Sive Morten

Special Consultant to the FPA

- Messages

- 18,659

Fundamentals

This week all eyes were on rumors and news from Great Britain. Investors were trying to not miss any word to understand what is going on and where situation is going to. These processes have made impact on all markets in general and our major currencies EUR and GBP have shown similar reaction. Technical tools were not very helpful and taken backseat when external political driving factors rule the situation. So, let's take a look what has happened and what most important events yet to come in nearest future, that we have to be careful to.

If you remember last week, US/China negotiation progress was among major driving factors. Despite positive relations we warned that this is subject to change as we saw it too often in recent time. And this has happened again.

The U.S. dollar rose on Monday, after two days of losses, attracting safe-haven bids, as optimism waned about a trade deal between the United States and China.

The safe havens gained on Monday after Bloomberg News reported China wants more talks as soon as the end of October to hammer out the details of the “phase one” deal.

U.S. Treasury Secretary Steven Mnuchin also said on Monday an additional round of tariffs on Chinese imports will likely be imposed if a trade deal with China has not been reached by the time they are set to start, but added that he expected the agreement to go through.

“Caution returned to markets as players realized that nothing has significantly changed with respect to the U.S.-China trade war and Brexit,” said Joe Manimbo, senior market analyst, at Western Union Business Solutions.

“The fact that nothing materially has changed and that uncertainty remains elevated served as a reality check and excuse for investors to play it safe,” he added.

Analysts said the partial trade deal between the world’s two largest economies appeared to lack substance with limited progress on structural issues such as technology transfers.

On Tuesday there were more noise on Brexit positive solution. The European Union’s chief Brexit negotiator, Michel Barnier, said a deal with Britain to cover its departure from the EU was still possible this week. Both the pound and the euro rose in response. A no-deal Brexit would damage the euro zone as well as Britain, most economists say.

Wednesday was relatively quiet session and markets were under impact of old driving factors and US/China in particular.

“The retreat in USD/JPY is obviously a function of the markets being a little nervous vis-à-vis any Chinese retaliation to the measures passed (in the U.S.),” said Jeremy Stretch, head of G10 foreign exchange strategy at CIBC Capital Markets.

On Tuesday, the International Monetary Fund said it expected the global economy to grow 3.0% in 2019, its slowest pace since the 2008-09 financial crisis.

“The cost of taking this dispute to its next stage of escalation has exponentially increased,” Morgan Stanley strategists said in a daily note, although they added the United States and China might adopt a more nuanced approach to the trade dispute in the coming days.

Later on Wednesday, U.S. dollar fell across the board as dismal U.S. retail sales data painted a gloomy picture of the economy and supported the case for further interest rate cuts by the Federal Reserve.

U.S. retail sales fell for the first time in seven months in September, suggesting that manufacturing-led weakness could be spreading to the broader economy.

“The U.S. economy is indeed revealing further weaknesses, justifying another rate cut by the Fed,” said Marc-André Fongern, a strategist at MAF Global Forex in Frankfurt.

With two weeks to go until their next policy meeting, U.S. central bankers remain divided about the need to cut borrowing costs for a third time this year.

“Overall, the retail sales figures support our view that economic growth is slowing,” Michael Pearce, senior U.S. economist at Capital Economics, said in a note.

“This is a report which gives reasons to worry about the U.S. outlook, but does not give a reason to panic,” said Paul Donovan, chief economist at UBS Global Wealth Management.

On Thursday new block of news on Brexit progress has appeared. The euro rallied to its highest levels in nearly two months against the dollar on Thursday after the European Union and Britain struck a Brexit deal.

Though the deal remains to be ratified by British lawmakers, traders briefly sent the British pound and the euro up by more than one percent and 0.5 percent respectively.

Britain clinched a Brexit deal with the European Union on Thursday, European Commission President Jean-Claude Juncker said, just a few hours before the start of a summit of the bloc’s leaders in Brussels.

“A move above $1.1210.. and the 200-day moving average is needed to boost confidence that a low is in place,” said Marc Chandler, chief market strategist at Bannockburn Global Forex.

Still, after initial euphoria, the rally fizzled a bit, as investors are concerned on results of voting in Parliament on Brexit agreement. Both sides had found a “legally operative solution” to avoid a hard border in Ireland - a key sticking point, EU chief negotiator Michel Barnier told reporters.

But the gains were temporary as the Northern Irish Democratic Unionist Party (DUP), which has a deal to support British Prime Minister Boris Johnson in parliament, said it would vote against the accord at an extraordinary session on Saturday.

That revived fears that Johnson will suffer the same fate as his predecessor: a failure to get British lawmakers to support the plan for the departure, plunging the country into another round of uncertainty.

“The question now is if the UK parliament will approve the deal or not,” said Athanasios Vamvakidis, global head of G10 forex strategy at BAML. Nonetheless, “in the scenario if the parliament doesn’t approve the deal, still having a deal is a good thing”, he said.

Therefore, now “the risk of a no-deal Brexit is very small”.

In an extraordinary Saturday sitting, the first since 1982, parliament will vote on approving British Prime Minister Boris Johnson’s deal. Britain is due to leave the EU on Oct. 31.

But Johnson, whose Conservatives have no majority in the 650-seat House of Commons, will face a deeply divided parliament where his opponents are trying to force both a delay to Brexit and another referendum.

“Amid the optimism ... as things stand, parliamentary ratification is far from certain,” Dean Turner, an economist at UBS, said.

Optimism that a Brexit deal would be finalised saw money markets reduce expectations of rate cuts from the Bank of England. They now see a 60% chance of a quarter point cut next December versus 76% on Tuesday and 90% last week.

Euro zone money markets too priced out chances of a year-end rate cut.

The euro was hovering on Friday around the seven-week high it reached against the U.S. dollar on Thursday as hopes that a Brexit deal between Britain and the European Union could prevent an economic recession in the euro zone.

The common currency has been rattled this year by dismal manufacturing data, as well as by worries that deepening economic tensions between the United States and China could make euro zone economies grow even slower.

But with Britain’s prime minister Boris Johnson and EU leaders agreeing a new deal for Britain to exit the bloc, and with U.S.-China tensions easing, the euro was enjoying a sigh of relief.

“Without Brexit, the euro might be now liberated from this burden,” said Antje Praefcke, a forex analyst at Commerzbank.

Moreover, expectations that the Federal Reserve may cut interest rates at the Oct. 30 meeting added further optimism, given that this would shrink yield differentials between the United States and euro area.

“The fed looks more willing to cut” in the immediate term, said Praefcke.

Traders worry that an initial relief at securing the long-awaited Brexit deal could be brief, however, because the prime minister still needs to sell the agreement to sceptical lawmakers when parliament sits on Saturday.

While the results of tomorrow’s vote is far from certain, we see the progress made over the past week as diminishing the chances of a no-deal Brexit,” said John Doyle, vice president for dealing and trading at Tempus Inc in Washington.

“A no-deal Brexit would be devastating for the U.K. economy, but the ripple effects into the mainland would be substantial,” Doyle said. “That has helped lift equity markets, regional currencies and put downward pressure on the greenback.”

The respite for the euro comes as U.S. economic data have grown increasingly gloomy, a development that could see the U.S. Federal Reserve cut interest rates later this month, its third rate cut this year.

Poor domestic data makes deeper cuts in U.S. interest rates a touch more likely, Tempus’ Doyle said.

Money markets are pricing in an 82% chance of a rate cut at the Oct. 30 meeting, Refinitiv data show.

That's being said our primary focus stands on today's voting in Parliament. I do not want to re-print few interesting articles here. So, if somebody wants to dig it deeper here is cool stuff to read:

Brexit day of reckoning: Johnson's deal faces wrecking amendment

British lawmakers switching sides

Brexit’s ‘Super Saturday’

These articles explain possible pitfalls and tricky moments in today's voting, but we have to understand simple thing - results of voting, this is the only thing that is important right now.

The Bottom line to Brexit soap opera well-said in Reuters article. Britain may be about to draw a line under almost 3-1/2 years of political chaos, economic uncertainty and tortuous discussions with the European Union over the terms of its exit from the bloc. If the UK parliament gives its nod to the divorce deal Prime Minister Johnson has secured — unlikely but possible — we might well see sterling rally more than 5%; shares in domestic-focused British companies might rocket to record highs.

Markets will be less euphoric if Johnson has to request an extension to the Oct. 31 Brexit deadline; it means three more months of Brexit noise, with a bitterly fought election likely thrown in. But with no-deal Brexit risks fading, the pullback may not be too drastic. Depending on the election outcome, Britain will either leave with Johnson’s deal or hold a second referendum that may cancel Brexit altogether.

But if the Brexit battle does end, another one may commence — the race to negotiate long-term trade deals with the rest of the world. Johnson or his successor may find that even more tough going.

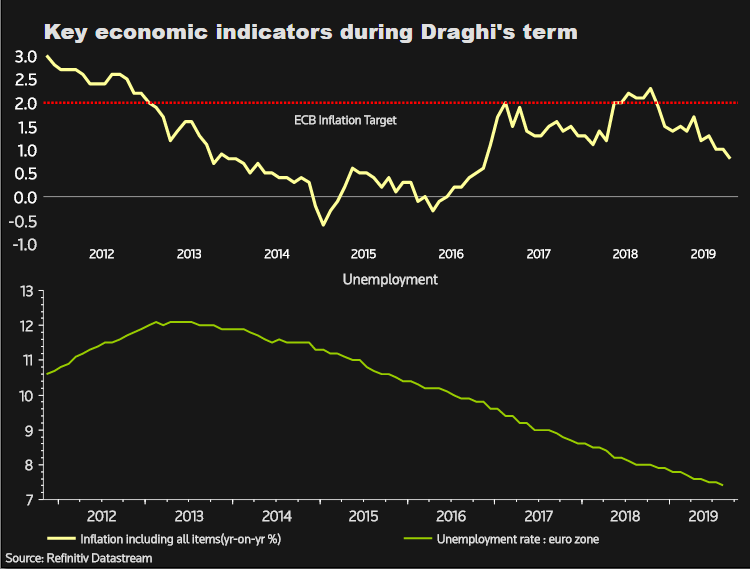

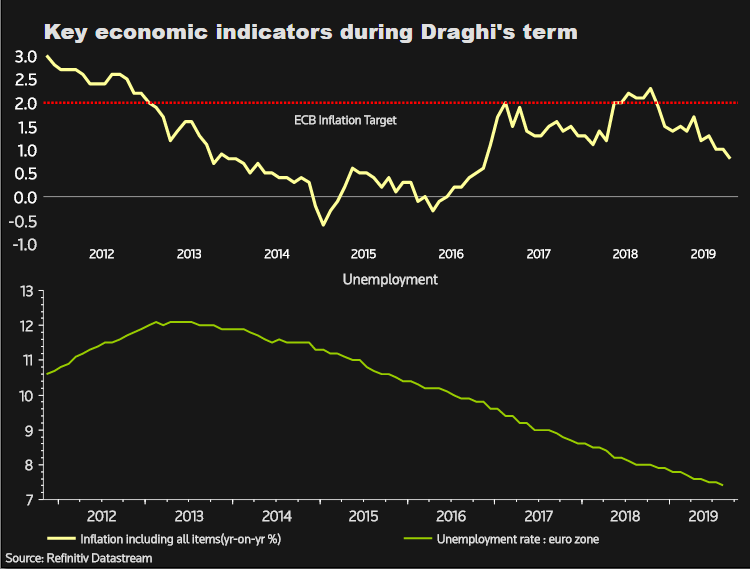

Next week we have another important event - ECB meeting. Thursday could be an emotional day for Mario Draghi, the ECB chief credited with saving the euro and euro zone with his pledge in 2012 to do “whatever it takes”.

Big policy decisions are not anticipated at the European Central Bank’s meeting given the sweeping easing steps unveiled in September. Instead it will largely be a goodbye to Draghi — whose eight-year term as president ends on Oct. 31.

Dubbed ‘Super Mario’, Draghi has restored confidence in the ECB’s crisis-fighting ability and navigated the uncharted waters of quantitative easing (QE) — all in the face of fierce opposition from Germany and other conservative euro zone states.

Draghi might feel a slight sense of disappointment though: Inflation remains well below the ECB’s target of below but close to 2%, meaning he leaves office as the first ECB president to never raise interest rates. And the unprecedented stimulus implemented under his regime leaves his successor with little ammunition to combat another crisis.

Draghi may use his last meeting to urge governments to use fiscal policy more effectively to boost growth and inflation. He’s also likely to be pressed on the divisions within the ECB over restarting QE — but clearly healing that rift will be down to his successor, Christine Lagarde.

Here is EU performance of a Draghi era:

What is really interesting, guys, is that we do not see any positive shift in EUR and GBP speculative positions. They still stand at the same net bearish levels:

This is GBP:

And here is EUR:

Source: cftc.gov

Charting by Investing.com

So, what information we have in the beginning of next week - weaker US statistics and growing chances on more rate cut from the Fed, stable bearish speculative position as on EUR as on GBP, strong rally on both markets as well and we also will get Parliament voting results.

From the fundamental point of view, the major question is how long this rally will last. Now we see what is called "buy on rumors" stage and it is a question when "sell on facts" will come. In general, this rally hardly will last too long as fundamentally EU/UK divorce sooner or later but impact their economies. The break of a whole economy space in two parts hardly could pass easily. Besides I'm worry a bit on CFTC positions - they stand too quiet in negative territory, which means that investors do not change their view by far.

At the same time, technical analysis has limited applicability as price is distorted by lasting effect of fundamental driving factors. In such circumstance it is very difficult to make trades and not to fall into process of "falling knife" catching. Trying to predict reversal could become very costly affair. Thus, although we've said, that technical picture suggests retracement - we can't take any positions yet.

Finally, we probably should ignore for awhile US/China factor until we get more clarity on the subject. At the same time, as US economy is loosing pace - it provides more support to EUR/USD as EUR is "critical but stable" condition.

Technicals

Monthly

We have good performance on EUR but it is too small still for monthly / weekly time frames. So we do not have any additional information yet.

Technically it could be treated as continuing reaction on Yearly Pivot Support 1. As we've mentioned earlier - market right now stands at crucial area from technical point of view. This is the middle of the range and YPS1. Once EUR will break it - road to the bottom of the range around 1.03 area will be opened. Conversely, if EUR, by the end of the year will be able to hold above YPS1 - 2019 action could be treated as retracement of 2016 - 2017 rally. And EUR will keep chances on extension in 2020.

Overall 2017- 2019 tendency still stands moderately bearish, as by price action as by MACD trend. In September EUR forms new low, keeping "lower top - lower bottom" sequence.

As we've said earlier, here we could recognize downside narrow channel and market stands accurately inside of it.

Neither big support nor oversold levels stand around and it is free space till 1.03 lows. The only support is YPS1 and middle of the range. That's major technical support here.

Now the major intrigue stands around fundamental background - it is changing. It is interesting whether its change will be strong enough to make impact on monthly chart and long lasting tendency here. As economy in EU hardly will improve soon - the major driving factor depends on US - how better/worse situation will be there.

Weekly

This week trend has turned bullish here. And price action itself stands different compares to previous upside reversals inside the channel. They were slower and calm while this one is faster and more straightforward.

Technically, the nearest barrier here is 1.12-1.1235 area. It includes Fib level ( actually this is daily K-resistance), and upper border of the channel. Market is not overbought here. Next level is stronger and it stands at K-resistance of 1.1450-1.1520 area, and accompanied by OB level.

Daily

Here, on daily time frame we have to increase the scale of our targets as EUR ignores technical barriers, driven by fundamental factors. As market has exceeded our XOP target, we take another AB-CD pattern. Now price stands at OP and is coming to daily/Weekly K-resistance area. On weekly chart this is 3/8 1.1235 level, here, on daily we have 5/8 1.1208.

Unfortunately again we can't please daily traders. Despite context strong bullish as on daily as on weekly chart but EUR is too overextended up and technical picture forces us to sit on the hands and wait a retracement for position taking. Maybe it will start from strong weekly level as fundamental questions also should be resolved by coming UK voting today.

Intraday

Here we do not have any hints on possible reversal, no patterns are forming as well. There are just two things that we could point here. First is support levels, which are accompanied by Pivots. Second - scalp traders could also watch for DiNapoli patterns, such as B&B or DRPO as final part of rally shows a good thrust.

Conclusion:

EUR now is totally controlled by political factors which give limited room for application of technical tools. Market is strong but it gives no chances yet to take a position. Some relief probably will come once we will get first facts on EU/UK agreement and voting results in UK Parliament.

This week all eyes were on rumors and news from Great Britain. Investors were trying to not miss any word to understand what is going on and where situation is going to. These processes have made impact on all markets in general and our major currencies EUR and GBP have shown similar reaction. Technical tools were not very helpful and taken backseat when external political driving factors rule the situation. So, let's take a look what has happened and what most important events yet to come in nearest future, that we have to be careful to.

If you remember last week, US/China negotiation progress was among major driving factors. Despite positive relations we warned that this is subject to change as we saw it too often in recent time. And this has happened again.

The U.S. dollar rose on Monday, after two days of losses, attracting safe-haven bids, as optimism waned about a trade deal between the United States and China.

The safe havens gained on Monday after Bloomberg News reported China wants more talks as soon as the end of October to hammer out the details of the “phase one” deal.

U.S. Treasury Secretary Steven Mnuchin also said on Monday an additional round of tariffs on Chinese imports will likely be imposed if a trade deal with China has not been reached by the time they are set to start, but added that he expected the agreement to go through.

“Caution returned to markets as players realized that nothing has significantly changed with respect to the U.S.-China trade war and Brexit,” said Joe Manimbo, senior market analyst, at Western Union Business Solutions.

“The fact that nothing materially has changed and that uncertainty remains elevated served as a reality check and excuse for investors to play it safe,” he added.

Analysts said the partial trade deal between the world’s two largest economies appeared to lack substance with limited progress on structural issues such as technology transfers.

On Tuesday there were more noise on Brexit positive solution. The European Union’s chief Brexit negotiator, Michel Barnier, said a deal with Britain to cover its departure from the EU was still possible this week. Both the pound and the euro rose in response. A no-deal Brexit would damage the euro zone as well as Britain, most economists say.

Wednesday was relatively quiet session and markets were under impact of old driving factors and US/China in particular.

“The retreat in USD/JPY is obviously a function of the markets being a little nervous vis-à-vis any Chinese retaliation to the measures passed (in the U.S.),” said Jeremy Stretch, head of G10 foreign exchange strategy at CIBC Capital Markets.

On Tuesday, the International Monetary Fund said it expected the global economy to grow 3.0% in 2019, its slowest pace since the 2008-09 financial crisis.

“The cost of taking this dispute to its next stage of escalation has exponentially increased,” Morgan Stanley strategists said in a daily note, although they added the United States and China might adopt a more nuanced approach to the trade dispute in the coming days.

Later on Wednesday, U.S. dollar fell across the board as dismal U.S. retail sales data painted a gloomy picture of the economy and supported the case for further interest rate cuts by the Federal Reserve.

U.S. retail sales fell for the first time in seven months in September, suggesting that manufacturing-led weakness could be spreading to the broader economy.

“The U.S. economy is indeed revealing further weaknesses, justifying another rate cut by the Fed,” said Marc-André Fongern, a strategist at MAF Global Forex in Frankfurt.

With two weeks to go until their next policy meeting, U.S. central bankers remain divided about the need to cut borrowing costs for a third time this year.

“Overall, the retail sales figures support our view that economic growth is slowing,” Michael Pearce, senior U.S. economist at Capital Economics, said in a note.

“This is a report which gives reasons to worry about the U.S. outlook, but does not give a reason to panic,” said Paul Donovan, chief economist at UBS Global Wealth Management.

On Thursday new block of news on Brexit progress has appeared. The euro rallied to its highest levels in nearly two months against the dollar on Thursday after the European Union and Britain struck a Brexit deal.

Though the deal remains to be ratified by British lawmakers, traders briefly sent the British pound and the euro up by more than one percent and 0.5 percent respectively.

Britain clinched a Brexit deal with the European Union on Thursday, European Commission President Jean-Claude Juncker said, just a few hours before the start of a summit of the bloc’s leaders in Brussels.

“A move above $1.1210.. and the 200-day moving average is needed to boost confidence that a low is in place,” said Marc Chandler, chief market strategist at Bannockburn Global Forex.

Still, after initial euphoria, the rally fizzled a bit, as investors are concerned on results of voting in Parliament on Brexit agreement. Both sides had found a “legally operative solution” to avoid a hard border in Ireland - a key sticking point, EU chief negotiator Michel Barnier told reporters.

But the gains were temporary as the Northern Irish Democratic Unionist Party (DUP), which has a deal to support British Prime Minister Boris Johnson in parliament, said it would vote against the accord at an extraordinary session on Saturday.

That revived fears that Johnson will suffer the same fate as his predecessor: a failure to get British lawmakers to support the plan for the departure, plunging the country into another round of uncertainty.

“The question now is if the UK parliament will approve the deal or not,” said Athanasios Vamvakidis, global head of G10 forex strategy at BAML. Nonetheless, “in the scenario if the parliament doesn’t approve the deal, still having a deal is a good thing”, he said.

Therefore, now “the risk of a no-deal Brexit is very small”.

In an extraordinary Saturday sitting, the first since 1982, parliament will vote on approving British Prime Minister Boris Johnson’s deal. Britain is due to leave the EU on Oct. 31.

But Johnson, whose Conservatives have no majority in the 650-seat House of Commons, will face a deeply divided parliament where his opponents are trying to force both a delay to Brexit and another referendum.

“Amid the optimism ... as things stand, parliamentary ratification is far from certain,” Dean Turner, an economist at UBS, said.

Optimism that a Brexit deal would be finalised saw money markets reduce expectations of rate cuts from the Bank of England. They now see a 60% chance of a quarter point cut next December versus 76% on Tuesday and 90% last week.

Euro zone money markets too priced out chances of a year-end rate cut.

The euro was hovering on Friday around the seven-week high it reached against the U.S. dollar on Thursday as hopes that a Brexit deal between Britain and the European Union could prevent an economic recession in the euro zone.

The common currency has been rattled this year by dismal manufacturing data, as well as by worries that deepening economic tensions between the United States and China could make euro zone economies grow even slower.

But with Britain’s prime minister Boris Johnson and EU leaders agreeing a new deal for Britain to exit the bloc, and with U.S.-China tensions easing, the euro was enjoying a sigh of relief.

“Without Brexit, the euro might be now liberated from this burden,” said Antje Praefcke, a forex analyst at Commerzbank.

Moreover, expectations that the Federal Reserve may cut interest rates at the Oct. 30 meeting added further optimism, given that this would shrink yield differentials between the United States and euro area.

“The fed looks more willing to cut” in the immediate term, said Praefcke.

Traders worry that an initial relief at securing the long-awaited Brexit deal could be brief, however, because the prime minister still needs to sell the agreement to sceptical lawmakers when parliament sits on Saturday.

While the results of tomorrow’s vote is far from certain, we see the progress made over the past week as diminishing the chances of a no-deal Brexit,” said John Doyle, vice president for dealing and trading at Tempus Inc in Washington.

“A no-deal Brexit would be devastating for the U.K. economy, but the ripple effects into the mainland would be substantial,” Doyle said. “That has helped lift equity markets, regional currencies and put downward pressure on the greenback.”

The respite for the euro comes as U.S. economic data have grown increasingly gloomy, a development that could see the U.S. Federal Reserve cut interest rates later this month, its third rate cut this year.

Poor domestic data makes deeper cuts in U.S. interest rates a touch more likely, Tempus’ Doyle said.

Money markets are pricing in an 82% chance of a rate cut at the Oct. 30 meeting, Refinitiv data show.

That's being said our primary focus stands on today's voting in Parliament. I do not want to re-print few interesting articles here. So, if somebody wants to dig it deeper here is cool stuff to read:

Brexit day of reckoning: Johnson's deal faces wrecking amendment

British lawmakers switching sides

Brexit’s ‘Super Saturday’

These articles explain possible pitfalls and tricky moments in today's voting, but we have to understand simple thing - results of voting, this is the only thing that is important right now.

The Bottom line to Brexit soap opera well-said in Reuters article. Britain may be about to draw a line under almost 3-1/2 years of political chaos, economic uncertainty and tortuous discussions with the European Union over the terms of its exit from the bloc. If the UK parliament gives its nod to the divorce deal Prime Minister Johnson has secured — unlikely but possible — we might well see sterling rally more than 5%; shares in domestic-focused British companies might rocket to record highs.

Markets will be less euphoric if Johnson has to request an extension to the Oct. 31 Brexit deadline; it means three more months of Brexit noise, with a bitterly fought election likely thrown in. But with no-deal Brexit risks fading, the pullback may not be too drastic. Depending on the election outcome, Britain will either leave with Johnson’s deal or hold a second referendum that may cancel Brexit altogether.

But if the Brexit battle does end, another one may commence — the race to negotiate long-term trade deals with the rest of the world. Johnson or his successor may find that even more tough going.

Next week we have another important event - ECB meeting. Thursday could be an emotional day for Mario Draghi, the ECB chief credited with saving the euro and euro zone with his pledge in 2012 to do “whatever it takes”.

Big policy decisions are not anticipated at the European Central Bank’s meeting given the sweeping easing steps unveiled in September. Instead it will largely be a goodbye to Draghi — whose eight-year term as president ends on Oct. 31.

Dubbed ‘Super Mario’, Draghi has restored confidence in the ECB’s crisis-fighting ability and navigated the uncharted waters of quantitative easing (QE) — all in the face of fierce opposition from Germany and other conservative euro zone states.

Draghi might feel a slight sense of disappointment though: Inflation remains well below the ECB’s target of below but close to 2%, meaning he leaves office as the first ECB president to never raise interest rates. And the unprecedented stimulus implemented under his regime leaves his successor with little ammunition to combat another crisis.

Draghi may use his last meeting to urge governments to use fiscal policy more effectively to boost growth and inflation. He’s also likely to be pressed on the divisions within the ECB over restarting QE — but clearly healing that rift will be down to his successor, Christine Lagarde.

Here is EU performance of a Draghi era:

What is really interesting, guys, is that we do not see any positive shift in EUR and GBP speculative positions. They still stand at the same net bearish levels:

This is GBP:

And here is EUR:

Source: cftc.gov

Charting by Investing.com

So, what information we have in the beginning of next week - weaker US statistics and growing chances on more rate cut from the Fed, stable bearish speculative position as on EUR as on GBP, strong rally on both markets as well and we also will get Parliament voting results.

From the fundamental point of view, the major question is how long this rally will last. Now we see what is called "buy on rumors" stage and it is a question when "sell on facts" will come. In general, this rally hardly will last too long as fundamentally EU/UK divorce sooner or later but impact their economies. The break of a whole economy space in two parts hardly could pass easily. Besides I'm worry a bit on CFTC positions - they stand too quiet in negative territory, which means that investors do not change their view by far.

At the same time, technical analysis has limited applicability as price is distorted by lasting effect of fundamental driving factors. In such circumstance it is very difficult to make trades and not to fall into process of "falling knife" catching. Trying to predict reversal could become very costly affair. Thus, although we've said, that technical picture suggests retracement - we can't take any positions yet.

Finally, we probably should ignore for awhile US/China factor until we get more clarity on the subject. At the same time, as US economy is loosing pace - it provides more support to EUR/USD as EUR is "critical but stable" condition.

Technicals

Monthly

We have good performance on EUR but it is too small still for monthly / weekly time frames. So we do not have any additional information yet.

Technically it could be treated as continuing reaction on Yearly Pivot Support 1. As we've mentioned earlier - market right now stands at crucial area from technical point of view. This is the middle of the range and YPS1. Once EUR will break it - road to the bottom of the range around 1.03 area will be opened. Conversely, if EUR, by the end of the year will be able to hold above YPS1 - 2019 action could be treated as retracement of 2016 - 2017 rally. And EUR will keep chances on extension in 2020.

Overall 2017- 2019 tendency still stands moderately bearish, as by price action as by MACD trend. In September EUR forms new low, keeping "lower top - lower bottom" sequence.

As we've said earlier, here we could recognize downside narrow channel and market stands accurately inside of it.

Neither big support nor oversold levels stand around and it is free space till 1.03 lows. The only support is YPS1 and middle of the range. That's major technical support here.

Now the major intrigue stands around fundamental background - it is changing. It is interesting whether its change will be strong enough to make impact on monthly chart and long lasting tendency here. As economy in EU hardly will improve soon - the major driving factor depends on US - how better/worse situation will be there.

Weekly

This week trend has turned bullish here. And price action itself stands different compares to previous upside reversals inside the channel. They were slower and calm while this one is faster and more straightforward.

Technically, the nearest barrier here is 1.12-1.1235 area. It includes Fib level ( actually this is daily K-resistance), and upper border of the channel. Market is not overbought here. Next level is stronger and it stands at K-resistance of 1.1450-1.1520 area, and accompanied by OB level.

Daily

Here, on daily time frame we have to increase the scale of our targets as EUR ignores technical barriers, driven by fundamental factors. As market has exceeded our XOP target, we take another AB-CD pattern. Now price stands at OP and is coming to daily/Weekly K-resistance area. On weekly chart this is 3/8 1.1235 level, here, on daily we have 5/8 1.1208.

Unfortunately again we can't please daily traders. Despite context strong bullish as on daily as on weekly chart but EUR is too overextended up and technical picture forces us to sit on the hands and wait a retracement for position taking. Maybe it will start from strong weekly level as fundamental questions also should be resolved by coming UK voting today.

Intraday

Here we do not have any hints on possible reversal, no patterns are forming as well. There are just two things that we could point here. First is support levels, which are accompanied by Pivots. Second - scalp traders could also watch for DiNapoli patterns, such as B&B or DRPO as final part of rally shows a good thrust.

Conclusion:

EUR now is totally controlled by political factors which give limited room for application of technical tools. Market is strong but it gives no chances yet to take a position. Some relief probably will come once we will get first facts on EU/UK agreement and voting results in UK Parliament.