Sive Morten

Special Consultant to the FPA

- Messages

- 18,699

Fundamentals

Reuters reports The dollar gained on Friday as sliding oil prices stirred disinflation fears in the euro zone and Japan, while investors also looked ahead to a heavy week of central bank meetings and the U.S. monthly employment report.

U.S. crude fell 10 percent on Friday on OPEC's decision not to cut output, settling at $66.15 a barrel.

Annual consumer inflation in the euro zone cooled to a five-year low as energy prices fell, suggesting deflation remains a real threat for the European Central Bank. Japan's annual core consumer inflation also slowed for a third straight month in October.

"The expectation that oil prices are going to remain under pressure at least for the next few months, and the disinflation data that came out, confirms that both Japan and the eurozone are struggling with disinflationary pressures that are quite severe. That helped the U.S. dollar stand out," said Martin Schwerdtfeger, a foreign exchange strategist at TD Securities in Toronto.

The euro weakened to $1.2442. The single currency is under pressure ahead of next week’s ECB meeting, where the central bank is expected to signal further action to ward off disinflation.

Central bank meetings are also due in England, Canada and Australia, while the United States will focus on Friday’s employment report for November.

Thursday’s decision not to cut oil output slammed the currencies of oil producing nations.

The Russian rouble weakened to more than 50 to the U.S. dollar in late Friday trade, setting a new all-time low.

The U.S. dollar rallied to more than seven Norwegian crowns for the first time in more than five years.

Investors unwinding positions for year-end may pause the dollar rally, though rising geopolitical tensions if oil prices stay low could favor the greenback.

"It causes pain in a lot of countries ... the response you would expect is not just market volatility, but over the medium-term geopolitical volatility," said Greg Anderson, global head of FX strategy for BMO Capital Markets in New York.

Unfortunately guys, we do not have CFTC data for last week, looks like due Thanksgiving celebration

Technicals

Monthly

Recently we’ve made wide comments on complex situation around EUR. As we’ve said previously EUR right now stands in center of geopolitical and economical turmoil and we have mutual 2-side relations EU-US and EU-Russia. And progress of these relations develops not very positive. Shortly speaking we expect that EUR will continue move down.

We will remind you here major points of our analysis. In EU-US relations there are two topics right now – political and economical. On political side US forces EU to increase pressure on Russia and take disandvantageous steps and measures that primary hurts EU and almost harmless for US. Here we know about sanctions, Mistrale ships question, etc. Simultaneously US is aiming to replace Russia as important and strategic partner for Europe by enforcing “Zone of free trade agreement”. This falsity of ally becomes possible mostly because Europe de facto is not independent but mostly the colony of US. That’s why US freely can give the law to EU.

Economically US and EU drives on opposite courses. Recently Draghi has given a hint that ECB will increase balance to the level of March 2012 and this assumes QE on approximately 3 Trln EUR. And recent comments from ECB make us think that if even this former statement will be tamed, EUR still will remain under pressure. US economy, in turn, now shows signs of improving. The major concern still is lack of inflation. Although Jobs are growing, but wealth of middle class and wages are stagnating.

This makes us think that EUR now stands under double pressure – EU pulls chestnuts out of the fire for US (in relation with Russia) and particularly due this action makes economical pit deeper. What could bit this sorrow?

As a result of blind or coercive following to US policy, EU meets problems with Russia, it’s 3rd largest trading partner. We suggest that situation will become worse, US will demand more and more sanctions from EU upon Russia. But in turn, economical situation EU-Russia stands in relation with geopolicy where US will not accept any compromises. Any ECB efforts on stabilizing of EU economy could be mitigated by new spiral of geopolitical tensions and painful sanctions. That’s why here is our conclusion – hardly real reversal on EUR is possible any time soon.

If you track recent events on this sub, you probably know that Ukraine president continues to accumulate military forces on demarcation line with south-east regions. This line was established by Minsk agreement. After Baden visit to Ukraine Poroshenko has made a statement that no federalization will be on Ukraine and it will remain unitary state. Simultaneously Ukraine wants to join NATO and NATO protocol forbids giving membership to countries that have some problems with territorial integrity. It means that Ukraine will try to resolve it by all means. And it means – war. Any attempt to do it will lead to proportional reply. And this in turn, will force EU to put new sanctions. In fact, US make double impact – it instigates war and particularly by this instigation – force EU apply new sanctions. So, it pulls the strings of both puppets – as EU as Ukraine.

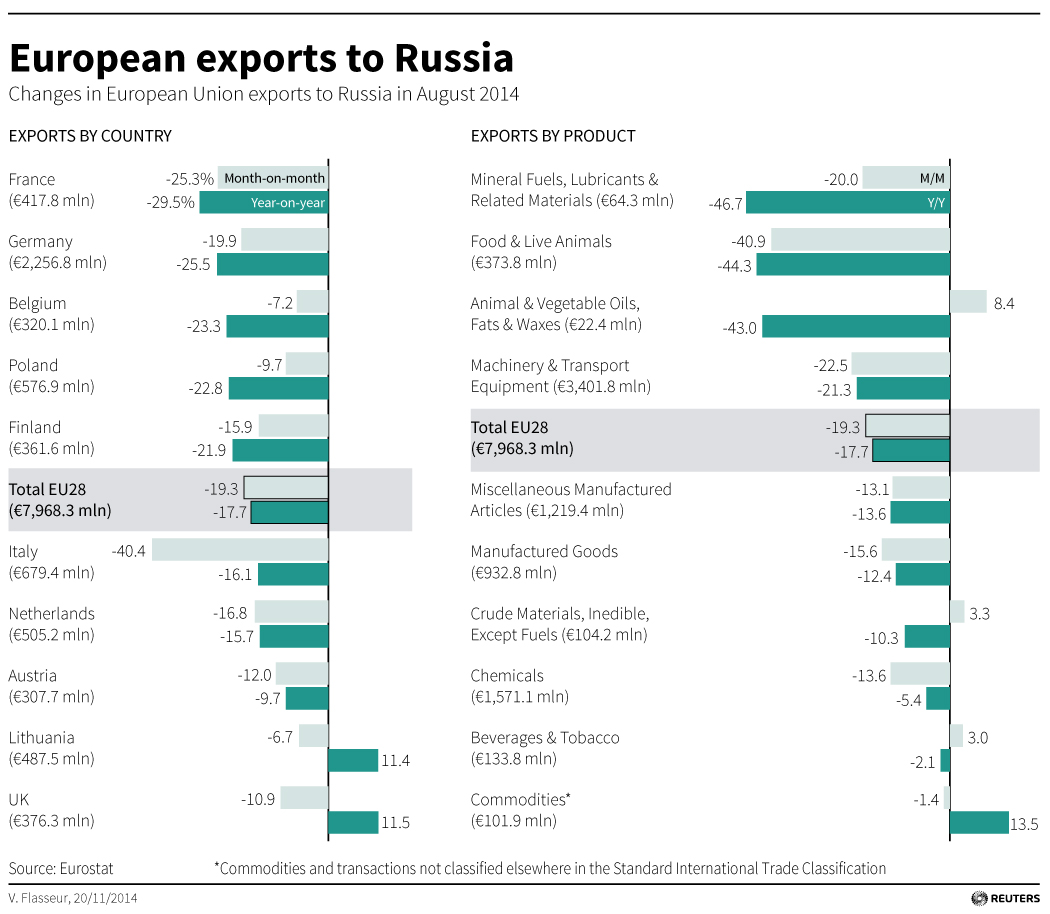

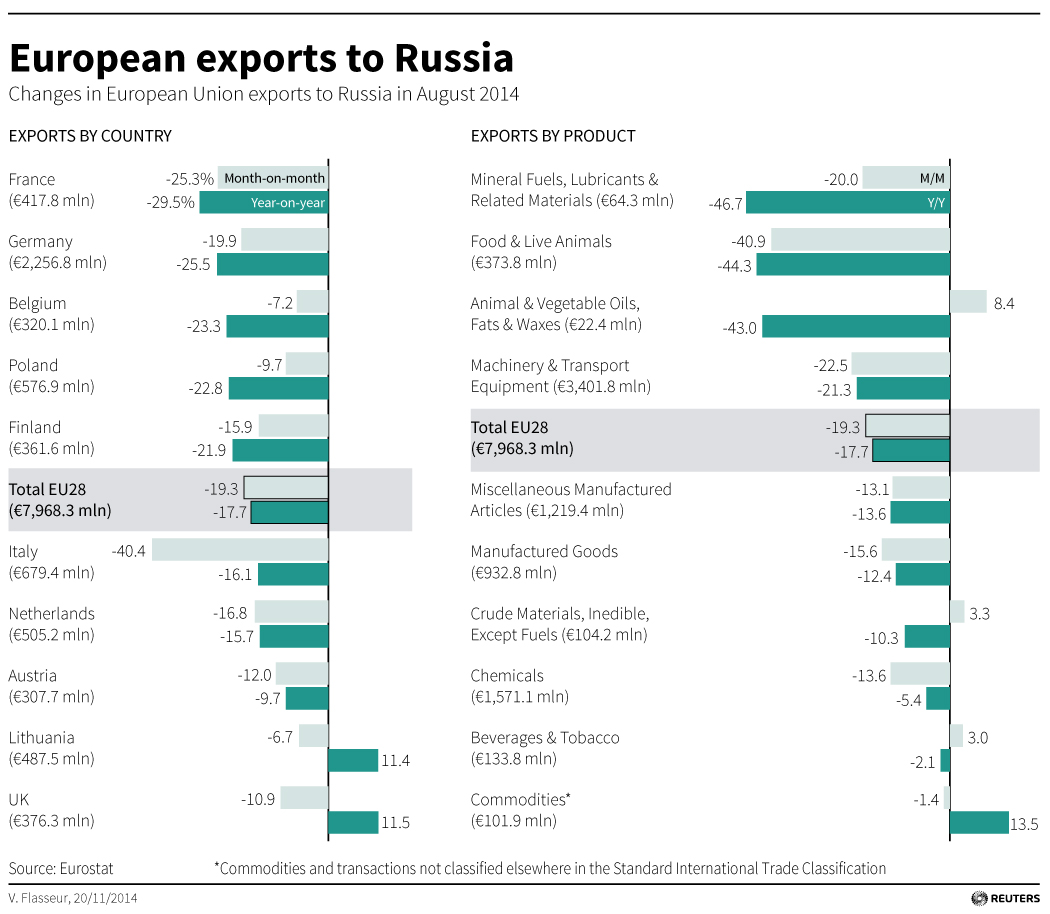

And here guys, results of these sanctions – drop of EU export to Russia. It looks very impressive. But due to events that yet to come – it is difficult to hope on soon EUR strength:

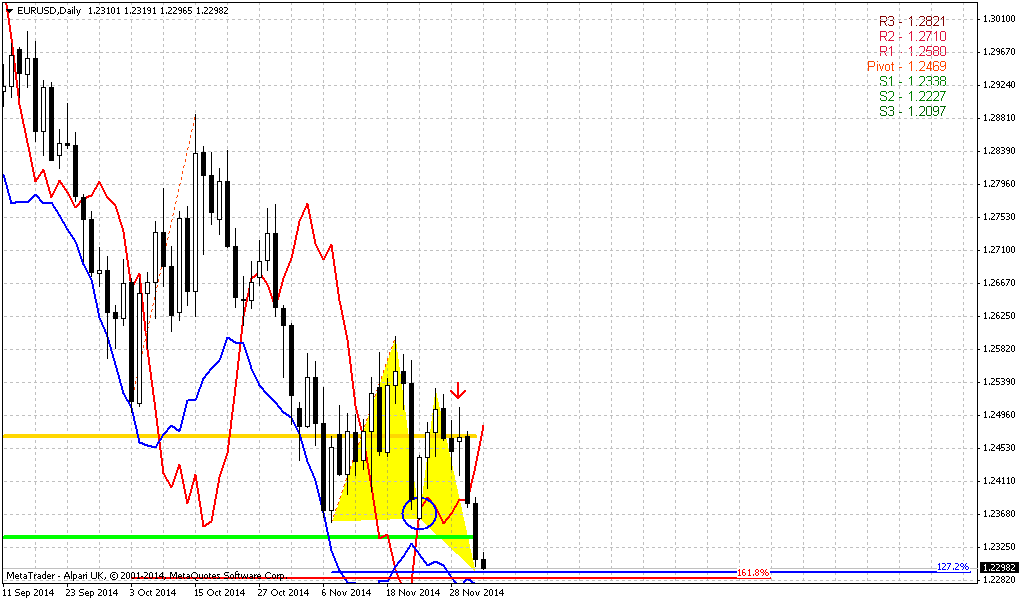

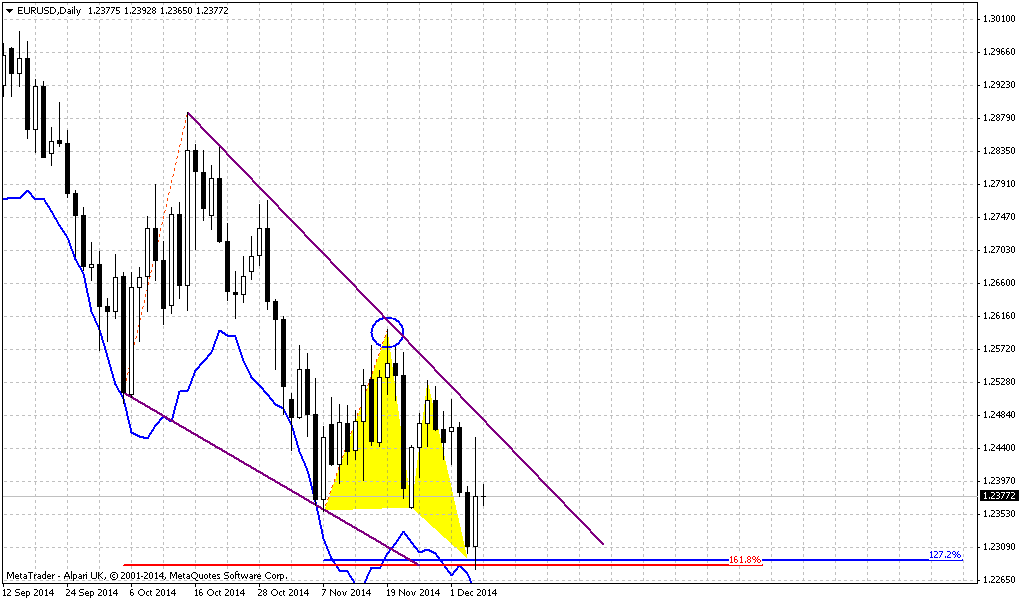

From technical point of view we’ve got another “black” month, trend holds bearish here, but market is not at oversold. Price has broken through all solid supports and right now stands in “free space” area. As we have large Gartley “222” Sell pattern, it nearest target is 1.22 – 0.618 AB-CD objective point. Take a look how harmonic this downside action, the speed of CD and AB legs are almost equal. EUR looks really heavy, month by month it opens at the high close at the low. Currently we see small relief but 1.22 target should be hit. Three black crows pattern and breakout through Yearly Pivot Support 1 suggests that 1.22 is not final target probably, and we should not surprise if we will see decline in next year as well. Only some structural shifts could change situation. In fact 1.22 is some sort of “must” target, but later downward continuation also could follow…

From technical point of view we’ve got another “black” month, trend holds bearish here, but market is not at oversold. Price has broken through all solid supports and right now stands in “free space” area. As we have large Gartley “222” Sell pattern, it nearest target is 1.22 – 0.618 AB-CD objective point. Take a look how harmonic this downside action, the speed of CD and AB legs are almost equal. EUR looks really heavy, month by month it opens at the high close at the low. Currently we see small relief but 1.22 target should be hit. Three black crows pattern and breakout through Yearly Pivot Support 1 suggests that 1.22 is not final target probably, and we should not surprise if we will see decline in next year as well. Only some structural shifts could change situation. In fact 1.22 is some sort of “must” target, but later downward continuation also could follow…

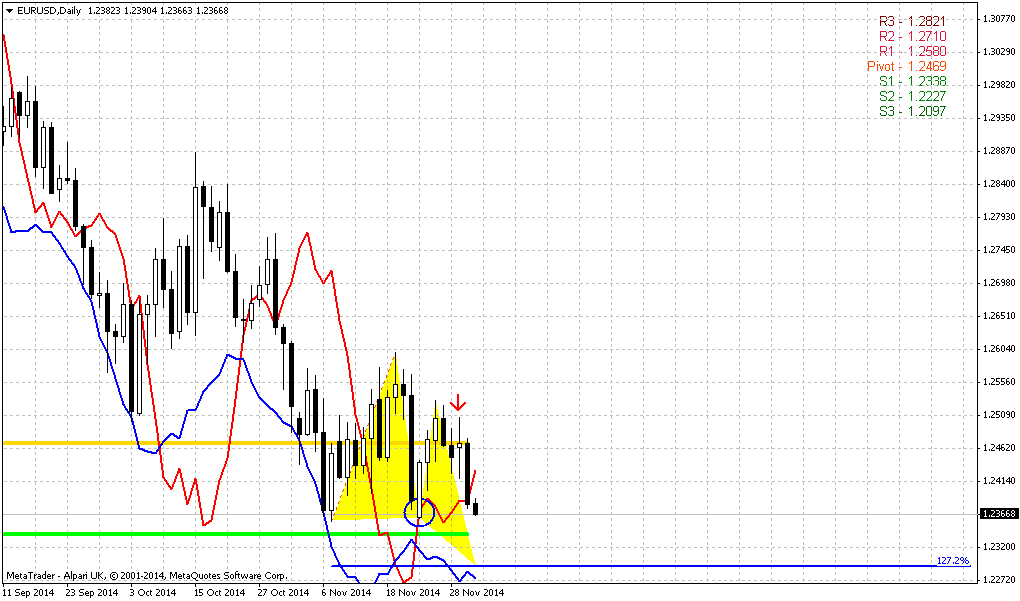

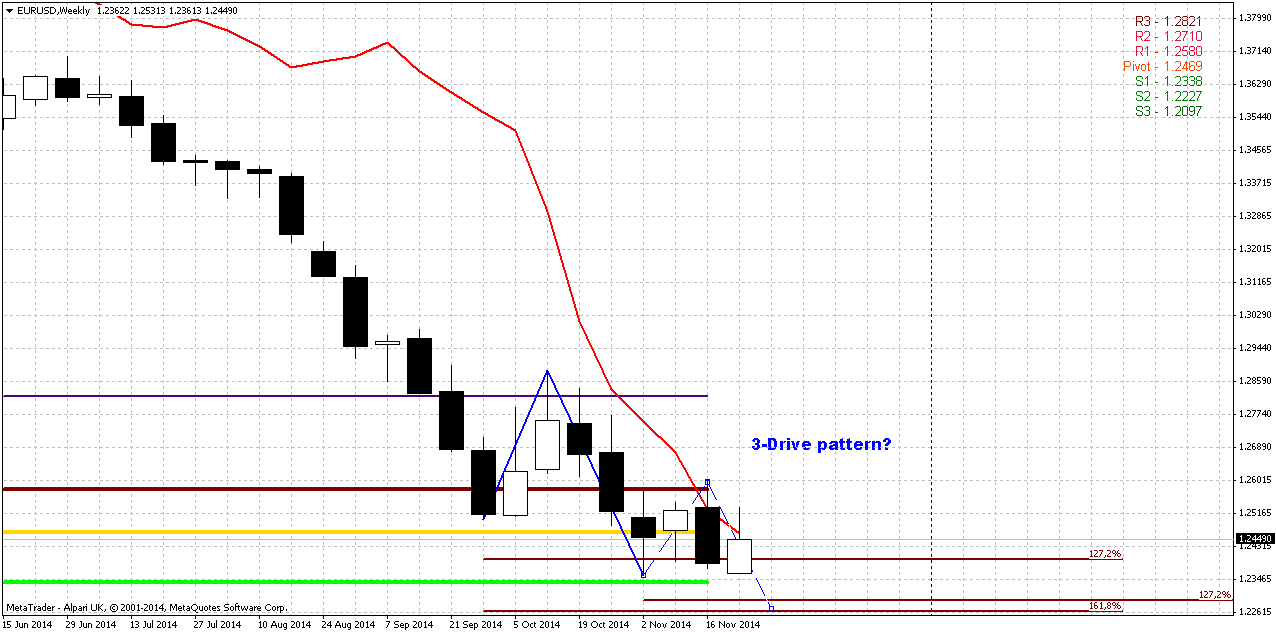

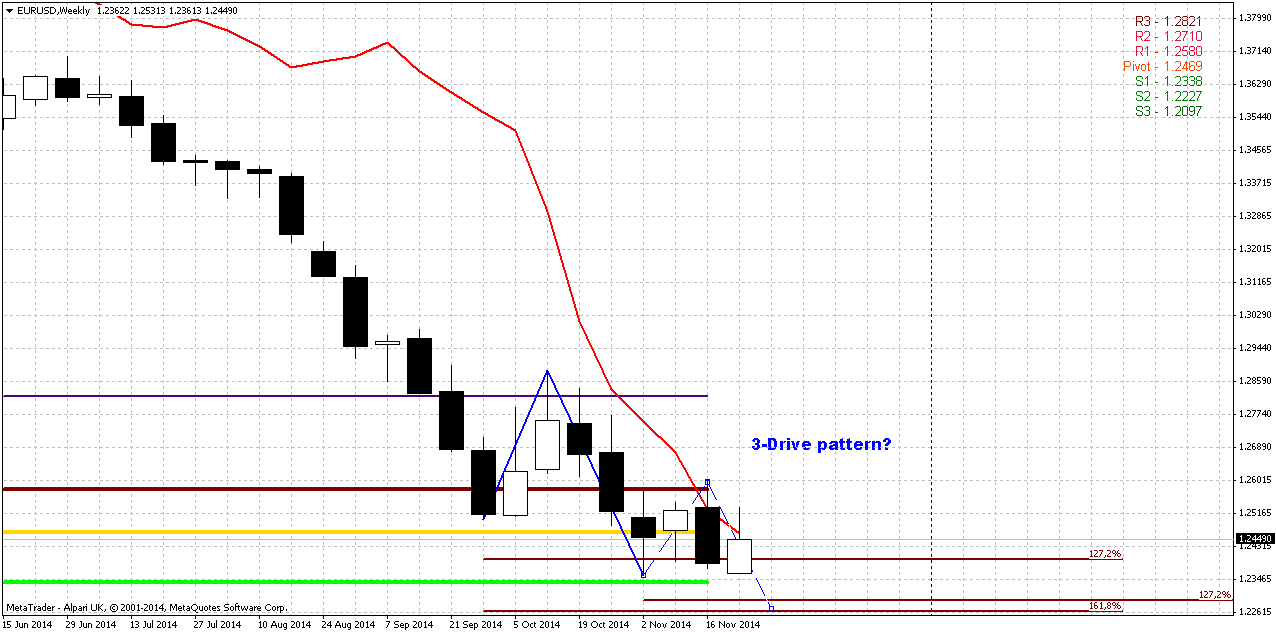

Weekly

Trend is bearish here, as well as on monthly chart. As we ‘ve said many times previously, market has no significant support till 1.22 and nothing could prevent downward action driving by bearish sentiment. Now we have new monthly pivots for December. As market was mostly flat – pivot levels stand very narrow and almost coincide with November ones, at least MPS1. As market still stands at support of MPS1 – this level is probably doomed since we’ve got bearish grabber of previous week and have got another one on last week. Yes, lows stand very close to current price and from that point of view profit potential of grabbers is rather shy, but we’re mostly interested with grabbers as trigger for downward action. Combination of lows’ breakout and abscence of meaningful support probably will lead EUR to our 1.22 target.

At the same time here we have a kind of 3-Drive “Buy” pattern with slightly higher target @ 1.2250. This probably will be our destination for coming week. I tell “a kind of” because it looks a bit small, just few candles with it and I’m not sure that we can treat it as fully-featured 3-Drive. That’s why we probably should focus on 1.22 still.

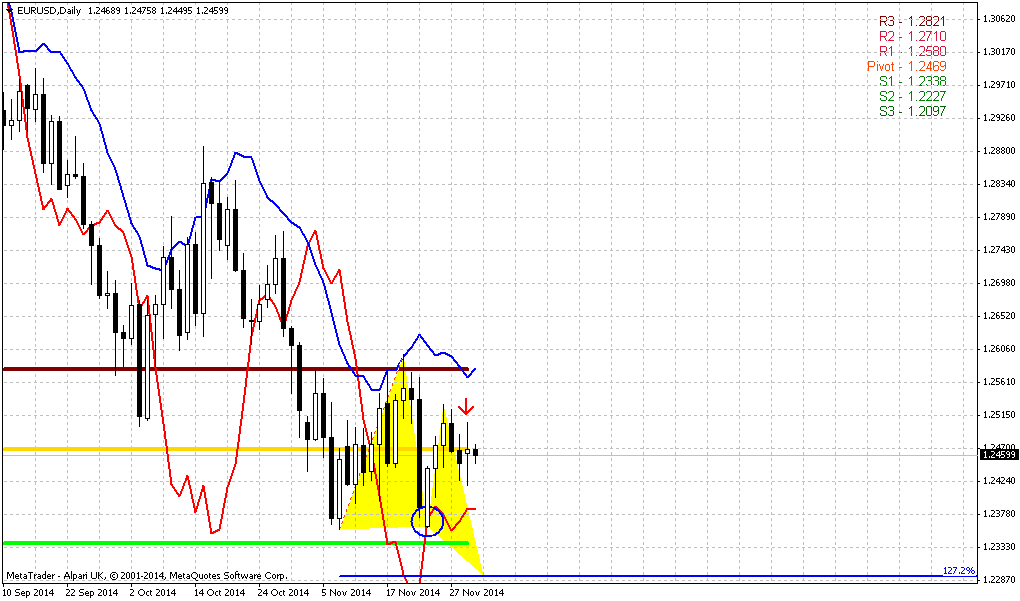

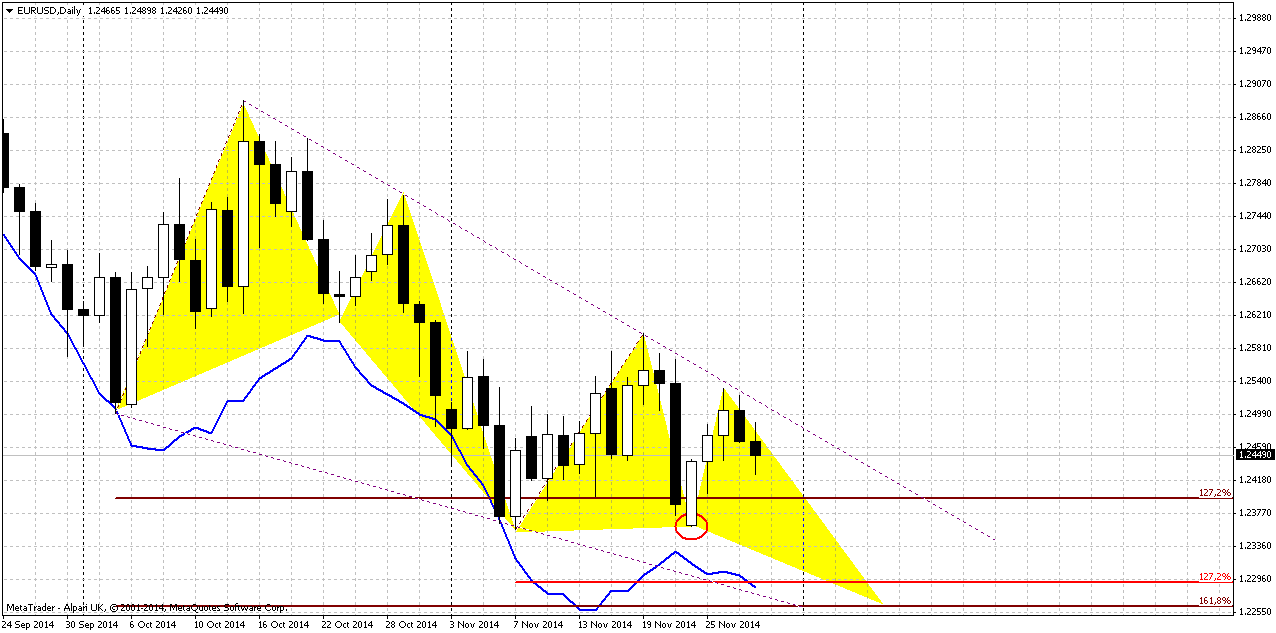

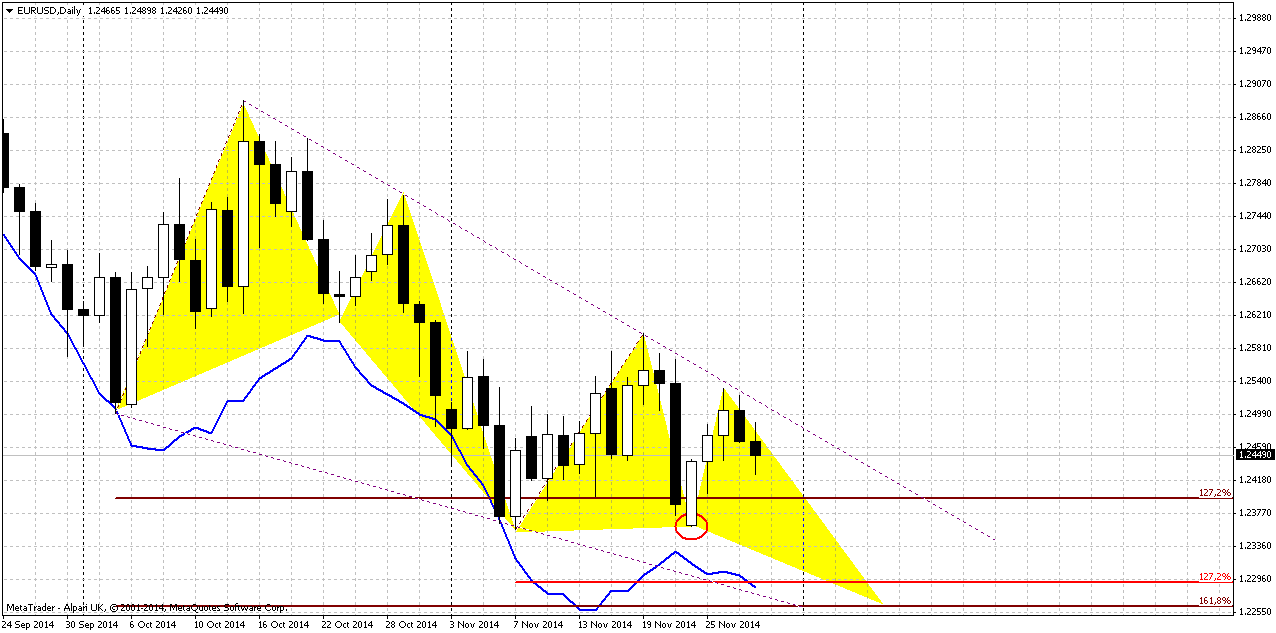

Daily

Here guys, 3-Drive looks a bit more attractive and takes classic shape of wedge and double butterfly. As we’ve got another bearish grabber on weekly – success of daily grabber (in red circle) now seems as remote possibility. Besides, market was not able even to touch November MPP, WPR1 and stayed below major Fib resistance. It confirms validity of current bear trend and probably we should tune on action to 3-Drive target area. As it will be also daily oversold – market could take some pause there. Major event that could lead to either drastical breakout or deep retracement is NFP probably.

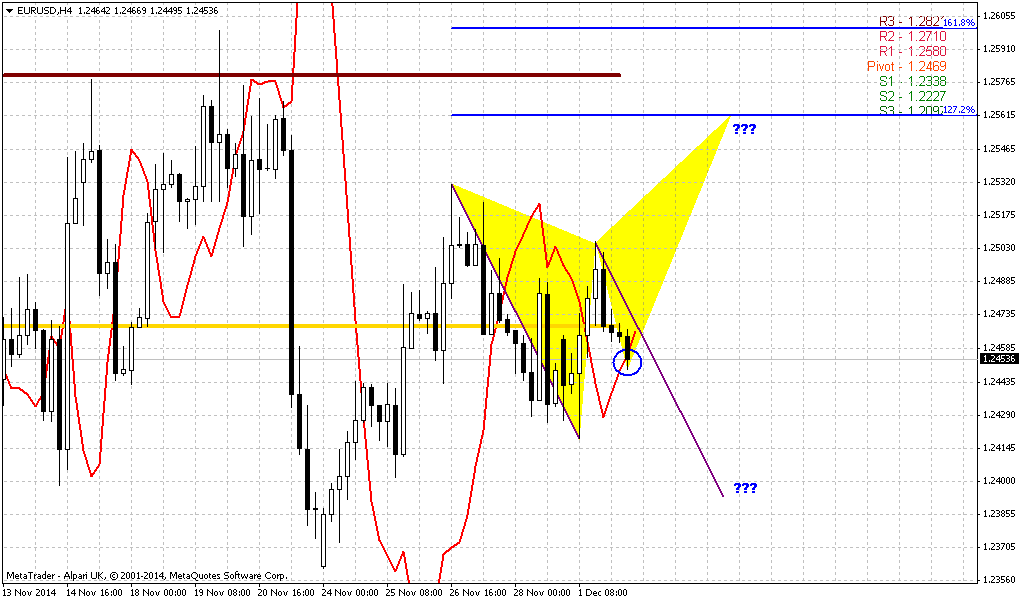

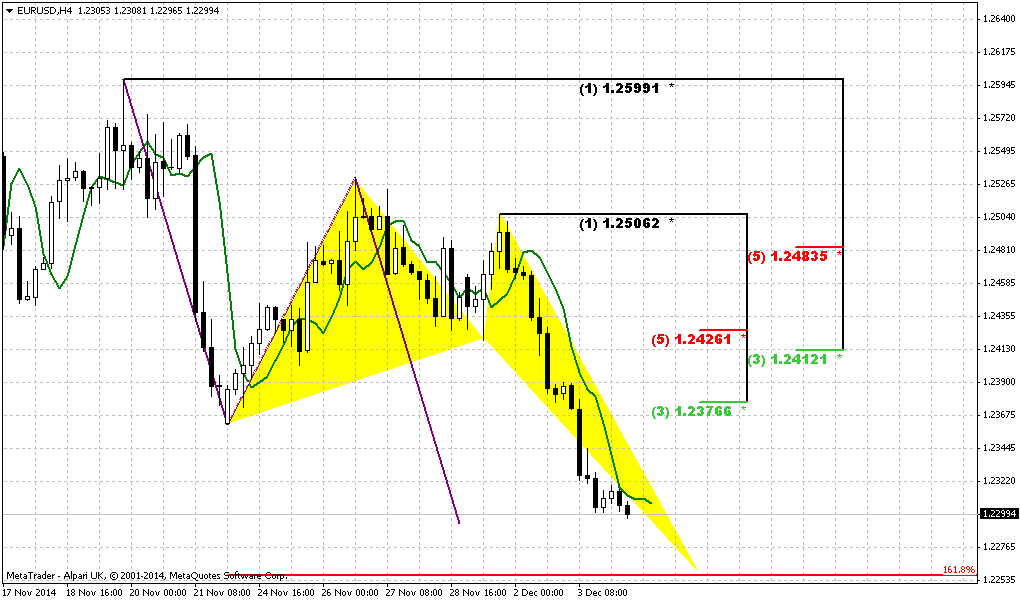

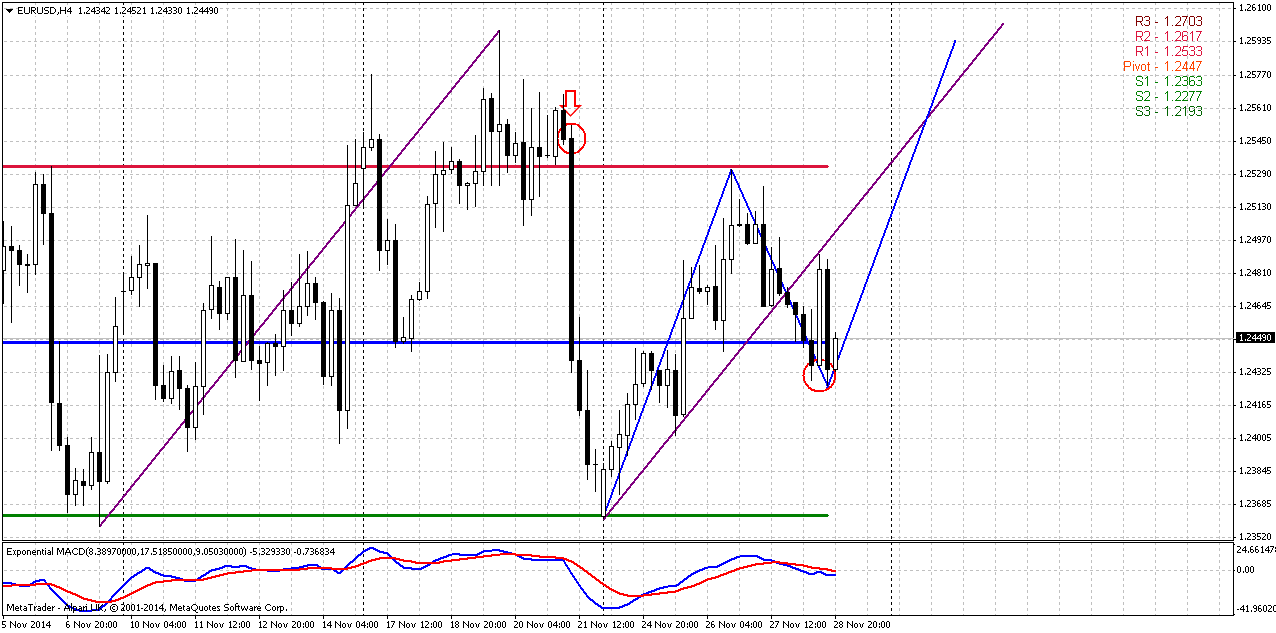

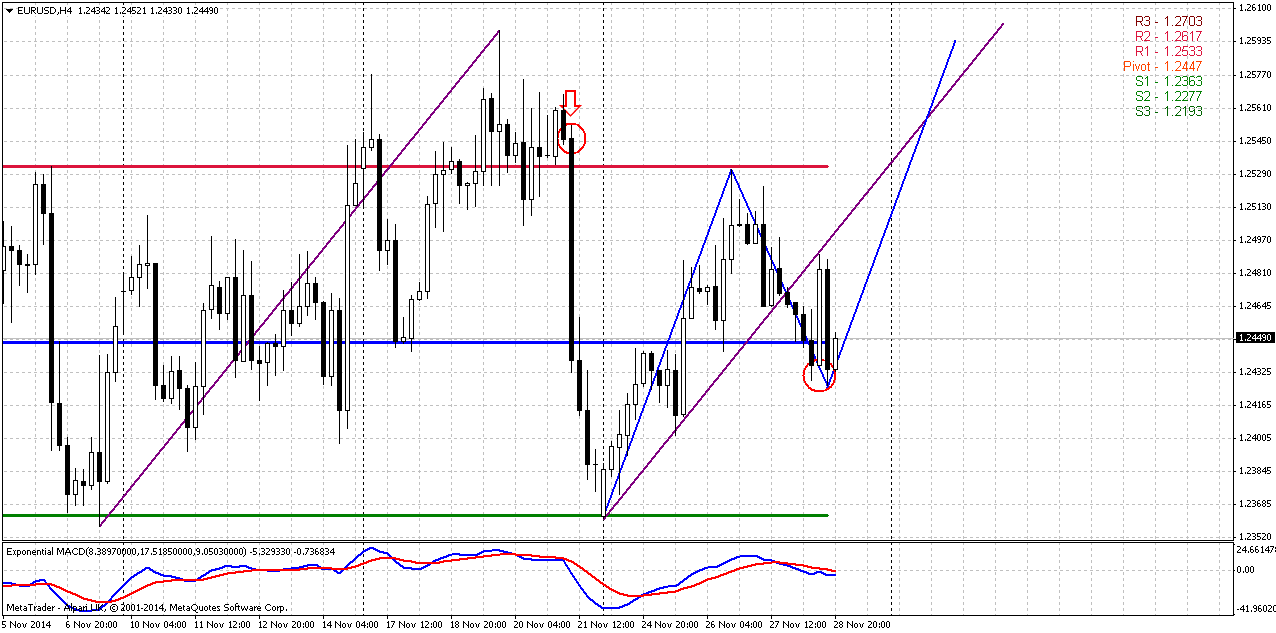

4-hour

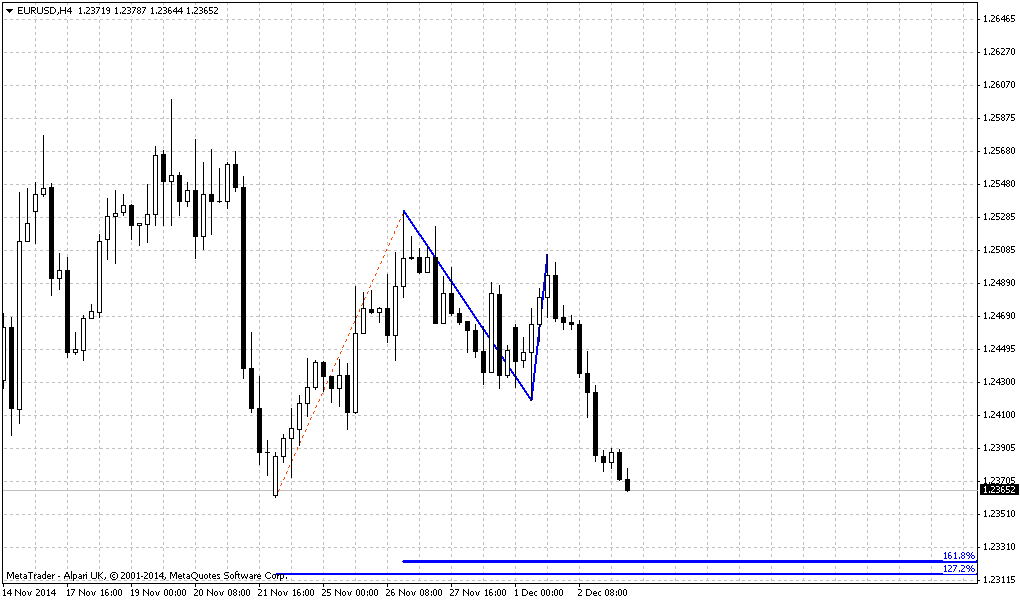

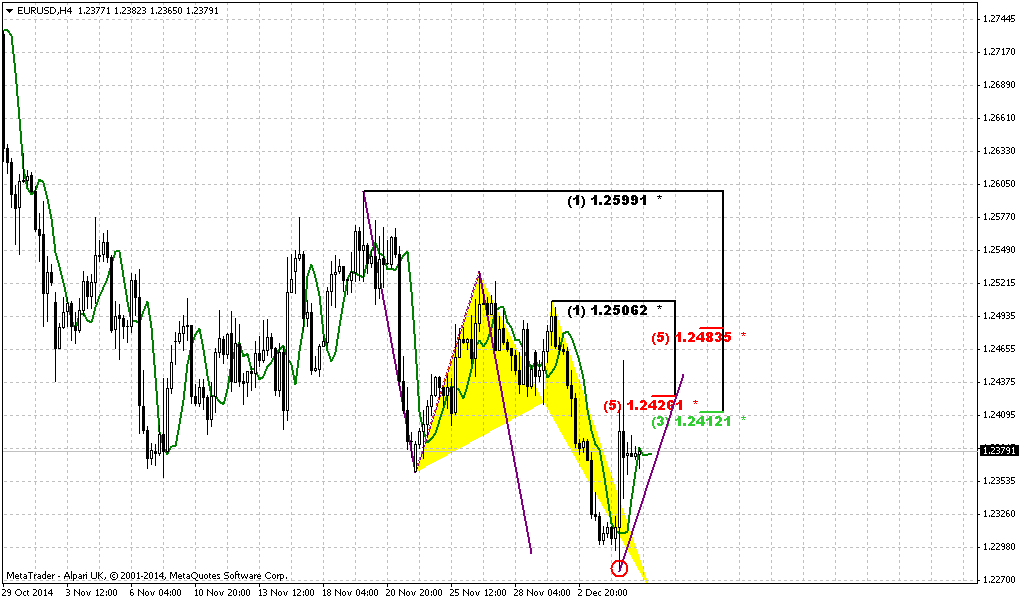

Intraday charts do not give us clear patterns as on higher charts, but we still can find some important moments that could help us with understanding overall situation. Here you can see our picture for possible bullish grabber on daily. We’ve said that if it will work – it probably should form some kind of AB-CD. Later we’ve seen that big CD leg could also take shape of minor inner ab-cd. What do we see right now? Recall that on previous week upside action was held by WPR1 and on Friday market has closed even below WPP. On small ab-cd we see that EUR has tried to start upside action at WPP and 50% support level but failed and returned right back down. At the same time EUR was not able to erase big nasty candle. Trend has turned bearish here. That’s being said that current picture tells that start-up of upside continuation from WPP has failed. Taking into consideration other moments on higher time frames – it seems that odds stand in favor of downward continuation still. More nuances we could get on hourly chart below…

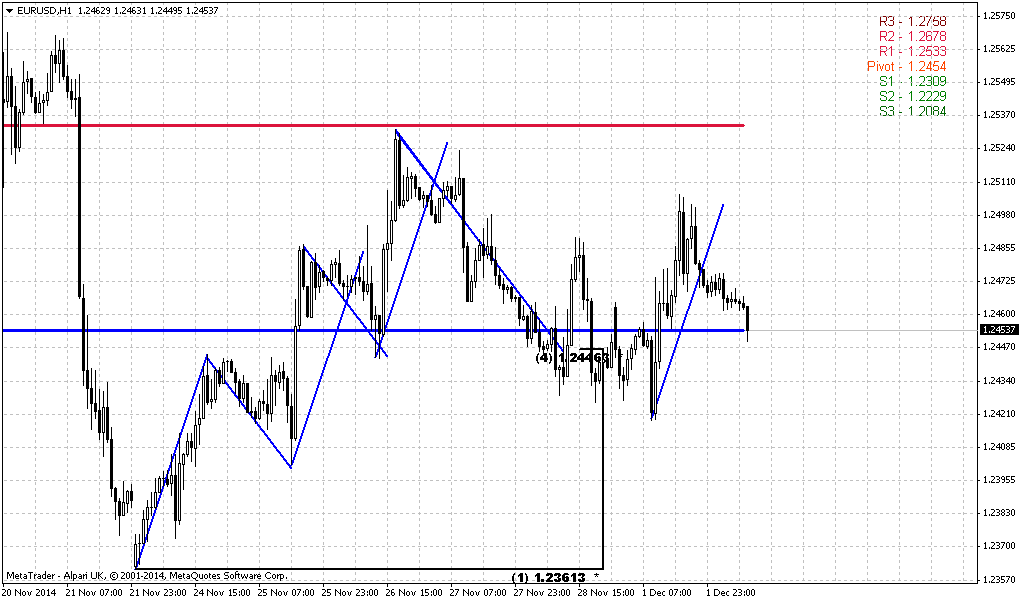

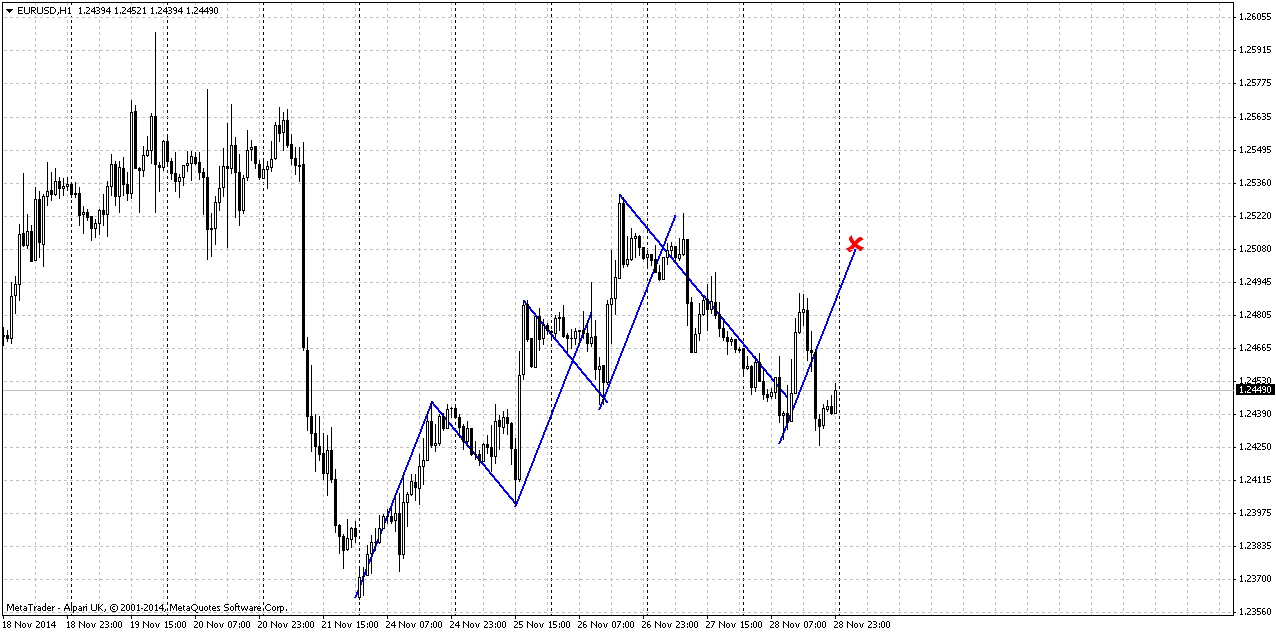

Hourly

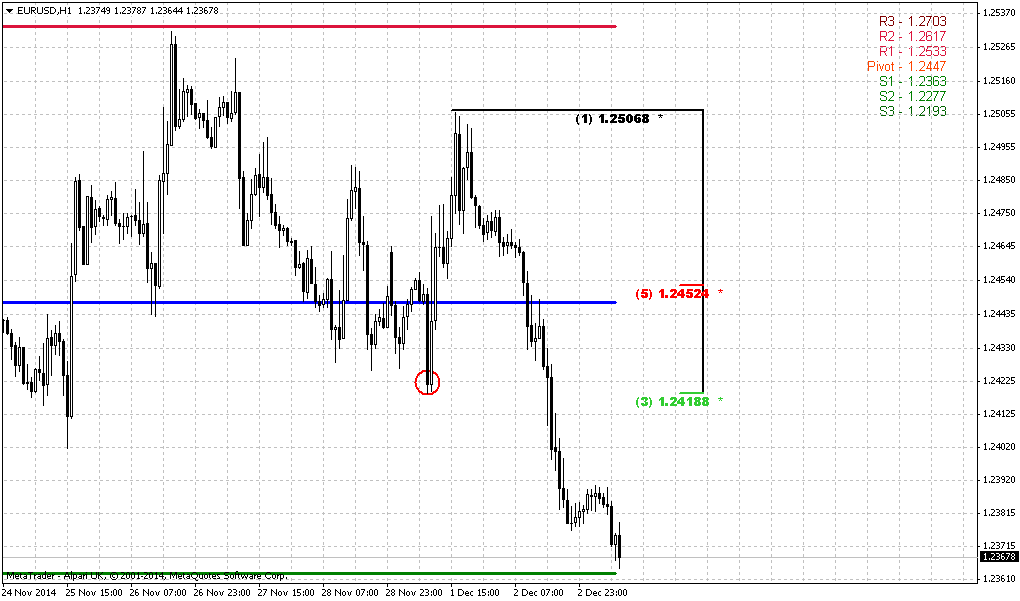

As we’ve said previous upside action was very harmonic – it shows 3 equal legs up and 2 equals retracements. Final move down also was harmonic but takes the 2 multiplier. As soon as 2-times retracement has been reached right at support - market has made an attempt to move higher, but failed and broke harmony – wasn’t able even to reach equal upside leg target. This is the sign of changes and easily could lead to downward continuation.

On Monday we could get another important clue. The point is EUR will open right around MPP and WPP. If market will move below them – it will confirm our thoughts on further downward continuation.

Conclusion:

Recent ECB comments and overall economy situation in EU leave blur hopes to bulls and put solid foundation for further decreasing of EUR. Intraday price behavior does not give us clear short-term patterns but has some signs of weakness and changes in previous tendency. This makes us think that coming week could be bearish. EUR will be extremely fast at the end of the week, probably as a result of ECB meeting and NFP release. These events could lead to drastical price action.

Still, our next target is 1.22 and on long-term charts there are no big changes that could make us review this target.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.

Reuters reports The dollar gained on Friday as sliding oil prices stirred disinflation fears in the euro zone and Japan, while investors also looked ahead to a heavy week of central bank meetings and the U.S. monthly employment report.

U.S. crude fell 10 percent on Friday on OPEC's decision not to cut output, settling at $66.15 a barrel.

Annual consumer inflation in the euro zone cooled to a five-year low as energy prices fell, suggesting deflation remains a real threat for the European Central Bank. Japan's annual core consumer inflation also slowed for a third straight month in October.

"The expectation that oil prices are going to remain under pressure at least for the next few months, and the disinflation data that came out, confirms that both Japan and the eurozone are struggling with disinflationary pressures that are quite severe. That helped the U.S. dollar stand out," said Martin Schwerdtfeger, a foreign exchange strategist at TD Securities in Toronto.

The euro weakened to $1.2442. The single currency is under pressure ahead of next week’s ECB meeting, where the central bank is expected to signal further action to ward off disinflation.

Central bank meetings are also due in England, Canada and Australia, while the United States will focus on Friday’s employment report for November.

Thursday’s decision not to cut oil output slammed the currencies of oil producing nations.

The Russian rouble weakened to more than 50 to the U.S. dollar in late Friday trade, setting a new all-time low.

The U.S. dollar rallied to more than seven Norwegian crowns for the first time in more than five years.

Investors unwinding positions for year-end may pause the dollar rally, though rising geopolitical tensions if oil prices stay low could favor the greenback.

"It causes pain in a lot of countries ... the response you would expect is not just market volatility, but over the medium-term geopolitical volatility," said Greg Anderson, global head of FX strategy for BMO Capital Markets in New York.

Unfortunately guys, we do not have CFTC data for last week, looks like due Thanksgiving celebration

Technicals

Monthly

Recently we’ve made wide comments on complex situation around EUR. As we’ve said previously EUR right now stands in center of geopolitical and economical turmoil and we have mutual 2-side relations EU-US and EU-Russia. And progress of these relations develops not very positive. Shortly speaking we expect that EUR will continue move down.

We will remind you here major points of our analysis. In EU-US relations there are two topics right now – political and economical. On political side US forces EU to increase pressure on Russia and take disandvantageous steps and measures that primary hurts EU and almost harmless for US. Here we know about sanctions, Mistrale ships question, etc. Simultaneously US is aiming to replace Russia as important and strategic partner for Europe by enforcing “Zone of free trade agreement”. This falsity of ally becomes possible mostly because Europe de facto is not independent but mostly the colony of US. That’s why US freely can give the law to EU.

Economically US and EU drives on opposite courses. Recently Draghi has given a hint that ECB will increase balance to the level of March 2012 and this assumes QE on approximately 3 Trln EUR. And recent comments from ECB make us think that if even this former statement will be tamed, EUR still will remain under pressure. US economy, in turn, now shows signs of improving. The major concern still is lack of inflation. Although Jobs are growing, but wealth of middle class and wages are stagnating.

This makes us think that EUR now stands under double pressure – EU pulls chestnuts out of the fire for US (in relation with Russia) and particularly due this action makes economical pit deeper. What could bit this sorrow?

As a result of blind or coercive following to US policy, EU meets problems with Russia, it’s 3rd largest trading partner. We suggest that situation will become worse, US will demand more and more sanctions from EU upon Russia. But in turn, economical situation EU-Russia stands in relation with geopolicy where US will not accept any compromises. Any ECB efforts on stabilizing of EU economy could be mitigated by new spiral of geopolitical tensions and painful sanctions. That’s why here is our conclusion – hardly real reversal on EUR is possible any time soon.

If you track recent events on this sub, you probably know that Ukraine president continues to accumulate military forces on demarcation line with south-east regions. This line was established by Minsk agreement. After Baden visit to Ukraine Poroshenko has made a statement that no federalization will be on Ukraine and it will remain unitary state. Simultaneously Ukraine wants to join NATO and NATO protocol forbids giving membership to countries that have some problems with territorial integrity. It means that Ukraine will try to resolve it by all means. And it means – war. Any attempt to do it will lead to proportional reply. And this in turn, will force EU to put new sanctions. In fact, US make double impact – it instigates war and particularly by this instigation – force EU apply new sanctions. So, it pulls the strings of both puppets – as EU as Ukraine.

And here guys, results of these sanctions – drop of EU export to Russia. It looks very impressive. But due to events that yet to come – it is difficult to hope on soon EUR strength:

Weekly

Trend is bearish here, as well as on monthly chart. As we ‘ve said many times previously, market has no significant support till 1.22 and nothing could prevent downward action driving by bearish sentiment. Now we have new monthly pivots for December. As market was mostly flat – pivot levels stand very narrow and almost coincide with November ones, at least MPS1. As market still stands at support of MPS1 – this level is probably doomed since we’ve got bearish grabber of previous week and have got another one on last week. Yes, lows stand very close to current price and from that point of view profit potential of grabbers is rather shy, but we’re mostly interested with grabbers as trigger for downward action. Combination of lows’ breakout and abscence of meaningful support probably will lead EUR to our 1.22 target.

At the same time here we have a kind of 3-Drive “Buy” pattern with slightly higher target @ 1.2250. This probably will be our destination for coming week. I tell “a kind of” because it looks a bit small, just few candles with it and I’m not sure that we can treat it as fully-featured 3-Drive. That’s why we probably should focus on 1.22 still.

Daily

Here guys, 3-Drive looks a bit more attractive and takes classic shape of wedge and double butterfly. As we’ve got another bearish grabber on weekly – success of daily grabber (in red circle) now seems as remote possibility. Besides, market was not able even to touch November MPP, WPR1 and stayed below major Fib resistance. It confirms validity of current bear trend and probably we should tune on action to 3-Drive target area. As it will be also daily oversold – market could take some pause there. Major event that could lead to either drastical breakout or deep retracement is NFP probably.

4-hour

Intraday charts do not give us clear patterns as on higher charts, but we still can find some important moments that could help us with understanding overall situation. Here you can see our picture for possible bullish grabber on daily. We’ve said that if it will work – it probably should form some kind of AB-CD. Later we’ve seen that big CD leg could also take shape of minor inner ab-cd. What do we see right now? Recall that on previous week upside action was held by WPR1 and on Friday market has closed even below WPP. On small ab-cd we see that EUR has tried to start upside action at WPP and 50% support level but failed and returned right back down. At the same time EUR was not able to erase big nasty candle. Trend has turned bearish here. That’s being said that current picture tells that start-up of upside continuation from WPP has failed. Taking into consideration other moments on higher time frames – it seems that odds stand in favor of downward continuation still. More nuances we could get on hourly chart below…

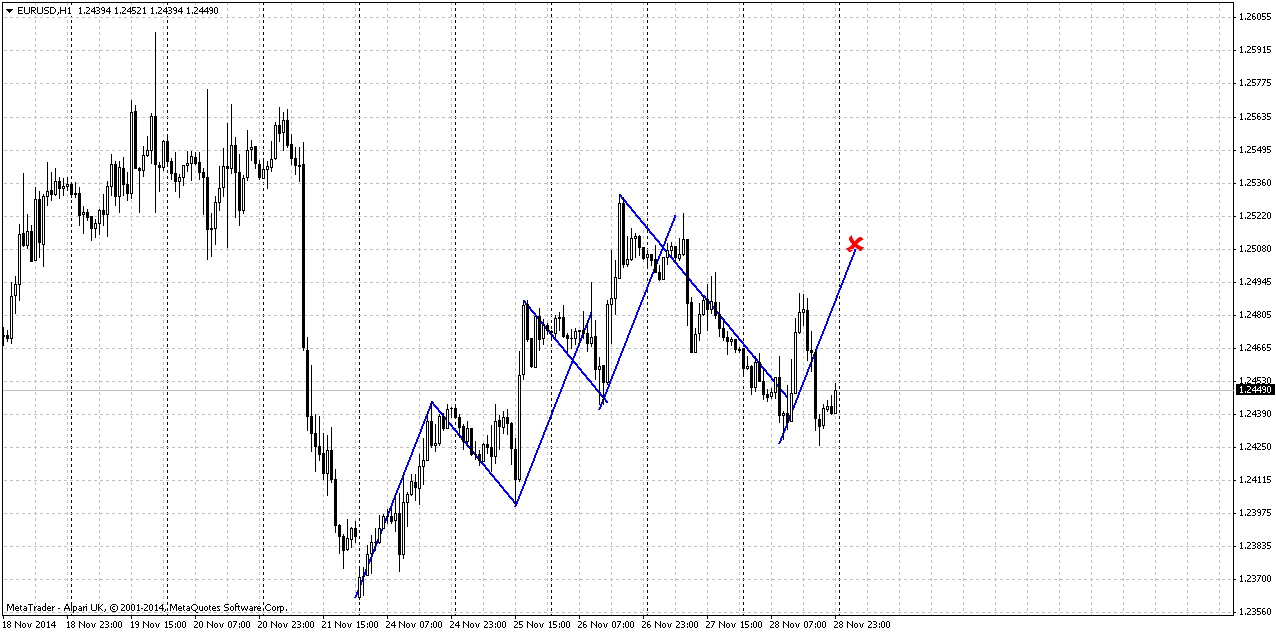

Hourly

As we’ve said previous upside action was very harmonic – it shows 3 equal legs up and 2 equals retracements. Final move down also was harmonic but takes the 2 multiplier. As soon as 2-times retracement has been reached right at support - market has made an attempt to move higher, but failed and broke harmony – wasn’t able even to reach equal upside leg target. This is the sign of changes and easily could lead to downward continuation.

On Monday we could get another important clue. The point is EUR will open right around MPP and WPP. If market will move below them – it will confirm our thoughts on further downward continuation.

Conclusion:

Recent ECB comments and overall economy situation in EU leave blur hopes to bulls and put solid foundation for further decreasing of EUR. Intraday price behavior does not give us clear short-term patterns but has some signs of weakness and changes in previous tendency. This makes us think that coming week could be bearish. EUR will be extremely fast at the end of the week, probably as a result of ECB meeting and NFP release. These events could lead to drastical price action.

Still, our next target is 1.22 and on long-term charts there are no big changes that could make us review this target.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.