SOLID ECN LLC

Solid ECN Representative

- Messages

- 514

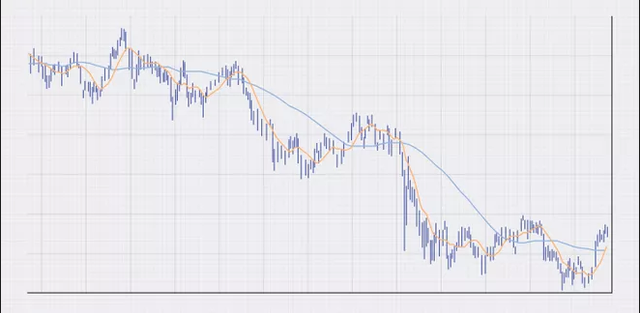

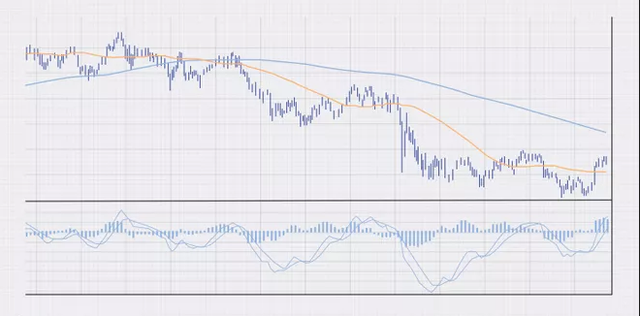

Solid ECN delivers an electronic system for buyers and sellers to come together to execute trades in the market. We do this by providing access to information about orders being entered, and by simplifying the execution of these deals. The network is created to fit buy and sell orders presently in the exchange. When detailed order information is not available, Solid ECN supplies prices mirror the highest bid and lowest ask recorded on the available market.

Benefits of Electronic Communications Networks

Price feed clarity is also a byproduct that many think is a benefit because of how the information is shared. All ECN brokers have access to the same feed and trade at the precise price that is provided. A particular amount of price history is also readily available, authorizing for a more straightforward analysis of certain trends within the marketplace. This helps limit price manipulation, as existing and old data are readily available to all, making it more difficult to act unscrupulously.

Benefits of Electronic Communications Networks

Price feed clarity is also a byproduct that many think is a benefit because of how the information is shared. All ECN brokers have access to the same feed and trade at the precise price that is provided. A particular amount of price history is also readily available, authorizing for a more straightforward analysis of certain trends within the marketplace. This helps limit price manipulation, as existing and old data are readily available to all, making it more difficult to act unscrupulously.

1:1000 Leverage | Spread from Zero | %40 Deposit Bonus | Negative Balance Protection