Sive Morten

Special Consultant to the FPA

- Messages

- 18,690

Fundamentals

Weekly Gold Tading Report prepared by Sive Morten exclusively for ForexPeaceArmy.com

As Reuters reports Gold surged 2.5 percent on Friday to just shy of $1,200 an ounce as short-covering, fund buying and a sudden weakening of the dollar offset better-than-expected U.S. data that diminished demand for safe-haven metals. Bullion bolted more than $40 to a two-week high at $1,193.34 in New York after dropping more than 1 percent in early trade to test the $1,145 level, where strong support was seen twice in the last four sessions, triggering pre-weekend short covering. The 10 a.m. EST (1500 GMT) spike was conspicuous in size and volume, with 25,000 lots traded in just ten minutes, and nearly half of the day's December contract volume changing hands in just over 30 minutes.

"The early morning pressure was met with significant bargain-hunting, and when the market was unable to continue its move lower, short-covering ensued," David Meger, director of metals trading at Vision Financial Markets. Gold tumbled early after the Commerce Department said U.S. retail sales rose 0.5 percent in October, a sign American consumers were spending with more gusto and could help keep the economy growing at a brisk pace.

The dramatic gains put gold on track for one of its best days in months and up more than 1 percent for the week, its second straight increase.

Still gold's long-term appeal is still in doubt. The U.S. economy is outpacing others, and investors are betting interest rates there will rise faster. Rising rates weigh on gold as they lift the opportunity cost of holding non-yielding assets.

Investors pulled another 2 tonnes from the world's top gold-backed exchange-traded fund, SPDR Gold Shares, in its eighth straight daily outflow, taking holdings to a six-year low of 720.62 tonnes.

As we’ve estimated on previous there is no big divergence between SPDR fund and gold dynamic. And on last week SPDR has shown outflow again. Now we need keep close eye on possible divergences between SPDR and spot gold.

Recent CFTC report shows solid jump in open interest with simultaneous decreasing of net long position again. This combination supports downward action:

Source: CFTC, Reuters

Source: CFTC, Reuters

Although this report was published prior Friday rally, and on next week we need to see what really has happened there. Somehow I suspect that short covering was just a reaction on some events and we need to understand what really has happened there. Why investors have turned to short covering? Hardly just because gold has not passed through next support area… May be some information has leaked on Swiss potential 2K tonnes purchasing… In general, even this rally does not break our view, since we treat action to 1200-1210 as normal reaction, but anyway, if this rally has no impact on CFTC data – we should treat it with suspicious.

Commercial Longs

Commercial Shorts

Commercial Shorts

Open interest

Open interest

Source: CFTC, Reuters

Source: CFTC, Reuters

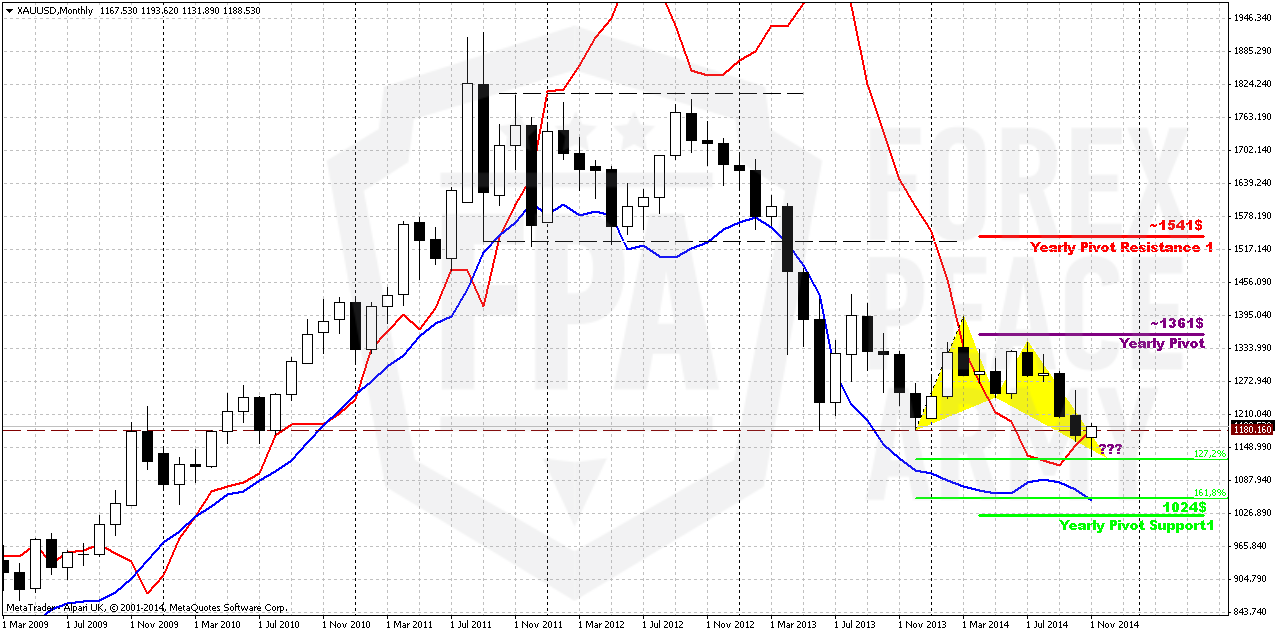

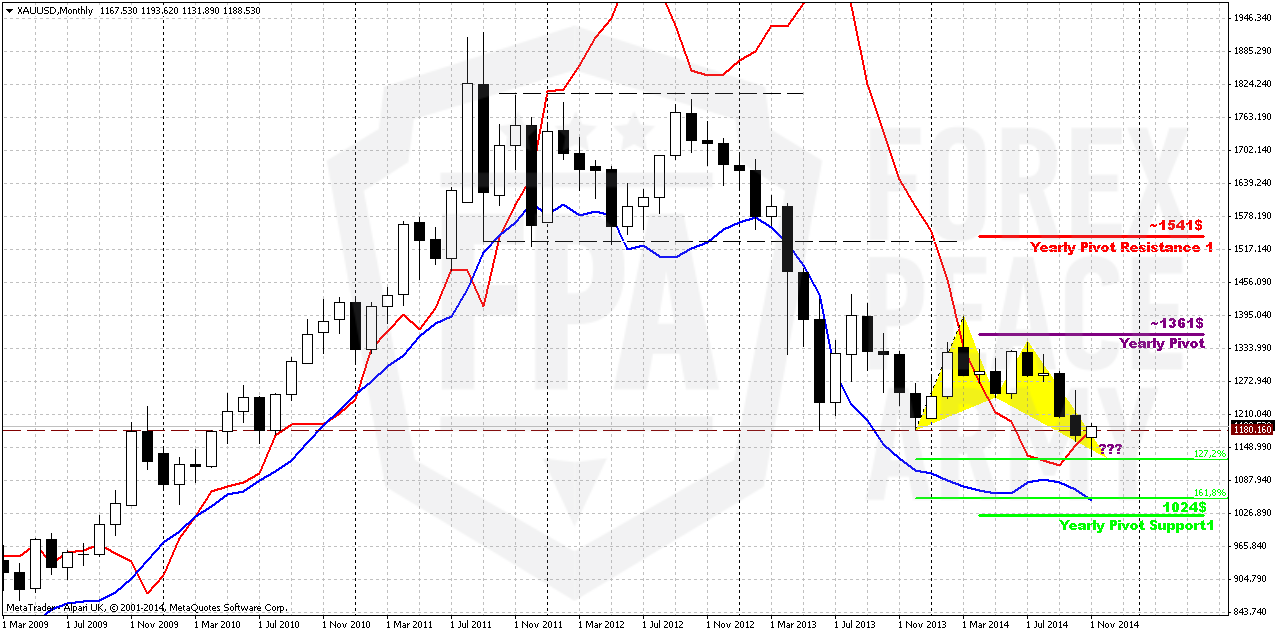

Monthly

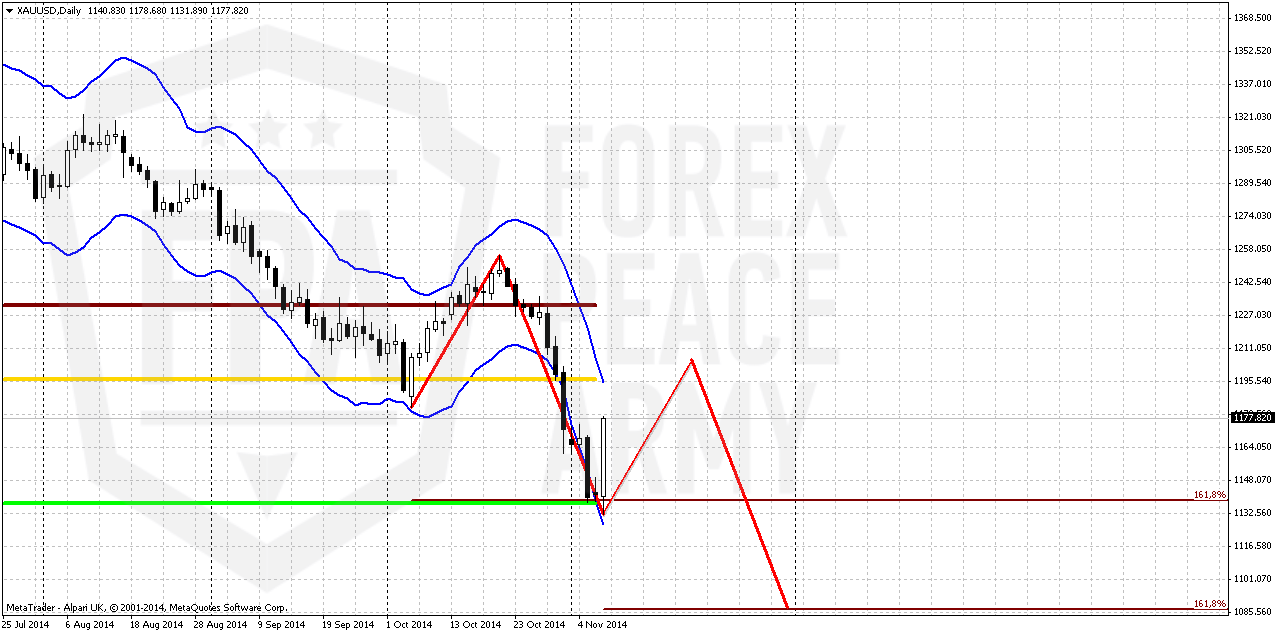

As we’ve said two of our patterns have been completed - bearish grabber @ 1400 and recent dynamic pressure that have led market to 1180 lows and clear them out. Still we have another one pattern in progress that is Volatility breakout (VOB). It suggests at least 0.618 AB-CD down. And this target is 1050$. But this is long-term perspective.

On previous week we’ve mentioned potential bullish grabber on gold market and recent rally could have absoutely special meaning for us. As less and less time till the end of November, chances on confirmation of this pattern are increasing. Grabber could become a reaction on butterfly pattern that we have here. Also, as we’ve mentioned previously, the depth of the reaction is also important.

As market now stands above 1180 this could be bullish sign. Let’s not call it as reversal by far, but anyway retracement that could be triggered will be very deep. And reason for that stands due potential monthly bullish grabber. Take a note that November MACDP=1183,04. That’s why moving above 1180 will be important from this point of view as well. This could be comfirmation of the grabber. In this case market at least will return right back to 1360 Yearly Pivot point. As you can see situation is really thrilling.

As market has turned to retracement up and until we will not know results of it (whether we will get grabber or not) currently it is not big sense to discuss on second question – how deep market could drop below 1180.

So here we just repeat what we’ve said previously on this subject. Currently we only can try to get hints here and there. Although some traders point on growing individual demand on gold and hope that this could trigger rally on gold. We would say that individual demand is just a part of global annual demand and this demand mostly planned and expected. If even as it was reported has grown for 20%, this is nothing compares to money of institutional investors with big part in futures market. It is not annual well known demand ~5-6K tonnes drives market, it is futures positions. Just imagine how big they are 75 K contracts in net long position. This is 75 K* 100 Oz per contract = 7,5 Mln Oz. ~ 2,3K tonnes. This is 50% of annual demand. But this is just net position. Open interest is 10 times greater. Thus, 20% increase in individual demand stands around 500-600 tonnes within a year and just dissolves in huge institutional volumes. Thus, to understand what will happen and how far gold could fall we need keep a close eye on CFTC and SPDR data because it will warn us about possible changing.

Another factor that could impact on gold market is possible gold buying from SNB. We’ve said about it on previous week:

Swiss gold referendum's support falls short of majority: poll | Reuters

Finally the major driving factor for Gold is inflation and particularly here US economy has problem. All stats are improving across the board but wages and wealth of middle class stagnates. Although this is typical for first stage of grow in economical cycle, but this does not support gold appreciation by far. Still, it seems that situation slightly starts to change here. Our ultimate target stands at 1050 and this is just 80 bucks above recent 1130 lows… ABN AMRO recently told about 800$ at the end of 2015, but we have solid doubts on this forecast. The point is that Fed “plans” to change rate somewhere in 2015. It means that inflation probably will become visible somehow. And in these conditions gold will react even earlier, as well as Treasury bond market.

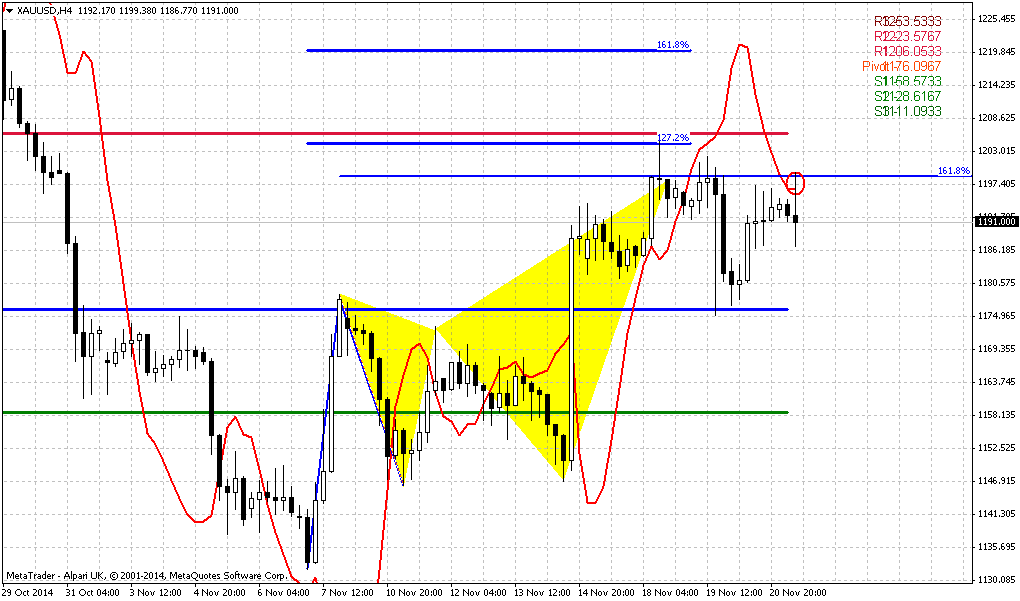

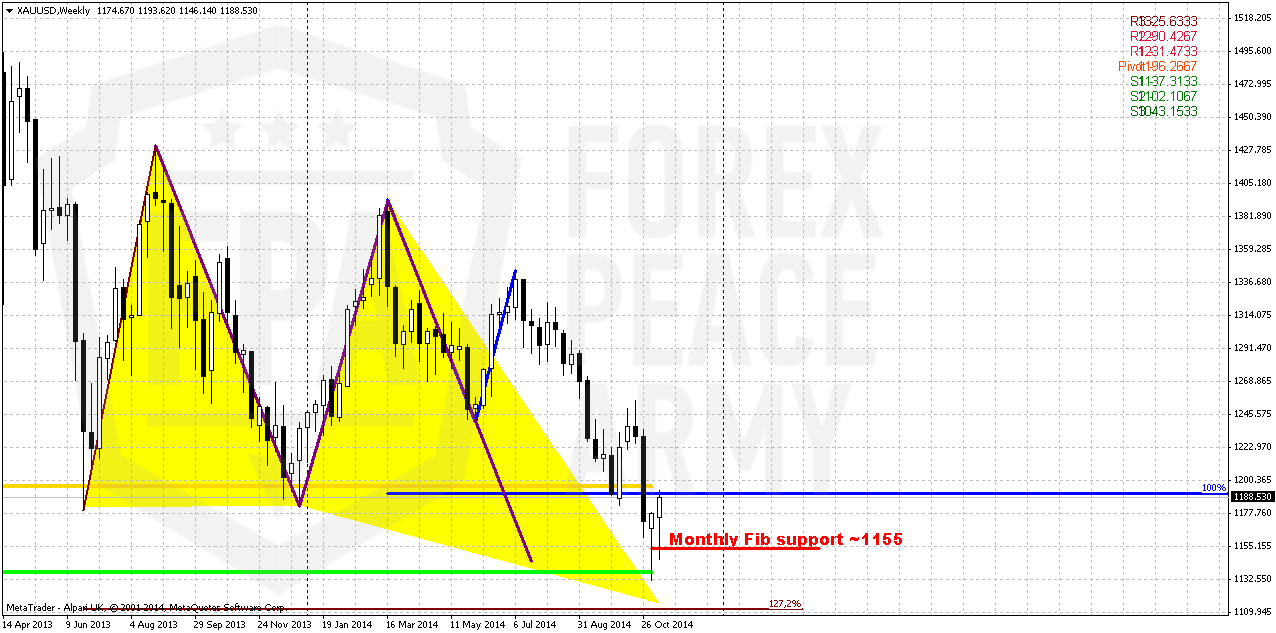

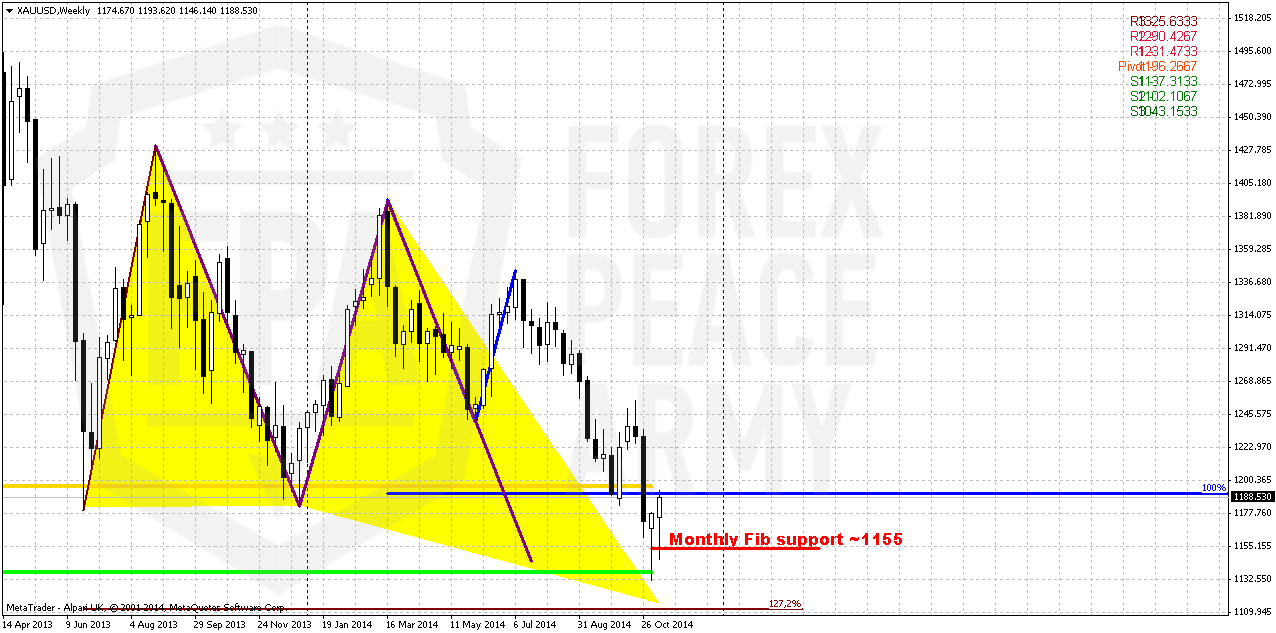

Weekly

Last week as reason for possible bounce we’ve mentioned significant support area that includes monthly Fib level, inner butterfly AB=CD target and MPS1. Although we’ve said above that gold has completed butterfly, but weekly chart shows that not quite. Besides, market has not reached 1.618 extension target of smaller AB=CD pattern. This makes us to be worry on perspectives of this rally. May be on intraday charts 40$ explosion looks outstanding – on weekly chart market just re-tested broken 1180’s lows and formed another hammer pattern. In short-term perspective rally could continue and it will be interesting what we will get around MPP and 1200-1210 area. Existence of untouched 1.27 butterfly target is a cloud on horizon of possible upside action. Probably we could say more, when we will get next CFTC report or some information about recent really, what else was on background besides of just short covering...

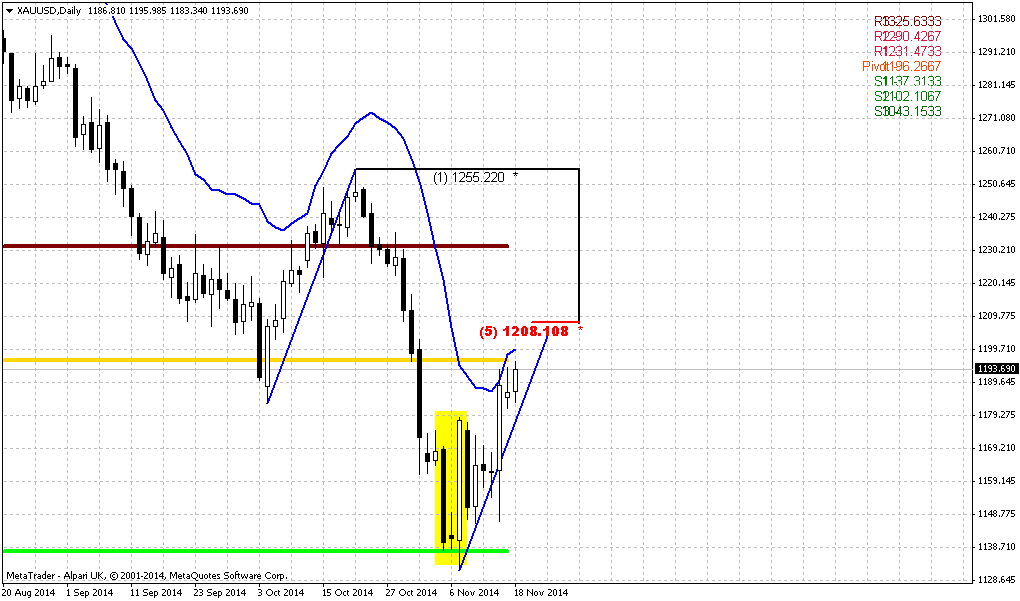

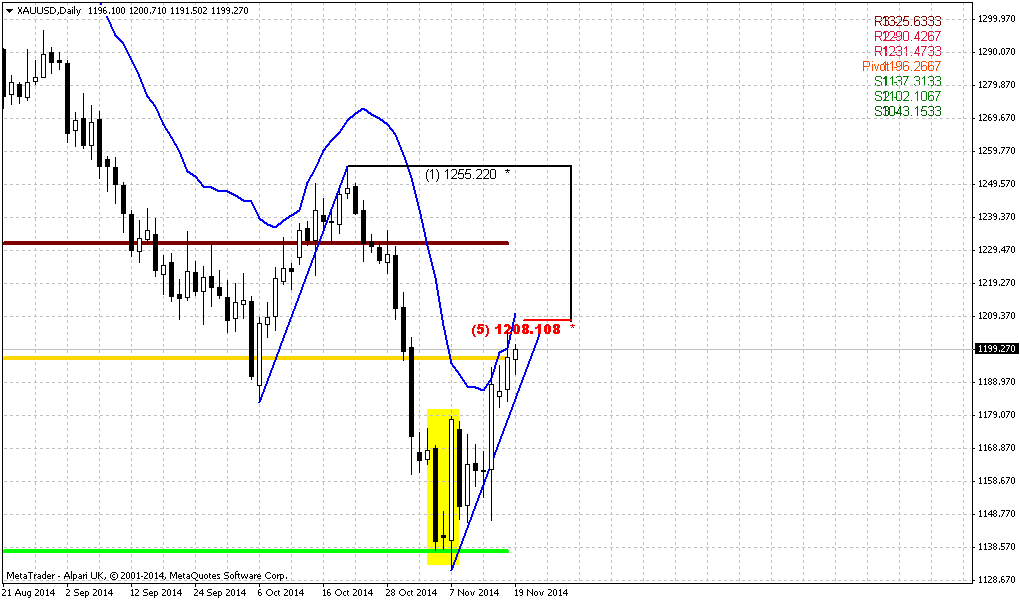

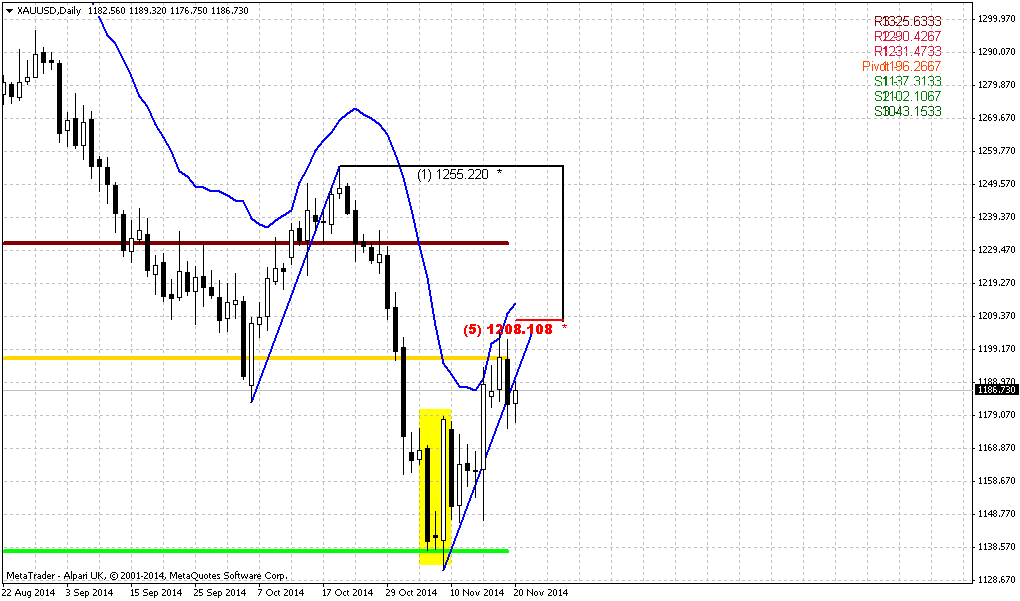

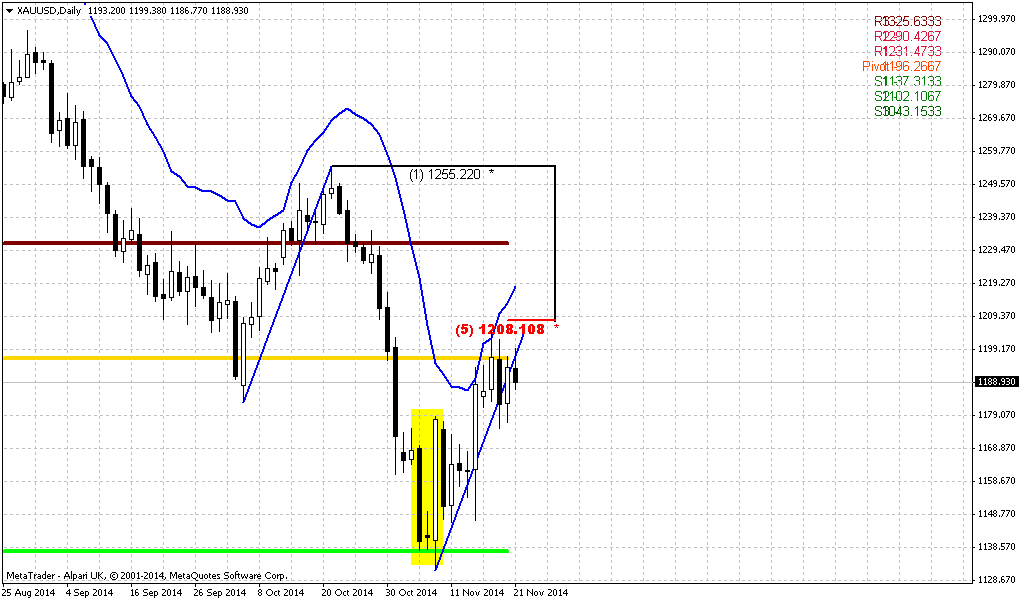

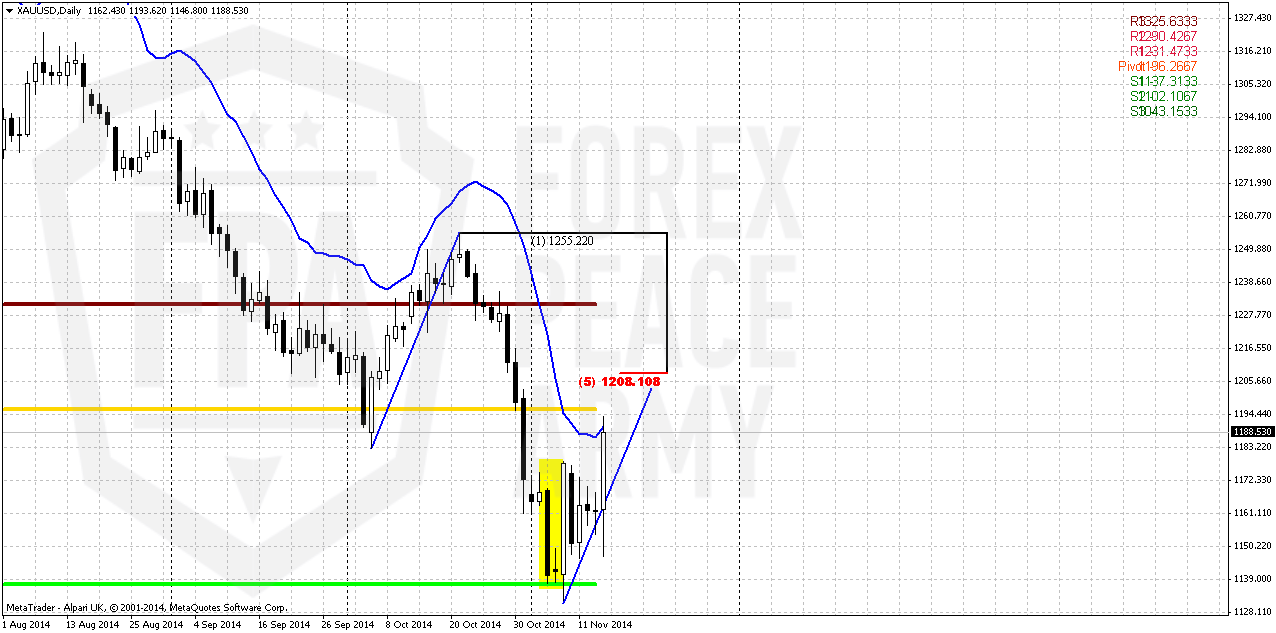

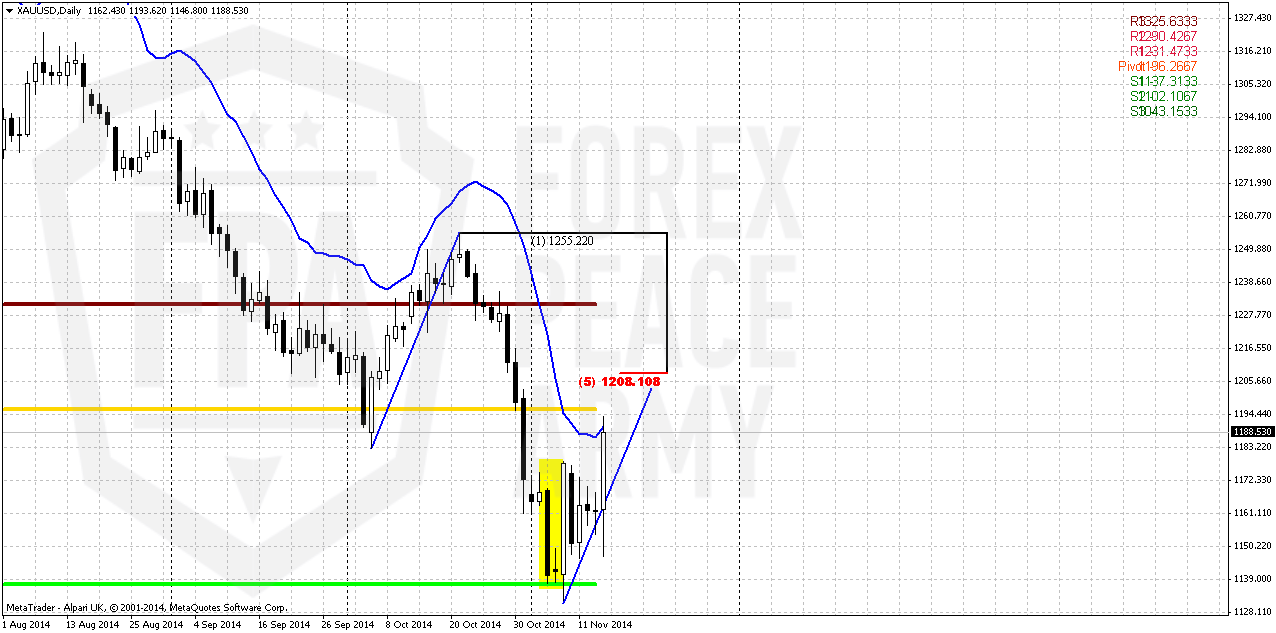

Daily

That was really tough action on previous week. We’ve awaited for this move for 4 days and on Friday morning even talked about possible failure of upside action, since market has not shown any upside reaction on 3-Drive Buy pattern on 4-hour chart. But, as 1143 lows were held valid – our setup was valid too and it has worked right at the final moment and our target was hit – daily overbought. Gold has not reached MPP mostly due this moment. As acceleration was really fast, chances on upside continuation are not bad and probably market will take the shape of some AB-CD on intraday chart. But on Monday we should be ready for retracement down as market has hit overbought and it will hold it from further valuable growth in short-term perspective.

And now take a look at this another daily chart – we’ve prepared it on previous week:

If we suggest that market will fail and turn down again, since it has some uncompleted targets lower – we could get 1.618 3-Drive “Buy” pattern among other possibilities. Applying here harmonic swing we can say that current retracement should be over somewhere around 1210$ area. That’s why 1210 area has absolutely special meaning. Because it will make an impact on everything: monthly grabber, daily 3-Drive, perspectives of retracement etc…

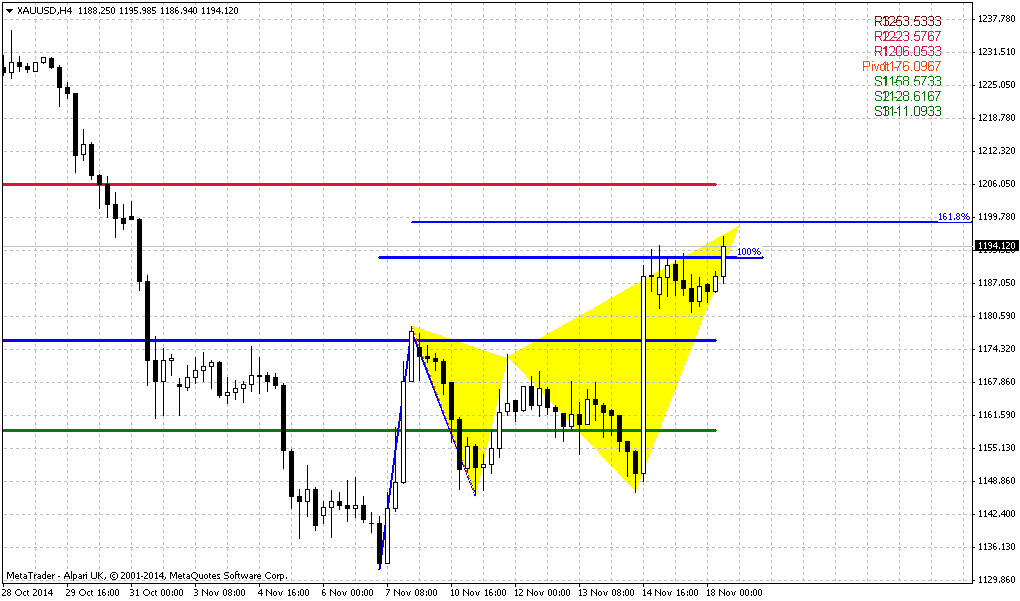

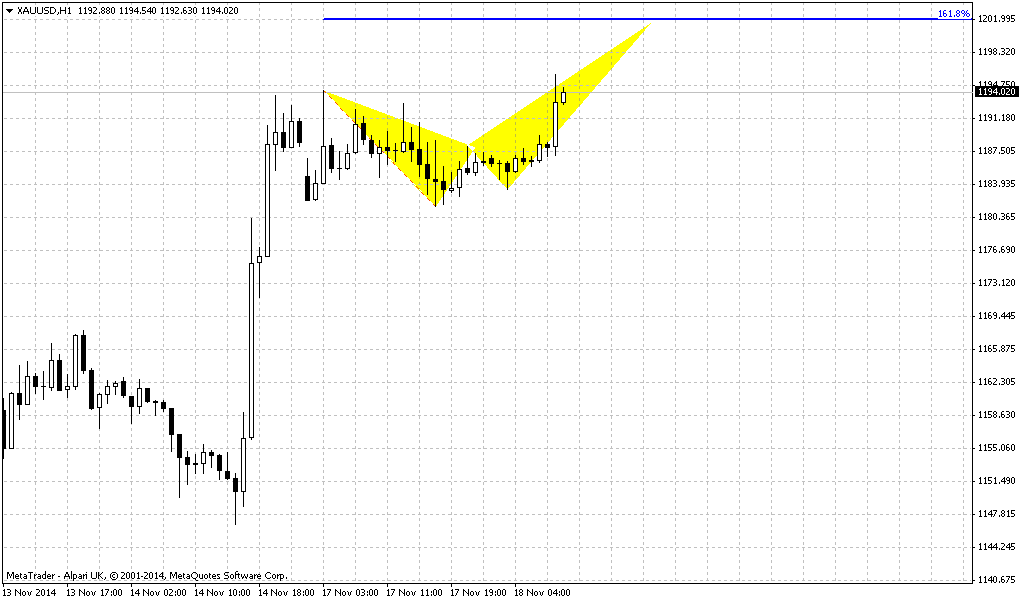

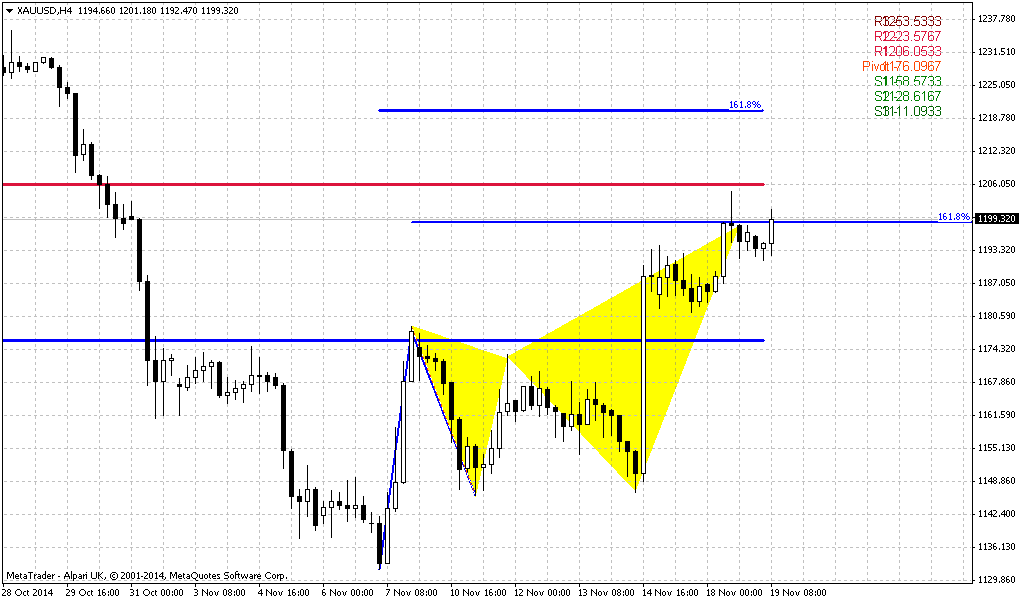

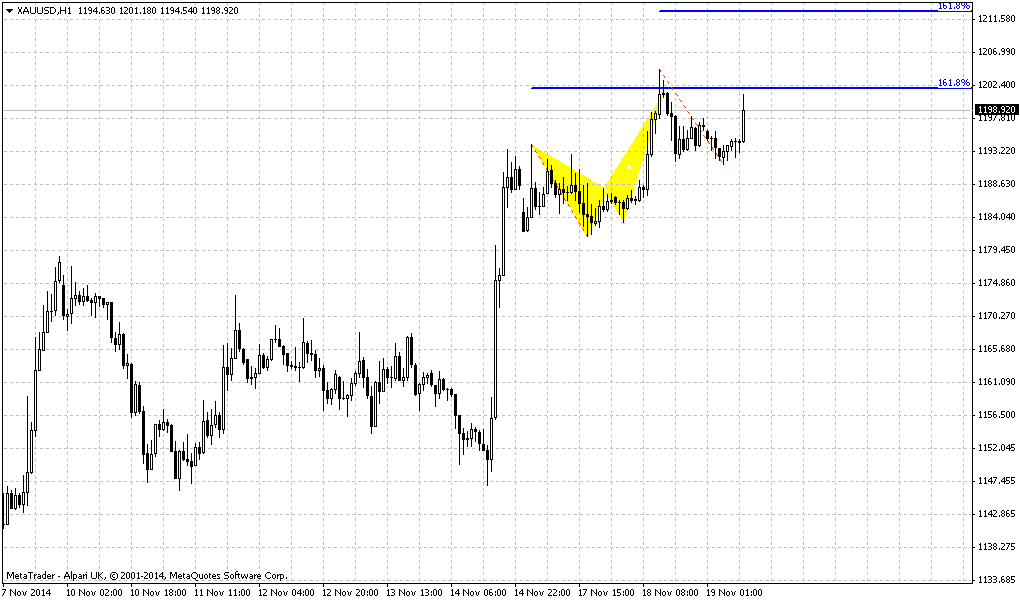

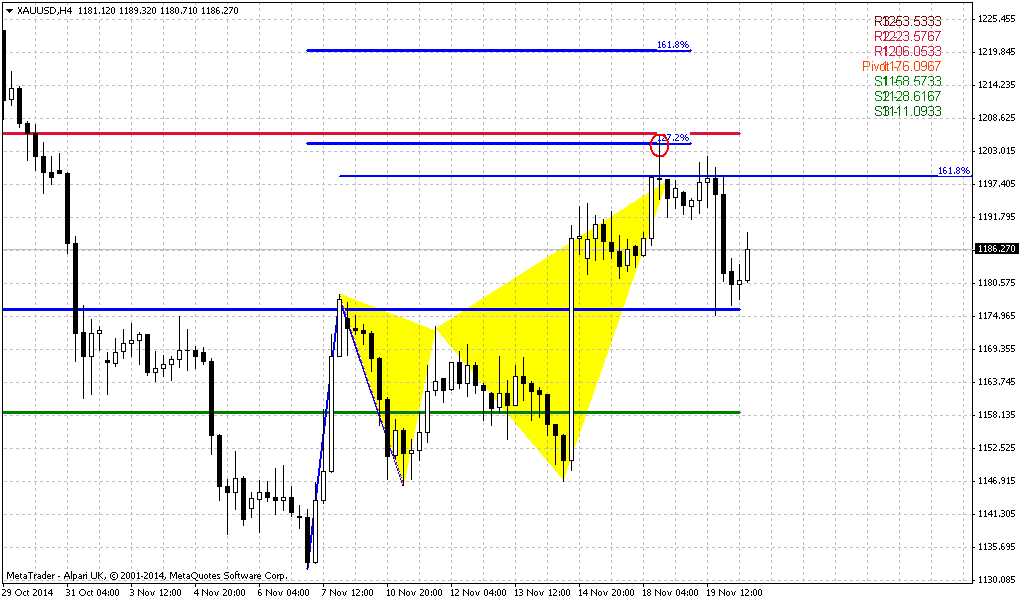

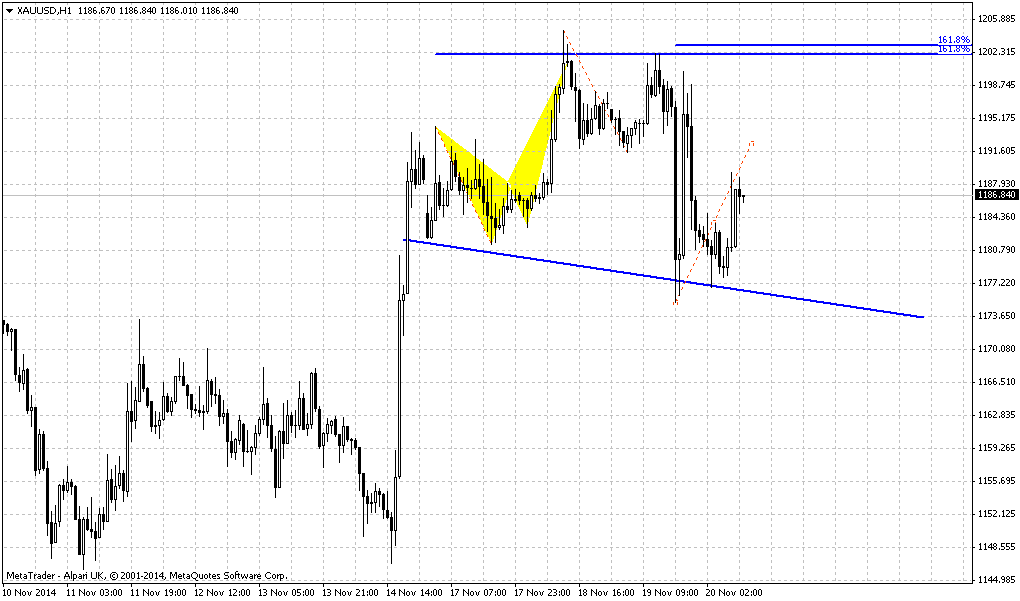

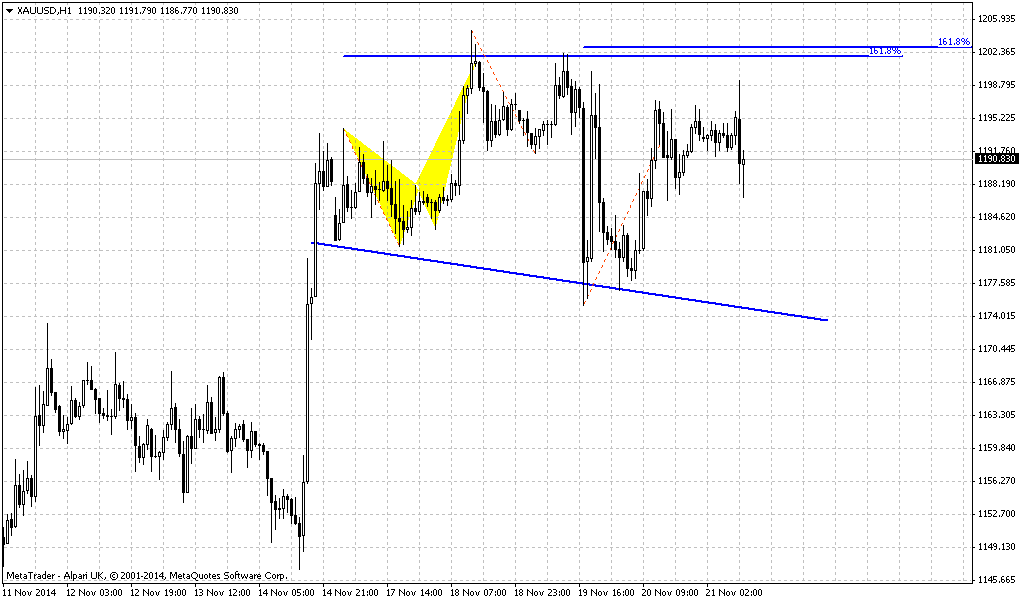

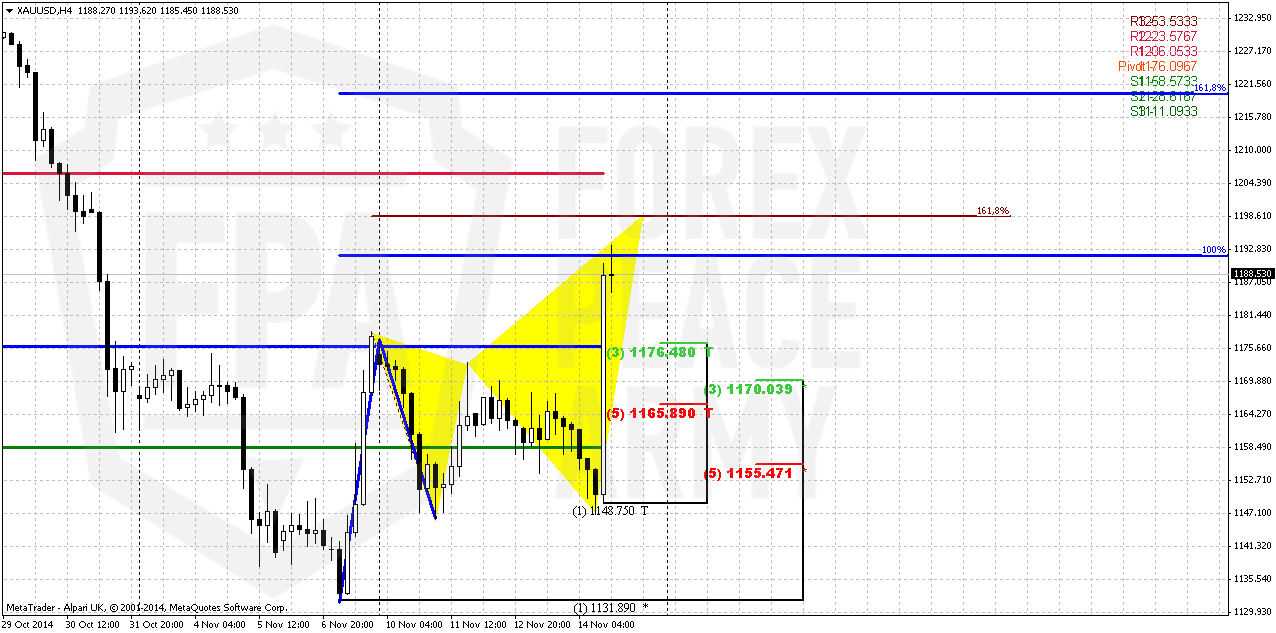

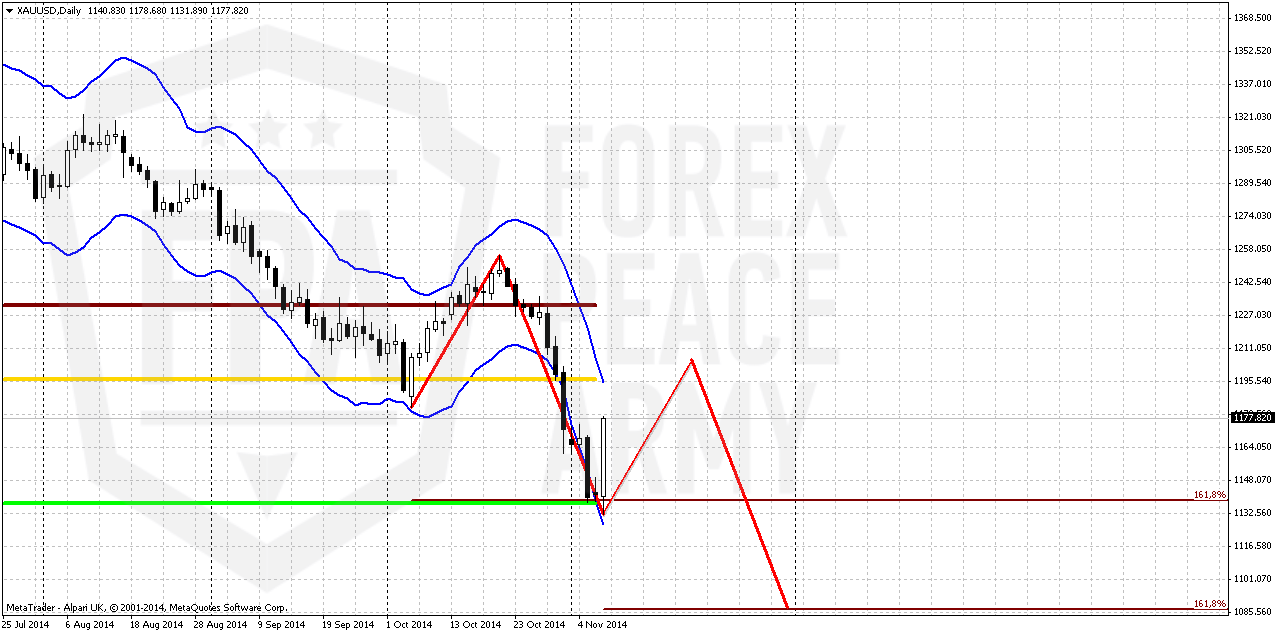

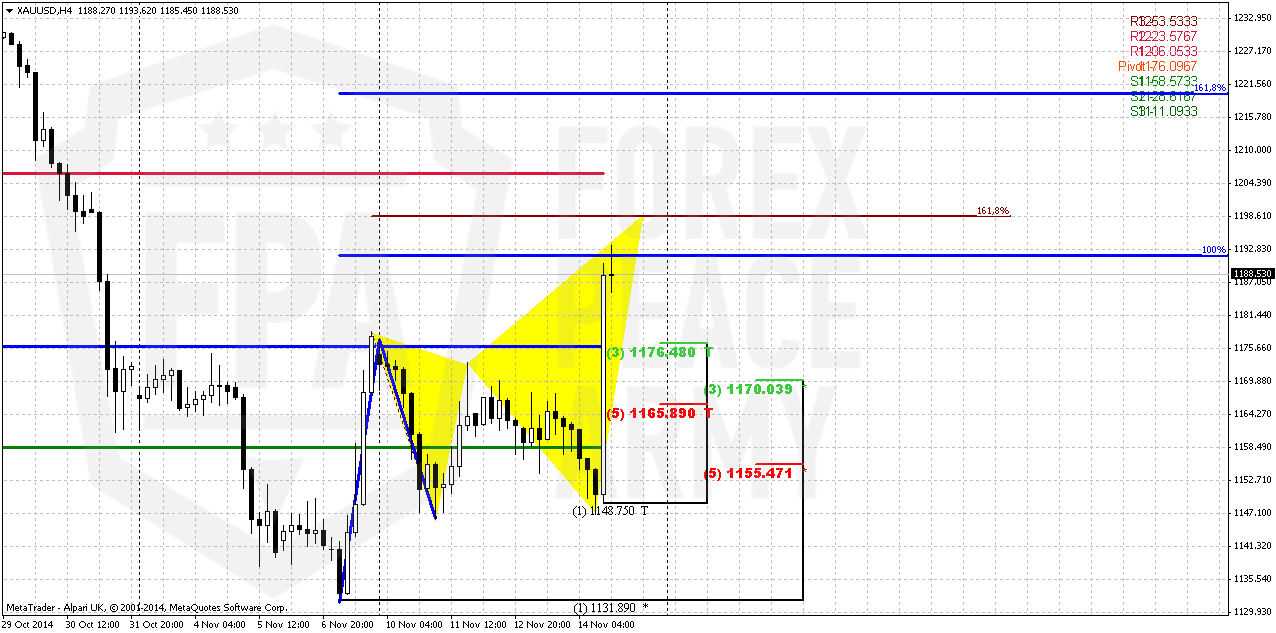

4-hour

This chart confirms as upside continuation as retracement first. Thus, strong thrust up and untouched 1.618 butterfly target assumes further upside continuation, but reaching of daily overbought, completion of AB=CD pattern here assumes retracement down first. On previous week gold has formed initial reversal swing and we’ve discussed deep retracement to 1143 support and this has happened. That was our long entry based on DRPO “Buy” if you remember this.

Now, retracement should not be to deep. There are two attractive levels for this. They are 1176 – agreement of Fib level and WPP and 1166-1170 K-support. Take a look at around 1200-1210 area we have resistance cluster. Butterfly target, WPR1, daily Fib resistance and 1.618 AB=CD target. So let’s see whether this level will hold market from further appreciation.

Conclusion:

Gold market has accomplished our “must” target and washed out 1180$ lows. Now we have last strategical question – how deep market could drop further. To answer on this question market needs time. The driving factor for gold is money of institutional investors. Despite what Asian traders tell about physical demand on holidays and festivals – this is not sufficient power to hold market. Now investors will re-assess situation on gold market and we need to understand what decision they will take. The only source of information that we have here is CFTC report and SPDR fund data. This is clue to solution. No changes in data – market will continue to creep lower. Technically, we will be watch for potential November bullish grabber. If market will confirm it – market could turn to deep upside retracement or even reversal. We hope that we will find out what stands under curtain of recent rally.

In short-term market has reached solid support area and shows nice upside rally. As gold has formed clear bullish pattern there - upside retracement could continue on the week. Most probable target of short-term rally is 1210 area – broken lows, WPR1, MPP and daily Fib level. But as gold still has uncompleted targets on higher time frames, we have to closely watch what will happen around 1210…

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.

Weekly Gold Tading Report prepared by Sive Morten exclusively for ForexPeaceArmy.com

As Reuters reports Gold surged 2.5 percent on Friday to just shy of $1,200 an ounce as short-covering, fund buying and a sudden weakening of the dollar offset better-than-expected U.S. data that diminished demand for safe-haven metals. Bullion bolted more than $40 to a two-week high at $1,193.34 in New York after dropping more than 1 percent in early trade to test the $1,145 level, where strong support was seen twice in the last four sessions, triggering pre-weekend short covering. The 10 a.m. EST (1500 GMT) spike was conspicuous in size and volume, with 25,000 lots traded in just ten minutes, and nearly half of the day's December contract volume changing hands in just over 30 minutes.

"The early morning pressure was met with significant bargain-hunting, and when the market was unable to continue its move lower, short-covering ensued," David Meger, director of metals trading at Vision Financial Markets. Gold tumbled early after the Commerce Department said U.S. retail sales rose 0.5 percent in October, a sign American consumers were spending with more gusto and could help keep the economy growing at a brisk pace.

The dramatic gains put gold on track for one of its best days in months and up more than 1 percent for the week, its second straight increase.

Still gold's long-term appeal is still in doubt. The U.S. economy is outpacing others, and investors are betting interest rates there will rise faster. Rising rates weigh on gold as they lift the opportunity cost of holding non-yielding assets.

Investors pulled another 2 tonnes from the world's top gold-backed exchange-traded fund, SPDR Gold Shares, in its eighth straight daily outflow, taking holdings to a six-year low of 720.62 tonnes.

As we’ve estimated on previous there is no big divergence between SPDR fund and gold dynamic. And on last week SPDR has shown outflow again. Now we need keep close eye on possible divergences between SPDR and spot gold.

Recent CFTC report shows solid jump in open interest with simultaneous decreasing of net long position again. This combination supports downward action:

Although this report was published prior Friday rally, and on next week we need to see what really has happened there. Somehow I suspect that short covering was just a reaction on some events and we need to understand what really has happened there. Why investors have turned to short covering? Hardly just because gold has not passed through next support area… May be some information has leaked on Swiss potential 2K tonnes purchasing… In general, even this rally does not break our view, since we treat action to 1200-1210 as normal reaction, but anyway, if this rally has no impact on CFTC data – we should treat it with suspicious.

Commercial Longs

Monthly

As we’ve said two of our patterns have been completed - bearish grabber @ 1400 and recent dynamic pressure that have led market to 1180 lows and clear them out. Still we have another one pattern in progress that is Volatility breakout (VOB). It suggests at least 0.618 AB-CD down. And this target is 1050$. But this is long-term perspective.

On previous week we’ve mentioned potential bullish grabber on gold market and recent rally could have absoutely special meaning for us. As less and less time till the end of November, chances on confirmation of this pattern are increasing. Grabber could become a reaction on butterfly pattern that we have here. Also, as we’ve mentioned previously, the depth of the reaction is also important.

As market now stands above 1180 this could be bullish sign. Let’s not call it as reversal by far, but anyway retracement that could be triggered will be very deep. And reason for that stands due potential monthly bullish grabber. Take a note that November MACDP=1183,04. That’s why moving above 1180 will be important from this point of view as well. This could be comfirmation of the grabber. In this case market at least will return right back to 1360 Yearly Pivot point. As you can see situation is really thrilling.

As market has turned to retracement up and until we will not know results of it (whether we will get grabber or not) currently it is not big sense to discuss on second question – how deep market could drop below 1180.

So here we just repeat what we’ve said previously on this subject. Currently we only can try to get hints here and there. Although some traders point on growing individual demand on gold and hope that this could trigger rally on gold. We would say that individual demand is just a part of global annual demand and this demand mostly planned and expected. If even as it was reported has grown for 20%, this is nothing compares to money of institutional investors with big part in futures market. It is not annual well known demand ~5-6K tonnes drives market, it is futures positions. Just imagine how big they are 75 K contracts in net long position. This is 75 K* 100 Oz per contract = 7,5 Mln Oz. ~ 2,3K tonnes. This is 50% of annual demand. But this is just net position. Open interest is 10 times greater. Thus, 20% increase in individual demand stands around 500-600 tonnes within a year and just dissolves in huge institutional volumes. Thus, to understand what will happen and how far gold could fall we need keep a close eye on CFTC and SPDR data because it will warn us about possible changing.

Another factor that could impact on gold market is possible gold buying from SNB. We’ve said about it on previous week:

Swiss gold referendum's support falls short of majority: poll | Reuters

Finally the major driving factor for Gold is inflation and particularly here US economy has problem. All stats are improving across the board but wages and wealth of middle class stagnates. Although this is typical for first stage of grow in economical cycle, but this does not support gold appreciation by far. Still, it seems that situation slightly starts to change here. Our ultimate target stands at 1050 and this is just 80 bucks above recent 1130 lows… ABN AMRO recently told about 800$ at the end of 2015, but we have solid doubts on this forecast. The point is that Fed “plans” to change rate somewhere in 2015. It means that inflation probably will become visible somehow. And in these conditions gold will react even earlier, as well as Treasury bond market.

Weekly

Last week as reason for possible bounce we’ve mentioned significant support area that includes monthly Fib level, inner butterfly AB=CD target and MPS1. Although we’ve said above that gold has completed butterfly, but weekly chart shows that not quite. Besides, market has not reached 1.618 extension target of smaller AB=CD pattern. This makes us to be worry on perspectives of this rally. May be on intraday charts 40$ explosion looks outstanding – on weekly chart market just re-tested broken 1180’s lows and formed another hammer pattern. In short-term perspective rally could continue and it will be interesting what we will get around MPP and 1200-1210 area. Existence of untouched 1.27 butterfly target is a cloud on horizon of possible upside action. Probably we could say more, when we will get next CFTC report or some information about recent really, what else was on background besides of just short covering...

Daily

That was really tough action on previous week. We’ve awaited for this move for 4 days and on Friday morning even talked about possible failure of upside action, since market has not shown any upside reaction on 3-Drive Buy pattern on 4-hour chart. But, as 1143 lows were held valid – our setup was valid too and it has worked right at the final moment and our target was hit – daily overbought. Gold has not reached MPP mostly due this moment. As acceleration was really fast, chances on upside continuation are not bad and probably market will take the shape of some AB-CD on intraday chart. But on Monday we should be ready for retracement down as market has hit overbought and it will hold it from further valuable growth in short-term perspective.

And now take a look at this another daily chart – we’ve prepared it on previous week:

If we suggest that market will fail and turn down again, since it has some uncompleted targets lower – we could get 1.618 3-Drive “Buy” pattern among other possibilities. Applying here harmonic swing we can say that current retracement should be over somewhere around 1210$ area. That’s why 1210 area has absolutely special meaning. Because it will make an impact on everything: monthly grabber, daily 3-Drive, perspectives of retracement etc…

4-hour

This chart confirms as upside continuation as retracement first. Thus, strong thrust up and untouched 1.618 butterfly target assumes further upside continuation, but reaching of daily overbought, completion of AB=CD pattern here assumes retracement down first. On previous week gold has formed initial reversal swing and we’ve discussed deep retracement to 1143 support and this has happened. That was our long entry based on DRPO “Buy” if you remember this.

Now, retracement should not be to deep. There are two attractive levels for this. They are 1176 – agreement of Fib level and WPP and 1166-1170 K-support. Take a look at around 1200-1210 area we have resistance cluster. Butterfly target, WPR1, daily Fib resistance and 1.618 AB=CD target. So let’s see whether this level will hold market from further appreciation.

Conclusion:

Gold market has accomplished our “must” target and washed out 1180$ lows. Now we have last strategical question – how deep market could drop further. To answer on this question market needs time. The driving factor for gold is money of institutional investors. Despite what Asian traders tell about physical demand on holidays and festivals – this is not sufficient power to hold market. Now investors will re-assess situation on gold market and we need to understand what decision they will take. The only source of information that we have here is CFTC report and SPDR fund data. This is clue to solution. No changes in data – market will continue to creep lower. Technically, we will be watch for potential November bullish grabber. If market will confirm it – market could turn to deep upside retracement or even reversal. We hope that we will find out what stands under curtain of recent rally.

In short-term market has reached solid support area and shows nice upside rally. As gold has formed clear bullish pattern there - upside retracement could continue on the week. Most probable target of short-term rally is 1210 area – broken lows, WPR1, MPP and daily Fib level. But as gold still has uncompleted targets on higher time frames, we have to closely watch what will happen around 1210…

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.