Sive Morten

Special Consultant to the FPA

- Messages

- 18,673

Fundamentals

As Reuters reports, profit-taking sent gold prices lower on Friday after they rallied the previous day on the shooting down of a passenger plane in eastern Ukraine, but traders said interest in bullion will be quick to rise again if geopolitical tensions heighten. Gold, seen as a hedge against risk in times of uncertainty, jumped 1.5 percent on Thursday as investors bought back their bearish bets in the metal and sought shelter from further turmoil in equities after a Malaysian airliner over Ukraine was shot down. On Friday, no concrete measures had yet been taken by world leaders even though they called for a rapid investigation of the jetliner's downing and justice for nearly 300 deaths in an incident that could mark a pivotal moment in deteriorating relations between Russia and the West. "Gold's selling off because it doesn't seem like the situation is escalating yet," said Phillip Streible, senior commodities broker at RJ O'Brien in Chicago. "But gold prices could definitely shoot up if geopolitical tensions rise further because of this," he said. Analysts said bullion prices should also benefit from Israel's intensifying ground offensive into Gaza against Hamas militants who fired hundreds of rockets into Israel.

The CBOE volatility index, or the VIX, known as the “fear gauge,” which measures the short-term volatility of S&P 500 stock index options, fell sharply on Friday after posting its biggest one-day gain since April 2013. However, interest in gold options was limited and option volatility rose only slightly despite Thursday's sudden rally, said COMEX options floor trader Jonathan Jossen.

Open interest has not grown recently, as well as net position has not changed significantly. At the same time you can see, that the same level of OI previous corresponds to 2 times less net position. And in general, open interest decreases for 10 consecutive months. As big differences have not come in demand/supply balance – gold will probably work and smack on previous information and watch for any updates that could come on geopolitical tensions in Iraq and Ukraine.

Open interest has not grown recently, as well as net position has not changed significantly. At the same time you can see, that the same level of OI previous corresponds to 2 times less net position. And in general, open interest decreases for 10 consecutive months. As big differences have not come in demand/supply balance – gold will probably work and smack on previous information and watch for any updates that could come on geopolitical tensions in Iraq and Ukraine.

Also, guys, I already mention this in EUR research – keep a close eye on Boeing accident. This is not an occasion and there were a lot of plans at the back of this crush. This could lead to unexpected and strong changes in geopolitical situation and I’m sure it will…

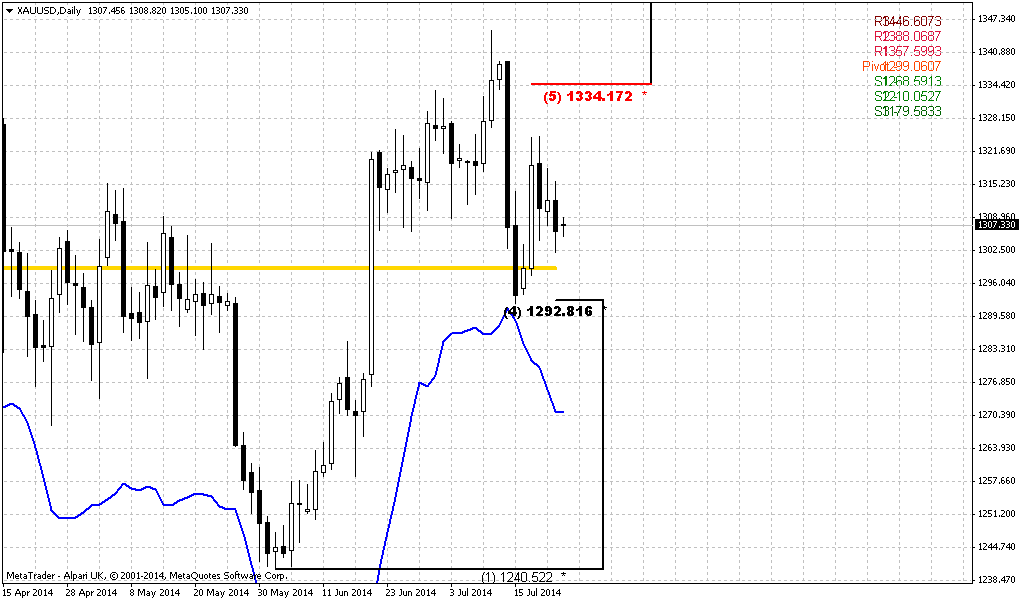

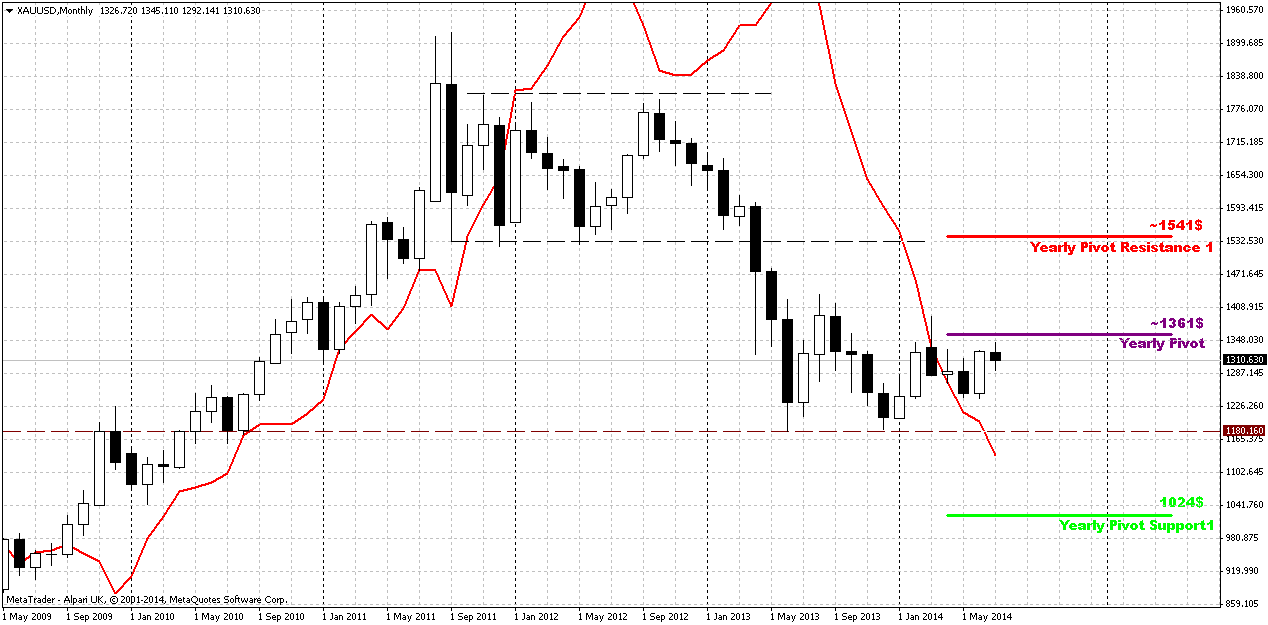

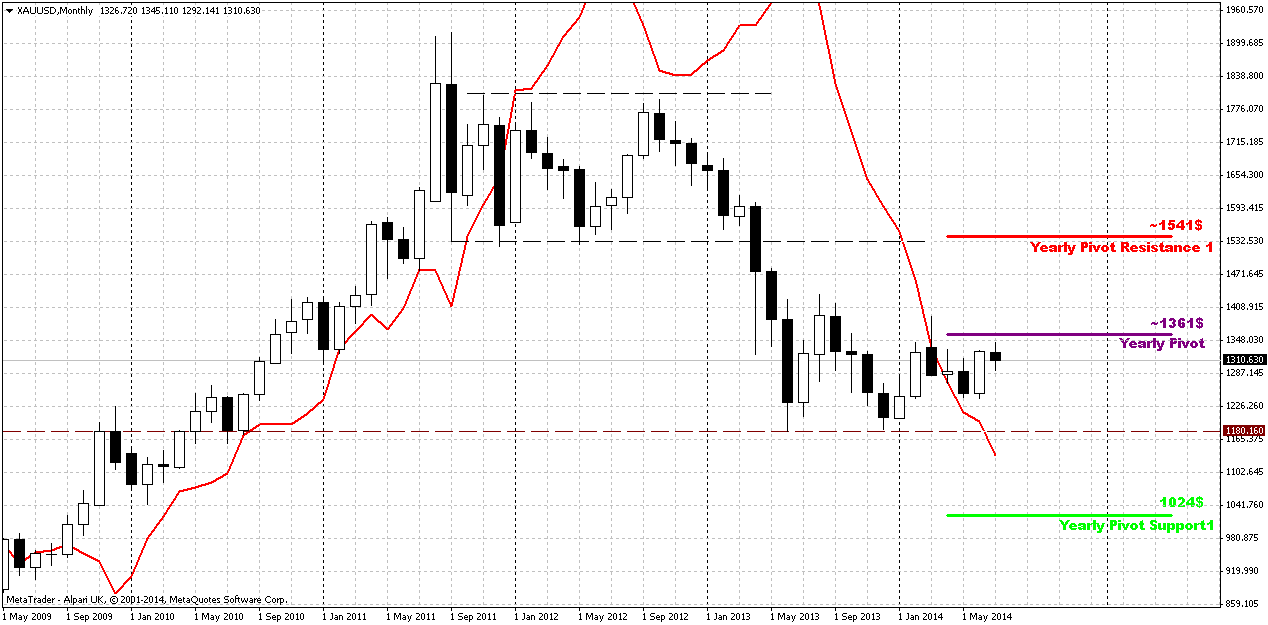

Monthly

Although recently market mostly shows upward action, long term picture changes slowly. Despite solid upward action our bearish grabber is still valid and price should pass solid distance to change situation drastically. Even if price will reach 1350 area – it will not change big picture. Situation could change only if market will move above 1400 area.

Currently there are too many variables on gold market that could impact on situation till the end of the year. Seasonal trend that should shift to bullish at the end of the August, coming data on US inflation and consumption, FOMC meeting and geopolitical tensions are also still exist. But on coming couple of weeks it is possible that market will turn finally to retracement. We see two reasons for that. First is recent upward action. It was mostly triggered by reaction on Iraq situaiton initially and then by India government and keeping import duty at 10%. This just was not supported by new money by CFTC report and SPDR fund reports on small but outflow. And second – as recent data was supportive for US dollar, investors probably accurately will start preparation for Fed meeting and this will press on gold. It will be probably very gradual and smooth but this will not let gold to move significantly higher.

Grabber pattern and pressure are important, but June, and especially recent 2-3 weeks has blocked gradual downward action and white candles break the bearish harmony of recent action. Next upside important level is 1360 – Yearly pivot point. If market will move above it (not neccesary it will happen in July) – this could be an indication that gold will continue move higher and this really could become a breaking moment on gold market. Otherwise, grabber will be valid and potentially could lead price back at least to 1180 lows again.

Among our driving factors, I mean seasonal demand; inflation and geopolitical tensions, latter will support gold due Iraq and Ukraine situation, but two others will remain under question. We suggest that seasonal demand could hurt by high import duties - at least it could be less than possible, since prices in India will be higher. Still seasonal demand will be supportive factor. Concerning inflation – it will mostly depend on Fed. If June data will show inflation growth but Fed will give more dovish comments than investors expect – this could support gold, if even data will be negative for gold. Not inflation hits gold per se (although it also does in long-term period), but rates level. Investors start to shift to interest bearing assets and reason is not in inflation per se, but in interest that investor could get from asset. That’s why Fed reaction and comments will be really important.

All these moments suggest that we should be focused still on tactical trading on daily chart, because there are too many uncertainty and “if-if” on monthly. And on coming couple of weeks probably we will be focused on possible bounce down.

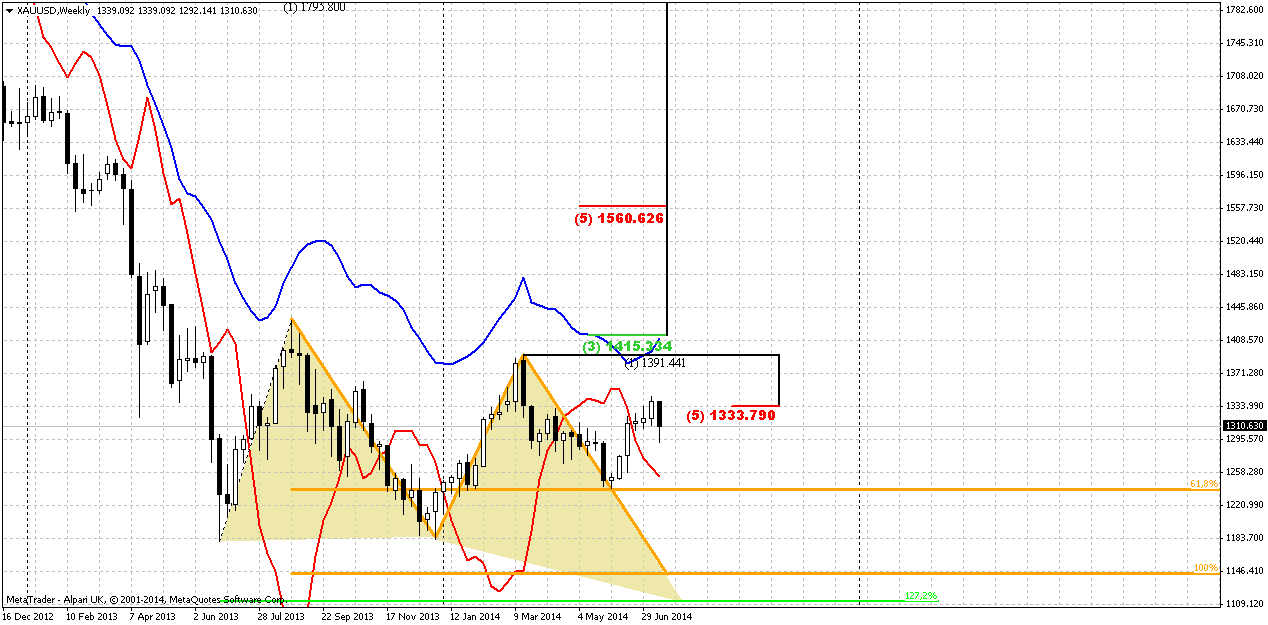

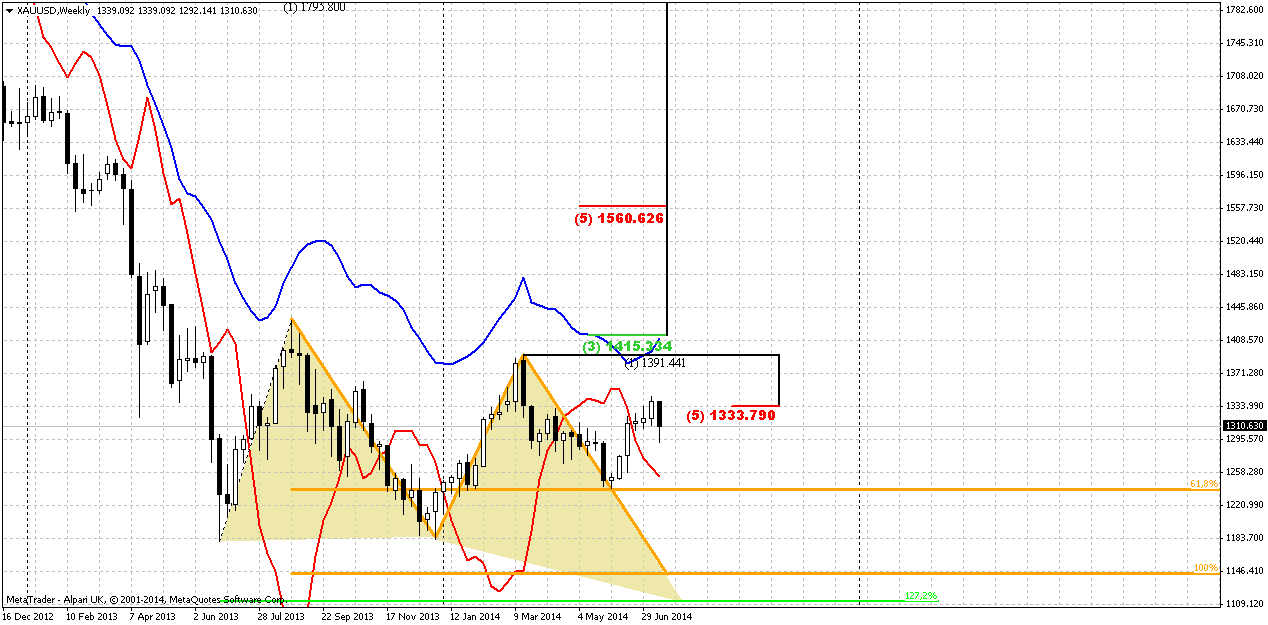

Weekly

Currently guys, here we have come to hot point. As we’ve said previously - in nearest couple of week the major question will be whether gold will hold above 1335 or not. And now we stand at hot point. Usually reaching of minor target does not suggest deep retracement. If market is really bearish it should continue move down soon and 1335 level – 5/8 Fib resistance will become the last edge. Retracement above 5/8 level will be too deep for minor bounce after reaching just minor AB=CD target. Spot traders tell that as soon as market reaches this area – buying volume starts to decline significantly and this is also confirmed by recent CFTC data.

Market’s return below 1335 and inability to hold above it keeps for us bearish setup, it makes setup still valid and it warns us that a bit too early to speak on bullish reversal yet. Many big banks (Goldman Sachs, BNP Paribas) also suggest this. Retracement to 1295 area has happened fast. Now we have classical picture – bearish engulfing right at 5/8 Fib resistance after reaching minor AB=CD target. Although just one downside week does not clarify overall situation, but it gives us some assistance. We know that 5/8 resistance at 1335 is crucial for us and market already has confirmed it by downside action. Thus, we probably could say that the recent top is invalidation point for bearish setup in short-term perspective. Market should re-start move down or bearish trend and AB=CD pattern will be broken.

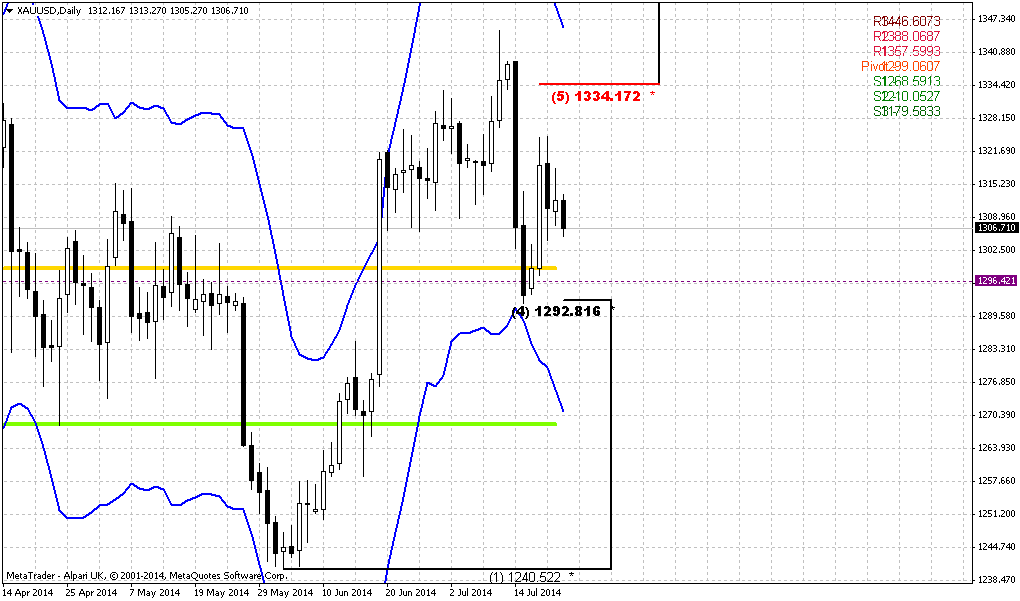

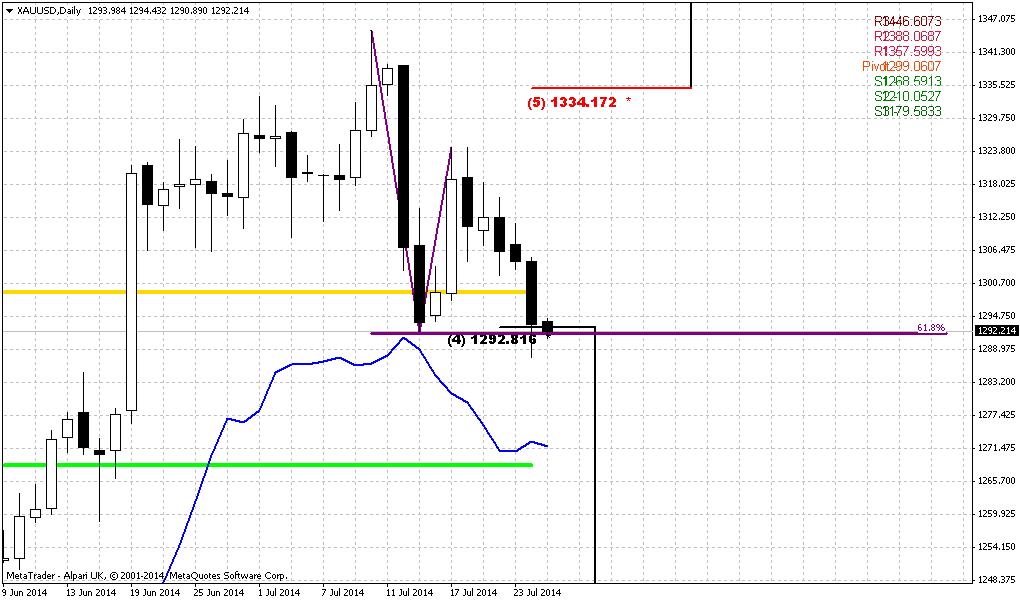

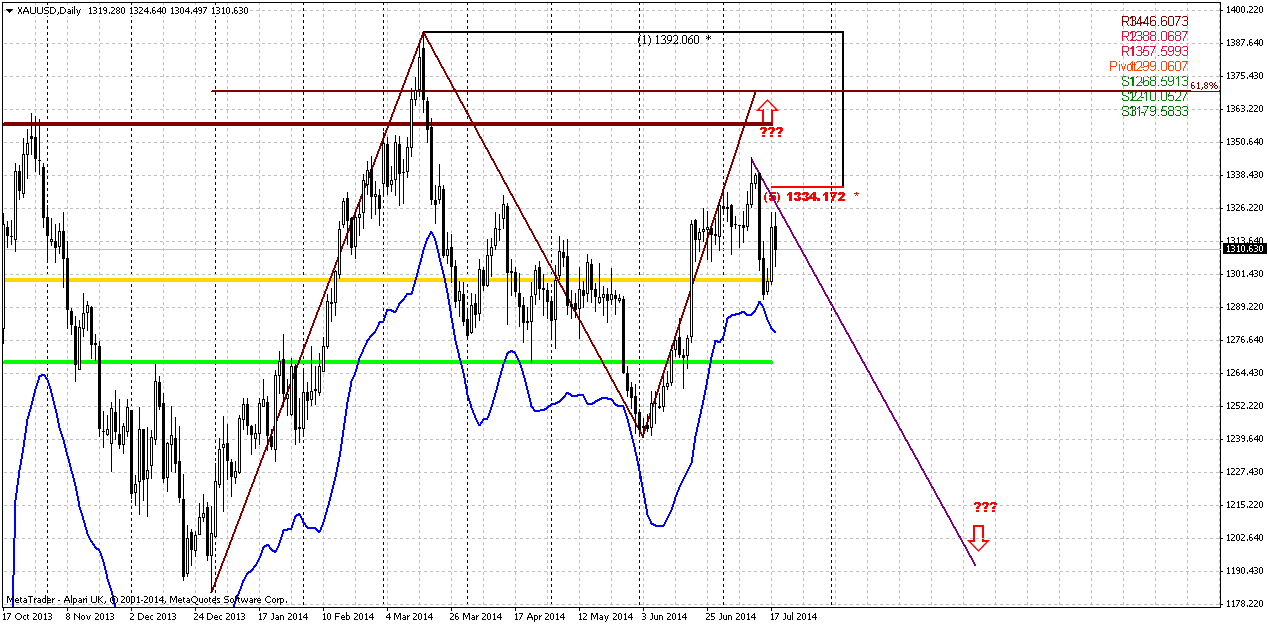

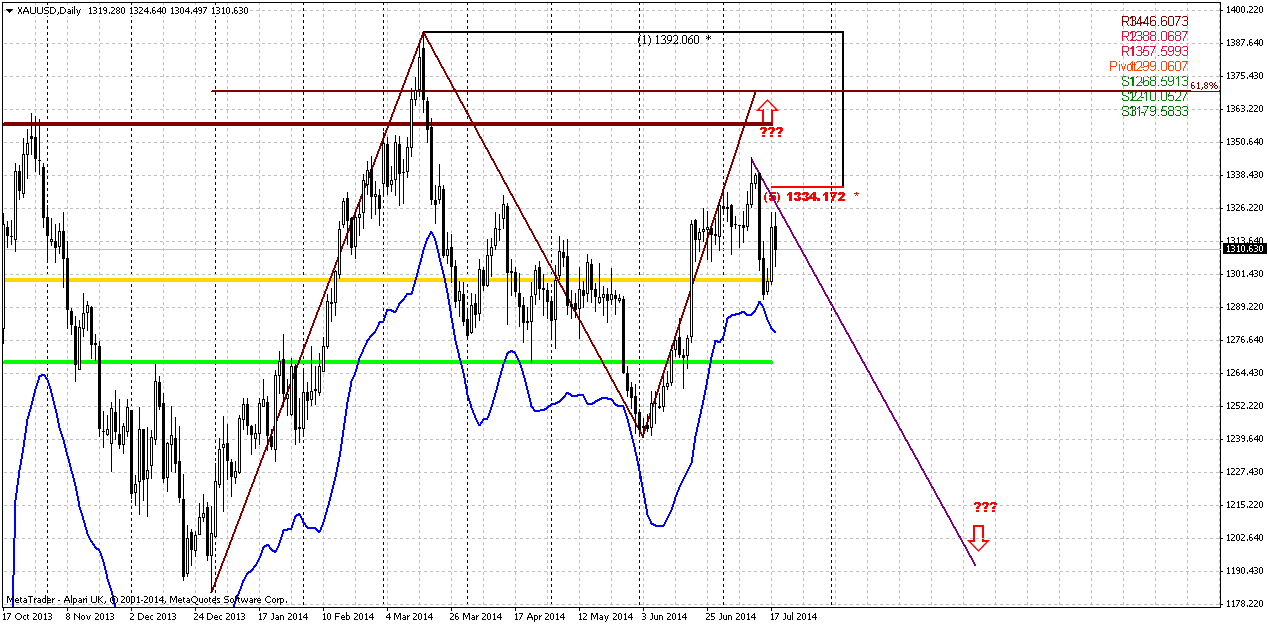

Daily

We have waited for retracement down and following upward bounce so long time, but they happened very quick – within a week. Now we draw major concerns on daily chart. Trend is bearish here. So, where market will follow? We have AB=CD up and it has not been completed yet – price has not reached 0.618 target at 1370, or it will follow down to AB=CD target first, then weekly targets and so on? But if it would follow down – why it has jumped up from MPP, does it confirm bullish sentiment? We suggest that in theory of upward continuation potentially three weak moments. First is market failure at 1335 and inability to hold above it. This simultaneously points as on corrective nature of upward action as problems with further upward continuation, since plunge was really strong. Second – is it really upward bounce has happened due MPP? It seems that mostly it has happened due oversold, because on a way up market has reached just 1325 Fib level of recent plunge and target of Stretch pattern, but has not even re-tested 1335 resistance. This is not quite common for the market that tries to move higher. Finally, third reason is a lack of physical demand on spot market. It is difficult to count on significant appreciation that demands breakout through strong levels without real big inflows. Closing of shorts can’t support rally for considerable period of time, especially it can’t push prices to new upward achievements.

Thus, it seems that downward continuation looks preferable strategically. Tactically we need confirmations. To keep bearish setup valid we need to control that price will remain below 1345 top and preferably will move below MPP again. For shifting to bullish setup we need price to stay above 1335 level.

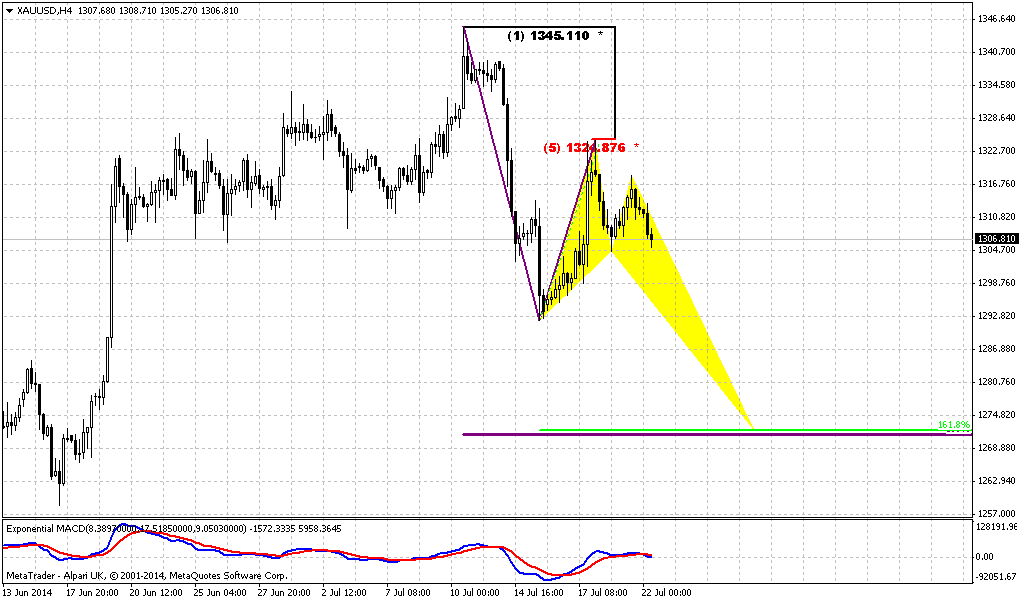

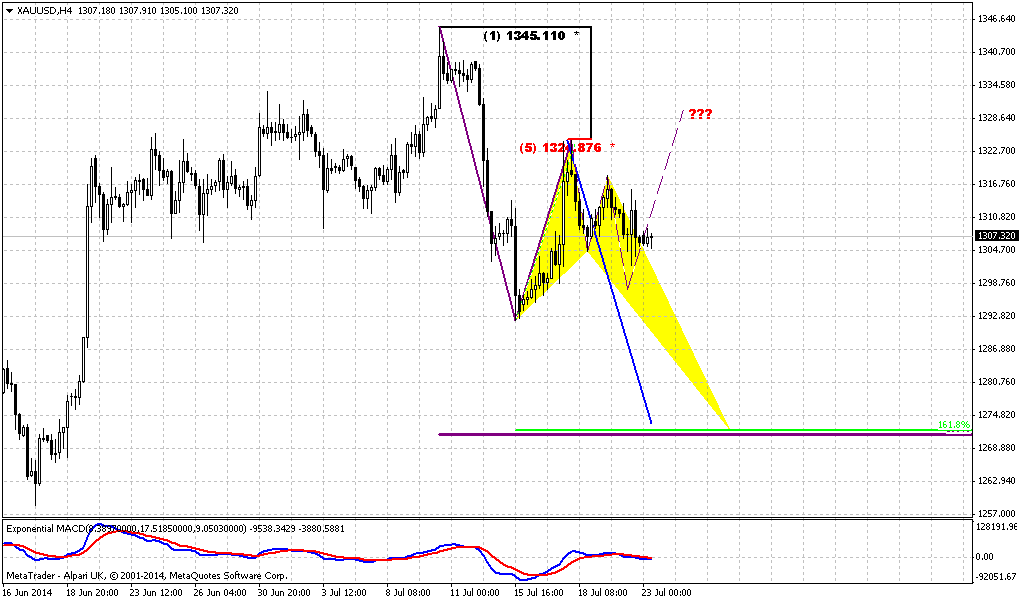

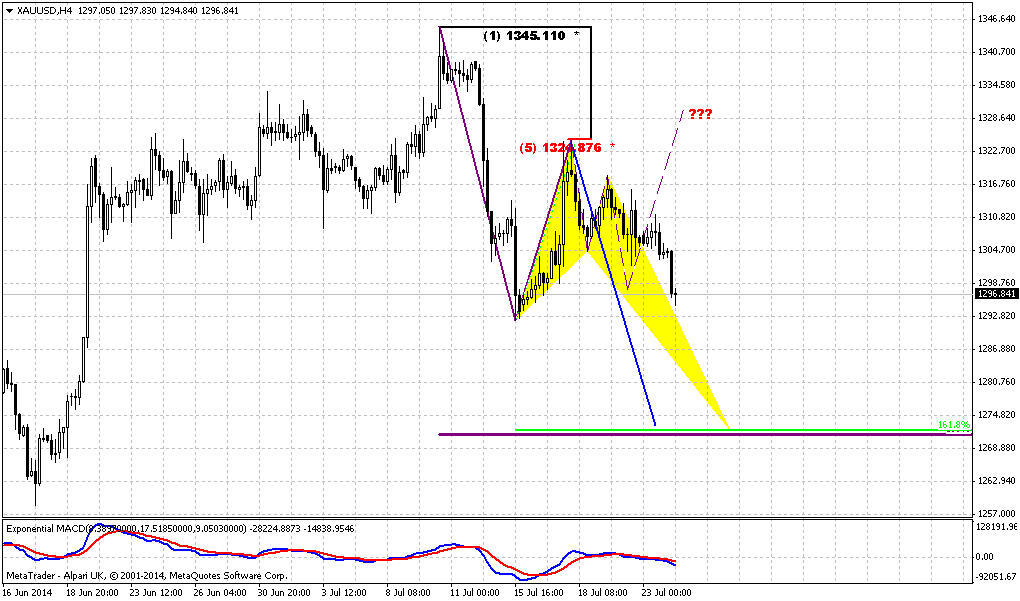

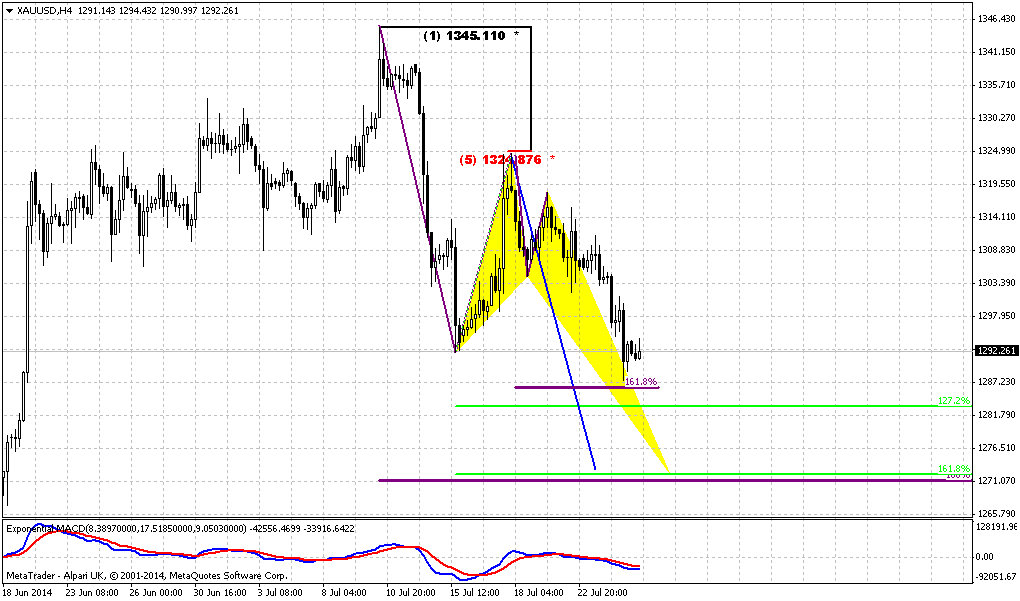

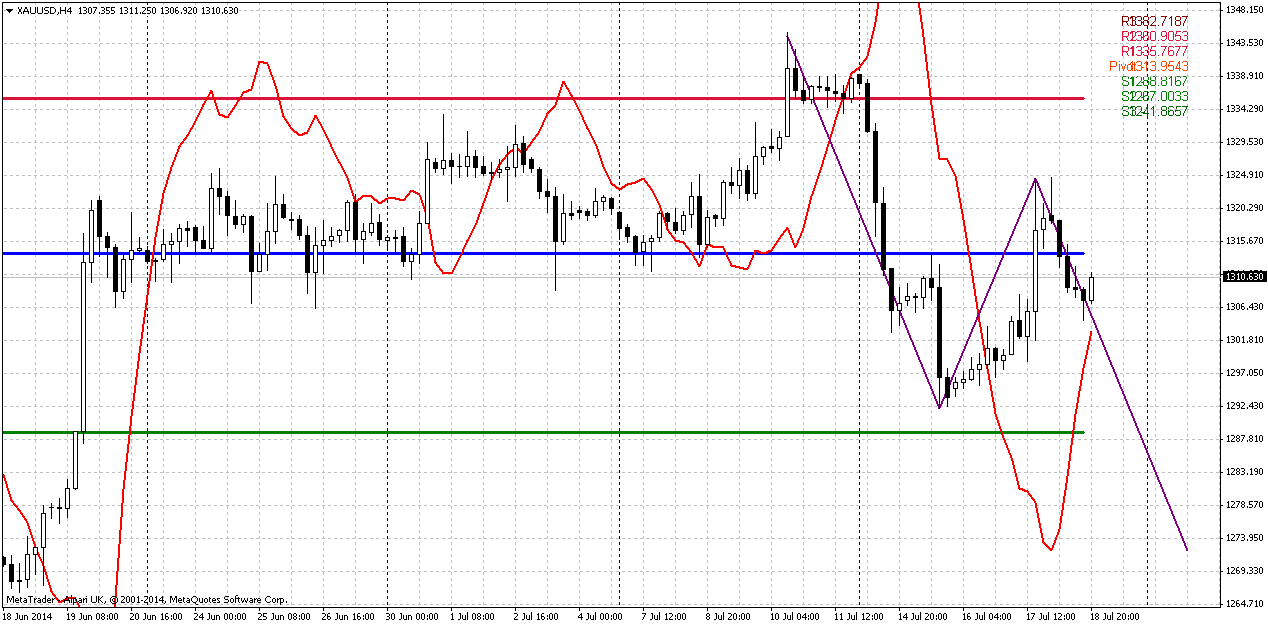

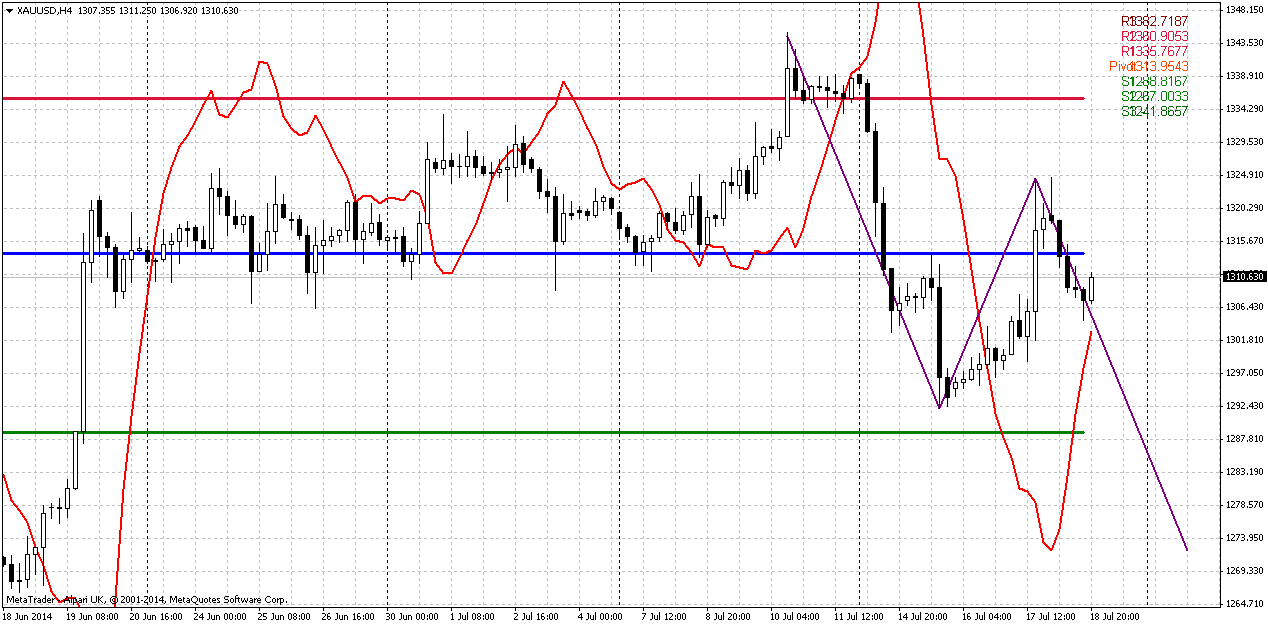

4-hour

So we’ve come to conclusion that in current situation chances on downward continuation seem prefferable. Meantime, in short-term perspective we could get minor AB=CD down on 4-hour chart. Gold has not formed H&S pattern that we’ve expected to get on previous week, but in general price action corresponds to our expectation. Interestingly that price during recent rebound has not been able to return back inside of previous consolidation. Now is a question whether this move down already has started or we still will see deeper retracement up?

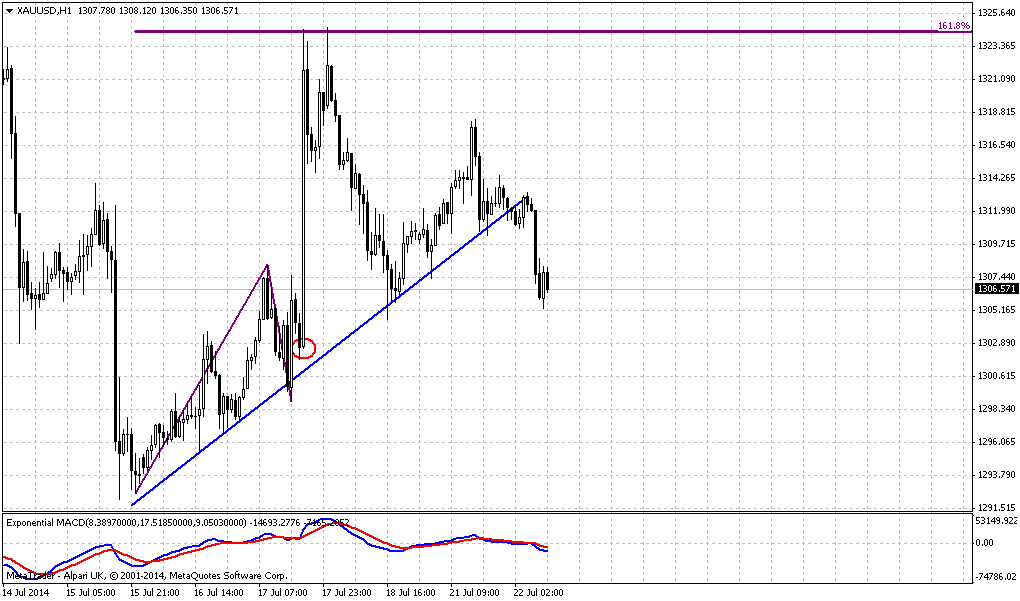

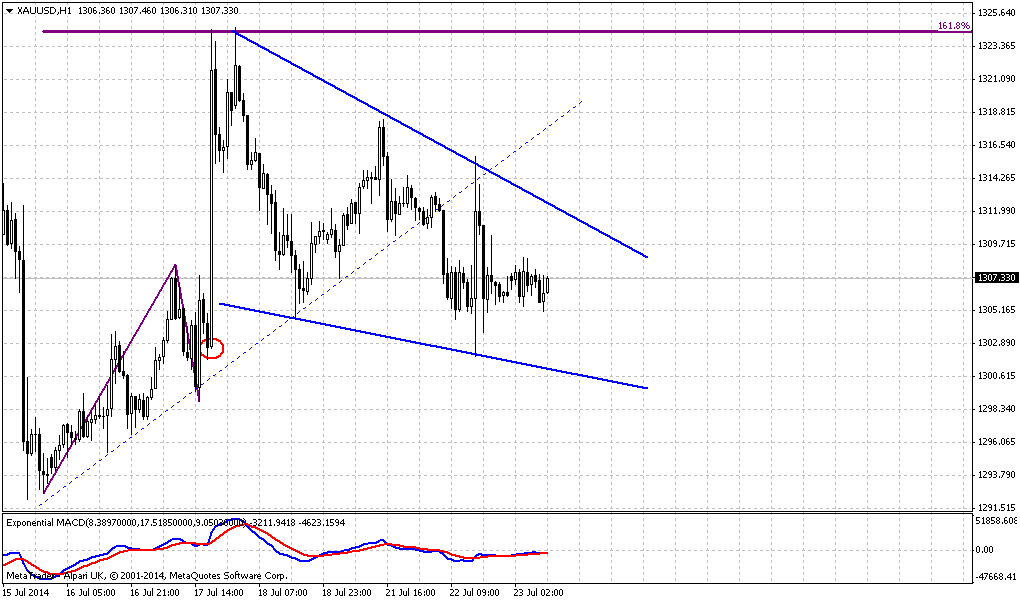

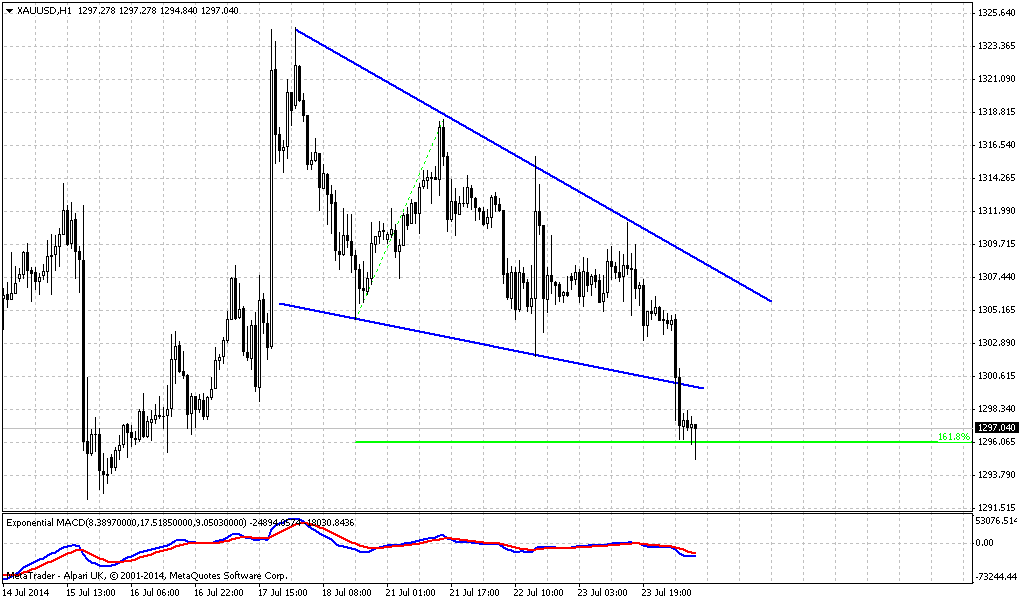

1-hour

In our Friday’s update we said that it is possible AB=CD upward retracement on hourly chart. If even it will happen – it will not change drastically the picture on 4-hour and daily charts – it will just slightly change starting point of CD leg. Hourly chart shows that this move could start from WPR1 and after completion of upward AB=CD pattern.

So what to do? WE have puzzle of nested AB=CD patterns on different time frames. First – watch for low of thrusting candle at hourly chart and WPP. If market will fail to pass through it and erase this white candle – that will be big move in advantage of downward AB=CD pattern on 4-hour chart.

This probably will be target of next week – AB=CD and MPS1 area around 1265-1268 area.

Conclusion:

Market has to breakout 1400 to change long-term situation significantly. Although we have some supportive impact from geopolitical turmoil and recent CFTC data but analysts still point on speculative character of current upward action and lack of support from institutional investors. This makes very difficult to make any forecasts of strength and timing of current upward action. Also keep an eye on situation on Boeing crush. This will be the cornerstone of geopolitical issues in nearest future.

Short-term situation looks messy – we have a set of AB=CD’s in different directions. Thus, let’s deal with them one by one and we will start from the shortest one – on hourly chart…

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.

As Reuters reports, profit-taking sent gold prices lower on Friday after they rallied the previous day on the shooting down of a passenger plane in eastern Ukraine, but traders said interest in bullion will be quick to rise again if geopolitical tensions heighten. Gold, seen as a hedge against risk in times of uncertainty, jumped 1.5 percent on Thursday as investors bought back their bearish bets in the metal and sought shelter from further turmoil in equities after a Malaysian airliner over Ukraine was shot down. On Friday, no concrete measures had yet been taken by world leaders even though they called for a rapid investigation of the jetliner's downing and justice for nearly 300 deaths in an incident that could mark a pivotal moment in deteriorating relations between Russia and the West. "Gold's selling off because it doesn't seem like the situation is escalating yet," said Phillip Streible, senior commodities broker at RJ O'Brien in Chicago. "But gold prices could definitely shoot up if geopolitical tensions rise further because of this," he said. Analysts said bullion prices should also benefit from Israel's intensifying ground offensive into Gaza against Hamas militants who fired hundreds of rockets into Israel.

The CBOE volatility index, or the VIX, known as the “fear gauge,” which measures the short-term volatility of S&P 500 stock index options, fell sharply on Friday after posting its biggest one-day gain since April 2013. However, interest in gold options was limited and option volatility rose only slightly despite Thursday's sudden rally, said COMEX options floor trader Jonathan Jossen.

Also, guys, I already mention this in EUR research – keep a close eye on Boeing accident. This is not an occasion and there were a lot of plans at the back of this crush. This could lead to unexpected and strong changes in geopolitical situation and I’m sure it will…

Monthly

Although recently market mostly shows upward action, long term picture changes slowly. Despite solid upward action our bearish grabber is still valid and price should pass solid distance to change situation drastically. Even if price will reach 1350 area – it will not change big picture. Situation could change only if market will move above 1400 area.

Currently there are too many variables on gold market that could impact on situation till the end of the year. Seasonal trend that should shift to bullish at the end of the August, coming data on US inflation and consumption, FOMC meeting and geopolitical tensions are also still exist. But on coming couple of weeks it is possible that market will turn finally to retracement. We see two reasons for that. First is recent upward action. It was mostly triggered by reaction on Iraq situaiton initially and then by India government and keeping import duty at 10%. This just was not supported by new money by CFTC report and SPDR fund reports on small but outflow. And second – as recent data was supportive for US dollar, investors probably accurately will start preparation for Fed meeting and this will press on gold. It will be probably very gradual and smooth but this will not let gold to move significantly higher.

Grabber pattern and pressure are important, but June, and especially recent 2-3 weeks has blocked gradual downward action and white candles break the bearish harmony of recent action. Next upside important level is 1360 – Yearly pivot point. If market will move above it (not neccesary it will happen in July) – this could be an indication that gold will continue move higher and this really could become a breaking moment on gold market. Otherwise, grabber will be valid and potentially could lead price back at least to 1180 lows again.

Among our driving factors, I mean seasonal demand; inflation and geopolitical tensions, latter will support gold due Iraq and Ukraine situation, but two others will remain under question. We suggest that seasonal demand could hurt by high import duties - at least it could be less than possible, since prices in India will be higher. Still seasonal demand will be supportive factor. Concerning inflation – it will mostly depend on Fed. If June data will show inflation growth but Fed will give more dovish comments than investors expect – this could support gold, if even data will be negative for gold. Not inflation hits gold per se (although it also does in long-term period), but rates level. Investors start to shift to interest bearing assets and reason is not in inflation per se, but in interest that investor could get from asset. That’s why Fed reaction and comments will be really important.

All these moments suggest that we should be focused still on tactical trading on daily chart, because there are too many uncertainty and “if-if” on monthly. And on coming couple of weeks probably we will be focused on possible bounce down.

Weekly

Currently guys, here we have come to hot point. As we’ve said previously - in nearest couple of week the major question will be whether gold will hold above 1335 or not. And now we stand at hot point. Usually reaching of minor target does not suggest deep retracement. If market is really bearish it should continue move down soon and 1335 level – 5/8 Fib resistance will become the last edge. Retracement above 5/8 level will be too deep for minor bounce after reaching just minor AB=CD target. Spot traders tell that as soon as market reaches this area – buying volume starts to decline significantly and this is also confirmed by recent CFTC data.

Market’s return below 1335 and inability to hold above it keeps for us bearish setup, it makes setup still valid and it warns us that a bit too early to speak on bullish reversal yet. Many big banks (Goldman Sachs, BNP Paribas) also suggest this. Retracement to 1295 area has happened fast. Now we have classical picture – bearish engulfing right at 5/8 Fib resistance after reaching minor AB=CD target. Although just one downside week does not clarify overall situation, but it gives us some assistance. We know that 5/8 resistance at 1335 is crucial for us and market already has confirmed it by downside action. Thus, we probably could say that the recent top is invalidation point for bearish setup in short-term perspective. Market should re-start move down or bearish trend and AB=CD pattern will be broken.

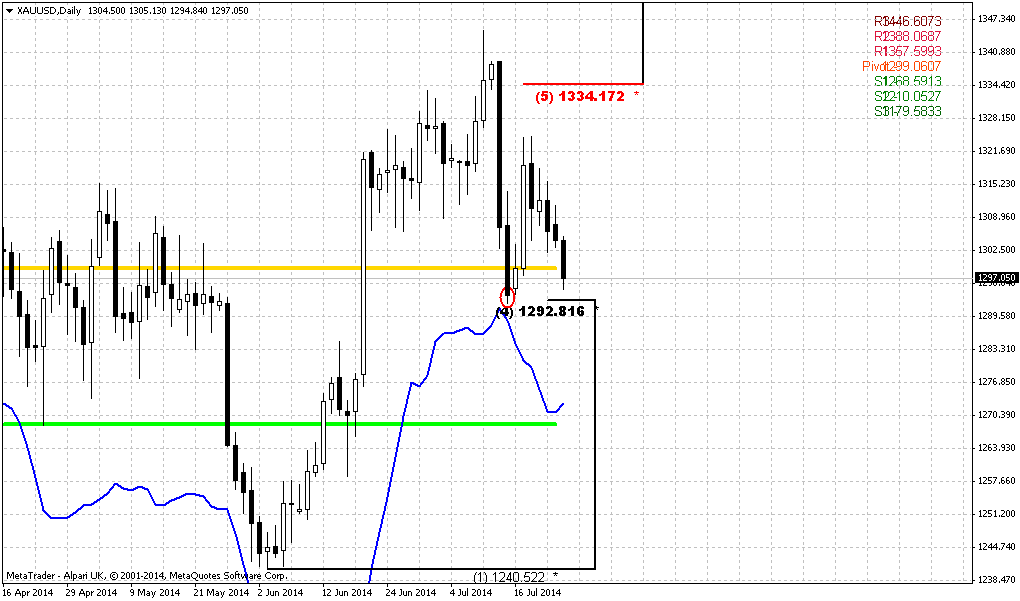

Daily

We have waited for retracement down and following upward bounce so long time, but they happened very quick – within a week. Now we draw major concerns on daily chart. Trend is bearish here. So, where market will follow? We have AB=CD up and it has not been completed yet – price has not reached 0.618 target at 1370, or it will follow down to AB=CD target first, then weekly targets and so on? But if it would follow down – why it has jumped up from MPP, does it confirm bullish sentiment? We suggest that in theory of upward continuation potentially three weak moments. First is market failure at 1335 and inability to hold above it. This simultaneously points as on corrective nature of upward action as problems with further upward continuation, since plunge was really strong. Second – is it really upward bounce has happened due MPP? It seems that mostly it has happened due oversold, because on a way up market has reached just 1325 Fib level of recent plunge and target of Stretch pattern, but has not even re-tested 1335 resistance. This is not quite common for the market that tries to move higher. Finally, third reason is a lack of physical demand on spot market. It is difficult to count on significant appreciation that demands breakout through strong levels without real big inflows. Closing of shorts can’t support rally for considerable period of time, especially it can’t push prices to new upward achievements.

Thus, it seems that downward continuation looks preferable strategically. Tactically we need confirmations. To keep bearish setup valid we need to control that price will remain below 1345 top and preferably will move below MPP again. For shifting to bullish setup we need price to stay above 1335 level.

4-hour

So we’ve come to conclusion that in current situation chances on downward continuation seem prefferable. Meantime, in short-term perspective we could get minor AB=CD down on 4-hour chart. Gold has not formed H&S pattern that we’ve expected to get on previous week, but in general price action corresponds to our expectation. Interestingly that price during recent rebound has not been able to return back inside of previous consolidation. Now is a question whether this move down already has started or we still will see deeper retracement up?

1-hour

In our Friday’s update we said that it is possible AB=CD upward retracement on hourly chart. If even it will happen – it will not change drastically the picture on 4-hour and daily charts – it will just slightly change starting point of CD leg. Hourly chart shows that this move could start from WPR1 and after completion of upward AB=CD pattern.

So what to do? WE have puzzle of nested AB=CD patterns on different time frames. First – watch for low of thrusting candle at hourly chart and WPP. If market will fail to pass through it and erase this white candle – that will be big move in advantage of downward AB=CD pattern on 4-hour chart.

This probably will be target of next week – AB=CD and MPS1 area around 1265-1268 area.

Conclusion:

Market has to breakout 1400 to change long-term situation significantly. Although we have some supportive impact from geopolitical turmoil and recent CFTC data but analysts still point on speculative character of current upward action and lack of support from institutional investors. This makes very difficult to make any forecasts of strength and timing of current upward action. Also keep an eye on situation on Boeing crush. This will be the cornerstone of geopolitical issues in nearest future.

Short-term situation looks messy – we have a set of AB=CD’s in different directions. Thus, let’s deal with them one by one and we will start from the shortest one – on hourly chart…

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.