FOREX.com

FOREX.com Representative

- Messages

- 33

Bonds could trump data next week if yields keep surging: The Week Ahead

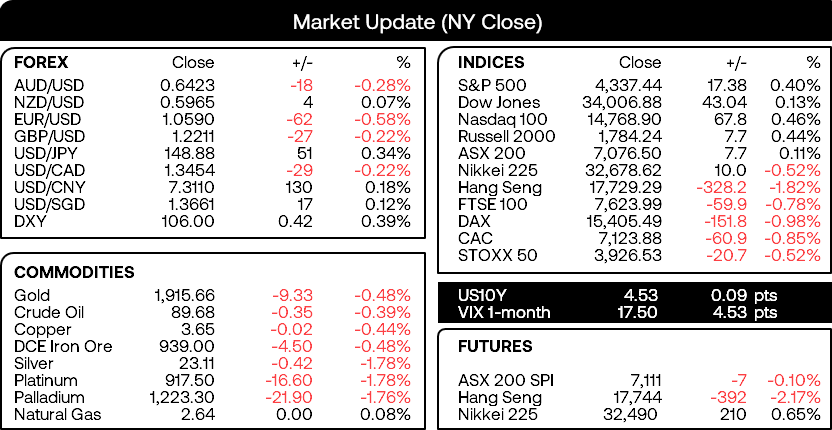

The most notable reaction following the latest FOMC meeting was the reaction of bond markets, which continued to plunge and send yields higher. Not even the US dollar could extend its rally meaningfully despite the rise of yields. But global stock markets certainly took notice and fell in tandem as investors finally took the Fed seriously that interest rates are likely to remain higher for longer. So whilst we have US PCE inflation, consumer sentiment, GDP, retail sales and the likes of China PMIs and Australian CPI, it is likely to be how bond yields behave next week as to how important these economic data points become.The week that was:

- The Fed held interest rates as widely expected, although upgraded their forecasts for growth, inflation and trimmed 50bp of cuts of the 2024 median Fed rate forecast

- This not only hammers home the ‘higher for longer’ theme for interest rates in the US, but also brings with it the potential for further hikes – even if money markets are not really pricing them in

- Notably softer US jobless claims figures after the Fed also served as a reminder that the US economy really is withstanding higher interest rates. For now at least.

- Bond yields surged on bets that rates will remain higher for longer, with the 20 and 30-year rising over 17bp each

- Global equity markets were lower after the Fed meeting, and higher yields weighed notably on technology stocks and sent the Nasdaq 100 to a 5-week low and on track for its worst week in six months

- The Bank of England (BOE) also held their interest rate thanks to a softer-than-expected set of inflation numbers the day prior (and with four key members including governor Bailey opting for a hold, it suggests the peak is at 5.25%)

- The BOJ kept their policy unchanged widely expected

The week ahead (calendar):

- Bondcano: Will higher yields crush sentiment?

- US PCE inflation

- US consumer confidence

- China PMIs

Bondcano: Will higher yields crush sentiment?

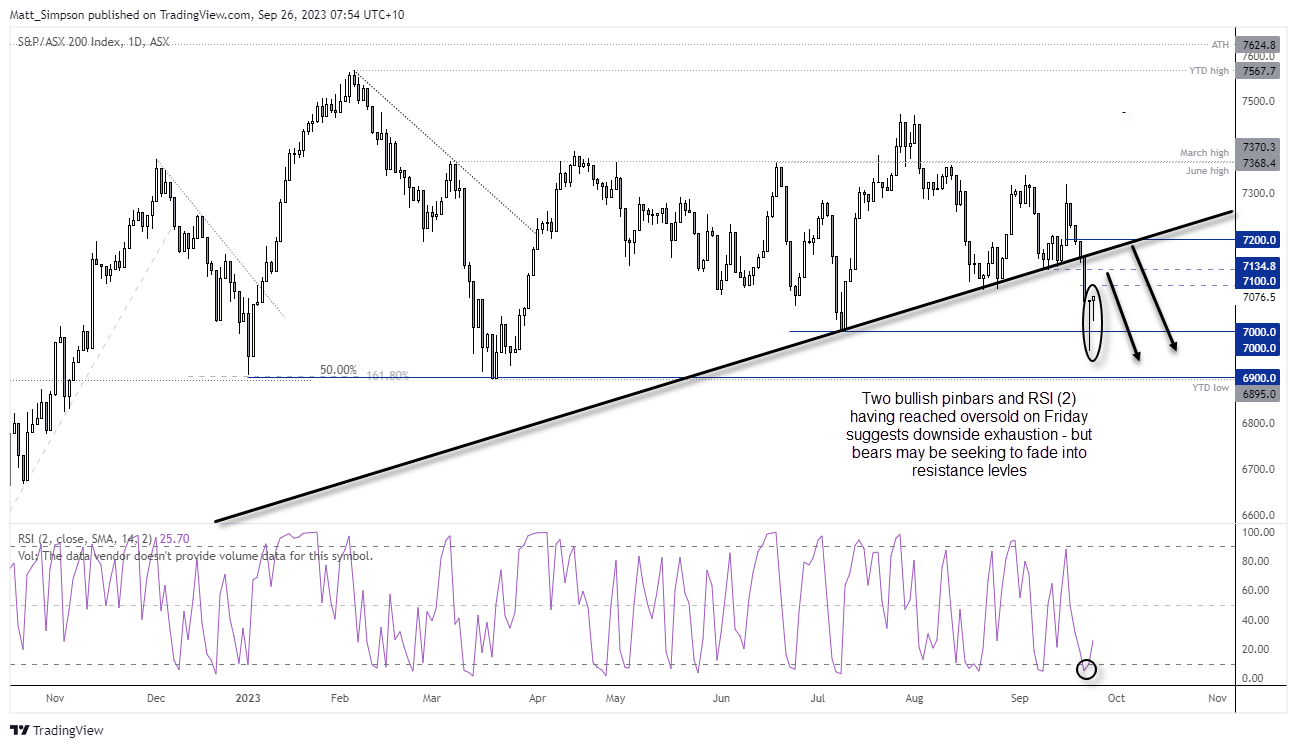

When I looked at next week’s calendar, a lot of the usual high-tier data seemed to have lost its shine following this week’s FOMC meeting. For example, PCE inflation will likely have to post an extremely wide deviation from estimates to sway markets expectations that the Fed aren’t simply in hold mode, will hold for a while and are more likely to hike than cut.And then my colleague hit the nail on the head as to why economic data may have lost its shine, when he succinctly said “bondcano, baby - that’s all that matters”. In a nutshell, the higher yields move and the longer they stay there, the more likely it is that risk assets are going to be in for a rude awakening. And if yields somehow pull back as investors decide to buy bonds? Then it should boost sentiment. But that seems unlikely right now given the rate at which bond yields are falling. Market to watch: Bonds/yields, USD/JPY, AUD/JPY, GBP/JPY, EUR/JPY, Nasdaq 100, S&P 500, Dow Jones, Nikkei 225, China A50, Hang Seng, VIX

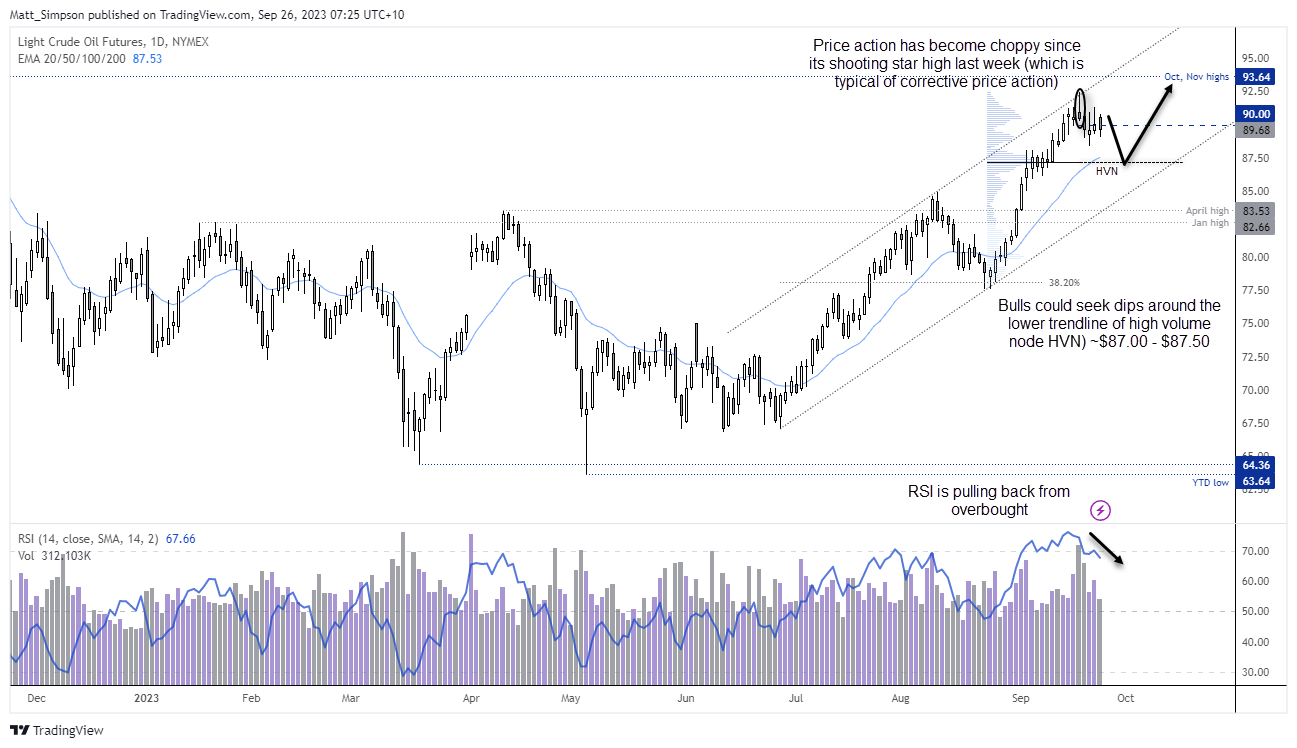

US PCE inflation

Energy prices and the basing effect have saw the annual rate of US inflation curl higher for a second month, although it is the core measure of inflation that really matter going forward. The Fed’s preferred measure of inflation is the personal consumption expenditure series (PCE) which is released next week. Core PCE is less volatile than core CPI and has been stickier than its CPI counterpart. And with the Fed having hammered home that high rates are here to stay, it would require an abnormally large miss to the downside for markets to ignore this week’s memo. That means PCE data is unlikely to be a market mover, unless is surprises to the upside to generate fresh bets of another Fed hike.Market to watch: EURUSD, USD/JPY, WTI Crude Oil, Gold, S&P 500, Nasdaq 100, Dow Jones

US consumer confidence

Two measures of consumer confidence are released for the US next week; the Conference Board Consumer Confidence survey and the University of Michigan Survey of Consumers. The two have clearly diverged in since March 2020, with the latter being the more pessimistic and volatile. Yet is also has a smaller sample size of 500 compare with the CB’s 5000, and focuses more on the individual’s state of affairs whereas CB is more about their perception of the economy as a whole. Yet they have both turned lower recently, and that is a trend that needs to continue to lessen the likelihood of higher for longer rates. But again, if the bond market continues to plunge and send yields sky rocketing, that could surely have a negative effect on sentiment and the wider economy as a whole.Market to watch: EURUSD, USD/JPY, WTI Crude Oil, Gold, S&P 500, Nasdaq 100, Dow Jones

As for the rest…

US retail sales, GDP, jobless claims: As suggested earlier, bond markets are the main driver in town. And that means second-tier data is even less appealing. With that said, retail sales is a form of consumer sentiment so any notably weak data from the US could at least hint at a cooling economy.We also have the final US GDP prints on Thursday, although jobless data is released at the same time and that may prove to be the bigger market mover if it prints another strong data set.

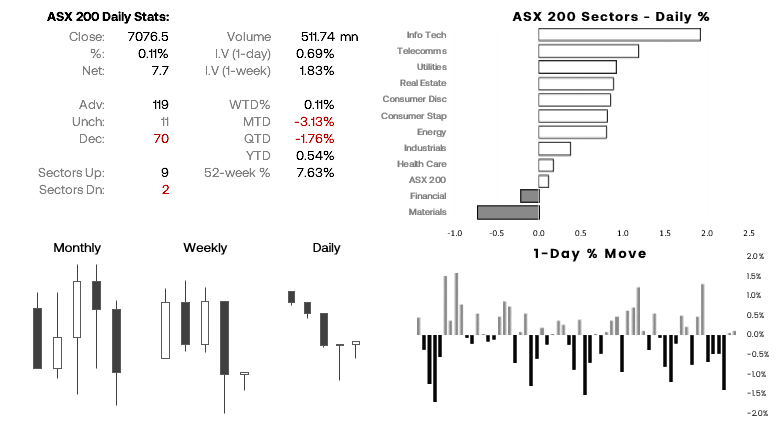

Australian inflation, retail sales: The majority of recent economic data points to a peak RBA rate of 4.1%. Whilst the Fed’s meeting was hawkish, it doesn’t really place any extra pressure on the RBA to hike unless they do themselves. Unless of course we see Australian inflation curl higher like we saw in the US and Canada recently. If not, it’s another reason not to be bullish AUD/USD.

China’s PMIs: I write this ahead of a series of flash PMI data from the US and Europe, and that could help shape expectations for China’s PMIs next week. With that said, the slowdown in the manufacturing sector has troughed according to the official government NBS data, although services PMI continues to grow at a weaker pace and is arguably the more important PMI to follow next week. Take note that the privately run survey by Caixin are released at the end of the week. But at this stage, an upside surprise may be required to be considered any sort of surprise at all.

Market to watch: USD/CNH, China A50, Hang Seng