Sive Morten

Special Consultant to the FPA

- Messages

- 18,732

Monthly

As Reuters reports, The dollar slumped on Friday, hitting a one-week low against a basket of other currencies, after a surprisingly weak U.S. jobs report spurred in a rally in bonds. U.S. employers hired the fewest workers in almost three years in December, though the setback was likely to be temporary amid signs that cold weather conditions might have had an impact. Still, the jobs data resulted in a rally in the bond market, pushing benchmark yields lower. Currencies often shift based on the difference between countries' interest-rate levels, so lower yields makes the U.S. dollar somewhat less attractive. Against the yen, the dollar hit a two-week low of 103.82 yen, last trading down 0.72 percent at 104.07 yen.

"The economists have looked at the numbers and have kind of downplayed some of this weakness, but the markets were taken by surprise," said Vassili Serebriakov, currency strategist at BNP Paribas in New York. "I think we’re still driven by the reactions in the rates market. You look at the trajectory in the front-end rates, and we're sitting at the lows of the day. The same goes for the 10 year," he said. U.S. Treasury yields, which move inversely to the price of the bonds, fell while stocks pared earlier losses.

Currency speculators, however, boosted bets in favor of the U.S. dollar in the latest week to their largest in four months at $21.11 billion, according to data from the Commodity Futures Trading Commission released on Friday. That optimism on the dollar could change next week given Friday's weak U.S. payrolls number.

JOBS DISAPPOINTMENT

Nonfarm payrolls rose only 74,000 last month, the smallest increase since January 2011, and the unemployment rate fell 0.3 percentage point to 6.7 percent, in part due to people leaving the labor force. "It was clearly a disappointing number and the markets are reflecting that disappointment by selling the dollar across the board," said Omer Esiner, chief market analyst at Commonwealth Foreign Exchange in Washington. "I do not think it alters the outlook for steady reductions in Fed stimulus. Certainly it will temper any talk of more accelerated pace of Fed policy reduction."

The Fed announced in December that it would trim its monthly purchases of Treasuries and mortgage-backed securities to $75 billion from $85 billion, and many economists expect it to decide on a similar-sized cut at its next meeting on Jan. 28-29. St. Louis Fed President James Bullard said on Friday he is "disinclined" to focus on December's job data alone when considering whether the central bank should continue to trim bond purchases.

One bright spot for the U.S. dollar was its performance against the Canadian dollar, continuing its week-long climb. Data out of Canada on Friday showed a surprise setback for the job market in December, capping the worst year for hiring since 2009. Meanwhile, demand for euro zone peripheral government bonds saw the single currency jump to its highest point against the dollar in a little more than a week, hitting a high of $1.3687. The euro was last trading at $1.3666, up 0.44 percent. A key theme at the start of 2014 is the divergence of outlooks on monetary policy, something that has benefited both the pound and the dollar, at the expense of the euro. European Central Bank President Mario Draghi added to pressure on the euro on Thursday by firming up the bank's promise to take more action to lower market borrowing costs if need be. But while the euro zone economy still looks fragile, government finances and banking in the bloc broadly look far healthier than six months ago, and players are starting to trade heavily on improvement in its debt-laden southern half.

Technical

On monthly time frame January candle is still an inside one for December and has not made any impact on overall situation yet. Appearing of YPP=1.3475 in current situation could play significant part on our analysis, since market stands just 100 pips above it. As we know that price always gravitates to pivot, this moment significantly increases the probability of more extended move down in short-term perspective.

Although we see solid downward action right now, but since monthly time frame is really big picture – this move has no drastical value yet. Most important here is recent 3-4 candles. Previously we’ve said that until market stands around current highs and above 1.33 chances on upward continuation still exists.

If we will follow to market mechanics, we’ll see that currently market should not show any solid retracement down. Any move of this kind should be treated as market weakness and it will increase probability of reversal. Take a look that as market has hit minor 0.618 AB-CD extension target right at rock hard resistance – Fib level and Agreement and former yearly PR1, it has shown reasonable bounce down and now it has tested it again. As retracement after 0.618 target already has happened, it is unlogical and unreasonable to see another deep bounce and it will look suspicious. Right now market still stands on the edge here. From one point of view price has failed to break up, but from another one – it still stands very close to previous highs. Thus, by looking at monthly chart we can’t say yet that price has reversed down already. This time frame can’t point us long-term direction yet, although MACD trend holds bullish.

Weekly

Here we have inside week as well. Trend is bearish. In general, our long-term analysis here still the same, since nothing has changed yet.

As EUR still holds around previous highs it’s very difficult to say “this is definitely reversal” or “this is definitely continuation”. Here we have to estimate clear conditions when we can treat price action as reversal and when it will be continuation. Signs and patterns that EUR shows us now have more bearish sentiment, rather than bullish. Here what we have – Butterfly “Sell” is forming right around major monthly resistance, price still can’t pass through it. Current AB-CD pattern has reached minor 0.618 target, but CD leg is much flatter than AB and this is the sign of weakness. On previous week trend has turned bearish and we’ve got bearish divergence here right at monthly resistance. As previous move down was solid and in fact, engulfs the action of previous 4-5 weeks, chances on reaching butterfly target become blur.

Our ideal criteria of reversal was to see butterfly completion and then – move below 1.33 lows. By looking at current action I’m not as sure with butterfly’s completion. Thus, we need at least move below 1.33 lows. In this case we will get reversal swing on weekly chart that could become at least something that could confirm downward ambitions.

Conversely, to speak about upward continuation, we need to get fulfilling of two conditions as well – market should coil around previous tops without significant retracement, and second – move above 1.3980 – butterfly 1.27 target. In this case next target will be right around 1.43-1.44 – weekly AB-CD, Yearly PR1 and butterfly 1.618. While market will stand inside of specified ranges – we can trade it based on lower time frame (daily and hourly) patterns and setups.

In shorter term, despite poor recent NFP data, bears have more weight right now, based on technical picture. Any pattern that stands on higher time frame has more weight than opposite one on lower time frame. Thus, W&R on weekly will dominate over any bullish action, say, on daily. Becaus of that yesterday’s upward rebound on daily chart hardly will overrule weekly W&R until price will not show suitable (at least minimum 0.382 retracement) on weekly chart. Besides, many things will depend on how we will treat action in red circle. I can’t exclude that we can treat it as some kind of “compound” bearish engulfing, since black candle engulfs almost a month of previous action. If we would look at it in this way, then current small upward action seems absolutely reasonable, because in 90% cases market shows some bounce inside of engulfing patterns right at the eve of downward action, triggered by them. Another reason for a bounce could be explained by existance of MPS1.

Daily

As we have no direction yet in long term, all that we can do now is to focus on short-term perspective. Here are some thoughts on this subject. If we would treat weekly action as W&R and engulfing and currently I see no reasons to avoid this possibility and I do not see any action yet that could point that this is wrong treatment – it suggests downward continuation. Hence we should get some extension down, may be in a way of AB-CD. This conclusion is also supported by reversal swing that was created recently here.

At the same time retracement up here could be a bit greater, because previous upward momentum was solid and since this is just first attempt to reverse down – market will show deeper retracement up due the residual of previous bullish impulse that it needs to fade. We’ve spoken a lot previously about it and that is absolutely common thing for any liquid market. Thus, it seems that our major task here is to try estimate target of retracement and where AB-CD down could start. Based on daily time frame we can suggest an area 1.3720-1.3760 as possible retracement target by two reasons. First is existence of EUR favorite 50% resistance level. Second – strong resistance per se that includes MPP and WPR1 surrounded by Fib levels. Also take a note that trend will remain bearish if even market will get there. If this really will become a downward reversal area, then it could lead to appearing of AB-CD that has a destination point right at Yearly Pivot.

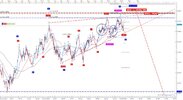

4-hour

Let’s try to take a look at intraday charts, what if we will get more precise target numbers of upward retracement? First of all, pay attention that upward action has started only after reaching of major 1.618 AB-CD downward target. Currently trend holds bullish here and market already has formed upward reversal swing. Probably we could treat this action as potential Double Bottom pattern. In this case it’s target will stand very close to daily Pivot cluster and we can say that it confirms our thought on possible retracement destination point.

1-hour

On hourly chart trend is bullish as well, but market now stands at daily 0.382 Fib resistance and has accomplished hourly 1.618 AB-CD target. Some retracement down is possible. At the same time this retracement should not deep, because if it will – this will put under question possible Double Bottom pattern, since price will return too deep below neckline. Thus, it would be great if price will stop somewhere around WPP and major 3/8 support 1.3635 area and simultaneously will test the pivot. Here I absolutely do not object against possible scalp long trading if you have skills to do that.

Conclusion:

Despite all positive recent USD data action on EUR does not suggest yet total and final reversal. Price still coiling around edge point and currently chances exist as for upward breakout as for downward reversal, although in recent time downward direction has become dominate. To rely on direction whatever it will be, we need to get clear patterns that could confirm it and point extended targets for us. But we do not have them yet.

Until this will not happen, we probably will have to deal with scalp fast trades on daily chart and lower ones. Thus, approximately we can assume that move above current highs will suggest upward continuation, while breakout below 1.33 will be first sign of possible downward reversal on long-term charts.

In shorter-term perspective market shows solid move down that probably will continue. Appearing of Yearly PP around 1.3475 makes it’s reaching very probable. Thus, in the beginning of the week we expect shy upward continuation to 1.3720-1.3760 resistance cluster, where, as we’ve suggested downward action to Yearly Pivot (1.3475) could start. That is our short-term view.

On intraday chart you could try to ride on upward action by watching on possible retracement to 1.3650 first, on Monday. Potential target of this move is WPR1=1.3720.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.

As Reuters reports, The dollar slumped on Friday, hitting a one-week low against a basket of other currencies, after a surprisingly weak U.S. jobs report spurred in a rally in bonds. U.S. employers hired the fewest workers in almost three years in December, though the setback was likely to be temporary amid signs that cold weather conditions might have had an impact. Still, the jobs data resulted in a rally in the bond market, pushing benchmark yields lower. Currencies often shift based on the difference between countries' interest-rate levels, so lower yields makes the U.S. dollar somewhat less attractive. Against the yen, the dollar hit a two-week low of 103.82 yen, last trading down 0.72 percent at 104.07 yen.

"The economists have looked at the numbers and have kind of downplayed some of this weakness, but the markets were taken by surprise," said Vassili Serebriakov, currency strategist at BNP Paribas in New York. "I think we’re still driven by the reactions in the rates market. You look at the trajectory in the front-end rates, and we're sitting at the lows of the day. The same goes for the 10 year," he said. U.S. Treasury yields, which move inversely to the price of the bonds, fell while stocks pared earlier losses.

Currency speculators, however, boosted bets in favor of the U.S. dollar in the latest week to their largest in four months at $21.11 billion, according to data from the Commodity Futures Trading Commission released on Friday. That optimism on the dollar could change next week given Friday's weak U.S. payrolls number.

JOBS DISAPPOINTMENT

Nonfarm payrolls rose only 74,000 last month, the smallest increase since January 2011, and the unemployment rate fell 0.3 percentage point to 6.7 percent, in part due to people leaving the labor force. "It was clearly a disappointing number and the markets are reflecting that disappointment by selling the dollar across the board," said Omer Esiner, chief market analyst at Commonwealth Foreign Exchange in Washington. "I do not think it alters the outlook for steady reductions in Fed stimulus. Certainly it will temper any talk of more accelerated pace of Fed policy reduction."

The Fed announced in December that it would trim its monthly purchases of Treasuries and mortgage-backed securities to $75 billion from $85 billion, and many economists expect it to decide on a similar-sized cut at its next meeting on Jan. 28-29. St. Louis Fed President James Bullard said on Friday he is "disinclined" to focus on December's job data alone when considering whether the central bank should continue to trim bond purchases.

One bright spot for the U.S. dollar was its performance against the Canadian dollar, continuing its week-long climb. Data out of Canada on Friday showed a surprise setback for the job market in December, capping the worst year for hiring since 2009. Meanwhile, demand for euro zone peripheral government bonds saw the single currency jump to its highest point against the dollar in a little more than a week, hitting a high of $1.3687. The euro was last trading at $1.3666, up 0.44 percent. A key theme at the start of 2014 is the divergence of outlooks on monetary policy, something that has benefited both the pound and the dollar, at the expense of the euro. European Central Bank President Mario Draghi added to pressure on the euro on Thursday by firming up the bank's promise to take more action to lower market borrowing costs if need be. But while the euro zone economy still looks fragile, government finances and banking in the bloc broadly look far healthier than six months ago, and players are starting to trade heavily on improvement in its debt-laden southern half.

Technical

On monthly time frame January candle is still an inside one for December and has not made any impact on overall situation yet. Appearing of YPP=1.3475 in current situation could play significant part on our analysis, since market stands just 100 pips above it. As we know that price always gravitates to pivot, this moment significantly increases the probability of more extended move down in short-term perspective.

Although we see solid downward action right now, but since monthly time frame is really big picture – this move has no drastical value yet. Most important here is recent 3-4 candles. Previously we’ve said that until market stands around current highs and above 1.33 chances on upward continuation still exists.

If we will follow to market mechanics, we’ll see that currently market should not show any solid retracement down. Any move of this kind should be treated as market weakness and it will increase probability of reversal. Take a look that as market has hit minor 0.618 AB-CD extension target right at rock hard resistance – Fib level and Agreement and former yearly PR1, it has shown reasonable bounce down and now it has tested it again. As retracement after 0.618 target already has happened, it is unlogical and unreasonable to see another deep bounce and it will look suspicious. Right now market still stands on the edge here. From one point of view price has failed to break up, but from another one – it still stands very close to previous highs. Thus, by looking at monthly chart we can’t say yet that price has reversed down already. This time frame can’t point us long-term direction yet, although MACD trend holds bullish.

Weekly

Here we have inside week as well. Trend is bearish. In general, our long-term analysis here still the same, since nothing has changed yet.

As EUR still holds around previous highs it’s very difficult to say “this is definitely reversal” or “this is definitely continuation”. Here we have to estimate clear conditions when we can treat price action as reversal and when it will be continuation. Signs and patterns that EUR shows us now have more bearish sentiment, rather than bullish. Here what we have – Butterfly “Sell” is forming right around major monthly resistance, price still can’t pass through it. Current AB-CD pattern has reached minor 0.618 target, but CD leg is much flatter than AB and this is the sign of weakness. On previous week trend has turned bearish and we’ve got bearish divergence here right at monthly resistance. As previous move down was solid and in fact, engulfs the action of previous 4-5 weeks, chances on reaching butterfly target become blur.

Our ideal criteria of reversal was to see butterfly completion and then – move below 1.33 lows. By looking at current action I’m not as sure with butterfly’s completion. Thus, we need at least move below 1.33 lows. In this case we will get reversal swing on weekly chart that could become at least something that could confirm downward ambitions.

Conversely, to speak about upward continuation, we need to get fulfilling of two conditions as well – market should coil around previous tops without significant retracement, and second – move above 1.3980 – butterfly 1.27 target. In this case next target will be right around 1.43-1.44 – weekly AB-CD, Yearly PR1 and butterfly 1.618. While market will stand inside of specified ranges – we can trade it based on lower time frame (daily and hourly) patterns and setups.

In shorter term, despite poor recent NFP data, bears have more weight right now, based on technical picture. Any pattern that stands on higher time frame has more weight than opposite one on lower time frame. Thus, W&R on weekly will dominate over any bullish action, say, on daily. Becaus of that yesterday’s upward rebound on daily chart hardly will overrule weekly W&R until price will not show suitable (at least minimum 0.382 retracement) on weekly chart. Besides, many things will depend on how we will treat action in red circle. I can’t exclude that we can treat it as some kind of “compound” bearish engulfing, since black candle engulfs almost a month of previous action. If we would look at it in this way, then current small upward action seems absolutely reasonable, because in 90% cases market shows some bounce inside of engulfing patterns right at the eve of downward action, triggered by them. Another reason for a bounce could be explained by existance of MPS1.

Daily

As we have no direction yet in long term, all that we can do now is to focus on short-term perspective. Here are some thoughts on this subject. If we would treat weekly action as W&R and engulfing and currently I see no reasons to avoid this possibility and I do not see any action yet that could point that this is wrong treatment – it suggests downward continuation. Hence we should get some extension down, may be in a way of AB-CD. This conclusion is also supported by reversal swing that was created recently here.

At the same time retracement up here could be a bit greater, because previous upward momentum was solid and since this is just first attempt to reverse down – market will show deeper retracement up due the residual of previous bullish impulse that it needs to fade. We’ve spoken a lot previously about it and that is absolutely common thing for any liquid market. Thus, it seems that our major task here is to try estimate target of retracement and where AB-CD down could start. Based on daily time frame we can suggest an area 1.3720-1.3760 as possible retracement target by two reasons. First is existence of EUR favorite 50% resistance level. Second – strong resistance per se that includes MPP and WPR1 surrounded by Fib levels. Also take a note that trend will remain bearish if even market will get there. If this really will become a downward reversal area, then it could lead to appearing of AB-CD that has a destination point right at Yearly Pivot.

4-hour

Let’s try to take a look at intraday charts, what if we will get more precise target numbers of upward retracement? First of all, pay attention that upward action has started only after reaching of major 1.618 AB-CD downward target. Currently trend holds bullish here and market already has formed upward reversal swing. Probably we could treat this action as potential Double Bottom pattern. In this case it’s target will stand very close to daily Pivot cluster and we can say that it confirms our thought on possible retracement destination point.

1-hour

On hourly chart trend is bullish as well, but market now stands at daily 0.382 Fib resistance and has accomplished hourly 1.618 AB-CD target. Some retracement down is possible. At the same time this retracement should not deep, because if it will – this will put under question possible Double Bottom pattern, since price will return too deep below neckline. Thus, it would be great if price will stop somewhere around WPP and major 3/8 support 1.3635 area and simultaneously will test the pivot. Here I absolutely do not object against possible scalp long trading if you have skills to do that.

Conclusion:

Despite all positive recent USD data action on EUR does not suggest yet total and final reversal. Price still coiling around edge point and currently chances exist as for upward breakout as for downward reversal, although in recent time downward direction has become dominate. To rely on direction whatever it will be, we need to get clear patterns that could confirm it and point extended targets for us. But we do not have them yet.

Until this will not happen, we probably will have to deal with scalp fast trades on daily chart and lower ones. Thus, approximately we can assume that move above current highs will suggest upward continuation, while breakout below 1.33 will be first sign of possible downward reversal on long-term charts.

In shorter-term perspective market shows solid move down that probably will continue. Appearing of Yearly PP around 1.3475 makes it’s reaching very probable. Thus, in the beginning of the week we expect shy upward continuation to 1.3720-1.3760 resistance cluster, where, as we’ve suggested downward action to Yearly Pivot (1.3475) could start. That is our short-term view.

On intraday chart you could try to ride on upward action by watching on possible retracement to 1.3650 first, on Monday. Potential target of this move is WPR1=1.3720.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.