Sive Morten

Special Consultant to the FPA

- Messages

- 18,760

Monthly

As Reuters the yen slipped to a 10-day low against the dollar on Friday after speculators unwound some safe-haven trades following encouraging U.S. economic data and on hopes for a diplomatic initiative seeking an end to violence in Ukraine. The dollar traded at 102.39 yen , and has ticked up in the past five sessions from a three-week low of 101.32 yen. Worries about tensions in Ukraine, which have prompted some safe-haven buying of the yen, eased somewhat on Thursday after the United States, Russia, Ukraine and the European Union called for an immediate halt to violence. Further, U.S. data pointed to activity regaining momentum after disruptions due to harsh winter weather. New claims for jobless benefits hovered near their pre-recession levels last week and manufacturing in the Mid-Atlantic region accelerated in April.

"There are signs of a pick-up in the U.S. economy markets have been long waiting for," said Shinichiro Kadota, chief forex strategist at Barclays Bank in Tokyo. Trading was subdued on Friday as many centres were closed for Easter, although Tokyo markets were open.

The euro was at $1.3814, little changed over the past few sessions. It hit a 2-1/2-year high near $1.40 last month, and since then a number of European Central Bank officials have tried to talk it down given concerns that a strong currency could derail the euro zone's fragile economic recovery. The latest was Executive Board member Yves Mersch, who said a sustained appreciation in the euro would inevitably trigger a reaction from the ECB. Last weekend, ECB President Mario Draghi identified the euro's strength as a possible trigger for easing policy. "The euro, if given the chance, tends to rise. The only really effective measure to counter the currency's strength would be quantitative easing," said Masafumi Yamamoto, market strategist at Providentia Strategy in Tokyo. "The ECB will want see the European Supreme Court approve the Outright Monetary Transactions first before it adopts quantitative easing. This may not take place until September at the earliest, and it will likely try to buy time until then." Outright Monetary Transactions (OMT) is the ECB's as-yet-unused "unlimited" bond-buying scheme, its flagship emergency measure against the euro zone's debt crisis. The German court took the unprecedented decision in February to defer the ruling regarding the OMT's legality to the European Court of Justice in Strasbourg.

Sterling hit a 4-1/2-year high of $1.6842 on Thursday, after better-than-expected UK jobless data bolstered expectations the Bank of England may have to raise interest rates earlier than its peers. On Friday it had eased back to $1.6785.

Technical

On monthly chart our major concern stands around breakout moment of 1.3830 Fib resistance and Agreement. That is also long-term downward trendline. We see that market has challenged this level twice already, but still stands below it and April action doesn’t look impressive yet here. In fact market stands in tight range since 2014. Thus, 1.33-1.3850 area is an area of “indecision”. While market stands inside of it we can talk about neither upward breakout nor downward reversal. At least, reversal identification could be done with yearly pivot – if market will move below it, this could be early sign of changing sentiment. But, as you can see, nothing among this issues have happened yet. The same has happened on previous week. Only 2 weeks ago we’ve disccused, as it was seemed, downward bounce out from 1.3850 level. But today we see that price has returned right back up to it.

Returning to discussion of Yearly Pivot - we’ve noted that upward bounce has started precisely from 1.3475 level. Now the major question stands as follows – whether this upward action is a confirmation of long-term bullish sentiment or just a respect of YPP first touch. Following the chart we see very useful combination for us – YPP stands very close to 1.33 – our invalidation point. And if market will move below YPP this will become bearish moment by itself.

Speaking about upward continuation, market mechanics does not allow price to show any deep retracement any more. Any move of this kind should be treated as market weakness and it will increase probability of reversal down. Take a look that as market has hit minor 0.618 AB-CD extension target right at rock hard resistance – Fib level and Agreement and former yearly PR1, it has shown reasonable bounce down to 1.33. As retracement after 0.618 target already has happened, it is unlogical and unreasonable to see another deep bounce and if it will happen - it will look suspicious.

So, speaking about monthly upside targets... If we will get finally real break through resistance, we have two major targets – AB=CD one around 1.44 and Yearly PR1 = 1.4205.

Thus, here we can make following conclusion – nothing drastical yet, market still coiling near resistance and we can continue to stick with working range for nearest perspective on monthly chart – an area between YPP=1.3475 and resistance around 1.3850. Monthly chart can’t give us direction yet and we need to find something else to trade on lower time frame charts.

Weekly

On passed week market has shown solid recovery. In fact, as we’ve seen on monthly chart, and on the weekly – if you will contract chart, we will get long-term wedge. Usually wedges are reversal or exhausting patterns, but sometimes they could be broken in unexpected direction. Anyway, any breakout usually accompanied by strong acceleration.

At the same time we have completed bearish butterfly pattern that suggests deeper retracement down, at least to 3/8 Fib support of whole butterfly action. This level stands at 1.35-1.3520 K-support area and Yearly Pivot. Previously we’ve made suggestion that market could show some respect and bounce up as reaction on current support area, but after that some downward continuation should follow. Major concern was about how this will happen. Looks like now we could get an answer. Although recent week was very tight and inside session to solid previous recovery, this week has become bearish stop grabber on weekly chart. It tells us that market should at least take out former lows and to form AB=CD down. Depending on how fast this move will be – may be later we will switch to 1.27 target that creates an Agreement precisely with minimum target of butterfly and weekly K-support.

What is interesting is that current situation coincides with fundamental atmosphere around EUR. As we’ve noted in the beginning of recearch – any signs of EUR appreciation will trigger monetary easing steps from ECB. Thus, it will press on market participants and could help downward action on EUR.

Thus, as we have bearish pattern on weekly accompanied by divergence – our direction is down, until market either will not complete it or grabber will fail.

Daily

Here I give you absolutely the same picture as on previous week. Price action on recent week has made poor attempts to move higher and we already have discussed why. Take a look that price has not even totally closed the gap. Price has formed long shadows and finally closed below MPP. There two interesting moments here. First is – why we use AB=CD target, but not, say, 0.618 extension? Mostly because we have weekly grabber and it suggests taking out the lows. Recent move up (our BC leg) was higher than 0.618 Fib resistance and has reached 0.768 Fib level. Hence, downward 0.618 extension stands above recent highs and doesn’t match overall situation. Second moment is oversold level – it stands very close to AB=CD target.

4-hour

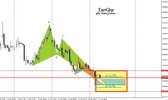

After DRPO “Sell” on previous week, here we have perfect “222” Gartley Sell pattern. AB-CD retracement up was perfect as in term of speed of legs, as in terms of distance. Major resistance where market has turned down was Fib level and gap area. Also take a look at MACD. It shows some upward slope while price action stands flat and even has started some downward action. The recent spike up around 1.3865 is our invalidation point, since this is the top of weekly grabber pattern.

1-hour

Here we have to decide where to enter short. To be honest currently we can’t definitely predict whether there will be any retracement up and how strong it will be. Since move down just has started market could just test WPP and go. At the same time we can’t totally exlcude possible retracement inside the body of the grabber. I such situations when you have solid pattern that you ready to follow, but have blur entry picture – the better way to act is to use scale-in technique. Thus, try to take small position around WPP. If market will continue higher add more on some Fib levels.

Conclusion:

While price stands in 1.33-1.38 area we can’t speak either on upward or downward breakout. Market continues to coiling inside of this range and April action does not look promising yet. Although we’ve seen solid upward recovery on recent week but currently this is insufficient to speak about long-term upward continuation.

Thus, until major question stands unclear – what will follow on big picture, we will focus on tactical trading, based on clear patterns. Thus, our major attention sticks with weekly bearish grabber pattern.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.

As Reuters the yen slipped to a 10-day low against the dollar on Friday after speculators unwound some safe-haven trades following encouraging U.S. economic data and on hopes for a diplomatic initiative seeking an end to violence in Ukraine. The dollar traded at 102.39 yen , and has ticked up in the past five sessions from a three-week low of 101.32 yen. Worries about tensions in Ukraine, which have prompted some safe-haven buying of the yen, eased somewhat on Thursday after the United States, Russia, Ukraine and the European Union called for an immediate halt to violence. Further, U.S. data pointed to activity regaining momentum after disruptions due to harsh winter weather. New claims for jobless benefits hovered near their pre-recession levels last week and manufacturing in the Mid-Atlantic region accelerated in April.

"There are signs of a pick-up in the U.S. economy markets have been long waiting for," said Shinichiro Kadota, chief forex strategist at Barclays Bank in Tokyo. Trading was subdued on Friday as many centres were closed for Easter, although Tokyo markets were open.

The euro was at $1.3814, little changed over the past few sessions. It hit a 2-1/2-year high near $1.40 last month, and since then a number of European Central Bank officials have tried to talk it down given concerns that a strong currency could derail the euro zone's fragile economic recovery. The latest was Executive Board member Yves Mersch, who said a sustained appreciation in the euro would inevitably trigger a reaction from the ECB. Last weekend, ECB President Mario Draghi identified the euro's strength as a possible trigger for easing policy. "The euro, if given the chance, tends to rise. The only really effective measure to counter the currency's strength would be quantitative easing," said Masafumi Yamamoto, market strategist at Providentia Strategy in Tokyo. "The ECB will want see the European Supreme Court approve the Outright Monetary Transactions first before it adopts quantitative easing. This may not take place until September at the earliest, and it will likely try to buy time until then." Outright Monetary Transactions (OMT) is the ECB's as-yet-unused "unlimited" bond-buying scheme, its flagship emergency measure against the euro zone's debt crisis. The German court took the unprecedented decision in February to defer the ruling regarding the OMT's legality to the European Court of Justice in Strasbourg.

Sterling hit a 4-1/2-year high of $1.6842 on Thursday, after better-than-expected UK jobless data bolstered expectations the Bank of England may have to raise interest rates earlier than its peers. On Friday it had eased back to $1.6785.

Technical

On monthly chart our major concern stands around breakout moment of 1.3830 Fib resistance and Agreement. That is also long-term downward trendline. We see that market has challenged this level twice already, but still stands below it and April action doesn’t look impressive yet here. In fact market stands in tight range since 2014. Thus, 1.33-1.3850 area is an area of “indecision”. While market stands inside of it we can talk about neither upward breakout nor downward reversal. At least, reversal identification could be done with yearly pivot – if market will move below it, this could be early sign of changing sentiment. But, as you can see, nothing among this issues have happened yet. The same has happened on previous week. Only 2 weeks ago we’ve disccused, as it was seemed, downward bounce out from 1.3850 level. But today we see that price has returned right back up to it.

Returning to discussion of Yearly Pivot - we’ve noted that upward bounce has started precisely from 1.3475 level. Now the major question stands as follows – whether this upward action is a confirmation of long-term bullish sentiment or just a respect of YPP first touch. Following the chart we see very useful combination for us – YPP stands very close to 1.33 – our invalidation point. And if market will move below YPP this will become bearish moment by itself.

Speaking about upward continuation, market mechanics does not allow price to show any deep retracement any more. Any move of this kind should be treated as market weakness and it will increase probability of reversal down. Take a look that as market has hit minor 0.618 AB-CD extension target right at rock hard resistance – Fib level and Agreement and former yearly PR1, it has shown reasonable bounce down to 1.33. As retracement after 0.618 target already has happened, it is unlogical and unreasonable to see another deep bounce and if it will happen - it will look suspicious.

So, speaking about monthly upside targets... If we will get finally real break through resistance, we have two major targets – AB=CD one around 1.44 and Yearly PR1 = 1.4205.

Thus, here we can make following conclusion – nothing drastical yet, market still coiling near resistance and we can continue to stick with working range for nearest perspective on monthly chart – an area between YPP=1.3475 and resistance around 1.3850. Monthly chart can’t give us direction yet and we need to find something else to trade on lower time frame charts.

Weekly

On passed week market has shown solid recovery. In fact, as we’ve seen on monthly chart, and on the weekly – if you will contract chart, we will get long-term wedge. Usually wedges are reversal or exhausting patterns, but sometimes they could be broken in unexpected direction. Anyway, any breakout usually accompanied by strong acceleration.

At the same time we have completed bearish butterfly pattern that suggests deeper retracement down, at least to 3/8 Fib support of whole butterfly action. This level stands at 1.35-1.3520 K-support area and Yearly Pivot. Previously we’ve made suggestion that market could show some respect and bounce up as reaction on current support area, but after that some downward continuation should follow. Major concern was about how this will happen. Looks like now we could get an answer. Although recent week was very tight and inside session to solid previous recovery, this week has become bearish stop grabber on weekly chart. It tells us that market should at least take out former lows and to form AB=CD down. Depending on how fast this move will be – may be later we will switch to 1.27 target that creates an Agreement precisely with minimum target of butterfly and weekly K-support.

What is interesting is that current situation coincides with fundamental atmosphere around EUR. As we’ve noted in the beginning of recearch – any signs of EUR appreciation will trigger monetary easing steps from ECB. Thus, it will press on market participants and could help downward action on EUR.

Thus, as we have bearish pattern on weekly accompanied by divergence – our direction is down, until market either will not complete it or grabber will fail.

Daily

Here I give you absolutely the same picture as on previous week. Price action on recent week has made poor attempts to move higher and we already have discussed why. Take a look that price has not even totally closed the gap. Price has formed long shadows and finally closed below MPP. There two interesting moments here. First is – why we use AB=CD target, but not, say, 0.618 extension? Mostly because we have weekly grabber and it suggests taking out the lows. Recent move up (our BC leg) was higher than 0.618 Fib resistance and has reached 0.768 Fib level. Hence, downward 0.618 extension stands above recent highs and doesn’t match overall situation. Second moment is oversold level – it stands very close to AB=CD target.

4-hour

After DRPO “Sell” on previous week, here we have perfect “222” Gartley Sell pattern. AB-CD retracement up was perfect as in term of speed of legs, as in terms of distance. Major resistance where market has turned down was Fib level and gap area. Also take a look at MACD. It shows some upward slope while price action stands flat and even has started some downward action. The recent spike up around 1.3865 is our invalidation point, since this is the top of weekly grabber pattern.

1-hour

Here we have to decide where to enter short. To be honest currently we can’t definitely predict whether there will be any retracement up and how strong it will be. Since move down just has started market could just test WPP and go. At the same time we can’t totally exlcude possible retracement inside the body of the grabber. I such situations when you have solid pattern that you ready to follow, but have blur entry picture – the better way to act is to use scale-in technique. Thus, try to take small position around WPP. If market will continue higher add more on some Fib levels.

Conclusion:

While price stands in 1.33-1.38 area we can’t speak either on upward or downward breakout. Market continues to coiling inside of this range and April action does not look promising yet. Although we’ve seen solid upward recovery on recent week but currently this is insufficient to speak about long-term upward continuation.

Thus, until major question stands unclear – what will follow on big picture, we will focus on tactical trading, based on clear patterns. Thus, our major attention sticks with weekly bearish grabber pattern.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.