FOREX.com

FOREX.com Representative

- Messages

- 33

EUR/USD implied volatility blows out ahead of ECB, US data: European open 14/09/2023

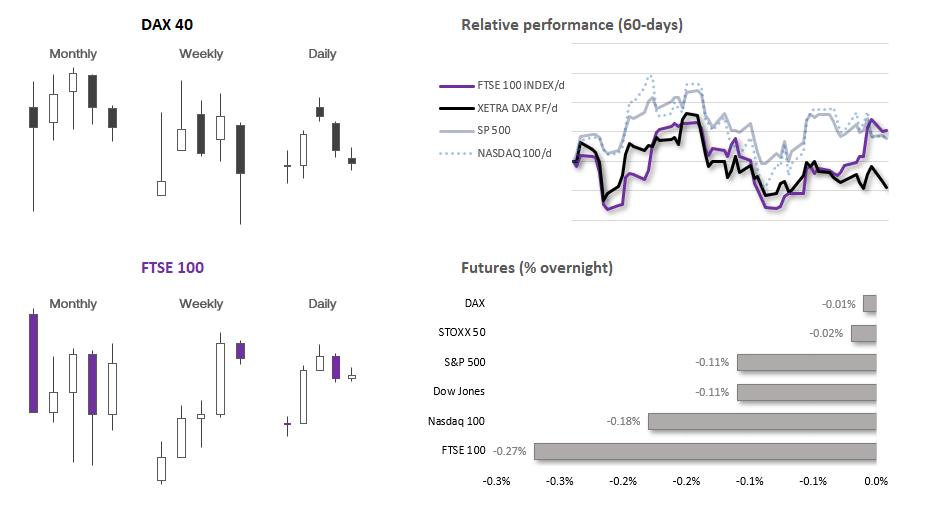

Asian Indices:

- Australia's ASX 200 index rose by 43 points (0.6%) and currently trades at 7,196.90

- Japan's Nikkei 225 index has risen by 448.65 points (1.37%) and currently trades at 33,155.17

- Hong Kong's Hang Seng index has fallen by -39.84 points (-0.22%) and currently trades at 17,969.38

- China's A50 Index has risen by 1.65 points (0.01%) and currently trades at 12,583.36

UK and Europe:

- UK's FTSE 100 futures are currently up 14 points (0.19%), the cash market is currently estimated to open at 7,539.99

- Euro STOXX 50 futures are currently up 10 points (0.24%), the cash market is currently estimated to open at 4,233.48

- Germany's DAX futures are currently up 35 points (0.22%), the cash market is currently estimated to open at 15,689.03

US Futures:

- DJI futures are currently up 77 points (0.22%)

- S&P 500 futures are currently up 14.25 points (0.32%)

- Nasdaq 100 futures are currently up 71.5 points (0.47%)

Events in focus (GMT+1):

- 13:15 – ECB monetary policy statement, interest rate decision

- 13:30 – US jobless claims data, producer prices, retail sales

- 13:45 – ECB press conference

- 15:15 – ECB President Lagarde speaks

Today’s ECB interest rate decision and following press conference are clearly the standout events. But with a host of US data sandwiched in between, it could make for an interesting hour of trade for forex speculators.

Markets favoured a hawkish hold at the beginning of the week, but odds have now shifted in favour of another 25bp hike after ‘sources’ claimed that the ECB planned to increase their inflation forecast above 3%. But will that really change much? European data continues to underperform expectations according to the CESI (Citi Economic Surprise Index) whilst inflation remains above target. And even if we see a hawkish hike today, odds favour the ECB are at or very near their terminal rate.

Whilst this might support the euro to a degree, I suspect it will be more in line with a retracement higher as opposed to the beginning of a fruitful bullish trend. And where EUR/USD specifically is concerned, its upside potential is more likely to be dictated by USD weakness.

We’ll find out more of the details at the press conference at 13:45 BST, but traders should keep in mind that a host of US data is released at 13:30. And if retail sales, producer prices come in hot and jobless claims data is softer, markets might take yesterday’s hotter inflation figures a bit more seriously than they did and boost the US dollar and yields, to the detriment of the euro and stock market sentiment.

But let’s look a bit further afield. If producer prices do feed into consumer prices, then it should be a concern that the PPI-CPI spread reached an extreme cycle low two months ago, and nudged up last month to suggest a trough is in place. And like many other indicators turning higher form multi-month lows, it points towards another bout of inflation in the months or even quarters ahead. And if a hot PPI is coupled with strong retail sales and soft jobless claims, I may have to revisit my call for an interim dollar top over the coming week/s. Either way, data might be a big driver today and has the potential to make or break trends.

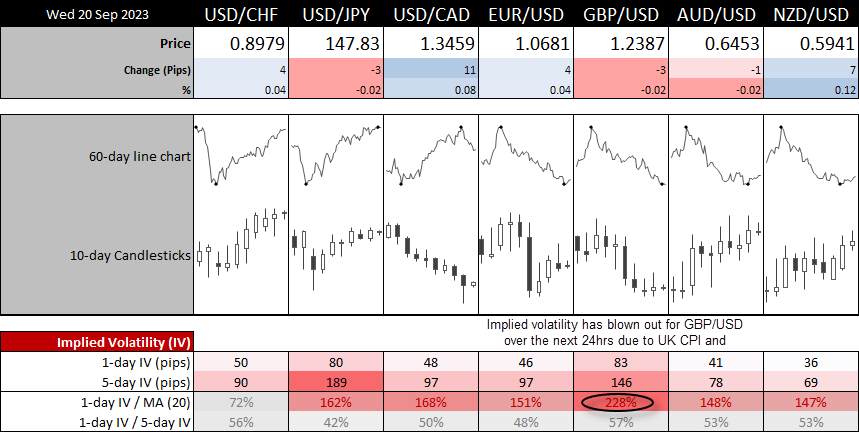

Traders should take note that the 1-day implied volatility level for EUR/USD is over 200% of its 20-day average. On one hand, traders like volatility and that can bring opportunity. On the other, it can also bring pain, especially if the volatility is large but ultimately non-directional. So whilst the volatility may be there for traders, for a clean directional / sustained move, we'd likely need to see US data stacked one way, in an opposing direction to the perceived level of the ECB's hawkishness/dovishness.

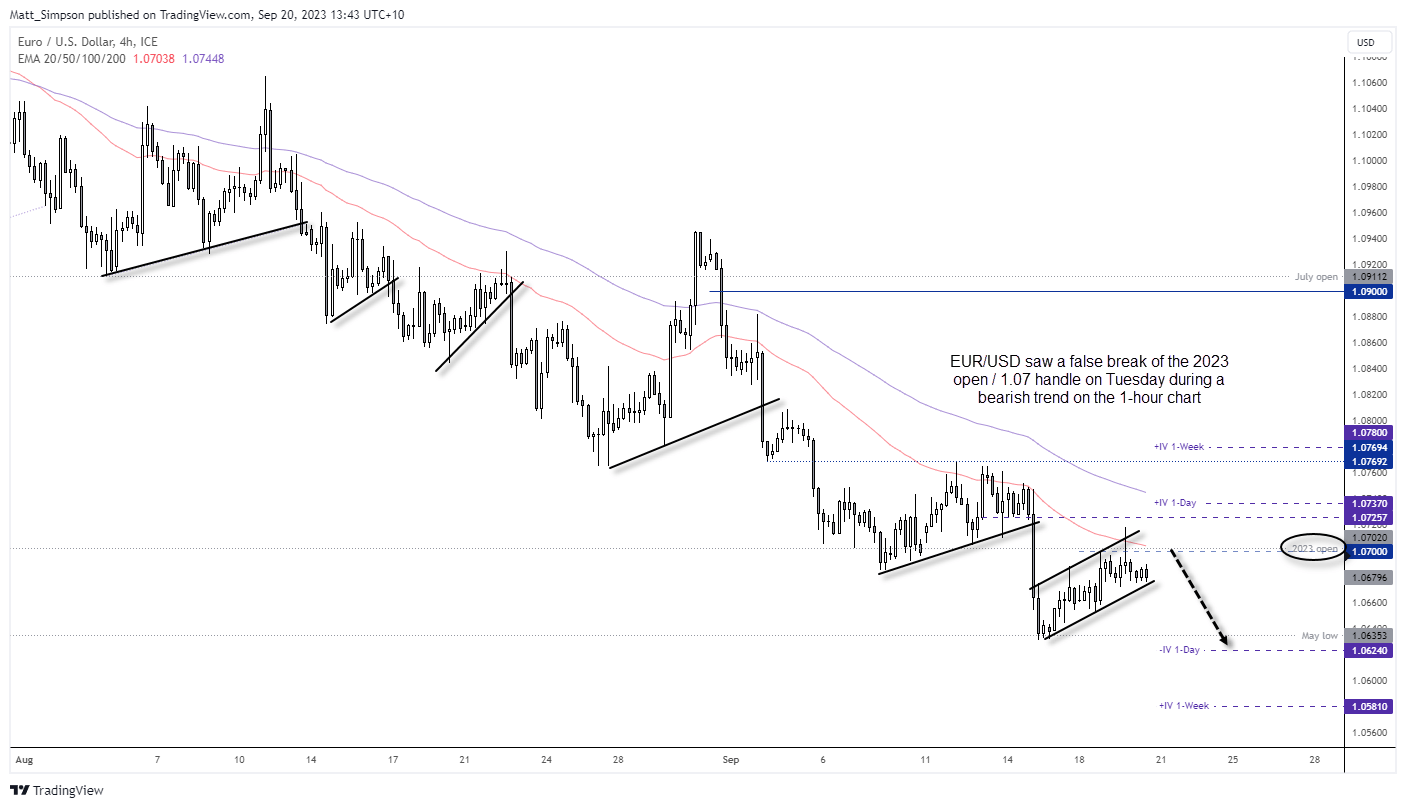

EUR/USD technical analysis (daily chart):

The EUR/USD daily chart remains within an established downtrend and, whilst I have made a case for a USD reversal, it doesn’t mean the actual low on EUR/USD has been set yet. EUR/USD is creeping higher ahead of today’s data and events, and even if it managed to break above this week’s high then the 1.0800 barrier may provide better resistance further out. And that could tease bears into action at higher prices. If US data comes in hot and markets are unimpressed with the ECB’s hawkish tone or hike, bears may look to slam EUR/USD lower before it reaches last week’s high.

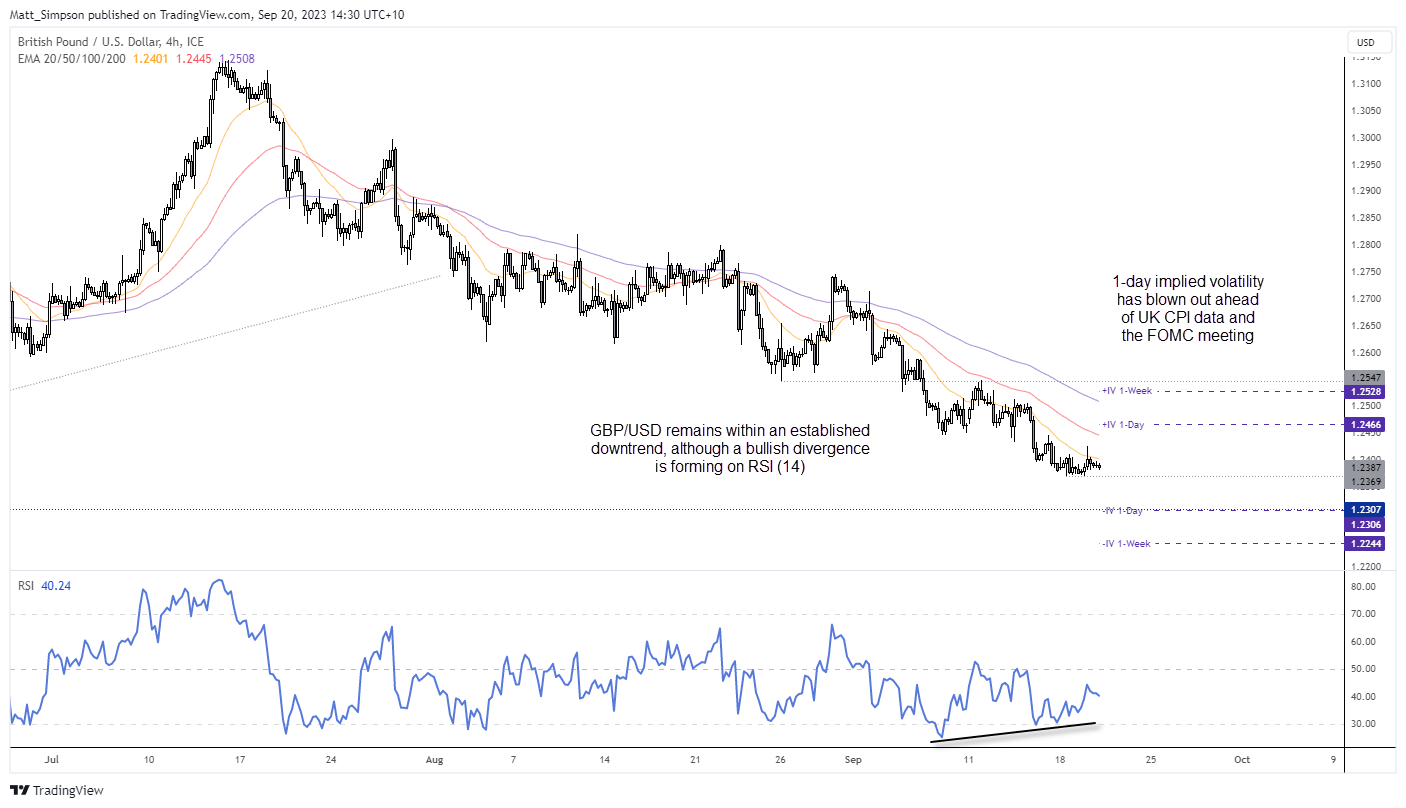

EUR/USD technical analysis (1-hour chart):

Intraday price action looks interesting on EUR/USD, because if recent price action is corrective as it appears, it assumes that at some point momentum has to realign with the prior impulsive move lower. In which case, bears may want to seek evidence of a swing high around resistance levels with a view of it eventually breaking to new lows.If the data stacks up for a bullish move, bulls could wait for signs of swing low to form around support and seek a move towards 1.0800. Either way, keep in mind volatility is expected to be high, and if a setup is not there then sometimes the best trade is to do nothing.