B&B Buy signal

Hi Sive

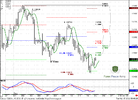

Thanks for your reply. Following your way of explanation of this B&B buy signal with potentially forming ‘W’ shape in the retracement move upside, can we assume that the first part of this ‘W’ shaped wave could be considered as ABC(top) pattern and then, entering the market on some suitable poolback from the top.

If this could be the case, what would be that ENTRY level, as well as - the corresponding EXIT level (maybe in terms of Fiv Expansion)?

Thanks!

Hi Sive

Thanks for your reply. Following your way of explanation of this B&B buy signal with potentially forming ‘W’ shape in the retracement move upside, can we assume that the first part of this ‘W’ shaped wave could be considered as ABC(top) pattern and then, entering the market on some suitable poolback from the top.

If this could be the case, what would be that ENTRY level, as well as - the corresponding EXIT level (maybe in terms of Fiv Expansion)?

Thanks!