Sive Morten

Special Consultant to the FPA

- Messages

- 18,699

Fundamentals

Reuters reports The U.S. dollar reached fresh multiyear highs on Friday after a stronger-than-forecast November U.S. jobs report increased expectations the Federal Reserve may begin raising interest rates sooner than previously thought.

Employers added the most workers in nearly three years in November and wages rose, the latest U.S. employment report showed. Nonfarm payrolls increased by 321,000, better than forecasts for an increase of 230,000. The unemployment rate held steady at a six-year low of 5.8 percent.

Earlier this week U.S. central bank officials such as New York Fed President William Dudley and Fed Vice Chairman Stanley Fischer made comments that pointed toward rate increases in response to stronger U.S. economic figures, maintaining a focus on what the data showed.

"The Fed already indicated that they were shifting. The comments from Dudley and Fischer earlier this week suggested they were beginning to think seriously about normalizing (policy) and this would make them think even more seriously, that they should be thinking about H1 (first half of the year) versus H2," said Steven Englander, global head of G10 foreign exchange strategy at CitiFX.

Friday's jobs data pulled market expectations for the Fed to start tightening monetary policy back toward mid-2015 from September.

Interest rate futures contracts now show that traders see about a 53 percent chance for a July 2015 hike, based on the CME FedWatch program. That is more in line with last month's Reuters poll of economists who see the first rate increase in June of next year.

"The trend is pretty good. Now comes the second-guessing in the market. It brings concerns that the Fed might look to raise earlier than some people had expected. I don’t think anyone should fear the Fed right now," said Scott Brown, chief economist at Raymond James in St. Petersburg, Florida. Brown said the increase could be seasonal but there is optimism heading into 2015.

Rising U.S. interest rates would be in stark contrast to the euro zone and Japan, where monetary policy is moving in the opposite direction. The pattern would increase the yield advantage for investors holding U.S. dollar-denominated assets.

"We think dollar/yen could hit 125 yen before the end of 2014. But then it is going to stabilize. We think that the good news will be priced in at that stage," said Englander, who added the euro has more to fall, perhaps reaching $1.20 before the end of the year and plumbing lows of $1.12 to $1.15 in 2015.

On Thursday, European Central Bank President Mario Draghi said the central bank would decide early next year whether to take fresh action to revive the economy. Draghi also said any decision by the bank's Governing Council need not be unanimous to begin quantitative easing measures, including buying of sovereign bonds in an effort to spur borrowing and investment.

Some in the market were disappointed Draghi did not find an even more explicit way of moving the bank closer to outright quantitative easing.

But his language, and a veiled warning that opposition from German policymakers would not stand in the way of the governing council acting if need be, pointed towards the launch of bond-buying in the first quarter.

"Taking on board likely further falls in headline HICP (inflation), Draghi's comments give succour to the idea that further policy moves are coming at the next couple of meetings," said London-based Gavin Friend, senior markets strategist at National Australia Bank.

Recent CFTC data shows some decreasing of bearish pressure – open interest shows shy growth as well as speculative longs, while shorts positions slightly decreased. But this was on 2nd of December. This was not a surprise since we many times said that pure technical picture looks bullish, but NFP could overrule it. As a result of recent NFP data we could get repairing of bearish status quo on next week:

Open interest:

Shorts:

Shorts:

Longs:

Longs:

Technicals

Monthly

Recently we’ve made wide comments on complex situation around EUR. As we’ve said previously EUR right now stands in center of geopolitical and economical turmoil and we have mutual 2-side relations EU-US and EU-Russia. And progress of these relations develops not very positive. Shortly speaking we expect that EUR will continue move down.

We just remind you here major points of our analysis. In EU-US relations there are two topics right now – political and economical. On political side US forces EU to increase pressure on Russia and take disandvantageous steps and measures that primary hurts EU and almost harmless for US. Here we know about sanctions, Mistrale ships question, etc. Last precedent was closing of “South stream” gas pipeline. Simultaneously US is aiming to replace Russia as important and strategic partner for Europe by enforcing “Zone of free trade agreement”. This falsity of ally becomes possible mostly because Europe de facto is not independent but mostly the colony of US. That’s why US freely can give the law to EU.

Economically US and EU drives on opposite courses. While US is tending to starting rate hiking cycle in mid 2015, ECB gives comments on QE and increasing of balance to the level of March 2012 and this assumes QE on approximately 3 Trln EUR.

This makes us think that EUR now stands under double pressure – EU pulls chestnuts out of the fire for US (in relation with Russia) and particularly due this action makes economical pit deeper. What could bit this sorrow?

As a result of blind or coercive following to US policy, EU meets problems with Russia, it’s 3rd largest trading partner. We suggest that situation will become worse, US will demand more and more sanctions from EU upon Russia. But in turn, economical situation EU-Russia stands in relation with geopolicy where US will not accept any compromises. Any ECB efforts on stabilizing of EU economy could be mitigated by new spiral of geopolitical tensions and painful sanctions. That’s why here is our conclusion – hardly real reversal on EUR is possible any time soon.

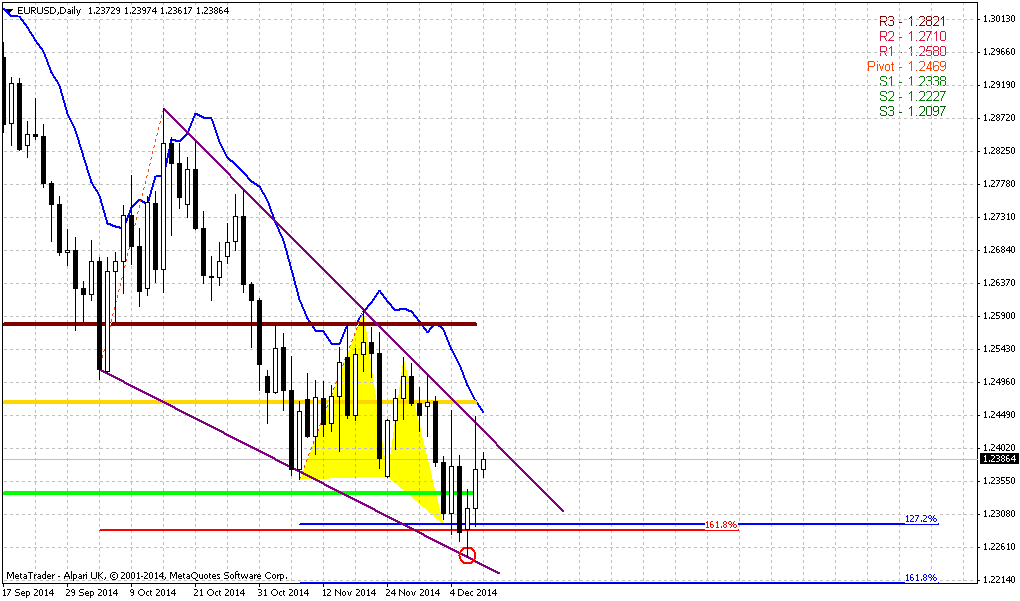

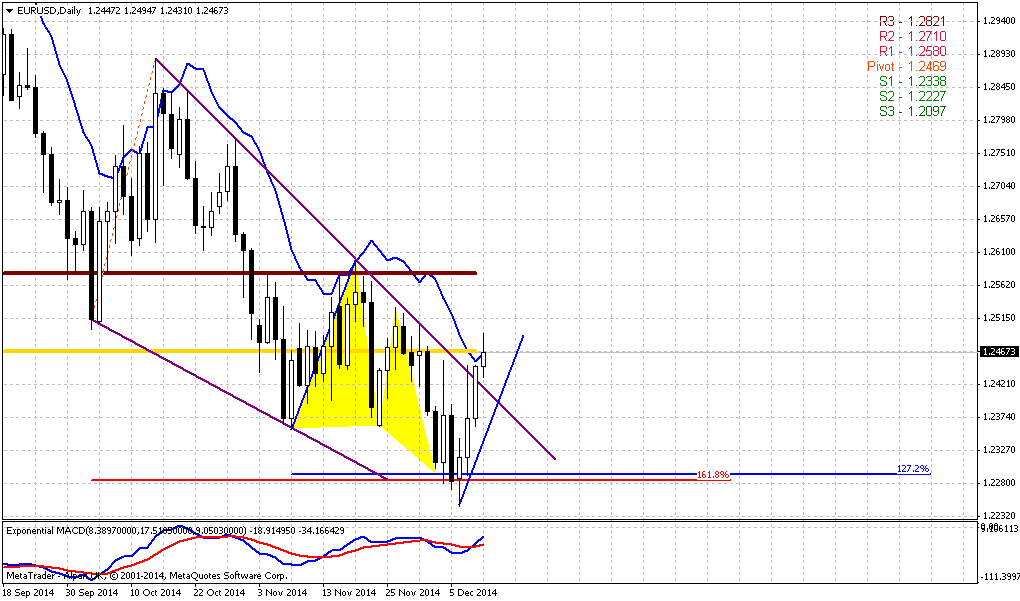

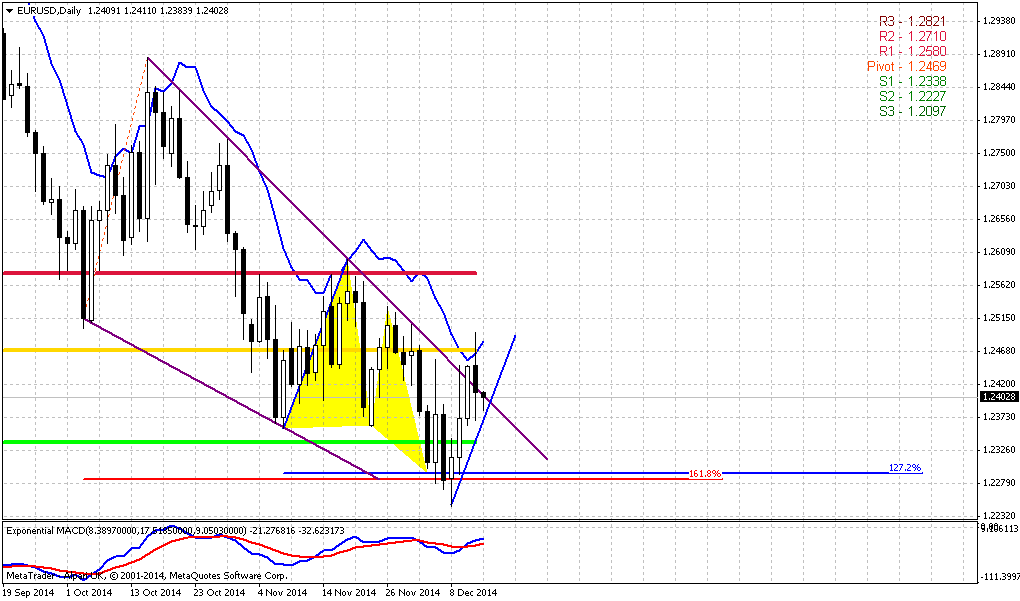

From technical point of view we’ve got another “black” month, trend holds bearish here, but market is not at oversold. Price has broken through all solid supports and right now stands in “free space” area. As we have large Gartley “222” Sell pattern, it nearest target is 1.22 – 0.618 AB-CD objective point. Take a look how harmonic this downside action, the speed of CD and AB legs are almost equal. EUR looks really heavy, month by month it opens at the high close at the low. Currently we see small relief but 1.22 target should be hit probably in December. “Three black crows” pattern and breakout through Yearly Pivot Support 1 suggests that 1.22 is not final target probably, and we should not surprise if we will see decline in next year as well. Only some structural shifts could change situation. In fact 1.22 is some sort of “must” target, but later downward continuation also could follow, especially because market will approach previous lows and stop grabbing could push EUR lower.

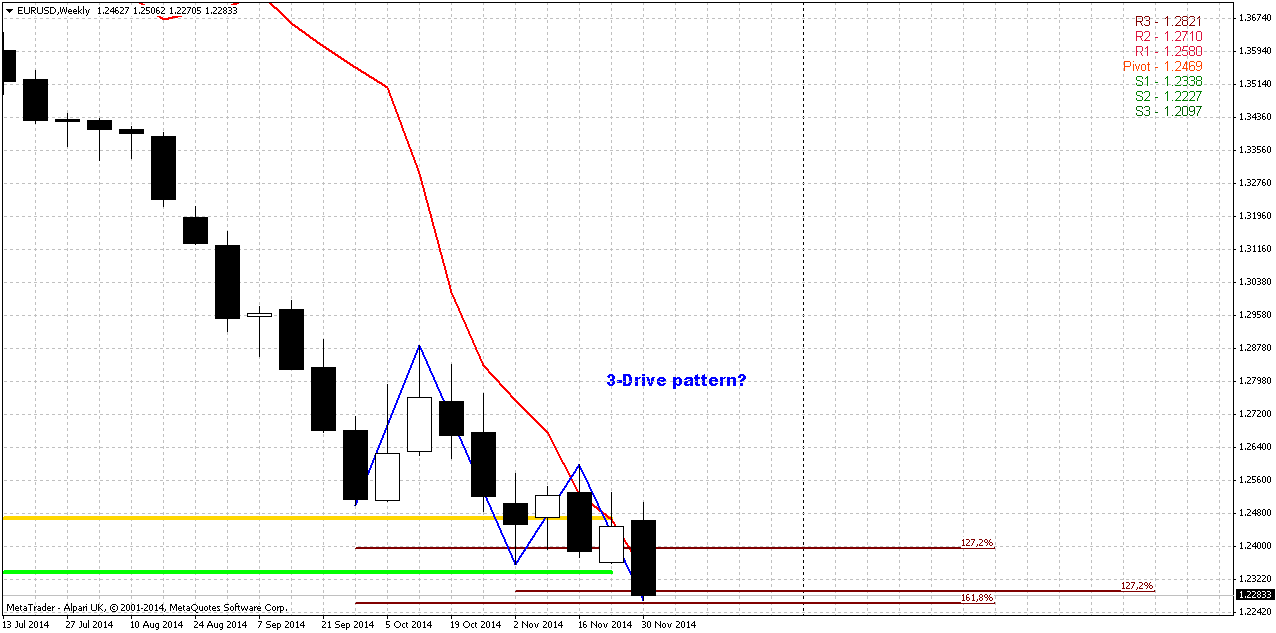

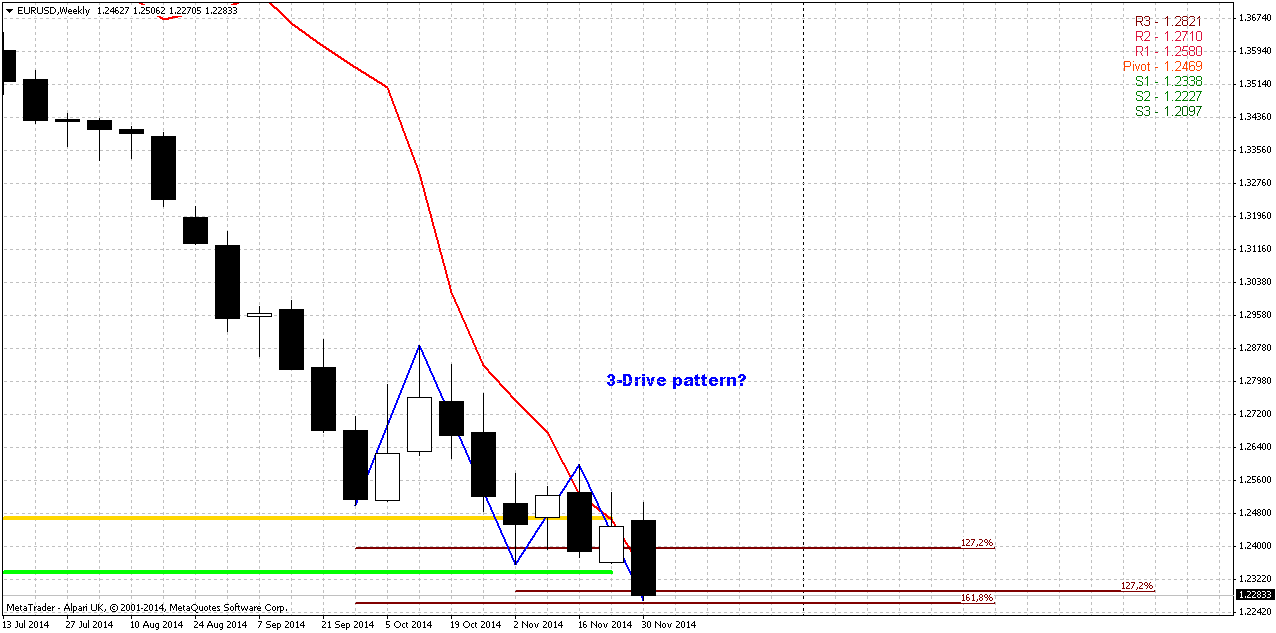

Weekly

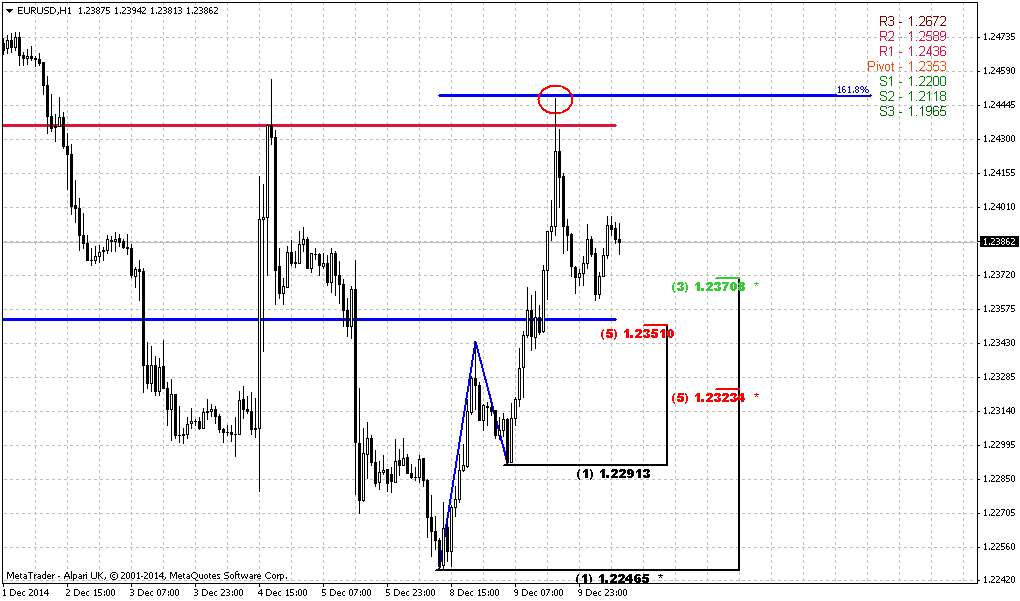

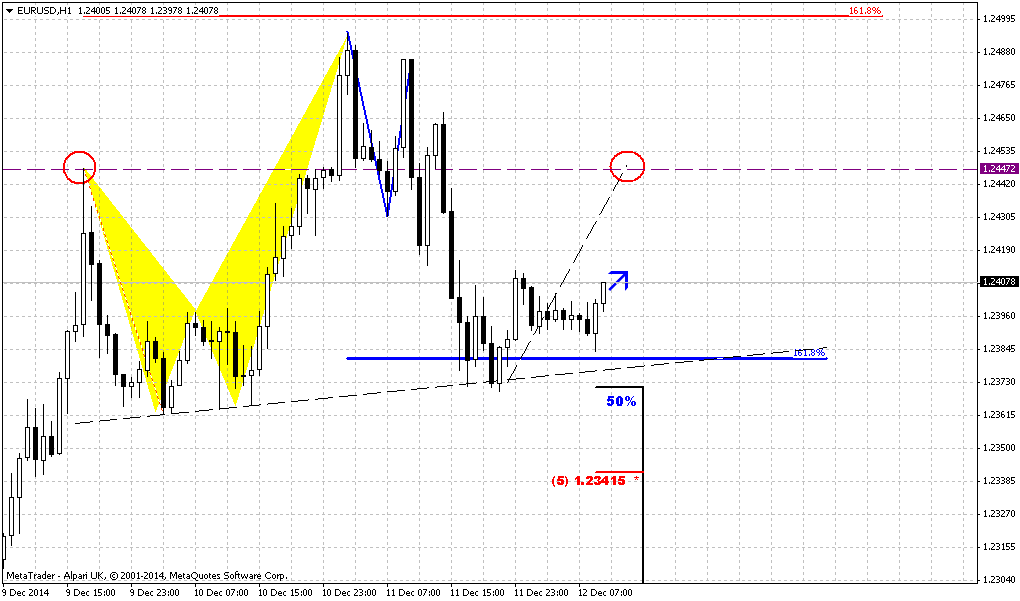

Trend is bearish here, as well as on monthly chart. So, in fact EUR has completed our target for last week. We’ve expected to get 3-Drive and we’ve got it. Market has reached 1.2250 area – crossing of 1.618 and 1.27 levels of 1st and 2nd drives correspondingly.

Previously, before NFP release we’ve said that pattern could fail under strike of positive NFP data. Indeed, NFP numbers have stopped upside action on EUR and turned it down again. But on Friday market was not able to pass through 1.2250 level and stopped there. That’s why formally 3-Drive has not failed yet.

Still we have to understand that trading it will be accompanied by greater risk, due Friday downside acceleration and we should not be surprised if on Monday we will get downward continuation, especially because right now EUR already stands below MPS1. But it doesn’t mean that we should just abandon it. If we will find nice pattern with as small risk as possible – we can try. We also could take smaller position, because risk/reward ratio will be outstanding if 3-Drive will work…

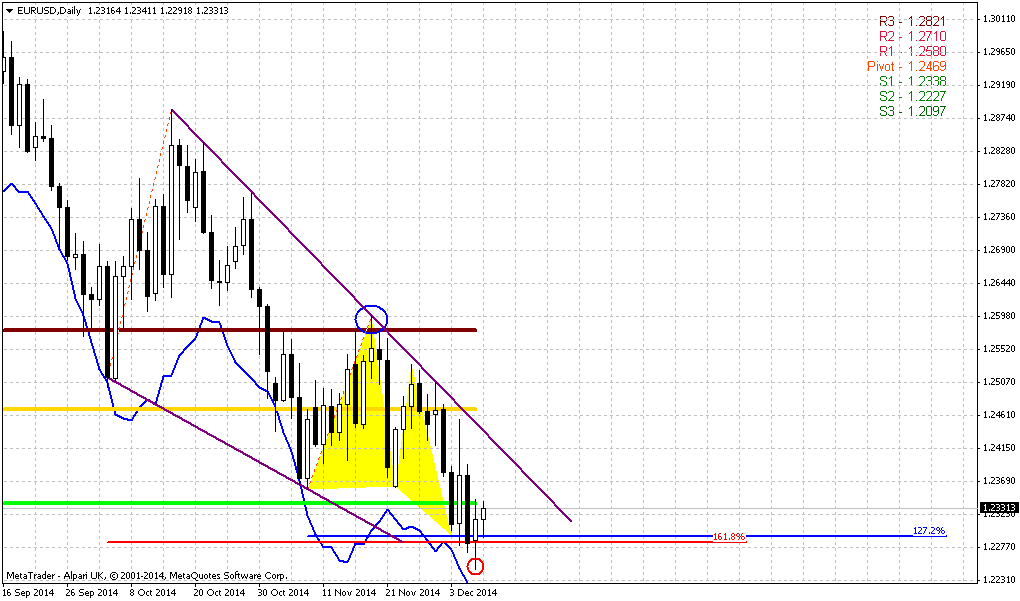

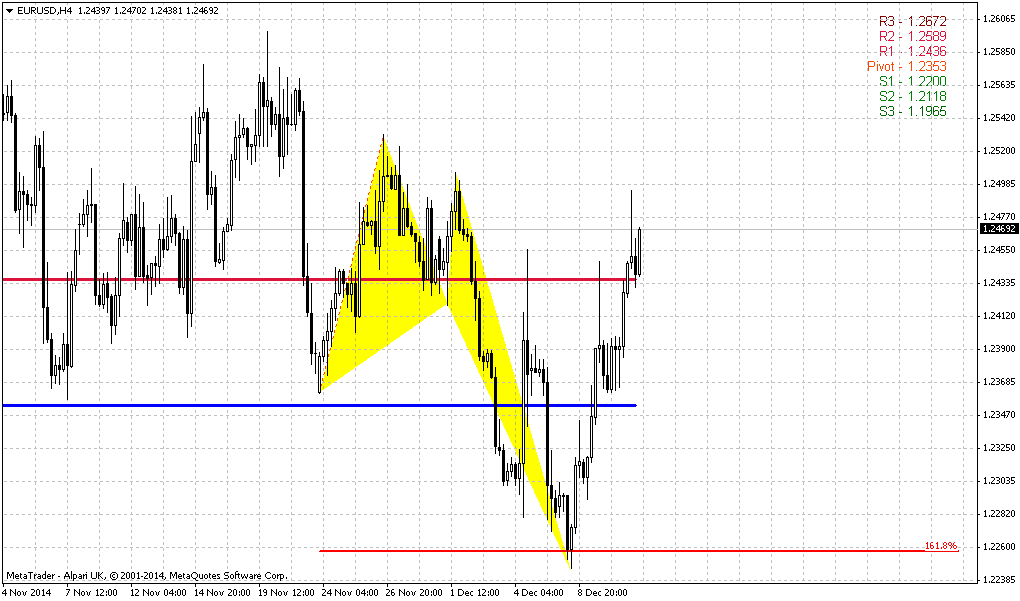

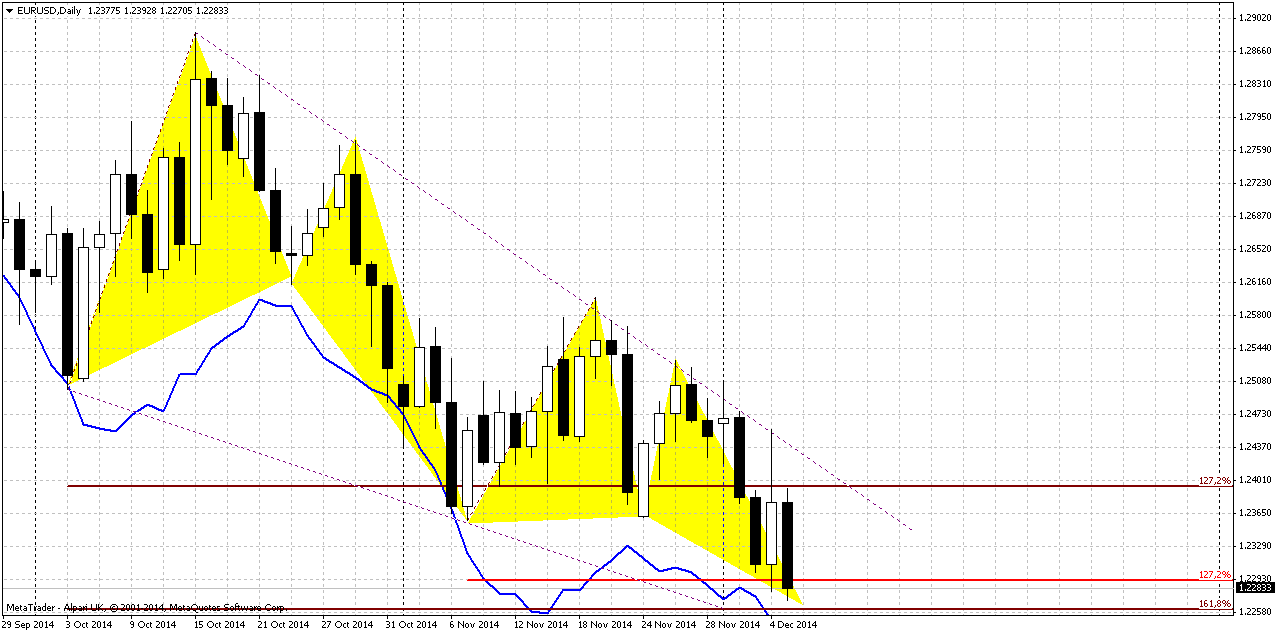

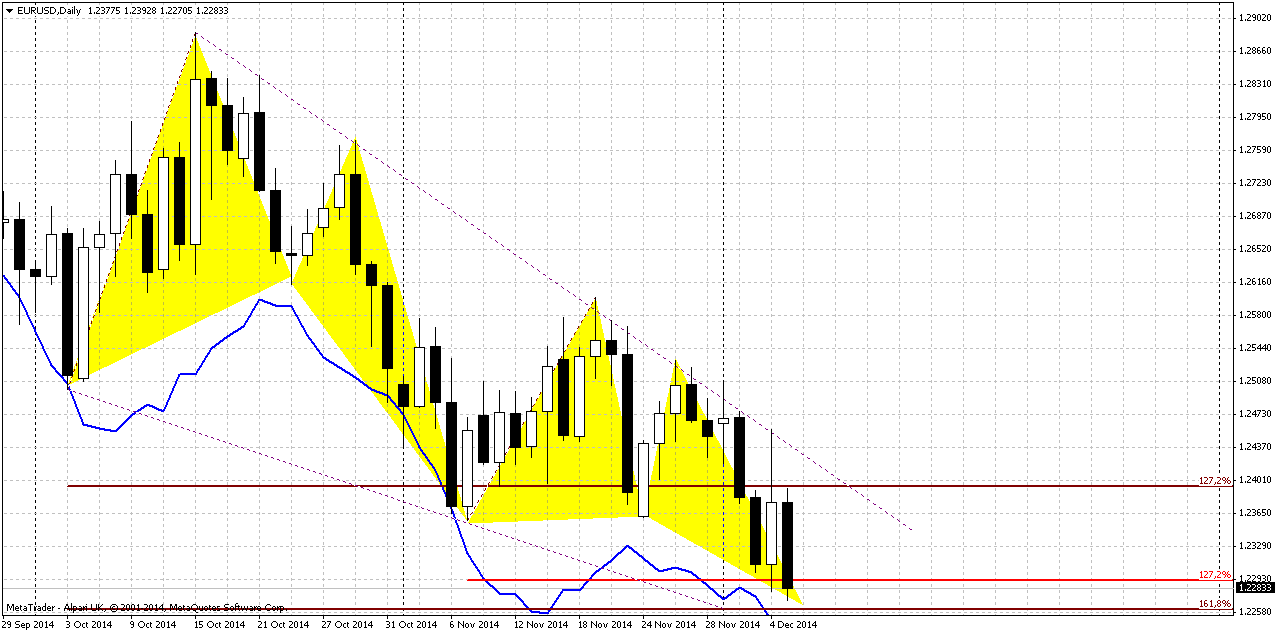

Daily

Despite recent solid action situation on EUR stands uncertain. From one point of view, bullish engulfing pattern has been erased, price moved below MPS1 and this is looks bearish. At the same time, market has not passed through crucial 3-Drive reversal point. Also, although NFP data has shown almost 30% positive surprise (300K+ vs. 230K expected), downside reaction was a bit limited. Yes, former upside retracement was erased but that was it. Market holds at 1.2250 support area. That’s why it is very difficult to say that market will go down at 100%. From another point of view – what reasons or events could prevent EUR from downward continuation? That’s why chances on downward action look preferable right now. In fact the only “bullish” moment here is 3-Drive support. All other factors – as technical as fundamental are stand not in favor of upside reversal.

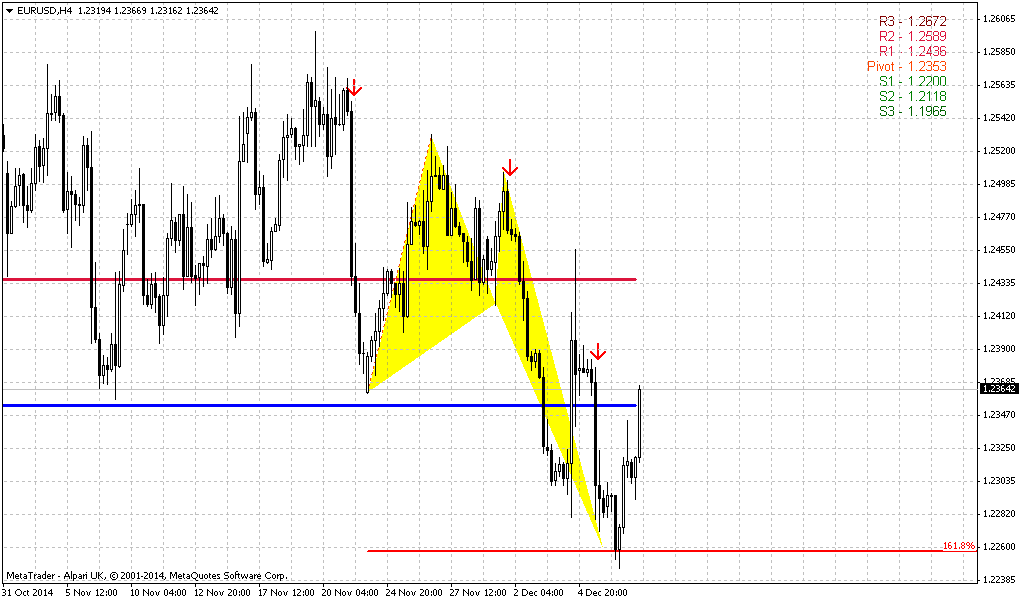

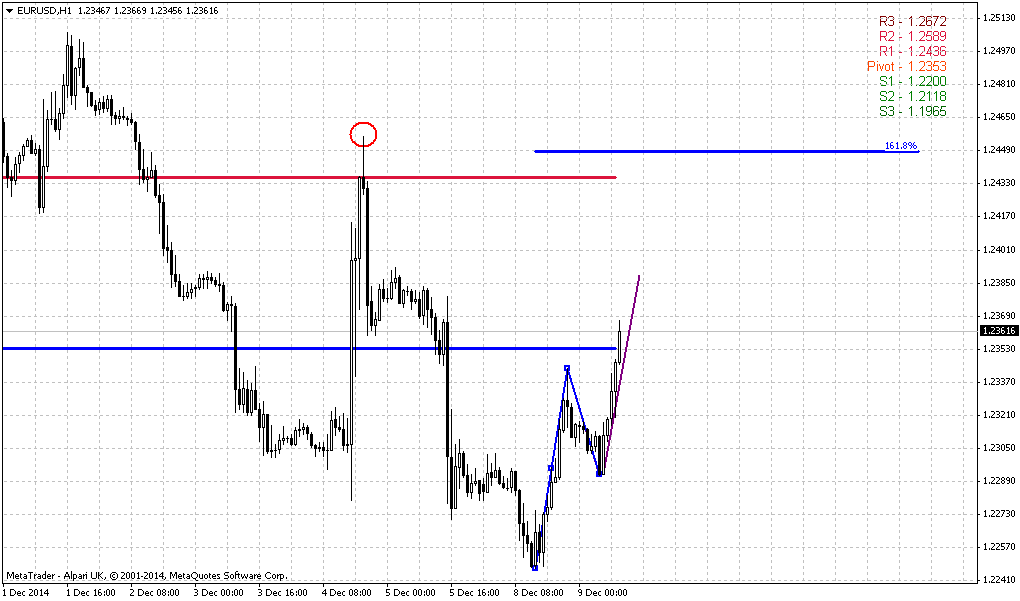

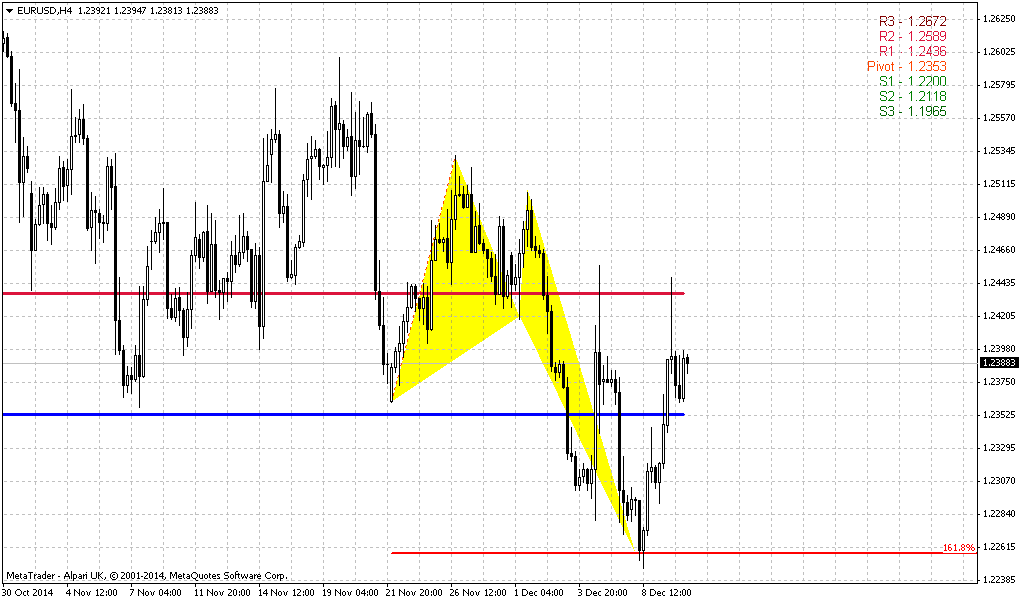

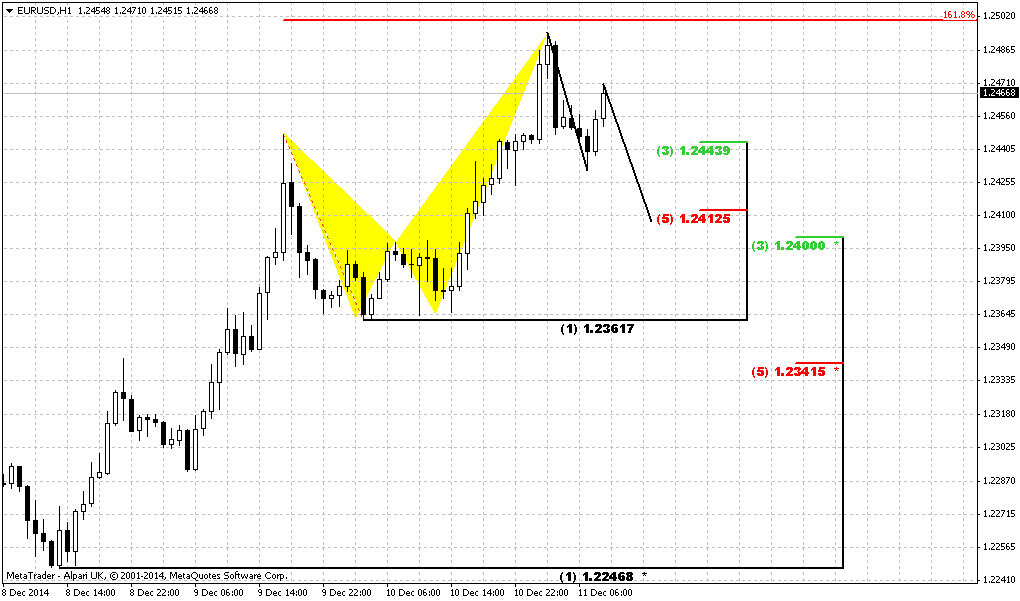

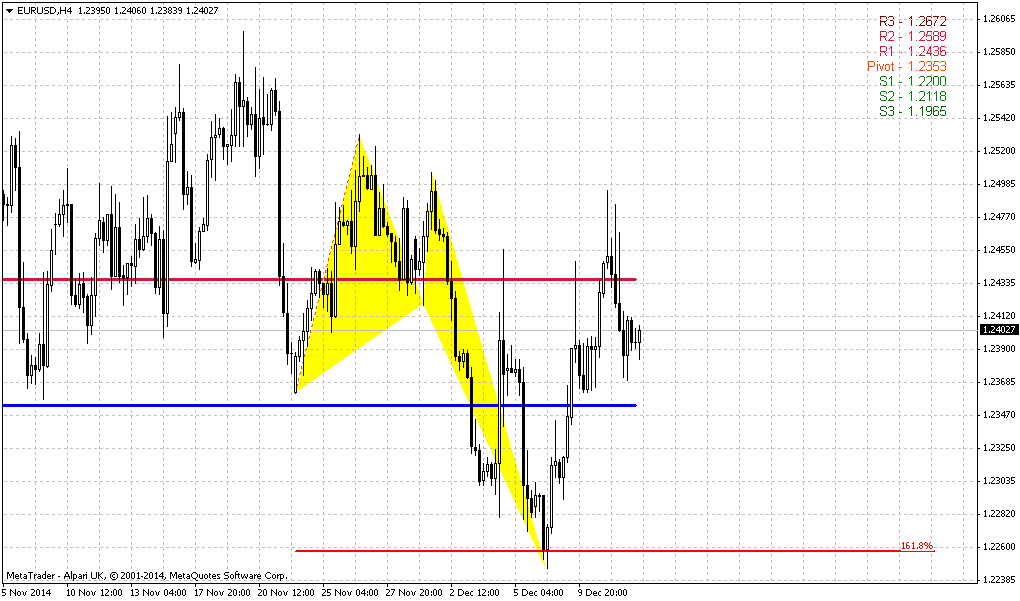

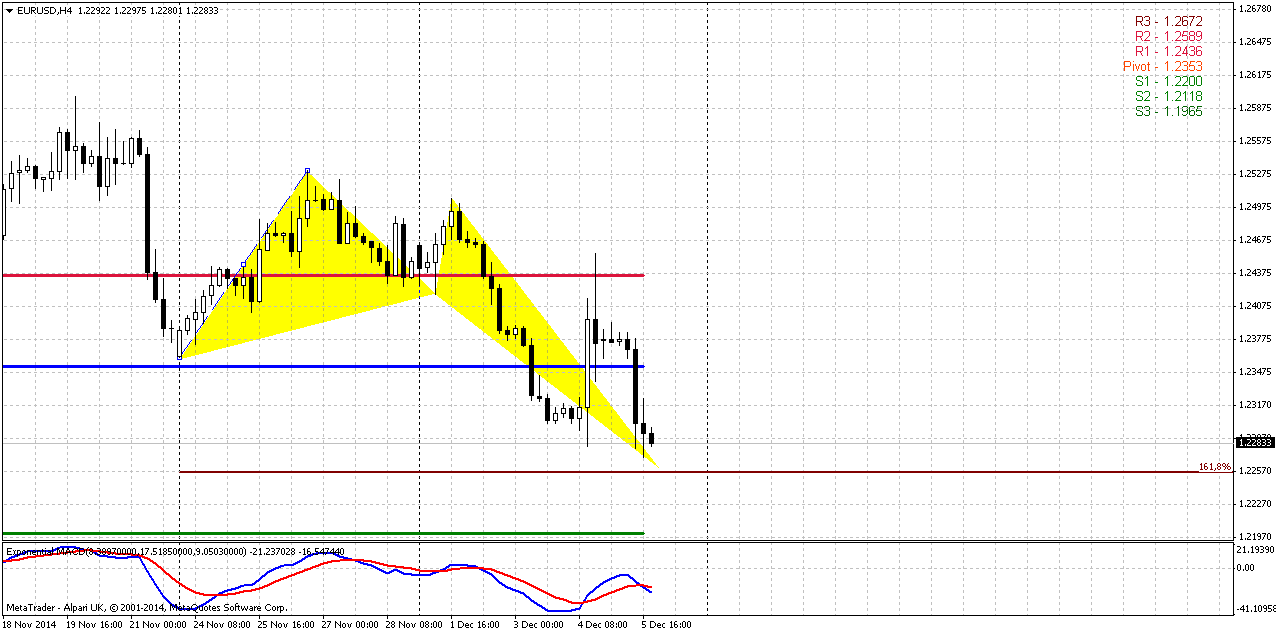

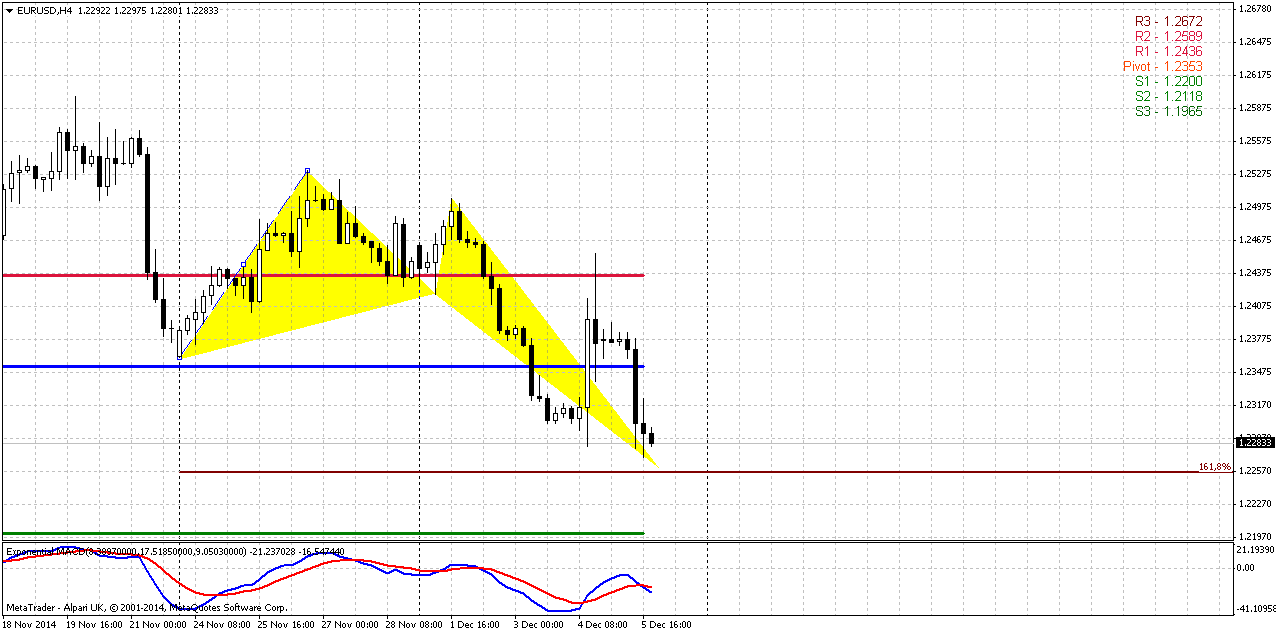

4-hour

Erasing of previous upside action always looks bearish. Some phantom hope stands with 1.2255 level – 1.618 extension of intraday butterfly that may be it will hold EUR and turn it to upside. But to be honest guys, when we stand just 50 pips above 1.22 area and potential target of upside retracement is 1.26, I have very little wish to catch blur possibility for long entry. 1.22 is monthly AB-CD target and WPS1. And for me it seems better to wait when it will be hit, or take position on some shy deep if upside reversal will start earlier (although I doubt that this will happen). Besides, here we do not have clear intraday reversal patterns that could definitely say that reversal is in progress right now. Even more, we mostly have not very encouraging combination of recent events for long entry, right? So our thought is better to wait for 1.22.

Conclusion:

Our long-term expectation stands the same and we expect further EUR decrease that probably will continue in 2015 as well. Technically market has moved deeply below YPS1 in 2014 and this tells on downward continuation in next year. Besides, recent US data makes rate hiking cycle closer and closer, while EU stands at the eve of QE…

In short-term perspective we think that relatively safe area for attempt of taking long position is 1.22 – combination of monthly AB-CD target and WPS1. 1.22 has at least some support – something is better than nothing. Although we have another patterns that are bullish by it’s nature, but their reversal points stand just 50 pips above major 1.22 target and it seems suspicious that 1.22 target will be left untouched.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.

Reuters reports The U.S. dollar reached fresh multiyear highs on Friday after a stronger-than-forecast November U.S. jobs report increased expectations the Federal Reserve may begin raising interest rates sooner than previously thought.

Employers added the most workers in nearly three years in November and wages rose, the latest U.S. employment report showed. Nonfarm payrolls increased by 321,000, better than forecasts for an increase of 230,000. The unemployment rate held steady at a six-year low of 5.8 percent.

Earlier this week U.S. central bank officials such as New York Fed President William Dudley and Fed Vice Chairman Stanley Fischer made comments that pointed toward rate increases in response to stronger U.S. economic figures, maintaining a focus on what the data showed.

"The Fed already indicated that they were shifting. The comments from Dudley and Fischer earlier this week suggested they were beginning to think seriously about normalizing (policy) and this would make them think even more seriously, that they should be thinking about H1 (first half of the year) versus H2," said Steven Englander, global head of G10 foreign exchange strategy at CitiFX.

Friday's jobs data pulled market expectations for the Fed to start tightening monetary policy back toward mid-2015 from September.

Interest rate futures contracts now show that traders see about a 53 percent chance for a July 2015 hike, based on the CME FedWatch program. That is more in line with last month's Reuters poll of economists who see the first rate increase in June of next year.

"The trend is pretty good. Now comes the second-guessing in the market. It brings concerns that the Fed might look to raise earlier than some people had expected. I don’t think anyone should fear the Fed right now," said Scott Brown, chief economist at Raymond James in St. Petersburg, Florida. Brown said the increase could be seasonal but there is optimism heading into 2015.

Rising U.S. interest rates would be in stark contrast to the euro zone and Japan, where monetary policy is moving in the opposite direction. The pattern would increase the yield advantage for investors holding U.S. dollar-denominated assets.

"We think dollar/yen could hit 125 yen before the end of 2014. But then it is going to stabilize. We think that the good news will be priced in at that stage," said Englander, who added the euro has more to fall, perhaps reaching $1.20 before the end of the year and plumbing lows of $1.12 to $1.15 in 2015.

On Thursday, European Central Bank President Mario Draghi said the central bank would decide early next year whether to take fresh action to revive the economy. Draghi also said any decision by the bank's Governing Council need not be unanimous to begin quantitative easing measures, including buying of sovereign bonds in an effort to spur borrowing and investment.

Some in the market were disappointed Draghi did not find an even more explicit way of moving the bank closer to outright quantitative easing.

But his language, and a veiled warning that opposition from German policymakers would not stand in the way of the governing council acting if need be, pointed towards the launch of bond-buying in the first quarter.

"Taking on board likely further falls in headline HICP (inflation), Draghi's comments give succour to the idea that further policy moves are coming at the next couple of meetings," said London-based Gavin Friend, senior markets strategist at National Australia Bank.

Recent CFTC data shows some decreasing of bearish pressure – open interest shows shy growth as well as speculative longs, while shorts positions slightly decreased. But this was on 2nd of December. This was not a surprise since we many times said that pure technical picture looks bullish, but NFP could overrule it. As a result of recent NFP data we could get repairing of bearish status quo on next week:

Open interest:

Technicals

Monthly

Recently we’ve made wide comments on complex situation around EUR. As we’ve said previously EUR right now stands in center of geopolitical and economical turmoil and we have mutual 2-side relations EU-US and EU-Russia. And progress of these relations develops not very positive. Shortly speaking we expect that EUR will continue move down.

We just remind you here major points of our analysis. In EU-US relations there are two topics right now – political and economical. On political side US forces EU to increase pressure on Russia and take disandvantageous steps and measures that primary hurts EU and almost harmless for US. Here we know about sanctions, Mistrale ships question, etc. Last precedent was closing of “South stream” gas pipeline. Simultaneously US is aiming to replace Russia as important and strategic partner for Europe by enforcing “Zone of free trade agreement”. This falsity of ally becomes possible mostly because Europe de facto is not independent but mostly the colony of US. That’s why US freely can give the law to EU.

Economically US and EU drives on opposite courses. While US is tending to starting rate hiking cycle in mid 2015, ECB gives comments on QE and increasing of balance to the level of March 2012 and this assumes QE on approximately 3 Trln EUR.

This makes us think that EUR now stands under double pressure – EU pulls chestnuts out of the fire for US (in relation with Russia) and particularly due this action makes economical pit deeper. What could bit this sorrow?

As a result of blind or coercive following to US policy, EU meets problems with Russia, it’s 3rd largest trading partner. We suggest that situation will become worse, US will demand more and more sanctions from EU upon Russia. But in turn, economical situation EU-Russia stands in relation with geopolicy where US will not accept any compromises. Any ECB efforts on stabilizing of EU economy could be mitigated by new spiral of geopolitical tensions and painful sanctions. That’s why here is our conclusion – hardly real reversal on EUR is possible any time soon.

From technical point of view we’ve got another “black” month, trend holds bearish here, but market is not at oversold. Price has broken through all solid supports and right now stands in “free space” area. As we have large Gartley “222” Sell pattern, it nearest target is 1.22 – 0.618 AB-CD objective point. Take a look how harmonic this downside action, the speed of CD and AB legs are almost equal. EUR looks really heavy, month by month it opens at the high close at the low. Currently we see small relief but 1.22 target should be hit probably in December. “Three black crows” pattern and breakout through Yearly Pivot Support 1 suggests that 1.22 is not final target probably, and we should not surprise if we will see decline in next year as well. Only some structural shifts could change situation. In fact 1.22 is some sort of “must” target, but later downward continuation also could follow, especially because market will approach previous lows and stop grabbing could push EUR lower.

Weekly

Trend is bearish here, as well as on monthly chart. So, in fact EUR has completed our target for last week. We’ve expected to get 3-Drive and we’ve got it. Market has reached 1.2250 area – crossing of 1.618 and 1.27 levels of 1st and 2nd drives correspondingly.

Previously, before NFP release we’ve said that pattern could fail under strike of positive NFP data. Indeed, NFP numbers have stopped upside action on EUR and turned it down again. But on Friday market was not able to pass through 1.2250 level and stopped there. That’s why formally 3-Drive has not failed yet.

Still we have to understand that trading it will be accompanied by greater risk, due Friday downside acceleration and we should not be surprised if on Monday we will get downward continuation, especially because right now EUR already stands below MPS1. But it doesn’t mean that we should just abandon it. If we will find nice pattern with as small risk as possible – we can try. We also could take smaller position, because risk/reward ratio will be outstanding if 3-Drive will work…

Daily

Despite recent solid action situation on EUR stands uncertain. From one point of view, bullish engulfing pattern has been erased, price moved below MPS1 and this is looks bearish. At the same time, market has not passed through crucial 3-Drive reversal point. Also, although NFP data has shown almost 30% positive surprise (300K+ vs. 230K expected), downside reaction was a bit limited. Yes, former upside retracement was erased but that was it. Market holds at 1.2250 support area. That’s why it is very difficult to say that market will go down at 100%. From another point of view – what reasons or events could prevent EUR from downward continuation? That’s why chances on downward action look preferable right now. In fact the only “bullish” moment here is 3-Drive support. All other factors – as technical as fundamental are stand not in favor of upside reversal.

4-hour

Erasing of previous upside action always looks bearish. Some phantom hope stands with 1.2255 level – 1.618 extension of intraday butterfly that may be it will hold EUR and turn it to upside. But to be honest guys, when we stand just 50 pips above 1.22 area and potential target of upside retracement is 1.26, I have very little wish to catch blur possibility for long entry. 1.22 is monthly AB-CD target and WPS1. And for me it seems better to wait when it will be hit, or take position on some shy deep if upside reversal will start earlier (although I doubt that this will happen). Besides, here we do not have clear intraday reversal patterns that could definitely say that reversal is in progress right now. Even more, we mostly have not very encouraging combination of recent events for long entry, right? So our thought is better to wait for 1.22.

Conclusion:

Our long-term expectation stands the same and we expect further EUR decrease that probably will continue in 2015 as well. Technically market has moved deeply below YPS1 in 2014 and this tells on downward continuation in next year. Besides, recent US data makes rate hiking cycle closer and closer, while EU stands at the eve of QE…

In short-term perspective we think that relatively safe area for attempt of taking long position is 1.22 – combination of monthly AB-CD target and WPS1. 1.22 has at least some support – something is better than nothing. Although we have another patterns that are bullish by it’s nature, but their reversal points stand just 50 pips above major 1.22 target and it seems suspicious that 1.22 target will be left untouched.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.