syamfx2020

Recruit

- Messages

- 0

The US dollar index slightly reversed from the 6-week highs. On Monday, the dollar index, which measures the greenback against six major peers reached a fresh 6-week high of 103.40. Moving ahead, the price actions appear to be part of a consolidation phase and the pair is likely to trade sideways today ahead of July US retail sales data, which should prompt even more volatility. The US Census Bureau will publish the country’s Retail Sales report today. The retail sales likely rose 0.4% in July, compared to a rise of 0.2% in the previous month.

EQUITIES

Stock markets across Europe opened lower after steep losses in the Asian session. Asian shares slipped after the release of disappointing economic data from China. The latest data showed that China retail sales declined to 2.5% over a year earlier in July from the previous month’s already low 3.1%. Following the release of negative economic data, China’s central bank cut interest rates by 15bps to 2.5% the largest cut since 2020.

OIL

Crude oil futures struggling to continue the upside momentum after the release of weak economic Chinese data in July. The overall momentum remained under pressure throughout the European session as investors weighed on the demand outlook in the world’s top crude importer. Moving ahead, oil traders should closely monitor the FOMC minutes and weekly crude inventory report on Wednesday to get a clear picture of the oil price’s long-term direction.

CURRENCIES

In the currency market, the Australian dollar remains the weakest currency amongst the majors. The Asian currency pair is already under pressure due to the concern over China's growth. The strong bearish sentiment was fueled on Tuesday Morning following the release of RBA meeting minutes. The minutes from the last RBA meeting showed that policymakers chose to maintain current interest rates due to a decelerating economy. Meantime, the euro extended the rebound against the dollar after the release of German economic data. The German ZEW headline number showed that the Economic Sentiment Index improved to -12.3 in August from -14.7 in July.

GOLD

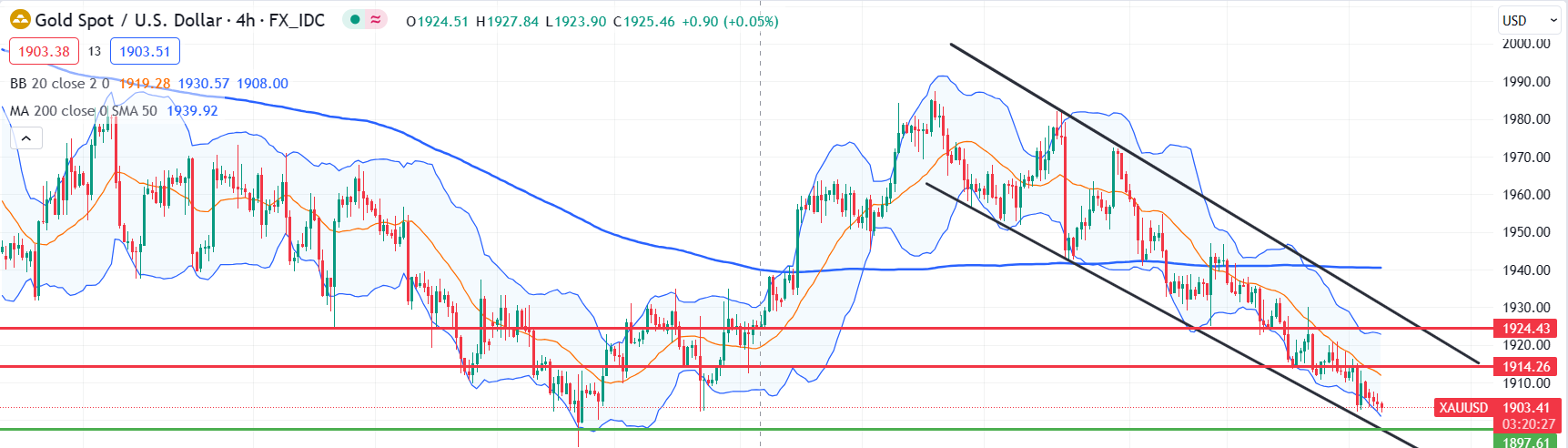

The rise in the dollar has been a setback for gold, which trades near its lowest in more than 6-weeks. As of this writing, the metal hovers near the psychological support area of $1900. The hawkish remarks from the FED policymakers also contributed to negative sentiment in the commodities market. Moving ahead to the North American session, the gold traders will now be focused on the latest US retail data which is set to be released at 12.30 GMT and comments from Minneapolis Fed President Kashkari.

Economic Outlook

On the data front, Japan's Gross domestic product grew at an annualized rate of 6% in the second quarter, the fastest pace since the fourth quarter of 2020. The figure exceeded economists’ forecast of 2.9% growth. This is the third consecutive quarter of positive growth.

Moving ahead today, the important events to watch:

Canada – CPI: GMT – 12:30

US – Retail sales: GMT – 12:30

Technical Outlook and Review

EURUSD: For today, if the pair continues to trade above 1.0900 in the coming hours, the euro is likely to extend its momentum toward the next resistance which stands at the 1.0960/70 level. On the downside side, 1.0880 will act as immediate support while 1.0840 will be a critical zone.

The important levels to watch for today: Support- 1.0900 and 1.0870 Resistance- 1.0950 and 1.0970.

GOLD: For gold, the first nearest support level is located at 1897 then 1890. On the upper side, 1914 will act as an immediate and strong hurdle while 1920 will be a critical resistance zone because, above this, bulls are likely to dominate.

The important levels to watch for today: Support- 1897 and 1890 Resistance- 1914 and 1920.

Quote of the day – “I learned that an opinion isn’t worth that much. It is more important to listen to the market. I became a reactive trader as opposed to an opinionated trader.” — Brian Gelber.

Read more - https://gulfbrokers.com/en/daily-market-report-703

EQUITIES

Stock markets across Europe opened lower after steep losses in the Asian session. Asian shares slipped after the release of disappointing economic data from China. The latest data showed that China retail sales declined to 2.5% over a year earlier in July from the previous month’s already low 3.1%. Following the release of negative economic data, China’s central bank cut interest rates by 15bps to 2.5% the largest cut since 2020.

OIL

Crude oil futures struggling to continue the upside momentum after the release of weak economic Chinese data in July. The overall momentum remained under pressure throughout the European session as investors weighed on the demand outlook in the world’s top crude importer. Moving ahead, oil traders should closely monitor the FOMC minutes and weekly crude inventory report on Wednesday to get a clear picture of the oil price’s long-term direction.

CURRENCIES

In the currency market, the Australian dollar remains the weakest currency amongst the majors. The Asian currency pair is already under pressure due to the concern over China's growth. The strong bearish sentiment was fueled on Tuesday Morning following the release of RBA meeting minutes. The minutes from the last RBA meeting showed that policymakers chose to maintain current interest rates due to a decelerating economy. Meantime, the euro extended the rebound against the dollar after the release of German economic data. The German ZEW headline number showed that the Economic Sentiment Index improved to -12.3 in August from -14.7 in July.

GOLD

The rise in the dollar has been a setback for gold, which trades near its lowest in more than 6-weeks. As of this writing, the metal hovers near the psychological support area of $1900. The hawkish remarks from the FED policymakers also contributed to negative sentiment in the commodities market. Moving ahead to the North American session, the gold traders will now be focused on the latest US retail data which is set to be released at 12.30 GMT and comments from Minneapolis Fed President Kashkari.

Economic Outlook

On the data front, Japan's Gross domestic product grew at an annualized rate of 6% in the second quarter, the fastest pace since the fourth quarter of 2020. The figure exceeded economists’ forecast of 2.9% growth. This is the third consecutive quarter of positive growth.

Moving ahead today, the important events to watch:

Canada – CPI: GMT – 12:30

US – Retail sales: GMT – 12:30

Technical Outlook and Review

EURUSD: For today, if the pair continues to trade above 1.0900 in the coming hours, the euro is likely to extend its momentum toward the next resistance which stands at the 1.0960/70 level. On the downside side, 1.0880 will act as immediate support while 1.0840 will be a critical zone.

The important levels to watch for today: Support- 1.0900 and 1.0870 Resistance- 1.0950 and 1.0970.

GOLD: For gold, the first nearest support level is located at 1897 then 1890. On the upper side, 1914 will act as an immediate and strong hurdle while 1920 will be a critical resistance zone because, above this, bulls are likely to dominate.

The important levels to watch for today: Support- 1897 and 1890 Resistance- 1914 and 1920.

Quote of the day – “I learned that an opinion isn’t worth that much. It is more important to listen to the market. I became a reactive trader as opposed to an opinionated trader.” — Brian Gelber.

Read more - https://gulfbrokers.com/en/daily-market-report-703