jarwan212

Recruit

- Messages

- 2

Yep. I always look for progression as well. Now we have "222" Sell on EUR and this is still a question what we will get in result.

I also keep in mind weekly bearish grabber. It has no relation to EW count, but it is important in DiNapoli context.

Update on EUR.

I believe we are witnessing complex, extended ABC correction in wave 2 which I expect to finish in 1.1280-1.1310 zone, and then bullish wave 3 could start. Nothing has changed and I keep my bullish view intact as long as 1.1266 support holds.

4H CHART:

View attachment 40677

1H CHART:

View attachment 40678

[url=https://postimg.cc/H8d641tR]

[/URL]

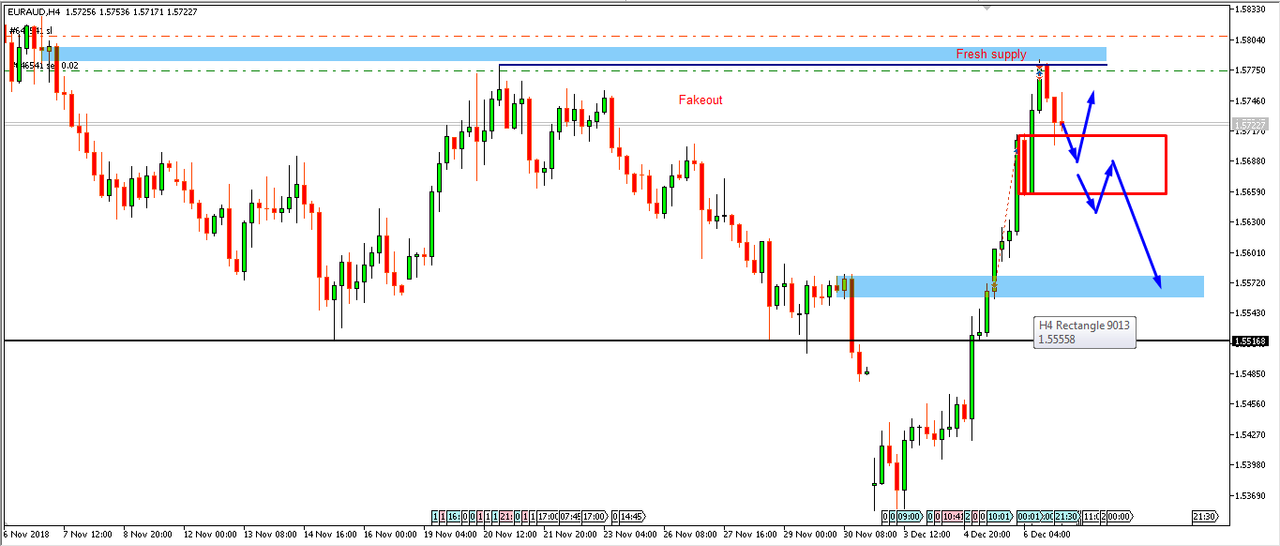

[/URL]Hallo everyone,Hello friends, introduce my name to Jarwan from Indonesia. let me join here to take part in discussing the Eur pair analysis i have plan trading in pair euraud im sell in fakeout when the price break high and price up again to trigger supply bearish engulfing pattern candle and then i sell at supply and im take stop loss at price 1.58074 and i will to hold position because i look at high time frame in daily the trend still is down.

thanks