Sive Morten

Special Consultant to the FPA

- Messages

- 18,699

Monthly

Weekly FX report prepared by Sive Morten exclusively for ForexPeaceArmy.com

As Reuters reports The dollar gained against a basket of major currencies on Friday, posting its 10th consecutive week of gains, as investors bet U.S. interest rates would rise more quickly than had been expected.

Some market participants, however, said the dollar's move was overdone and its rally should pause fairly soon. Fundamentally, the dollar seemed to be getting just a marginal boost from positive U.S. economic news, they added.

"I just think we've come a long way very quickly here and the dollar doesn't seem to be getting incremental support from positive developments," said Shaun Osborne, chief currency strategist at TD Securities in Toronto.

"This will be the 10th week of gains for the dollar index and it's unusual to see consecutive weekly gains extend beyond more than that. If we are going to stop anywhere, this may be a good point to slow down in this rally."

David Rodriguez, quantitative strategist at DailyFX.com, a unit of retail FX broker FXCM in New York, echoed Osborne's sentiment. He said FXCM's FX volume data showed euro selling and U.S. dollar buying have slowed significantly despite the fact that the euro hit a 14-month low against the dollar, of $1.2832 . It last traded at $1.2835, down 0.7 percent. "A drop in enthusiasm could naturally turn into revulsion, and the dollar could turn lower in a hurry," said Rodriguez.

Osborne added that the Federal Reserve's interest rate forecasts released on Wednesday only served to confuse the market. "I just thought that the shift in the U.S. rate forecasts was marginal and the Fed is still very much data-dependent. If the U.S. jobs number for some reason weakens from here on, then those rate forecasts will change too," Osborne said.

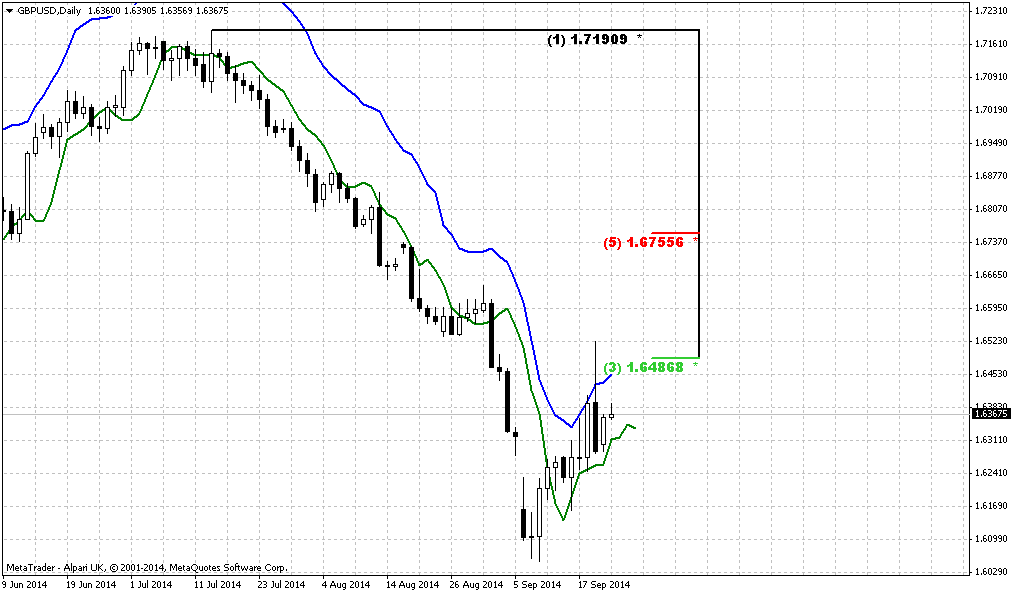

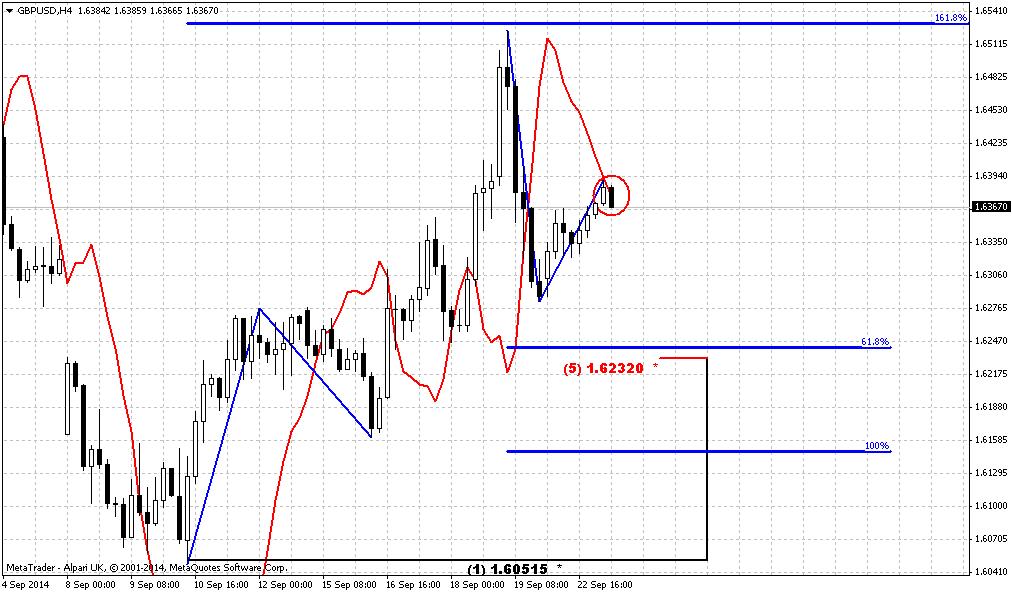

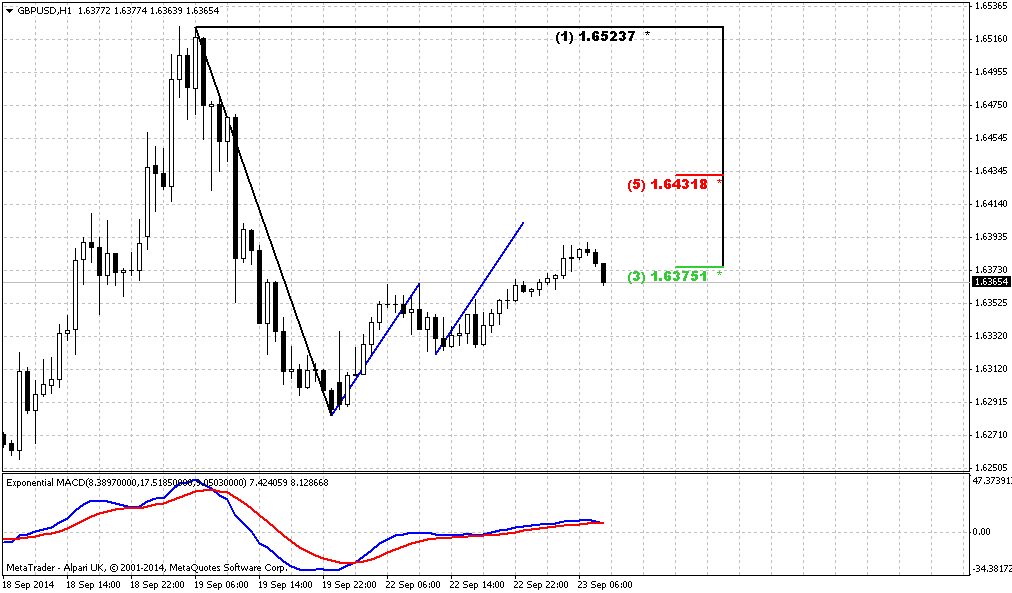

Sterling is the other big mover in the market, jumping to a two-week high against the dollar and a two-year peak versus the euro, after Scotland voted in a referendum to stay within the United Kingdom. However, the pound fell back on profit-taking in New York trading. Analysts pointed to issues such as promises for more powers to Scotland that could open up the prospects for some constitutional changes to next May's general election as risk factors for the pound. These could add some uncertainty to UK growth prospects and tie sterling down in the near term.

So, investors finally start to hint on EUR/USD overextension to the downside. We could definitely tell about it, since we have DiNapoli Oscillator Predictor tool… Anyway solid shift in sentiment should be visible in CFTC data. On current week report is very informative. It shows reducing of open interest and simultaneously solid jump in speculative longs:

Open interest:

Longs:

Shorts:

But how it could be? The answer is as follows. First – you can see solid drop of spread positions. It does not impact on sign of net position, but it impacts on open interest. Second – we can see significant decreasing of hedgers’ positions, i.e. commercials:

Longs:

Shorts:

So, as a result we see that speculators have increased longs, while hedgers has decreased hedge positions. By this information we probably could agree that chances on possible retracement is really not bad...

Currently our ratio of short positions has slightly decreased on 5% to 218606/(218606+77348)=73,8%.

In long term perspective our suggestion that EUR will stay under pressure for long time but as Fed has kept moderately dovish rethoric, EUR downward action will be more gradual and smooth.

We still think that recent significant ECB meeting brings new colors to current balance. If we even will not take on recent rate cutting, Draghi has announced 1 Trln EUR QE program. It means that EU and US financial policy will go on opposite courses.

Currently first driving factor is US economy improvement. Macroeconomy suggests that when economy comes out from recession into growth – the first stage is “desinflation growth”. Economy shows improvement without jump in inflation. May be right now we are entering in this stage, at least most analysts point on obvious improvements in US economy and there are no doubts about it.

Combining these two moments makes me think that probably this is really first stage. Second stage will be “inflationary growth” – this is a period when Fed’s rate dancing will start. Probably we will see first bell of this when wages in US will start to grow that we do not see yet. Since we have at least 8-12 months when rate will not change.

At the same time, it seems that EUR will remain under pressure as Draghi confirms this, and we see some reasons for this as well. Even before Ukranian crisis EU has its own problems that press ECB keeps rate low and even apply clearly dovish rethoric. As EU has intiated sunctions against Russia this will hurt trade balance and negatively impact on EU. At the same time this is just small part of goods that Russia could forbid potentially and recent data on GDP of Germany, France, Italy shows slightly worse that expected numbers. Other words, mutual sanctions do not assume improvement in economy.

Reducing of export for EU countries will mean also unemployment growth, reducing of trade balance, GDP and budget income. In current situation this is not good, especially for new members of EU that are more sensible to economic negative situations and that were hurted stronger in 2008. At the same time EU still has its own problems, such as desinflation in major economies.

Recent NATO meeting in Wales will totally put Europe in financial burden, since they call for increasing of military spending to 2% of GDP of each country. US Military companies take 75% of all NATO defense spendings and now European taxpayers and citizens will pay to US for approximately 2% of GDP annually. Hardly this will support EU economy. Surprisingly a lot of separatizm sentiment has risen in Europe. Scotland, next is Catalonia in November, and I will not be surprised if we will start to hear about Flanders in Belgium, North Italy and/or Florence.

And finally – carry trade. As dollar is coming out from low rates pit and euro is falling there – eur could replace dollar on carry trade action and stand in a row with Yen. It means that right now we should keep an eye, say on EUR/AUD, EUR/NZD pairs. Spinning up carry spiral could hurt EUR even more. Since investors will start to borrow and sell EUR on open market.

All these facts make us think that EUR/USD will continue move south with moderate pace during the 8-12 months and even could accelearted when real hazard of US rate hiking will appear if any positive shifts in EU economy will not come. Depending on how external political atmospehre will change – we will gradually adjust our view.

Technical

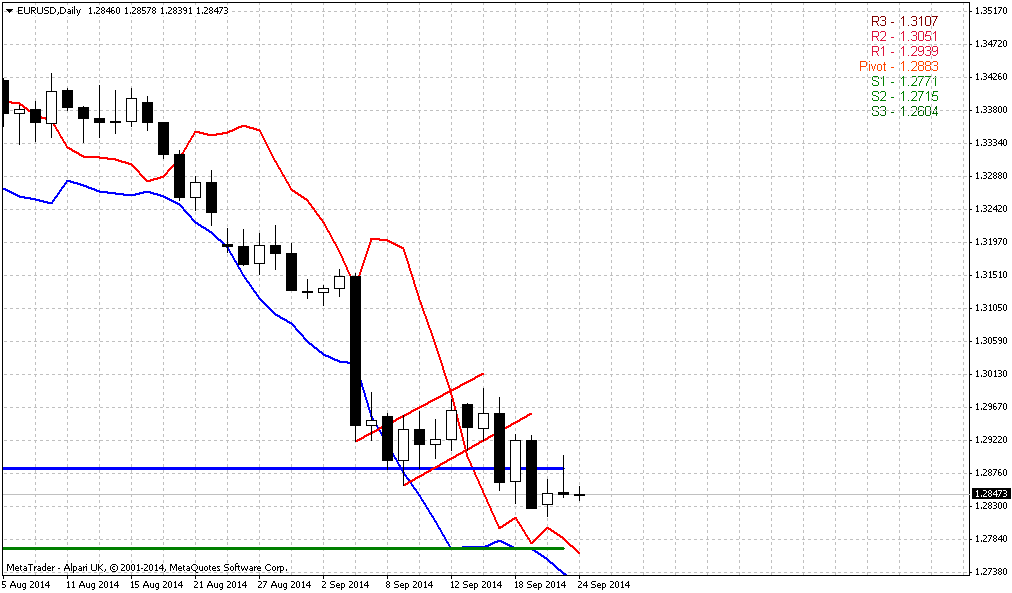

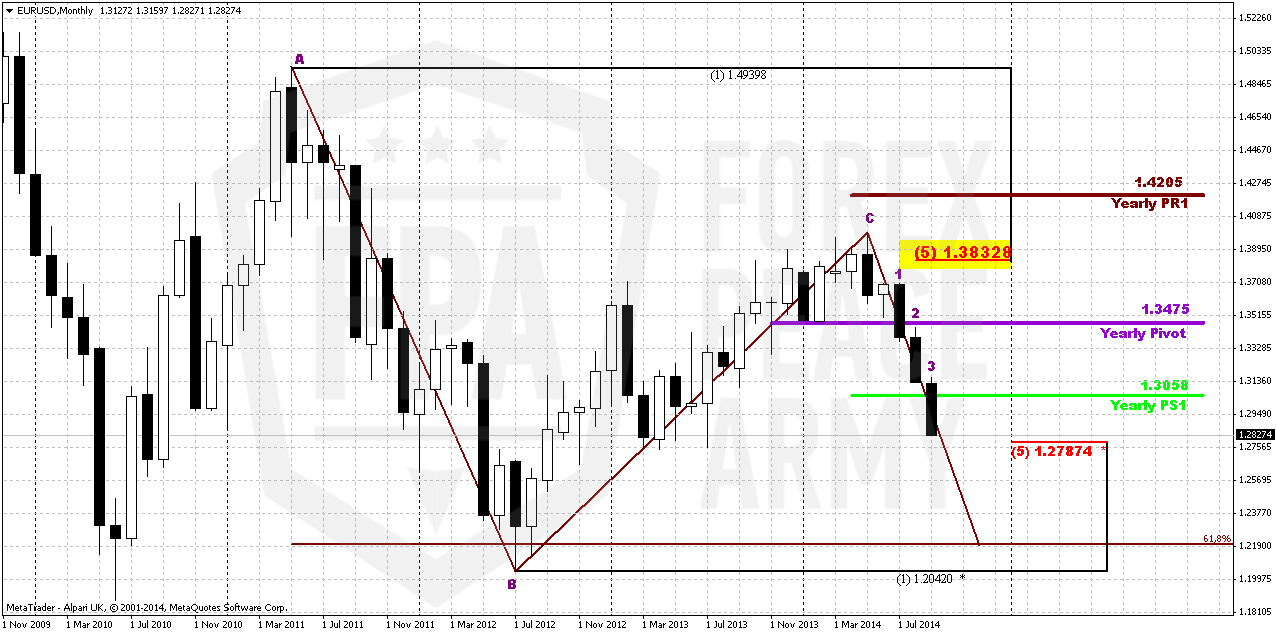

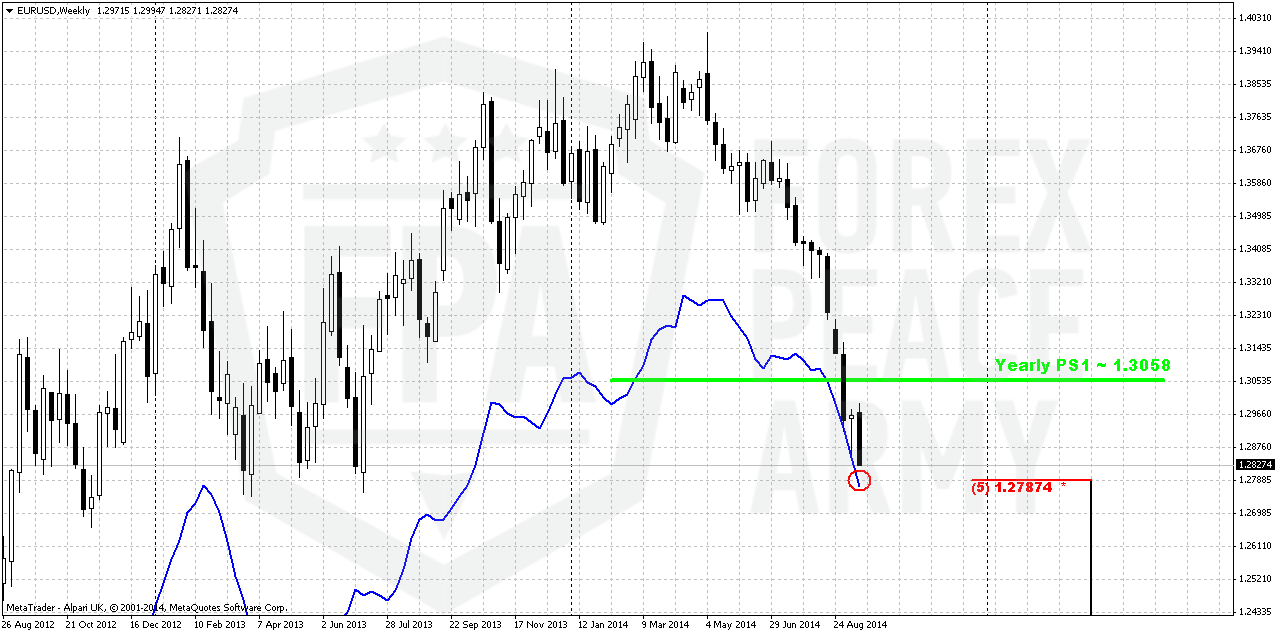

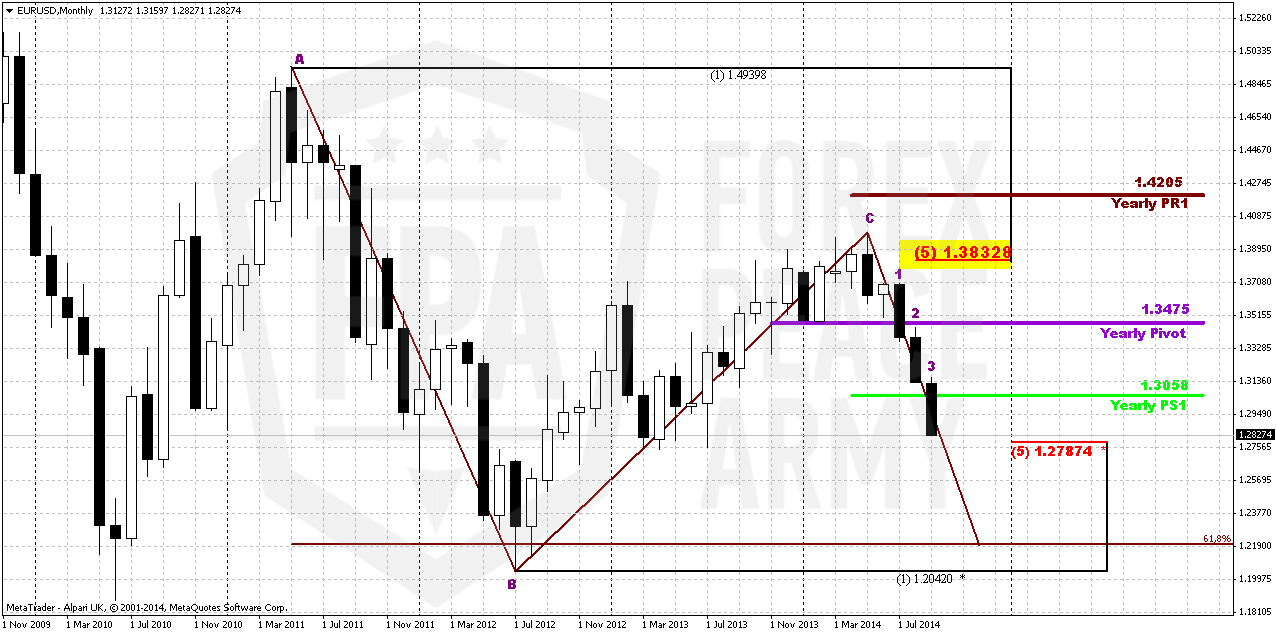

So, situation on long-term chart enters in new stage. Trend is bearish here and market has broken below Yearly PS1. As a rule, moving below any PS1 suggests appearing of new bearish trend or continuation of existing one. Since we’re talking about yearly pivots, we mean that 2015 could stand under sign of bears. Market is not at oversold – it stands below 1.20. So from this point of view market has no limits to move down further.

Now about targets. Next support is 1.2787 – major 5/8 Fib level. But sooner or later it seems that market will gravitate to 0.618 extension of Huge AB=CD pattern at 1.2190 level. This probably will become our next long-term target. And finally, I’m not sure but looks like here we have 3 black crows pattern – I’ve marked it by numbers. If this is indeed so, then it proves of new bear trend and 1.2190 target seems not as fantastic as it looks right now. Now is the question will we get third crow or not, since September bar has not closed yet, although currently September bar looks impressive.

Weekly

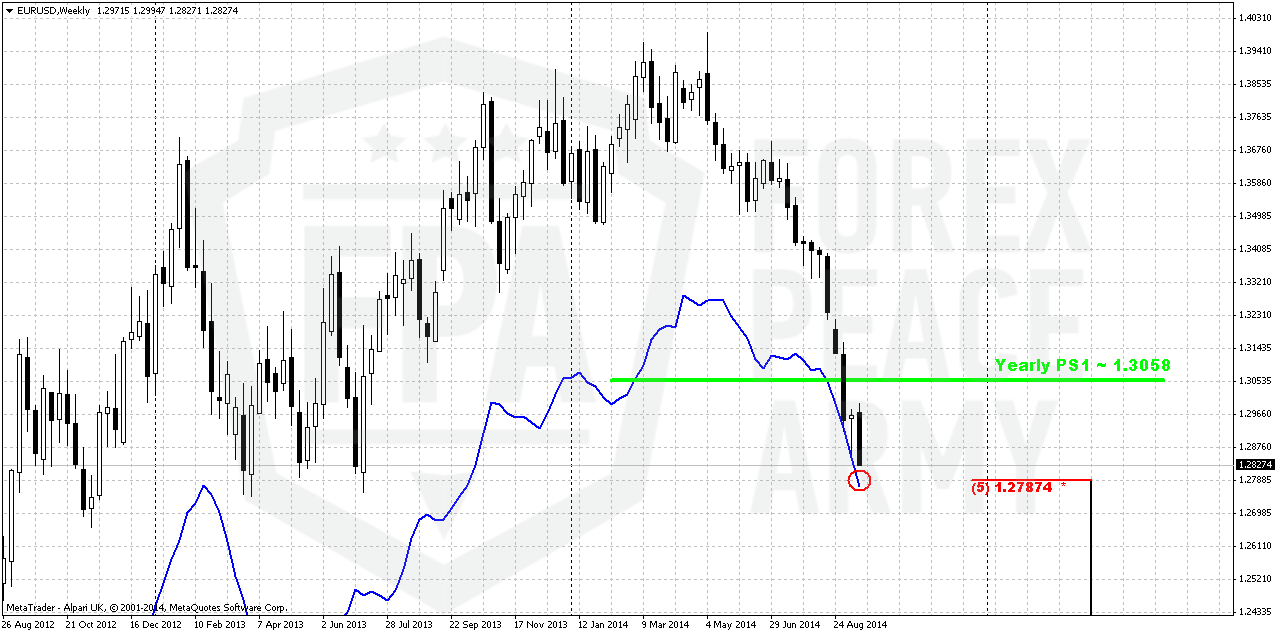

As CFTC data increases chances on possible retracement here and this thought is also confirmed technically by our Oscillator Predictor – our task is to catch first signs of possible bounce and patterns that could be the starting point of it.

Recently market has proved its extreme bearish sentiment by consequence of steps – breakout of K-support @1.3240 without any respect, open gap down, no retracement at 1.618 AB-CD completion point, moving below YPS1, and right now – close below hammer pattern.

Thus, right now we do not see any patterns that could justify bounce up. But... we can watch for couple of things. First is thrust. It’s perfect and has all chances to become foundation for DiNapoli directional pattern – either B&B or DRPO. Second – major 5/8 support @1.2787. This is only support till the major lows and it will coincide with weekly oversold again. We think that it will be major level for monitoring on coming week, because if any retracement will start at all – it probably will start from this support area.

Finally, we have to understand that weekly reversal will have to start from some extended pattern on daily chart. By “extended” I mean not a bullish engulfing or hammer, but 3-Drive, Butterfly, H&S or something of this sort. What we would like to say is that we do not need to hurry and rush to buy any hint on reversal.

That’s being said, first thing that we should watch for is reaching of major 5/8 Fib support.

Daily

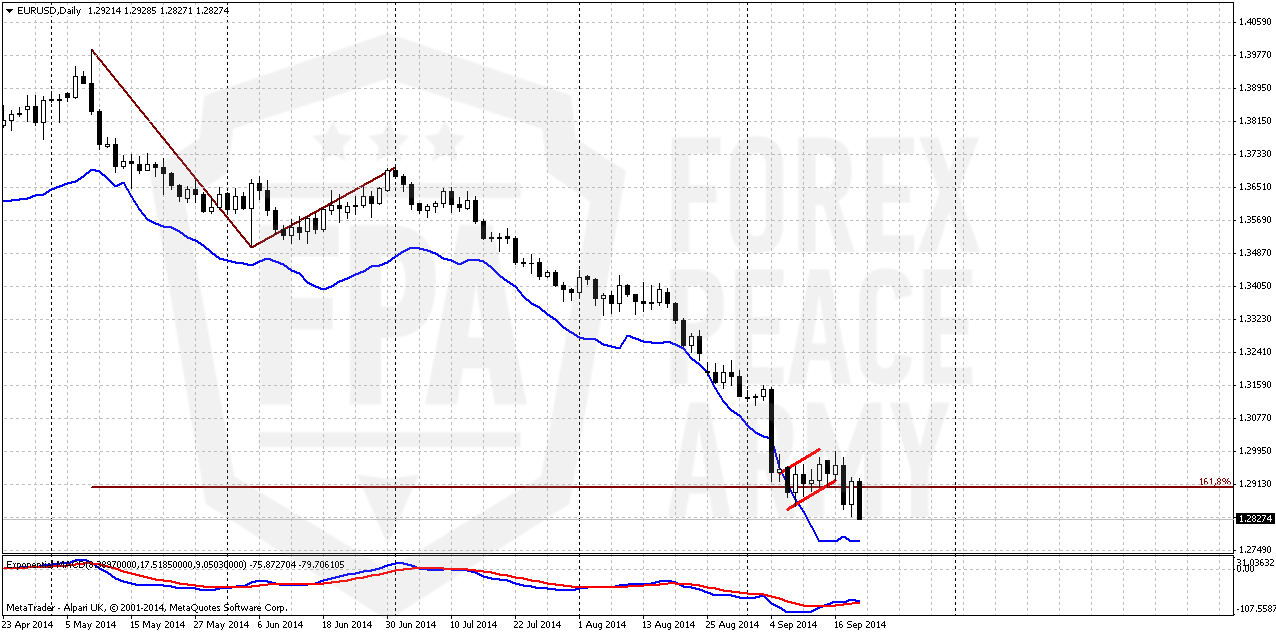

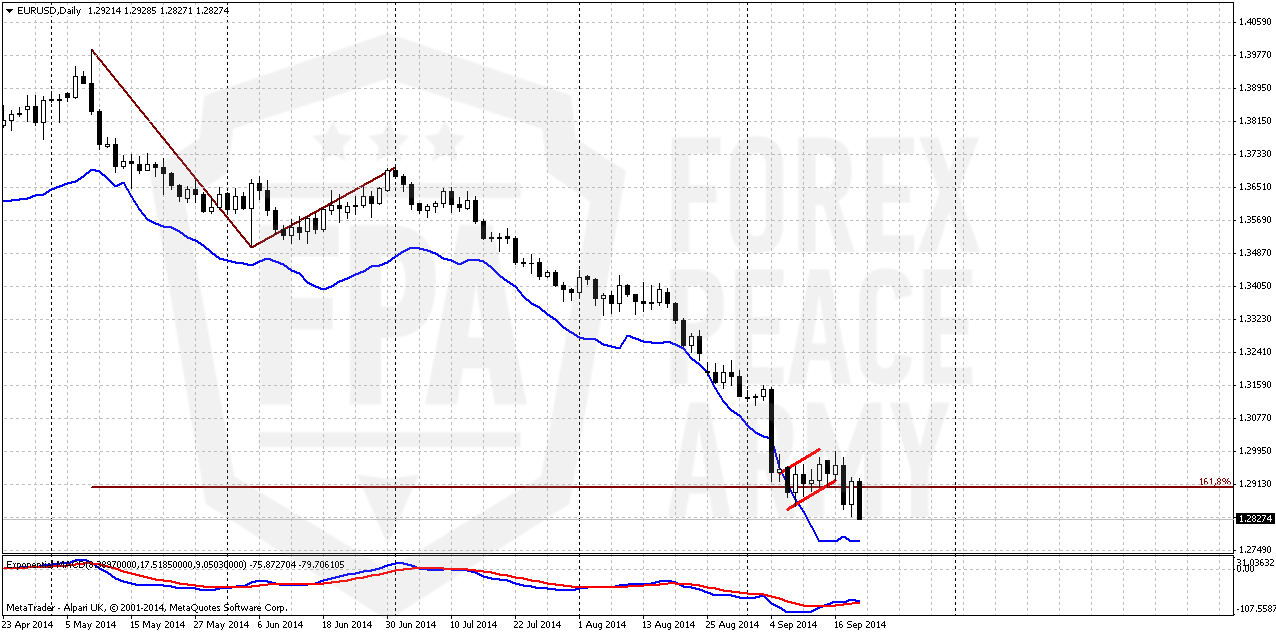

Usually daily chart is most informative one, but on coming week here is not much to comment. As you can see there was very shy reaction on AB-CD completion target, only small flag pattern has been formed. The one thing that we can say here is daily oversold will coincide with the same 1.2787 Fib support area and weekly oversold.

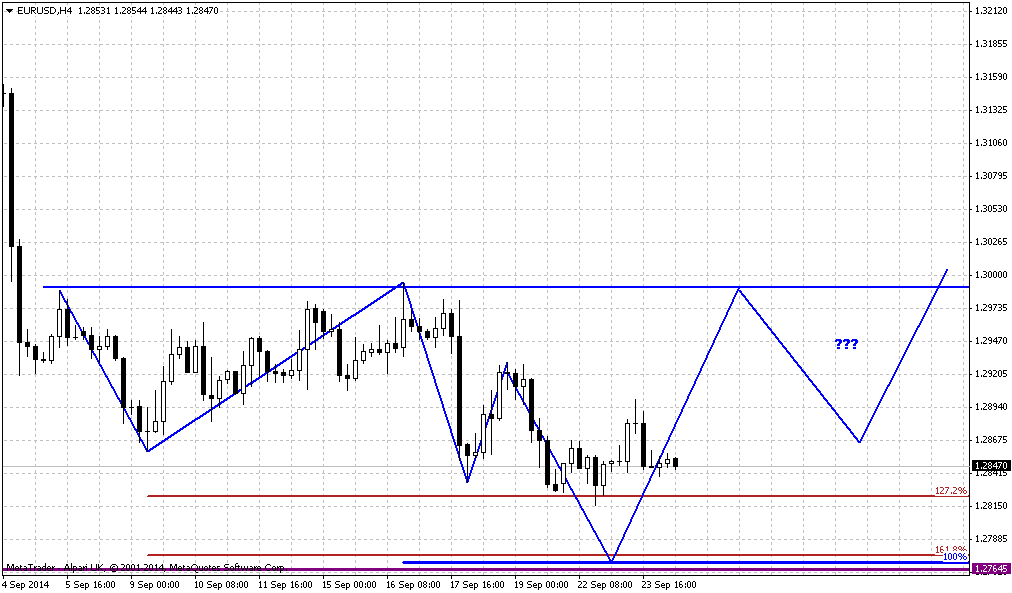

4-hour

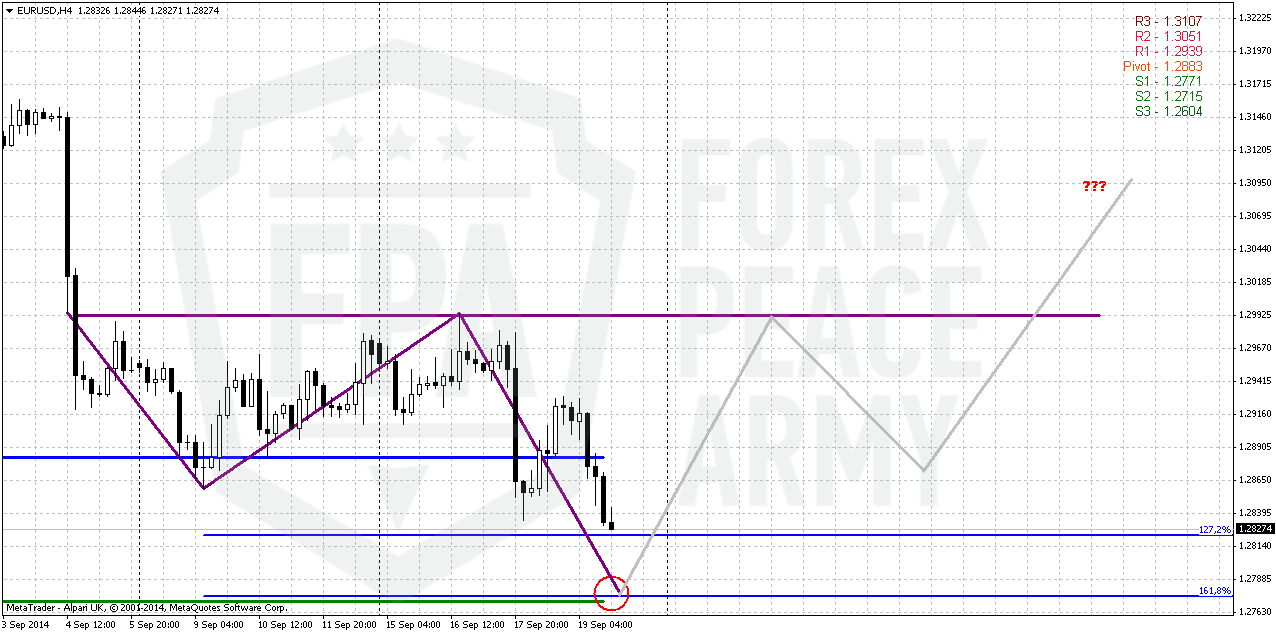

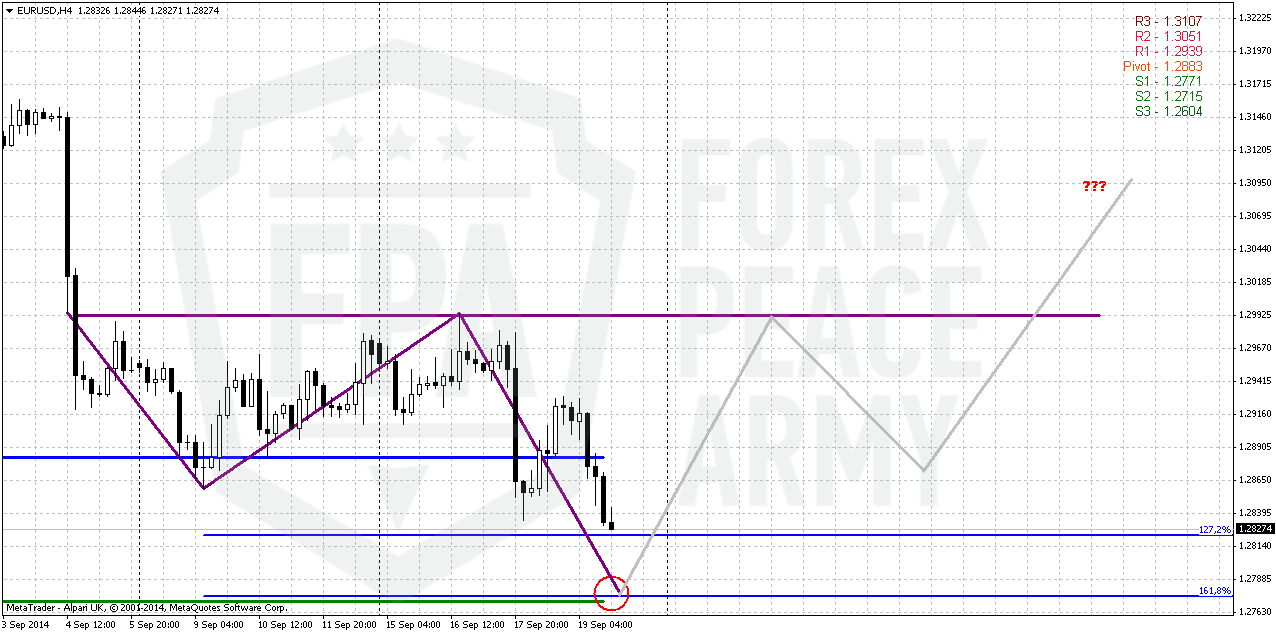

Very important chart by far. Flag extention down shows that 1.618 level coincides presicely with the same area around 1.2760-1.2780. Here we have to exclude butterflies and 3-Drives, because relation between retracements and extensions does not let us to get acceptable combination of extensions. Thus, if market really will have any intention to reverse – we could get either H&S or say, Double Bottom. Take a note that WPS1 will stand in the same support area as well. And do not treat this picture as “must” scenario. I hope you understand that this is just suggestion by far – one of the possible scenarios. Based on changing sentiment and existence of solid support we make an assumption of possible retracement, but how definitely it will start and will it start at all – that’s the question.

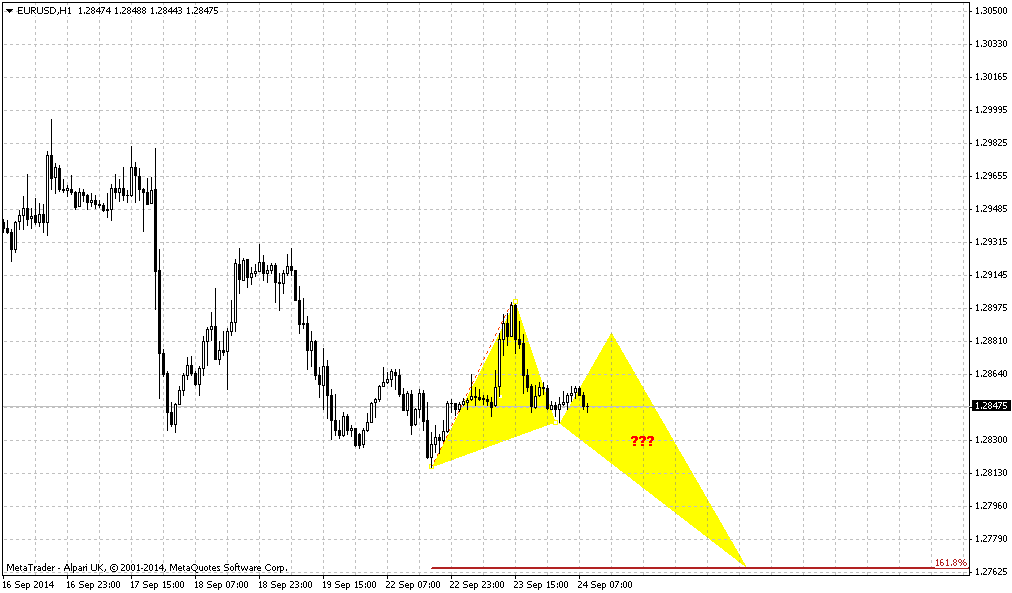

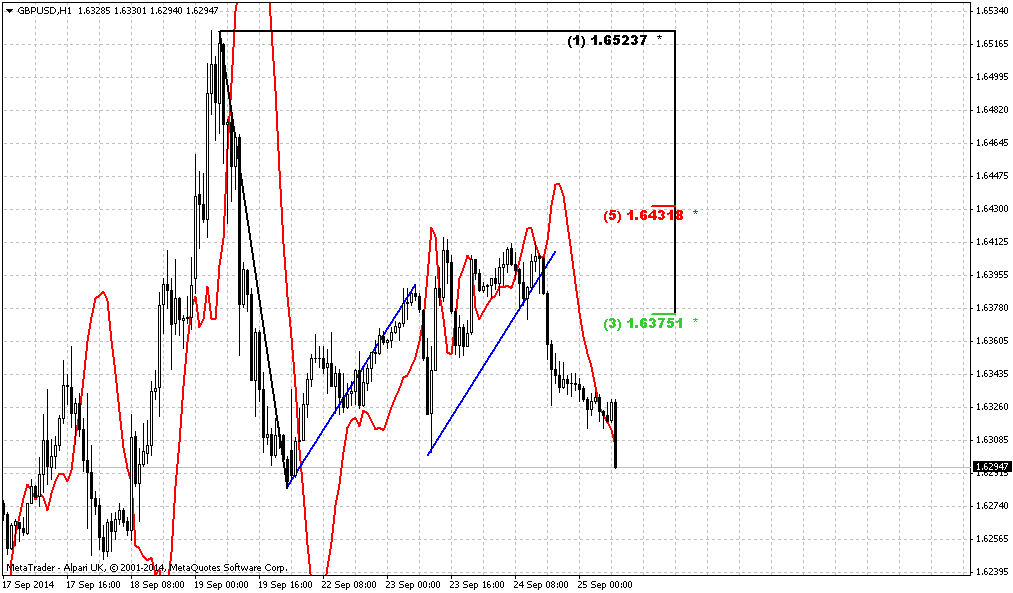

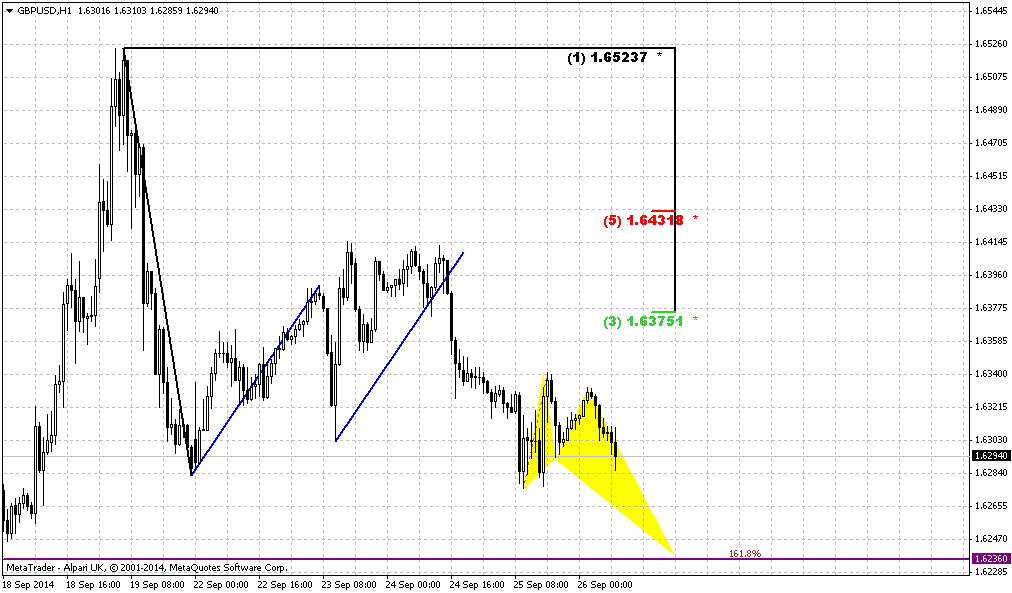

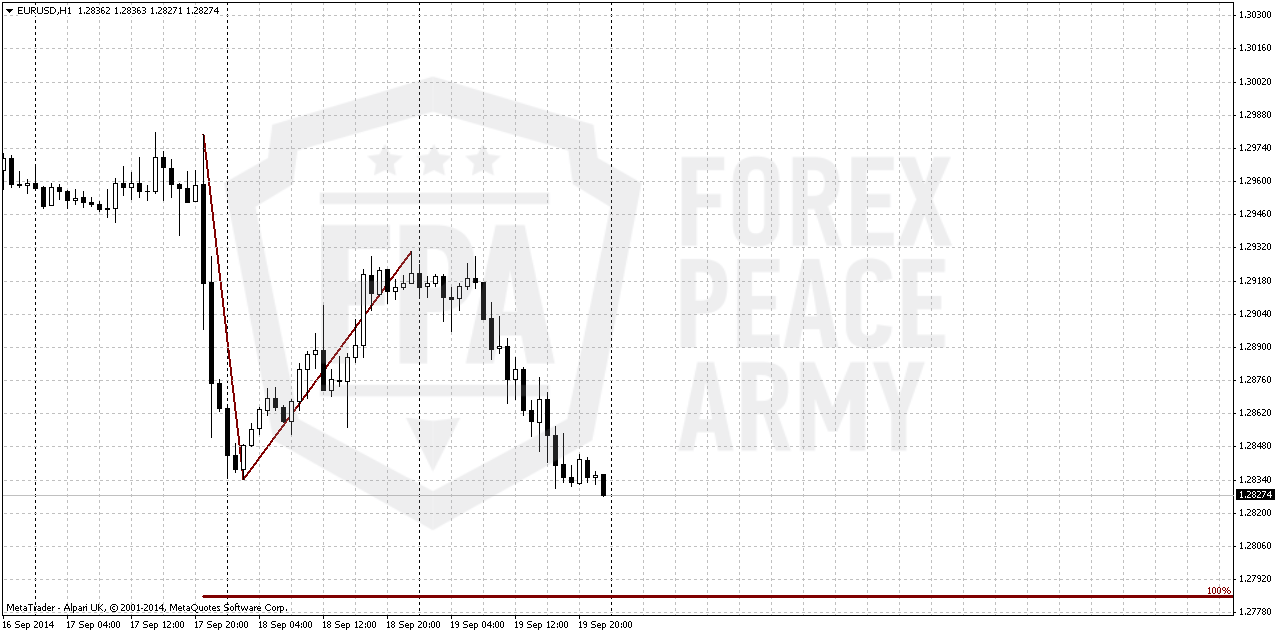

1-hour

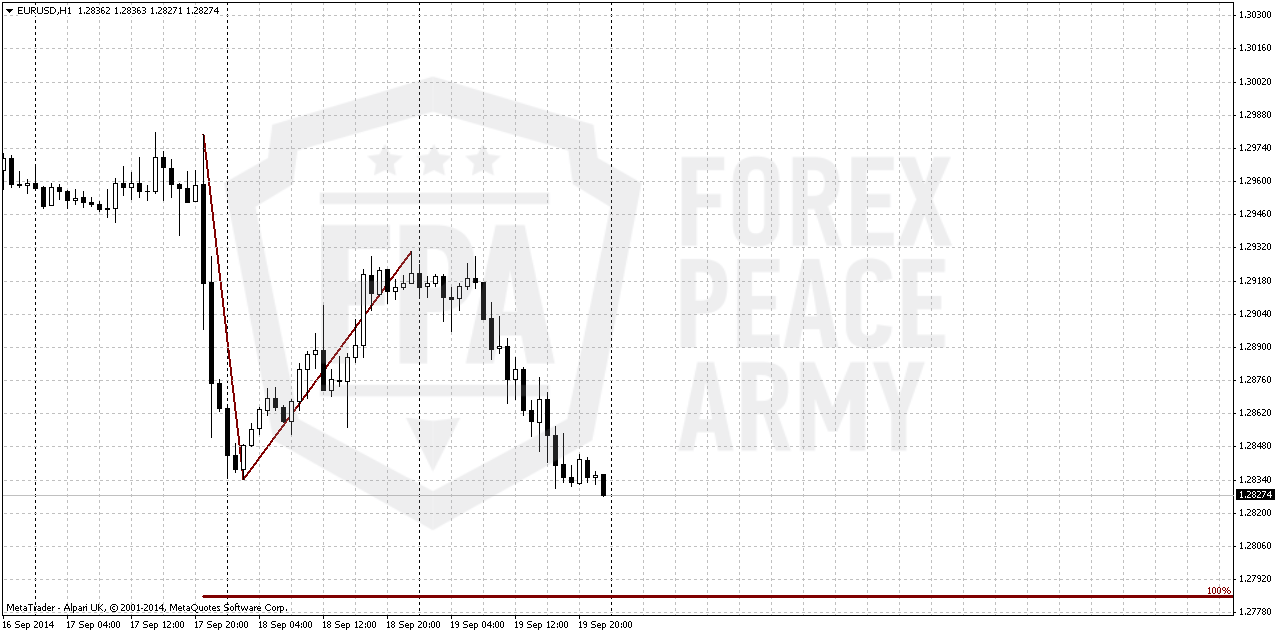

Here we have another pattern – AB=CD that has completion point guess where – right, at the same 1.2780s. Taking into consideration the fact that CD leg is much flatter, as a rule this leads to reversal and AB-CD works as reversal pattern, rather than just retracement before continuation to next farer target.

Conclusion:

Big picture on EUR has entered in new phase. It could turn so that our next target could be 1.21.

In shorter-term perspective we sign shy change in market sentiment and existence of strong support area around 1.2760-1.2780. This moment encourage on possible retracement.

Our trading plan suggests waiting when market will reach support, second – form reversal pattern.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.

Weekly FX report prepared by Sive Morten exclusively for ForexPeaceArmy.com

As Reuters reports The dollar gained against a basket of major currencies on Friday, posting its 10th consecutive week of gains, as investors bet U.S. interest rates would rise more quickly than had been expected.

Some market participants, however, said the dollar's move was overdone and its rally should pause fairly soon. Fundamentally, the dollar seemed to be getting just a marginal boost from positive U.S. economic news, they added.

"I just think we've come a long way very quickly here and the dollar doesn't seem to be getting incremental support from positive developments," said Shaun Osborne, chief currency strategist at TD Securities in Toronto.

"This will be the 10th week of gains for the dollar index and it's unusual to see consecutive weekly gains extend beyond more than that. If we are going to stop anywhere, this may be a good point to slow down in this rally."

David Rodriguez, quantitative strategist at DailyFX.com, a unit of retail FX broker FXCM in New York, echoed Osborne's sentiment. He said FXCM's FX volume data showed euro selling and U.S. dollar buying have slowed significantly despite the fact that the euro hit a 14-month low against the dollar, of $1.2832 . It last traded at $1.2835, down 0.7 percent. "A drop in enthusiasm could naturally turn into revulsion, and the dollar could turn lower in a hurry," said Rodriguez.

Osborne added that the Federal Reserve's interest rate forecasts released on Wednesday only served to confuse the market. "I just thought that the shift in the U.S. rate forecasts was marginal and the Fed is still very much data-dependent. If the U.S. jobs number for some reason weakens from here on, then those rate forecasts will change too," Osborne said.

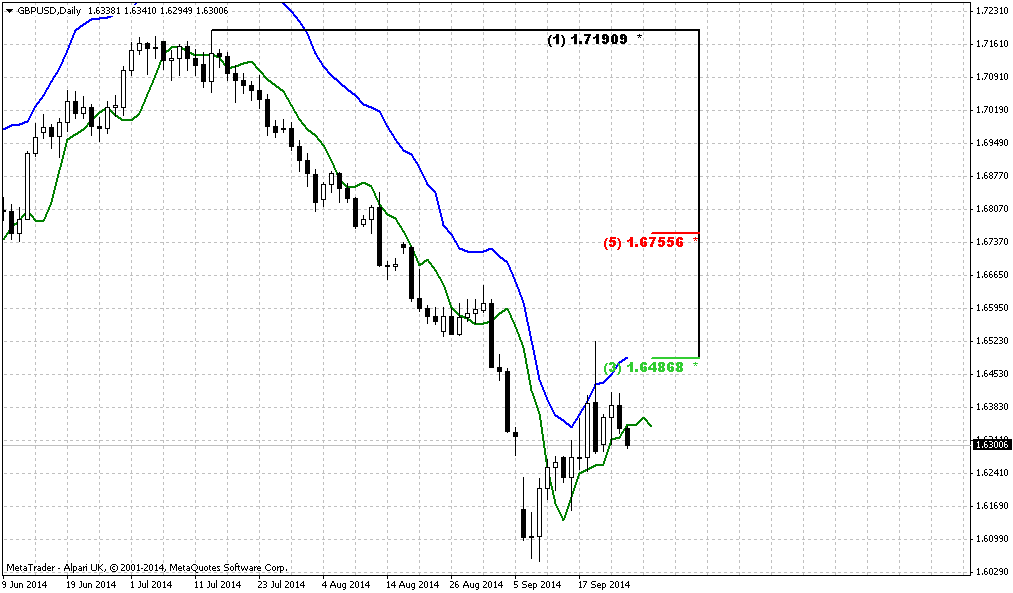

Sterling is the other big mover in the market, jumping to a two-week high against the dollar and a two-year peak versus the euro, after Scotland voted in a referendum to stay within the United Kingdom. However, the pound fell back on profit-taking in New York trading. Analysts pointed to issues such as promises for more powers to Scotland that could open up the prospects for some constitutional changes to next May's general election as risk factors for the pound. These could add some uncertainty to UK growth prospects and tie sterling down in the near term.

So, investors finally start to hint on EUR/USD overextension to the downside. We could definitely tell about it, since we have DiNapoli Oscillator Predictor tool… Anyway solid shift in sentiment should be visible in CFTC data. On current week report is very informative. It shows reducing of open interest and simultaneously solid jump in speculative longs:

Open interest:

Longs:

Shorts:

But how it could be? The answer is as follows. First – you can see solid drop of spread positions. It does not impact on sign of net position, but it impacts on open interest. Second – we can see significant decreasing of hedgers’ positions, i.e. commercials:

Longs:

Shorts:

So, as a result we see that speculators have increased longs, while hedgers has decreased hedge positions. By this information we probably could agree that chances on possible retracement is really not bad...

Currently our ratio of short positions has slightly decreased on 5% to 218606/(218606+77348)=73,8%.

In long term perspective our suggestion that EUR will stay under pressure for long time but as Fed has kept moderately dovish rethoric, EUR downward action will be more gradual and smooth.

We still think that recent significant ECB meeting brings new colors to current balance. If we even will not take on recent rate cutting, Draghi has announced 1 Trln EUR QE program. It means that EU and US financial policy will go on opposite courses.

Currently first driving factor is US economy improvement. Macroeconomy suggests that when economy comes out from recession into growth – the first stage is “desinflation growth”. Economy shows improvement without jump in inflation. May be right now we are entering in this stage, at least most analysts point on obvious improvements in US economy and there are no doubts about it.

Combining these two moments makes me think that probably this is really first stage. Second stage will be “inflationary growth” – this is a period when Fed’s rate dancing will start. Probably we will see first bell of this when wages in US will start to grow that we do not see yet. Since we have at least 8-12 months when rate will not change.

At the same time, it seems that EUR will remain under pressure as Draghi confirms this, and we see some reasons for this as well. Even before Ukranian crisis EU has its own problems that press ECB keeps rate low and even apply clearly dovish rethoric. As EU has intiated sunctions against Russia this will hurt trade balance and negatively impact on EU. At the same time this is just small part of goods that Russia could forbid potentially and recent data on GDP of Germany, France, Italy shows slightly worse that expected numbers. Other words, mutual sanctions do not assume improvement in economy.

Reducing of export for EU countries will mean also unemployment growth, reducing of trade balance, GDP and budget income. In current situation this is not good, especially for new members of EU that are more sensible to economic negative situations and that were hurted stronger in 2008. At the same time EU still has its own problems, such as desinflation in major economies.

Recent NATO meeting in Wales will totally put Europe in financial burden, since they call for increasing of military spending to 2% of GDP of each country. US Military companies take 75% of all NATO defense spendings and now European taxpayers and citizens will pay to US for approximately 2% of GDP annually. Hardly this will support EU economy. Surprisingly a lot of separatizm sentiment has risen in Europe. Scotland, next is Catalonia in November, and I will not be surprised if we will start to hear about Flanders in Belgium, North Italy and/or Florence.

And finally – carry trade. As dollar is coming out from low rates pit and euro is falling there – eur could replace dollar on carry trade action and stand in a row with Yen. It means that right now we should keep an eye, say on EUR/AUD, EUR/NZD pairs. Spinning up carry spiral could hurt EUR even more. Since investors will start to borrow and sell EUR on open market.

All these facts make us think that EUR/USD will continue move south with moderate pace during the 8-12 months and even could accelearted when real hazard of US rate hiking will appear if any positive shifts in EU economy will not come. Depending on how external political atmospehre will change – we will gradually adjust our view.

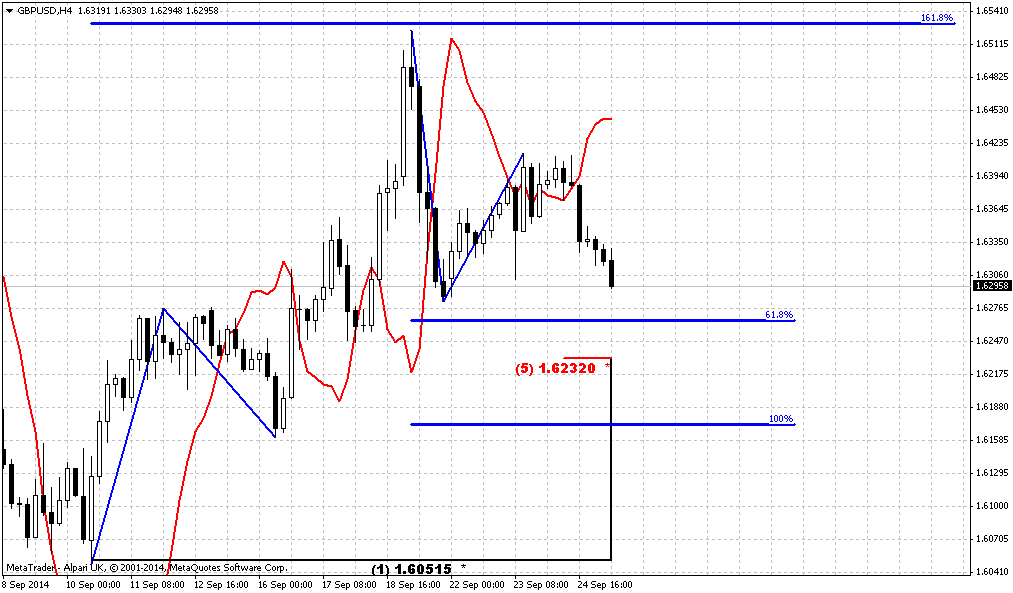

Technical

So, situation on long-term chart enters in new stage. Trend is bearish here and market has broken below Yearly PS1. As a rule, moving below any PS1 suggests appearing of new bearish trend or continuation of existing one. Since we’re talking about yearly pivots, we mean that 2015 could stand under sign of bears. Market is not at oversold – it stands below 1.20. So from this point of view market has no limits to move down further.

Now about targets. Next support is 1.2787 – major 5/8 Fib level. But sooner or later it seems that market will gravitate to 0.618 extension of Huge AB=CD pattern at 1.2190 level. This probably will become our next long-term target. And finally, I’m not sure but looks like here we have 3 black crows pattern – I’ve marked it by numbers. If this is indeed so, then it proves of new bear trend and 1.2190 target seems not as fantastic as it looks right now. Now is the question will we get third crow or not, since September bar has not closed yet, although currently September bar looks impressive.

Weekly

As CFTC data increases chances on possible retracement here and this thought is also confirmed technically by our Oscillator Predictor – our task is to catch first signs of possible bounce and patterns that could be the starting point of it.

Recently market has proved its extreme bearish sentiment by consequence of steps – breakout of K-support @1.3240 without any respect, open gap down, no retracement at 1.618 AB-CD completion point, moving below YPS1, and right now – close below hammer pattern.

Thus, right now we do not see any patterns that could justify bounce up. But... we can watch for couple of things. First is thrust. It’s perfect and has all chances to become foundation for DiNapoli directional pattern – either B&B or DRPO. Second – major 5/8 support @1.2787. This is only support till the major lows and it will coincide with weekly oversold again. We think that it will be major level for monitoring on coming week, because if any retracement will start at all – it probably will start from this support area.

Finally, we have to understand that weekly reversal will have to start from some extended pattern on daily chart. By “extended” I mean not a bullish engulfing or hammer, but 3-Drive, Butterfly, H&S or something of this sort. What we would like to say is that we do not need to hurry and rush to buy any hint on reversal.

That’s being said, first thing that we should watch for is reaching of major 5/8 Fib support.

Daily

Usually daily chart is most informative one, but on coming week here is not much to comment. As you can see there was very shy reaction on AB-CD completion target, only small flag pattern has been formed. The one thing that we can say here is daily oversold will coincide with the same 1.2787 Fib support area and weekly oversold.

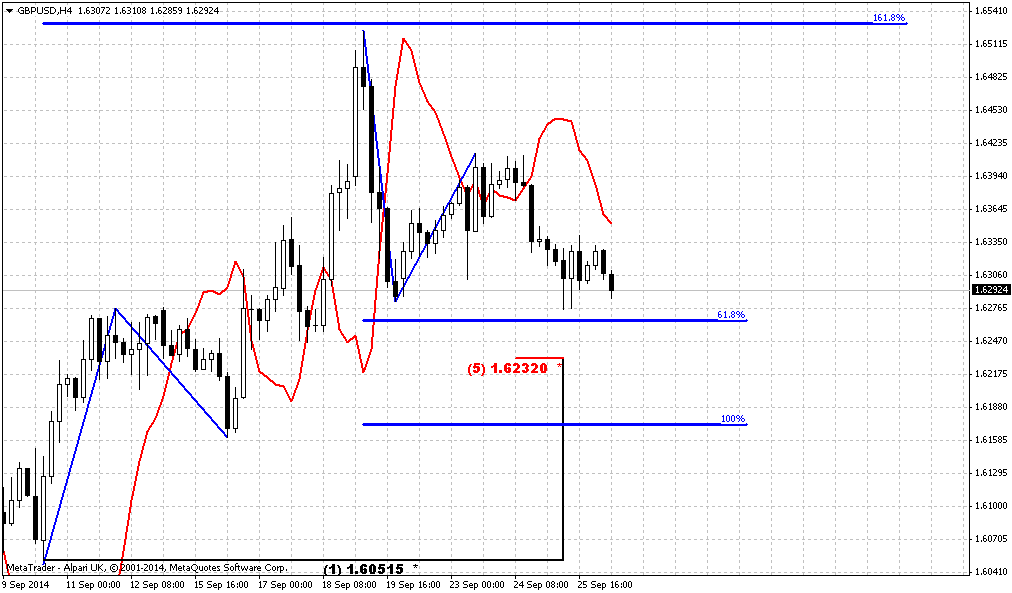

4-hour

Very important chart by far. Flag extention down shows that 1.618 level coincides presicely with the same area around 1.2760-1.2780. Here we have to exclude butterflies and 3-Drives, because relation between retracements and extensions does not let us to get acceptable combination of extensions. Thus, if market really will have any intention to reverse – we could get either H&S or say, Double Bottom. Take a note that WPS1 will stand in the same support area as well. And do not treat this picture as “must” scenario. I hope you understand that this is just suggestion by far – one of the possible scenarios. Based on changing sentiment and existence of solid support we make an assumption of possible retracement, but how definitely it will start and will it start at all – that’s the question.

1-hour

Here we have another pattern – AB=CD that has completion point guess where – right, at the same 1.2780s. Taking into consideration the fact that CD leg is much flatter, as a rule this leads to reversal and AB-CD works as reversal pattern, rather than just retracement before continuation to next farer target.

Conclusion:

Big picture on EUR has entered in new phase. It could turn so that our next target could be 1.21.

In shorter-term perspective we sign shy change in market sentiment and existence of strong support area around 1.2760-1.2780. This moment encourage on possible retracement.

Our trading plan suggests waiting when market will reach support, second – form reversal pattern.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.