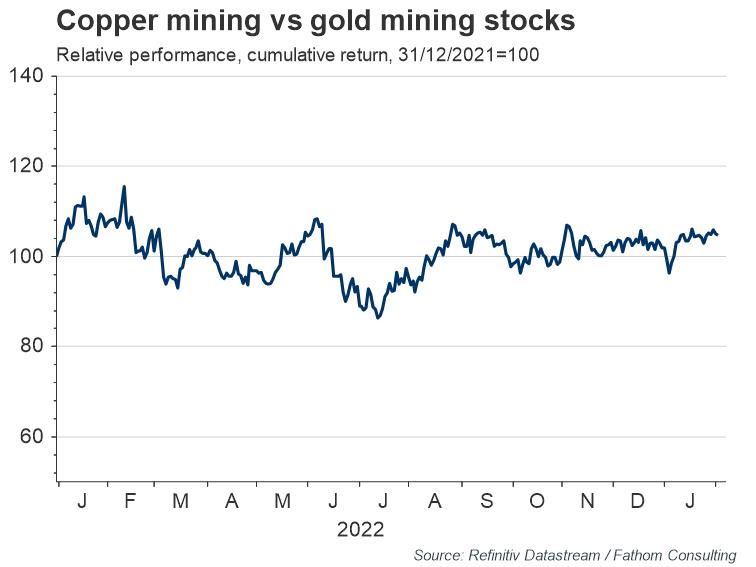

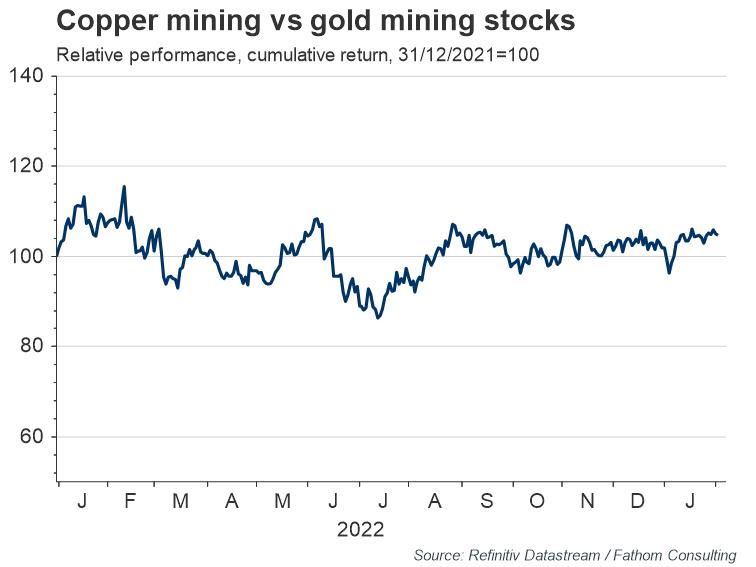

But the problem is Copper relation to Gold. Obviously, safe haven gold should lag behind copper during economy boom and Copper/Gold ratio should climb up, which we do not see now. there is evidence to argue that the market upswing since last summer was driven mainly by hopes of a Fed pivot. One example is the performance of gold mining stocks, which showed little variation relative to copper mining stocks in 2022, despite their much lower sensitivity to macro conditions. In other words, copper mining stocks ought to have significantly outperformed gold ones if improving fundamentals had been the main driver of their recent strong performance.

The same conclusion could be made from expectations of companies' earnings in general. Hard economic data indicates that recession is still on the cards. US earnings expectations continue to be revised lower by analysts, with the growth rate in expected earnings from US companies over the next twelve months having reached zero. There is room for further downside revisions, as earning expectations have not yet reached levels consistent with previous recessions.

Recent economic data have supplied more evidence that conditions could take a turn for the worse. Last week, the US reported a drop in real spending driven by higher savings, and this week German GDP was reported to have unexpectedly contracted by -0.2%.

So, it will be even more interesting to see what CPI numbers we will get next week. People have same suspicions concerning job market and particular most recent superb report that seems absolutely amazing. Given the number of layoffs and the general slowing of the economy, the notion that 517,000 jobs were created in January just doesn’t make sense. Turns out that your skepticism is warranted.

Nevertheless, the media ran with the headline numbers and gushed over the employment report. As Ryan McMaken at the Mises Institute pointed out, the words “wow” and “stunner” were frequently used. But as with so many government numbers, you need to look a little more closely. A recent article published by MarketWatch did just that and found that there are five significant reasons to think the big January number was an anomaly and not a sign of a roaring economy.

As reported by MarketWatch, economists at Morgan Stanley determined that three factors boosting job growth were likely temporary and give a false impression about the state of the labor market.

There is another factor that few people seem to be talking about. Most of these new jobs are part-time. McMaken points out that since September, month-to-month employment growth in full-time jobs has been negative. Meanwhile, growth in part-time jobs has been positive.

The fact people are moving from full-time to part-time work, and more people are taking on extra part-time jobs to make ends meet does not scream “strong economy.” In fact, it’s the opposite. This reveals an economy with a rotting foundation.

Finally, MarketWatch highlights a Philadelphia Federal Reserve report called the Quarterly Census of Employment and Wages that casts more doubt on the BLS numbers. In a nutshell, the QCEW estimates that the BLS data overstated the number of jobs created by roughly 1 million jobs in Q2.

Standard Chartered head of North American macro strategy Steve Englander told MarketWatch he found the QCEW data “quite reliable,” and his own analysis found that the headline job numbers may have been over-reported by as much as 1.1 million.

And now, let's think about it in terms of gold price action. In fact, recent collapse that we saw two weeks ago was triggered by this "slightly adjusted" employment report. And then we have second coming question. If data is not quite correct, how reliable the action is. Because all chain of conclusions might be wrong - strong job market - Fed rate hike - low inflation and so on. If job market is not as strong, then Fed is not as hawkish, then evident signs of recession as not as far away etc.

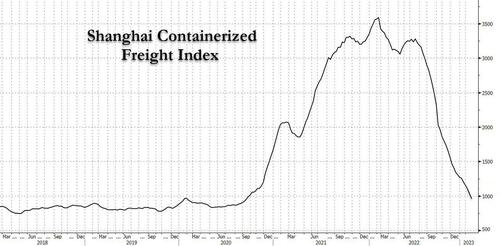

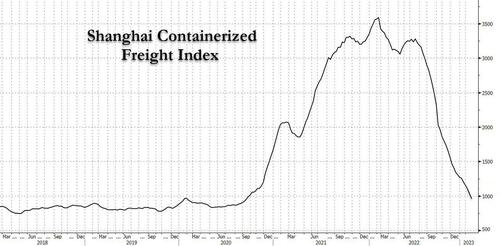

Finally, we have some global signs of slowdown. For example, The Shanghai Containerized Freight Index (SCFI) issued after Chinese New Year 2023 saw the index fall into the triple digits, closing at US$995 for the week ending 10 February 2023.

According to Chris Bryant opinion, a Bloomberg columnist, Maersk foresees global container demand for the year to fall by 2.5%. It is also foreseeing the contract rates to fall and settle in line with the spot market. (It must already be seen that the long-term rates on Xeneta took a 13% dive, the previous month to register the fifth straight month of consecutive losses.) This could be a big hit in terms of the overall yield. Rightly so, even the guidance numbers for the logistics giant stipulate the same. Its operating profit numbers for 2023 are seen somewhere between US$2-5 Billion for 2023, just about 6-15% of its 2022 numbers at US$31 billion. In fact, they are just a tad better than the 2019 numbers of US$1.7 billion. We just talked about Chinese economy yesterday. In terms of global trading, China and the US are the same, they are two sides of the same medal. And one can't show growth without another one. China shows clear signs of economy decrease, and recent piking just accelerates mutual negative effect.

Now ZeroHedge also has released an article, where speaks that the US is already in recession. We said this in the mid of 2022 when we've changed the style of weekly reports and start digging fundamentals more closely. In fact, the US stands in recession since the late 2021. As ZeroHedge writes, the US, with its 125% debt-to-GDP and 7% deficit-to-GDP ratios, was, and already is, in a recession heading into 2023, despite official efforts in DC to re-define the very definition of a recession.

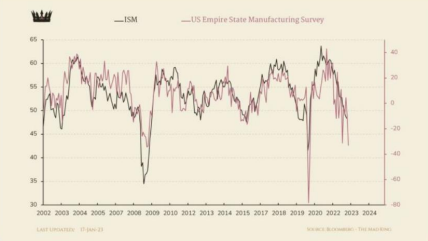

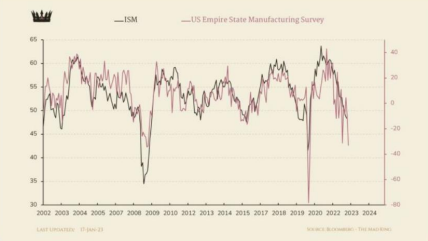

In fact, the manufacturing figures have not been this bad since 2008 and 2020, which, if I recall, were pretty bad vintage years for markets—”saved” only by money printing at warp speed.This, of course, raises the ever-charged question of whether Powell will be forced to return to more desperate mouse-click money creation—i.e., “quantitative easing.” For now, of course, the current Fed is going the other direction, “tightening” rather than “easing” reserve assets to the tune of -$95B per month into a perfect debt storm.

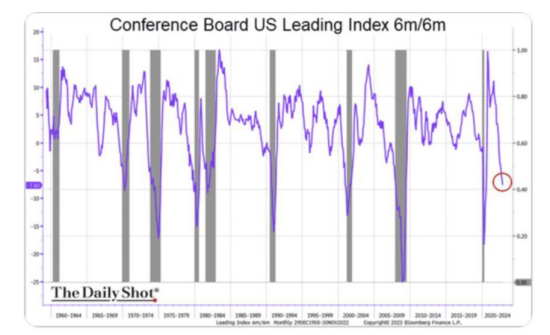

In case, however, we still need more recessionary evidence, the dramatic 6 month decline in the Conference Board’s index of leading indicators serves as yet another neon-flashing warning that the recession—if not under our bow—is certainly right off our bow. Furthermore, and despite Powell’s belief that his office can manage a recession with the precision of a home thermostat, his faith in what he lately described as a “softish landing” is almost as farcical as his prior attempt to describe inflation as “transitory.”

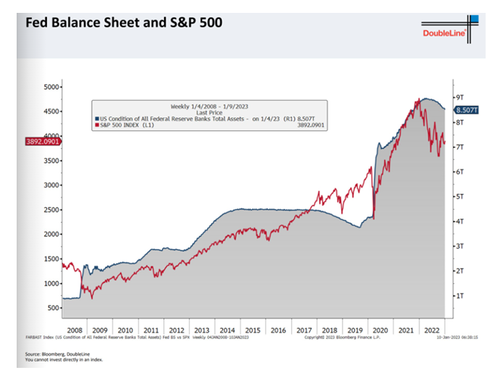

The simple math and reality of even centralized and central-bank distorted markets is quite simple: These markets rise and fall on liquidity. Once the monetary “grease” required to maintain the MMT fantasy of mouse-click money as a debt solution “tightens” too tight or runs too dry, the entire house of cards of the post-2008 fairytale comes to a hard rather than “softish” end. Again, we saw the first signs of this collapse in the “tightening” backdrop of 2022. Last time, in 2008 Fed has closed QT after ~800 Bln bonds sell-off. Now we've passed the half way by far with around 550 Bln been sold.

This critical “liquidity” won’t be coming from economic growth, rising tax receipts, a robust Main Street or a fairly-priced market. Instead, and as expected, it now comes from out of thin air… Unless Powell puts his finger on the Eccles-based mouse-clicker to create more fiat money (highly inflationary), US and global credit markets will simply continue their race to the ocean floor (highly deflationary or at least dis-inflationary).

As credit markets sink and bond yields and rates rise, this also means that equity markets, who have been sickly addicted to years of central-bank repressed low rates and cheap debt, will merely join those bonds on the bottom of the dark ocean floor. In short, bonds (and hence risk parity portfolios) won’t save you. Rather than hedge stocks, they are now correlated to the same.

In fact, it was during those October market lows that the queen of toxic liquidity, former Fed-Chair-turned-Treasury-Secretary (imagine that?) Janet Yellen, was suddenly ringing the bell for more magical money—i.e., “liquidity.” Specifically, Yellen was wondering who would be buying Uncle Sam’s IOU’s without more mouse-click money from the Eccles Building? The answer was simple: No one.

Instead, foreign central banks were and are selling rather than buying America’s bonds. Just ask the Japanese…Is Yellen, contrary to Powell, silently suggesting that QT has backfired? Is Yellen, unlike Powell, realizing that there are no buyers for our increasingly issued yet unloved USTs but the Fed itself?

Perhaps these tensions within the Treasury market provide the hidden clues as to why the USD has been sliding rather than rising from the DXY’s October highs?

After all, a weaker USD means less forced need for foreign nations to dump their UST reserves to come up with the money to buy their own dying bonds and strengthen their own dying currencies as a direct response to Powell’s (and originally, Yellen’s) strong USD policy. In short, perhaps our Treasury Secretary now wants to stop the bleeding in her Treasury market…

Meanwhile, however, you have the math-challenged but psychologically tragic Jay Powell wanting to save his legacy as a Paul Volcker rather than as an Arthur Burns.

Like a child wanting to be John Wayne rather than Daffy Duck, Powell and his rate-hiked strong USD refuses to see the $31T debt pile in front of him which makes it impossible to be a reborn Volcker, who in 1980 faced a much smaller debt pile of $900B. In short, Powell’s America of 2023, unlike Volcker’s America of 1980, can’t stomach rising rates or a strong USD.

Yellen or Powell, QT or QE, strong Dollar or weak Dollar, the global financial system is nevertheless doomed. We either tighten the bond and hence stock markets into a free fall and economic disaster, or we loosen and ease liquidity into an inflationary nightmare. Pick your poison—depression or hyperinflation. Or perhaps both…namely stagflation. Either way, of course, Powell, and the American economy, is now doomed. And he has only Greenspan, Bernanke, Yellen, himself and years of mouse-click fantasy to blame.

This leads to the best we can hope for from the very “experts” who have brought the global economy toward a mathematically unavoidable cliff are now empty words and twisted math, as per above. Such disloyalty from our financial generals on the eve of an unprecedented strategic and tactical economic defeat of their own making reminds me of officers sitting miles from the trenches as investors go “over-the-top” toward a row of cannons pointed straight at their trusting chests.

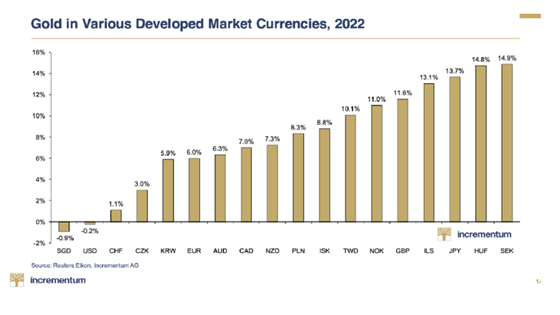

Gold was a far more loyal asset than stocks and bonds in the turbulent times of 2022; and given that 2023 portends to be even worse, we can expect better loyalty from this so-called “barbarous relic” of the past. With inflation ripping and war blazing, many still argue that gold did not do enough.

Hmmm…

But gold in every currency but the USD (see above) would beg to differ. Furthermore, and as argued so many ways and times, that USD strength will not hold, as gold’s price moves this year have already tracked. Gold’s future strength and rise is thus easy to foresee, as gold doesn’t rise, currencies just fall. It’s really that simple.

Based upon the foregoing, each of us must therefore ask ourselves where to find his or her safe haven in a time of extended war, dishonest math, re-defined recessions, dying bonds, debased currencies and gyrating equity markets trending noticeably south. Traditionally, of course, the risk-free-return of sovereign bonds in general and USTs in particular was understood as the safest bet.

Based, however, upon 1) the non-traditional, and complete distortion/destruction of the global bond markets due to years of criminally negligent monetary policies from Tokyo to DC and 2) the genuine rather than reported real (i.e., inflation-adjusted) return on Uncle Sam’s IOUs, it becomes increasingly clear that their “risk-free-return” is little more than return-free-risk.

That is why more informed investors, willing to take the extra minutes to understand simple bond history and math soon discover that yes, even the 0% yield of gold with its naturally-derived/constrained stock to flow ratio (i.e., a nearly “finite” annual production of barely 2%) and infinite duration does a far better job of preserving wealth than bonds of finite duration and seemingly infinite issuance…

Sounds familiar, right? This is opinion of Matthew Piepenburg from Gold Switzerland, All these points we've discussed in details. We do not know the scale of data manipulation, it could reach absolutely astronomic levels, which makes us to think about gold even more. At least in some part of portfolio, at least for saving wealth and long-term investing. In current situation it is necessary.

To be continued...

At first glance, this week we do not have any gold-specific news. But this is only on a first glance. In fact, J. Biden speech in Congress and geopolitical consequences of earthquake in Turkey might become decisive for the gold performance in a long run. Another important conclusion that we could make, based on recent headlines in Twitter, news agencies - more and more analysts start speaking about issues that we've covered last year. They are pitfall in the US debt market, inability of the Fed to keep rates high for a long-term, manipulation of statistics data, especially employment and CPI and many others. This also could make effect soon as common sense based view is becoming more popular.

For example, CPI data. Last week we've said that due to regularly changing algorithm of CPI calculation skews the real inflation numbers down. Economists who have studied this phenomenon, tells that conservative US Inflation now should be around 10% on average, with more realistic level is around 12-15%. ZeroHedge even has released article on this subject, but it is only for Primary subscribers. Now, it is "super core" CPI numbers appeared that excludes everything - energy, food, shelter, old cars etc, which shows inflation below 2%. Obviously if we exclude everything then inflation will be zero. Great solution. Next week, on Tue we will be watching for CPI again, and Reuters poll suggests some uptick, even with this "adjusted" CPI.

Among other tricks, the aim of the Office of BS is to now use neighborhood level information on housing structure types for a calendar year to effectively manipulate a lower than honest CPI inflation rate. This is rich coming from a CPI scale (red line below) that is already notorious for under-reporting genuine inflation by 50% when compared to the old inflation scale (blue line below) used in the Volcker era. Here is our 15% by the way:

Effectively, such lies may never be right, but as the official data point of the US Government, they are also never wrong. Such tricks open the door for Powell to even return to more inflationary money printing without risking inflationary headlines simply because the CPI scale is telling us the inflation “data” is improving—despite the fact that consumer expenses are literally burning with a 103-degree fever, night sweats and aching muscles… Just ask yourselves: Does your cost of living seem to be rising by 6.5%, or does that “fever” feel a bit higher than what you’re being told?

As former Finance Minister and European Commission President, Jean-Claud Juncker, famously confessed, “when it becomes serious, you have to lie.”

Concerning inflation in general, many investors additionally are watching for some commodities, especially Copper. Copper is an industrial metal and always rising in a period of economy growth. Moderate inflation in a period of economy boom is a normal and a positive sign. Indeed, if we take a look at copper market is shows upside action. Also, notoriously macro-sensitive stocks such as copper miners have gained about 40% more than the broader S&P500 index since the start of September 2022, including a 10% relative rise in 2023 alone. All this could indicate that the market believes that the worst of the macro news may be behind us:

But the problem is Copper relation to Gold. Obviously, safe haven gold should lag behind copper during economy boom and Copper/Gold ratio should climb up, which we do not see now. there is evidence to argue that the market upswing since last summer was driven mainly by hopes of a Fed pivot. One example is the performance of gold mining stocks, which showed little variation relative to copper mining stocks in 2022, despite their much lower sensitivity to macro conditions. In other words, copper mining stocks ought to have significantly outperformed gold ones if improving fundamentals had been the main driver of their recent strong performance.

The same conclusion could be made from expectations of companies' earnings in general. Hard economic data indicates that recession is still on the cards. US earnings expectations continue to be revised lower by analysts, with the growth rate in expected earnings from US companies over the next twelve months having reached zero. There is room for further downside revisions, as earning expectations have not yet reached levels consistent with previous recessions.

Recent economic data have supplied more evidence that conditions could take a turn for the worse. Last week, the US reported a drop in real spending driven by higher savings, and this week German GDP was reported to have unexpectedly contracted by -0.2%.

So, it will be even more interesting to see what CPI numbers we will get next week. People have same suspicions concerning job market and particular most recent superb report that seems absolutely amazing. Given the number of layoffs and the general slowing of the economy, the notion that 517,000 jobs were created in January just doesn’t make sense. Turns out that your skepticism is warranted.

Nevertheless, the media ran with the headline numbers and gushed over the employment report. As Ryan McMaken at the Mises Institute pointed out, the words “wow” and “stunner” were frequently used. But as with so many government numbers, you need to look a little more closely. A recent article published by MarketWatch did just that and found that there are five significant reasons to think the big January number was an anomaly and not a sign of a roaring economy.

As reported by MarketWatch, economists at Morgan Stanley determined that three factors boosting job growth were likely temporary and give a false impression about the state of the labor market.

- Unusually warm weather

- An end to California’s higher education strike bringing people off the unemployment rolls.

- A very strong upward seasonal adjustment.

There is another factor that few people seem to be talking about. Most of these new jobs are part-time. McMaken points out that since September, month-to-month employment growth in full-time jobs has been negative. Meanwhile, growth in part-time jobs has been positive.

A switch from full-time-driven employment to part-time-driven employment usually indicates that a recession is coming. We saw it happen in 1981, 1990, 2001, 2008, 2020. Now it’s happened again in 2023.”

The fact people are moving from full-time to part-time work, and more people are taking on extra part-time jobs to make ends meet does not scream “strong economy.” In fact, it’s the opposite. This reveals an economy with a rotting foundation.

Finally, MarketWatch highlights a Philadelphia Federal Reserve report called the Quarterly Census of Employment and Wages that casts more doubt on the BLS numbers. In a nutshell, the QCEW estimates that the BLS data overstated the number of jobs created by roughly 1 million jobs in Q2.

Standard Chartered head of North American macro strategy Steve Englander told MarketWatch he found the QCEW data “quite reliable,” and his own analysis found that the headline job numbers may have been over-reported by as much as 1.1 million.

And now, let's think about it in terms of gold price action. In fact, recent collapse that we saw two weeks ago was triggered by this "slightly adjusted" employment report. And then we have second coming question. If data is not quite correct, how reliable the action is. Because all chain of conclusions might be wrong - strong job market - Fed rate hike - low inflation and so on. If job market is not as strong, then Fed is not as hawkish, then evident signs of recession as not as far away etc.

Finally, we have some global signs of slowdown. For example, The Shanghai Containerized Freight Index (SCFI) issued after Chinese New Year 2023 saw the index fall into the triple digits, closing at US$995 for the week ending 10 February 2023.

According to Chris Bryant opinion, a Bloomberg columnist, Maersk foresees global container demand for the year to fall by 2.5%. It is also foreseeing the contract rates to fall and settle in line with the spot market. (It must already be seen that the long-term rates on Xeneta took a 13% dive, the previous month to register the fifth straight month of consecutive losses.) This could be a big hit in terms of the overall yield. Rightly so, even the guidance numbers for the logistics giant stipulate the same. Its operating profit numbers for 2023 are seen somewhere between US$2-5 Billion for 2023, just about 6-15% of its 2022 numbers at US$31 billion. In fact, they are just a tad better than the 2019 numbers of US$1.7 billion. We just talked about Chinese economy yesterday. In terms of global trading, China and the US are the same, they are two sides of the same medal. And one can't show growth without another one. China shows clear signs of economy decrease, and recent piking just accelerates mutual negative effect.

Now ZeroHedge also has released an article, where speaks that the US is already in recession. We said this in the mid of 2022 when we've changed the style of weekly reports and start digging fundamentals more closely. In fact, the US stands in recession since the late 2021. As ZeroHedge writes, the US, with its 125% debt-to-GDP and 7% deficit-to-GDP ratios, was, and already is, in a recession heading into 2023, despite official efforts in DC to re-define the very definition of a recession.

In fact, the manufacturing figures have not been this bad since 2008 and 2020, which, if I recall, were pretty bad vintage years for markets—”saved” only by money printing at warp speed.This, of course, raises the ever-charged question of whether Powell will be forced to return to more desperate mouse-click money creation—i.e., “quantitative easing.” For now, of course, the current Fed is going the other direction, “tightening” rather than “easing” reserve assets to the tune of -$95B per month into a perfect debt storm.

In case, however, we still need more recessionary evidence, the dramatic 6 month decline in the Conference Board’s index of leading indicators serves as yet another neon-flashing warning that the recession—if not under our bow—is certainly right off our bow. Furthermore, and despite Powell’s belief that his office can manage a recession with the precision of a home thermostat, his faith in what he lately described as a “softish landing” is almost as farcical as his prior attempt to describe inflation as “transitory.”

The simple math and reality of even centralized and central-bank distorted markets is quite simple: These markets rise and fall on liquidity. Once the monetary “grease” required to maintain the MMT fantasy of mouse-click money as a debt solution “tightens” too tight or runs too dry, the entire house of cards of the post-2008 fairytale comes to a hard rather than “softish” end. Again, we saw the first signs of this collapse in the “tightening” backdrop of 2022. Last time, in 2008 Fed has closed QT after ~800 Bln bonds sell-off. Now we've passed the half way by far with around 550 Bln been sold.

This critical “liquidity” won’t be coming from economic growth, rising tax receipts, a robust Main Street or a fairly-priced market. Instead, and as expected, it now comes from out of thin air… Unless Powell puts his finger on the Eccles-based mouse-clicker to create more fiat money (highly inflationary), US and global credit markets will simply continue their race to the ocean floor (highly deflationary or at least dis-inflationary).

As credit markets sink and bond yields and rates rise, this also means that equity markets, who have been sickly addicted to years of central-bank repressed low rates and cheap debt, will merely join those bonds on the bottom of the dark ocean floor. In short, bonds (and hence risk parity portfolios) won’t save you. Rather than hedge stocks, they are now correlated to the same.

In fact, it was during those October market lows that the queen of toxic liquidity, former Fed-Chair-turned-Treasury-Secretary (imagine that?) Janet Yellen, was suddenly ringing the bell for more magical money—i.e., “liquidity.” Specifically, Yellen was wondering who would be buying Uncle Sam’s IOU’s without more mouse-click money from the Eccles Building? The answer was simple: No one.

Instead, foreign central banks were and are selling rather than buying America’s bonds. Just ask the Japanese…Is Yellen, contrary to Powell, silently suggesting that QT has backfired? Is Yellen, unlike Powell, realizing that there are no buyers for our increasingly issued yet unloved USTs but the Fed itself?

Perhaps these tensions within the Treasury market provide the hidden clues as to why the USD has been sliding rather than rising from the DXY’s October highs?

After all, a weaker USD means less forced need for foreign nations to dump their UST reserves to come up with the money to buy their own dying bonds and strengthen their own dying currencies as a direct response to Powell’s (and originally, Yellen’s) strong USD policy. In short, perhaps our Treasury Secretary now wants to stop the bleeding in her Treasury market…

Meanwhile, however, you have the math-challenged but psychologically tragic Jay Powell wanting to save his legacy as a Paul Volcker rather than as an Arthur Burns.

Like a child wanting to be John Wayne rather than Daffy Duck, Powell and his rate-hiked strong USD refuses to see the $31T debt pile in front of him which makes it impossible to be a reborn Volcker, who in 1980 faced a much smaller debt pile of $900B. In short, Powell’s America of 2023, unlike Volcker’s America of 1980, can’t stomach rising rates or a strong USD.

Yellen or Powell, QT or QE, strong Dollar or weak Dollar, the global financial system is nevertheless doomed. We either tighten the bond and hence stock markets into a free fall and economic disaster, or we loosen and ease liquidity into an inflationary nightmare. Pick your poison—depression or hyperinflation. Or perhaps both…namely stagflation. Either way, of course, Powell, and the American economy, is now doomed. And he has only Greenspan, Bernanke, Yellen, himself and years of mouse-click fantasy to blame.

This leads to the best we can hope for from the very “experts” who have brought the global economy toward a mathematically unavoidable cliff are now empty words and twisted math, as per above. Such disloyalty from our financial generals on the eve of an unprecedented strategic and tactical economic defeat of their own making reminds me of officers sitting miles from the trenches as investors go “over-the-top” toward a row of cannons pointed straight at their trusting chests.

Gold was a far more loyal asset than stocks and bonds in the turbulent times of 2022; and given that 2023 portends to be even worse, we can expect better loyalty from this so-called “barbarous relic” of the past. With inflation ripping and war blazing, many still argue that gold did not do enough.

Hmmm…

But gold in every currency but the USD (see above) would beg to differ. Furthermore, and as argued so many ways and times, that USD strength will not hold, as gold’s price moves this year have already tracked. Gold’s future strength and rise is thus easy to foresee, as gold doesn’t rise, currencies just fall. It’s really that simple.

Based upon the foregoing, each of us must therefore ask ourselves where to find his or her safe haven in a time of extended war, dishonest math, re-defined recessions, dying bonds, debased currencies and gyrating equity markets trending noticeably south. Traditionally, of course, the risk-free-return of sovereign bonds in general and USTs in particular was understood as the safest bet.

Based, however, upon 1) the non-traditional, and complete distortion/destruction of the global bond markets due to years of criminally negligent monetary policies from Tokyo to DC and 2) the genuine rather than reported real (i.e., inflation-adjusted) return on Uncle Sam’s IOUs, it becomes increasingly clear that their “risk-free-return” is little more than return-free-risk.

That is why more informed investors, willing to take the extra minutes to understand simple bond history and math soon discover that yes, even the 0% yield of gold with its naturally-derived/constrained stock to flow ratio (i.e., a nearly “finite” annual production of barely 2%) and infinite duration does a far better job of preserving wealth than bonds of finite duration and seemingly infinite issuance…

Sounds familiar, right? This is opinion of Matthew Piepenburg from Gold Switzerland, All these points we've discussed in details. We do not know the scale of data manipulation, it could reach absolutely astronomic levels, which makes us to think about gold even more. At least in some part of portfolio, at least for saving wealth and long-term investing. In current situation it is necessary.

To be continued...