victoriajensen

Private, 1st Class

- Messages

- 1,117

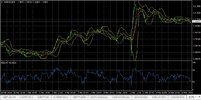

Eur/Usd found the immediate support level back to 1.1100 neighbourhood, the pair probably continue stay within the range between 1.105 to 1.1200.

It will likely break below the support at 1.1100, considering the hanging man candlestick on the daily time frame below the resistance at 1.1200.