Sive Morten

Special Consultant to the FPA

- Messages

- 18,655

Fundamentals

No doubts, the major economical news is inflation report. So we need to take a look and dig a bit deeper to understand the real situation in the US economy. Another event, which I would call as political event #1 of this week is Xi visit to the US. Formally he has come to APEC summit, but everybody understand that the major aim was to speak with Biden. We suggest that China-US relations will accelerate very soon, as some important events, such as Taiwan elections on 13th of January, are just around the corner. This will have decisive impact for markets in long-term, especially for Gold. So, this topic among the others, we will cover tomorrow, and explain what particular Xi and Biden have discussed.

Market overview

The dollar fell more than 1% against major currencies on Tuesday after U.S. consumer price data showed the pace of inflation moderating further in October, increasing the odds that the Federal Reserve is done hiking interest rates. U.S. consumer prices were unchanged last month amid lower gasoline prices, the Labor Department's Bureau of Labor Statistics (BLS) said, following a 0.4% rise in September. In the 12 months through October, the consumer price index (CPI) climbed 3.2% after rising 3.7% in September, BLS said.

The dollar immediately tumbled on the report's release and Treasury yields plunged. The benchmark 10-year fell below 4.5%, removing a major support to the dollar's strength this year. The data was welcome news in the market, where many analysts have been predicting the Fed's interest rate hiking has peaked - "You can say goodbye to the rate-hiking era," said Brian Jacobsen, chief economist at Annex Wealth Management in Menomonee Falls, Wisconsin.

But Doyle, among others, cautioned the end of rate hikes did not mean rate cuts would be coming as soon as markets were predicting due to a tight American labor market and resilient U.S. economy that has kept consumers spending. "I don't think that they're going to be itching to cut rates necessarily," he said, referring to Fed policymakers. "The Fed's going to feel pretty comfortable to ride it out longer." An annualized 3.2%, the pace of inflation remains well above the Fed's 2% target, leaving the question of when the Fed will cut rates unresolved.

San Francisco Federal Reserve President Mary Daly warned against calling time on rate-rising cycle too soon, in an interview to Financial Times on Wednesday. Daly refused to rule out another interest rate increase, given uncertainty about whether the central bank has done enough to push consumer price growth back down to its 2 per cent target.

Futures show more than a 68% probability that the Fed cuts its overnight lending rate by 25 basis points or more by next May, according to the CME's FedWatch tool.

U.S. retail sales fell for the first time in seven months in October, the Commerce Department's Census Bureau said, while producer prices posted the biggest decline in three-and-a-half years last month, according to the Labor Department's Bureau of Labor Statistics. More than 80% of the decline last month in the Producer Price Index for final demand goods was attributed to a 15.3% drop in gasoline prices, BLS said.

The crucial holiday shopping season kicks off with Black Friday on Nov. 24 at a time when investors are questioning whether the consumer-driven U.S. economy can remain resilient.

After all, the dollar posted its second-steepest weekly decline versus other major currencies this year on Friday. Cooler-than-expected U.S. inflation data on Tuesday and Wednesday hastened market expectations for how soon the Federal Reserve will cut rates. Such a move would weaken a major dollar support and could come as early as next year's first quarter. The yield on benchmark 10-year Treasury notes fell to a two-month low of 4.379%.

Concerning ECB interest rates, the European Central Bank will hold interest rates steady well into next year, with a majority of economists polled by Reuters sticking to forecasts the first cut will have to wait until at least July despite expectations of a euro zone recession. The results are similar to a survey last month where 58% expected no cut before the July meeting.

An earlier than expected rate reduction would likely require a recession deep enough to prompt easing even if inflation remains above the ECB's 2% target. Money markets now have fully priced 100 bps of rate cuts in the euro zone next year. Nonetheless, European Central Bank (ECB) policymakers Robert Holzmann and Joachim Nagel said on Friday the bloc must stand ready to raise interest rates again if necessary.

Meantime, we see that something is going on around debt market, as in the US as in EU. It seems that public opinion of "riskless" government debt is a subject to change. First is, C. Lagarde said on Thursday that "European banks may suffer significant losses if they need to sell their bond holdings to raise cash". EU banks’ holdings of fixed income securities could be marked down quite significantly, should they need to be sold," she told the annual conference of the European Systemic Risk Board, which she chairs.

The nonpartisan Congressional Budget Office (CBO) has estimated that cumulative budget deficits will total about $20 trillion in the coming decade. Moody's, which last week lowered its outlook on U.S. credit, expects the government to continue to run wide fiscal deficits due to increased spending and higher debt interest payments.

Meanwhile, investors have in recent months sounded alarm bells on the U.S. fiscal position. Hedge fund Bridgewater Associates' Ray Dalio expects a U.S. debt crisis. "As we look forward we have a debt problem, because you can't keep adding to debt faster than you add to income," he told CNBC on Friday.

Rating agency Fitch said on Wednesday that U.S. regional banks will face continued challenges in 2024, with those lacking scale or focused on commercial loan growth disproportionately pressured. Fitch's caution follows Moody's last week saying that the banking sector is not yet out of the woods, with re-inflation a risk if banks fail to sufficiently predict rate moves.

Market Insider also writes - US Treasuries have long been the go-to asset when uncertainty, fear, and full-blown panic send investors looking for safety — but that reputation has take major hits lately. Financial markets have been engaged in a growing debate over the risks that lurk in Treasurys, with prominent voices raising doubts. On Friday, Moody's lowered the US credit outlook to "negative," signaling that a downgrade is possible in the future.

Meanwhile, Principal Asset's Seema Shah told CNBC in a separate interview last month that "there's so many different forces which are buffeting the bond space that it's difficult to really say with great conviction that today Treasuries are your safe haven."

In June, a Dallas Federal Reserve paper said buyers view short-duration T-bills as the true safe haven, pointing out that net inflows in long-dated Treasuries fell during the 2008 crash and COVID pandemic. "Long-term Treasury bonds may have no default risk, but they have liquidity risk and interest rate risk — when selling the bond prior to maturity, the sales price is sometimes uncertain, especially in times of financial market stress," it said.

For awhile, investors ignore all these warnings. Current market sentiment is clear. Investors expect stable rates for ~ 6 months with tendency to decrease thereafter, slowing of inflation and more or less stable, weak but positive economy performance. Still we see some flaws in this rosy scenario.

BEHIND CPI

So there are "optimistic" data on inflation in the United States, which the market, it seems, interprets incorrectly. The reaction to this data is extremely positive - the markets are in the green zone, everything is fine. The yield of 10-year treasuries has fallen below 4.5%, although quite recently it was at a level above 5%.

The market completely misunderstands the data. Falling inflation with rising unemployment and a budget deficit of 8% of GDP is not normal at all. This means that the stakes are high enough that the recession is already slowly approaching. Because such incentives are no longer enough to spur demand. One could say that output is growing and therefore the price is falling, but then why is unemployment growing, that is, how can the use of labor resources decrease with output growth?

US Continues Claims - at the top in 2 years.

Besides, output can't grow if consumption (i.e. retail sales) are decreasing as we have shown above. If take a look at the US Industrial production Index, you'll see that

industrial production declined 0.7% in October,the strongest decline since February 2021– the post-covid recovery period is over, which never turned into an expansion in production. For the past 15-16 years, the industrial sector has been at the same level – it is just 1% growth since October 2007. Impenetrable resistance level. This strongly impacts on the US political decisions, which we will discuss tomorrow, but here it is important to say that falling inflation now shows deteriorating processes and distracting of domestic production and manufacturing sector rather than some positive shifts in the US economy.

At this rate, we will come exactly where we have been going for a year and a half - to a global recession and perhaps even short-term deflation, if we overdo it. And the Fed and the government are most afraid of deflation. Even more than inflation. These are phantom pains after the Great Depression.

But this is only the half of the story. Let's take a look at wide PPI index on all commodities, that shows better picture.

Deflation at the end of October (that is, the price change for the year, from November 2022 to October 2023) was 3.6%, while the previous month it was 3.4%.

The minimum, -9.4% was in June, and then deflation began to decrease, it seemed that a little more and the situation would settle down. But instead, the decline in prices has intensified.

In fact, this is the same symptom as the reduction in the length of the working week, which we discussed in the previous review. In the US, a rather serious decline is clearly continuing, and it clearly manifests itself not even in one, but in a whole series of symptoms. And this is what we need to proceed from when assessing the economic situation, and not the optimistic desires of current politicians, who are already clearly thinking about the upcoming elections.

There is another coincidence that confuses. A week ago, banks said it was time to take long-term treasuries, because the peak rates have been reached. The market starts buying, and then Yellen comes out and says that in terms of placing treasuries for the next six months, there is an increase in long-term bonds. So, we're gradually turn to analysis of US debt/budget situation.

To keep problem easy, we have drop of tax revenues and big bulk of debt refinancing, coming in 2024. Nominal tax revenues to the US federal budget decreased by 8% compared to last year in October. This is the seventh consecutive month of decline compared to last year. Next year, the Treasury faces claims to repay as much as $8.2 trillion of US government debt (a third of the total volume of Treasury bonds still outstanding. Also, the budget deficit at such a percentage rate on the domestic debt market will require at least another $2 trillion in addition to the $8.2 trillion that needs to be reissued.

Such problems can only be solved with support from the Fed (lowering interest rates, stopping the sale of debt securities from the balance sheet) or in the event of a severe recession with the emergence of deflation. In any case, the next year will not be easy, especially in the first months.

Now the next shutdown is avoided. Problem is postponed on next year. Big fight on budget spending sequestration is still ahead It is very interesting to see what kind of compromise they will get on funding. Meantime we have temporal budget once again until the beginning of the next year. Economy stands due to cutting of "excessive" spendings in a way of Ukraine and Israel. And this brings 2 months of relief - everybody wants meet Xmas without a headache.

But if what the Republicans are talking about happens, that is, they still limit spending, then the situation will have to worsen, since the deficit will be reduced and, accordingly, demand support/demand in the economy will weaken. Thus the first quarter of 2024 for a recession and the second quarter for a financial crisis look the most likely.

Continuing the topic of ratings. Guess it once: if the rating agency war begins in earnest, what will happen to the far end of the curve? And it doesn’t matter in what papers: European, American, Chinese. Right - it hits painfully, as long-term rates will start raising fast. And China easily could become an object for attack from "independent" risk agencies, especially in the light of recent Xi-Biden meeting on APEC summit. China tries to boost economy with huge inflows from PBOC to stimulate domestic consumption, holding rates low, to support economy growth. In fact, it goes by the steps of the US, which seems a dead way in long-term perspective.

The Central Bank of China poured 600 billion into the banking system. RMB through medium-term loans and almost 500 billion yuan in loans. through weekly reverse repos. On charts below we see acceleration of retail sales for 7.6% - 5 months peak, but no changes in consumer loans, which means that PBOC efforts are not successful by far. Unemployment remains stable, as well as Industrial production.

At the same time, China is loosing foreign investing, showing contraction of nominal GDP which makes investors to b worry. Cumulative cross border capital flows are decreasing:

So, China easily could become the first victim of attack by rating agencies, confirming and accelerating the trend of capital outflows that already is started.

Conclusion:

Guys, I do not want to overload report, so it becomes annoying to read it and postpone a 2nd part of US debt analysis on tomorrow with Gold report. We will speak on real cashflows and what time limit the US has until difficulties come. It more relates to long-term analysis and gold market rather than to FX and EUR. Things that we already said above is enough to make some conclusions. First is, the US has no growth and no improvement in economy, despite what officials tell. It means that soft landing has very phantom chances to happen. At the same time, situation in EU stands the same and hardly looks better.

As we will show tomorrow, situation with the US budget and deficit is not critical yet and could last recently painless until the Spring-Summer of 2024. Which means that straightforward dollar weakness now is overestimated. We get wide wobbling action with periods of strength and weakness in the US Dollar, but without strong direct tendency in any direction. We suggest that Morgan Stanley is close to our view in their analysis. Closer to the summer situation could start spinning up.

This is central scenario if other things as political as economical will remain equal. But if we get some force-major twists, such as escalation of US-China confrontation, Ukraine's defeat (coupe, capitulation etc), Iran involving in the M. East confrontation or some others, the shape of the market could change drastically.

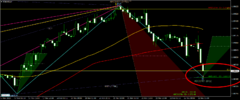

Technically, we do not see signs yet that cancel our long-term 0.9 target on EUR/USD. Definitely at some circumstances it might be reached. But also we have to be prepared to flatter and more wobbling price behavior.

No doubts, the major economical news is inflation report. So we need to take a look and dig a bit deeper to understand the real situation in the US economy. Another event, which I would call as political event #1 of this week is Xi visit to the US. Formally he has come to APEC summit, but everybody understand that the major aim was to speak with Biden. We suggest that China-US relations will accelerate very soon, as some important events, such as Taiwan elections on 13th of January, are just around the corner. This will have decisive impact for markets in long-term, especially for Gold. So, this topic among the others, we will cover tomorrow, and explain what particular Xi and Biden have discussed.

Market overview

The dollar fell more than 1% against major currencies on Tuesday after U.S. consumer price data showed the pace of inflation moderating further in October, increasing the odds that the Federal Reserve is done hiking interest rates. U.S. consumer prices were unchanged last month amid lower gasoline prices, the Labor Department's Bureau of Labor Statistics (BLS) said, following a 0.4% rise in September. In the 12 months through October, the consumer price index (CPI) climbed 3.2% after rising 3.7% in September, BLS said.

The dollar immediately tumbled on the report's release and Treasury yields plunged. The benchmark 10-year fell below 4.5%, removing a major support to the dollar's strength this year. The data was welcome news in the market, where many analysts have been predicting the Fed's interest rate hiking has peaked - "You can say goodbye to the rate-hiking era," said Brian Jacobsen, chief economist at Annex Wealth Management in Menomonee Falls, Wisconsin.

"We think that the dollar will continue to weaken a bit throughout the end of the year, maybe even early into January," said John Doyle, head of trading and dealing at Monex USA in Washington.

But Doyle, among others, cautioned the end of rate hikes did not mean rate cuts would be coming as soon as markets were predicting due to a tight American labor market and resilient U.S. economy that has kept consumers spending. "I don't think that they're going to be itching to cut rates necessarily," he said, referring to Fed policymakers. "The Fed's going to feel pretty comfortable to ride it out longer." An annualized 3.2%, the pace of inflation remains well above the Fed's 2% target, leaving the question of when the Fed will cut rates unresolved.

San Francisco Federal Reserve President Mary Daly warned against calling time on rate-rising cycle too soon, in an interview to Financial Times on Wednesday. Daly refused to rule out another interest rate increase, given uncertainty about whether the central bank has done enough to push consumer price growth back down to its 2 per cent target.

Futures show more than a 68% probability that the Fed cuts its overnight lending rate by 25 basis points or more by next May, according to the CME's FedWatch tool.

U.S. retail sales fell for the first time in seven months in October, the Commerce Department's Census Bureau said, while producer prices posted the biggest decline in three-and-a-half years last month, according to the Labor Department's Bureau of Labor Statistics. More than 80% of the decline last month in the Producer Price Index for final demand goods was attributed to a 15.3% drop in gasoline prices, BLS said.

The crucial holiday shopping season kicks off with Black Friday on Nov. 24 at a time when investors are questioning whether the consumer-driven U.S. economy can remain resilient.

After all, the dollar posted its second-steepest weekly decline versus other major currencies this year on Friday. Cooler-than-expected U.S. inflation data on Tuesday and Wednesday hastened market expectations for how soon the Federal Reserve will cut rates. Such a move would weaken a major dollar support and could come as early as next year's first quarter. The yield on benchmark 10-year Treasury notes fell to a two-month low of 4.379%.

"Everything is pointing towards a fourth-quarter slowdown in the United States," said Thierry Wizman, global FX and interest rate strategist at Macquarie in New York, adding that a key signal would be companies guiding growth expectations lower. "They're not seeing the pricing power they saw in Q3 and they're not seeing the kind of enthusiasm on the part of customers that they were seeing in Q3 either," Wizman said.

Concerning ECB interest rates, the European Central Bank will hold interest rates steady well into next year, with a majority of economists polled by Reuters sticking to forecasts the first cut will have to wait until at least July despite expectations of a euro zone recession. The results are similar to a survey last month where 58% expected no cut before the July meeting.

"It seems that not much has to happen to push the eurozone into recession," wrote Peter Vanden Houte, chief euro zone economist at ING, noting that ECB has acknowledged growth has been weaker than it expected. "But that doesn't mean that the ECB is in a hurry to cut rates... We don't expect any rate cuts before the summer of 2024."

An earlier than expected rate reduction would likely require a recession deep enough to prompt easing even if inflation remains above the ECB's 2% target. Money markets now have fully priced 100 bps of rate cuts in the euro zone next year. Nonetheless, European Central Bank (ECB) policymakers Robert Holzmann and Joachim Nagel said on Friday the bloc must stand ready to raise interest rates again if necessary.

Meantime, we see that something is going on around debt market, as in the US as in EU. It seems that public opinion of "riskless" government debt is a subject to change. First is, C. Lagarde said on Thursday that "European banks may suffer significant losses if they need to sell their bond holdings to raise cash". EU banks’ holdings of fixed income securities could be marked down quite significantly, should they need to be sold," she told the annual conference of the European Systemic Risk Board, which she chairs.

Concerns over increased government bond supply and larger fiscal deficits contributed to a surge in government bond yields - which move inversely to prices - to 16-year highs this year, while pushing rating agencies Fitch and Moody's to turn negative on U.S. government creditworthiness.Rising U.S. government debt and fiscal deficits that have helped lift government bond yields this year will likely become secondary factors for investors, as their focus shifts to economic fundamentals, Citi analysts said. The fact that authorities have to respond to this is potentially how we see the lifecycle of any crisis playing out in the U.S. moving forward. There is going to be an extraction of higher yields from these investors, said Jabaz Mathai, head of G10 rates strategy at Citi.

The nonpartisan Congressional Budget Office (CBO) has estimated that cumulative budget deficits will total about $20 trillion in the coming decade. Moody's, which last week lowered its outlook on U.S. credit, expects the government to continue to run wide fiscal deficits due to increased spending and higher debt interest payments.

Meanwhile, investors have in recent months sounded alarm bells on the U.S. fiscal position. Hedge fund Bridgewater Associates' Ray Dalio expects a U.S. debt crisis. "As we look forward we have a debt problem, because you can't keep adding to debt faster than you add to income," he told CNBC on Friday.

Rating agency Fitch said on Wednesday that U.S. regional banks will face continued challenges in 2024, with those lacking scale or focused on commercial loan growth disproportionately pressured. Fitch's caution follows Moody's last week saying that the banking sector is not yet out of the woods, with re-inflation a risk if banks fail to sufficiently predict rate moves.

"Regional banks lacking in scale will be disproportionately pressured to reduce cost bases and optimize loan composition," Fitch said on Wednesday, adding this would "diminish their ratings headroom, leaving larger players relatively well-positioned to continue to gain market share. Fitch said that a delay in meaningful loosening of monetary policy would likely translate into "sustained competition for deposits" and "stubbornly weak loan growth."

Market Insider also writes - US Treasuries have long been the go-to asset when uncertainty, fear, and full-blown panic send investors looking for safety — but that reputation has take major hits lately. Financial markets have been engaged in a growing debate over the risks that lurk in Treasurys, with prominent voices raising doubts. On Friday, Moody's lowered the US credit outlook to "negative," signaling that a downgrade is possible in the future.

"You have people talking about bitcoin, about equity being the 'safe asset' because they've lost confidence in government bonds being the safe assets because of the nature of this interest-rate risk," economist Mohamed El-Erian told CNBC last month.

Meanwhile, Principal Asset's Seema Shah told CNBC in a separate interview last month that "there's so many different forces which are buffeting the bond space that it's difficult to really say with great conviction that today Treasuries are your safe haven."

In June, a Dallas Federal Reserve paper said buyers view short-duration T-bills as the true safe haven, pointing out that net inflows in long-dated Treasuries fell during the 2008 crash and COVID pandemic. "Long-term Treasury bonds may have no default risk, but they have liquidity risk and interest rate risk — when selling the bond prior to maturity, the sales price is sometimes uncertain, especially in times of financial market stress," it said.

For awhile, investors ignore all these warnings. Current market sentiment is clear. Investors expect stable rates for ~ 6 months with tendency to decrease thereafter, slowing of inflation and more or less stable, weak but positive economy performance. Still we see some flaws in this rosy scenario.

BEHIND CPI

So there are "optimistic" data on inflation in the United States, which the market, it seems, interprets incorrectly. The reaction to this data is extremely positive - the markets are in the green zone, everything is fine. The yield of 10-year treasuries has fallen below 4.5%, although quite recently it was at a level above 5%.

The market completely misunderstands the data. Falling inflation with rising unemployment and a budget deficit of 8% of GDP is not normal at all. This means that the stakes are high enough that the recession is already slowly approaching. Because such incentives are no longer enough to spur demand. One could say that output is growing and therefore the price is falling, but then why is unemployment growing, that is, how can the use of labor resources decrease with output growth?

US Continues Claims - at the top in 2 years.

Besides, output can't grow if consumption (i.e. retail sales) are decreasing as we have shown above. If take a look at the US Industrial production Index, you'll see that

industrial production declined 0.7% in October,the strongest decline since February 2021– the post-covid recovery period is over, which never turned into an expansion in production. For the past 15-16 years, the industrial sector has been at the same level – it is just 1% growth since October 2007. Impenetrable resistance level. This strongly impacts on the US political decisions, which we will discuss tomorrow, but here it is important to say that falling inflation now shows deteriorating processes and distracting of domestic production and manufacturing sector rather than some positive shifts in the US economy.

At this rate, we will come exactly where we have been going for a year and a half - to a global recession and perhaps even short-term deflation, if we overdo it. And the Fed and the government are most afraid of deflation. Even more than inflation. These are phantom pains after the Great Depression.

But this is only the half of the story. Let's take a look at wide PPI index on all commodities, that shows better picture.

Deflation at the end of October (that is, the price change for the year, from November 2022 to October 2023) was 3.6%, while the previous month it was 3.4%.

The minimum, -9.4% was in June, and then deflation began to decrease, it seemed that a little more and the situation would settle down. But instead, the decline in prices has intensified.

In fact, this is the same symptom as the reduction in the length of the working week, which we discussed in the previous review. In the US, a rather serious decline is clearly continuing, and it clearly manifests itself not even in one, but in a whole series of symptoms. And this is what we need to proceed from when assessing the economic situation, and not the optimistic desires of current politicians, who are already clearly thinking about the upcoming elections.

There is another coincidence that confuses. A week ago, banks said it was time to take long-term treasuries, because the peak rates have been reached. The market starts buying, and then Yellen comes out and says that in terms of placing treasuries for the next six months, there is an increase in long-term bonds. So, we're gradually turn to analysis of US debt/budget situation.

To keep problem easy, we have drop of tax revenues and big bulk of debt refinancing, coming in 2024. Nominal tax revenues to the US federal budget decreased by 8% compared to last year in October. This is the seventh consecutive month of decline compared to last year. Next year, the Treasury faces claims to repay as much as $8.2 trillion of US government debt (a third of the total volume of Treasury bonds still outstanding. Also, the budget deficit at such a percentage rate on the domestic debt market will require at least another $2 trillion in addition to the $8.2 trillion that needs to be reissued.

Such problems can only be solved with support from the Fed (lowering interest rates, stopping the sale of debt securities from the balance sheet) or in the event of a severe recession with the emergence of deflation. In any case, the next year will not be easy, especially in the first months.

Now the next shutdown is avoided. Problem is postponed on next year. Big fight on budget spending sequestration is still ahead It is very interesting to see what kind of compromise they will get on funding. Meantime we have temporal budget once again until the beginning of the next year. Economy stands due to cutting of "excessive" spendings in a way of Ukraine and Israel. And this brings 2 months of relief - everybody wants meet Xmas without a headache.

But if what the Republicans are talking about happens, that is, they still limit spending, then the situation will have to worsen, since the deficit will be reduced and, accordingly, demand support/demand in the economy will weaken. Thus the first quarter of 2024 for a recession and the second quarter for a financial crisis look the most likely.

Continuing the topic of ratings. Guess it once: if the rating agency war begins in earnest, what will happen to the far end of the curve? And it doesn’t matter in what papers: European, American, Chinese. Right - it hits painfully, as long-term rates will start raising fast. And China easily could become an object for attack from "independent" risk agencies, especially in the light of recent Xi-Biden meeting on APEC summit. China tries to boost economy with huge inflows from PBOC to stimulate domestic consumption, holding rates low, to support economy growth. In fact, it goes by the steps of the US, which seems a dead way in long-term perspective.

The Central Bank of China poured 600 billion into the banking system. RMB through medium-term loans and almost 500 billion yuan in loans. through weekly reverse repos. On charts below we see acceleration of retail sales for 7.6% - 5 months peak, but no changes in consumer loans, which means that PBOC efforts are not successful by far. Unemployment remains stable, as well as Industrial production.

At the same time, China is loosing foreign investing, showing contraction of nominal GDP which makes investors to b worry. Cumulative cross border capital flows are decreasing:

So, China easily could become the first victim of attack by rating agencies, confirming and accelerating the trend of capital outflows that already is started.

Conclusion:

Guys, I do not want to overload report, so it becomes annoying to read it and postpone a 2nd part of US debt analysis on tomorrow with Gold report. We will speak on real cashflows and what time limit the US has until difficulties come. It more relates to long-term analysis and gold market rather than to FX and EUR. Things that we already said above is enough to make some conclusions. First is, the US has no growth and no improvement in economy, despite what officials tell. It means that soft landing has very phantom chances to happen. At the same time, situation in EU stands the same and hardly looks better.

As we will show tomorrow, situation with the US budget and deficit is not critical yet and could last recently painless until the Spring-Summer of 2024. Which means that straightforward dollar weakness now is overestimated. We get wide wobbling action with periods of strength and weakness in the US Dollar, but without strong direct tendency in any direction. We suggest that Morgan Stanley is close to our view in their analysis. Closer to the summer situation could start spinning up.

This is central scenario if other things as political as economical will remain equal. But if we get some force-major twists, such as escalation of US-China confrontation, Ukraine's defeat (coupe, capitulation etc), Iran involving in the M. East confrontation or some others, the shape of the market could change drastically.

Technically, we do not see signs yet that cancel our long-term 0.9 target on EUR/USD. Definitely at some circumstances it might be reached. But also we have to be prepared to flatter and more wobbling price behavior.