Sive Morten

Special Consultant to the FPA

- Messages

- 18,697

Monthly

Weekly FX Tading Report prepared by Sive Morten exclusively for ForexPeaceArmy.com

According to Reuters news dollar gave up strong early gains and turned lower on Friday after the battered euro pivoted to price gains amid reports of short-covering in the common currency and a drop in U.S. bond yields. The euro had its first weekly gain in four weeks and on Friday last traded at $1.2523, up 0.40 percent for the day. But the basket of major currencies traded against the dollar has now had four straight weekly rises, a pattern that some strategists and traders say signals more increases are likely.

"We have a fairly well-developed upward trend in the U.S. dollar," said Camilla Sutton, chief currency strategist at Scotiabank in Toronto. Persistent weakness in the Japanese yen and Britain's sterling benefit the dollar, Sutton said.

During the trading day, the euro struck a low of $1.2399 before climbing. "The euro's ability to hold above that $1.24 level encouraged some investors to unwind short positions, essentially buying back the euro at these lower levels," said Omer Esiner, chief market analyst at Commonwealth Foreign Exchange in Washington, D.C.

Other investors quit dollar investments as U.S. Treasuries yields declined after rising on hopes of piercing key levels, according to Sebastien Galy, currency strategist at Societe Generale. "The market tried to go for the break very slowly, and we just sort of failed at that," Galy said. "From there we consolidated with some profit-taking on the dollar."

U.S. Treasury 10-year yields last stood at 2.322 percent after touching a high of 2.377 percent.

Recent CFTC data does not show something special. Open interest shows shy decrease, as well as speculating positions. This just tells that nothing drastical has happened on market sentiment and lets us treat current upside action as retracement.

Non-Commercial Shorts:

Non-Commercial Longs:

Open Interest:

Technical

On previous week we’ve made wide comments on complex situation around EUR. As we’ve said previously EUR right now stands in center of geopolitical and economical turmoil and we have mutual 2-side relations EU-US and EU-Russia. And progress of these relations develops not very positive. Shortly speaking we expect that EUR will continue move down.

We will remind you here major points of our analysis. In EU-US relations there are two topics right now – political and economical. On political side US forces EU to increase pressure on Russia and take disandvantageous steps and measures that primary hurts EU and almost harmless for US. Here we know about sanctions, Mistrale ships question, etc. Simultaneously US is aiming to replace Russia as important and strategic partner for Europe by enforcing “Zone of free trade agreement”. This falsity of ally becomes possible mostly because Europe de facto is not independent but mostly the colony of US. That’s why US freely can give the law to EU.

Economically US and EU drives on opposite courses. Recently Draghi has given a hint that ECB will increase balance to the level of March 2012 and this assumes QE on approximately 3 Trln EUR. US economy, in turn, now shows signs of improving. The major concern still is lack of inflation. Although Jobs are growing, but wealth of middle class and wages are stagnating.

This makes us think that EUR now stands under double pressure – EU pulls chestnuts out of the fire for US (in relation with Russia) and particularly due this action makes economical pit deeper. What could bit this sorrow?

As a result of blind or coercive following to US policy, EU meets problems with Russia, it’s 3rd largest trading partner. We suggest that situation will become worse, US will demand more and more sanctions from EU upon Russia. But in turn, economical situation EU-Russia stands in relation with geopolicy where US will not accept any compromises. Any ECB efforts on stabilizing of EU economy could be mitigated by new spiral of geopolitical tensions and painful sanctions. That’s why here is our conclusion – hardly real reversal on EUR is possible any time soon.

From technical point of view trend holds bearish here, but market is not at oversold. Price has broken through all solid supports and right now stands in “free space” area. As we have large Gartley “222” Sell pattern, it nearest target is 1.22 – 0.618 AB-CD objective point. Take a look how harmonic this downside action, the speed of CD and AB legs are almost equal. EUR looks really heavy, month by month it opens at the high close at the low. Currently we see small relief but 1.22 target should be hit.

Weekly

Picture on weekly chart has not changed significantly. Still, although last week was an inside one, market has remined above our support area of MPS1. Even on Friday morning it was seemed that EUR probably will not hold and drop, but on US data currency has shown solid rebound and returned initial setup of our analysis.

As we’ve said previously that EUR right now stands in “free space” and passed through all major Fib supports, the only support on the way to 1.22 target is MPS1. As previous retracement up was due oversold – market has continued move down and reached current support level.

Although we have nice thrust down, but we do not have any patterns – no grabbers, no DiNapoli directionals or even candlesticks. Let’s see how market will react on MPS1 and wether it will lead to some greater retracement or may be some pattern. On previous week market has not reached our expected destination around MPP and just re-test previous lows. At the same time market has not shown downside breakout either, thus the stuff that we’ve expected on previous week probably will be valid and reasonable for coming week as well.

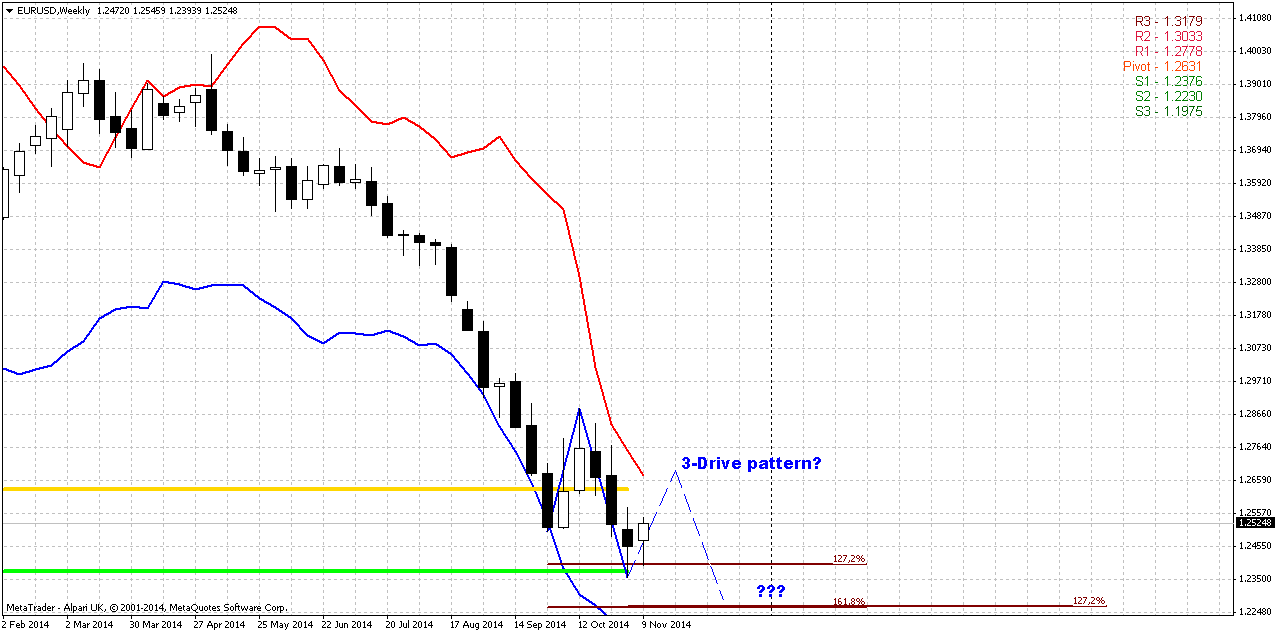

Thus, as current low stands at 1.27 of retracement up and our target stands at 1.22 - I’ve drawn 3-Drive pattern here, because it seems logical here and leads particularly to this area. Weekly chart is not at oversold and hardly any reversal will happen prior reaching of monthy 0.618 AB-CD target.

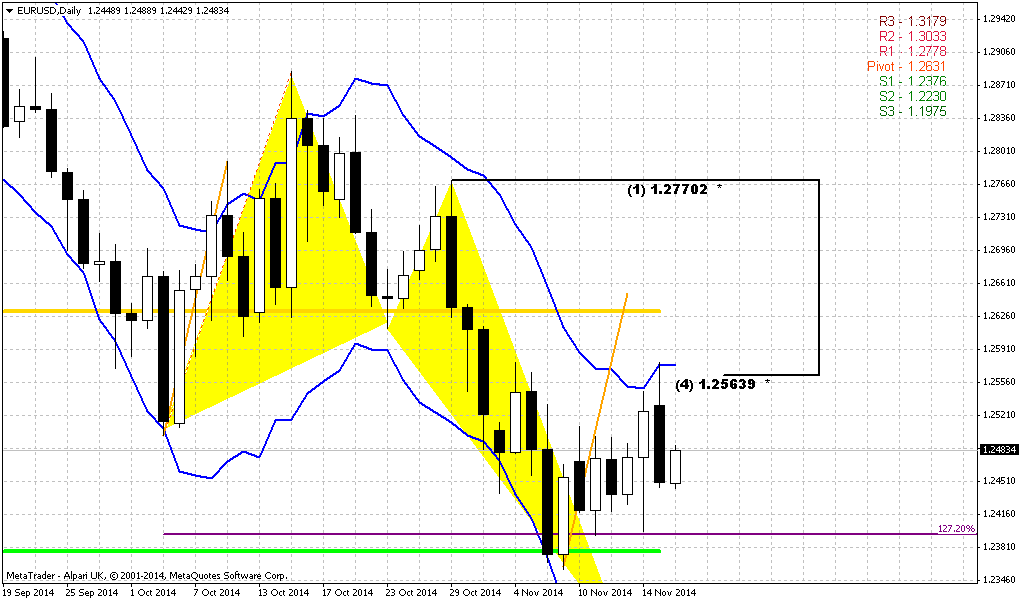

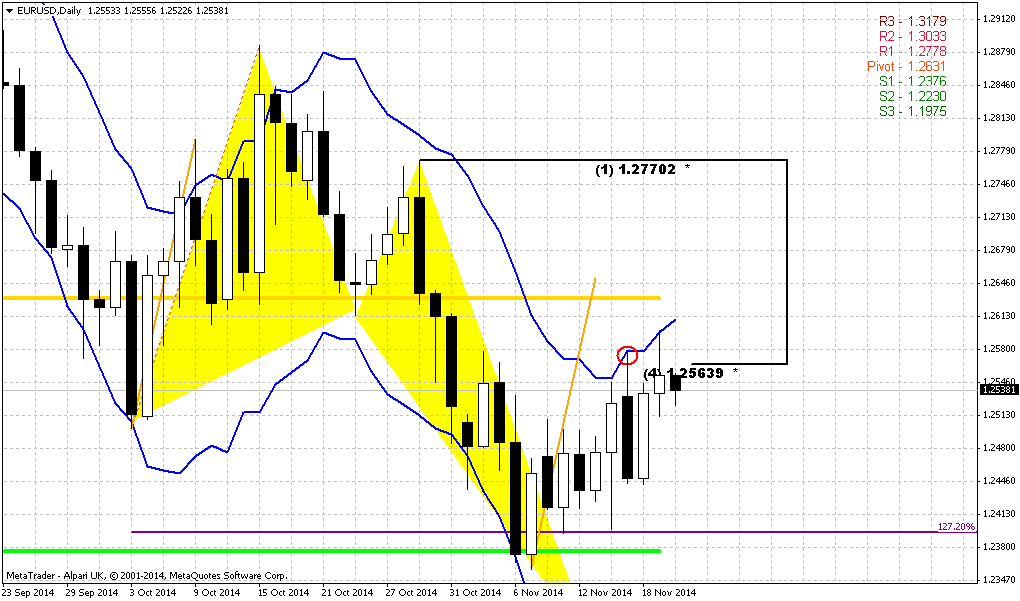

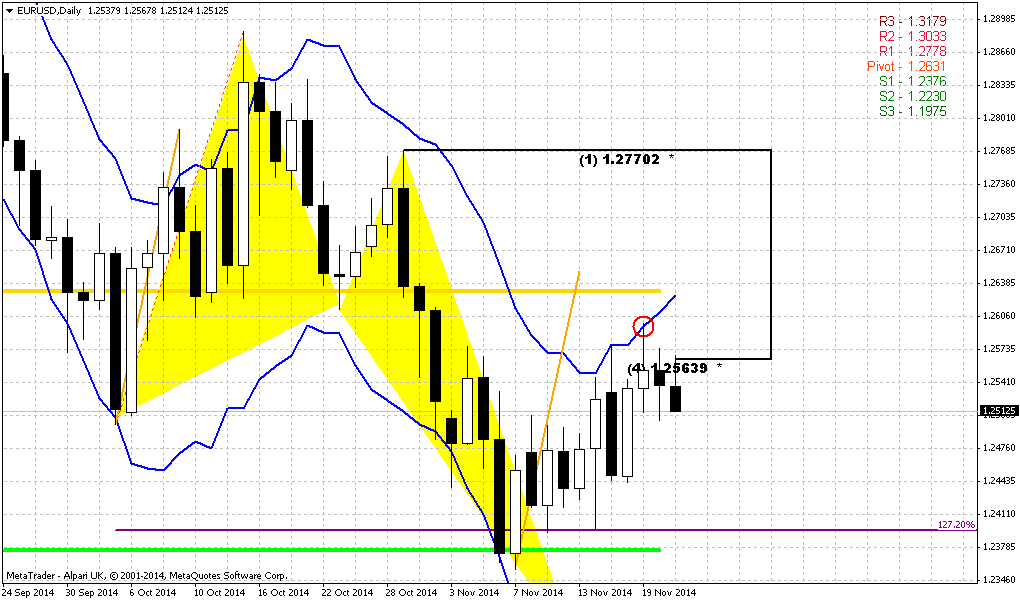

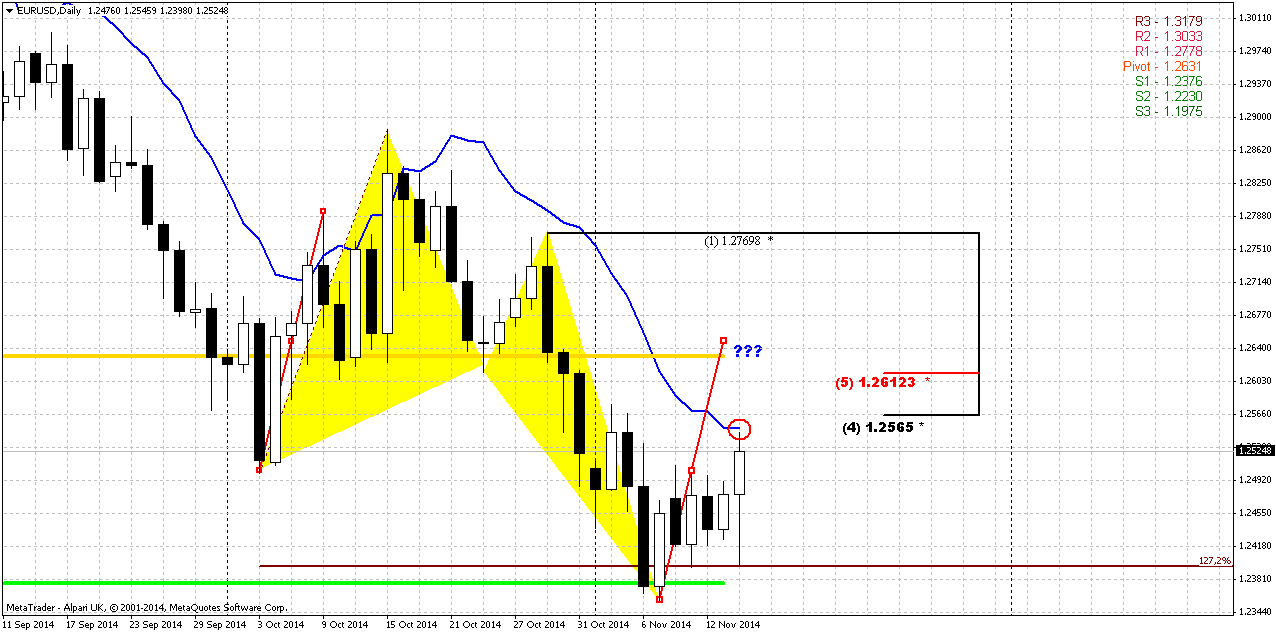

Daily

Our former analysis suggests possible minor bounce on daily EUR as market was oversold and at support. As EUR was flat for 4 day and has not supported bullish trend shifting, when we’ve just despaired to see any rally up – this has happened. Now price stands at resistance – daily overbought, former lows and 50% Fib level. We know that EUR likes 50% levels and in general, what chances on further upside continuation? Actually we do not have many reasons to count on further upside action. Technically we have untouched MPP and harmonic swing and that’s all. 3-Drive pattern that we’ve discussed above is just a desirable suggestion that’s based on the same harmonic swing by the way, but not some objective factor that has to happen. Anyway if somehow upside retracement will continue – it should happen a bit later when market will leave overbought area.

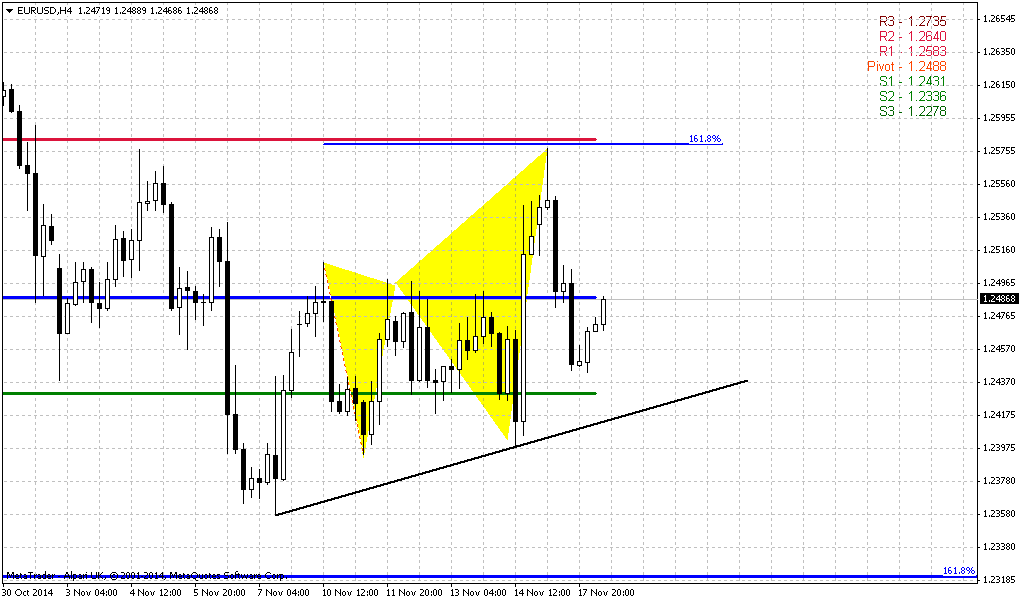

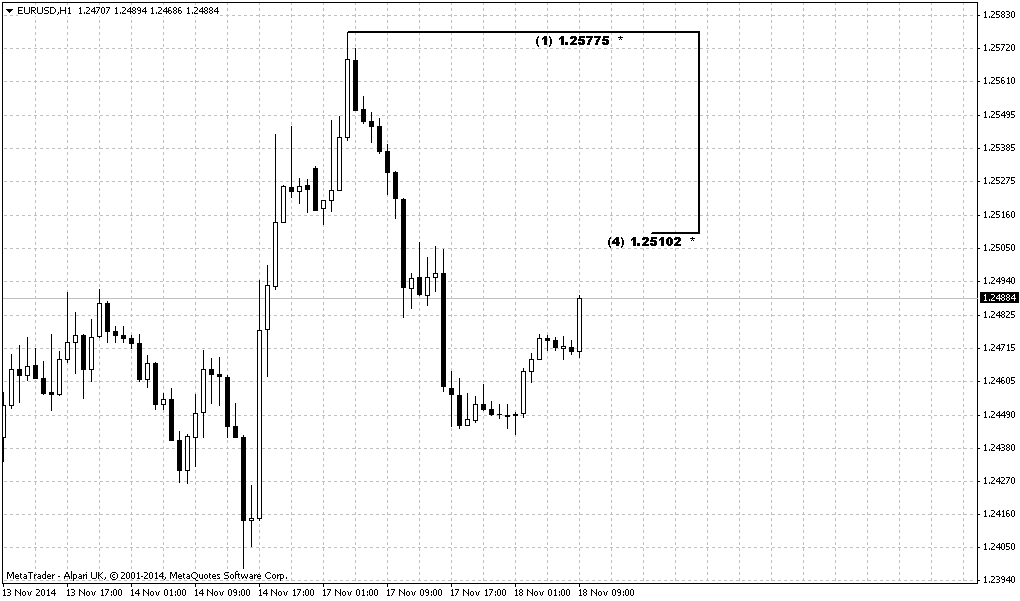

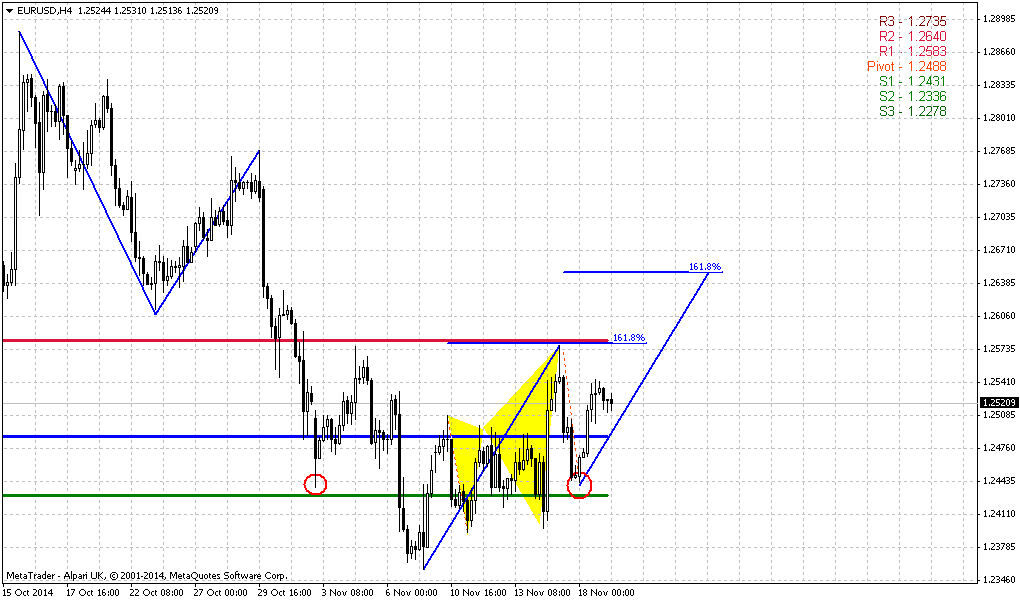

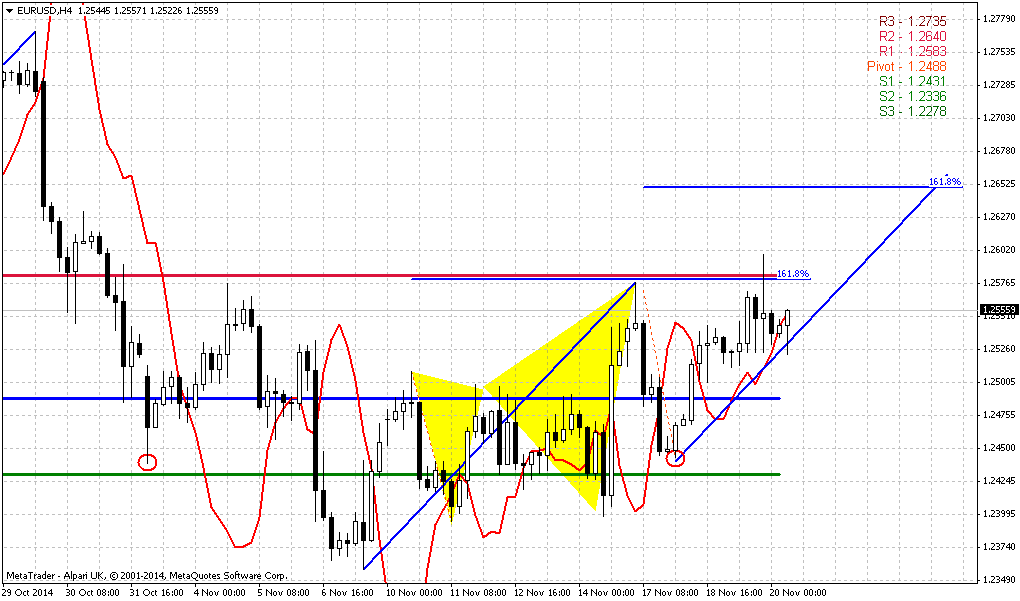

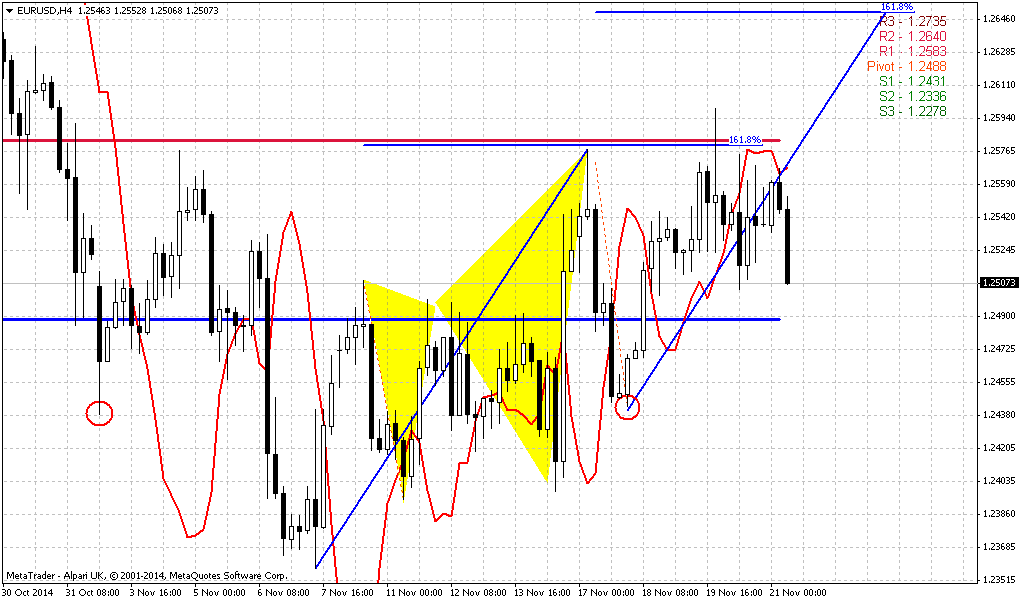

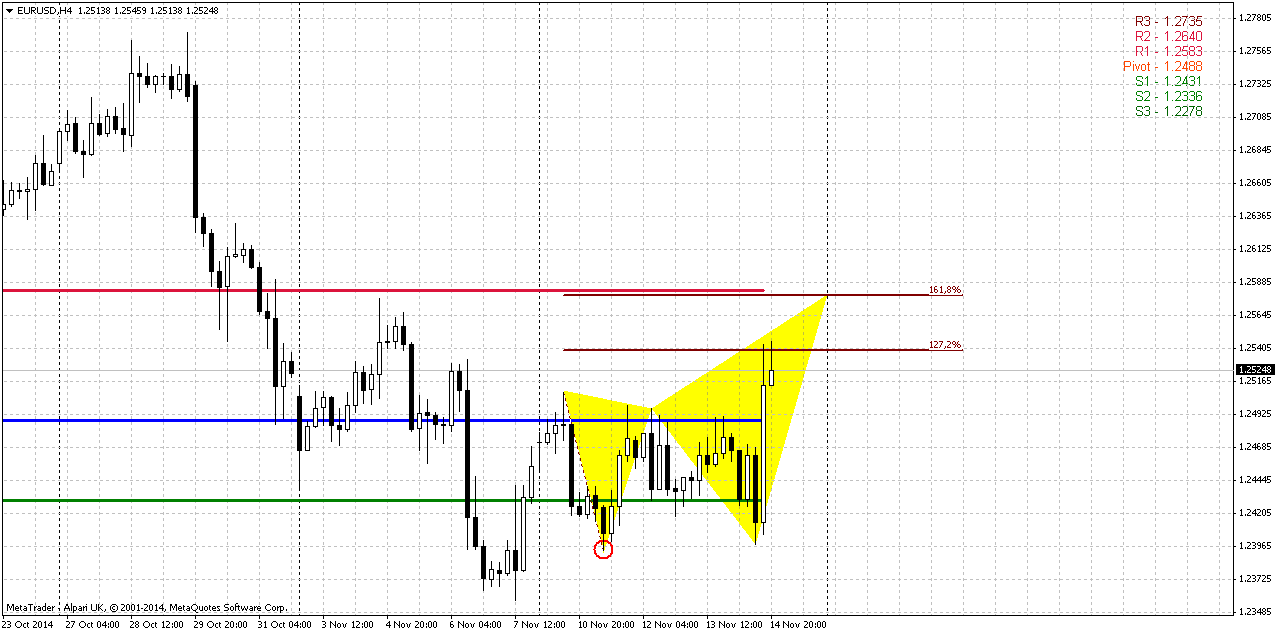

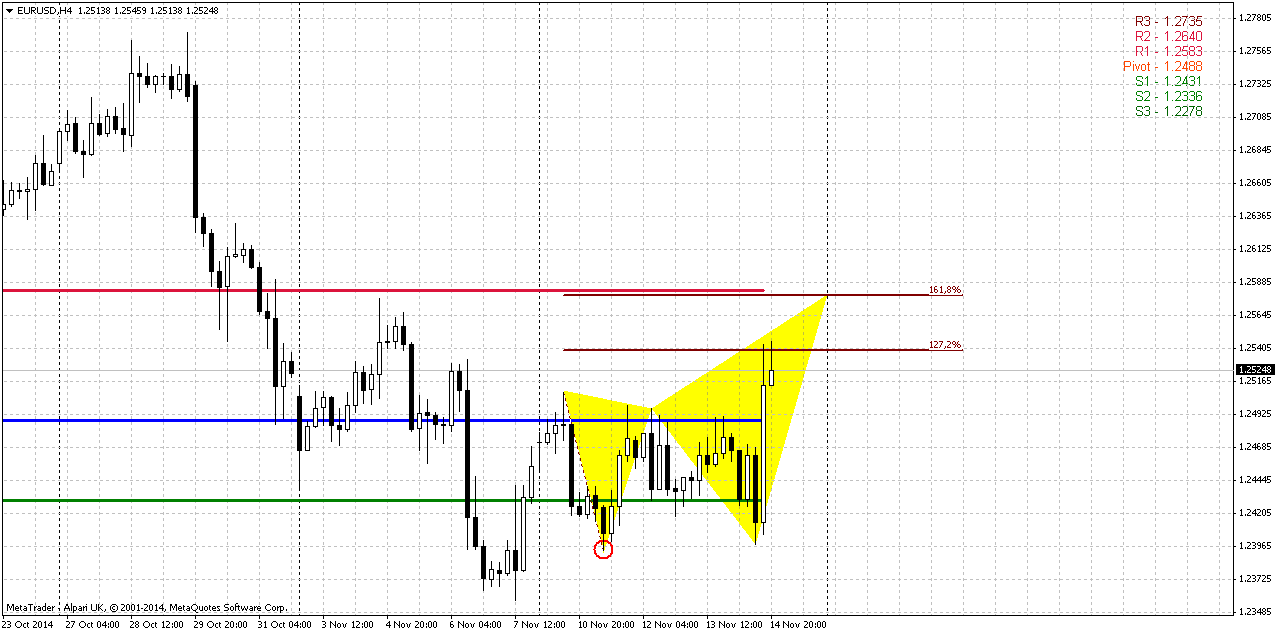

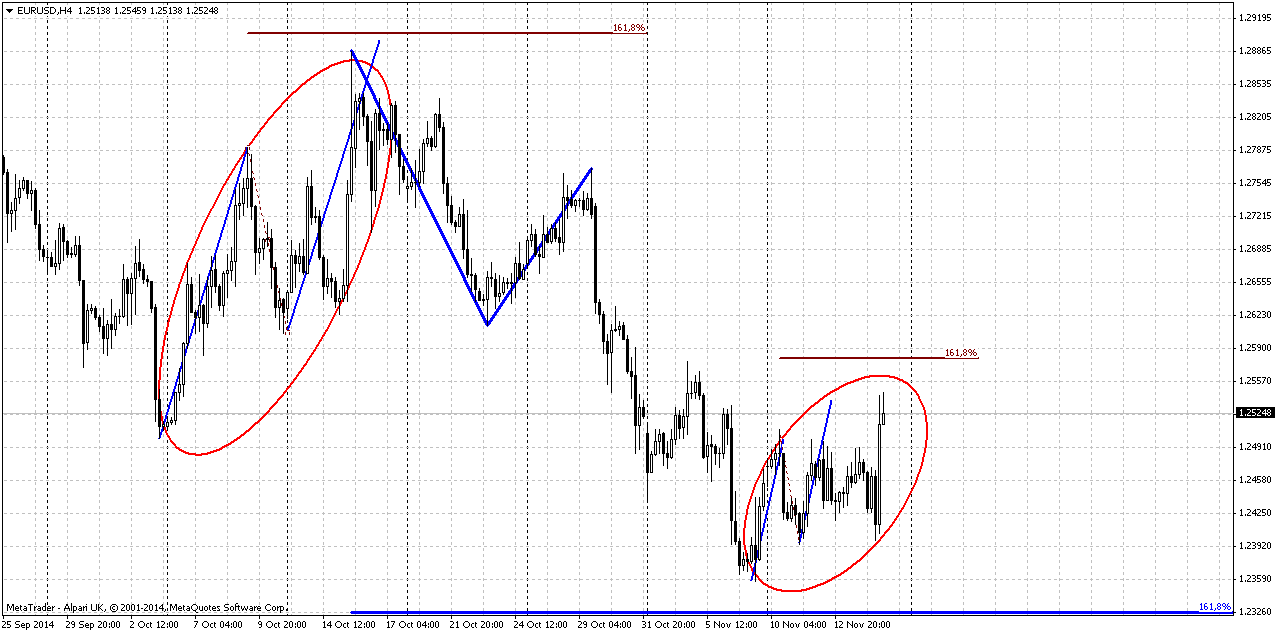

4-hour

This picture is very blur. Shortly speaking, with conditions that we have right now we can neither confirm nor argue against upside continuation. From one point of view recent thrust up was fast and assumes continuation at least to 1.618 butterfly point and WPR1. At the same time market stands at resistace and overbought, has completed upside AB-CD and it will not be surprise if it will turn down again right from here. Besides, we still should keep in mind uncompleted 1.618 AB=CD @1.2325 area

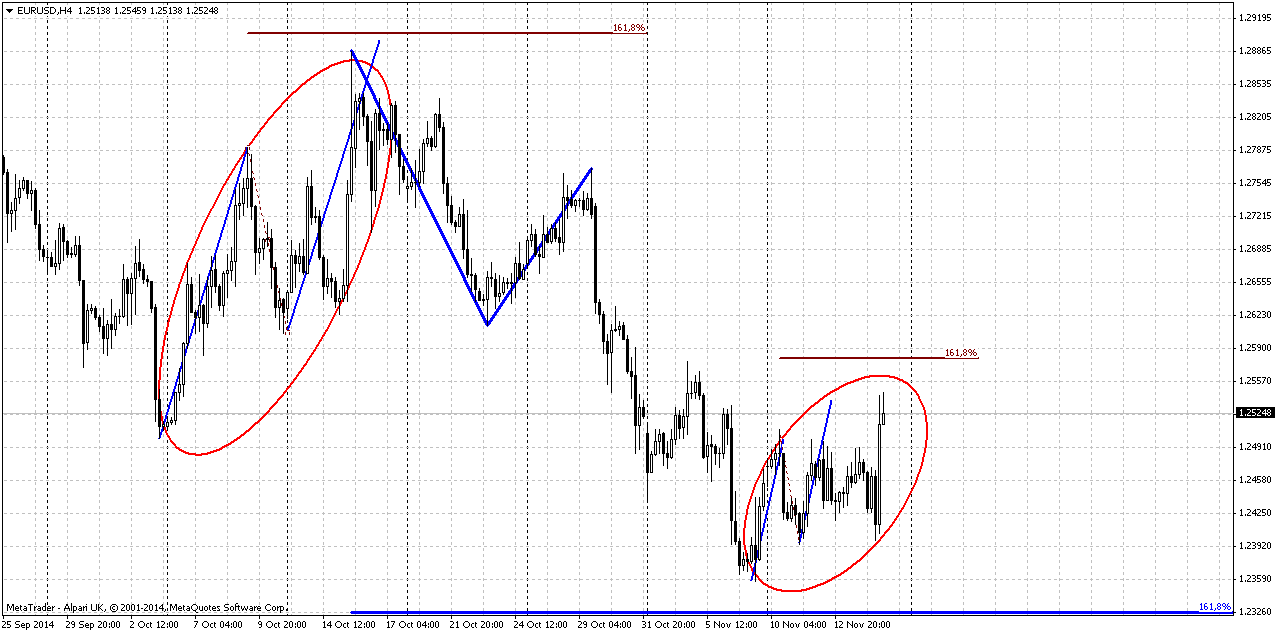

Also, guys I’ve taken a closer look at 4-hour chart and find this interesting similarity in upside retracements. Current retracement has smaller scale but the shape and swing consequences shows uncanny resemblance. On previous large retracement pattern market also has not quite reached 1.618 extension and AB-CD pattern. Acceleration up there was also fast... So, what we should to think right now?

What we definitely know, or at least based on probabilities, that market should show some move down first, due to the reasons that we’ve mentioned above. So, it seems that better idea right to just to wait for this bounce and then we will see what will happen.

Conclusion:

In long-term perspective we expect further EUR depreciation. May be it will not be fast and furious as previously but gradually it should become weaker. Our nearest target stands at 1.22 and probably it will be reached within November.

In short-term perspective market has reached support of MPS1 and even has turned to upside retracement on US data release on Friday. Although we would like to see this retracement up to reach a bit higher levels, but currently we have absolutely no confidence that this will happen. What we do know is that market at resistance and overbought and on Monday chances on downward action are greater. As bounce down will happen – we will take a look and see could we still count on retracement continuation or not. The point is that reasons for upside continuation are not very strong.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.

Weekly FX Tading Report prepared by Sive Morten exclusively for ForexPeaceArmy.com

According to Reuters news dollar gave up strong early gains and turned lower on Friday after the battered euro pivoted to price gains amid reports of short-covering in the common currency and a drop in U.S. bond yields. The euro had its first weekly gain in four weeks and on Friday last traded at $1.2523, up 0.40 percent for the day. But the basket of major currencies traded against the dollar has now had four straight weekly rises, a pattern that some strategists and traders say signals more increases are likely.

"We have a fairly well-developed upward trend in the U.S. dollar," said Camilla Sutton, chief currency strategist at Scotiabank in Toronto. Persistent weakness in the Japanese yen and Britain's sterling benefit the dollar, Sutton said.

During the trading day, the euro struck a low of $1.2399 before climbing. "The euro's ability to hold above that $1.24 level encouraged some investors to unwind short positions, essentially buying back the euro at these lower levels," said Omer Esiner, chief market analyst at Commonwealth Foreign Exchange in Washington, D.C.

Other investors quit dollar investments as U.S. Treasuries yields declined after rising on hopes of piercing key levels, according to Sebastien Galy, currency strategist at Societe Generale. "The market tried to go for the break very slowly, and we just sort of failed at that," Galy said. "From there we consolidated with some profit-taking on the dollar."

U.S. Treasury 10-year yields last stood at 2.322 percent after touching a high of 2.377 percent.

Recent CFTC data does not show something special. Open interest shows shy decrease, as well as speculating positions. This just tells that nothing drastical has happened on market sentiment and lets us treat current upside action as retracement.

Non-Commercial Shorts:

Non-Commercial Longs:

Open Interest:

Technical

On previous week we’ve made wide comments on complex situation around EUR. As we’ve said previously EUR right now stands in center of geopolitical and economical turmoil and we have mutual 2-side relations EU-US and EU-Russia. And progress of these relations develops not very positive. Shortly speaking we expect that EUR will continue move down.

We will remind you here major points of our analysis. In EU-US relations there are two topics right now – political and economical. On political side US forces EU to increase pressure on Russia and take disandvantageous steps and measures that primary hurts EU and almost harmless for US. Here we know about sanctions, Mistrale ships question, etc. Simultaneously US is aiming to replace Russia as important and strategic partner for Europe by enforcing “Zone of free trade agreement”. This falsity of ally becomes possible mostly because Europe de facto is not independent but mostly the colony of US. That’s why US freely can give the law to EU.

Economically US and EU drives on opposite courses. Recently Draghi has given a hint that ECB will increase balance to the level of March 2012 and this assumes QE on approximately 3 Trln EUR. US economy, in turn, now shows signs of improving. The major concern still is lack of inflation. Although Jobs are growing, but wealth of middle class and wages are stagnating.

This makes us think that EUR now stands under double pressure – EU pulls chestnuts out of the fire for US (in relation with Russia) and particularly due this action makes economical pit deeper. What could bit this sorrow?

As a result of blind or coercive following to US policy, EU meets problems with Russia, it’s 3rd largest trading partner. We suggest that situation will become worse, US will demand more and more sanctions from EU upon Russia. But in turn, economical situation EU-Russia stands in relation with geopolicy where US will not accept any compromises. Any ECB efforts on stabilizing of EU economy could be mitigated by new spiral of geopolitical tensions and painful sanctions. That’s why here is our conclusion – hardly real reversal on EUR is possible any time soon.

From technical point of view trend holds bearish here, but market is not at oversold. Price has broken through all solid supports and right now stands in “free space” area. As we have large Gartley “222” Sell pattern, it nearest target is 1.22 – 0.618 AB-CD objective point. Take a look how harmonic this downside action, the speed of CD and AB legs are almost equal. EUR looks really heavy, month by month it opens at the high close at the low. Currently we see small relief but 1.22 target should be hit.

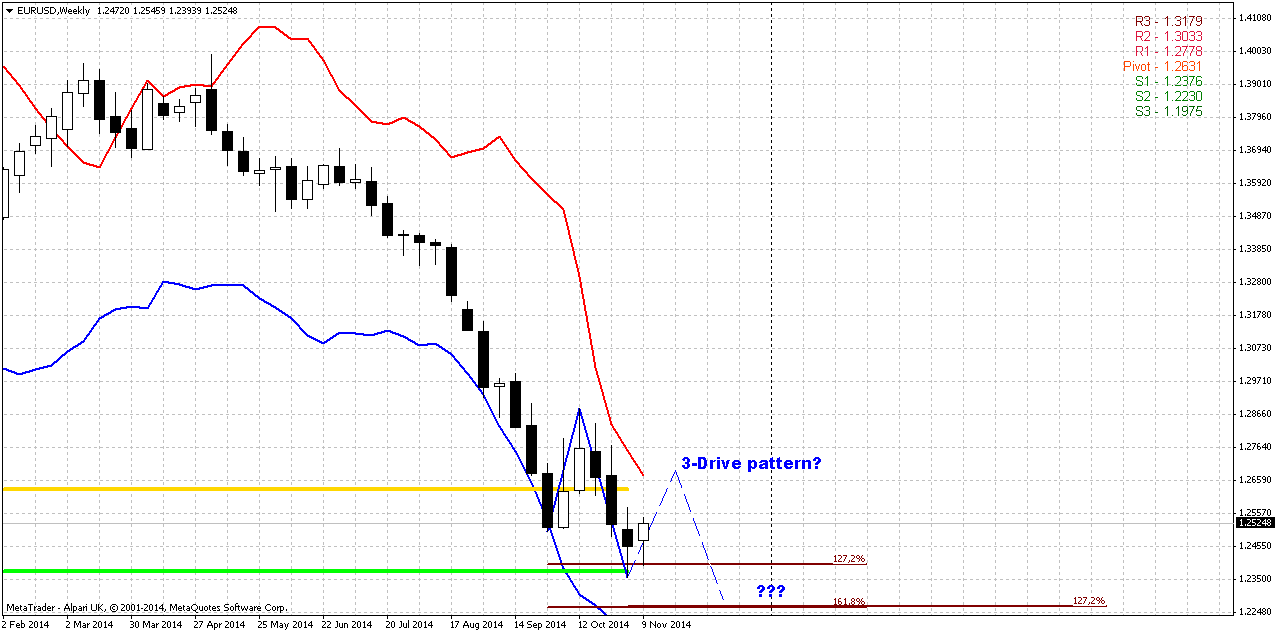

Weekly

Picture on weekly chart has not changed significantly. Still, although last week was an inside one, market has remined above our support area of MPS1. Even on Friday morning it was seemed that EUR probably will not hold and drop, but on US data currency has shown solid rebound and returned initial setup of our analysis.

As we’ve said previously that EUR right now stands in “free space” and passed through all major Fib supports, the only support on the way to 1.22 target is MPS1. As previous retracement up was due oversold – market has continued move down and reached current support level.

Although we have nice thrust down, but we do not have any patterns – no grabbers, no DiNapoli directionals or even candlesticks. Let’s see how market will react on MPS1 and wether it will lead to some greater retracement or may be some pattern. On previous week market has not reached our expected destination around MPP and just re-test previous lows. At the same time market has not shown downside breakout either, thus the stuff that we’ve expected on previous week probably will be valid and reasonable for coming week as well.

Thus, as current low stands at 1.27 of retracement up and our target stands at 1.22 - I’ve drawn 3-Drive pattern here, because it seems logical here and leads particularly to this area. Weekly chart is not at oversold and hardly any reversal will happen prior reaching of monthy 0.618 AB-CD target.

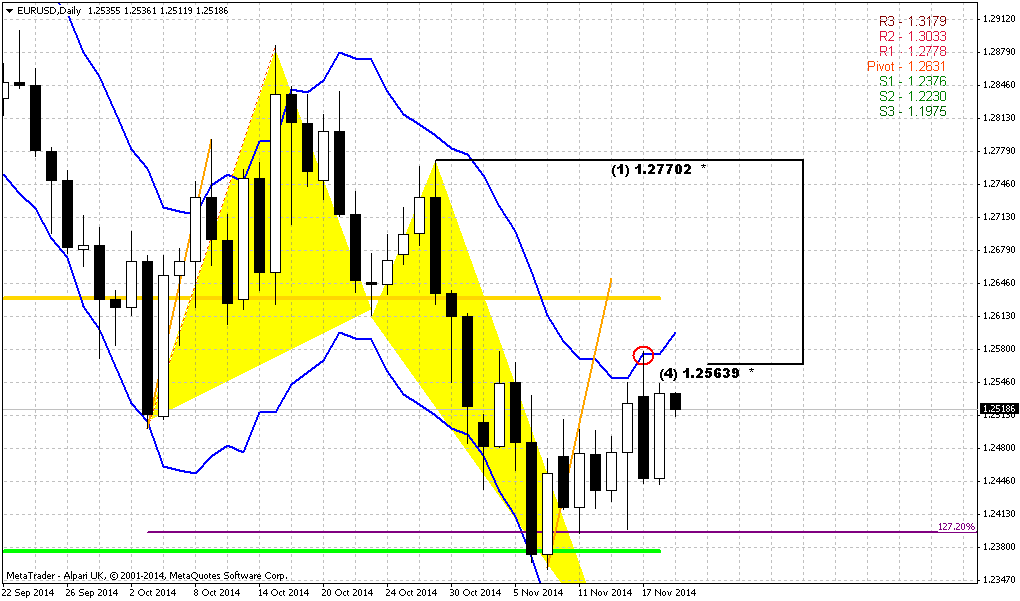

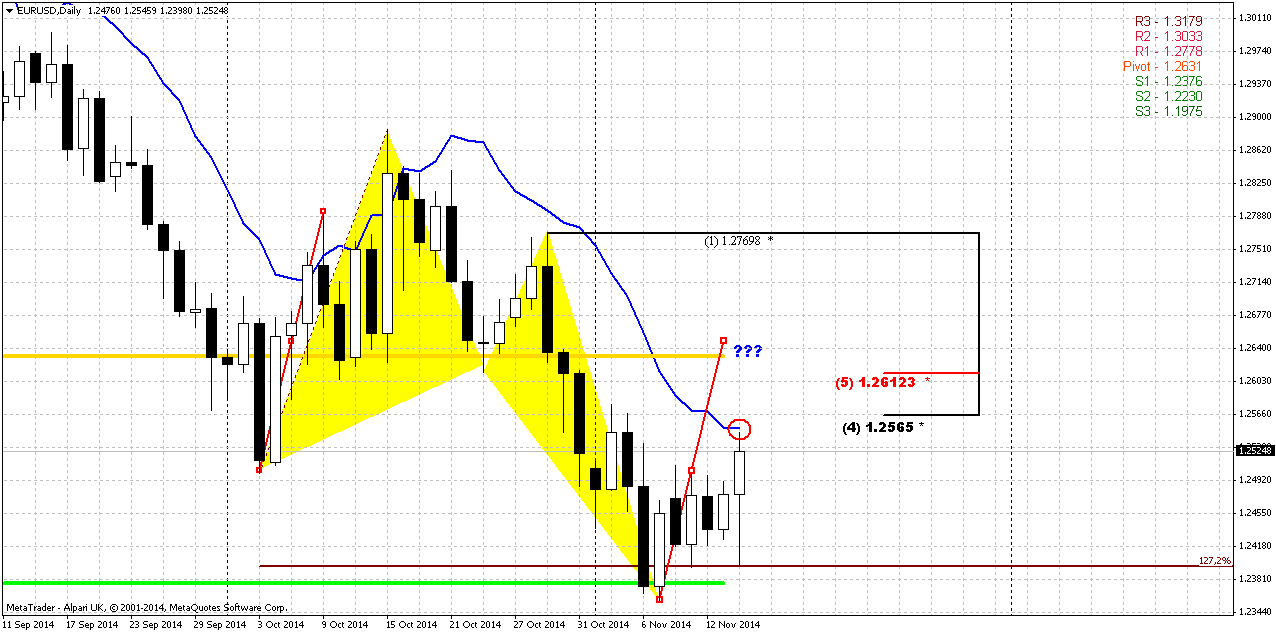

Daily

Our former analysis suggests possible minor bounce on daily EUR as market was oversold and at support. As EUR was flat for 4 day and has not supported bullish trend shifting, when we’ve just despaired to see any rally up – this has happened. Now price stands at resistance – daily overbought, former lows and 50% Fib level. We know that EUR likes 50% levels and in general, what chances on further upside continuation? Actually we do not have many reasons to count on further upside action. Technically we have untouched MPP and harmonic swing and that’s all. 3-Drive pattern that we’ve discussed above is just a desirable suggestion that’s based on the same harmonic swing by the way, but not some objective factor that has to happen. Anyway if somehow upside retracement will continue – it should happen a bit later when market will leave overbought area.

4-hour

This picture is very blur. Shortly speaking, with conditions that we have right now we can neither confirm nor argue against upside continuation. From one point of view recent thrust up was fast and assumes continuation at least to 1.618 butterfly point and WPR1. At the same time market stands at resistace and overbought, has completed upside AB-CD and it will not be surprise if it will turn down again right from here. Besides, we still should keep in mind uncompleted 1.618 AB=CD @1.2325 area

Also, guys I’ve taken a closer look at 4-hour chart and find this interesting similarity in upside retracements. Current retracement has smaller scale but the shape and swing consequences shows uncanny resemblance. On previous large retracement pattern market also has not quite reached 1.618 extension and AB-CD pattern. Acceleration up there was also fast... So, what we should to think right now?

What we definitely know, or at least based on probabilities, that market should show some move down first, due to the reasons that we’ve mentioned above. So, it seems that better idea right to just to wait for this bounce and then we will see what will happen.

Conclusion:

In long-term perspective we expect further EUR depreciation. May be it will not be fast and furious as previously but gradually it should become weaker. Our nearest target stands at 1.22 and probably it will be reached within November.

In short-term perspective market has reached support of MPS1 and even has turned to upside retracement on US data release on Friday. Although we would like to see this retracement up to reach a bit higher levels, but currently we have absolutely no confidence that this will happen. What we do know is that market at resistance and overbought and on Monday chances on downward action are greater. As bounce down will happen – we will take a look and see could we still count on retracement continuation or not. The point is that reasons for upside continuation are not very strong.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.