Sive Morten

Special Consultant to the FPA

- Messages

- 18,702

EUR/USD Daily Update, Wed 02, February 2011

Good morning,

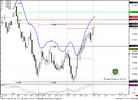

Well, unfortunately we didn't recieve either DRPO or B&B. Market just broke out 0.618 Fib resistance and continue move up.

Now we can say that market just touched the pivot point at 1.3662 and go - this is normal bullish price action.

Today I do not see any strong signals that are worthy to be traded. So, all that I can do now is to show some levels to watch for:

1.39 area - 1.618 target of daily Butterfly "Buy", so be carefull in establishing any Long positions just below this area.

Above the market you can see on the chart deep Fib resistances - 0.786 and 0.88

On 4-hour chart we see that market just accomplished not perfect AB-CD at 1.3817 and just above the market around 1.39 some additional targets, particularly 0.618 from recent ABC.

So, if you're bullish it's better to wait for some pullback to intraday support to enter on Long side of the market. If you're bearish - wait for possible Sell signals. I do not see any currently.

Good morning,

Well, unfortunately we didn't recieve either DRPO or B&B. Market just broke out 0.618 Fib resistance and continue move up.

Now we can say that market just touched the pivot point at 1.3662 and go - this is normal bullish price action.

Today I do not see any strong signals that are worthy to be traded. So, all that I can do now is to show some levels to watch for:

1.39 area - 1.618 target of daily Butterfly "Buy", so be carefull in establishing any Long positions just below this area.

Above the market you can see on the chart deep Fib resistances - 0.786 and 0.88

On 4-hour chart we see that market just accomplished not perfect AB-CD at 1.3817 and just above the market around 1.39 some additional targets, particularly 0.618 from recent ABC.

So, if you're bullish it's better to wait for some pullback to intraday support to enter on Long side of the market. If you're bearish - wait for possible Sell signals. I do not see any currently.