Sive Morten

Special Consultant to the FPA

- Messages

- 18,699

Monthly

Weekly FX Tading Report prepared by Sive Morten exclusively for ForexPeaceArmy.com

According to Reuters news The euro rose on Friday ahead of an official report on the health of the euro zone's main banks as investors continued a trend of covering their short-positions leading to buying of the currency against the U.S. dollar.

Despite Friday's weakness, the dollar is on track to close the week with a gain. Concerns about the first diagnosed case of Ebola in New York City, which stifled the dollar's rally late Thursday, have waned, strategists said.

The U.S. Federal Reserve will meet next Tuesday and Wednesday, and the consensus view is that it will wrap up asset purchases under its third round of quantitative easing.

A group of 25 banks have failed European stress tests, while up to 10 of those continue to have a capital shortfall, sources familiar with the matter told Reuters on Friday.

Bloomberg News first reported the results of the tests, which are due on Sunday. Currency strategists said this just added more fuel to the short-covering that has supported the euro's position.

"It is all speculation at this point and the ECB tried to remind us of that. It just highlights that this is a risk that is not as negative perhaps as was priced in," said Camilla Sutton, chief currency strategist at Scotiabank in Toronto.

The euro zone's 130 biggest banks received the European Central Bank's final verdict on their finances on Thursday after a review aimed at drawing a line under persistent doubts about the health of the region's banking sector. They will not be made public until 1100 GMT on Sunday.

"The dollar rally has paused a bit here and I think one of the core reasons is a bit of added uncertainty as to how the Fed will react to the stronger dollar, and to the renewed worries about global growth concerns," said Brian Daingerfield, currency strategist at the Royal Bank of Scotland in Stamford, Connecticut.

The Fed's statement will be parsed for clues on how quickly the central bank might start raising interest rates, now not expected until late 2015.

"For the dollar to appreciate, you need the stock market to hold up in the face of a clean exit from QE3 by the Fed," said David Woo, head of global rates and currency research at Bank of America Merrill Lynch in New York.

Elsewhere, sterling rose to $1.6087 , up 0.37 percent. Third quarter gross domestic product data showed Britain's economy grew by 0.7 percent, down from 0.9 percent the quarter before, but in line with economists' expectations.

Investors’ interest still stands depressed on GBP, as trading volume of futures and options on CME as well as size of open interest still can’t restore previous levels. As investors participation on this part of FX futures market has dropped significantly, whether this information really shows clear picture? Anyway on recent CFTC reports most important is drop of short positions of speculators. Long positions also have decreased and all these contraction has led to drop in open interest. At the same time closing of shorts seems was more significant. We hope that this is a good sign for our monthly upside trade.

Non-Commercial Longs:

Open Interest:

Technical

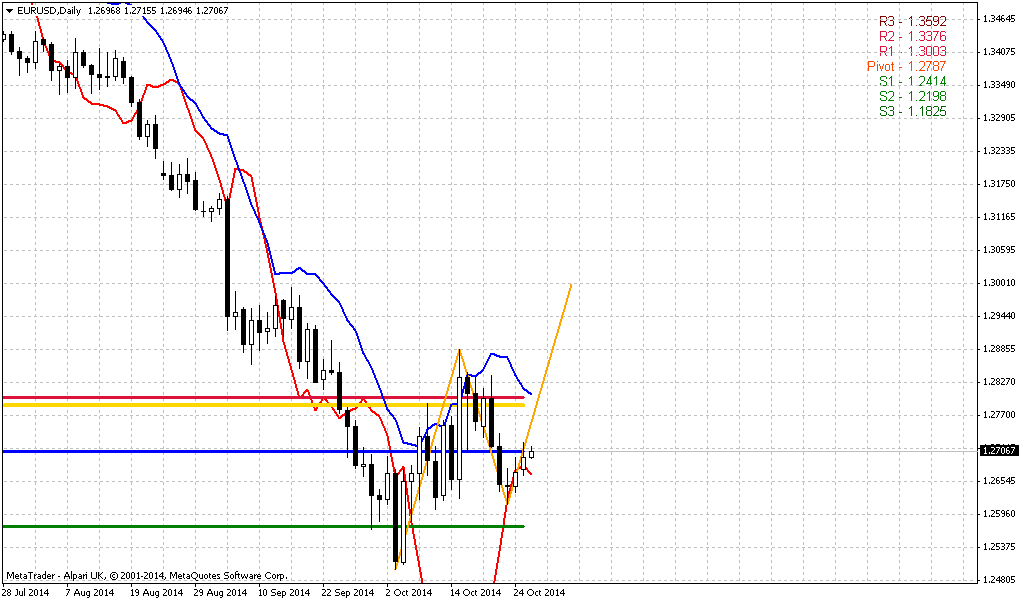

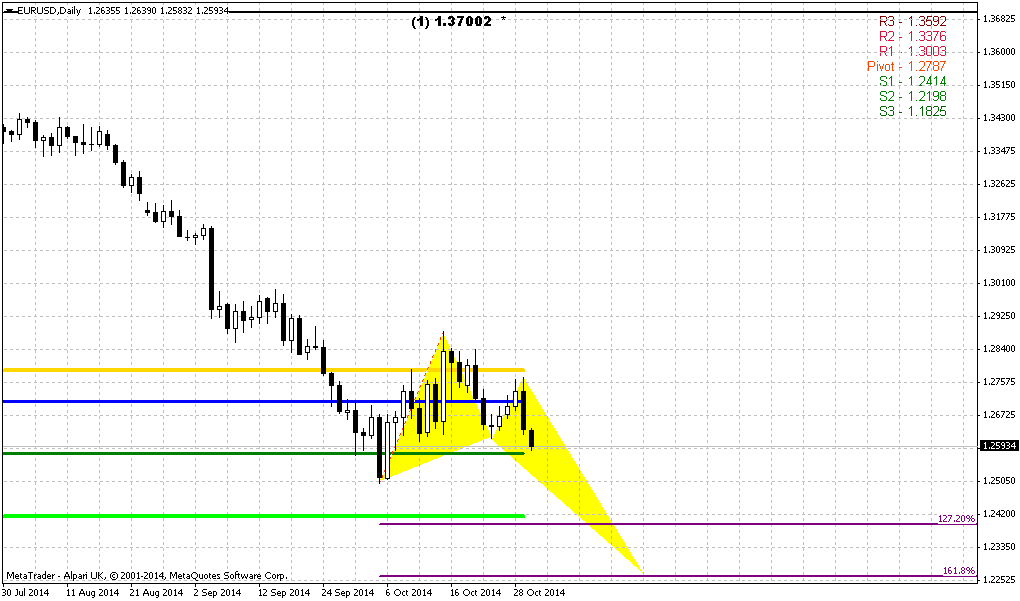

Before we will continue discussion of cable – couple of words on EUR. We’ve checked it and currently do not see anything special. One thing that is worthy of our attention on coming week are stop grabbers on daily chart, that potentially could lead to appearing of upside AB=CD. That’s all. On monthly chart we do not see neccesity for comments – our target still stands ~ 1.21 Beside, EUR right now stands in the center of turmoil and is hit from all sides – inner domestic problems, geopolicy, etc. In fact EUR discussion demands separate research, but it will have shy relation to trading directly and will stand on long perspective. That’s why we probably will finish our B&B on GBP despite how it will end, and then turn to something else. Because here we’re mostly for trading but not for dry economical and political discussions, right?

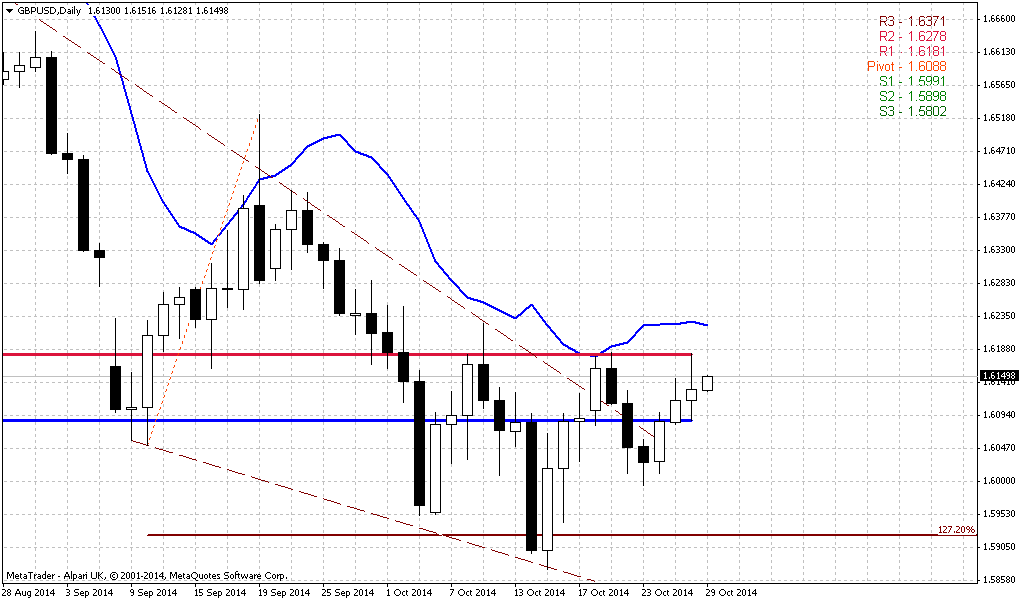

In general, situation on monthly chart has not changed. Pound has closed just few pips lower compares to previous week. Our recent comments are still valid.

As we’ve said, Scotland referendum has made an impact and adjusted normal market’s behavior. Right now USD growth also presses on market. As political turmoil has gone to history market will try to correct the skew that was made by political impact. This in turn, could give us promising setups on different time scales. At the same time we agree that setups that we will discuss today mostly tactical, although they could last for considerable period of time.

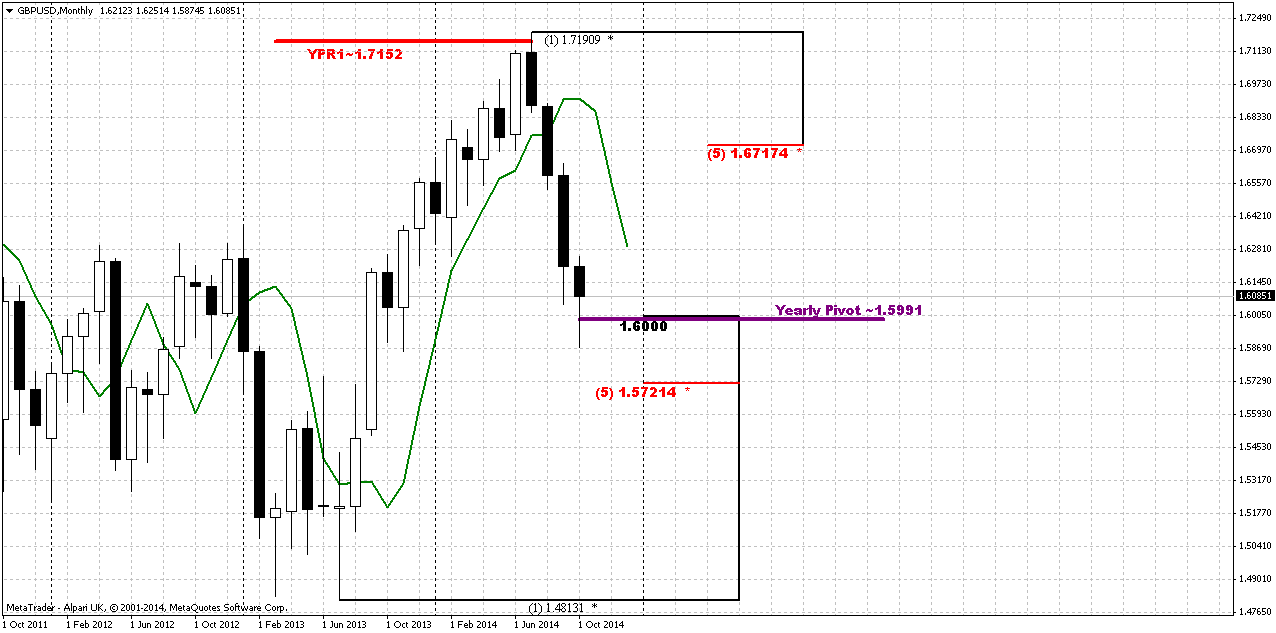

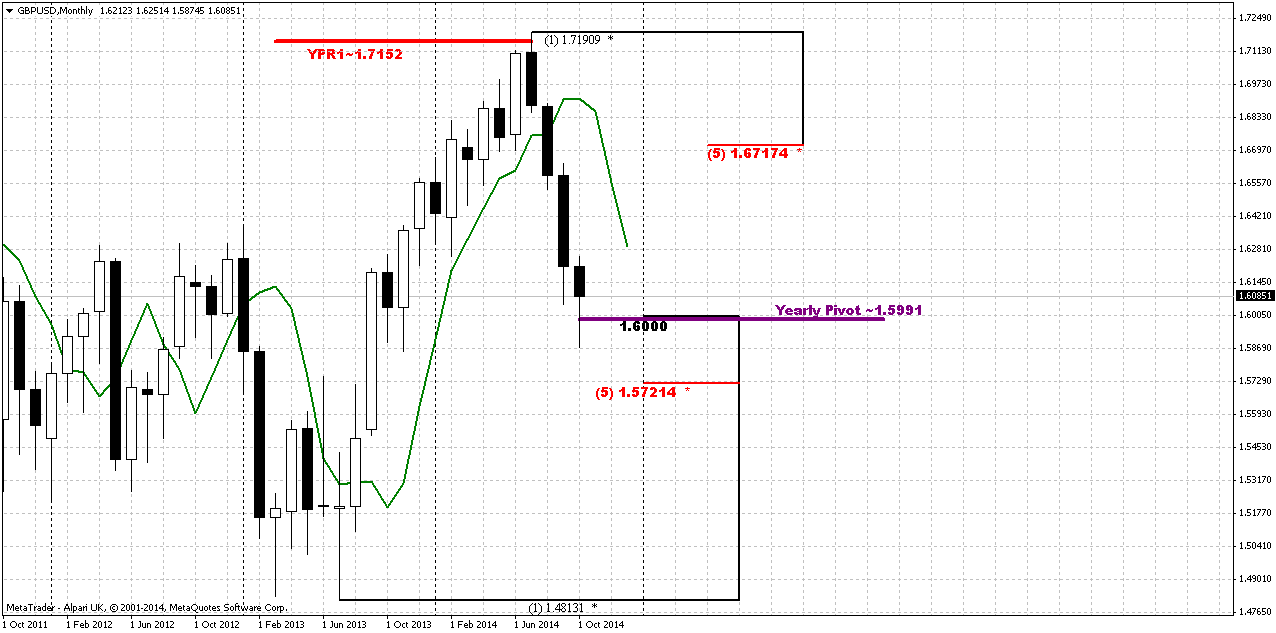

As political force was eliminated after voting – we see that market logically should return to previous action and at least return some previous looses. Besides, pure technical view suggests existing of previous upside momentum that has not dissapeared but was temporally muted by political mess. This leads to appearing of monthly DiNapoli B&B “Buy” setup, as it is shown no second chart:

In the beginning of the year market has tested YPR1 and now stands at YPP. So, we have not just 50% Fib support. And by result of previous week we see that YPP has suported market and led it to bounce higher.

According to B&B rules market has to reach some significant Fib support level within 3 periods of closing below 3x3 DMA. Although we previously expected that B&B has chances to start from 3/8 Fib support, but this has not happened. But following to rules – market can start B&B as from 50% Fib level as from 5/8.The major condition - this level has to be reached within 3 periods after 3x3 DMA has been crossed. And you can see that October is a third period. Hence – we know that B&B will start in October, but we do not know from which level – 50% or 5/8. Right now GBP stands at 50% support. As we’ve find out existing of YPP – situation has changed and chances on upward action right from here increases.

The target of this pattern is 5/8 Fib resistance of total move down after thrust up. As you will see later - right now this is 1.6717 area.

Although B&B is very reliable pattern because it is based not on some trader’s view or opinion or some men-invented patterns, but on real market mechanics, sometimes it still could fail. Besides, thrust here is not tremendous – just minimum required number of candles up. That’s why reaching of strong support and completion of other conditions are not enough to take position. Since this is monthly pattern – upward action should be visible on lower time frames and probably should start from some clear upside reversal pattern on daily chart. Advantage of this one B&B stands also with its political background – there was a “problem” that now is mostly gone, although some consequences probably will remain. Anyway this should let market to return previous positions, at least partially and 5/8 upside retracement looks really as a mite and rather realistic target.

Previously we have been able to verify the need for a reversal pattern. And still we will expect pattern that will let us to step in.

Weekly

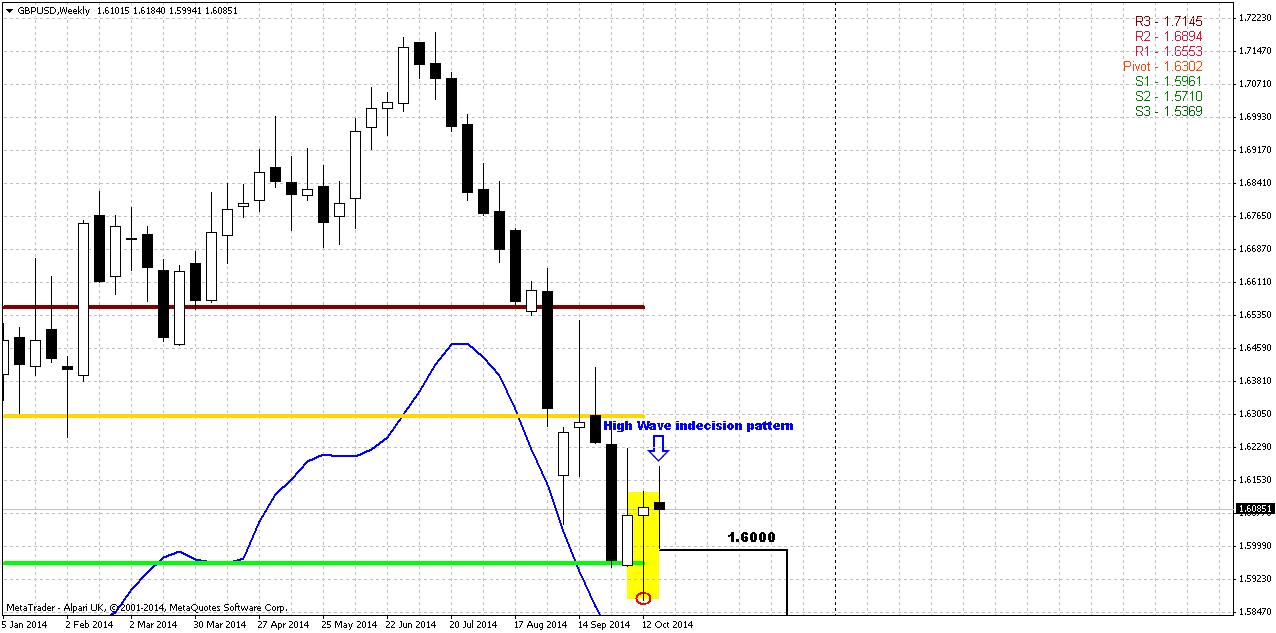

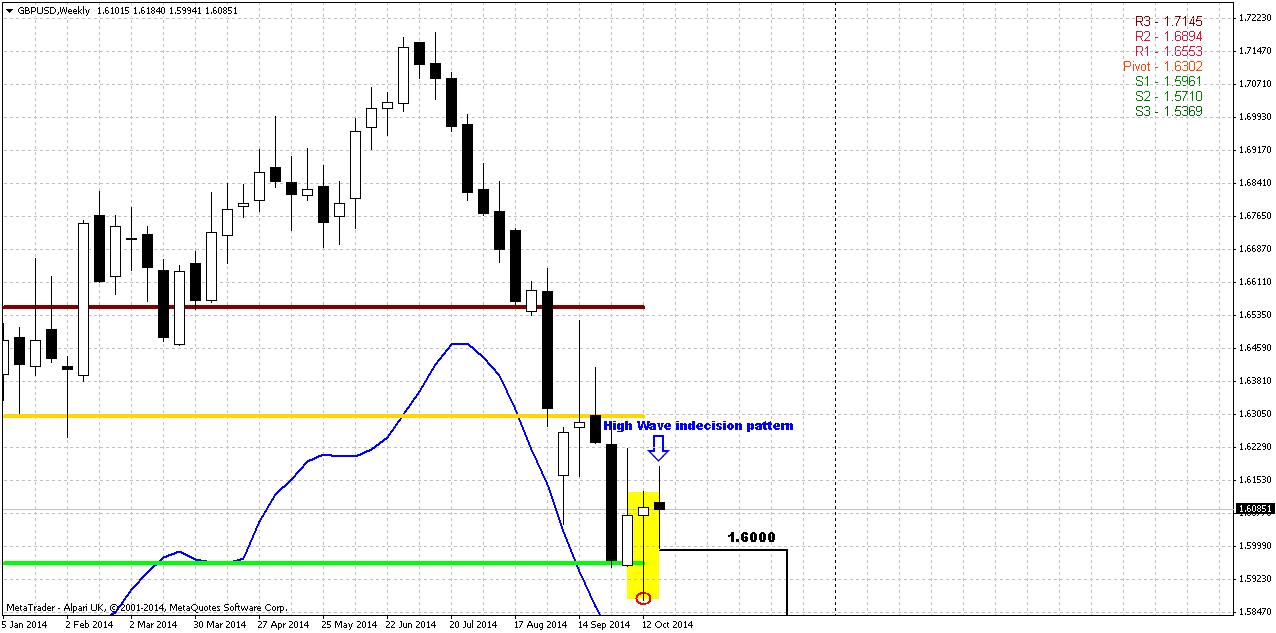

Previously we’ve said that appearing of bullish hammer pattern could be the one that we awaitng for, especially taking in consideration that GBP stands at MPS1, YPP and 50% support. This pattern has not failed, as lows were kept untouch. Until it holds – chances on upward action will exist. Thus, gradually support area becomes more and more solid and there are real chances that upside bounce could start somewhere around.

Last we’ve got this high wave pattern. From one point of view it could be treated as retracement after hammer pattern. This is common thing, when market shows either hammer or bullish engulfing pattern. From another point of view high wave pattern is not a directional one. It indicates temporal equilibrium or indecision on market. And further direction mostly will depend on side of breakout.

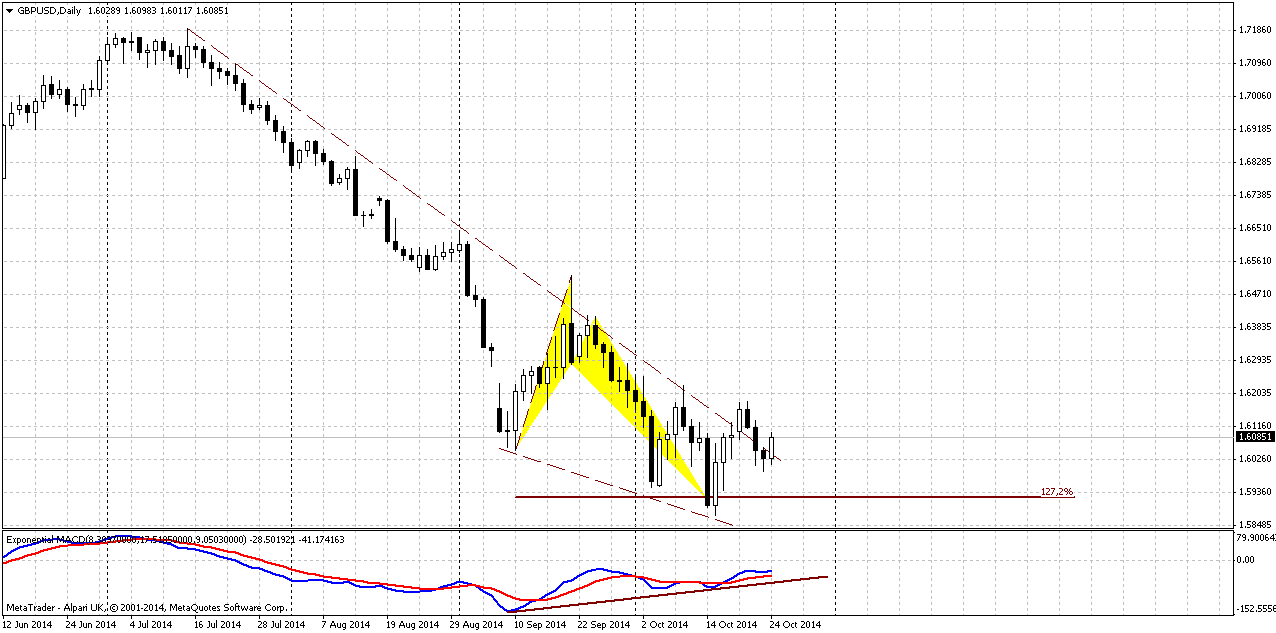

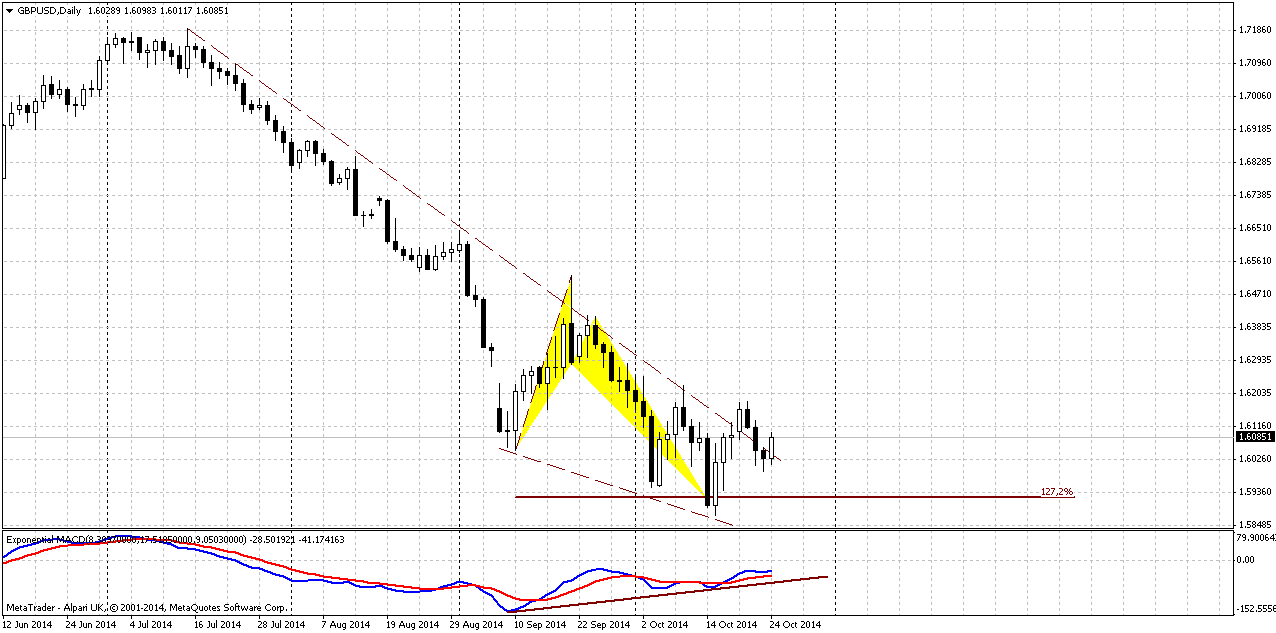

Daily

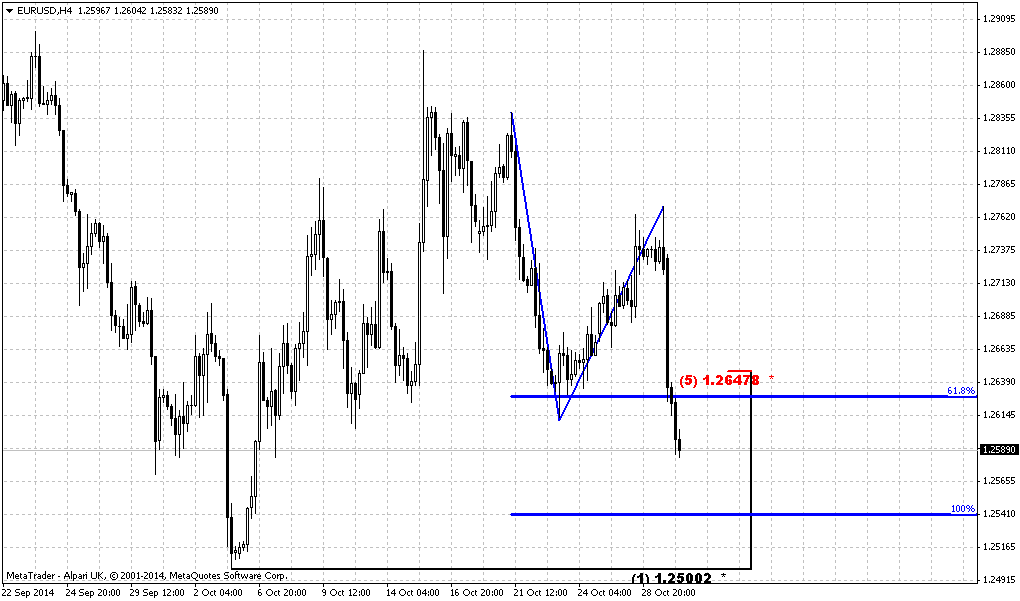

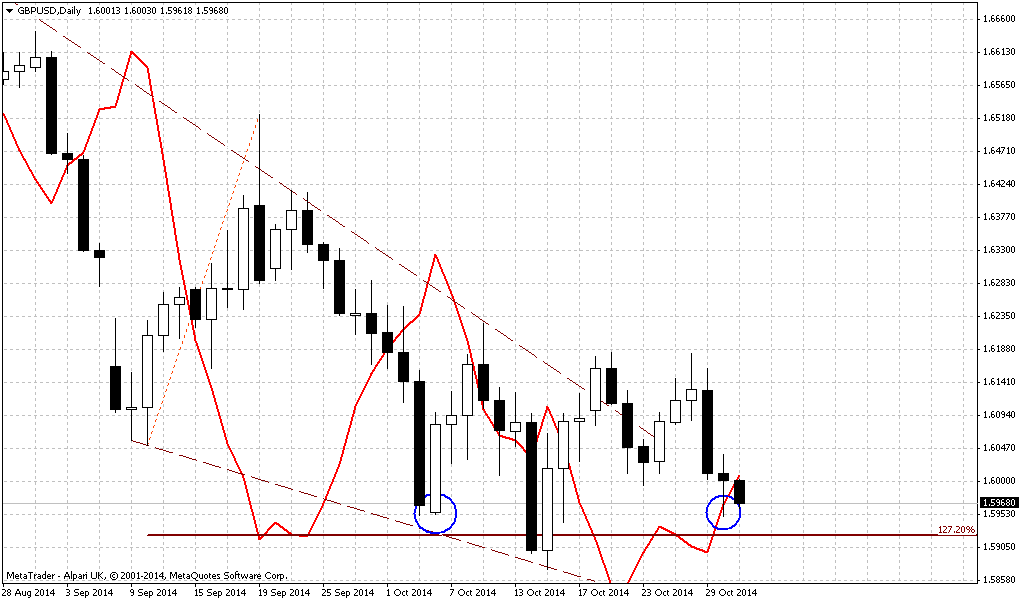

So what do we have now? Market stands at strong support and has formed weekly bullish hammer pattern. On daily chart trend has turned bullish and MACD shows nice divergence right at support area. Also we have 1.27 Butterfly “buy” pattern. So all these factors point that may be we particularly this area could become the foundation for 1.6717 journey due monthly B&B “Buy” pattern.

“2-step forward, 1-step back” pattern has not been broken totally yet, but market has not created lower low again. Wedge pattern also has not been broken yet, but price coiling right around its border. Still we can’t be disappointed because market mostly has accomplished two initial steps of our trading plan. First, it has tested WPR1 on previous week and by this action has confirmed our confidence in shape of reverse H&S. Second – returned right back down and formed bottom of potential right shoulder. Next week probably will become a moment of truth and we will understand whether B&B will take start from our H&S or not.

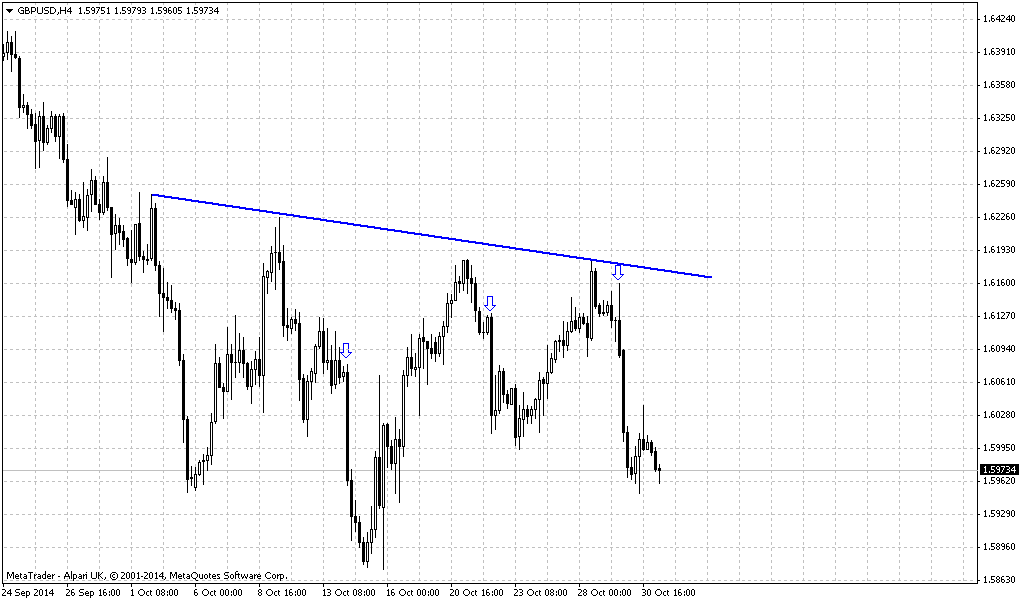

4-hour

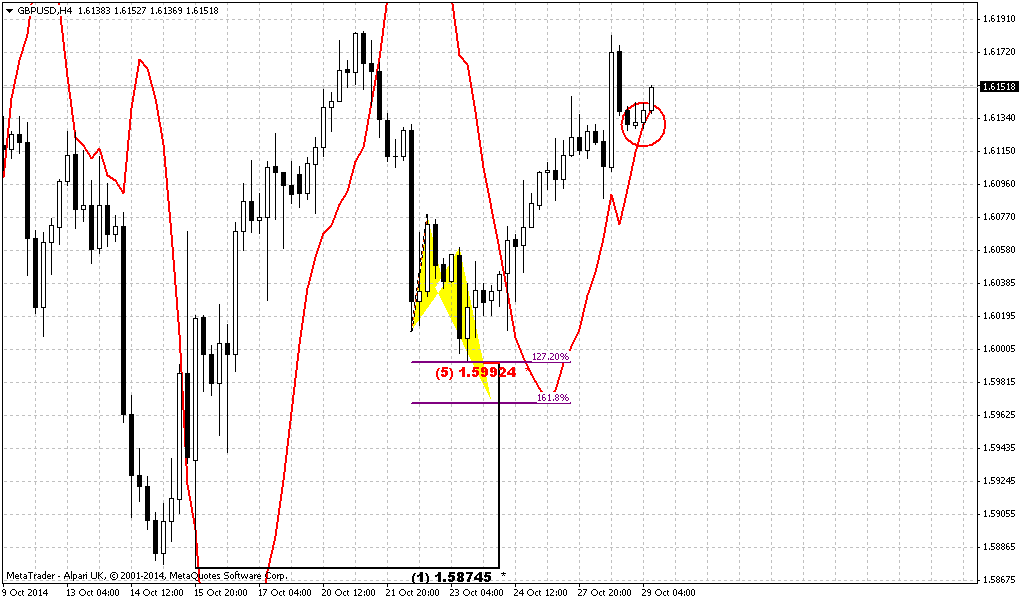

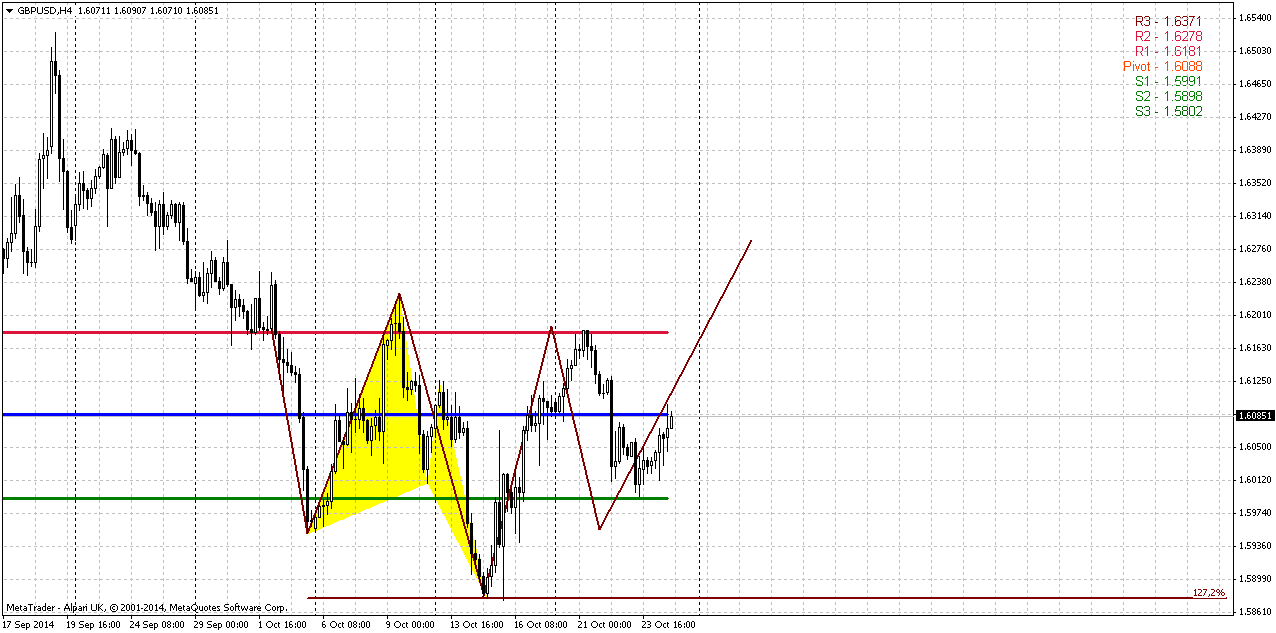

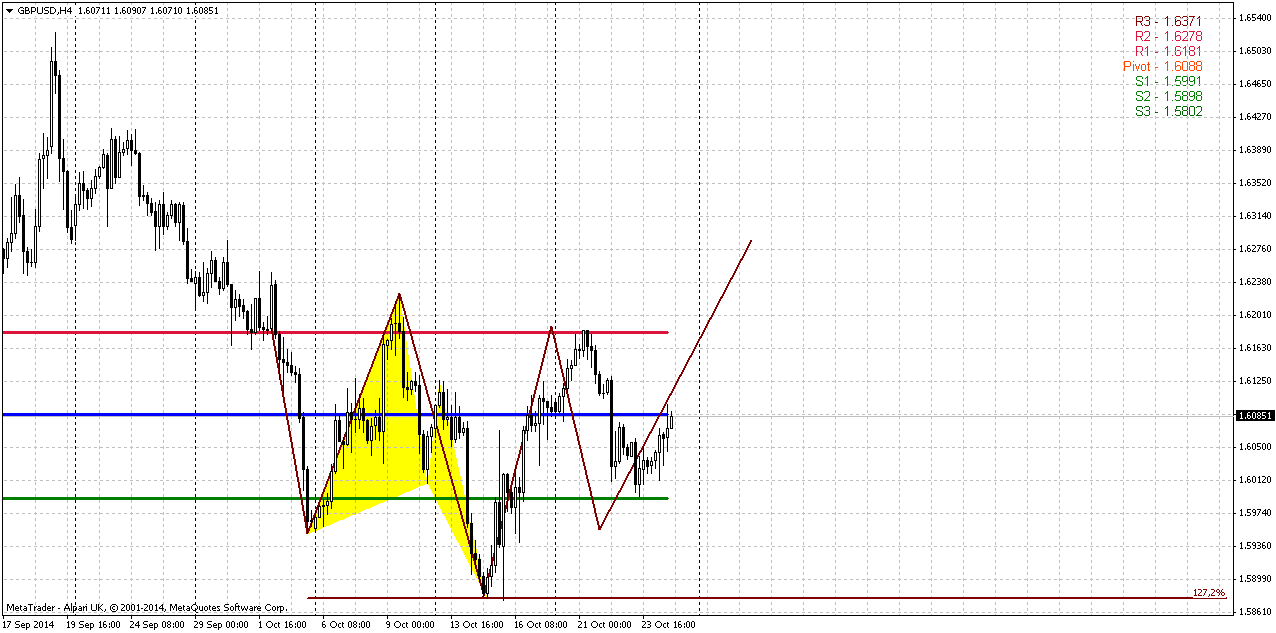

Our reverse H&S takes more and more clear shape. Still this picture just shows what could happen if reversal really will come. Pattern is accompanied by butterfly and this pattern very often becomes a part of H&S.

As we’ve said retracement down to right shoulder’s bottom will be our major point where we think about taking long position. Simultaneously this will be retracement back in the body of weekly hammer. That we have right now, in fact.

Alternative scenario is 3-Drive “buy” pattern but it suggests failure of weekly hammer and deeper downward action to next weekly support area. This scenario is also probable due some reasons as we’ve said above – but we’ve discussed it in details on previous week.

1-hour

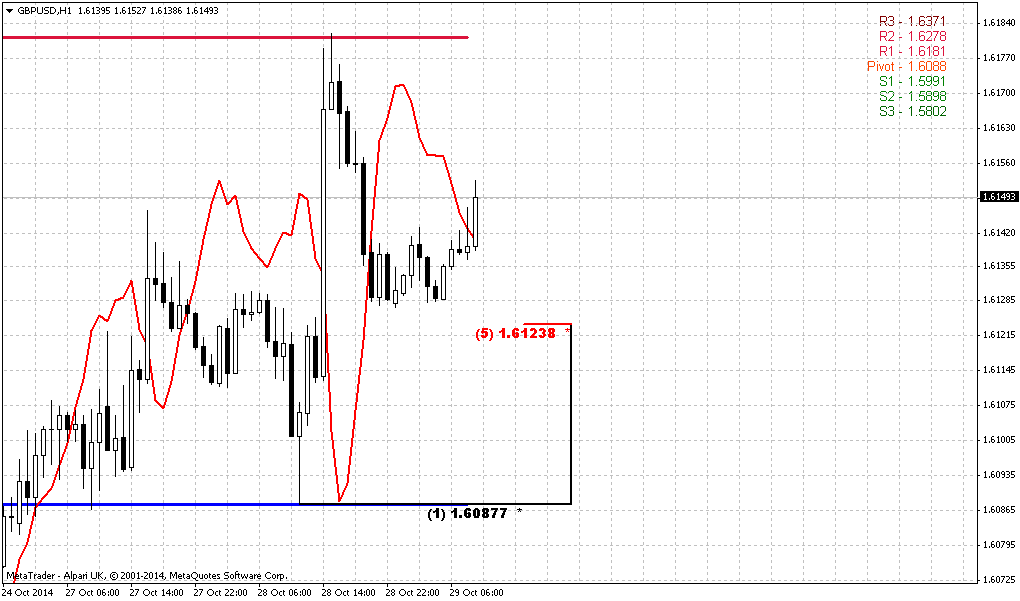

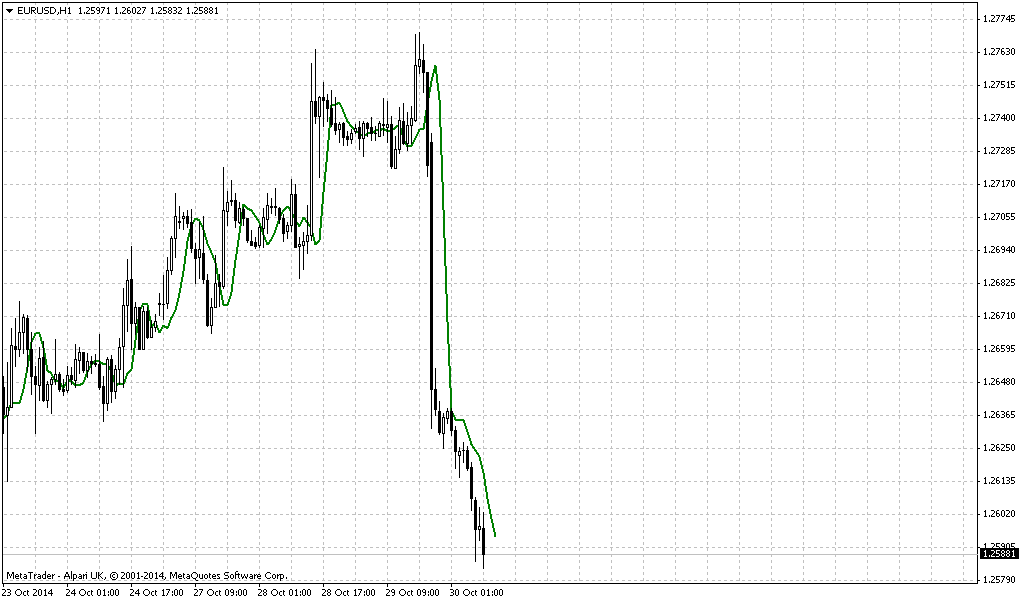

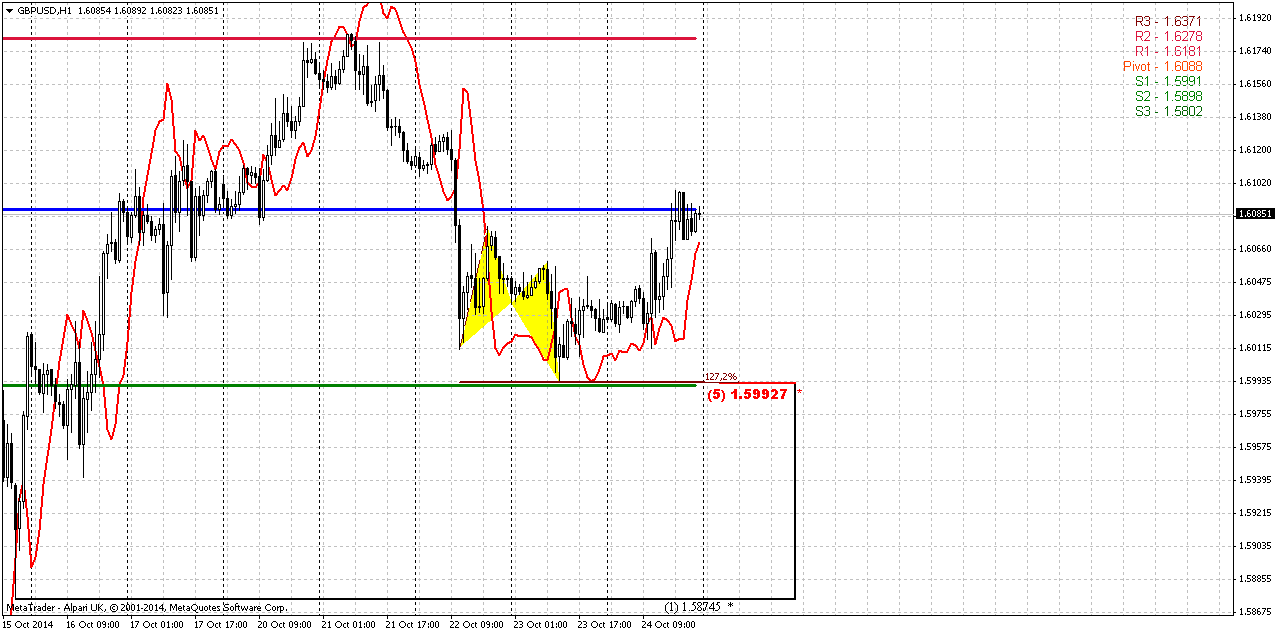

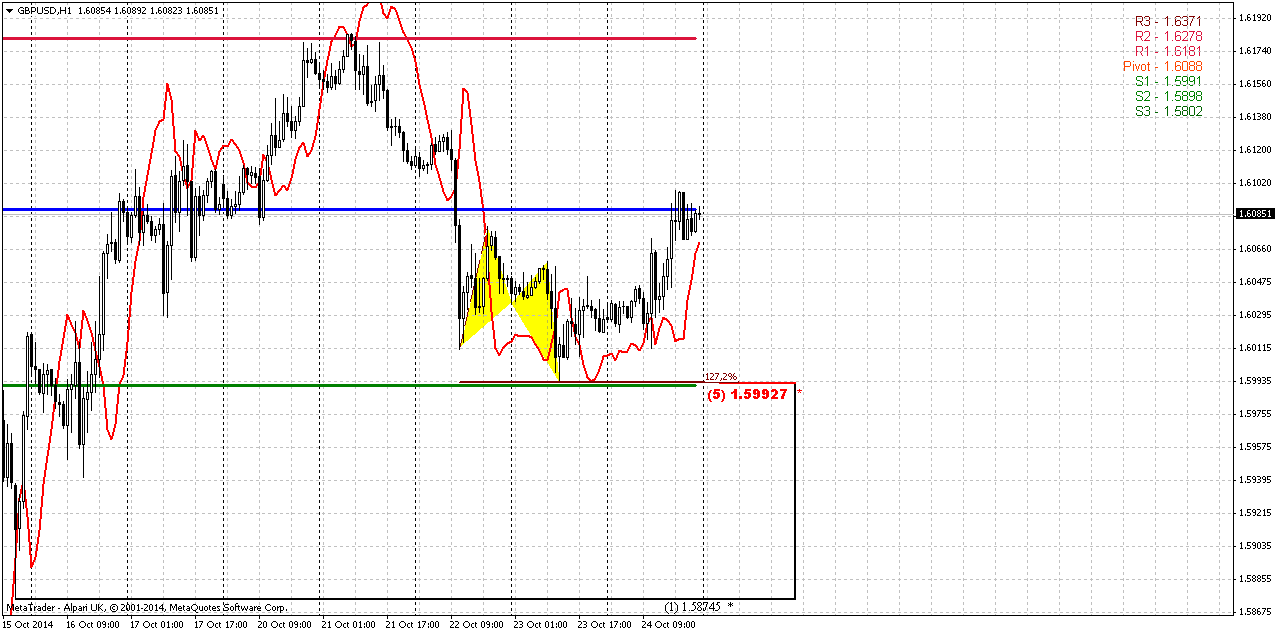

On Friday we’ve said that market has chances to show another leg down, as there were some signs of weakness. Still, on GBP data market has rebound and shown upside action. Cable will open around WPP and here we will have to watch what will happen. We would like to see upside action and moving above WPP. It seems that we can search chances for taking long position as we still stand near bottom of right shoulder of our pattern. Stop probably should be placed below WPS1. If market will break it then it will put under question H&S itself, since it will be failure of the right shoulder. Usually market moves to bottom of the head then.

Conclusion:

So, we are tempted by appetite setup on monthly chart of GBP that looks promising, at least right now. Since this pattern is forming on big picture – it could lasts for weeks and particularly by this reason it looks attractive. Currently we’ve estimated the target of this pattern at 1.6717

In shorter-term perspective the importance and strength of support area and bullish signs that have appeared around it tells that may be B&B has started. Thus, on coming week we will search chances on taking long position. Major area to monitor is WPS1 and lows of right shoulder. They should hold to keep H&S pattern valid. Breaking below this area will vanish H&S and will force us to sit on the hand and wait new signals from the market.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.

Weekly FX Tading Report prepared by Sive Morten exclusively for ForexPeaceArmy.com

According to Reuters news The euro rose on Friday ahead of an official report on the health of the euro zone's main banks as investors continued a trend of covering their short-positions leading to buying of the currency against the U.S. dollar.

Despite Friday's weakness, the dollar is on track to close the week with a gain. Concerns about the first diagnosed case of Ebola in New York City, which stifled the dollar's rally late Thursday, have waned, strategists said.

The U.S. Federal Reserve will meet next Tuesday and Wednesday, and the consensus view is that it will wrap up asset purchases under its third round of quantitative easing.

A group of 25 banks have failed European stress tests, while up to 10 of those continue to have a capital shortfall, sources familiar with the matter told Reuters on Friday.

Bloomberg News first reported the results of the tests, which are due on Sunday. Currency strategists said this just added more fuel to the short-covering that has supported the euro's position.

"It is all speculation at this point and the ECB tried to remind us of that. It just highlights that this is a risk that is not as negative perhaps as was priced in," said Camilla Sutton, chief currency strategist at Scotiabank in Toronto.

The euro zone's 130 biggest banks received the European Central Bank's final verdict on their finances on Thursday after a review aimed at drawing a line under persistent doubts about the health of the region's banking sector. They will not be made public until 1100 GMT on Sunday.

"The dollar rally has paused a bit here and I think one of the core reasons is a bit of added uncertainty as to how the Fed will react to the stronger dollar, and to the renewed worries about global growth concerns," said Brian Daingerfield, currency strategist at the Royal Bank of Scotland in Stamford, Connecticut.

The Fed's statement will be parsed for clues on how quickly the central bank might start raising interest rates, now not expected until late 2015.

"For the dollar to appreciate, you need the stock market to hold up in the face of a clean exit from QE3 by the Fed," said David Woo, head of global rates and currency research at Bank of America Merrill Lynch in New York.

Elsewhere, sterling rose to $1.6087 , up 0.37 percent. Third quarter gross domestic product data showed Britain's economy grew by 0.7 percent, down from 0.9 percent the quarter before, but in line with economists' expectations.

Investors’ interest still stands depressed on GBP, as trading volume of futures and options on CME as well as size of open interest still can’t restore previous levels. As investors participation on this part of FX futures market has dropped significantly, whether this information really shows clear picture? Anyway on recent CFTC reports most important is drop of short positions of speculators. Long positions also have decreased and all these contraction has led to drop in open interest. At the same time closing of shorts seems was more significant. We hope that this is a good sign for our monthly upside trade.

Non-Commercial Longs:

Open Interest:

Technical

Before we will continue discussion of cable – couple of words on EUR. We’ve checked it and currently do not see anything special. One thing that is worthy of our attention on coming week are stop grabbers on daily chart, that potentially could lead to appearing of upside AB=CD. That’s all. On monthly chart we do not see neccesity for comments – our target still stands ~ 1.21 Beside, EUR right now stands in the center of turmoil and is hit from all sides – inner domestic problems, geopolicy, etc. In fact EUR discussion demands separate research, but it will have shy relation to trading directly and will stand on long perspective. That’s why we probably will finish our B&B on GBP despite how it will end, and then turn to something else. Because here we’re mostly for trading but not for dry economical and political discussions, right?

In general, situation on monthly chart has not changed. Pound has closed just few pips lower compares to previous week. Our recent comments are still valid.

As we’ve said, Scotland referendum has made an impact and adjusted normal market’s behavior. Right now USD growth also presses on market. As political turmoil has gone to history market will try to correct the skew that was made by political impact. This in turn, could give us promising setups on different time scales. At the same time we agree that setups that we will discuss today mostly tactical, although they could last for considerable period of time.

As political force was eliminated after voting – we see that market logically should return to previous action and at least return some previous looses. Besides, pure technical view suggests existing of previous upside momentum that has not dissapeared but was temporally muted by political mess. This leads to appearing of monthly DiNapoli B&B “Buy” setup, as it is shown no second chart:

In the beginning of the year market has tested YPR1 and now stands at YPP. So, we have not just 50% Fib support. And by result of previous week we see that YPP has suported market and led it to bounce higher.

According to B&B rules market has to reach some significant Fib support level within 3 periods of closing below 3x3 DMA. Although we previously expected that B&B has chances to start from 3/8 Fib support, but this has not happened. But following to rules – market can start B&B as from 50% Fib level as from 5/8.The major condition - this level has to be reached within 3 periods after 3x3 DMA has been crossed. And you can see that October is a third period. Hence – we know that B&B will start in October, but we do not know from which level – 50% or 5/8. Right now GBP stands at 50% support. As we’ve find out existing of YPP – situation has changed and chances on upward action right from here increases.

The target of this pattern is 5/8 Fib resistance of total move down after thrust up. As you will see later - right now this is 1.6717 area.

Although B&B is very reliable pattern because it is based not on some trader’s view or opinion or some men-invented patterns, but on real market mechanics, sometimes it still could fail. Besides, thrust here is not tremendous – just minimum required number of candles up. That’s why reaching of strong support and completion of other conditions are not enough to take position. Since this is monthly pattern – upward action should be visible on lower time frames and probably should start from some clear upside reversal pattern on daily chart. Advantage of this one B&B stands also with its political background – there was a “problem” that now is mostly gone, although some consequences probably will remain. Anyway this should let market to return previous positions, at least partially and 5/8 upside retracement looks really as a mite and rather realistic target.

Previously we have been able to verify the need for a reversal pattern. And still we will expect pattern that will let us to step in.

Weekly

Previously we’ve said that appearing of bullish hammer pattern could be the one that we awaitng for, especially taking in consideration that GBP stands at MPS1, YPP and 50% support. This pattern has not failed, as lows were kept untouch. Until it holds – chances on upward action will exist. Thus, gradually support area becomes more and more solid and there are real chances that upside bounce could start somewhere around.

Last we’ve got this high wave pattern. From one point of view it could be treated as retracement after hammer pattern. This is common thing, when market shows either hammer or bullish engulfing pattern. From another point of view high wave pattern is not a directional one. It indicates temporal equilibrium or indecision on market. And further direction mostly will depend on side of breakout.

Daily

So what do we have now? Market stands at strong support and has formed weekly bullish hammer pattern. On daily chart trend has turned bullish and MACD shows nice divergence right at support area. Also we have 1.27 Butterfly “buy” pattern. So all these factors point that may be we particularly this area could become the foundation for 1.6717 journey due monthly B&B “Buy” pattern.

“2-step forward, 1-step back” pattern has not been broken totally yet, but market has not created lower low again. Wedge pattern also has not been broken yet, but price coiling right around its border. Still we can’t be disappointed because market mostly has accomplished two initial steps of our trading plan. First, it has tested WPR1 on previous week and by this action has confirmed our confidence in shape of reverse H&S. Second – returned right back down and formed bottom of potential right shoulder. Next week probably will become a moment of truth and we will understand whether B&B will take start from our H&S or not.

4-hour

Our reverse H&S takes more and more clear shape. Still this picture just shows what could happen if reversal really will come. Pattern is accompanied by butterfly and this pattern very often becomes a part of H&S.

As we’ve said retracement down to right shoulder’s bottom will be our major point where we think about taking long position. Simultaneously this will be retracement back in the body of weekly hammer. That we have right now, in fact.

Alternative scenario is 3-Drive “buy” pattern but it suggests failure of weekly hammer and deeper downward action to next weekly support area. This scenario is also probable due some reasons as we’ve said above – but we’ve discussed it in details on previous week.

1-hour

On Friday we’ve said that market has chances to show another leg down, as there were some signs of weakness. Still, on GBP data market has rebound and shown upside action. Cable will open around WPP and here we will have to watch what will happen. We would like to see upside action and moving above WPP. It seems that we can search chances for taking long position as we still stand near bottom of right shoulder of our pattern. Stop probably should be placed below WPS1. If market will break it then it will put under question H&S itself, since it will be failure of the right shoulder. Usually market moves to bottom of the head then.

Conclusion:

So, we are tempted by appetite setup on monthly chart of GBP that looks promising, at least right now. Since this pattern is forming on big picture – it could lasts for weeks and particularly by this reason it looks attractive. Currently we’ve estimated the target of this pattern at 1.6717

In shorter-term perspective the importance and strength of support area and bullish signs that have appeared around it tells that may be B&B has started. Thus, on coming week we will search chances on taking long position. Major area to monitor is WPS1 and lows of right shoulder. They should hold to keep H&S pattern valid. Breaking below this area will vanish H&S and will force us to sit on the hand and wait new signals from the market.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.