Sive Morten

Special Consultant to the FPA

- Messages

- 18,655

Fundamentals

Today we try to cover two major topics - coming changes in ECB policy and current situation on UK economy. This week few important numbers have been released, UK GDP in particular, which makes strong impact on GBP and could trigger long-lasting effect. On technical part we take a look at GBP, since on EUR picture stands the same through the week.

First, let's take a brief look on this week events. As Reuters reports, on Thursday as risk sentiment rose after resilient Chinese trade data and as Beijing’s efforts to slow a slide in the value of the renminbi encouraged investors to buy riskier currencies.

Data showed Chinese exports rose 3.3% in July from a year earlier, while analysts had looked for a fall of 2%. Policymakers meanwhile fixed the daily value of the yuan at a firmer level than many had expected, even though it was beyond the 7 per dollar level for the first time since the global financial crisis.

“The recent comments from Chinese officials suggest they want to stabilise their currency, otherwise a sharp currency drop may fuel capital outflows,” said Manuel Oliveri, an FX strategist at Credit Agricole in London.

“The other factor helping risk sentiment is a growing swathe of central bank cuts.”

Those rate cuts have helped soothe sentiment this week among investors anxious about the downside risks to the global economy from a trade conflict between Washington and Beijing.

Trade war worries and the prospect of early elections in Italy and Britain hit European markets hard on Friday, while the search for safety left gold on course for its best week in three years, Japan’s yen near an eight-month high and bonds surging.

A turbulent week dominated by a symbolic drop in China’s currency was not finished yet. A report that Washington was delaying a decision about allowing some trade between U.S. companies and Huawei again spooked Asia .

Europe then plunged lower due to a 2.4% slump in Italian stocks after Matteo Salvini, the leader of one of the country’s ruling parties, the League, pulled his support for the governing coalition on Thursday.

Snap elections have been likely for months, but markets were jarred by the speed at which Salvini – who had previously insisted the government would last its full five years – pushed for a new poll.

“Those who waste time hurt the country,” the League said in a statement as it presented a no-confidence motion to the Senate in Rome.

Investors dumped Italian government debt, pushing yields — which move inversely to prices — on Rome’s 10-year bonds up 26 basis points to 1.8%, the biggest daily increase in over a year.

“It has been a very volatile week,” said Elwin de Groot, Rabobank’s head of macro strategy.

“Until recently, the markets’ view was that this trade war will be resolved, but clearly now the thinking is that maybe this is not the case and it could be accelerating from here,” and Italy and Brexit worries are now adding to that, he said.

U.S. President Donald Trump on Friday said he was not ready to make a deal with China and even called a September round of trade talks into question, reviving concerns on financial markets that the bilateral dispute is unlikely to end anytime soon.

Trump also sowed confusion by saying that the United States would not do business with Chinese telecoms giant Huawei Technologies, only to have a White House official later clarify that he was referring to a ban on U.S. government purchases of Huawei equipment, not requests for sales by U.S. companies, which are still being assessed.

“We’re talking with China. We’re not ready to make a deal - but we’ll see what happens,” Trump told reporters at the White House before departing for fundraisers on Long Island, New York.

“China wants to do something, but I’m not ready to do anything yet. Twenty-five years of abuse - I’m not ready so fast, so we’ll see how that works out,” he said.

Next is UK situation. Sterling’s recent slide is not yet over as the chances Britain and the European Union part ways without a withdrawal deal have jumped again after arch-Brexiteer Boris Johnson took over as prime minister last month, a Reuters poll found.

Johnson, who was the face of the leave campaign ahead of the 2016 referendum and who took office on July 24, has repeatedly said he will take Britain out of the EU on Oct. 31 with or without a deal. Sterling fell to a low against the dollar not seen since early 2017 at the start of August.

Before that divorce date arrives, the pound will fall further and trade between $1.17 and $1.20, a Reuters poll of foreign exchange strategists predicted, below the $1.21 it was at on Wednesday.

“Fears of a no deal Brexit are likely to worsen, though we anticipate it will be avoided. Our official house view is that there will be a delay, but kicking the can down the road doesn’t ease uncertainty,” said Jane Foley, head of FX strategy at Rabobank and the most accurate forecaster for major currencies in Reuters FX polls last year.

Britain was originally due to leave the EU at the end of March but the departure date was extended.

The median forecast for a disorderly Brexit - whereby no deal is agreed - jumped in an Aug. 2-7 Reuters poll of economists to 35%, up from 30% given in July and the highest since Reuters began asking this question two years ago.

Forecasts in this poll ranged from as low as 15% to a high of 75%.

“Until now, it was difficult to know what a Johnson-led government would do about Brexit, given his indecisiveness, unpredictability and, at times, conflicting messages on Brexit,” said Daniel Vernazza, chief international economist at UniCredit.

“However, it now seems pretty clear that Boris Johnson’s strategy is to try to force through a no-deal Brexit on October 31,” Vernazza, who does not expect Johnson to succeed, added.

Economists in Reuters polls since the June 2016 referendum have consistently warned a no-deal Brexit would be the worst outcome for Britain’s economy.

But as they have since late 2016 when Reuters first started asking about the most likely eventual outcome, a strong majority of economists polled still think the two sides will eventually settle on a free-trade deal.

Again in second place was the more extreme option of leaving without a deal and trading under World Trade Organization rules.

The third most likely outcome was Britain remaining a member of the European Economic Area, paying into the EU budget to maintain access to the Single Market yet having no say over policy. Fourth place once more went to cancelling Brexit.

With a deal expected, median forecasts in the wider poll of over 50 forex market watchers gave a healthier outlook for sterling and it was expected to have rallied to $1.27 in six months and then be trading 10% higher at $1.33 in a year.

Against the euro, which may struggle as the European Central Bank is expected to ease policy in September, the pound will also gain ground. On Wednesday, one euro was worth about 92.1 pence but in a year, the poll said it would drop to 87.1p.

Brexit worries and a U.S.-China trade war have increased concern about a global downturn and Britain’s economy has struggled to gain traction.

Growth flatlined last quarter, the poll predicted, and the economy will expand only 0.3% per quarter through to the end of next year, a touch weaker than predicted last month.

However the country will probably dodge a recession - the median likelihood of one within a year was put at 35% and at 40% for one in two years, up five percentage points each from last month.

Other major economies are being supported by central banks easing - or about to ease - policy. But the Bank of England is not expected to change its key rate until 2021.

At its policy meeting last week the Bank lowered its growth forecasts due to increased Brexit worries and a slowing global economy, but stopped short of following other central banks and considering an interest rate cut.

Only 12 of 55 economists polled with a view on Bank Rate expected a cut this year or next and 19 had an increase pencilled in.

“While the buoyant wage growth backdrop means it is too early to be talking about Bank of England rate cuts, the increasingly uncertain Brexit outlook means it is very unlikely that policymakers will be looking at tightening policy in the foreseeable future either,” said James Smith, developed markets economist at ING.

But on Friday, sterling skidded again, hitting its lowest in more than two years, after an unexpected second quarter contraction in the economy alarmed investors already fretting that Britain is headed for a no-deal Brexit.

Britain’s economy shrank at a quarterly rate of 0.2%, the first contraction since 2012 and below all forecasts in a Reuters poll.

Year-on-year economic growth slid to 1.2% from 1.8% in the first quarter, Britain’s Office for National Statistics said, its weakest showing since the start of 2018.

British government bond yields fell as investors sought safety in fixed income assets.

Some investors now expect Britain to enter a technical recession, which represents two consecutive quarters of negative growth, if the economic situation continues to worsen.

“Overall, these are clearly a disappointing set of figures which have significantly raised the likelihood of a technical recession,” said Azad Zangana, senior European economist and strategist at Schroders.

BNP Paribas raised on Friday the probability of a no-deal Brexit to 50% from 40%. Some analysts say there could be more pain to come.

“As the political risk premium rose, sterling was the worst-performing major currency in each of May, June and July, but the negative risk premium can still rise further,” RBC Capital Markets analyst Adam Cole said.

Johnson is planning to hold a parliamentary election in the days after Brexit if lawmakers sink the government with a no-confidence vote, British media have reported, further unnerving currency traders.

It is growing increasingly likely that Johnson will face a vote of no confidence soon after Sept. 3, when parliament returns from its summer recess, analysts say.

Vasileios Gkionakis, global head of forex strategy at Lombard Odier, said he was worried about an election, but was also ready to unload some sterling short positions he had accumulated since a lot of bad news had been already priced in.

“If no-deal (Brexit) increases in probability, then of course sterling would be a sell, but until then I’m becoming a bit more neutral,” Gkionakis said, adding that he expects sterling to “settle around $1.20” before market participants reassess their expectations of that outcome.

Others in the market mirrored Gkionakis’ views on Friday.

Paul Hollingsworth, senior European economist at BNP Paribas, said he was “reluctant to enter short sterling positions” and that he found “risk-reward more attractive to consider entering structural long sterling positions as we get closer to September”.

The shrinking economic growth in the second quarter did not make investors more confident that the Bank of England will cut interest rates in September. Some economists expect the central bank to embark on more easing soon, however.

“As uncertainty continues to loom over the UK economy, the difficult run of data is expected to continue and the BoE will need to consider its next step carefully as its global peers embark on further rate cuts,” said Geoffrey Yu, head of the UK Investment Office at UBS Wealth Management.

Money markets are pricing in a 25 basis point cut by January 2020.

Before we turn to analysis of ECB policy, let's make some conclusion from information that we have on UK. In general all things that we've talked previously are correct. First, BoE view on UK economy and its policy is lagged behind real situation. They are too optimistic on perspective and undervalue negative factors that hurt UK economy. This mismatch is confirmed by UK Guilt yields, which are dropping consistently in recent few months and shows "real" interest rate that match to current economy conditions. Recent "surprising" GDP drop also confirms this view.

Second, the major view on Brexit perspective still is "no deal" scenario, but here we have new factor. Actually, not quite new, as we've mentioned it in recent report, but still... This is possible "vote of no confidence" to B. Johnson as soon as in September, when Parliament should return back to work. By analysts view, this could make impact on GBP/USD performance and trigger solid retracement, at least until new information on Brexit and Prime Minister will appear.

By looking at CFTC data, we see that bearish net position has reached its ultimate level, which also stands in favor of possible retracement and contraction of short positions. It means that investors could turn to profit taking slightly in advance of Sep. 3rd, trying to fix profit and turn to cash until situation around B. Johnson voting will become clear. This is very important information for us.

Source: cftc.gov

Charting by Investing.com

This combination of factors makes us suggest two things. First is, our long-term bearish scenario stands intact and GBP should continue dropping. BoE should match its policy to reality which also will be dovish factor for GBP, supporting bearish trend. Second - in coming 3-6 weeks solid upside retracement is possible, as investors will try to protect themselves from political uncertainty and oversold situation on GBP.

Speaking on future ECB policy, Fathom consulting provides new update.

Based on ECB minutes protocol that has been released recently, Fathom concludes that it mostly corresponds to M. Draghi speech and suggest more dovish tools from the ECB in the future.

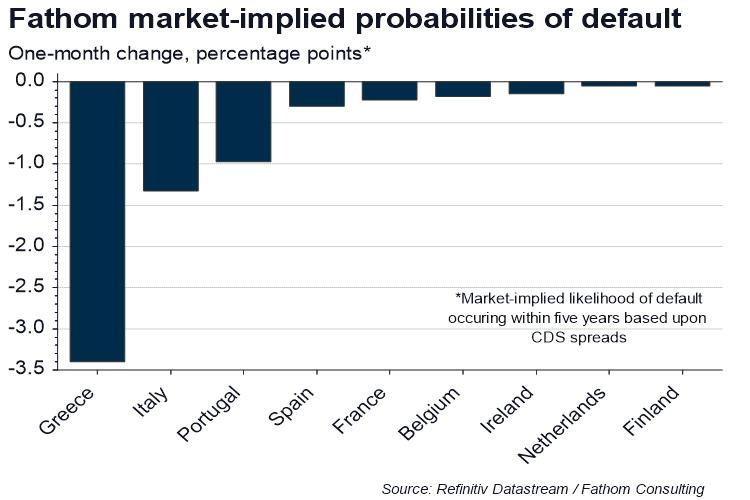

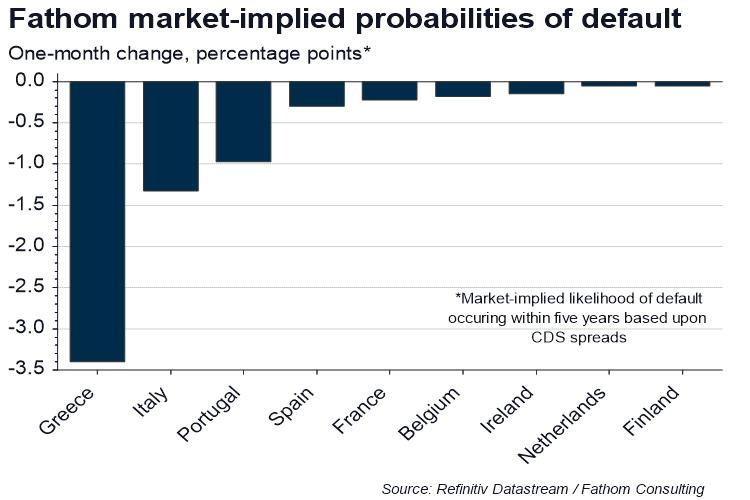

Fathom now expects the ECB to ease policy through some combination of asset purchases and the introduction of a system of tiered deposit rates. The growing likelihood of further loosening has been reflected in bond markets, with the yield on ten-year Bunds falling roughly 90 basis points over the past twelve months. The prospect of yields remaining lower for longer has been interpreted as good news for the public finances of the peripheral economies, with Fathom’s proprietary probability of default indicators showing that, in most countries, the market-implied likelihood of a sovereign default has continued to fall.

Thus, speaking on EUR/USD rate, it seems that it is determined by dovishness degree between Fed and ECB. Now, all eyes on Fed September meeting where another rate cut is widely expected. Although probability has dropped from 98% to 85% within two weeks. It is almost the month till the meeting, so, situation could change more, especially on background that tariffs make weaker effect compares to what was suggested initially, even on Chinese economy. Our opinion is the same - we think that Fed will not be led by the nose by markets this time and follow its own strategy that was announced in July. They have one rate cut in reserve, and probably they will safe it for future, as economy data shows no necessity to cut the rate in September.

Technicals

Monthly

Monthly chart shows no signs that could make us doubt on bearish long-term setup by far. Market has free space between 1.20 lows and our 1.1335 butterfly target. Breaking YPS1 confirms existence of long-term bear trend as well.

In longer-term perspective market stands with our all time AB-CD pattern. COP target and following retracement are done. Now CD leg continues and in long-term perspective, we have OP target at 0.95 level.

Still, taking in consideration new inputs of coming September 3rd political risk and overextension of bearish positions, as well as solid distance to 1.13 area - we suggest that market could start something around 1.20 lows.

Weekly

Here is another hint for us. Last week we've agreed to keep an eye on COP target, which is also 1.27 butterfly extension. Market has spent some time there in flat on daily chart, but no retracement has started.

OP target of our AB-CD pattern stands too far, around 1.14, but 1.18 butterfly extension could be useful for us. We suggest that it should be amount of stops below 1.20, which could let market to hit 1.18 target once they will be triggered. At the same time, we need to keep an eye on reversal there, fake 1.20 breakout (aka Wash&Rinse) or something of this kind. GBP stands oversold on weekly chart, which also supports this idea. That's being said - 1.18-1.20 area is the one that we will work on coming week:

Daily

Unfortunately we have nothing interesting on daily chart. All our targets and extensions have been hit and passed. No clear patterns have been formed yet. So, here we could only put the Fib levels, and try to estimate upside retracement target. Since we have a deal with a butterfly - 1.25 K-area is the first that corresponds it, as butterfly should shows at least 3/8 retracement. Besides, MPR1 and previous weekly lows also stand at the same area. Thus, this is our first destination point, if suggestion on upside reversal will become correct.

Intraday

On intraday charts is nothing to talk about by far. We will need them when 1.20 lows will be challenged and market shows first reaction. Some bullish reversal pattern should be formed around 1.20, or in 1.18-1.20 area, if our suggestion is correct.

Conclusion:

Analysis of fundamental factors this week confirms existing of bearish sentiment and we keep our long-term bearish view on GBP. In longer term perspective we expect that GBP will trade lower due Brexit culmination and more adopted BoE policy which now stands out of reality a bit. Technically, we have two targets - 1.13 and 0.95.

In shorter-term perspective, 2-5 weeks probably, we expect fake 1.20 breakout and upside bounce due overextended speculative position on GBP which stands at all time lows and possible "vote on confidence" of BJ in Parliament in September. Despite results on voting and whether it will happen or not at all, investors should try to insure this risk and temporary cut short positions. Technical analysis also supports this view as market stands oversold on weekly chart and near 1.18 target and 1.20 lows.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.

Today we try to cover two major topics - coming changes in ECB policy and current situation on UK economy. This week few important numbers have been released, UK GDP in particular, which makes strong impact on GBP and could trigger long-lasting effect. On technical part we take a look at GBP, since on EUR picture stands the same through the week.

First, let's take a brief look on this week events. As Reuters reports, on Thursday as risk sentiment rose after resilient Chinese trade data and as Beijing’s efforts to slow a slide in the value of the renminbi encouraged investors to buy riskier currencies.

Data showed Chinese exports rose 3.3% in July from a year earlier, while analysts had looked for a fall of 2%. Policymakers meanwhile fixed the daily value of the yuan at a firmer level than many had expected, even though it was beyond the 7 per dollar level for the first time since the global financial crisis.

“The recent comments from Chinese officials suggest they want to stabilise their currency, otherwise a sharp currency drop may fuel capital outflows,” said Manuel Oliveri, an FX strategist at Credit Agricole in London.

“The other factor helping risk sentiment is a growing swathe of central bank cuts.”

Those rate cuts have helped soothe sentiment this week among investors anxious about the downside risks to the global economy from a trade conflict between Washington and Beijing.

Trade war worries and the prospect of early elections in Italy and Britain hit European markets hard on Friday, while the search for safety left gold on course for its best week in three years, Japan’s yen near an eight-month high and bonds surging.

A turbulent week dominated by a symbolic drop in China’s currency was not finished yet. A report that Washington was delaying a decision about allowing some trade between U.S. companies and Huawei again spooked Asia .

Europe then plunged lower due to a 2.4% slump in Italian stocks after Matteo Salvini, the leader of one of the country’s ruling parties, the League, pulled his support for the governing coalition on Thursday.

Snap elections have been likely for months, but markets were jarred by the speed at which Salvini – who had previously insisted the government would last its full five years – pushed for a new poll.

“Those who waste time hurt the country,” the League said in a statement as it presented a no-confidence motion to the Senate in Rome.

Investors dumped Italian government debt, pushing yields — which move inversely to prices — on Rome’s 10-year bonds up 26 basis points to 1.8%, the biggest daily increase in over a year.

“It has been a very volatile week,” said Elwin de Groot, Rabobank’s head of macro strategy.

“Until recently, the markets’ view was that this trade war will be resolved, but clearly now the thinking is that maybe this is not the case and it could be accelerating from here,” and Italy and Brexit worries are now adding to that, he said.

U.S. President Donald Trump on Friday said he was not ready to make a deal with China and even called a September round of trade talks into question, reviving concerns on financial markets that the bilateral dispute is unlikely to end anytime soon.

Trump also sowed confusion by saying that the United States would not do business with Chinese telecoms giant Huawei Technologies, only to have a White House official later clarify that he was referring to a ban on U.S. government purchases of Huawei equipment, not requests for sales by U.S. companies, which are still being assessed.

“We’re talking with China. We’re not ready to make a deal - but we’ll see what happens,” Trump told reporters at the White House before departing for fundraisers on Long Island, New York.

“China wants to do something, but I’m not ready to do anything yet. Twenty-five years of abuse - I’m not ready so fast, so we’ll see how that works out,” he said.

Next is UK situation. Sterling’s recent slide is not yet over as the chances Britain and the European Union part ways without a withdrawal deal have jumped again after arch-Brexiteer Boris Johnson took over as prime minister last month, a Reuters poll found.

Johnson, who was the face of the leave campaign ahead of the 2016 referendum and who took office on July 24, has repeatedly said he will take Britain out of the EU on Oct. 31 with or without a deal. Sterling fell to a low against the dollar not seen since early 2017 at the start of August.

Before that divorce date arrives, the pound will fall further and trade between $1.17 and $1.20, a Reuters poll of foreign exchange strategists predicted, below the $1.21 it was at on Wednesday.

“Fears of a no deal Brexit are likely to worsen, though we anticipate it will be avoided. Our official house view is that there will be a delay, but kicking the can down the road doesn’t ease uncertainty,” said Jane Foley, head of FX strategy at Rabobank and the most accurate forecaster for major currencies in Reuters FX polls last year.

Britain was originally due to leave the EU at the end of March but the departure date was extended.

The median forecast for a disorderly Brexit - whereby no deal is agreed - jumped in an Aug. 2-7 Reuters poll of economists to 35%, up from 30% given in July and the highest since Reuters began asking this question two years ago.

Forecasts in this poll ranged from as low as 15% to a high of 75%.

“Until now, it was difficult to know what a Johnson-led government would do about Brexit, given his indecisiveness, unpredictability and, at times, conflicting messages on Brexit,” said Daniel Vernazza, chief international economist at UniCredit.

“However, it now seems pretty clear that Boris Johnson’s strategy is to try to force through a no-deal Brexit on October 31,” Vernazza, who does not expect Johnson to succeed, added.

Economists in Reuters polls since the June 2016 referendum have consistently warned a no-deal Brexit would be the worst outcome for Britain’s economy.

But as they have since late 2016 when Reuters first started asking about the most likely eventual outcome, a strong majority of economists polled still think the two sides will eventually settle on a free-trade deal.

Again in second place was the more extreme option of leaving without a deal and trading under World Trade Organization rules.

The third most likely outcome was Britain remaining a member of the European Economic Area, paying into the EU budget to maintain access to the Single Market yet having no say over policy. Fourth place once more went to cancelling Brexit.

With a deal expected, median forecasts in the wider poll of over 50 forex market watchers gave a healthier outlook for sterling and it was expected to have rallied to $1.27 in six months and then be trading 10% higher at $1.33 in a year.

Against the euro, which may struggle as the European Central Bank is expected to ease policy in September, the pound will also gain ground. On Wednesday, one euro was worth about 92.1 pence but in a year, the poll said it would drop to 87.1p.

Brexit worries and a U.S.-China trade war have increased concern about a global downturn and Britain’s economy has struggled to gain traction.

Growth flatlined last quarter, the poll predicted, and the economy will expand only 0.3% per quarter through to the end of next year, a touch weaker than predicted last month.

However the country will probably dodge a recession - the median likelihood of one within a year was put at 35% and at 40% for one in two years, up five percentage points each from last month.

Other major economies are being supported by central banks easing - or about to ease - policy. But the Bank of England is not expected to change its key rate until 2021.

At its policy meeting last week the Bank lowered its growth forecasts due to increased Brexit worries and a slowing global economy, but stopped short of following other central banks and considering an interest rate cut.

Only 12 of 55 economists polled with a view on Bank Rate expected a cut this year or next and 19 had an increase pencilled in.

“While the buoyant wage growth backdrop means it is too early to be talking about Bank of England rate cuts, the increasingly uncertain Brexit outlook means it is very unlikely that policymakers will be looking at tightening policy in the foreseeable future either,” said James Smith, developed markets economist at ING.

But on Friday, sterling skidded again, hitting its lowest in more than two years, after an unexpected second quarter contraction in the economy alarmed investors already fretting that Britain is headed for a no-deal Brexit.

Britain’s economy shrank at a quarterly rate of 0.2%, the first contraction since 2012 and below all forecasts in a Reuters poll.

Year-on-year economic growth slid to 1.2% from 1.8% in the first quarter, Britain’s Office for National Statistics said, its weakest showing since the start of 2018.

British government bond yields fell as investors sought safety in fixed income assets.

Some investors now expect Britain to enter a technical recession, which represents two consecutive quarters of negative growth, if the economic situation continues to worsen.

“Overall, these are clearly a disappointing set of figures which have significantly raised the likelihood of a technical recession,” said Azad Zangana, senior European economist and strategist at Schroders.

BNP Paribas raised on Friday the probability of a no-deal Brexit to 50% from 40%. Some analysts say there could be more pain to come.

“As the political risk premium rose, sterling was the worst-performing major currency in each of May, June and July, but the negative risk premium can still rise further,” RBC Capital Markets analyst Adam Cole said.

Johnson is planning to hold a parliamentary election in the days after Brexit if lawmakers sink the government with a no-confidence vote, British media have reported, further unnerving currency traders.

It is growing increasingly likely that Johnson will face a vote of no confidence soon after Sept. 3, when parliament returns from its summer recess, analysts say.

Vasileios Gkionakis, global head of forex strategy at Lombard Odier, said he was worried about an election, but was also ready to unload some sterling short positions he had accumulated since a lot of bad news had been already priced in.

“If no-deal (Brexit) increases in probability, then of course sterling would be a sell, but until then I’m becoming a bit more neutral,” Gkionakis said, adding that he expects sterling to “settle around $1.20” before market participants reassess their expectations of that outcome.

Others in the market mirrored Gkionakis’ views on Friday.

Paul Hollingsworth, senior European economist at BNP Paribas, said he was “reluctant to enter short sterling positions” and that he found “risk-reward more attractive to consider entering structural long sterling positions as we get closer to September”.

The shrinking economic growth in the second quarter did not make investors more confident that the Bank of England will cut interest rates in September. Some economists expect the central bank to embark on more easing soon, however.

“As uncertainty continues to loom over the UK economy, the difficult run of data is expected to continue and the BoE will need to consider its next step carefully as its global peers embark on further rate cuts,” said Geoffrey Yu, head of the UK Investment Office at UBS Wealth Management.

Money markets are pricing in a 25 basis point cut by January 2020.

Before we turn to analysis of ECB policy, let's make some conclusion from information that we have on UK. In general all things that we've talked previously are correct. First, BoE view on UK economy and its policy is lagged behind real situation. They are too optimistic on perspective and undervalue negative factors that hurt UK economy. This mismatch is confirmed by UK Guilt yields, which are dropping consistently in recent few months and shows "real" interest rate that match to current economy conditions. Recent "surprising" GDP drop also confirms this view.

Second, the major view on Brexit perspective still is "no deal" scenario, but here we have new factor. Actually, not quite new, as we've mentioned it in recent report, but still... This is possible "vote of no confidence" to B. Johnson as soon as in September, when Parliament should return back to work. By analysts view, this could make impact on GBP/USD performance and trigger solid retracement, at least until new information on Brexit and Prime Minister will appear.

By looking at CFTC data, we see that bearish net position has reached its ultimate level, which also stands in favor of possible retracement and contraction of short positions. It means that investors could turn to profit taking slightly in advance of Sep. 3rd, trying to fix profit and turn to cash until situation around B. Johnson voting will become clear. This is very important information for us.

Source: cftc.gov

Charting by Investing.com

This combination of factors makes us suggest two things. First is, our long-term bearish scenario stands intact and GBP should continue dropping. BoE should match its policy to reality which also will be dovish factor for GBP, supporting bearish trend. Second - in coming 3-6 weeks solid upside retracement is possible, as investors will try to protect themselves from political uncertainty and oversold situation on GBP.

Speaking on future ECB policy, Fathom consulting provides new update.

Based on ECB minutes protocol that has been released recently, Fathom concludes that it mostly corresponds to M. Draghi speech and suggest more dovish tools from the ECB in the future.

Fathom now expects the ECB to ease policy through some combination of asset purchases and the introduction of a system of tiered deposit rates. The growing likelihood of further loosening has been reflected in bond markets, with the yield on ten-year Bunds falling roughly 90 basis points over the past twelve months. The prospect of yields remaining lower for longer has been interpreted as good news for the public finances of the peripheral economies, with Fathom’s proprietary probability of default indicators showing that, in most countries, the market-implied likelihood of a sovereign default has continued to fall.

Thus, speaking on EUR/USD rate, it seems that it is determined by dovishness degree between Fed and ECB. Now, all eyes on Fed September meeting where another rate cut is widely expected. Although probability has dropped from 98% to 85% within two weeks. It is almost the month till the meeting, so, situation could change more, especially on background that tariffs make weaker effect compares to what was suggested initially, even on Chinese economy. Our opinion is the same - we think that Fed will not be led by the nose by markets this time and follow its own strategy that was announced in July. They have one rate cut in reserve, and probably they will safe it for future, as economy data shows no necessity to cut the rate in September.

Technicals

Monthly

Monthly chart shows no signs that could make us doubt on bearish long-term setup by far. Market has free space between 1.20 lows and our 1.1335 butterfly target. Breaking YPS1 confirms existence of long-term bear trend as well.

In longer-term perspective market stands with our all time AB-CD pattern. COP target and following retracement are done. Now CD leg continues and in long-term perspective, we have OP target at 0.95 level.

Still, taking in consideration new inputs of coming September 3rd political risk and overextension of bearish positions, as well as solid distance to 1.13 area - we suggest that market could start something around 1.20 lows.

Weekly

Here is another hint for us. Last week we've agreed to keep an eye on COP target, which is also 1.27 butterfly extension. Market has spent some time there in flat on daily chart, but no retracement has started.

OP target of our AB-CD pattern stands too far, around 1.14, but 1.18 butterfly extension could be useful for us. We suggest that it should be amount of stops below 1.20, which could let market to hit 1.18 target once they will be triggered. At the same time, we need to keep an eye on reversal there, fake 1.20 breakout (aka Wash&Rinse) or something of this kind. GBP stands oversold on weekly chart, which also supports this idea. That's being said - 1.18-1.20 area is the one that we will work on coming week:

Daily

Unfortunately we have nothing interesting on daily chart. All our targets and extensions have been hit and passed. No clear patterns have been formed yet. So, here we could only put the Fib levels, and try to estimate upside retracement target. Since we have a deal with a butterfly - 1.25 K-area is the first that corresponds it, as butterfly should shows at least 3/8 retracement. Besides, MPR1 and previous weekly lows also stand at the same area. Thus, this is our first destination point, if suggestion on upside reversal will become correct.

Intraday

On intraday charts is nothing to talk about by far. We will need them when 1.20 lows will be challenged and market shows first reaction. Some bullish reversal pattern should be formed around 1.20, or in 1.18-1.20 area, if our suggestion is correct.

Conclusion:

Analysis of fundamental factors this week confirms existing of bearish sentiment and we keep our long-term bearish view on GBP. In longer term perspective we expect that GBP will trade lower due Brexit culmination and more adopted BoE policy which now stands out of reality a bit. Technically, we have two targets - 1.13 and 0.95.

In shorter-term perspective, 2-5 weeks probably, we expect fake 1.20 breakout and upside bounce due overextended speculative position on GBP which stands at all time lows and possible "vote on confidence" of BJ in Parliament in September. Despite results on voting and whether it will happen or not at all, investors should try to insure this risk and temporary cut short positions. Technical analysis also supports this view as market stands oversold on weekly chart and near 1.18 target and 1.20 lows.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.