Sive Morten

Special Consultant to the FPA

- Messages

- 18,699

Fundamentals

Weekly Gold Tading Report prepared by Sive Morten exclusively for ForexPeaceArmy.com

Gold prices hit two-week highs on Friday and were poised for their biggest weekly jump since mid-January, after the U.S. Federal Reserve's cautious note on interest rates arrested a dollar rally and sparked broad-based buying of commodities.

Today's run is part of a broad-based correction with the dollar weakness," said Eli Tesfaye, senior market strategist for RJO Futures in Chicago.

Spot gold has risen over 2 percent this week, recovering from a four-month low touched on Tuesday under pressure from expectations that the U.S. central bank is on track for its first interest rate increase in nearly a decade.

Such a move would boost the dollar and lift the opportunity cost of holding non-yielding bullion. The Fed, however, indicated it preferred a more gradual path.

"We obviously saw a slight change in sentiment earlier this week, with Janet Yellen apparently joining an ever-increasing number of central bank doves," Saxo Bank's head of commodity research Ole Hansen said, referring to the Fed chief.

"I think we will settle into a $1,150 to $1,190 range for now."

Post-Fed, the world's largest gold-backed exchange-traded fund, New York-listed SPDR Gold Shares , saw its first inflows since Feb. 20, also boosting sentiment.

In the physical markets, Chinese buying was steady, with premiums on the Shanghai Gold Exchange staying at a robust $6-$7 an ounce on Friday. Sustained physical buying could further support prices.

Silver outperformed other precious metals to hit 1-high of $16.89 an ounce and was up 4.7 percent at $16.85, and spot platinum was up 1.5 percent at $1,139.70 an ounce.

Platinum continued to trade at a roughly $50 discount to gold, a factor that is likely to stoke physical demand according to the Perth Mint, which is ramping up production of its platinum coins.

Palladium was up 1.2 percent at $773.98 an ounce, though it was the worst-performing precious metal of the week, down nearly 2 percent.

Recent CFTC data shows simultaneous increase in open interest and drop in net long positions. It means just one thing – shorts are growing very fast. At the same time balance of shorts and longs is not critical yet. Shorts stands for ~105K while longs for 180K.

SPDR fund reports on small growth but right now storages are 744 Tonnes and this is even less than on previous week of 750 tonnes. It is definitely show that recent upside action is nothing more but retracement.

Again we remind that gold is entering into bearish seasonal trend. All these moments obviously do not support bullish reversal on gold. It looks like bulls have failed the test on quality and recent upside action on gold mostly was respect of support and butterfly pattern, rather than reversal.

So sentiment statistics mostly confirms bearish sentiment and makes us treat recent upside action only as retracement. Thus, in long-term perspective we should use it for short entry.

Here is detailed breakdown of speculative positions:

Open interest:

Shorts:

Shorts:

Longs:

Longs:

Summary:

Summary:

Technicals

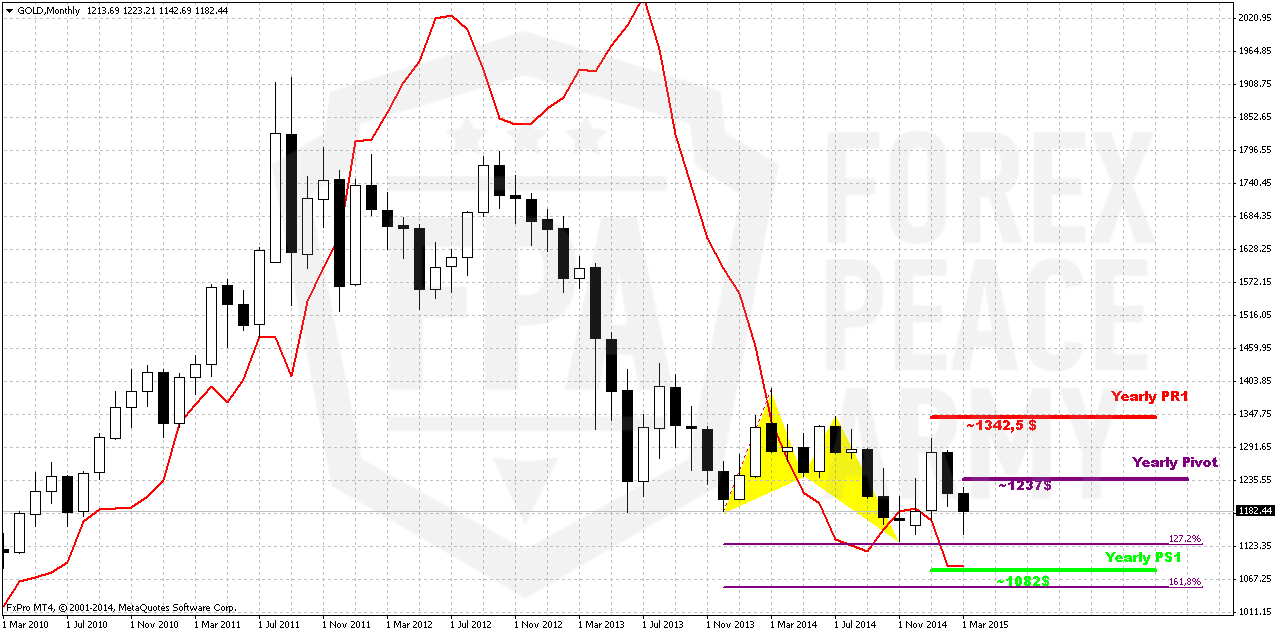

Monthly

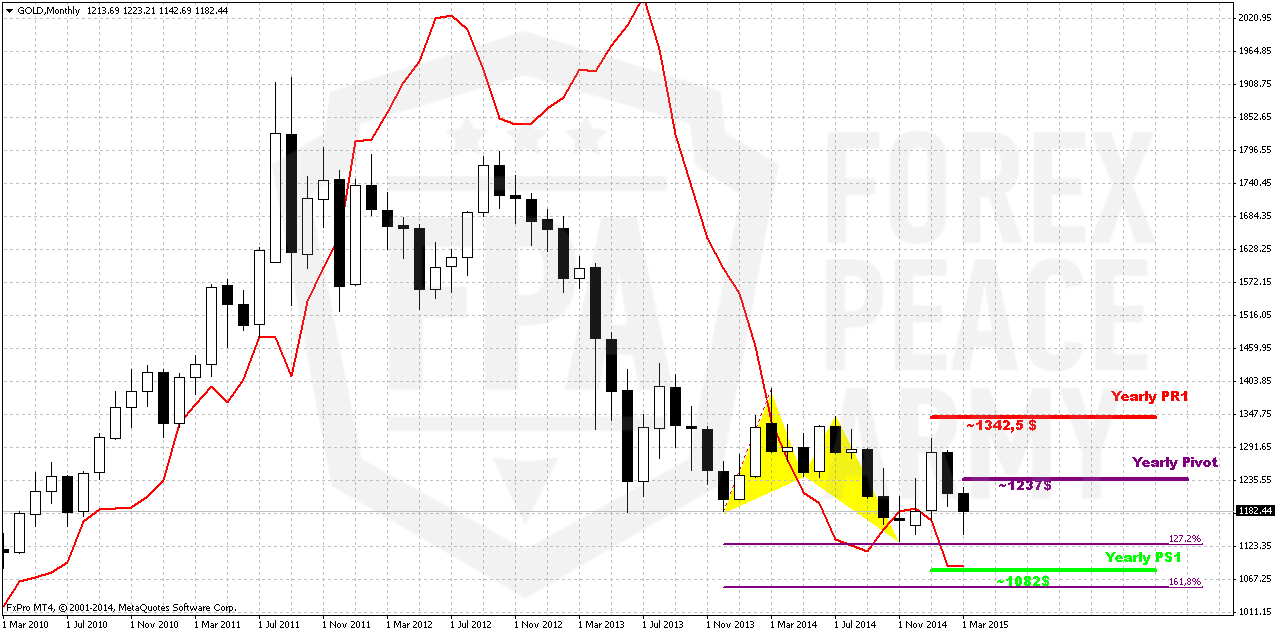

So, drop on recent couple of weeks looks significant. Here we still have last big pattern in progress that is Volatility breakout (VOB). It suggests at least 0.618 AB-CD down. And this target is 1050$. At the same time February still stands as inside month and we need 1130 breakout to start clearly speak on 1050 target.

Since the beginning of the year market showed solid upside action. Market was able to exceed yearly pivot, passed half way to Yearly Pivot resistance 1 but right now has reversed down and closed below YPP. From technical point of view this is bearish sign. This could be very significant moment and next logical destination will be yearly pivot support 1 around 1083$.

Recent NFP data shows impressive growth, but labor cost not as stably good as unemployment. Many investors concern about anemic wage growth, although in recent time this indicator shows improving. So, it seems that gold will remain hostage of dollar value and US economical data in nearest perspective. Approximately the same was announced by Fed in forecast on inflation and had become a reason of dovish approach to rate hiking. Another concern right now is too strong dollar that becomes a problem per se for economy growth.

Still, if we will take into consideration geopolitical situation and risks that have appeared recently, it could happen that situation will change, especially if situation in Ukraine will escalate and peaceful regulation will fail. Day by day we see worrying geopolitical news.

That’s being said, economical data supports further gold decreasing but geopolicy could bring significant adjustment. Unfortunately the geopolicy is sphere where we can’t do much. As gold has passed through 1200, our next destination point is previous lows at 1130, but since gold is returning to them again – this is temporal destination and we should prepare for further downward action. Besides, right now we can clear recognized bearish dynamic pressure on monthly chart. Take a look, although trend has turned bullish, but market was unable to show more or less meaningful upside action. Right now we see the tendency of lower highs creation and this significantly increases chances on downward breakout.

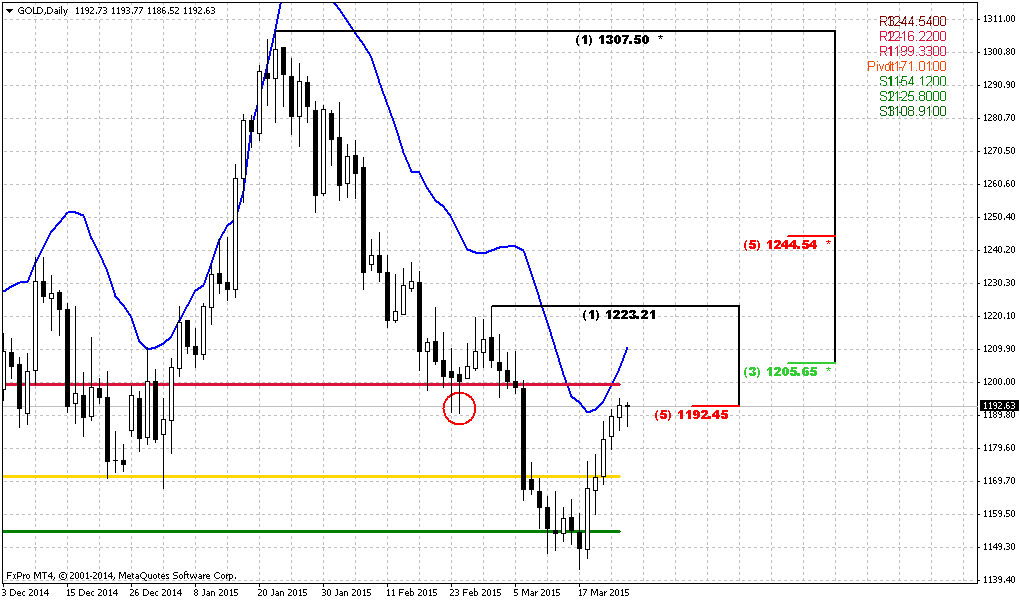

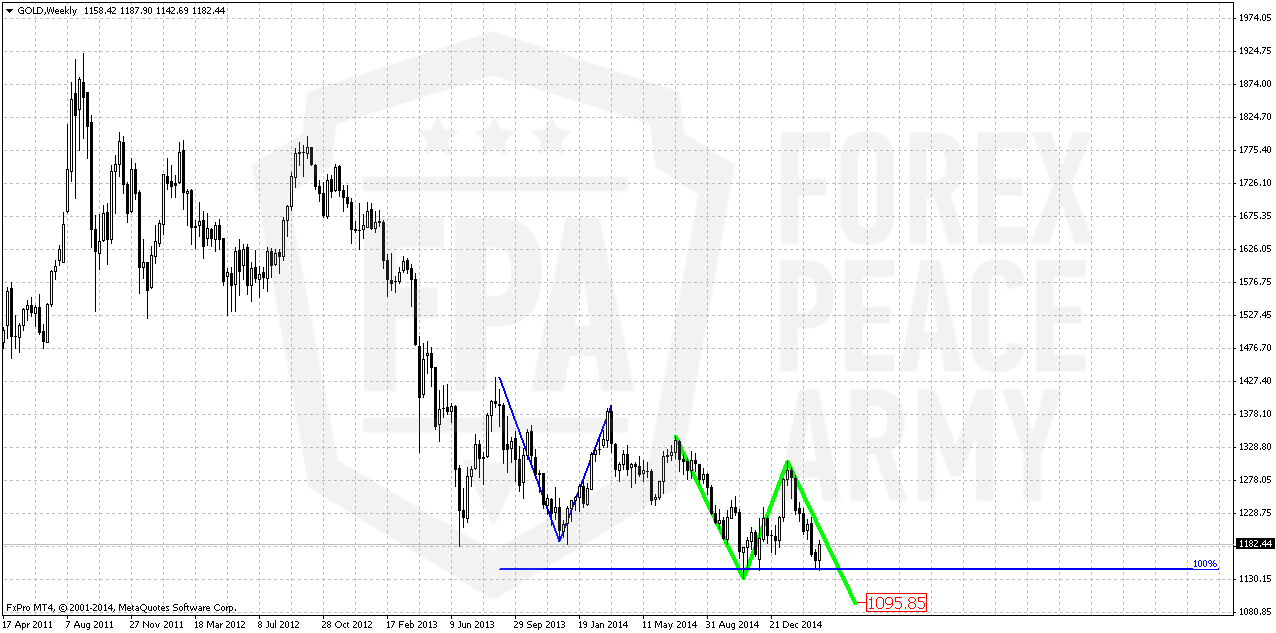

Weekly

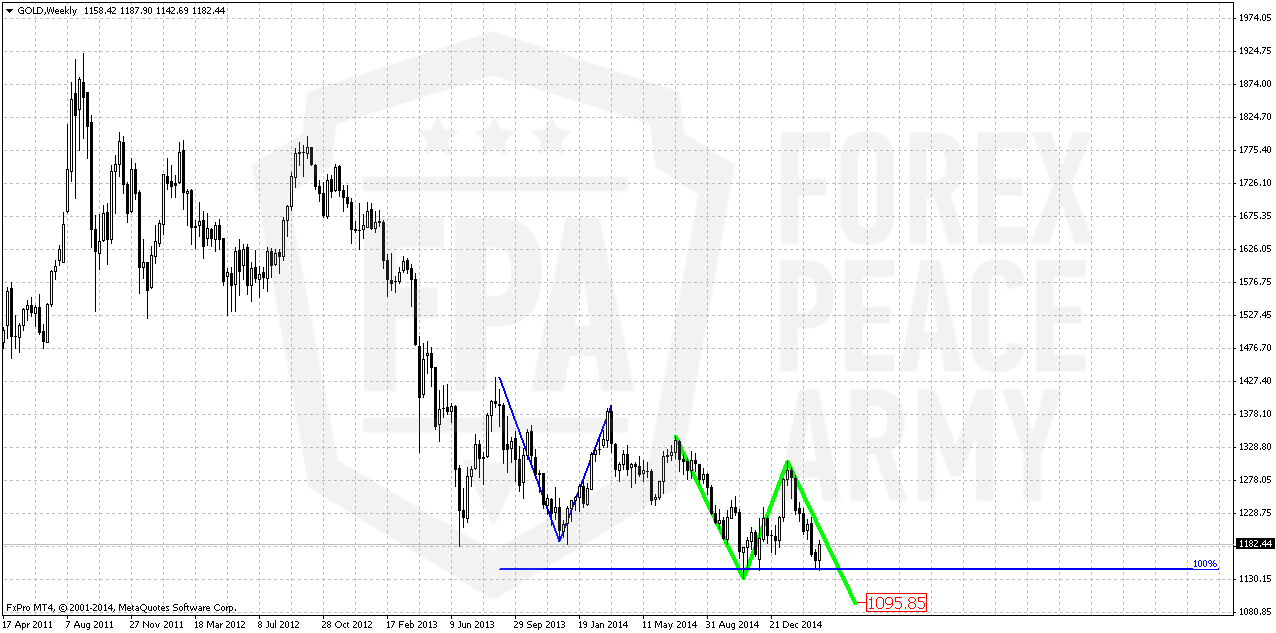

Trend has turned bearish. So gold was not able to hold above 1200 strong support and moved below not just Fib level, but also MPS1. This tells that previous upside trend has failed. If you will take a look at weekly chart closely you will find a lot of different targets – AB-CD’s, couple of butterflies etc. But right now it makes sense probably to focus on most close target that is based on most recent AB-CD pattern. 1130 level is very close and it makes sense to take a look a bit lower. This AB-CD points on 1095-1100 destination point. Current picture points on solid chances of downward continuation, because CD leg is faster than AB. All other targets stand significantly lower – 1080, 1050 and even 990$.

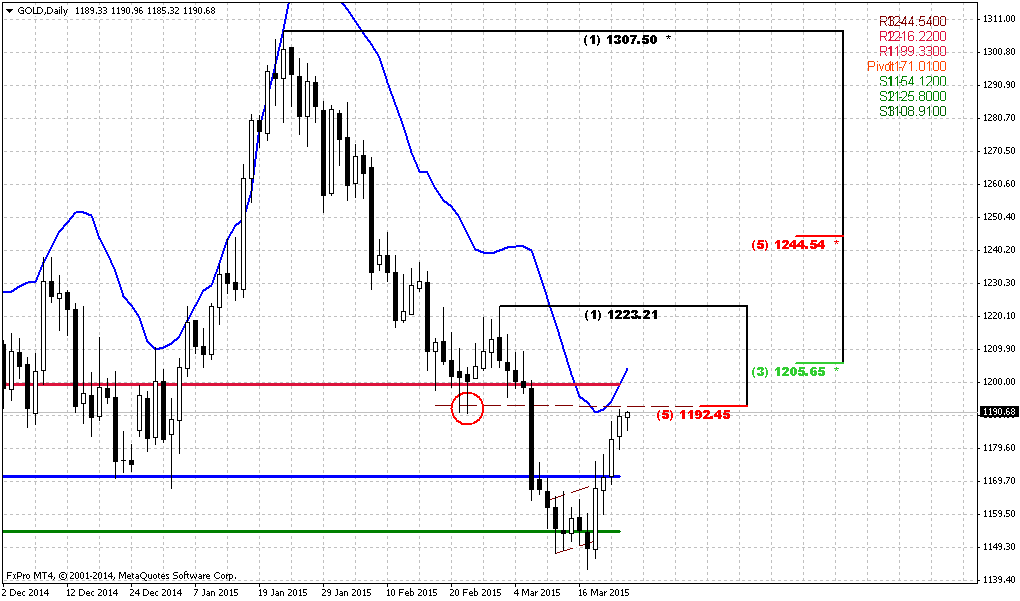

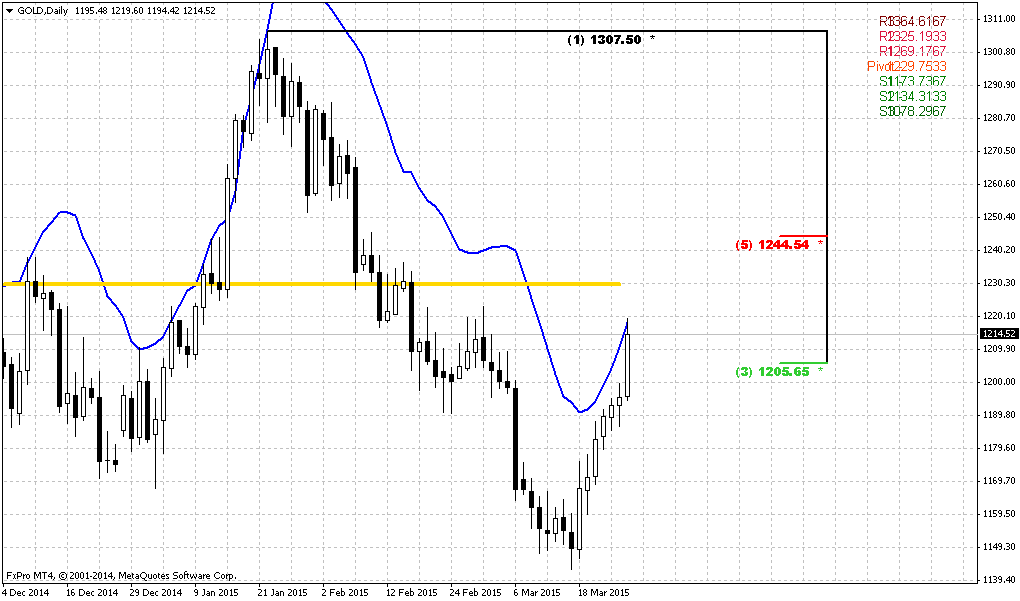

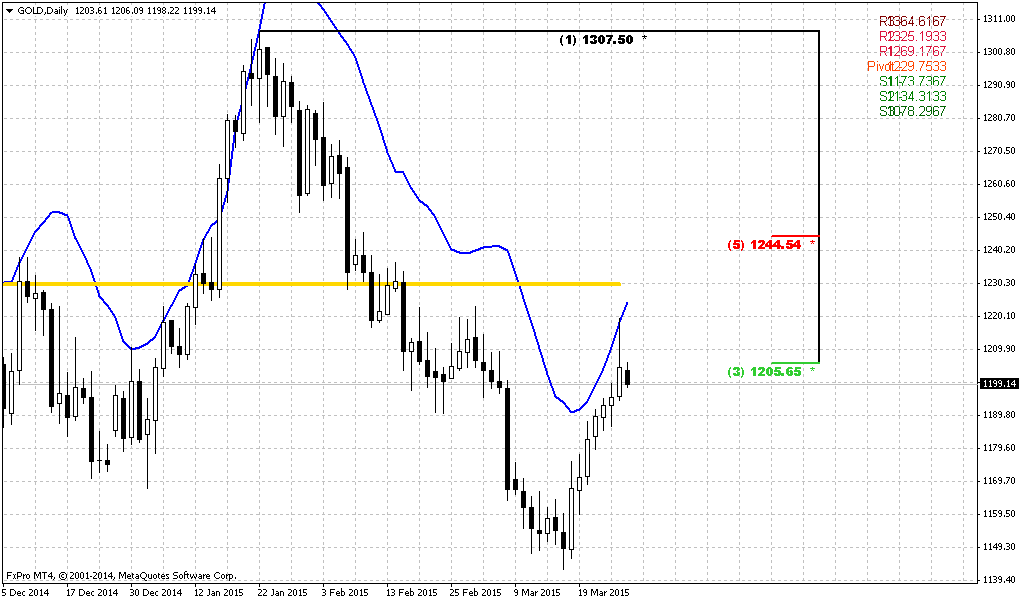

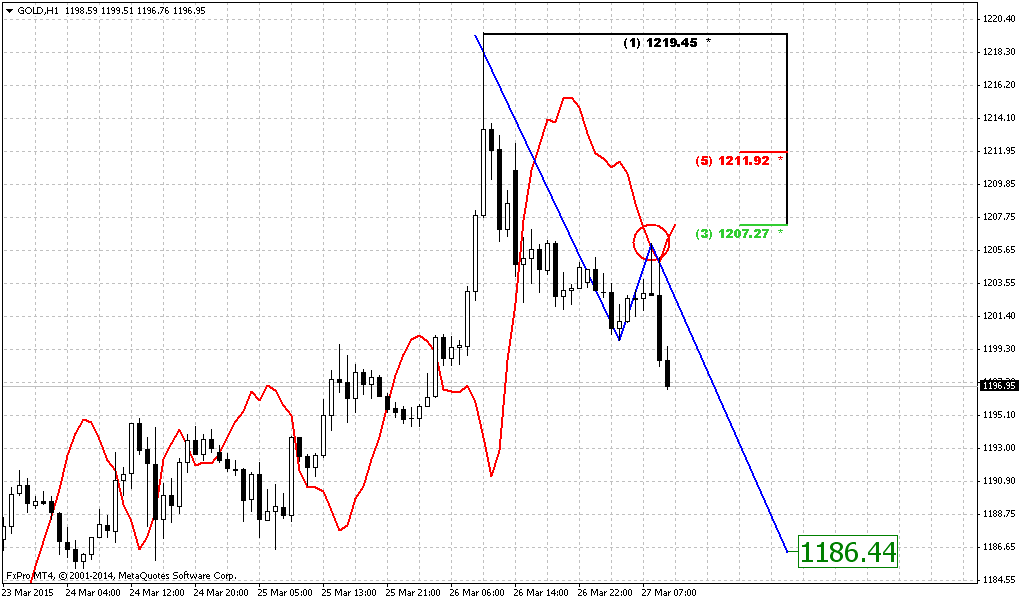

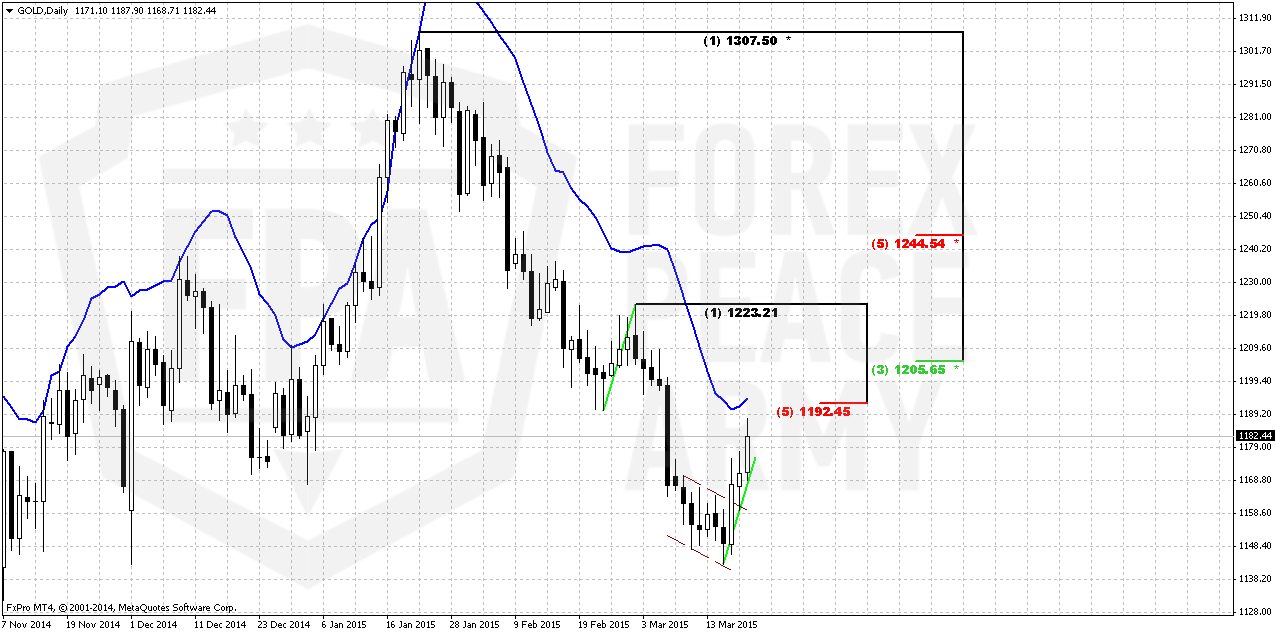

Daily

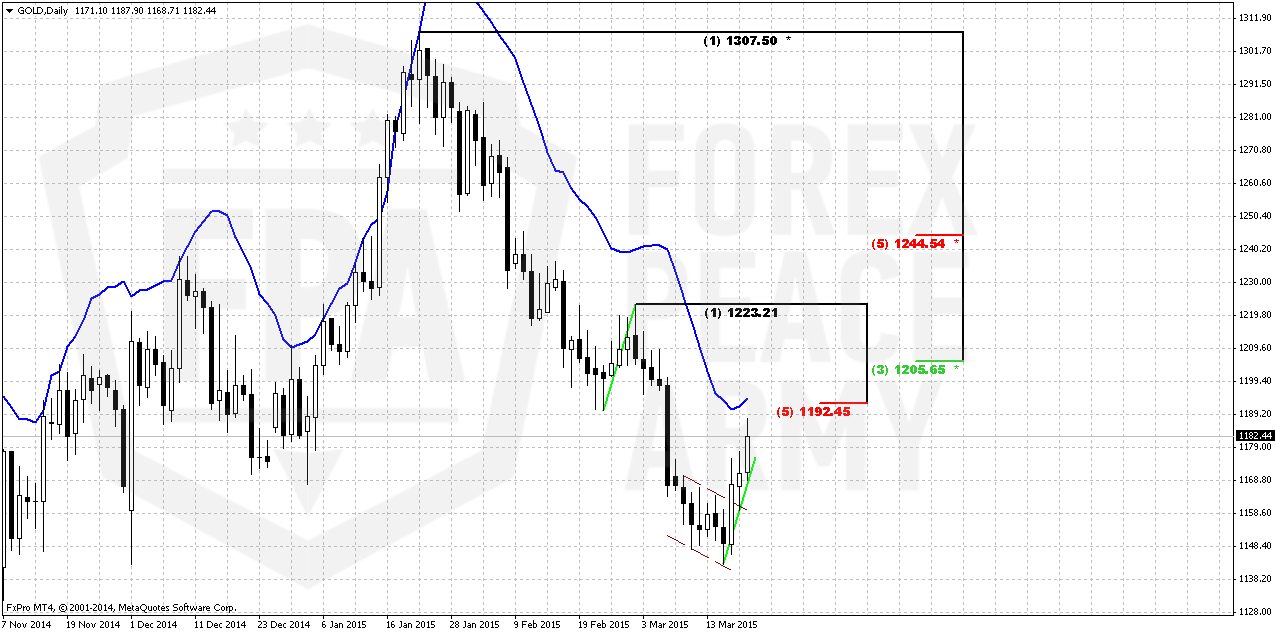

So, our suggestion about upside action was confirmed. As we’ve said that market has formed failure breakout of bearish flag, i.e. bearish trap – upward action has started. Minor target that we’ve specified is 1190-1200 area, that is also daily overbought and it almost has been reached. Anyway market probably will stuck inside of this area, since this is also daily K-resistance and if even upward action will continue – this should happen after some bounce…

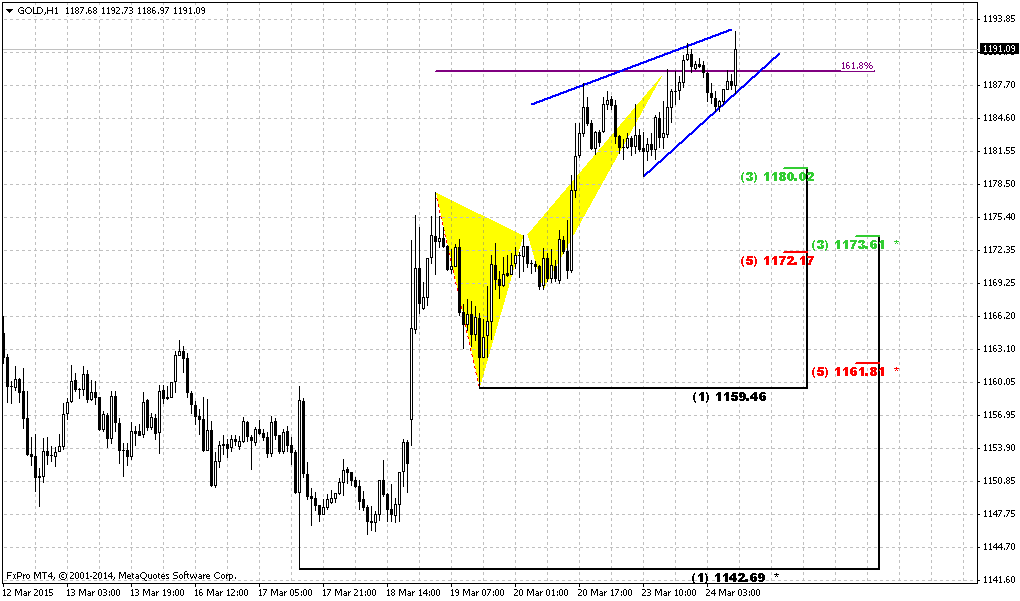

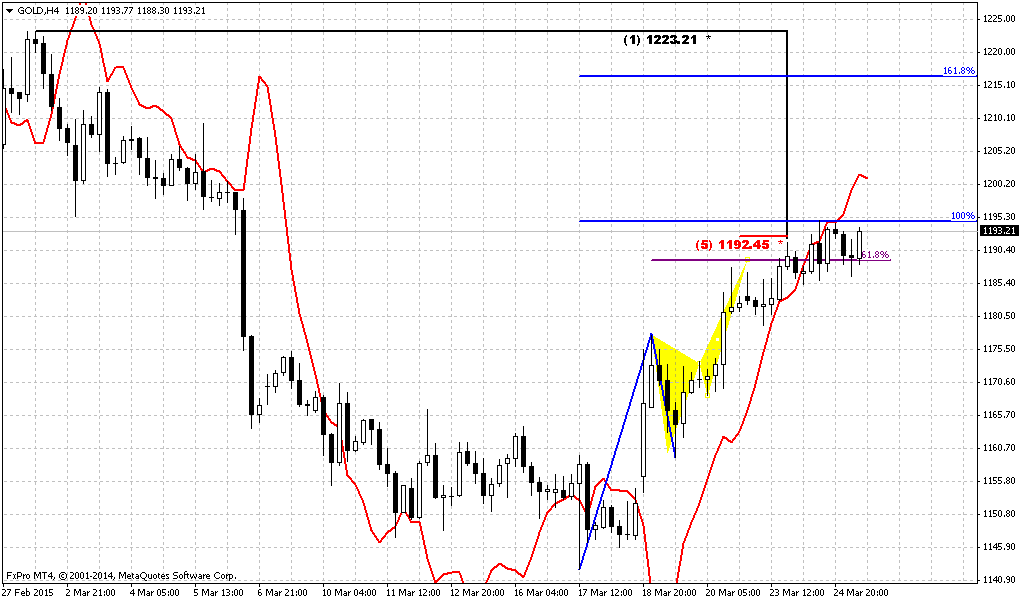

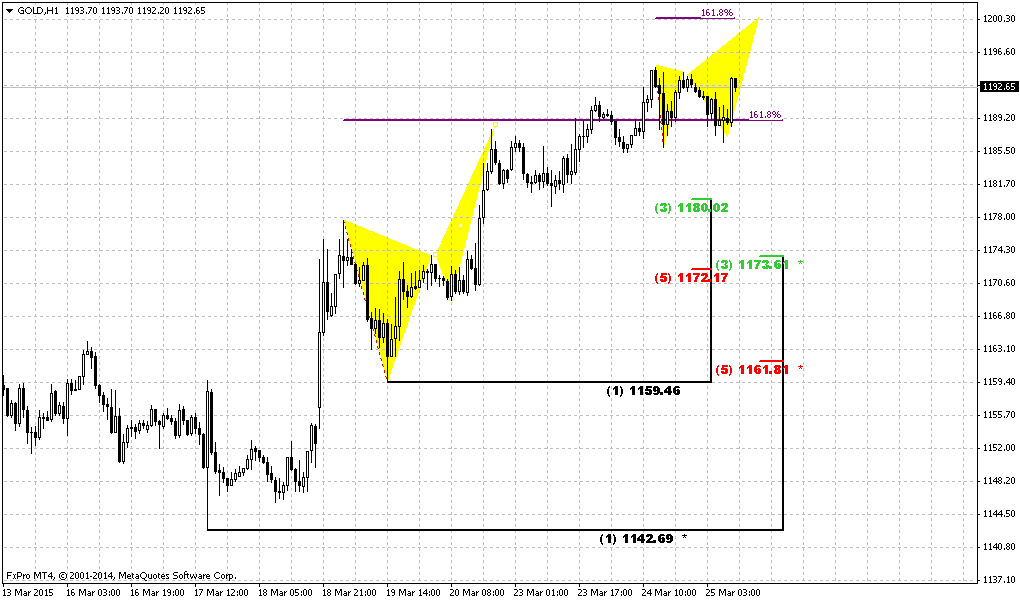

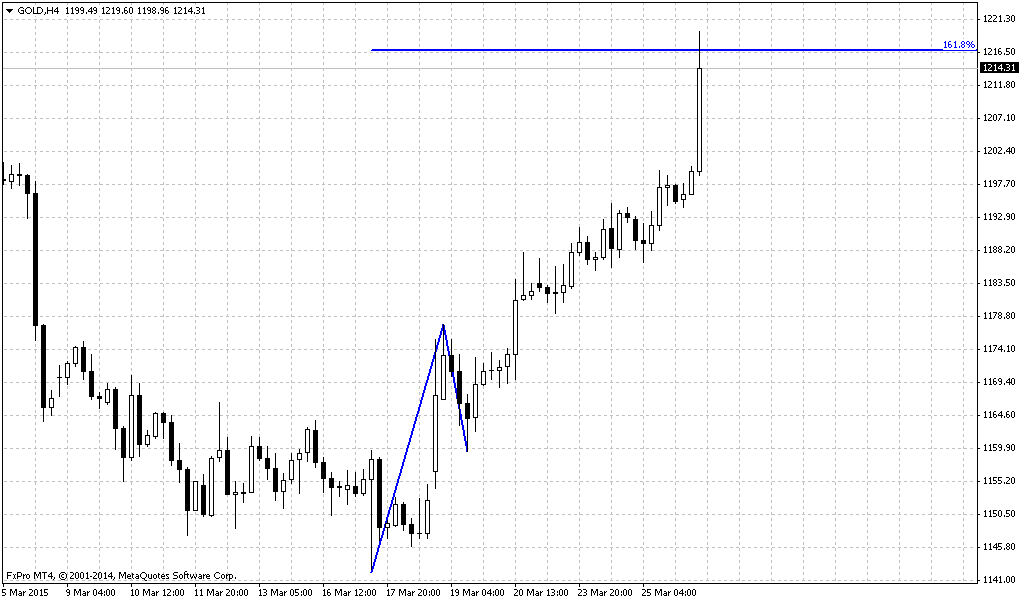

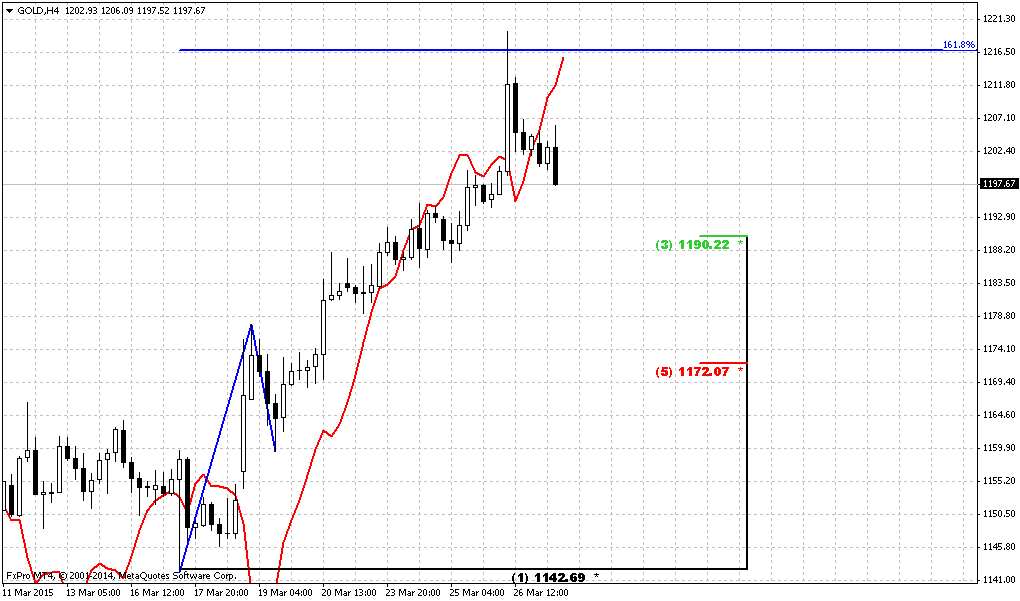

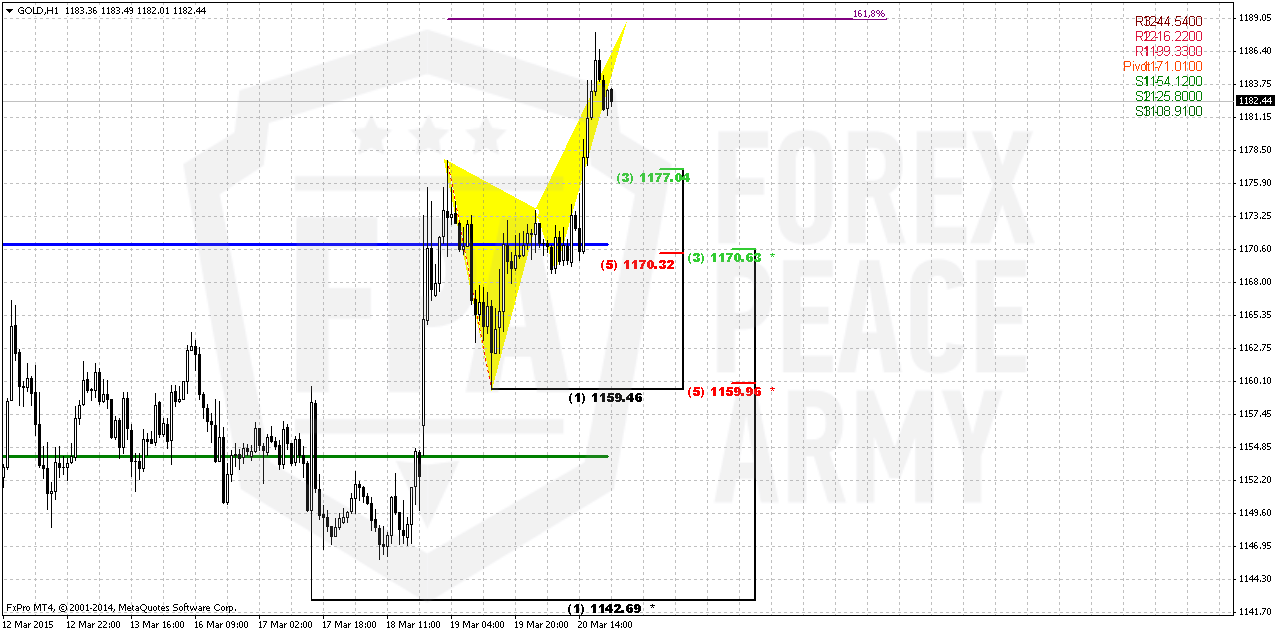

4-hour

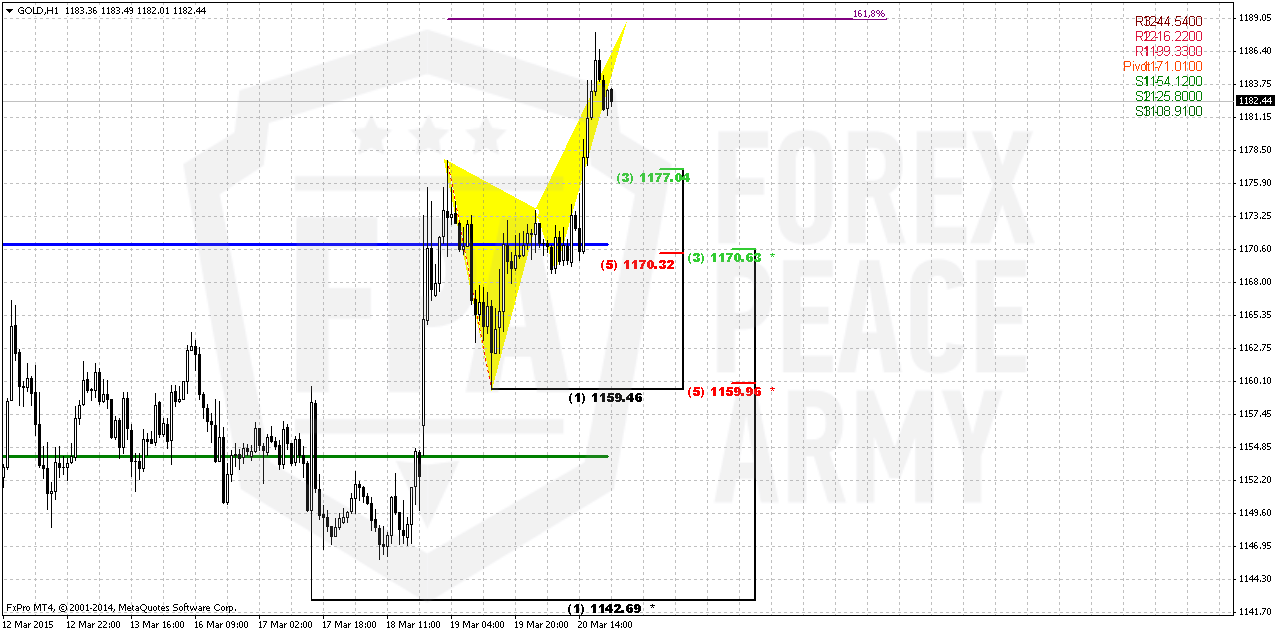

Target, that we’ve appointed on Friday has been completed. Market has reached 1.618 Butterfly. So, as we talk on retracement, appearing of butterfly looks very supportive for this view. Most probable retracement destination stands at 1170 – K-support and WPP. And after that we will see – wait for another leg up or market just will turn down again…

Conclusion:

From technical point of view we have no reasons yet to abandon possible long-term downward AB-CD as VoB (Volatility breakout) development. Fundamental background is not very supportive for gold right now and one cluster of events that could bring unexpected bullish surprise is geopolitical tensions.

In short-term perspective market stands in upside retracement. The first part of it has been completed recently, while whether we will get second part depends now on 1170 area.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.

Weekly Gold Tading Report prepared by Sive Morten exclusively for ForexPeaceArmy.com

Gold prices hit two-week highs on Friday and were poised for their biggest weekly jump since mid-January, after the U.S. Federal Reserve's cautious note on interest rates arrested a dollar rally and sparked broad-based buying of commodities.

Today's run is part of a broad-based correction with the dollar weakness," said Eli Tesfaye, senior market strategist for RJO Futures in Chicago.

Spot gold has risen over 2 percent this week, recovering from a four-month low touched on Tuesday under pressure from expectations that the U.S. central bank is on track for its first interest rate increase in nearly a decade.

Such a move would boost the dollar and lift the opportunity cost of holding non-yielding bullion. The Fed, however, indicated it preferred a more gradual path.

"We obviously saw a slight change in sentiment earlier this week, with Janet Yellen apparently joining an ever-increasing number of central bank doves," Saxo Bank's head of commodity research Ole Hansen said, referring to the Fed chief.

"I think we will settle into a $1,150 to $1,190 range for now."

Post-Fed, the world's largest gold-backed exchange-traded fund, New York-listed SPDR Gold Shares , saw its first inflows since Feb. 20, also boosting sentiment.

In the physical markets, Chinese buying was steady, with premiums on the Shanghai Gold Exchange staying at a robust $6-$7 an ounce on Friday. Sustained physical buying could further support prices.

Silver outperformed other precious metals to hit 1-high of $16.89 an ounce and was up 4.7 percent at $16.85, and spot platinum was up 1.5 percent at $1,139.70 an ounce.

Platinum continued to trade at a roughly $50 discount to gold, a factor that is likely to stoke physical demand according to the Perth Mint, which is ramping up production of its platinum coins.

Palladium was up 1.2 percent at $773.98 an ounce, though it was the worst-performing precious metal of the week, down nearly 2 percent.

Recent CFTC data shows simultaneous increase in open interest and drop in net long positions. It means just one thing – shorts are growing very fast. At the same time balance of shorts and longs is not critical yet. Shorts stands for ~105K while longs for 180K.

SPDR fund reports on small growth but right now storages are 744 Tonnes and this is even less than on previous week of 750 tonnes. It is definitely show that recent upside action is nothing more but retracement.

Again we remind that gold is entering into bearish seasonal trend. All these moments obviously do not support bullish reversal on gold. It looks like bulls have failed the test on quality and recent upside action on gold mostly was respect of support and butterfly pattern, rather than reversal.

So sentiment statistics mostly confirms bearish sentiment and makes us treat recent upside action only as retracement. Thus, in long-term perspective we should use it for short entry.

Here is detailed breakdown of speculative positions:

Open interest:

Technicals

Monthly

So, drop on recent couple of weeks looks significant. Here we still have last big pattern in progress that is Volatility breakout (VOB). It suggests at least 0.618 AB-CD down. And this target is 1050$. At the same time February still stands as inside month and we need 1130 breakout to start clearly speak on 1050 target.

Since the beginning of the year market showed solid upside action. Market was able to exceed yearly pivot, passed half way to Yearly Pivot resistance 1 but right now has reversed down and closed below YPP. From technical point of view this is bearish sign. This could be very significant moment and next logical destination will be yearly pivot support 1 around 1083$.

Recent NFP data shows impressive growth, but labor cost not as stably good as unemployment. Many investors concern about anemic wage growth, although in recent time this indicator shows improving. So, it seems that gold will remain hostage of dollar value and US economical data in nearest perspective. Approximately the same was announced by Fed in forecast on inflation and had become a reason of dovish approach to rate hiking. Another concern right now is too strong dollar that becomes a problem per se for economy growth.

Still, if we will take into consideration geopolitical situation and risks that have appeared recently, it could happen that situation will change, especially if situation in Ukraine will escalate and peaceful regulation will fail. Day by day we see worrying geopolitical news.

That’s being said, economical data supports further gold decreasing but geopolicy could bring significant adjustment. Unfortunately the geopolicy is sphere where we can’t do much. As gold has passed through 1200, our next destination point is previous lows at 1130, but since gold is returning to them again – this is temporal destination and we should prepare for further downward action. Besides, right now we can clear recognized bearish dynamic pressure on monthly chart. Take a look, although trend has turned bullish, but market was unable to show more or less meaningful upside action. Right now we see the tendency of lower highs creation and this significantly increases chances on downward breakout.

Weekly

Trend has turned bearish. So gold was not able to hold above 1200 strong support and moved below not just Fib level, but also MPS1. This tells that previous upside trend has failed. If you will take a look at weekly chart closely you will find a lot of different targets – AB-CD’s, couple of butterflies etc. But right now it makes sense probably to focus on most close target that is based on most recent AB-CD pattern. 1130 level is very close and it makes sense to take a look a bit lower. This AB-CD points on 1095-1100 destination point. Current picture points on solid chances of downward continuation, because CD leg is faster than AB. All other targets stand significantly lower – 1080, 1050 and even 990$.

Daily

So, our suggestion about upside action was confirmed. As we’ve said that market has formed failure breakout of bearish flag, i.e. bearish trap – upward action has started. Minor target that we’ve specified is 1190-1200 area, that is also daily overbought and it almost has been reached. Anyway market probably will stuck inside of this area, since this is also daily K-resistance and if even upward action will continue – this should happen after some bounce…

4-hour

Target, that we’ve appointed on Friday has been completed. Market has reached 1.618 Butterfly. So, as we talk on retracement, appearing of butterfly looks very supportive for this view. Most probable retracement destination stands at 1170 – K-support and WPP. And after that we will see – wait for another leg up or market just will turn down again…

Conclusion:

From technical point of view we have no reasons yet to abandon possible long-term downward AB-CD as VoB (Volatility breakout) development. Fundamental background is not very supportive for gold right now and one cluster of events that could bring unexpected bullish surprise is geopolitical tensions.

In short-term perspective market stands in upside retracement. The first part of it has been completed recently, while whether we will get second part depends now on 1170 area.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.