SOLID ECN LLC

Solid ECN Representative

- Messages

- 514

EURUSD

The European currency shows multidirectional dynamics of trading during the morning session, holding near the local highs of September 22, updated at the end of last week. Investors are in no hurry to open new long positions on the instrument, as they are concerned about inflation statistics released last Friday. In September, the Consumer Price Index in the euro area reached a new record high of 10.0%, which strengthened the confidence of market participants that the European Central Bank (ECB) will continue the policy of tightening monetary conditions and may even noticeably accelerate in this matter. In addition, the escalation of the military conflict on the territory of Ukraine, which provoked the rapid development of the energy crisis in the region, remains a significant factor of uncertainty. Pressure on the euro at the beginning of the week was exerted by uncertain macroeconomic statistics from Europe. The Manufacturing PMI from S&P Global in September showed a decline from 48.5 points to 48.4 points with neutral forecasts. Data from Germany further disappointed the markets: the Manufacturing PMI in September fell from 48.3 points to 47.8 points, while analysts did not expect any changes. Today, the focus will be on European statistics on the dynamics of producer inflation, where current forecasts suggest acceleration in the growth of the Producer Price Index in monthly terms from 4.0% to 5.0%, and from 37.9% to 43.2% in annual terms.

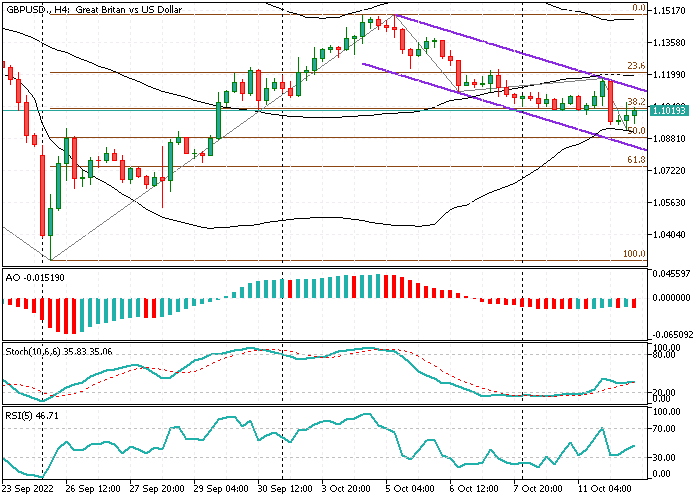

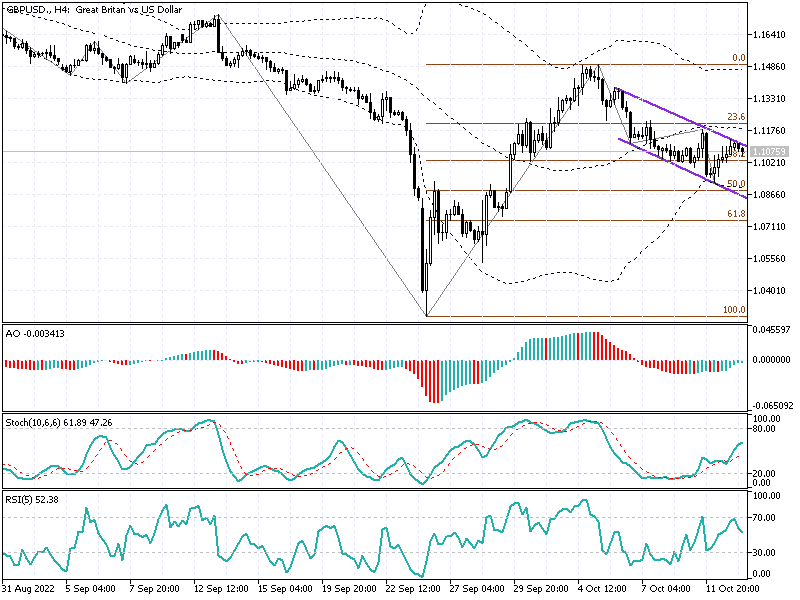

GBPUSD

The GBPUSD pair shows flat trading dynamics during the morning session, consolidating slightly above 1.1300 and updating local highs from September 22. British investors reacted to the government's initiative to cut taxes unprecedented in the past 50 years with sales of the pound, as a result of which the currency corrected to an all-time low against the US dollar, and since the beginning of the year it has lost 20%, but the decision to amend the program suspended the fall in quotations. Despite the fact that, according to officials, the reform is designed to stimulate economic growth in a crisis, it caused a negative reaction from experts who believe that its full implementation could lead to an increase in inflation and the volume of the country's public debt. The day before, the Ministry of Finance announced the abandonment of the initiative to reduce duties for the wealthiest segments of the population (the abolition of the 45% maximum income tax rate). However, the rest of the fiscal policy changes are still in place and the UK government intends to implement them, as well as a program to subsidize electricity bills for households and businesses. Additional support for the instrument on Monday was provided by not the most confident macroeconomic statistics from the US. The Manufacturing PMI from the Institute of Supply Management (ISM) in September showed a decrease from 52.8 points to 50.9 points, while the forecast was 52.2 points. In the UK, the Manufacturing PMI from S&P Global/CIPS adjusted from 48.5 points to 48.4 points with neutral preliminary estimates.

XAUUSD

Gold prices are consolidating near the level of 1.700.0 after active growth the day before, when the quotations were significantly supported by the fact of the decrease in the yield of US bonds, which reacted to the appearance of uncertain macroeconomic statistics from the USA. In particular, the Institute for Supply Management (ISM) Manufacturing PMI in September showed a decrease from 52.8 points to 50.9 points, which was the lowest value since May 2020. The yield on 10-year bonds dropped to 3.587% the day before after reaching 3.804% the day before. Gold was also supported by the fact that the RBA only raised interest rates by 25.0 basis points, and the UK government decided to abandon some of its most criticized fiscal reforms. It also sparked speculation about a more measured rate hike by the Bank of England. It is likely that the agency will not increase the estimated rate of adjustment until the end of the year.