Sive Morten

Special Consultant to the FPA

- Messages

- 18,679

Fundamentals

Recent week provides not too much fundamental events and statistics, so investors try to go in habit with issues that already stand on table and new spiral of Brexit saga. Second important issue is rising concern on US government shutdown that lasts record time and as more it comes to pass as it becomes worse. So, I'm not sure that markets absolutely calm on this subject. We still yet to get results of shutdown impact on GDP in IQ of 2019.

Still, as Reuters reports - The dollar held firm against its rivals on Friday, set for its first weekly gain since mid-December on optimism about talks to end the trade war between China and the United States.

Media reports on Thursday and Friday suggested both countries were considering concessions ahead of a Washington visit from Chinese Vice Premier Liu He on Jan. 30 and 31 for talks aimed at resolving the trade standoff between the world’s two largest economies.

China has offered to go on a six-year buying spree to ramp up imports from the United States in order to reconfigure the relation between the two countries, Bloomberg reported on Friday, citing people familiar with the matter.

U.S. Treasury Secretary Steven Mnuchin discussed lifting some or all tariffs on Chinese goods and suggested offering a tariff rollback during the trade discussions scheduled for Jan. 30, the Wall Street Journal reported on Thursday, citing people familiar with the internal deliberations.

Although a Treasury spokesman denied Thursday’s report, the positive sentiment was enough to lift the dollar index and the three major U.S. stock indexes Friday morning. Following the publication of the Bloomberg story on Friday, the dollar index added to its gains rising 0.3 percent, last at 96.352.

“Yesterday’s WSJ headline concerning a possible rollback of the Trump tariffs was a setback for (the U.S. dollar/renminbi cross), and although it was subsequently denied, it had created confusion in the foreign exchange space,” said Stephen Gallo, European head of foreign exchange strategy at BMO Capital Markets in London.

Stronger-than-expected U.S. industrial production numbers also helped lift the greenback. American manufacturing output increased by the most in 10 months in December, pushed up by a surge in the production of motor vehicles and a range of other goods, the Federal Reserve said on Friday.

Going into 2019, weakness in the dollar was a consensus view among currency market traders. The bet was that the U.S. central bank would stop raising interest rates and the economy would slow after a fiscal boost last year. While expectations of a U.S. rate pause have manifested in money markets, bets on policy tightening by other major central banks have also receded, giving a boost to the dollar.

The pound slipped against the euro and against the dollar, trimming overnight gains, as traders wagered on a second referendum vote on Britain’s EU membership.

Recent light improve in sentiment also changes the anticipation of Fed rate. Take a look that Fed Fund rate futures of Dec 2019 rate decision has returned at the level where they was 4 weeks ago. Now 0.25% rate change by the end of 2019 increases to ~29% again:

Source: cmegroup.com

As US-China relations comes on first stage, Fathom consulting tries to analyse recent change in US economy sentiment and find major driving factors for nearest perspective.

Particularly speaking, they wrote in recent report:

"Our US ESI fell from 5.8% to 4.6% in December. This was the lowest reading since July 2017, and the decline during the month was large by past standards. That said, we think that too much pessimism has been priced into financial markets. Despite the fall in the US ESI last month, sentiment is still strong by historical standards and December’s blockbuster employment report suggests that the economy is still growing at a solid clip and above potential. For now, we think that external shocks, such as a slowdown in China, are likely to have a relatively small effect on the US real economy. We still think a US-led global recession is likely within the next couple of years, but that this is unlikely to happen in 2019 and it would take a much larger drop in the US ESI for us to alter this view."

As a confirmation we see healthy inflation in hourly earnings and 200K new jobs every month on average. Indeed, it is difficult to talk about recession, having background of this kind.

So, it seems as all news come from US. Previously they was against USD, when Fed announced pause in rate change cycle and new stage of US-China tariffs piking has started, exacerbated by US government shutdown. Now they turn to positive ones. But nothing comes from EU - France stands in long-term yellow jackets unrest, UK stuck in endless Brexit negotiations etc.

It seems that further EUR/USD direction mostly will depend on US situation and how their problems will be resolved, as EU and ECB has nothing to add to market drivers.

Technicals

Monthly

Our long term picture mostly stands the same. December month shows very small range and has no impact on monthly picture at all. Here we mostly wait for clarity - either downside breakout and start action to 1.08 and later to 1.03 or ability of the EUR to hold above 1.12 and turning up. Market stands at support area around major 5/8 Fib level. In case of upside action, YPP will be important target , because, as a rule, market tends to touch YPP through the year.

Indirect technical factors point on market's weakness, at least in long-term perspectives, as EUR can't jump out from strong support within more than 5-6 months and just lays upon it. Trend stands bearish here.

Monthly situation shortly could be described as indecision with light gravitation to the downside. In fact, long standing around Yearly Pivot confirms things that we've discussed above. MACD trend stands bearish here.

Thus we keep valid our downside COP target around 1.03 by far.

Weekly

On weekly chart market still keeps dual setup. Last week was bearish, but it stands in a row with recent consolidation and makes no significant impact on the chart. Here actually we have two different setups. First is our initial bearish setup, which, in fact, is continuation on the same logic that we have on monthly chart.

Here we have downside channel. Yesterday again, market turned down from its resistance line. Since market shows very weak reaction on major 5/8 Fib support level - it brings some signs of bearish dynamic pressure, when MACD shows upside trend but price action stands flat.

Conversely, we have MACD divergence and possible reverse H&S shape. But market has to climb back to neckline at least, to resurrect this scenario, and break the channel up. But particularly this action we do not see. It means that we could get some different action, say, fallen wedge pattern instead. Anyway, currently weekly chart doesn't support any bullish inspiration and overall price action looks mostly indecision.

It means that again we mostly will be focused on daily/intraday tactical setups as we do not have any longer-term direction yet.

Daily

Last week we deal with retracement and some intraday targets. This job is over right now and we have to acknowledge that market has shown really weak reaction on solid support area. Although it has not dropped too far down, but overall upside reaction was too small. Anyway, currently it is difficult to talk on some bullish setup.

Nearest destination point is 1.13-1.1350 - space between MPS1 and major 5/8 Fib level. We will see whether EUR could stop and hold there. Personally I have real doubts on this subject. Close look at EU shares tells that upside rally there that has started recently should continue. In fact German DAX is oversold on monthly chart and on daily we have reverse H&S pattern, which suggest 12-15% of rally. As a rule, equity rally is accompanied by weakness of the currency. We do not need to search special example - just take a look at Friday action of DAX and EUR.

Following to these thoughts I gravitate more to scenario where EUR could return back to 1.12 lows. Besides, 1.13-1.1350 is also a long-term trend line. Actually this is monthly flag support. Breaking of 1.13 area will be decisive moment as EUR forms downside reversal swing and could get far-going consequences.

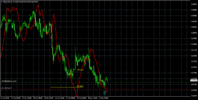

Intraday

4H chart shows that upside reaction and retracement that we were watching for, was too small. This indirect bearish sign. That was pretty nice support area and Agreement. But we've got the same puny harmonic lazy pullback, with no respect to area's strength. Yes, it was enough to move stops to breakeven and we've got no loss, but we have no satisfaction from this trade as well.

In fact, here we have the same H&S pattern as on DAX index. Technically recent drop with acceleration increases chances on further downside action to 1.13 area where we have XOP target.

Conclusion:

We expect that major driving factor in 2019 will be undervaluation of Fed hawkishness, as market right now supposes no rate increase in 2019.

In shorter-term perspective we continue our trading in the range, but also keep an eye on two weekly scenarios - possible action to 1.1740 area or downside breakout. Personally, I gravitate a bit more to bearish one, as EU and ECB policy stands half-and-halfer while investors gradually is turning to common sense from emotions and starts to see US economy fundamentals again.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.

Recent week provides not too much fundamental events and statistics, so investors try to go in habit with issues that already stand on table and new spiral of Brexit saga. Second important issue is rising concern on US government shutdown that lasts record time and as more it comes to pass as it becomes worse. So, I'm not sure that markets absolutely calm on this subject. We still yet to get results of shutdown impact on GDP in IQ of 2019.

Still, as Reuters reports - The dollar held firm against its rivals on Friday, set for its first weekly gain since mid-December on optimism about talks to end the trade war between China and the United States.

Media reports on Thursday and Friday suggested both countries were considering concessions ahead of a Washington visit from Chinese Vice Premier Liu He on Jan. 30 and 31 for talks aimed at resolving the trade standoff between the world’s two largest economies.

China has offered to go on a six-year buying spree to ramp up imports from the United States in order to reconfigure the relation between the two countries, Bloomberg reported on Friday, citing people familiar with the matter.

U.S. Treasury Secretary Steven Mnuchin discussed lifting some or all tariffs on Chinese goods and suggested offering a tariff rollback during the trade discussions scheduled for Jan. 30, the Wall Street Journal reported on Thursday, citing people familiar with the internal deliberations.

Although a Treasury spokesman denied Thursday’s report, the positive sentiment was enough to lift the dollar index and the three major U.S. stock indexes Friday morning. Following the publication of the Bloomberg story on Friday, the dollar index added to its gains rising 0.3 percent, last at 96.352.

“Yesterday’s WSJ headline concerning a possible rollback of the Trump tariffs was a setback for (the U.S. dollar/renminbi cross), and although it was subsequently denied, it had created confusion in the foreign exchange space,” said Stephen Gallo, European head of foreign exchange strategy at BMO Capital Markets in London.

Stronger-than-expected U.S. industrial production numbers also helped lift the greenback. American manufacturing output increased by the most in 10 months in December, pushed up by a surge in the production of motor vehicles and a range of other goods, the Federal Reserve said on Friday.

Going into 2019, weakness in the dollar was a consensus view among currency market traders. The bet was that the U.S. central bank would stop raising interest rates and the economy would slow after a fiscal boost last year. While expectations of a U.S. rate pause have manifested in money markets, bets on policy tightening by other major central banks have also receded, giving a boost to the dollar.

The pound slipped against the euro and against the dollar, trimming overnight gains, as traders wagered on a second referendum vote on Britain’s EU membership.

Recent light improve in sentiment also changes the anticipation of Fed rate. Take a look that Fed Fund rate futures of Dec 2019 rate decision has returned at the level where they was 4 weeks ago. Now 0.25% rate change by the end of 2019 increases to ~29% again:

Source: cmegroup.com

As US-China relations comes on first stage, Fathom consulting tries to analyse recent change in US economy sentiment and find major driving factors for nearest perspective.

Particularly speaking, they wrote in recent report:

"Our US ESI fell from 5.8% to 4.6% in December. This was the lowest reading since July 2017, and the decline during the month was large by past standards. That said, we think that too much pessimism has been priced into financial markets. Despite the fall in the US ESI last month, sentiment is still strong by historical standards and December’s blockbuster employment report suggests that the economy is still growing at a solid clip and above potential. For now, we think that external shocks, such as a slowdown in China, are likely to have a relatively small effect on the US real economy. We still think a US-led global recession is likely within the next couple of years, but that this is unlikely to happen in 2019 and it would take a much larger drop in the US ESI for us to alter this view."

As a confirmation we see healthy inflation in hourly earnings and 200K new jobs every month on average. Indeed, it is difficult to talk about recession, having background of this kind.

So, it seems as all news come from US. Previously they was against USD, when Fed announced pause in rate change cycle and new stage of US-China tariffs piking has started, exacerbated by US government shutdown. Now they turn to positive ones. But nothing comes from EU - France stands in long-term yellow jackets unrest, UK stuck in endless Brexit negotiations etc.

It seems that further EUR/USD direction mostly will depend on US situation and how their problems will be resolved, as EU and ECB has nothing to add to market drivers.

Technicals

Monthly

Our long term picture mostly stands the same. December month shows very small range and has no impact on monthly picture at all. Here we mostly wait for clarity - either downside breakout and start action to 1.08 and later to 1.03 or ability of the EUR to hold above 1.12 and turning up. Market stands at support area around major 5/8 Fib level. In case of upside action, YPP will be important target , because, as a rule, market tends to touch YPP through the year.

Indirect technical factors point on market's weakness, at least in long-term perspectives, as EUR can't jump out from strong support within more than 5-6 months and just lays upon it. Trend stands bearish here.

Monthly situation shortly could be described as indecision with light gravitation to the downside. In fact, long standing around Yearly Pivot confirms things that we've discussed above. MACD trend stands bearish here.

Thus we keep valid our downside COP target around 1.03 by far.

Weekly

On weekly chart market still keeps dual setup. Last week was bearish, but it stands in a row with recent consolidation and makes no significant impact on the chart. Here actually we have two different setups. First is our initial bearish setup, which, in fact, is continuation on the same logic that we have on monthly chart.

Here we have downside channel. Yesterday again, market turned down from its resistance line. Since market shows very weak reaction on major 5/8 Fib support level - it brings some signs of bearish dynamic pressure, when MACD shows upside trend but price action stands flat.

Conversely, we have MACD divergence and possible reverse H&S shape. But market has to climb back to neckline at least, to resurrect this scenario, and break the channel up. But particularly this action we do not see. It means that we could get some different action, say, fallen wedge pattern instead. Anyway, currently weekly chart doesn't support any bullish inspiration and overall price action looks mostly indecision.

It means that again we mostly will be focused on daily/intraday tactical setups as we do not have any longer-term direction yet.

Daily

Last week we deal with retracement and some intraday targets. This job is over right now and we have to acknowledge that market has shown really weak reaction on solid support area. Although it has not dropped too far down, but overall upside reaction was too small. Anyway, currently it is difficult to talk on some bullish setup.

Nearest destination point is 1.13-1.1350 - space between MPS1 and major 5/8 Fib level. We will see whether EUR could stop and hold there. Personally I have real doubts on this subject. Close look at EU shares tells that upside rally there that has started recently should continue. In fact German DAX is oversold on monthly chart and on daily we have reverse H&S pattern, which suggest 12-15% of rally. As a rule, equity rally is accompanied by weakness of the currency. We do not need to search special example - just take a look at Friday action of DAX and EUR.

Following to these thoughts I gravitate more to scenario where EUR could return back to 1.12 lows. Besides, 1.13-1.1350 is also a long-term trend line. Actually this is monthly flag support. Breaking of 1.13 area will be decisive moment as EUR forms downside reversal swing and could get far-going consequences.

Intraday

4H chart shows that upside reaction and retracement that we were watching for, was too small. This indirect bearish sign. That was pretty nice support area and Agreement. But we've got the same puny harmonic lazy pullback, with no respect to area's strength. Yes, it was enough to move stops to breakeven and we've got no loss, but we have no satisfaction from this trade as well.

In fact, here we have the same H&S pattern as on DAX index. Technically recent drop with acceleration increases chances on further downside action to 1.13 area where we have XOP target.

Conclusion:

We expect that major driving factor in 2019 will be undervaluation of Fed hawkishness, as market right now supposes no rate increase in 2019.

In shorter-term perspective we continue our trading in the range, but also keep an eye on two weekly scenarios - possible action to 1.1740 area or downside breakout. Personally, I gravitate a bit more to bearish one, as EU and ECB policy stands half-and-halfer while investors gradually is turning to common sense from emotions and starts to see US economy fundamentals again.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.