Sive Morten

Special Consultant to the FPA

- Messages

- 18,692

Fundamentals

Reuters reports euro advanced broadly on Friday, jumping more than 2 percent against the yen, on optimism Greece would be able to forge a debt deal with its creditors, enabling the troubled nation to stay in the euro zone.

The yen and the Swiss franc, which tend to do well during turmoil in financial markets, both fell as demand for riskier assets also picked up after Chinese shares rebounded.

Eurogroup President Jeroen Dijsselbloem said on Friday euro zone finance ministers may make a "major decision" when they hold an emergency session on Saturday to weigh the Greek proposal.

Many in the market were optimistic about an agreement, although investors were cautious about holding large bets going into the weekend.

Kathy Lien, managing director at BK Asset Management in New York, said there were concerns Germany could still block a deal. A German finance ministry spokesman said on Friday Berlin will not accept any form of debt reduction for Greece that would lower its real value.

"We still believe a deal will be done but being exposed to euros ahead of these meetings is risky and we took profits on all of our positions before the weekend was out," Lien said.

Also helping risk sentiment were signs Chinese equities may have stabilized after their recent 30 percent fall. Shanghai shares rallied for a second straight day, helped by emergency steps taken by the government.

Gains in the dollar accelerated after Federal Reserve Chair Janet Yellen said she expects the Fed to raise interest rates at some point this year.

Yellen's remarks were nothing new, said Greg Anderson, global head of FX strategy at BMO Capital Markets in New York.

"But the context had a little bit more uncertainty and therefore for her to steer through that and say an interest rate rise is likely to be appropriate, that was a ... hawkish surprise".

Federal Reserve chair Janet Yellen on Friday said she expects the Fed to raise interest rates at some point this year, but pointed strongly to her concerns that U.S. labor markets remain weak and that more workers could be encouraged back into the job market with stronger growth.

In her speech Yellen gave no direct hint about whether she anticipates more than one rate hike over the Fed's four remaining meetings of 2015. But her focus on domestic economic developments looked beyond recent market turbulence over Greece and China, and keeps the Fed's plans on track.

She said she expects the economy should grow steadily for the remainder of the year, allowing the Fed to move ahead with its first rate hike in nearly a decade.

"I expect it will be appropriate at some point later this year to take the first step to raise the federal funds rate and thus begin normalizing monetary policy," Yellen said in a speech to the City Club of Cleveland, a civic group that sponsors high-level speakers.

"But I want to emphasize that the course of the economy and inflation remains highly uncertain...We will be watching carefully to see if there is continued improvement in labor market conditions, and we will need to be reasonably confident that inflation will move back to 2 percent in the next few years."

U.S. Treasury yields rose and the dollar rallied against a basket of currencies after Yellen's remarks, while stocks modestly pared gains.

Despite the improvement of recent years, she said labor markets remain out of line, with high levels of part-time work and weak participation rates.

The low unemployment rate "does not fully capture the extent of slack," she said. "I think a significant number of individuals still are not seeking work because they perceive a lack of good job opportunities and that a stronger economy would draw some of them back into the labor force."

Analysts saw Yellen's comments deviating little from the central bank's recent policy statement. Though global markets have been turbulent in recent weeks since the Fed's June meeting, Yellen focused on U.S. growth she feels is likely to continue and will push the economy closer to the Fed's full-employment and 2 percent inflation goals.

"If the economy continues to improve, the Fed will raise rates this year. It clearly wants to," said Jim McDonald, chief investment strategist at Chicago-based Northern Trust Asset Management.

Yellen's remarks come less than a week before she is to appear before Congress for a biannual briefing on monetary policy, and as the central bank approaches a likely rate hike decision.

It is a step that will have global implications, putting the Fed on a path separate from central banks in Europe and Japan that continue fighting economic crises, and potentially drawing capital out of developing economies.

According to the individual economic projections released by Fed officials at their June meeting, there was a roughly even divide between those who expect only one interest rate increase this year - and might thus be prepared to wait until late in the year to hike - and those who expect two and would want to move sooner.

Yellen's position on that point remains uncertain, though her influence as chair is likely pivotal in the ultimate decision.

Fed officials seem to have set the stage for an initial increase as early as September. But recent events - the stock market collapse in China and the confusion in Greece in particular - have raised fresh concerns over how the world economy may hurt U.S. growth. Investors now believe an initial hike is not likely until next year.

The Fed has kept rates near zero for almost seven years.

Though it will likely take years for the central bank to gradually return rates to more normal levels, the initial step -

"liftoff" - has attracted outsized attention as a symbol that the Fed is ready to declare the crisis over.

Yellen said she felt that initial step will have a small impact, and that the Fed would be raising rates only gradually from that point on.

Yellen said she agreed that a slow start to the year was likely the result of temporary factors, such as low oil prices undercutting investment in the U.S. energy sector, and a rising dollar pushing up the international price for U.S. exports.

But she also said the economy faced constraints that could hold it back, from a still underperforming housing market to the unresolved crisis in Greece.

CFTC data can’t help us much this time. Even in comments, traders said that they have mostly closed positions on EUR at the eve of crucial solution on Greek debt program. CFTC data shows approximately the same. We see huge drop in Open interest in June and no action since then, as in short as in long positions.

Open Interest:

Longs:

Longs:

Shorts:

Shorts:

Here we will not repeat our thoughts on Greece situation and importance of Greece for EU and US as from geopolitical point of view as from economical one. We’ve said a lot on this subject last time. Now we clearly understand that despite our conclusion that we will make today on technical picture, market will be driven by final solution on Greek crisis, so our analysis could appear to be in vain. Still, let’s see what technical picture tells us.

Technicals

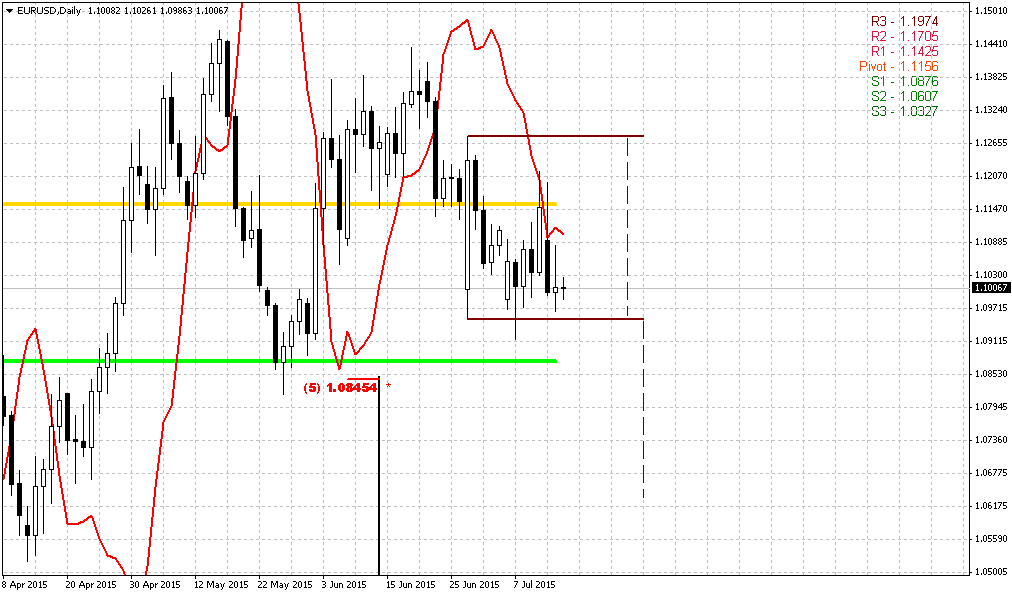

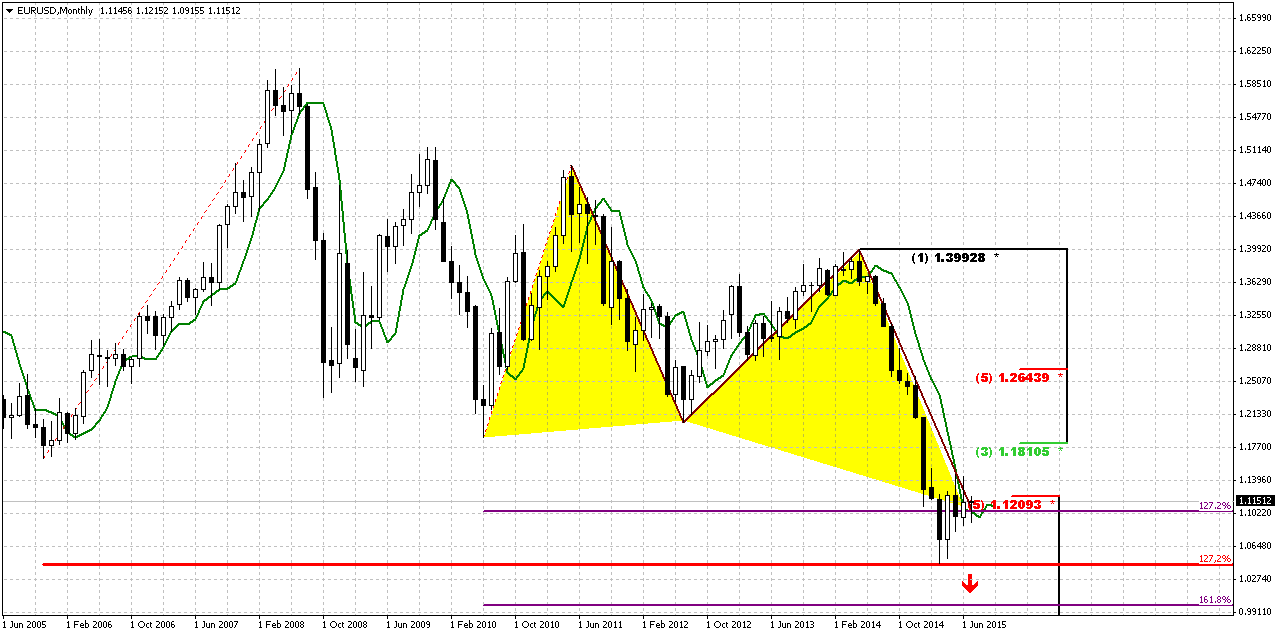

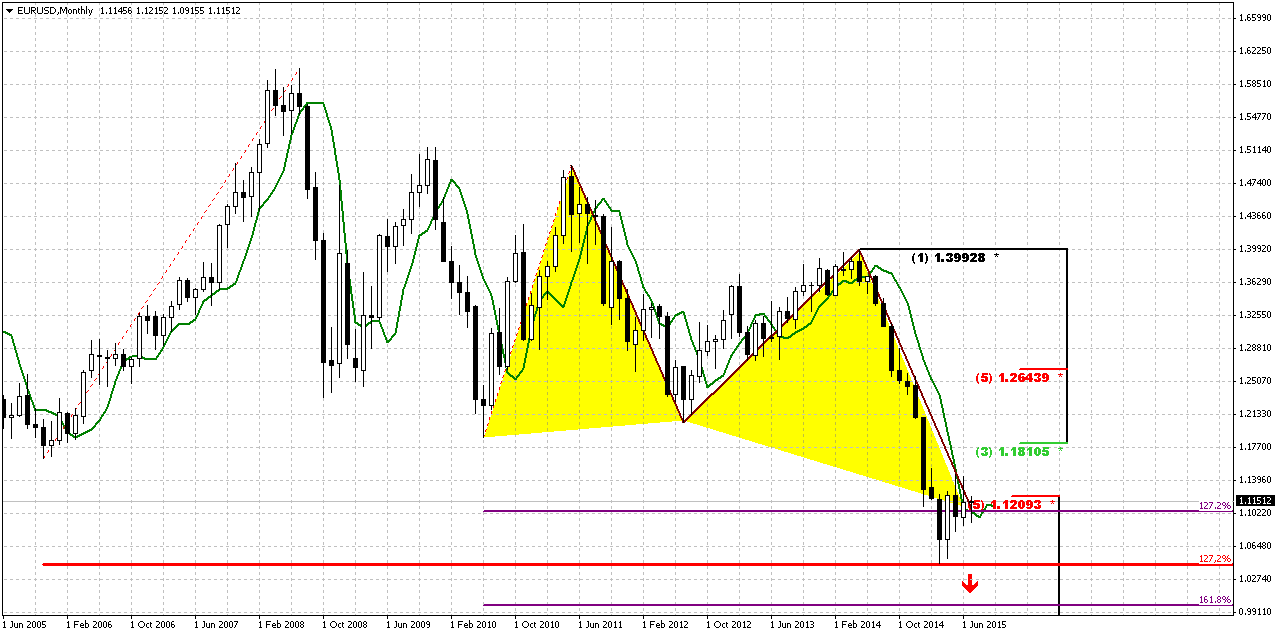

Monthly

Trend is bearish on monthly chart, July is inside month by far and does not impact significantly on overall picture. As we’ve said, technical picture right now is secondary issue, until situation around Greek debt will be resolved.

Still, as we have estimated previously 1.05 is 1.27 extension of huge upside swing in 2005-2008 that also has created large & wide butterfly pattern. Recent action does not quite look like normal butterfly wing, but extension is valid and 1.05 is precisely 1.27 ratio. At the same time we have here another supportive targets, as most recent AB=CD, oversold and 1.27 of recent butterfly.

April has closed and confirmed nicely looking bullish engulfing pattern. We know that most probable target of this pattern is length of the bars counted upside. This will give us approximately 3/8 Fib resistance 1.1810 area. But most recent action, guys, makes us worry for perspective of upside retracement. After engulfing pattern been formed, EUR can’t turn to upside action within 2 months and can’t pass through 1.1450 area. This is not good sign for bulls. Of cause, we expect downward continuation as we’ve said, but previously we’ve thought that it will happen after upside retracement.

Now about our recent talk on possible B&B or DRPO here. We’ve said that B&B seems more probable. We’ve got close above 3x3 DMA in June, but this barely has happened. July action stands flat, although above 3x3 DMA, but this is not sufficient to get B&B “Sell”. So chances on its appearing are melting as time is passing by. Still we will keep watching for DiNapoli directional patterns but probably they will appear not as fast as we have expected.

Despite whether upside retracement will happen or not our next long-term target stands the same – parity as 1.618 completion point of recent butterfly. Currently we should treat possible bounce up, even to 1.18 area, only as retracement within bear trend. Yes, tactically fundamentals have become weaker in US with dovish recent Fed comments, and open door for pause in bearish trend, but overall picture has not changed drastically yet.

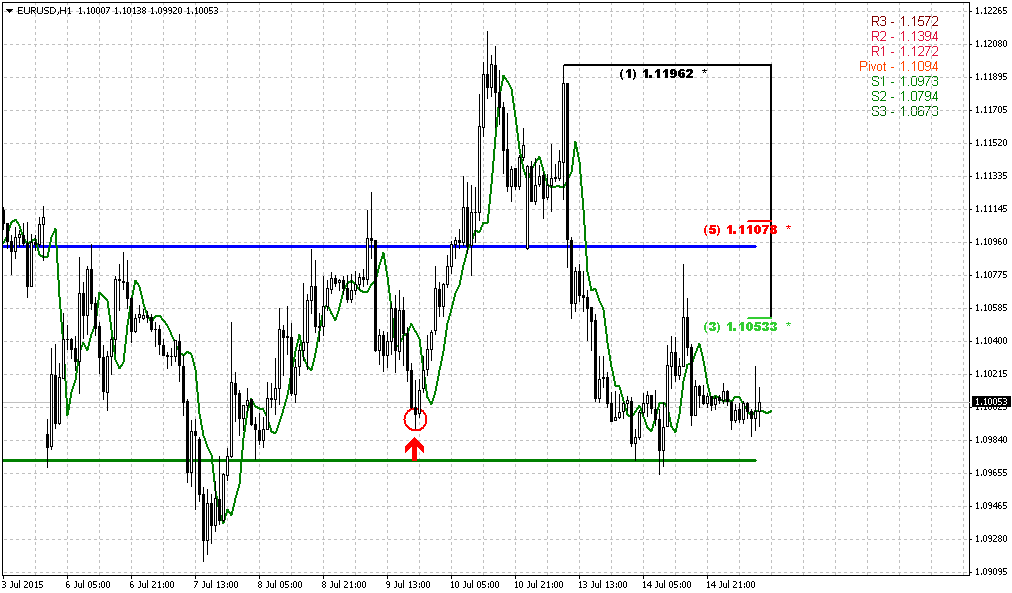

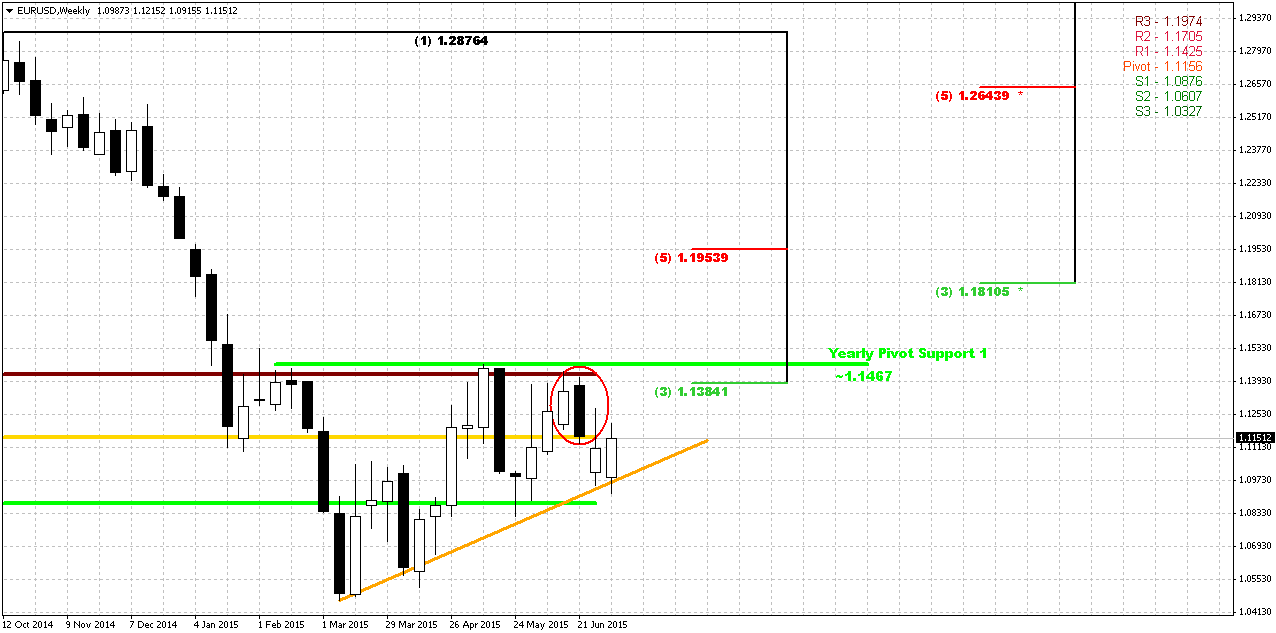

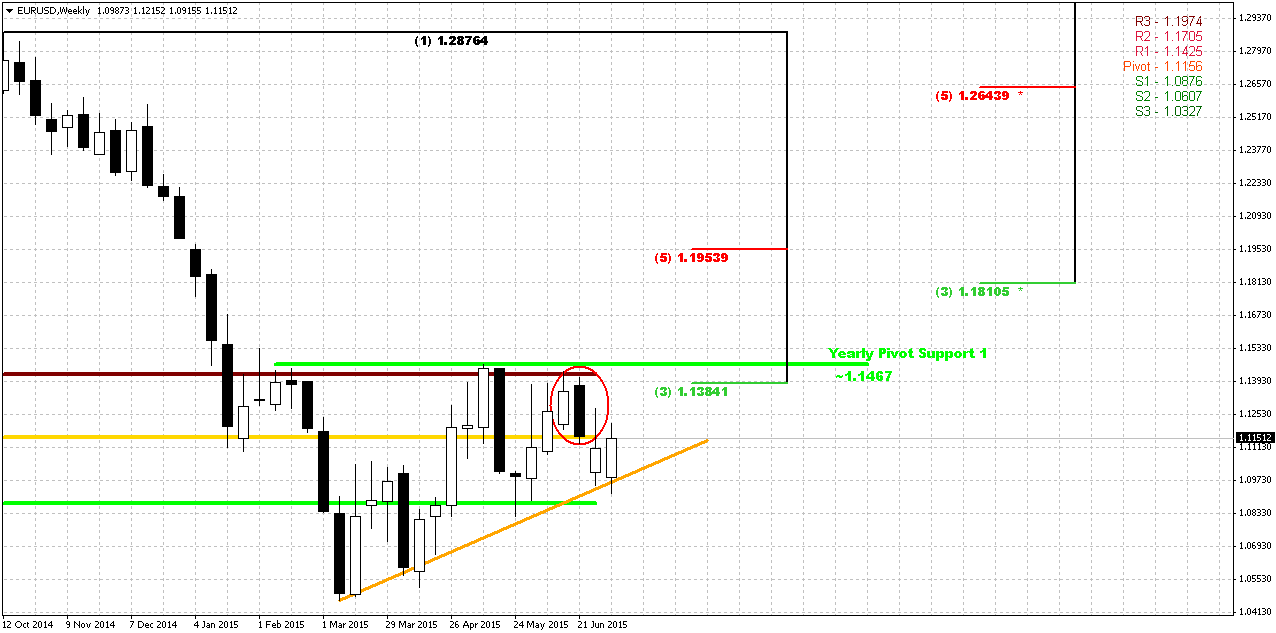

Weekly

Trend is bullish on weekly chart, market is not at oversold or overbought. Weekly chart shows the complexity situation that we have on EUR. First of all, recent week was mostly inside one and has not made any impact on overall picture. Currently EUR still keeps chances valid as for bullish as for bearish patterns.

On bullish side market could form butterfly “Sell” and AB-CD that could lead us precisely to 1.18-1.19 weekly K-resistance area. On bearish side, as EUR still stands below 1.15 highs, market keeps chances for butterfly “Buy” pattern with 1.618 extension at the same level – parity.

The only result that we see last week is reaching the target of bearish engulfing pattern right at support line.

Putting it’s all together, including monthly picture, we find suspicious signs. Thus, on monthly market can’t continue move up for 3rd month in a row after bullish engulfing pattern has been formed. Here, on weekly chart, previous bounce down was absolutely logical, since EUR has met Fib resistance, MPS1 former YPS1 and overbought. Later we’ve got another bearish engulfing pattern at the same place, but market is not overbought any more.

Thus, on weekly chart we could only appoint important levels. If market will break through them, this probably will tell us following direction.

Since 1.1450 shows itself as strong resistance and our next target is 1.18-1.1950 K-resistance, it would be better to take long position if EUR will break through 1.15 area. For those of you, who would like to trade EUR short – wait for downward breakout of 1.08 level. This probably will destroy any potential patterns, such as butterfly “Sell” or may be even H&S and will lead to further weakness of EUR.

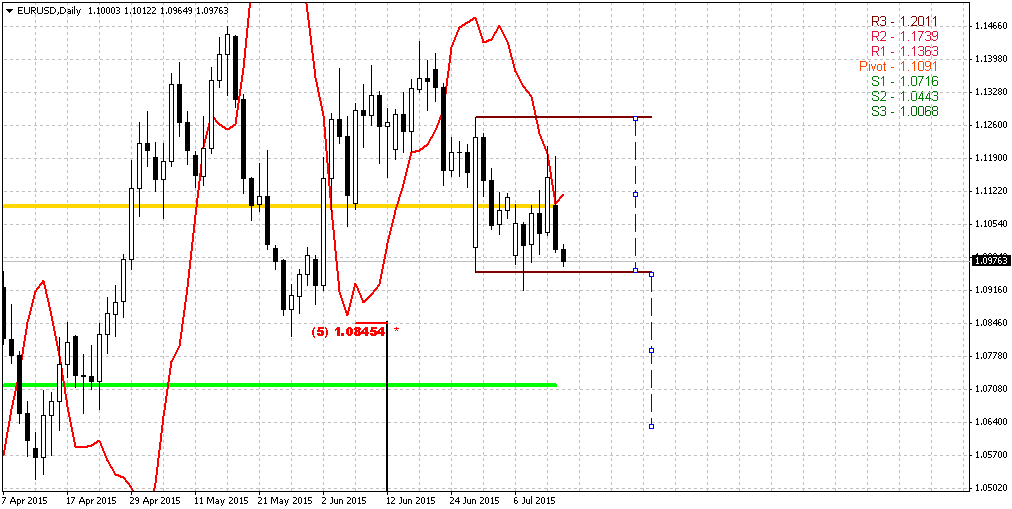

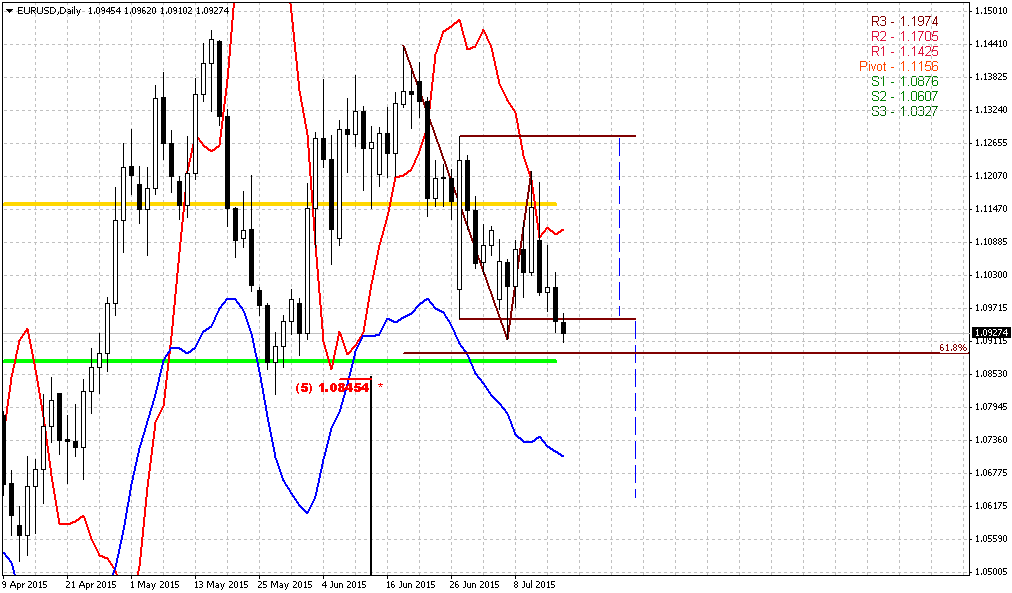

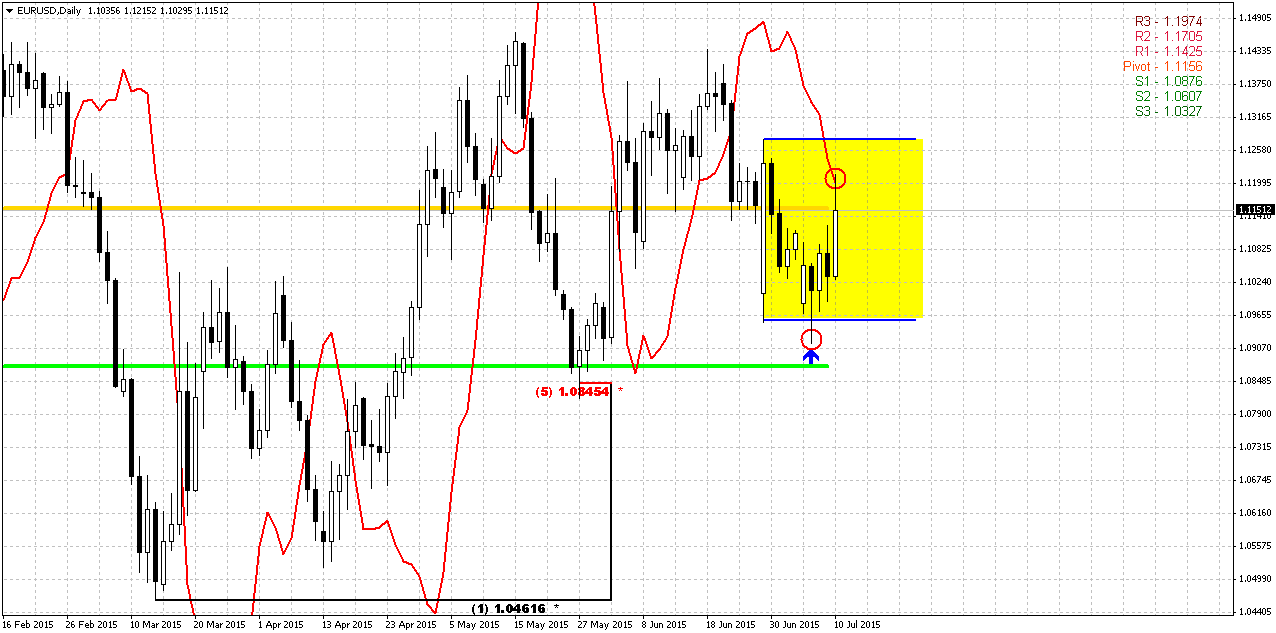

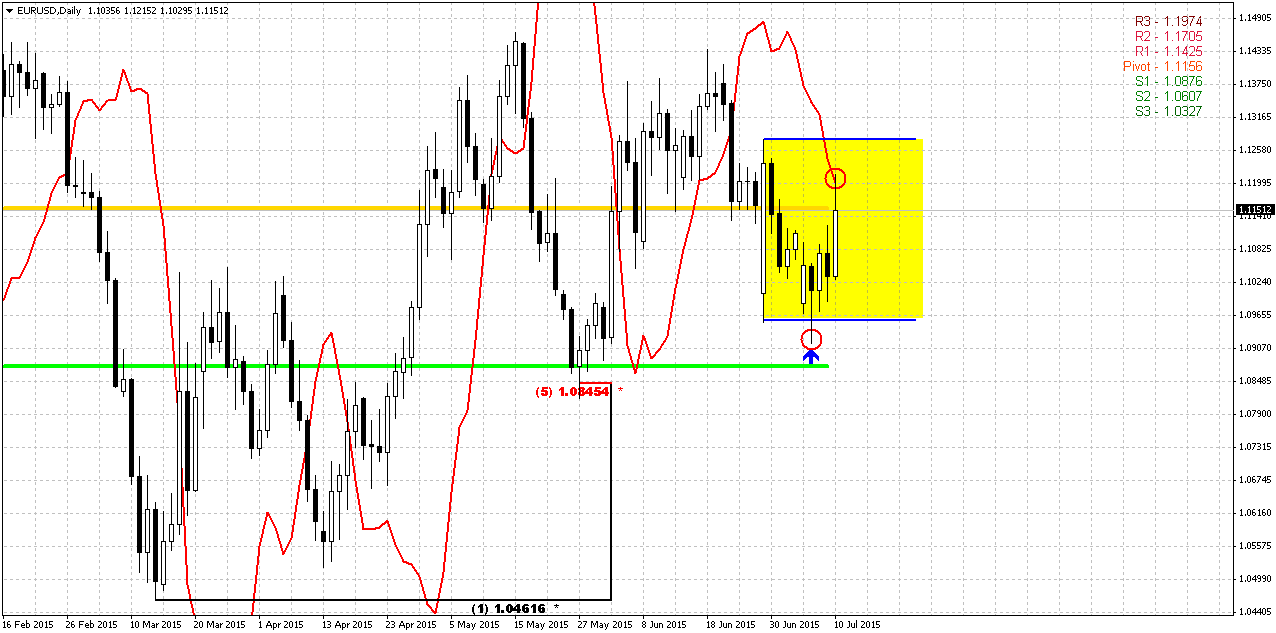

Daily

So, previously we already has said, when market forms long-ranged candle – it could keep price action for considerable period of time and price could fluctuate inside this range with no direction. But importance of these long-ranged candles stands particular in its extreme points, i.e. high and low. The point is that when market breaks this range either upside or downside it continues action in this direction.

Yesterday market has formed bearish grabber. Currently, this is the only clue that we have here right now. IF this grabber will work – it will lead EUR below recent 1.09 lows and this probably will mean downward breakout. At least, appearing of grabber fits into our yesterday analysis and what we’ve said about DiNapoli “H&S failure” pattern, etc. remember?

But larger picture on daily chart mostly confirms what we’ve said above. There are two major levels on daily chart that we have to monitor. First one is 1.1450. We see that this is not just strong resistance, but also minor AB-CD target. Current move down technically looks absolutely natural, since this is minor retracement after 0.618 target has been completed. If market will move above 1.1450, it will keep valid AB-CD and could start butterfly “Sell”. Both patterns have the same target around 1.18. We’ve mentioned this level on weekly and monthly chart as well. This scenario could launch monthly B&B “Sell” pattern.

Second level is 1.08. Moving below this level will cancel as butterfly as current AB-CD and could put the starting point for long-term move to parity. Currently we also have some kind of bearish divergence with MACD right at strong resistance level. Besides, overall action looks like triangle or pennant on higher time frame charts.

So, grabber could work and could be traded but carefully and it is not suitable for everybody. May be patience and deliberation will be not superfluous in current situation.

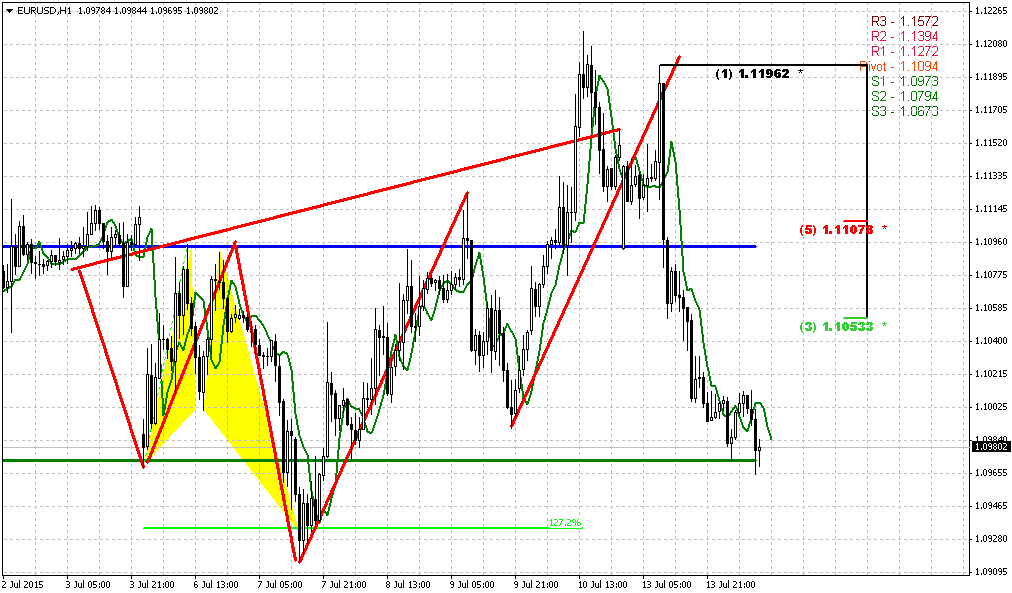

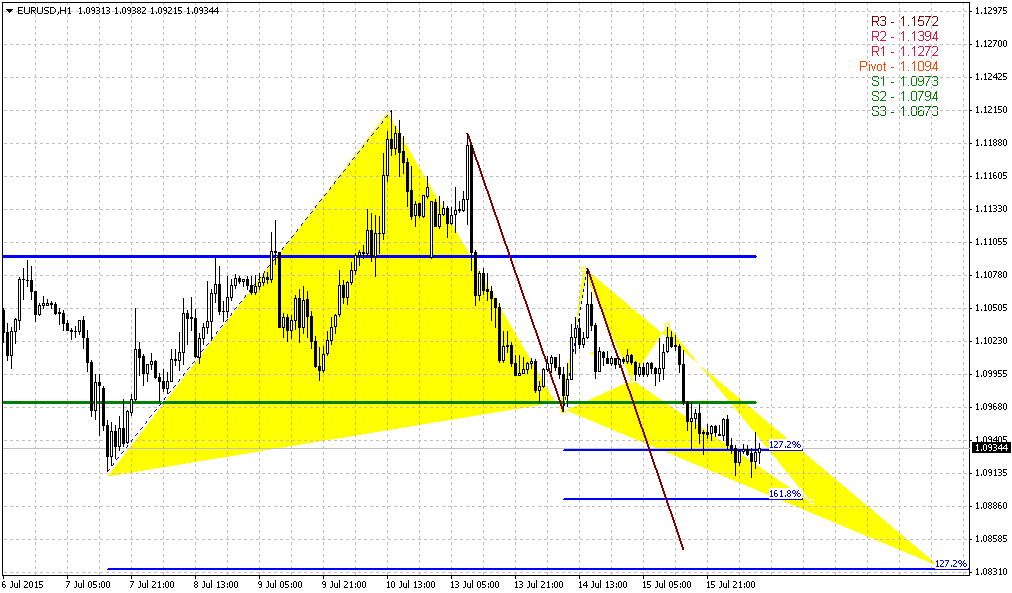

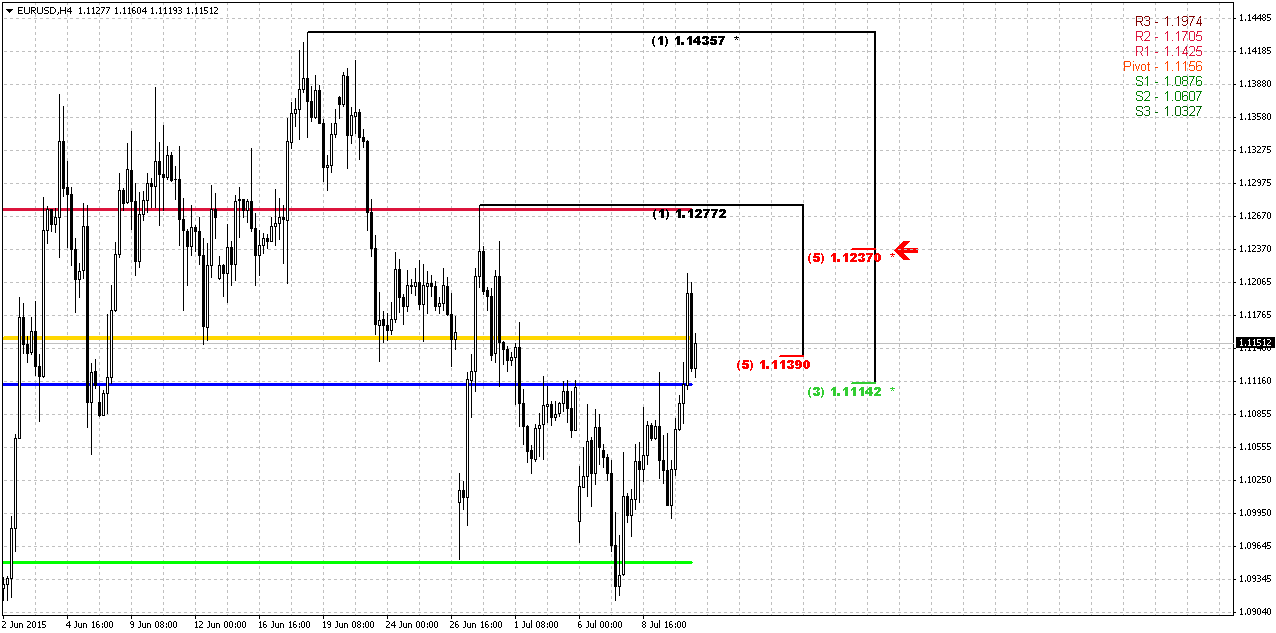

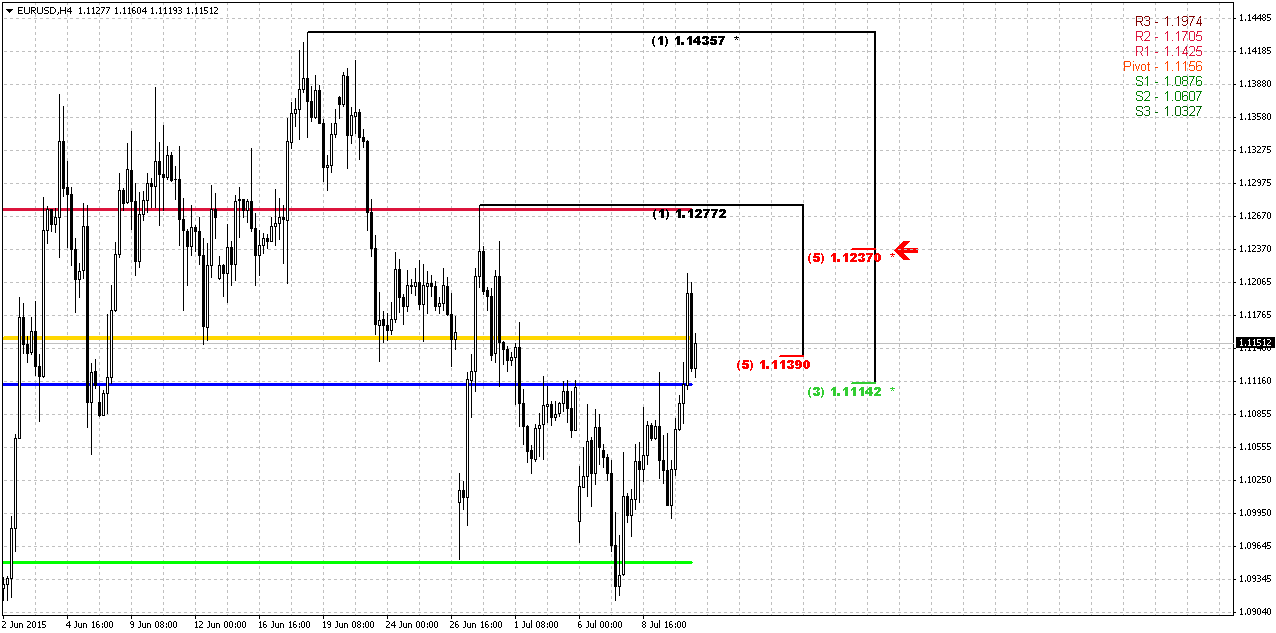

4-Hour

So, guys, despite how brilliant and fascinating our analysis was, we have to acknowledge that mostly it has failed. Not in term of possible downward reversal – this could happen still, but mostly in term of existence DiNapoli directional “H&S Failure” Pattern.

This chart shows that strong resistance level – K-resistance + WPP + MPP mostly was broken and didn’t hold market on a way up. Yes, EUR still stands below MPP, but K-resistance was destroyed. The only Fib level that is valid here - 5/8 resistance at 1.1237. So what do we going to do now? We will continue to watch for possible failure of H&S pattern on hourly chart. Yes, this failure has not happened in a way of DiNapoli pattern, but this does not mean that it can’t fail at all. Still we have bearish grabber on daily chart…

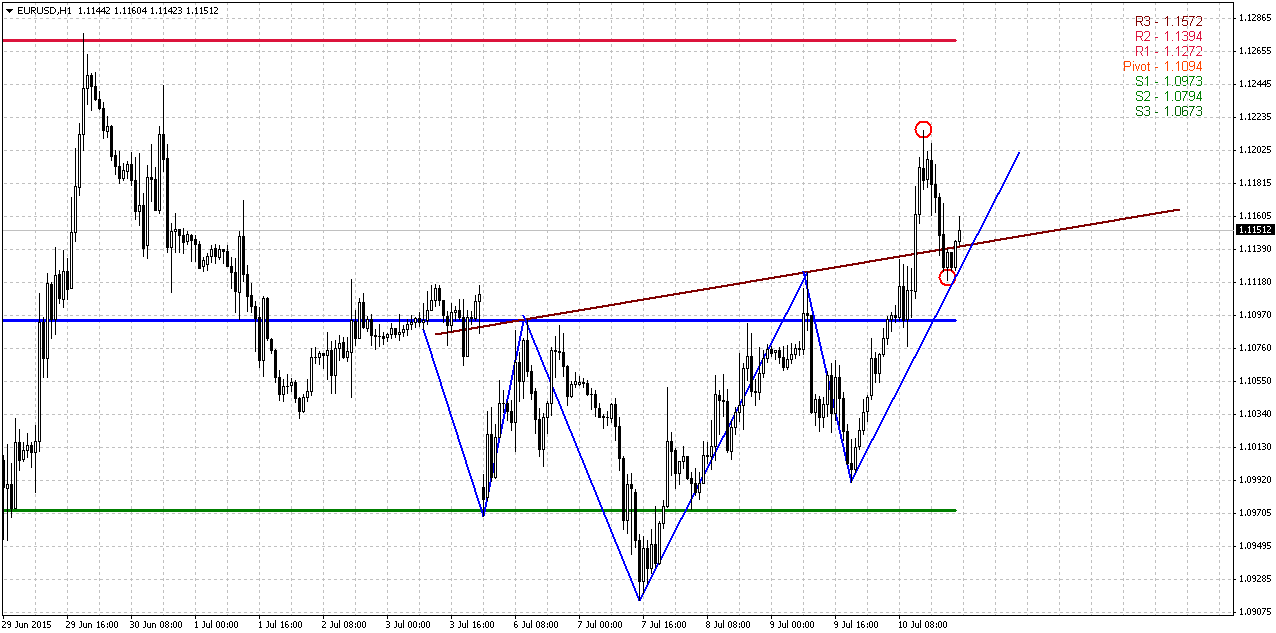

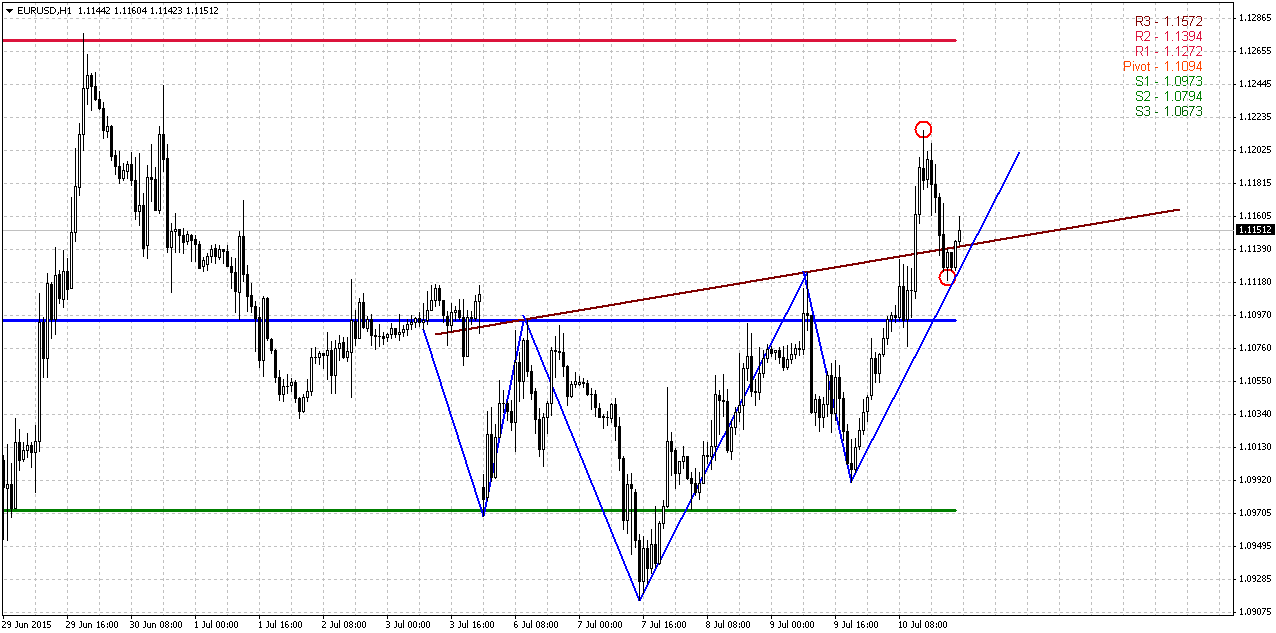

1-Hour

Hourly chart shows that may be we even can’t talk on failure of H&S pattern, because it seems that EUR has completed AB=CD pattern. It will be better to place question just on further direction. From that standpoint situation looks simpler. Fundamentally EUR has rallied up on anticipation of final agreement on Greece crisis, while later in the day, Yellen’s speech has chilled out market a bit. Thus, if market will move below WPP, this increases chances that bearish grabber will work and we could try to take bet on short side, while moving above recent top will erase the grabber and make possible further upside action.

Conclusion:

Market right now mostly is driven by Greece situation and we understand that our analysis of technical picture could be in vain. Still, we’ve founded some interesting patterns and levels that could help us in early estimation of direction, as soon as these levels will be broken.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.

Reuters reports euro advanced broadly on Friday, jumping more than 2 percent against the yen, on optimism Greece would be able to forge a debt deal with its creditors, enabling the troubled nation to stay in the euro zone.

The yen and the Swiss franc, which tend to do well during turmoil in financial markets, both fell as demand for riskier assets also picked up after Chinese shares rebounded.

Eurogroup President Jeroen Dijsselbloem said on Friday euro zone finance ministers may make a "major decision" when they hold an emergency session on Saturday to weigh the Greek proposal.

Many in the market were optimistic about an agreement, although investors were cautious about holding large bets going into the weekend.

Kathy Lien, managing director at BK Asset Management in New York, said there were concerns Germany could still block a deal. A German finance ministry spokesman said on Friday Berlin will not accept any form of debt reduction for Greece that would lower its real value.

"We still believe a deal will be done but being exposed to euros ahead of these meetings is risky and we took profits on all of our positions before the weekend was out," Lien said.

Also helping risk sentiment were signs Chinese equities may have stabilized after their recent 30 percent fall. Shanghai shares rallied for a second straight day, helped by emergency steps taken by the government.

Gains in the dollar accelerated after Federal Reserve Chair Janet Yellen said she expects the Fed to raise interest rates at some point this year.

Yellen's remarks were nothing new, said Greg Anderson, global head of FX strategy at BMO Capital Markets in New York.

"But the context had a little bit more uncertainty and therefore for her to steer through that and say an interest rate rise is likely to be appropriate, that was a ... hawkish surprise".

Federal Reserve chair Janet Yellen on Friday said she expects the Fed to raise interest rates at some point this year, but pointed strongly to her concerns that U.S. labor markets remain weak and that more workers could be encouraged back into the job market with stronger growth.

In her speech Yellen gave no direct hint about whether she anticipates more than one rate hike over the Fed's four remaining meetings of 2015. But her focus on domestic economic developments looked beyond recent market turbulence over Greece and China, and keeps the Fed's plans on track.

She said she expects the economy should grow steadily for the remainder of the year, allowing the Fed to move ahead with its first rate hike in nearly a decade.

"I expect it will be appropriate at some point later this year to take the first step to raise the federal funds rate and thus begin normalizing monetary policy," Yellen said in a speech to the City Club of Cleveland, a civic group that sponsors high-level speakers.

"But I want to emphasize that the course of the economy and inflation remains highly uncertain...We will be watching carefully to see if there is continued improvement in labor market conditions, and we will need to be reasonably confident that inflation will move back to 2 percent in the next few years."

U.S. Treasury yields rose and the dollar rallied against a basket of currencies after Yellen's remarks, while stocks modestly pared gains.

Despite the improvement of recent years, she said labor markets remain out of line, with high levels of part-time work and weak participation rates.

The low unemployment rate "does not fully capture the extent of slack," she said. "I think a significant number of individuals still are not seeking work because they perceive a lack of good job opportunities and that a stronger economy would draw some of them back into the labor force."

Analysts saw Yellen's comments deviating little from the central bank's recent policy statement. Though global markets have been turbulent in recent weeks since the Fed's June meeting, Yellen focused on U.S. growth she feels is likely to continue and will push the economy closer to the Fed's full-employment and 2 percent inflation goals.

"If the economy continues to improve, the Fed will raise rates this year. It clearly wants to," said Jim McDonald, chief investment strategist at Chicago-based Northern Trust Asset Management.

Yellen's remarks come less than a week before she is to appear before Congress for a biannual briefing on monetary policy, and as the central bank approaches a likely rate hike decision.

It is a step that will have global implications, putting the Fed on a path separate from central banks in Europe and Japan that continue fighting economic crises, and potentially drawing capital out of developing economies.

According to the individual economic projections released by Fed officials at their June meeting, there was a roughly even divide between those who expect only one interest rate increase this year - and might thus be prepared to wait until late in the year to hike - and those who expect two and would want to move sooner.

Yellen's position on that point remains uncertain, though her influence as chair is likely pivotal in the ultimate decision.

Fed officials seem to have set the stage for an initial increase as early as September. But recent events - the stock market collapse in China and the confusion in Greece in particular - have raised fresh concerns over how the world economy may hurt U.S. growth. Investors now believe an initial hike is not likely until next year.

The Fed has kept rates near zero for almost seven years.

Though it will likely take years for the central bank to gradually return rates to more normal levels, the initial step -

"liftoff" - has attracted outsized attention as a symbol that the Fed is ready to declare the crisis over.

Yellen said she felt that initial step will have a small impact, and that the Fed would be raising rates only gradually from that point on.

Yellen said she agreed that a slow start to the year was likely the result of temporary factors, such as low oil prices undercutting investment in the U.S. energy sector, and a rising dollar pushing up the international price for U.S. exports.

But she also said the economy faced constraints that could hold it back, from a still underperforming housing market to the unresolved crisis in Greece.

CFTC data can’t help us much this time. Even in comments, traders said that they have mostly closed positions on EUR at the eve of crucial solution on Greek debt program. CFTC data shows approximately the same. We see huge drop in Open interest in June and no action since then, as in short as in long positions.

Open Interest:

Here we will not repeat our thoughts on Greece situation and importance of Greece for EU and US as from geopolitical point of view as from economical one. We’ve said a lot on this subject last time. Now we clearly understand that despite our conclusion that we will make today on technical picture, market will be driven by final solution on Greek crisis, so our analysis could appear to be in vain. Still, let’s see what technical picture tells us.

Technicals

Monthly

Trend is bearish on monthly chart, July is inside month by far and does not impact significantly on overall picture. As we’ve said, technical picture right now is secondary issue, until situation around Greek debt will be resolved.

Still, as we have estimated previously 1.05 is 1.27 extension of huge upside swing in 2005-2008 that also has created large & wide butterfly pattern. Recent action does not quite look like normal butterfly wing, but extension is valid and 1.05 is precisely 1.27 ratio. At the same time we have here another supportive targets, as most recent AB=CD, oversold and 1.27 of recent butterfly.

April has closed and confirmed nicely looking bullish engulfing pattern. We know that most probable target of this pattern is length of the bars counted upside. This will give us approximately 3/8 Fib resistance 1.1810 area. But most recent action, guys, makes us worry for perspective of upside retracement. After engulfing pattern been formed, EUR can’t turn to upside action within 2 months and can’t pass through 1.1450 area. This is not good sign for bulls. Of cause, we expect downward continuation as we’ve said, but previously we’ve thought that it will happen after upside retracement.

Now about our recent talk on possible B&B or DRPO here. We’ve said that B&B seems more probable. We’ve got close above 3x3 DMA in June, but this barely has happened. July action stands flat, although above 3x3 DMA, but this is not sufficient to get B&B “Sell”. So chances on its appearing are melting as time is passing by. Still we will keep watching for DiNapoli directional patterns but probably they will appear not as fast as we have expected.

Despite whether upside retracement will happen or not our next long-term target stands the same – parity as 1.618 completion point of recent butterfly. Currently we should treat possible bounce up, even to 1.18 area, only as retracement within bear trend. Yes, tactically fundamentals have become weaker in US with dovish recent Fed comments, and open door for pause in bearish trend, but overall picture has not changed drastically yet.

Weekly

Trend is bullish on weekly chart, market is not at oversold or overbought. Weekly chart shows the complexity situation that we have on EUR. First of all, recent week was mostly inside one and has not made any impact on overall picture. Currently EUR still keeps chances valid as for bullish as for bearish patterns.

On bullish side market could form butterfly “Sell” and AB-CD that could lead us precisely to 1.18-1.19 weekly K-resistance area. On bearish side, as EUR still stands below 1.15 highs, market keeps chances for butterfly “Buy” pattern with 1.618 extension at the same level – parity.

The only result that we see last week is reaching the target of bearish engulfing pattern right at support line.

Putting it’s all together, including monthly picture, we find suspicious signs. Thus, on monthly market can’t continue move up for 3rd month in a row after bullish engulfing pattern has been formed. Here, on weekly chart, previous bounce down was absolutely logical, since EUR has met Fib resistance, MPS1 former YPS1 and overbought. Later we’ve got another bearish engulfing pattern at the same place, but market is not overbought any more.

Thus, on weekly chart we could only appoint important levels. If market will break through them, this probably will tell us following direction.

Since 1.1450 shows itself as strong resistance and our next target is 1.18-1.1950 K-resistance, it would be better to take long position if EUR will break through 1.15 area. For those of you, who would like to trade EUR short – wait for downward breakout of 1.08 level. This probably will destroy any potential patterns, such as butterfly “Sell” or may be even H&S and will lead to further weakness of EUR.

Daily

So, previously we already has said, when market forms long-ranged candle – it could keep price action for considerable period of time and price could fluctuate inside this range with no direction. But importance of these long-ranged candles stands particular in its extreme points, i.e. high and low. The point is that when market breaks this range either upside or downside it continues action in this direction.

Yesterday market has formed bearish grabber. Currently, this is the only clue that we have here right now. IF this grabber will work – it will lead EUR below recent 1.09 lows and this probably will mean downward breakout. At least, appearing of grabber fits into our yesterday analysis and what we’ve said about DiNapoli “H&S failure” pattern, etc. remember?

But larger picture on daily chart mostly confirms what we’ve said above. There are two major levels on daily chart that we have to monitor. First one is 1.1450. We see that this is not just strong resistance, but also minor AB-CD target. Current move down technically looks absolutely natural, since this is minor retracement after 0.618 target has been completed. If market will move above 1.1450, it will keep valid AB-CD and could start butterfly “Sell”. Both patterns have the same target around 1.18. We’ve mentioned this level on weekly and monthly chart as well. This scenario could launch monthly B&B “Sell” pattern.

Second level is 1.08. Moving below this level will cancel as butterfly as current AB-CD and could put the starting point for long-term move to parity. Currently we also have some kind of bearish divergence with MACD right at strong resistance level. Besides, overall action looks like triangle or pennant on higher time frame charts.

So, grabber could work and could be traded but carefully and it is not suitable for everybody. May be patience and deliberation will be not superfluous in current situation.

4-Hour

So, guys, despite how brilliant and fascinating our analysis was, we have to acknowledge that mostly it has failed. Not in term of possible downward reversal – this could happen still, but mostly in term of existence DiNapoli directional “H&S Failure” Pattern.

This chart shows that strong resistance level – K-resistance + WPP + MPP mostly was broken and didn’t hold market on a way up. Yes, EUR still stands below MPP, but K-resistance was destroyed. The only Fib level that is valid here - 5/8 resistance at 1.1237. So what do we going to do now? We will continue to watch for possible failure of H&S pattern on hourly chart. Yes, this failure has not happened in a way of DiNapoli pattern, but this does not mean that it can’t fail at all. Still we have bearish grabber on daily chart…

1-Hour

Hourly chart shows that may be we even can’t talk on failure of H&S pattern, because it seems that EUR has completed AB=CD pattern. It will be better to place question just on further direction. From that standpoint situation looks simpler. Fundamentally EUR has rallied up on anticipation of final agreement on Greece crisis, while later in the day, Yellen’s speech has chilled out market a bit. Thus, if market will move below WPP, this increases chances that bearish grabber will work and we could try to take bet on short side, while moving above recent top will erase the grabber and make possible further upside action.

Conclusion:

Market right now mostly is driven by Greece situation and we understand that our analysis of technical picture could be in vain. Still, we’ve founded some interesting patterns and levels that could help us in early estimation of direction, as soon as these levels will be broken.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.