GlossaryEditor

Glossary Editor

- Messages

- 48

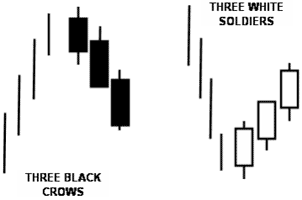

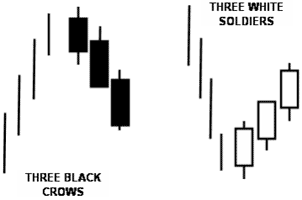

Three White Soldiers is a bullish candlestick reversal pattern. It looks like three side-by-side white candles, each of them having a higher close than the previous one. The second and third candles should have an open price in the middle of the previous candle body, and the close should be near the high price.

Three white soldiers, in fact, is an opposite pattern to three black crows.

You can get more information about these patterns in the FPA's Forex Military School lesson on Triple Candlestick Patterns.

Treatment

Since Three white soldiers is reversal pattern, it is preferable, when it appears after solid previous bear trend or in the area of long-term lows. Major properties of Three white soldiers are as follows:

- Close prices should be near the high, i.e. candles should have very small upper shadows. If shadow is absent - much better;

- Open price should be near the middle of previous candle;

- If open price of 2nd and 3rd candles coincides correspondingly with close price of 1st and 2nd candles, this pattern is treated as three identical soldiers and has greater bullish power;

- Pattern treated as stronger one, if it appears not just after long-term downward tendency, but after a sideways consolidation that separates the downtrend and the pattern;

- Preferably, the second candle will be bigger than the first one and the third will be at least the same size as the second.

This chart shows an impressive bullish rally after the appearance of 3 white soldiers.

Three white soldiers, in fact, is an opposite pattern to three black crows.

You can get more information about these patterns in the FPA's Forex Military School lesson on Triple Candlestick Patterns.

Treatment

Since Three white soldiers is reversal pattern, it is preferable, when it appears after solid previous bear trend or in the area of long-term lows. Major properties of Three white soldiers are as follows:

- Close prices should be near the high, i.e. candles should have very small upper shadows. If shadow is absent - much better;

- Open price should be near the middle of previous candle;

- If open price of 2nd and 3rd candles coincides correspondingly with close price of 1st and 2nd candles, this pattern is treated as three identical soldiers and has greater bullish power;

- Pattern treated as stronger one, if it appears not just after long-term downward tendency, but after a sideways consolidation that separates the downtrend and the pattern;

- Preferably, the second candle will be bigger than the first one and the third will be at least the same size as the second.

This chart shows an impressive bullish rally after the appearance of 3 white soldiers.