Sive Morten

Special Consultant to the FPA

- Messages

- 18,699

Fundamentals

Weekly Gold Tading Report prepared by Sive Morten exclusively for ForexPeaceArmy.com

Gold fell nearly 3 percent to a three-month low on Friday after stronger-than-expected U.S. non-farm payrolls fueled expectations the Federal Reserve will raise rates sooner rather than later, and the dollar jumped to an 11-1/2 year high.

U.S. employers stepped up hiring in February and the unemployment rate fell to nearly a seven-year low, putting further pressure on the Fed to raise interest rates in June. An increase in U.S. interest rates would further boost the value of the dollar, in turn hurting demand for non-interest-bearing assets such as gold.

"The market may be reading too much into one data release," said Frances Hudson, global thematic strategist at Standard Life Investments in Edinburgh.

"When the central bank tells you the move is going to be data dependent, I'm pretty sure they're not going to say that particular data release will be the tipping point because payroll figures are quite often subject to pretty substantial revisions."

A stronger U.S. currency makes dollar-denominated gold more expensive for holders of other currencies, while a rise in yields on U.S. bonds is negative for the metal, whose holders earn no interest.

"We continue to forecast a further strengthening of the U.S. dollar, which will keep gold under pressure," Deutsche Bank said in a note.

On the physical market, prices on the Shanghai Gold Exchange suggested physical demand for gold in China, the second biggest bullion consumer, remained at healthy levels.

Chinese gold prices were about $4 to $5 an ounce higher than the global benchmark.

Recent CFTC data shows end of open interest drop. Long positions has not changed mostly but shorts have increased and open interest has increased correspondingly. During the week SPDR fund reports on solid drop of storages – from 771 tonnes on 27th of February to 756 tonnes on Friday.

Also it makes sense to remind that gold is entering into bearish seasonal trend. All these moments obviously do not support bullish reversal on gold. It looks like bulls have failed the test on quality and recent upside action on gold mostly was respect of support and butterfly pattern, rather than reversal.

Here is detailed breakdown of speculative positions:

Open interest:

Shorts:

Shorts:

Longs:

Longs:

Technicals

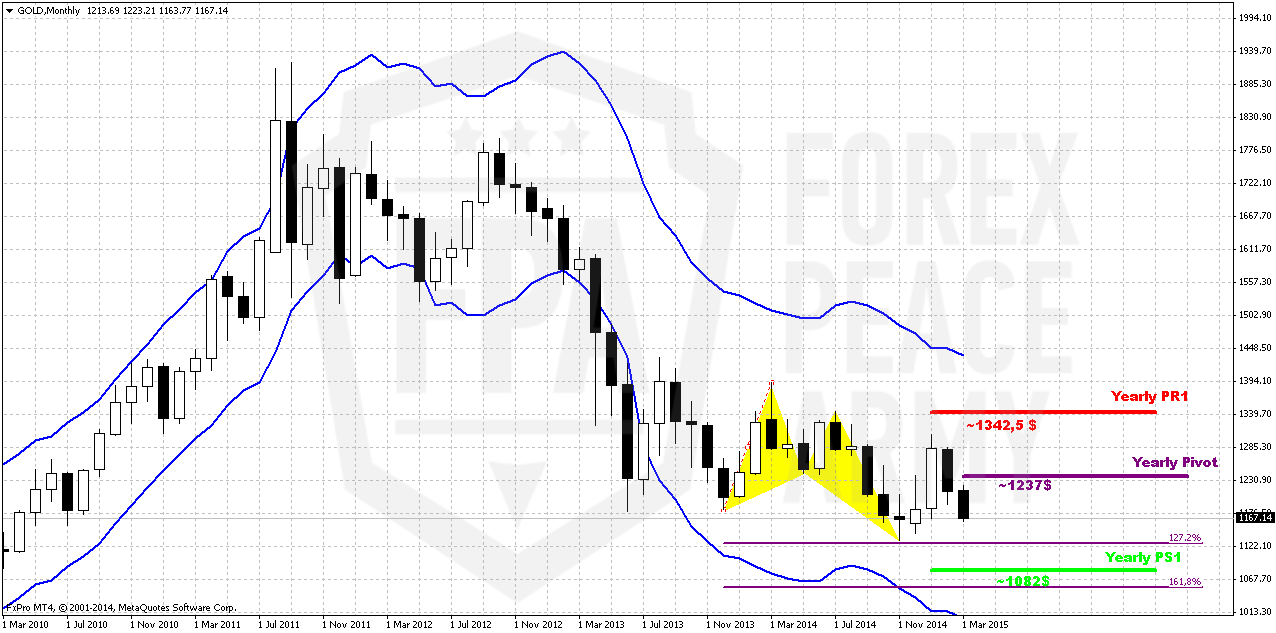

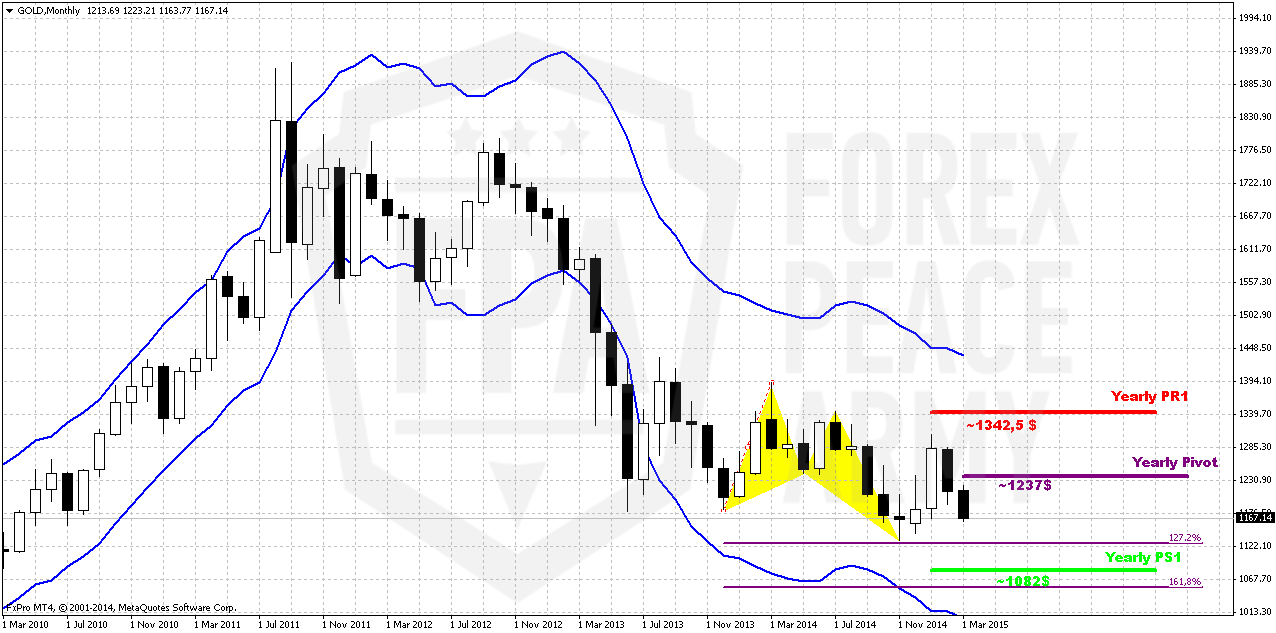

Monthly

So, drop on recent couple of weeks looks significant. Here we still have last big pattern in progress that is Volatility breakout (VOB). It suggests at least 0.618 AB-CD down. And this target is 1050$. At the same time February still stands as inside month and we need 1130 breakout to start clearly speak on 1050 target.

Since the beginning of the year market shows solid upside action. Market was able to exceed yearly pivot, passed half way to Yearly Pivot resistance 1 but right now has reversed down and closed below YPP. From technical point of view this is bearish sign. This could be very significant moment and next logical destination will be yearly pivot support 1 around 1083$.

Recent NFP data shows impressive growth, but labor cost not as stably good as unemployment. Many investors concern about anemic wage growth, although in recent time this indicator shows improving. So, it seems that gold will remain hostage of dollar value and US economical data in nearest perspective.

Thus gold will fluctuate in difficult period. If coming data will be gradual and supportive for rate hike – NFP will continue show upside trend, inflation and cosumption will grow, GDP will keep high pace – gold will remain under pressure till first rate hike. After that inflation will be supportive factor for gold.

If data will be mixed – then it could lead to local strength on gold market. This is in fact, what we see from 1200 level – slightly dovish comments from Yellen, downward revision of GDP and worse consumption data and gold has turned to upside retracement.

Still, if we will take into consideration geopolitical situation and risks that have appeared recently, it could happen that situation will change, especially if situation in Ukraine will escalate and peaceful regulation will fail.

That’s being said, economical data supports further gold decreasing but geopolicy could bring significant adjustment. Unfortunately the geopolicy is sphere where we can’t do much. As gold has passed through 1200, our next destination point is previous lows at 1130, but since gold is returning to them again – this is temporal destination and we should prepare for further downward action.

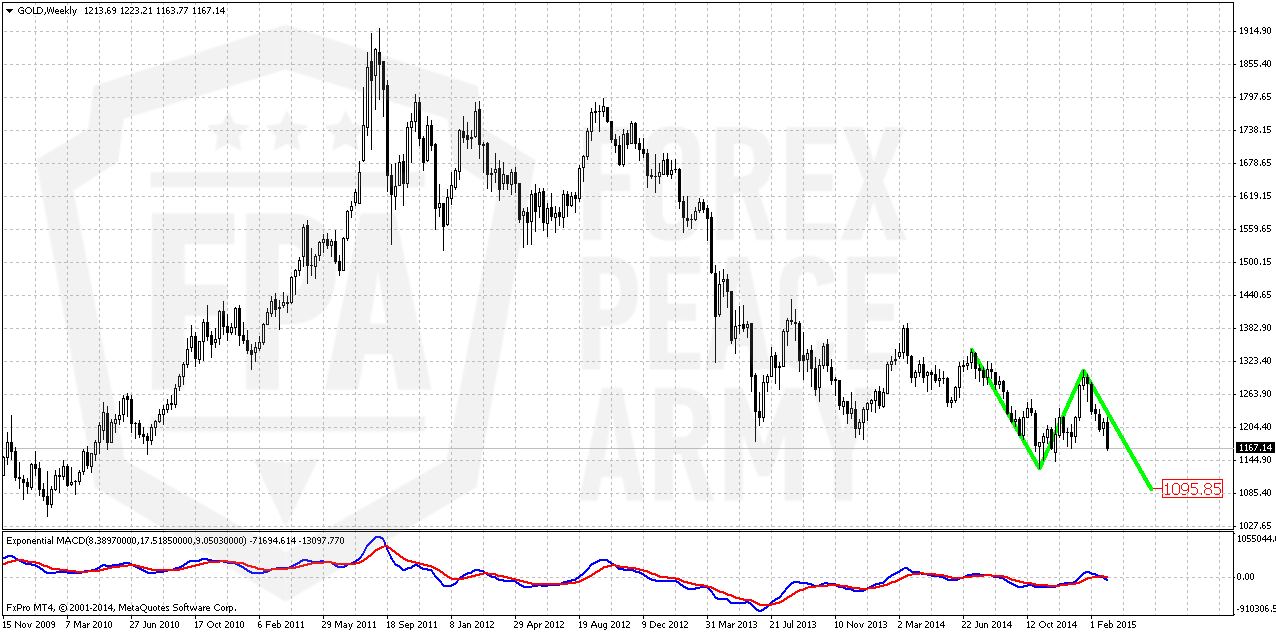

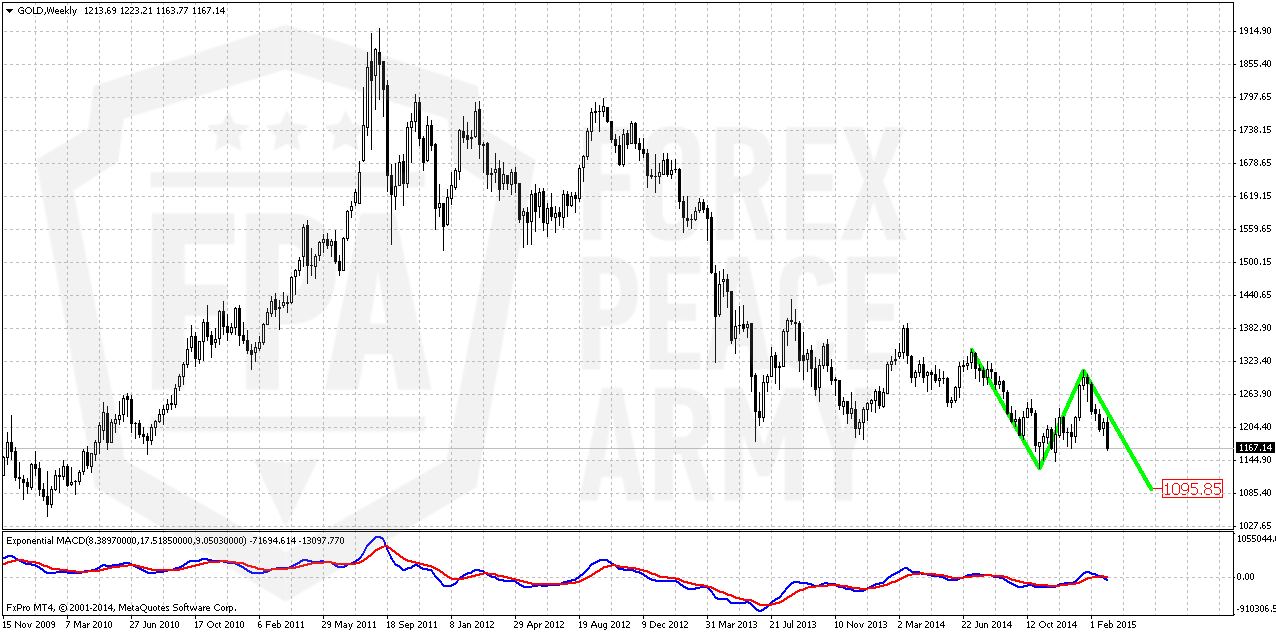

Weekly

Trend has turned bearish. So gold was not able to hold above 1200 strong support and moved below not just Fib level, but also MPS1. This tells that previous upside trend has failed. If you will take a look at weekly chart closely you will find a lot of different targets – AB-CD’s, couple of butterflies etc. But right now it makes sense probably to focus on most close target that is based on most recent AB-CD pattern. 1130 level is very close and it makes sense to take a look a bit lower. This AB-CD points on 1095-1100 destination point. All other targets stand significantly lower – 1080, 1050 and even 990$.

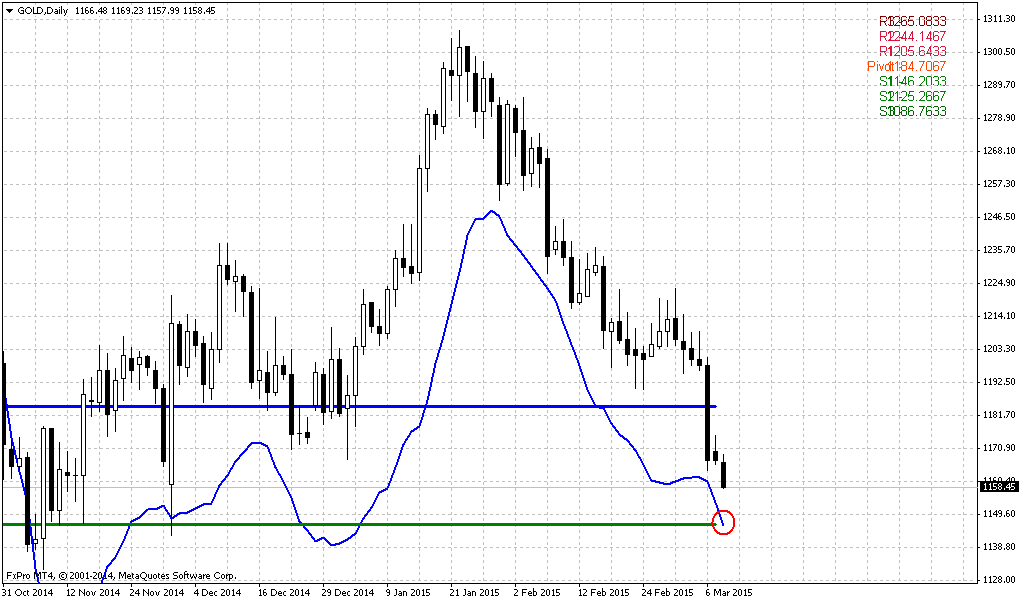

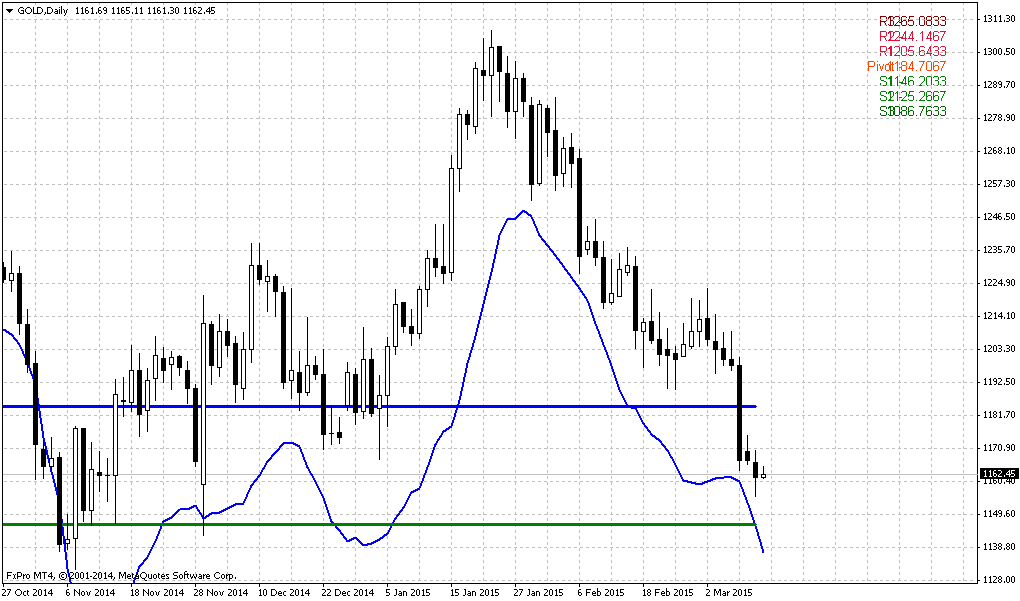

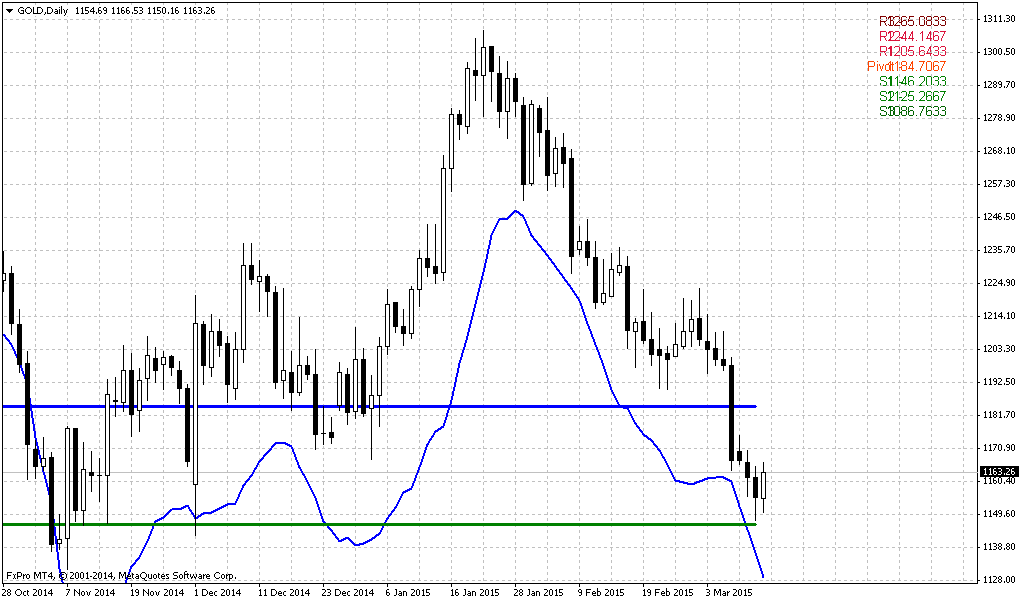

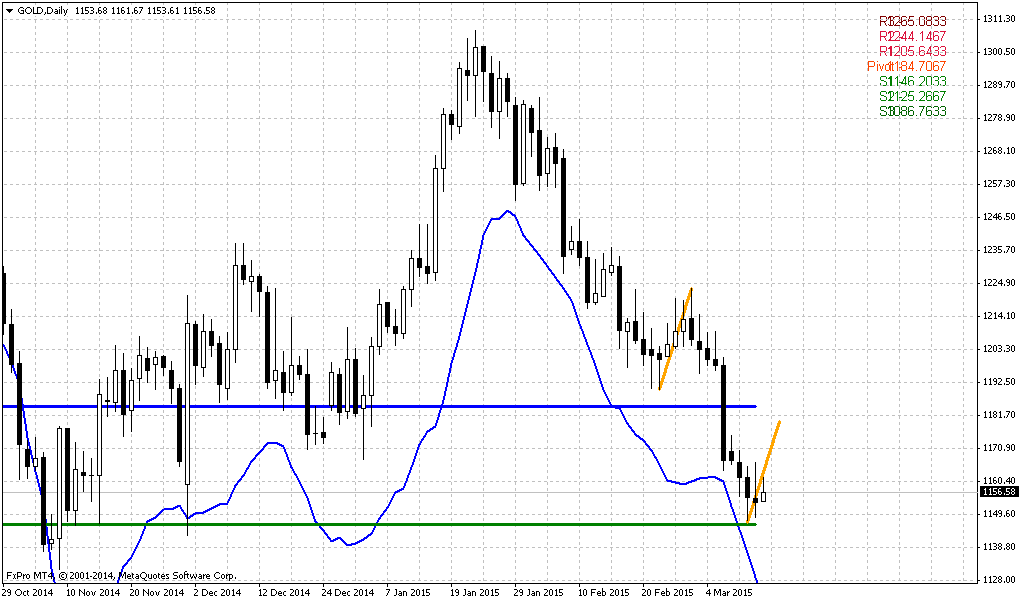

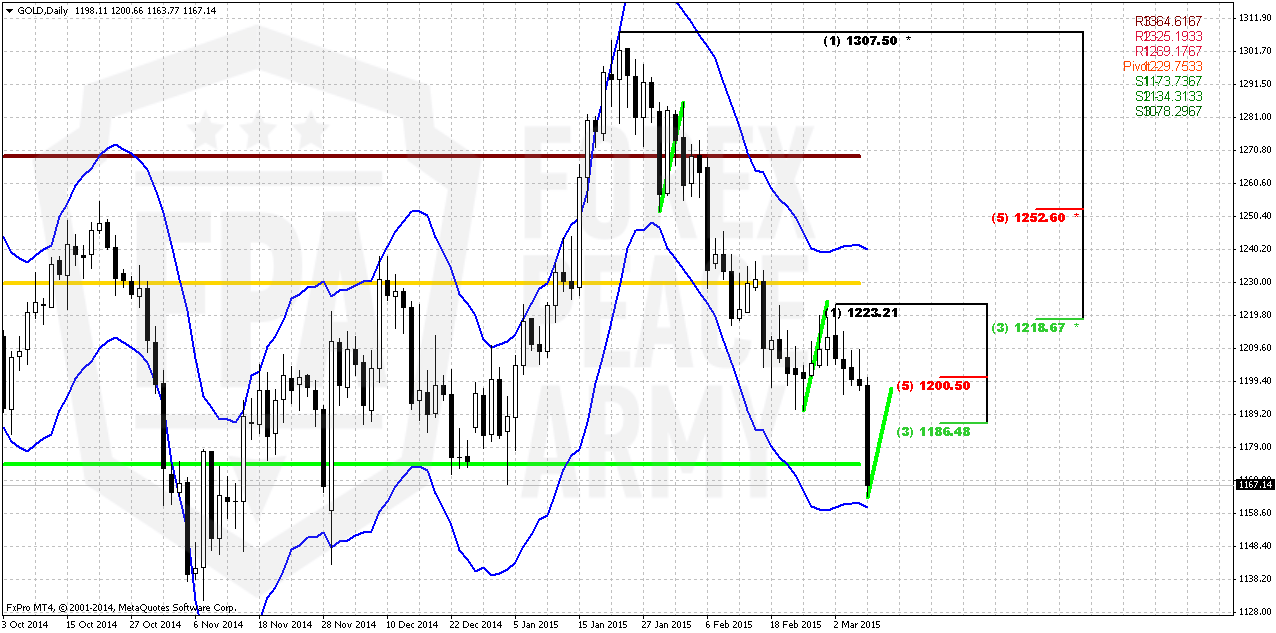

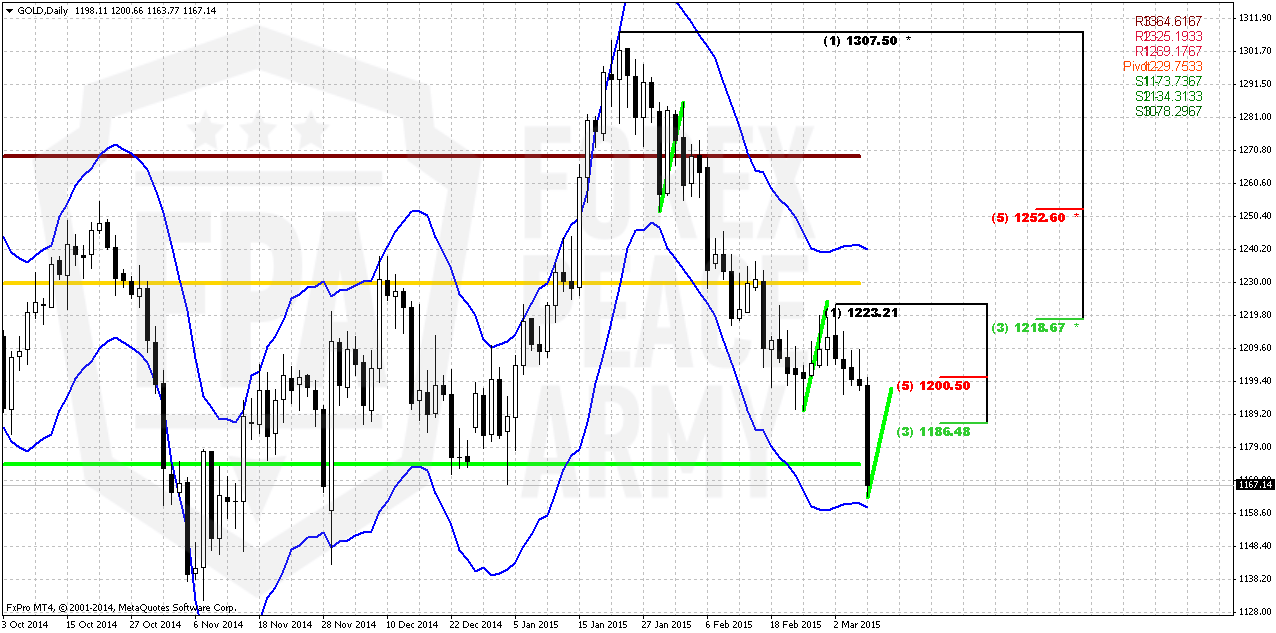

Daily

After Friday’s drop market almost has reached oversold. That’s why some upside bounce could happen. Applying harmonic swing we could estimate possible re-testing of 1200 level. This also will be Fib resistance, and in general, re-testing of broken levels is a habit of gold market. Overall situation looks like on EUR in our current weekly research. Only if gold will show fast upside return back to 1220 area – chances on reversal will appear. Any other action will suggest downward continuation for 1130. So, our primary task in the beginning of the week – wait for bounce up out from oversold and watch for its nature. Gradual rally will be just retracement and we will try to sell it. While fast and furious return back (although we have no idea on reasons for such action) to 1220 could chance situation and resurrect bullish sentiment. Still it is reasonable just to watch for 1200 re-testing as potential possibility for short entry.

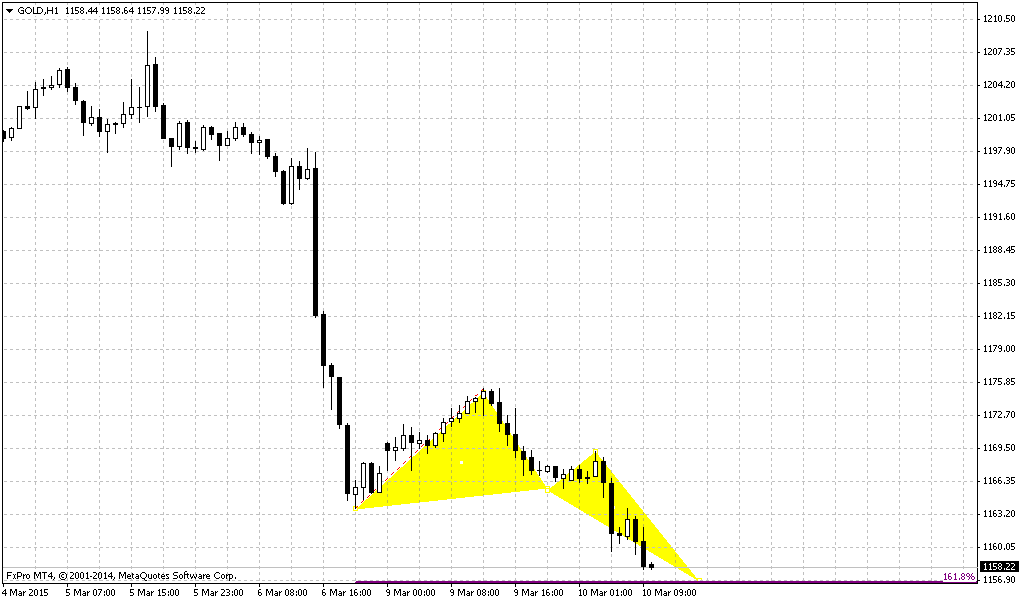

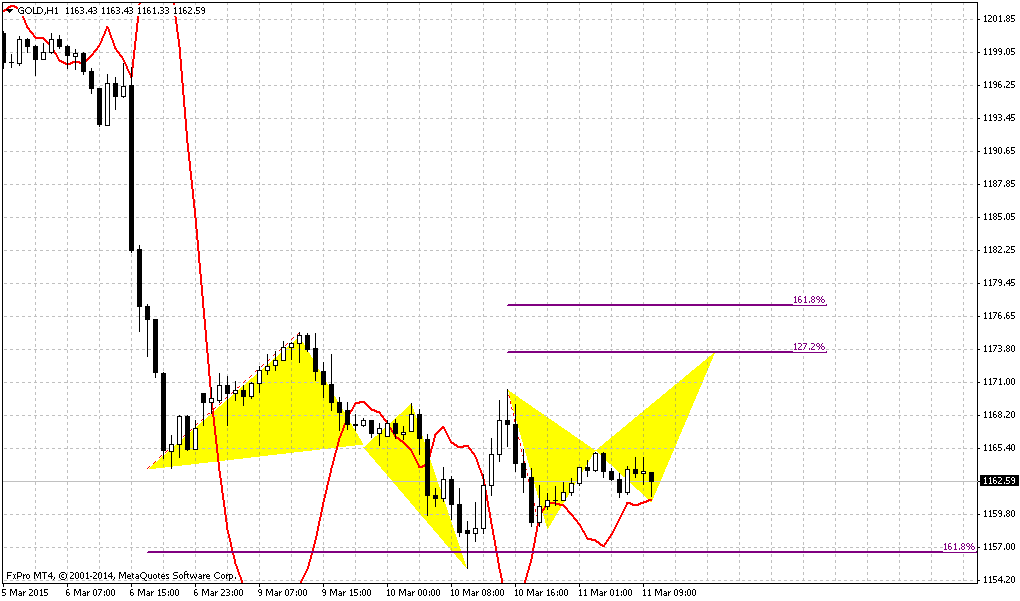

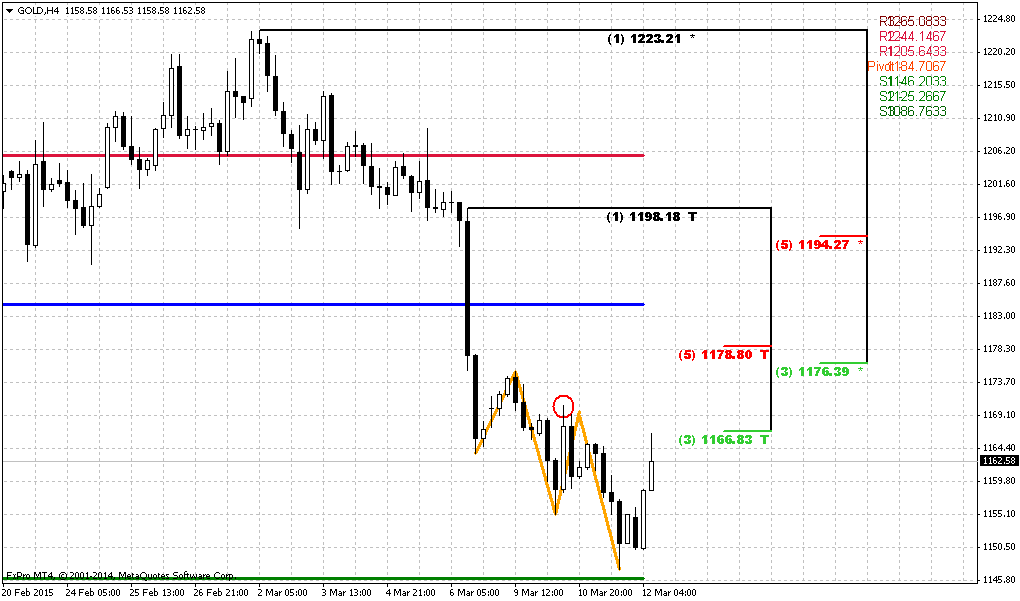

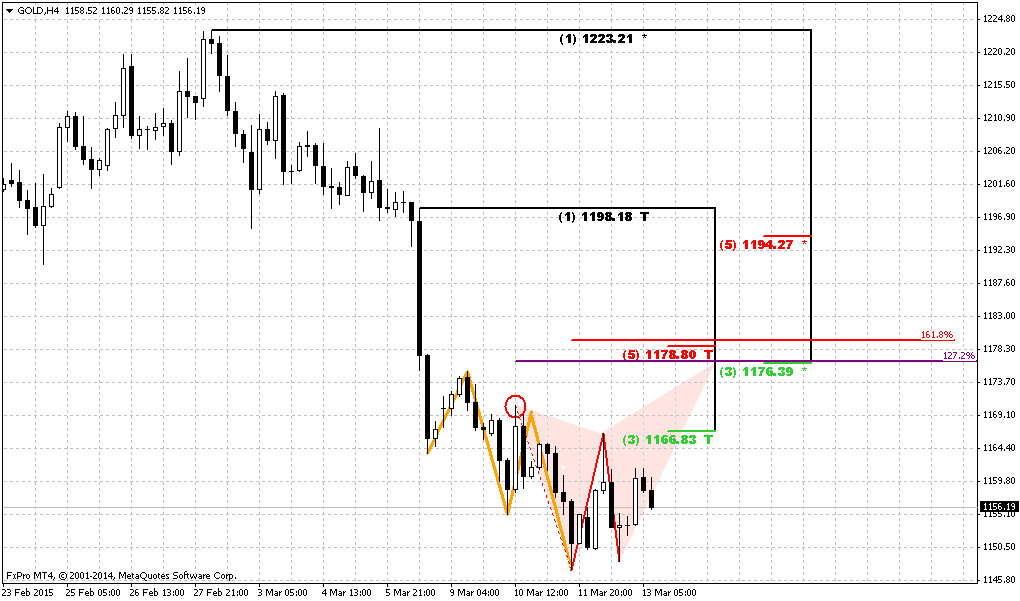

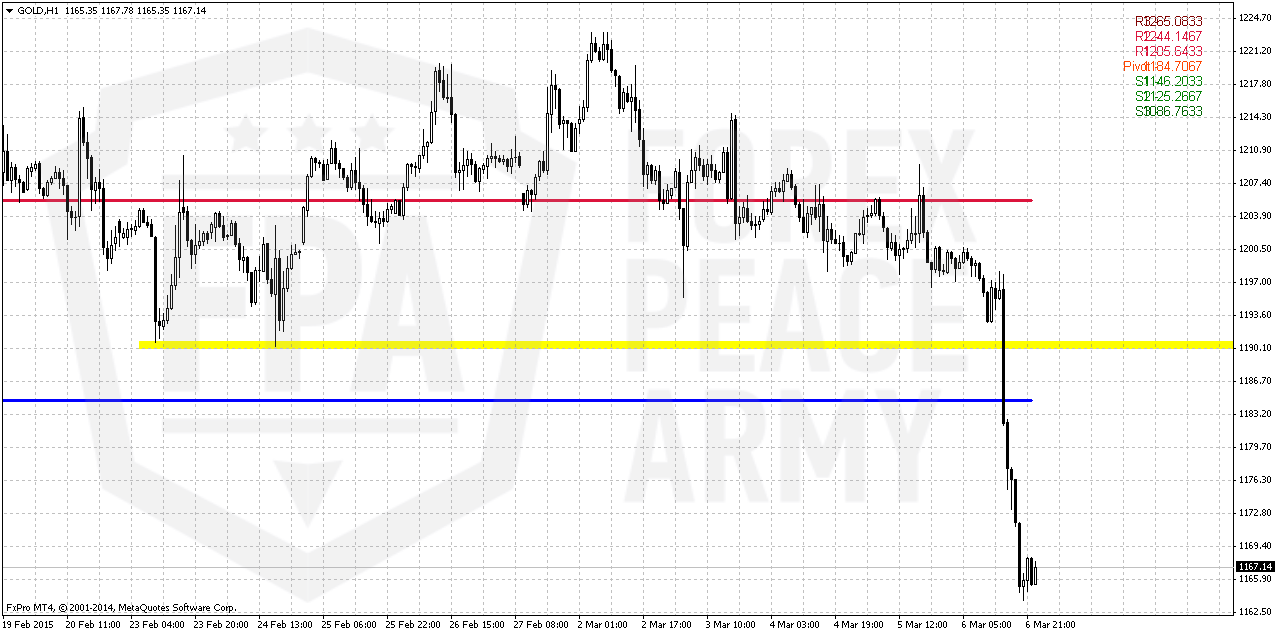

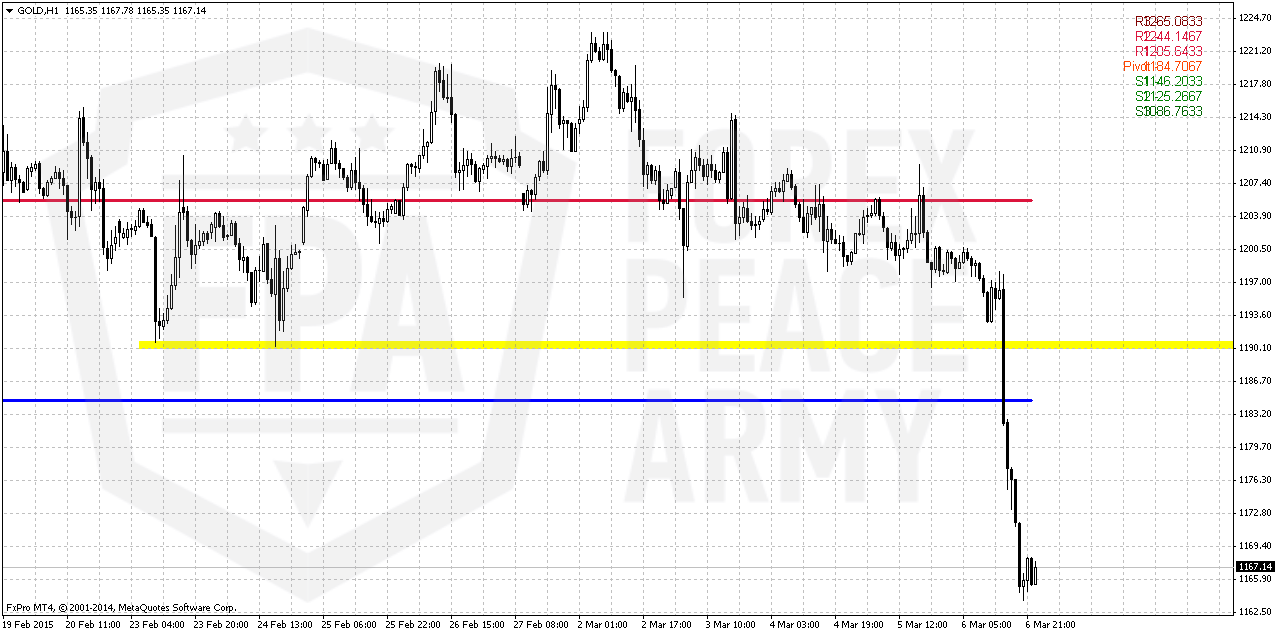

1-hour

Since drop just has finished – intraday charts do not give us a lot information, no patterns have been formed yet. Here we just see weekly pivots and previous lows stand very close to WPP. This is most probable destination of short-term retracement.

Conclusion:

From technical point of view we have no reasons yet to abandon possible long-term downward AB-CD as VoB (Volatility breakout) development. Fundamental background is not very supportive for gold right now and one cluster of events that could bring unexpected bullish surprise is geopolitical tensions.

Market has dropped below key level of 1200 and if it will not return back to 1220 area somehow – road to 1130 will be open.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.

Weekly Gold Tading Report prepared by Sive Morten exclusively for ForexPeaceArmy.com

Gold fell nearly 3 percent to a three-month low on Friday after stronger-than-expected U.S. non-farm payrolls fueled expectations the Federal Reserve will raise rates sooner rather than later, and the dollar jumped to an 11-1/2 year high.

U.S. employers stepped up hiring in February and the unemployment rate fell to nearly a seven-year low, putting further pressure on the Fed to raise interest rates in June. An increase in U.S. interest rates would further boost the value of the dollar, in turn hurting demand for non-interest-bearing assets such as gold.

"The market may be reading too much into one data release," said Frances Hudson, global thematic strategist at Standard Life Investments in Edinburgh.

"When the central bank tells you the move is going to be data dependent, I'm pretty sure they're not going to say that particular data release will be the tipping point because payroll figures are quite often subject to pretty substantial revisions."

A stronger U.S. currency makes dollar-denominated gold more expensive for holders of other currencies, while a rise in yields on U.S. bonds is negative for the metal, whose holders earn no interest.

"We continue to forecast a further strengthening of the U.S. dollar, which will keep gold under pressure," Deutsche Bank said in a note.

On the physical market, prices on the Shanghai Gold Exchange suggested physical demand for gold in China, the second biggest bullion consumer, remained at healthy levels.

Chinese gold prices were about $4 to $5 an ounce higher than the global benchmark.

Recent CFTC data shows end of open interest drop. Long positions has not changed mostly but shorts have increased and open interest has increased correspondingly. During the week SPDR fund reports on solid drop of storages – from 771 tonnes on 27th of February to 756 tonnes on Friday.

Also it makes sense to remind that gold is entering into bearish seasonal trend. All these moments obviously do not support bullish reversal on gold. It looks like bulls have failed the test on quality and recent upside action on gold mostly was respect of support and butterfly pattern, rather than reversal.

Here is detailed breakdown of speculative positions:

Open interest:

Technicals

Monthly

So, drop on recent couple of weeks looks significant. Here we still have last big pattern in progress that is Volatility breakout (VOB). It suggests at least 0.618 AB-CD down. And this target is 1050$. At the same time February still stands as inside month and we need 1130 breakout to start clearly speak on 1050 target.

Since the beginning of the year market shows solid upside action. Market was able to exceed yearly pivot, passed half way to Yearly Pivot resistance 1 but right now has reversed down and closed below YPP. From technical point of view this is bearish sign. This could be very significant moment and next logical destination will be yearly pivot support 1 around 1083$.

Recent NFP data shows impressive growth, but labor cost not as stably good as unemployment. Many investors concern about anemic wage growth, although in recent time this indicator shows improving. So, it seems that gold will remain hostage of dollar value and US economical data in nearest perspective.

Thus gold will fluctuate in difficult period. If coming data will be gradual and supportive for rate hike – NFP will continue show upside trend, inflation and cosumption will grow, GDP will keep high pace – gold will remain under pressure till first rate hike. After that inflation will be supportive factor for gold.

If data will be mixed – then it could lead to local strength on gold market. This is in fact, what we see from 1200 level – slightly dovish comments from Yellen, downward revision of GDP and worse consumption data and gold has turned to upside retracement.

Still, if we will take into consideration geopolitical situation and risks that have appeared recently, it could happen that situation will change, especially if situation in Ukraine will escalate and peaceful regulation will fail.

That’s being said, economical data supports further gold decreasing but geopolicy could bring significant adjustment. Unfortunately the geopolicy is sphere where we can’t do much. As gold has passed through 1200, our next destination point is previous lows at 1130, but since gold is returning to them again – this is temporal destination and we should prepare for further downward action.

Weekly

Trend has turned bearish. So gold was not able to hold above 1200 strong support and moved below not just Fib level, but also MPS1. This tells that previous upside trend has failed. If you will take a look at weekly chart closely you will find a lot of different targets – AB-CD’s, couple of butterflies etc. But right now it makes sense probably to focus on most close target that is based on most recent AB-CD pattern. 1130 level is very close and it makes sense to take a look a bit lower. This AB-CD points on 1095-1100 destination point. All other targets stand significantly lower – 1080, 1050 and even 990$.

Daily

After Friday’s drop market almost has reached oversold. That’s why some upside bounce could happen. Applying harmonic swing we could estimate possible re-testing of 1200 level. This also will be Fib resistance, and in general, re-testing of broken levels is a habit of gold market. Overall situation looks like on EUR in our current weekly research. Only if gold will show fast upside return back to 1220 area – chances on reversal will appear. Any other action will suggest downward continuation for 1130. So, our primary task in the beginning of the week – wait for bounce up out from oversold and watch for its nature. Gradual rally will be just retracement and we will try to sell it. While fast and furious return back (although we have no idea on reasons for such action) to 1220 could chance situation and resurrect bullish sentiment. Still it is reasonable just to watch for 1200 re-testing as potential possibility for short entry.

1-hour

Since drop just has finished – intraday charts do not give us a lot information, no patterns have been formed yet. Here we just see weekly pivots and previous lows stand very close to WPP. This is most probable destination of short-term retracement.

Conclusion:

From technical point of view we have no reasons yet to abandon possible long-term downward AB-CD as VoB (Volatility breakout) development. Fundamental background is not very supportive for gold right now and one cluster of events that could bring unexpected bullish surprise is geopolitical tensions.

Market has dropped below key level of 1200 and if it will not return back to 1220 area somehow – road to 1130 will be open.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.