Sive Morten

Special Consultant to the FPA

- Messages

- 18,695

Fundamentals

Reuters reports euro fell to fresh 11-year lows against the dollar on Friday following the European Central Bank's announcement on Thursday that it would pump a trillion euros into the euro zone economy to revive sagging growth and ward off deflation.

After a similar tumble on Thursday, the euro was down over 7 percent since the start of the year and was on track for its biggest monthly fall since the depths of the financial crisis in early 2009. The euro fell over 3 percent against the dollar this week.

"What the ECB is trying to do is enough to drive the euro below parity by the end of this year," said Shaun Osborne, chief foreign exchange strategist at TD Securities in Toronto. He said the euro could hit 96 cents by the end of 2015.

The euro is set for another trial as global markets await snap Greek elections on Sunday. A win for the leftist Syriza party could trigger a standoff with Greece's EU/IMF lenders. Analysts said the uncertainty added to the euro's weakness.

The dollar appeared to be headed higher given the Federal Reserve's path toward tighter monetary policy in contrast with the looser policies of other developed market central banks such as the ECB and the Bank of Japan, analysts said.

"The name of the game is that the dollar will continue to appreciate against currencies of central banks that are easing,” said Mark McCormick, currency strategist at Credit Agricole in New York.

CFTC data shows increasing of open interest and faster growth on short position. Right now speculative shorts stand for 225’167 and increased for 10K contracts past week vs. longs of 48’677 – almost the same as previously. Thus, our ratio has increased to 82,22% and gradually approaches to crucial numbers when market will need some pause or pullback to reduce this number.

Open interest:

Shorts:

Shorts:

Longs:

Longs:

Here guys, I will keep our previous thoughts and discussion because it is still important and actual. But today I would like to add some new object for discussion. Is it possible some secret agreement to support value of US Dollar. I know that these talks on huge american debt and sooner or later dollar should fail are old. Still, it seems suspicious that dollar appreciates across the board particularly when emerging markets start to take steps in direction of expelling of US dollar in mutual trading. Of cause these steps are not quite evident and not advertised very wide, still they exist. It is difficult to judge how successful they are, but this work is continuing. For example, today Central Bank of Iran announced denying of USD and its application in international transactions. The same steps come from many other countries – China, Brazil, Russia and others. Currently they do not exclude USD totally, but softly “replace” it partially in mutual trading.

And we see very suspicious action on all financial markets. Crude Oil has dropped and pressed CAD, gold has dropped and pressed AUD. EU has started QE, while Japan takes these steps for long period already. Could this be some collective measures to support USD and keep it as major reserve currency? Turmoil and instability triggered by US across the world increases uncertainty and makes investors come to safe haven. Artificial pressing on crude oil and gold makes them to believe that USD is high value currency and only USD could protect their wealth. This is not a statement, we just call you to discussion, but this is really looks suspicious when you see that all markets and west countries take steps for dollar support…

Recently guys, we’ve put our thoughts on SNB action. We think that major reason stands beyond European QE. QE is just small add-on but not major factor. To better understand what really has happened we need to take a look at Switzerland economy. Economy stands near recession, struggles with deflation, SNB reduces rates and right now it stands at -0.75%. To understand what usually country does in this kind of situation – take a look at Japan. Here we see massive government spending and lending programs, massive easing program and steps of stimulation of consumption and spending. Significant steps to stimulate inflation and reduce the value of national currency to pump export.

But the trick is Switzerland stands in the same situation – export oriented country falls in recession but what they do – increase the value of franc for 30% to USD and 20% to EUR. Why? What for? My college has spent Xmas time in Switzerland and brought me a present – Swiss “Lindt” chocolate sweets. Small box costs around 11 francs! Even in Russia I can buy the same sweets cheaper in German “Metro” store.

So, we were able to find only one explanation of this SNB step. They intend to buy something. This is single logical explanation why SNB took this step in current economic conditions. And we suspect that this “something” will be gold.

As you know among other events we’re tracking geopolitical situation and try to catch some relations that we see there. Of cause, geopolicy is most blur sphere of international relations and nobody could say definitely what is really going on. But still, we think that situation in Ukraine, terrorist attack in France and across the Europe, crude oil prices, gold and SNB action is the part of the same chain.

If you will monitor, say, Germany newspapers and recent media you’ll see that Ukraine almost totally disappeared from major news. As we’ve mentioned previously shooting in France has happened when Hollande gave hints on warming relations with Russia.

Recently NATO Stoltenberg has come to Germany trying to get additional financing and frighten Europe with “Russian menace”. He treads that US right now has contracted possibilities while Germany and France are rather rich and they could do much more for NATO. Otherwise they will be one-on-one with dreadful Putin. The major background for this “speech” was September conference when NATO members have decided to increase spending to 2% of GDP of each member.

But what result of this meeting, I mean recent visit of Stoltenberg… Germany said “nein”. But you may ask what about G7 meeting, Russia was not invited, what about sanctions prolongation etc… We would say that we should take in consideration not speeches but deeds and facts:

Merkel has banned on the use of nuclear energy to generate electricity, which she has pushed despite the resistance of the industry, putting the economy heavily dependent on Russian gas, the failure to increase investment in the defense industry, failure of Ukraine in the financial assistance and other moments.

Anyway, now we can try to collect puzzle. It is obvious that EU attitude to situation is changing and it becomes healthier. This comes in contradiction with US policy who tries to keep globe dominant power as economical as political. Gradually world starts to doubt real reliability and safety of US dollar and US has applied unprecedented steps to keep it. Subprime crisis in 2008, mass wars across the Globe to spread instability and sow chaos across the planet, to convince global financial society that only US dollar worthy to be an absolute protection again globe turmoil. Then drop in crude oil price and gold should prove that US dollar is strong and expensive. Right now nobody has any doubts that crude oil drives not by economical law of demand and supply.

When they saw that Europe is trying to be on her own mind – they start to frighten it, triggering terror, hinting that it will become worse if you will continue this line. Right in this moment war in Ukraine has activated again and turns to hot stage. And right now SNB cancels the cap… and gold shows unprecedented rally. This is the part of the same chain. SNB decision looks negative for US, especially if they will start to buy gold… Franc now becomes a rival for US dollar. Franc is not yen, because Japan totally depends on US export, keeps huge volumes of US debt and now applies mass money printing. Other words, yen stability is based on US stability. CHF is a quite another tune.

There is a rumor on the market that US keeps gold price low by selling its own gold storages. Nobody knows any details, and to be honest I have real doubts on this, but this is what I’ve heard on the markets. Still it does not seem as absolutely impossible.

As Europe still stands on its way to make its own policy and try to become real member of geopolitical game – US will continue somehow to press on it. Thus, we can’t exclude some bad events in EU of any type – either economical, may be again some social turmoil that we already see. Besides, 25th of January Greece will take voting on its future.

In economy sphere we mostly watch for two major events – details on ECB QE that should be announced on 22nd of January, second – impact of Fed rate policy on EUR. The major concern here how EUR will behave in this whitewater of financial events and Greece voting on 25th of January.

Probably we need to explain a bit. At first glance it seems all simple – US will start rise rate and hence EUR should fall even deeper. But this is not quite so. We suspect that this will be true only till the moment of first rate hiking by Fed. We suspect that starting of QE program by ECB will attract a lot of investors who will want to make easy money. As US experience of QE shows, real Central Bank money mostly was put in equities but not in long-term loans of real industrial sector, population, manufacturing and etc. This has led to huge bubble on US equities. We suspect that something of this sort could appear on EU equities. Initially it will be gradual. But as soon as Fed will start to increase rates capital will start to flow to EU. As amount of money will increase this will lead to additional demand on EUR and here drop of EUR could stop, or at least will loose its pace, despite opposite courses in rate policy…

Currently it is very difficult to predict how definitely this will happen; we just mention common view on this situation. But what we do know that this will not be as simple as “US rising rates while EU not, hence USD will dominate over EUR”.

And finally couple of words on QE. It will start in March for 60Bln per month and will last till 2016. As we have suggested EU stocks and bonds will start to rise and they are started. Probably gold and EU assets will show best growth in nearest 6-12 months.

Technicals

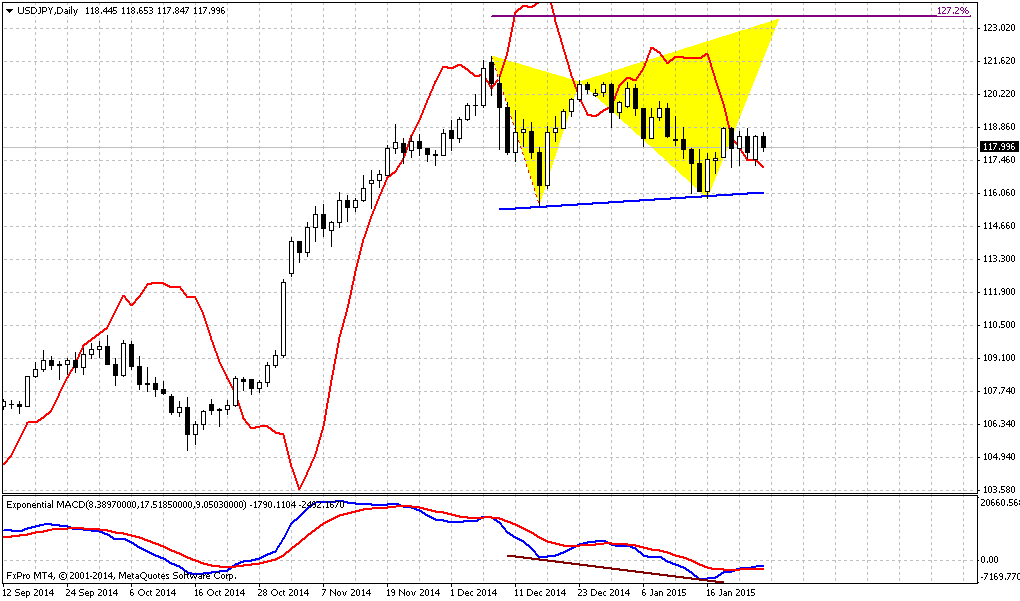

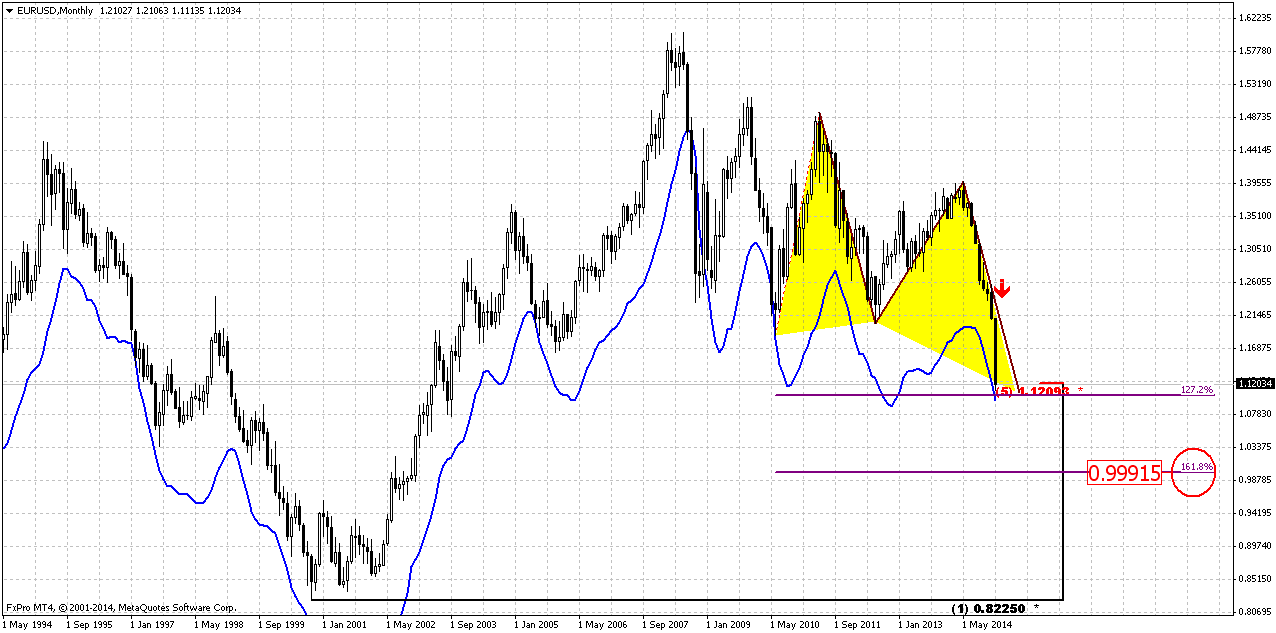

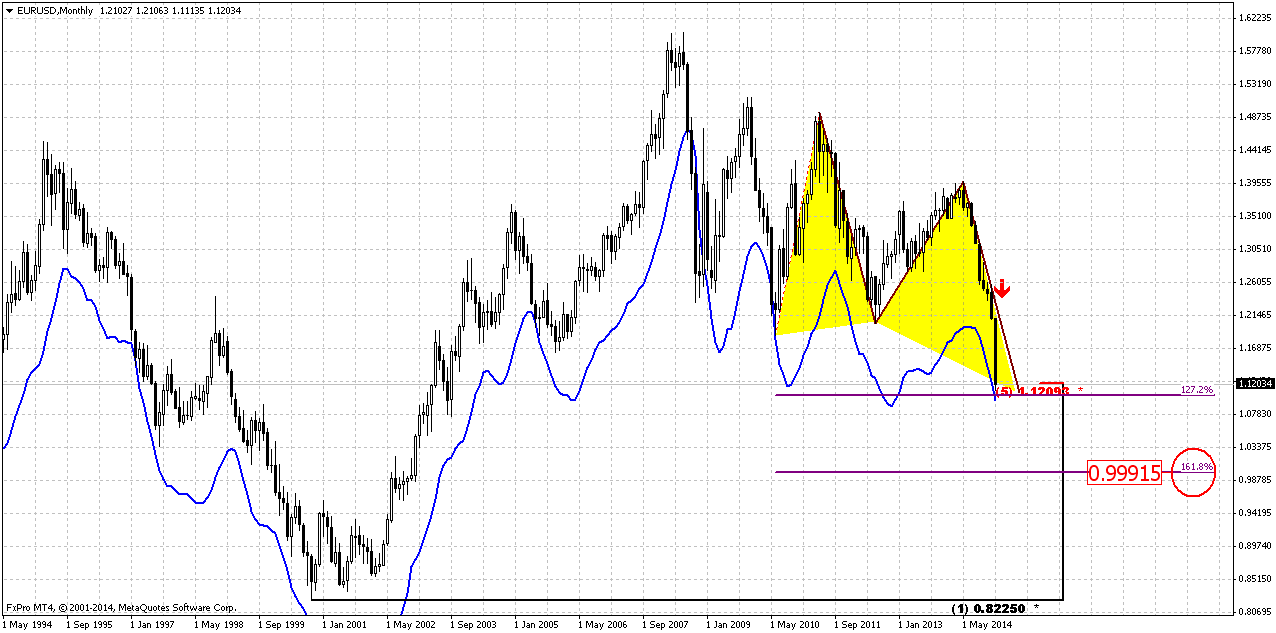

Monthly

So, January is dreadful month for EUR. We have plunge that we haven’t seen since 2008 crisis. Now euro stands at the eve of most interesting action. I do not know whether we will find anything interesting on intraday charts, but monthly looks very cool. You, guys, probably see everything by yourself already. Yes, EUR has passed through YPP and YPS1 with a blink of an eye – it needs just 3 weeks to pass through yearly barrier. But right now currency stands at rock hard support area – monthly oversold, major 5/8 Fib level, AB=CD target and 1.27 extension target. It should be upside retracement, guys!!! It needs absolutely unprecedented power to push EUR lower. It is interesting that all four recent legs down have approximately the same length. So, it seems that EUR is also at the peak of harmonic swing.

At the same time after retracement (if it will happen of cause) downward action will continue. EUR has dropped to 1.27 butterfly target too fast. Odds suggest continuation to 1.618 extension. By the way, the same suggestion we could make based on AB-CD. CD leg is also too fast. But where does it stand? Right – at 1.0 point, parity. Bingo… This will be next destination point when and if market will pass through 1.11-1.12 area. Also we need to say that we knew about 1.11-1.12 and we have discussed it here and even pointed on it as possible “long-term” target. But it has appeared that it is not “long-term”. That’s why we’re talking of scale increasing on EUR. Right now EUR passes for week distances that previously it has passed for months. When I see this, I recall “three black crows” pattern that we’ve discussed 3-4 months ago and it seems not bad pattern to me…

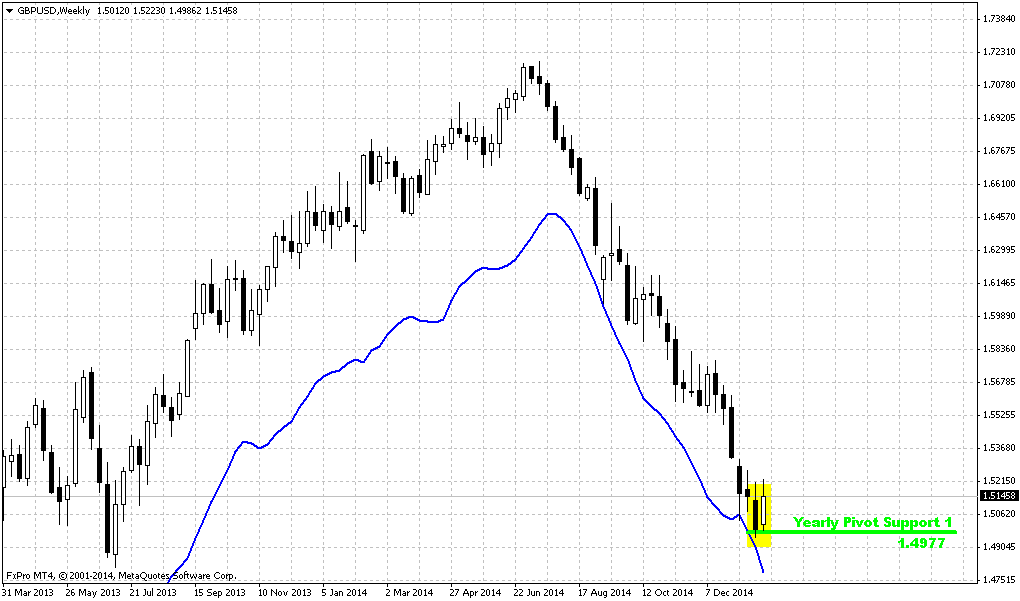

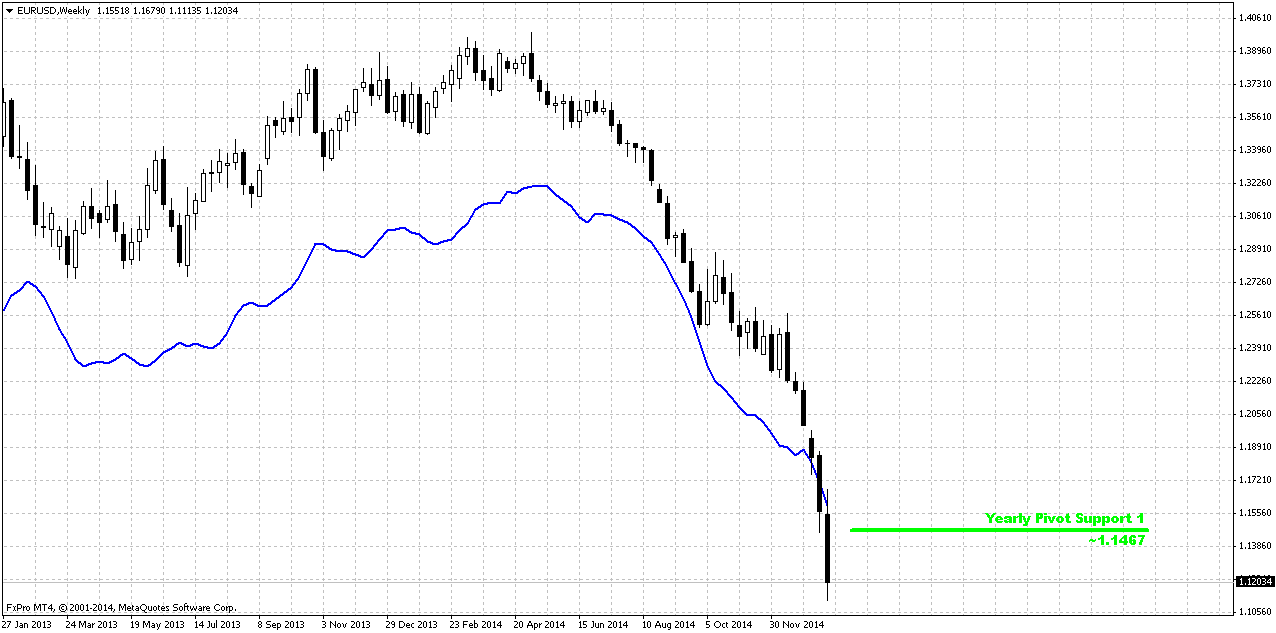

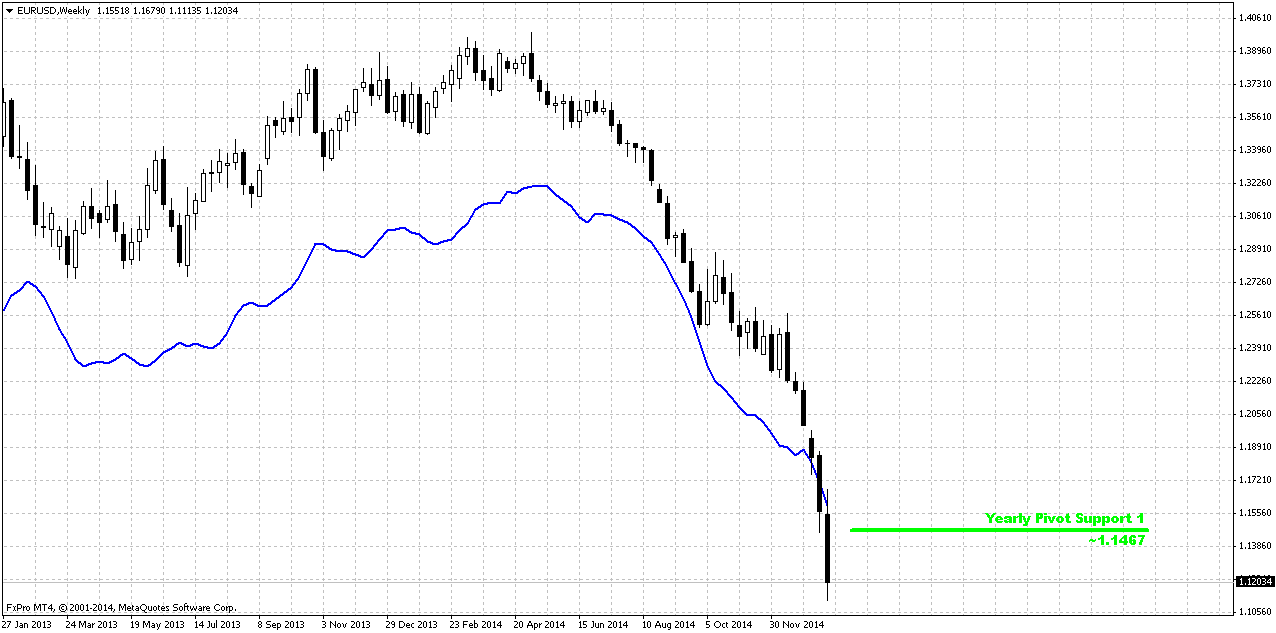

Weekly

So guys, we could discuss here? We just see downward action without any hitch – very smooth. EUR stands at oversold here as well (who would doubt) and it passed through YPS1. I do not have monthly pivots here, guys, because market already has passed through all of them. All that we could do here is probably to watch for DiNapoli directional patterns, because all that we have here is perfect thrust down…

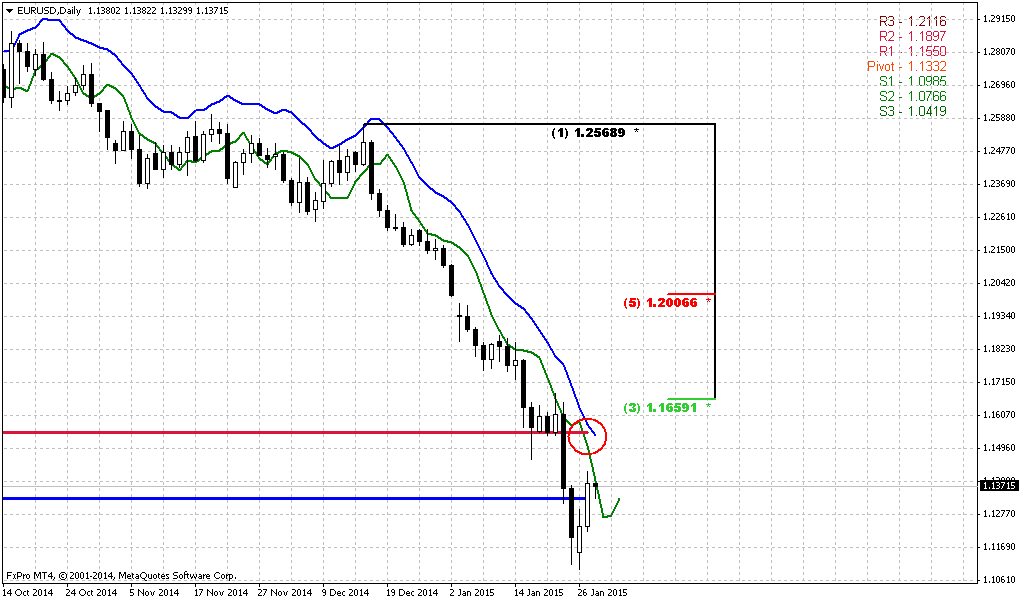

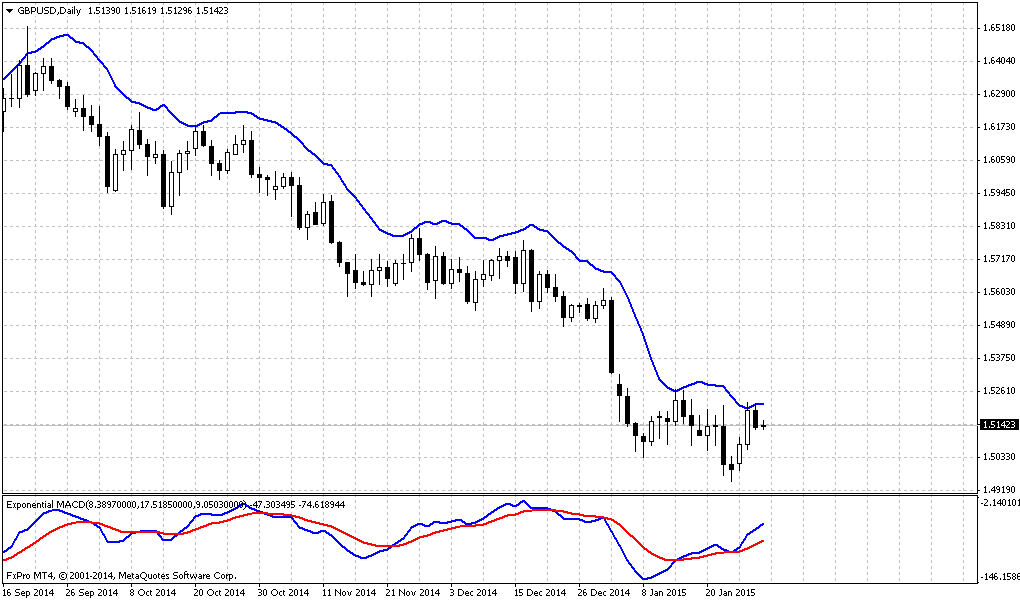

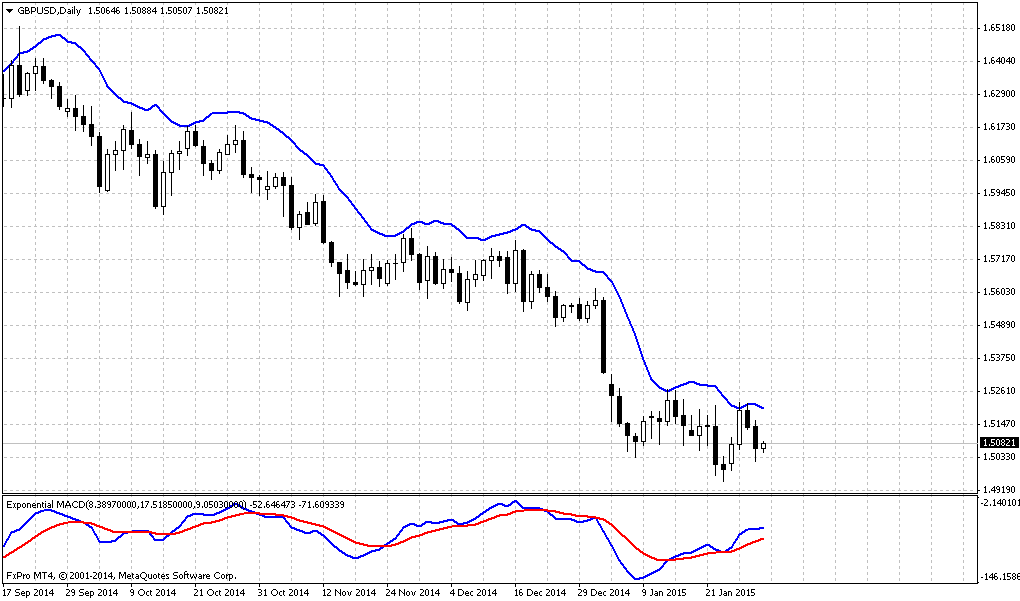

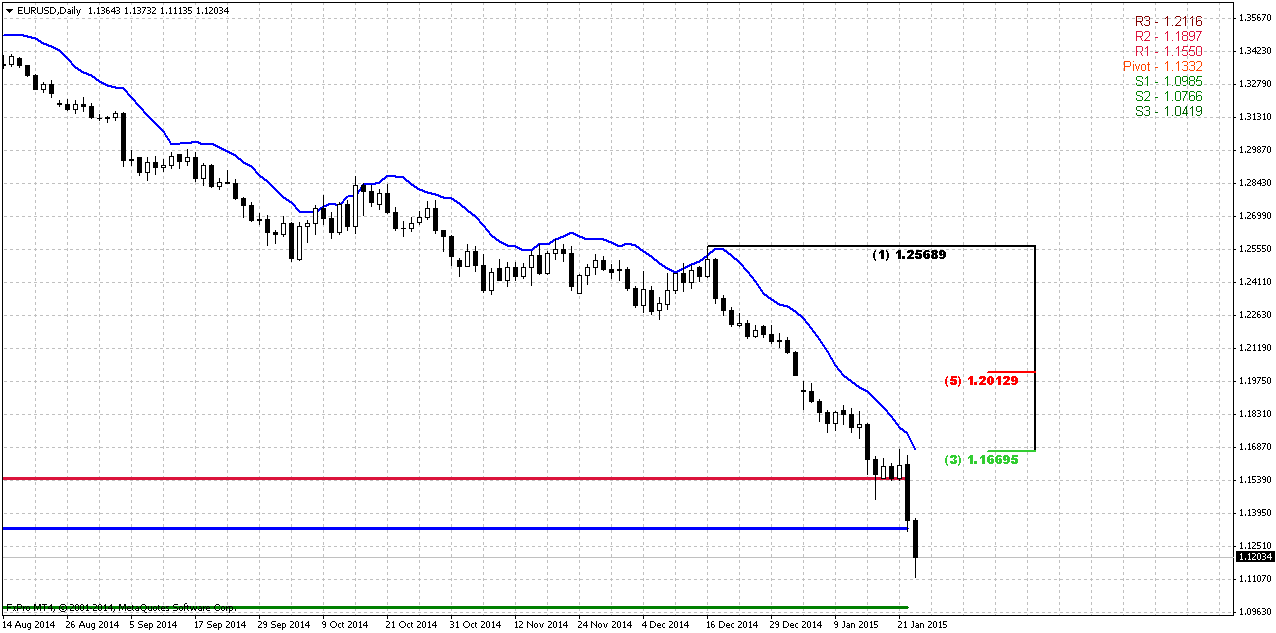

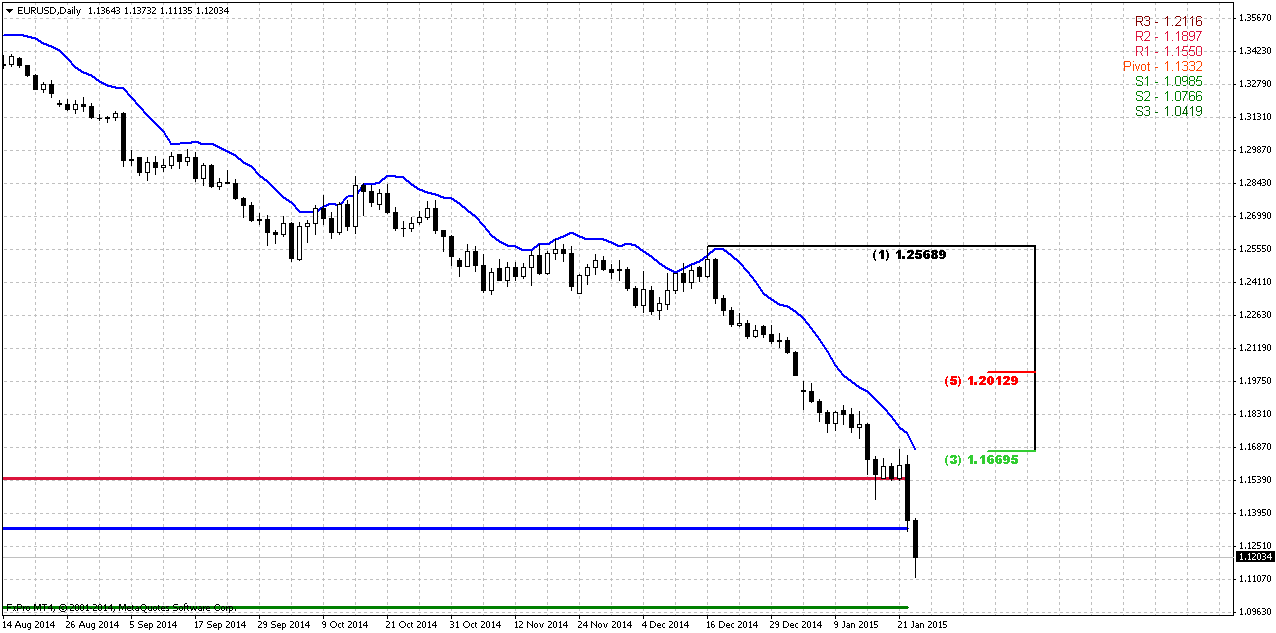

Daily

EUR is obviously oversold here. If upside retracement will start somehow then it probably will stop initially at 1.1670 area. It includes overbought level and Fib resistance. Some surprises could happen, say Greece voting. Right now EUR probably already has priced-in fears of Greece exit, although with small percent. Or may be some other negative moments for union currency on coming Greece elections…

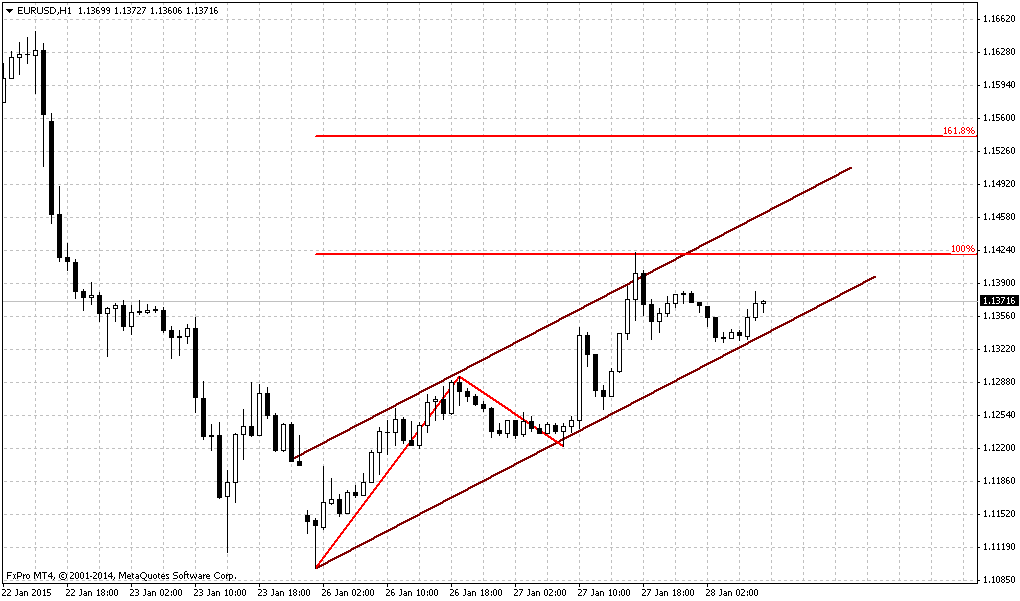

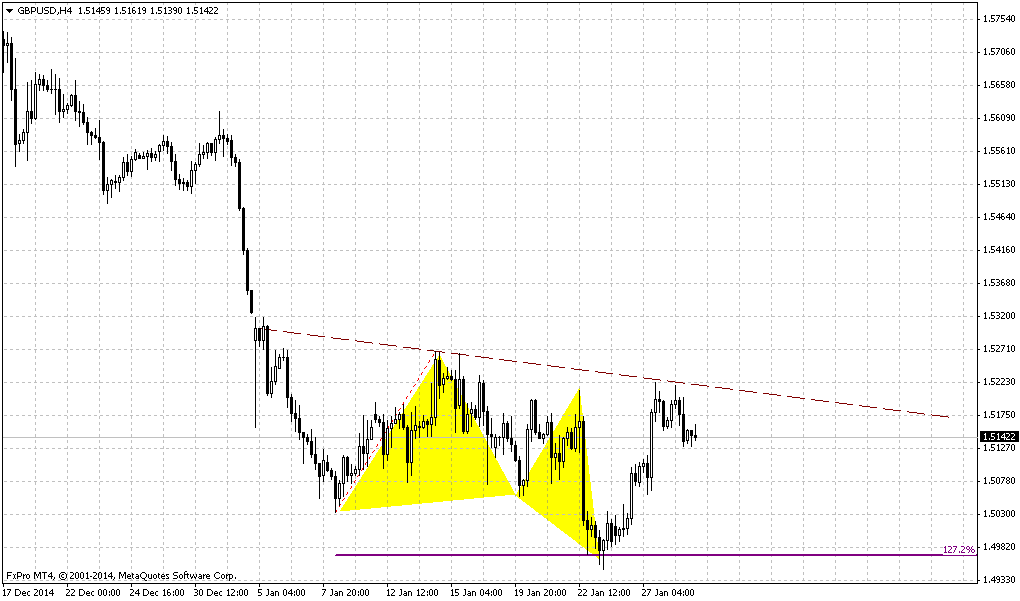

Hourly

Finally, we have something to discuss on intraday charts. As market has reached strong support area, we could start to get some bullish setups although they could appear to be false either. Anyway, here we could get DRPO “Buy” pattern on Monday. Probably we should not treat it in relation with daily or even monthly charts, since it looks to small. It is better to treat is as just separate scalp setup. If it will be confirmed and work – it could lead market at least to 1.1380 area.

Conclusion:

In 2015 it will be interesting to watch on EUR, since overall situation around EU as political as economical is very sophisticated and potentially in carries a lot of opportunities.

In long-term perspective we will be watching for patterns and events that we’ve mentioned in “Monthly” part of our analysis.

In short-term we mostly wonder, whether market will response on current support and will we get some retracement before market will start move to next target…

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.

Reuters reports euro fell to fresh 11-year lows against the dollar on Friday following the European Central Bank's announcement on Thursday that it would pump a trillion euros into the euro zone economy to revive sagging growth and ward off deflation.

After a similar tumble on Thursday, the euro was down over 7 percent since the start of the year and was on track for its biggest monthly fall since the depths of the financial crisis in early 2009. The euro fell over 3 percent against the dollar this week.

"What the ECB is trying to do is enough to drive the euro below parity by the end of this year," said Shaun Osborne, chief foreign exchange strategist at TD Securities in Toronto. He said the euro could hit 96 cents by the end of 2015.

The euro is set for another trial as global markets await snap Greek elections on Sunday. A win for the leftist Syriza party could trigger a standoff with Greece's EU/IMF lenders. Analysts said the uncertainty added to the euro's weakness.

The dollar appeared to be headed higher given the Federal Reserve's path toward tighter monetary policy in contrast with the looser policies of other developed market central banks such as the ECB and the Bank of Japan, analysts said.

"The name of the game is that the dollar will continue to appreciate against currencies of central banks that are easing,” said Mark McCormick, currency strategist at Credit Agricole in New York.

CFTC data shows increasing of open interest and faster growth on short position. Right now speculative shorts stand for 225’167 and increased for 10K contracts past week vs. longs of 48’677 – almost the same as previously. Thus, our ratio has increased to 82,22% and gradually approaches to crucial numbers when market will need some pause or pullback to reduce this number.

Open interest:

Here guys, I will keep our previous thoughts and discussion because it is still important and actual. But today I would like to add some new object for discussion. Is it possible some secret agreement to support value of US Dollar. I know that these talks on huge american debt and sooner or later dollar should fail are old. Still, it seems suspicious that dollar appreciates across the board particularly when emerging markets start to take steps in direction of expelling of US dollar in mutual trading. Of cause these steps are not quite evident and not advertised very wide, still they exist. It is difficult to judge how successful they are, but this work is continuing. For example, today Central Bank of Iran announced denying of USD and its application in international transactions. The same steps come from many other countries – China, Brazil, Russia and others. Currently they do not exclude USD totally, but softly “replace” it partially in mutual trading.

And we see very suspicious action on all financial markets. Crude Oil has dropped and pressed CAD, gold has dropped and pressed AUD. EU has started QE, while Japan takes these steps for long period already. Could this be some collective measures to support USD and keep it as major reserve currency? Turmoil and instability triggered by US across the world increases uncertainty and makes investors come to safe haven. Artificial pressing on crude oil and gold makes them to believe that USD is high value currency and only USD could protect their wealth. This is not a statement, we just call you to discussion, but this is really looks suspicious when you see that all markets and west countries take steps for dollar support…

Recently guys, we’ve put our thoughts on SNB action. We think that major reason stands beyond European QE. QE is just small add-on but not major factor. To better understand what really has happened we need to take a look at Switzerland economy. Economy stands near recession, struggles with deflation, SNB reduces rates and right now it stands at -0.75%. To understand what usually country does in this kind of situation – take a look at Japan. Here we see massive government spending and lending programs, massive easing program and steps of stimulation of consumption and spending. Significant steps to stimulate inflation and reduce the value of national currency to pump export.

But the trick is Switzerland stands in the same situation – export oriented country falls in recession but what they do – increase the value of franc for 30% to USD and 20% to EUR. Why? What for? My college has spent Xmas time in Switzerland and brought me a present – Swiss “Lindt” chocolate sweets. Small box costs around 11 francs! Even in Russia I can buy the same sweets cheaper in German “Metro” store.

So, we were able to find only one explanation of this SNB step. They intend to buy something. This is single logical explanation why SNB took this step in current economic conditions. And we suspect that this “something” will be gold.

As you know among other events we’re tracking geopolitical situation and try to catch some relations that we see there. Of cause, geopolicy is most blur sphere of international relations and nobody could say definitely what is really going on. But still, we think that situation in Ukraine, terrorist attack in France and across the Europe, crude oil prices, gold and SNB action is the part of the same chain.

If you will monitor, say, Germany newspapers and recent media you’ll see that Ukraine almost totally disappeared from major news. As we’ve mentioned previously shooting in France has happened when Hollande gave hints on warming relations with Russia.

Recently NATO Stoltenberg has come to Germany trying to get additional financing and frighten Europe with “Russian menace”. He treads that US right now has contracted possibilities while Germany and France are rather rich and they could do much more for NATO. Otherwise they will be one-on-one with dreadful Putin. The major background for this “speech” was September conference when NATO members have decided to increase spending to 2% of GDP of each member.

But what result of this meeting, I mean recent visit of Stoltenberg… Germany said “nein”. But you may ask what about G7 meeting, Russia was not invited, what about sanctions prolongation etc… We would say that we should take in consideration not speeches but deeds and facts:

Merkel has banned on the use of nuclear energy to generate electricity, which she has pushed despite the resistance of the industry, putting the economy heavily dependent on Russian gas, the failure to increase investment in the defense industry, failure of Ukraine in the financial assistance and other moments.

Anyway, now we can try to collect puzzle. It is obvious that EU attitude to situation is changing and it becomes healthier. This comes in contradiction with US policy who tries to keep globe dominant power as economical as political. Gradually world starts to doubt real reliability and safety of US dollar and US has applied unprecedented steps to keep it. Subprime crisis in 2008, mass wars across the Globe to spread instability and sow chaos across the planet, to convince global financial society that only US dollar worthy to be an absolute protection again globe turmoil. Then drop in crude oil price and gold should prove that US dollar is strong and expensive. Right now nobody has any doubts that crude oil drives not by economical law of demand and supply.

When they saw that Europe is trying to be on her own mind – they start to frighten it, triggering terror, hinting that it will become worse if you will continue this line. Right in this moment war in Ukraine has activated again and turns to hot stage. And right now SNB cancels the cap… and gold shows unprecedented rally. This is the part of the same chain. SNB decision looks negative for US, especially if they will start to buy gold… Franc now becomes a rival for US dollar. Franc is not yen, because Japan totally depends on US export, keeps huge volumes of US debt and now applies mass money printing. Other words, yen stability is based on US stability. CHF is a quite another tune.

There is a rumor on the market that US keeps gold price low by selling its own gold storages. Nobody knows any details, and to be honest I have real doubts on this, but this is what I’ve heard on the markets. Still it does not seem as absolutely impossible.

As Europe still stands on its way to make its own policy and try to become real member of geopolitical game – US will continue somehow to press on it. Thus, we can’t exclude some bad events in EU of any type – either economical, may be again some social turmoil that we already see. Besides, 25th of January Greece will take voting on its future.

In economy sphere we mostly watch for two major events – details on ECB QE that should be announced on 22nd of January, second – impact of Fed rate policy on EUR. The major concern here how EUR will behave in this whitewater of financial events and Greece voting on 25th of January.

Probably we need to explain a bit. At first glance it seems all simple – US will start rise rate and hence EUR should fall even deeper. But this is not quite so. We suspect that this will be true only till the moment of first rate hiking by Fed. We suspect that starting of QE program by ECB will attract a lot of investors who will want to make easy money. As US experience of QE shows, real Central Bank money mostly was put in equities but not in long-term loans of real industrial sector, population, manufacturing and etc. This has led to huge bubble on US equities. We suspect that something of this sort could appear on EU equities. Initially it will be gradual. But as soon as Fed will start to increase rates capital will start to flow to EU. As amount of money will increase this will lead to additional demand on EUR and here drop of EUR could stop, or at least will loose its pace, despite opposite courses in rate policy…

Currently it is very difficult to predict how definitely this will happen; we just mention common view on this situation. But what we do know that this will not be as simple as “US rising rates while EU not, hence USD will dominate over EUR”.

And finally couple of words on QE. It will start in March for 60Bln per month and will last till 2016. As we have suggested EU stocks and bonds will start to rise and they are started. Probably gold and EU assets will show best growth in nearest 6-12 months.

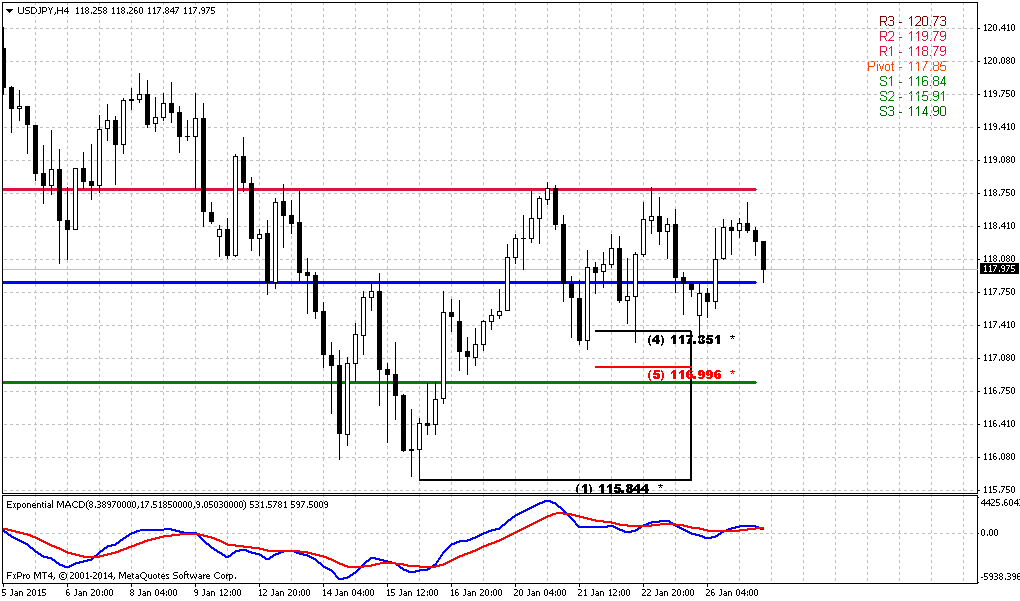

Technicals

Monthly

So, January is dreadful month for EUR. We have plunge that we haven’t seen since 2008 crisis. Now euro stands at the eve of most interesting action. I do not know whether we will find anything interesting on intraday charts, but monthly looks very cool. You, guys, probably see everything by yourself already. Yes, EUR has passed through YPP and YPS1 with a blink of an eye – it needs just 3 weeks to pass through yearly barrier. But right now currency stands at rock hard support area – monthly oversold, major 5/8 Fib level, AB=CD target and 1.27 extension target. It should be upside retracement, guys!!! It needs absolutely unprecedented power to push EUR lower. It is interesting that all four recent legs down have approximately the same length. So, it seems that EUR is also at the peak of harmonic swing.

At the same time after retracement (if it will happen of cause) downward action will continue. EUR has dropped to 1.27 butterfly target too fast. Odds suggest continuation to 1.618 extension. By the way, the same suggestion we could make based on AB-CD. CD leg is also too fast. But where does it stand? Right – at 1.0 point, parity. Bingo… This will be next destination point when and if market will pass through 1.11-1.12 area. Also we need to say that we knew about 1.11-1.12 and we have discussed it here and even pointed on it as possible “long-term” target. But it has appeared that it is not “long-term”. That’s why we’re talking of scale increasing on EUR. Right now EUR passes for week distances that previously it has passed for months. When I see this, I recall “three black crows” pattern that we’ve discussed 3-4 months ago and it seems not bad pattern to me…

Weekly

So guys, we could discuss here? We just see downward action without any hitch – very smooth. EUR stands at oversold here as well (who would doubt) and it passed through YPS1. I do not have monthly pivots here, guys, because market already has passed through all of them. All that we could do here is probably to watch for DiNapoli directional patterns, because all that we have here is perfect thrust down…

Daily

EUR is obviously oversold here. If upside retracement will start somehow then it probably will stop initially at 1.1670 area. It includes overbought level and Fib resistance. Some surprises could happen, say Greece voting. Right now EUR probably already has priced-in fears of Greece exit, although with small percent. Or may be some other negative moments for union currency on coming Greece elections…

Hourly

Finally, we have something to discuss on intraday charts. As market has reached strong support area, we could start to get some bullish setups although they could appear to be false either. Anyway, here we could get DRPO “Buy” pattern on Monday. Probably we should not treat it in relation with daily or even monthly charts, since it looks to small. It is better to treat is as just separate scalp setup. If it will be confirmed and work – it could lead market at least to 1.1380 area.

Conclusion:

In 2015 it will be interesting to watch on EUR, since overall situation around EU as political as economical is very sophisticated and potentially in carries a lot of opportunities.

In long-term perspective we will be watching for patterns and events that we’ve mentioned in “Monthly” part of our analysis.

In short-term we mostly wonder, whether market will response on current support and will we get some retracement before market will start move to next target…

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.