Sive Morten

Special Consultant to the FPA

- Messages

- 18,673

Fundamentals

Gold prices rose on Friday, recovering from their lowest in nearly three months hit earlier in the session, after disappointing U.S. payrolls data tempered speculation that the Federal Reserve will raise interest rates any time soon.

Bullion pared some gains, however, after Ukraine and rebels agreed a ceasefire, seen as the first step towards ending a conflict in eastern Ukraine that has caused the worst standoff between Moscow and the West since the Cold War ended.

U.S. employers hired the fewest number of workers in eight months in August and more Americans gave up the hunt for jobs, providing a cautious U.S. central bank with more reasons to wait longer before raising interest rates.

"The higher gold prices are reflecting the expectation the Fed will not immediately raise interest rates after the weak job numbers, but the ceasefire deflated safe-haven appetite somewhat," said Alfonso Esparza, senior currency strategist at online forex broker Oanda in Toronto.

In overnight trade, the metal hit $1,256.90, its lowest since June 11. Gold prices posted a 1.6 percent drop for week on economic optimism and as the dollar rallied, marking their third decline in the last four weeks.

The U.S. Labor Department said non-farm payrolls rose 142,000 last month, the smallest increase in eight months. U.S. short-term interest rate futures contracts rose after the report, leading traders to boost bets the Fed will not raise interest rates until the second half of 2015.

In the main physical gold markets, where demand has been soft in recent months, buying picked up slightly. Asian dealers said premiums in China, the top buyer of gold, rose to $4 to $5 an ounce above spot prices, from $3 in the previous session.

However, SPDR Gold Trust, the world's largest gold-backed exchange-traded fund and a good measure of investor sentiment, said its holdings fell 4.78 tonnes to 785.73 tonnes on Thursday - the biggest one-day drop since April 16.

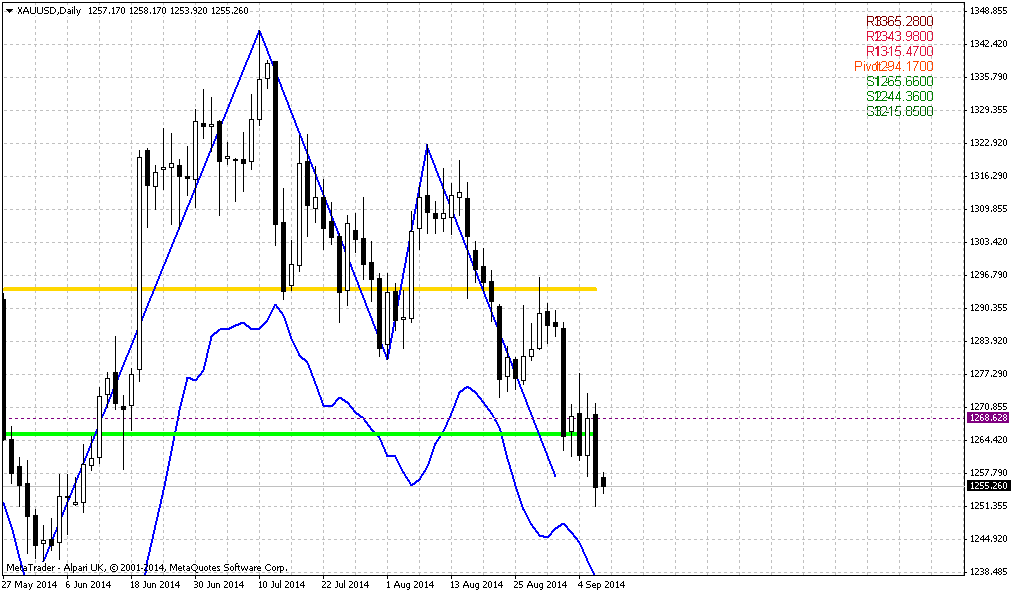

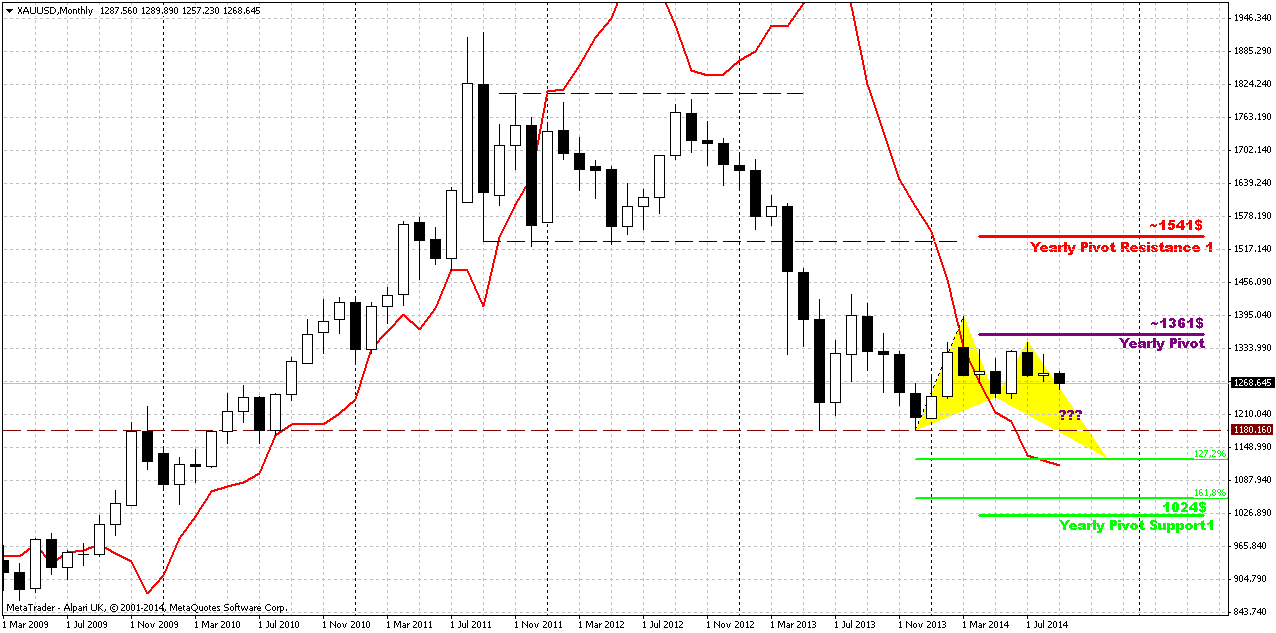

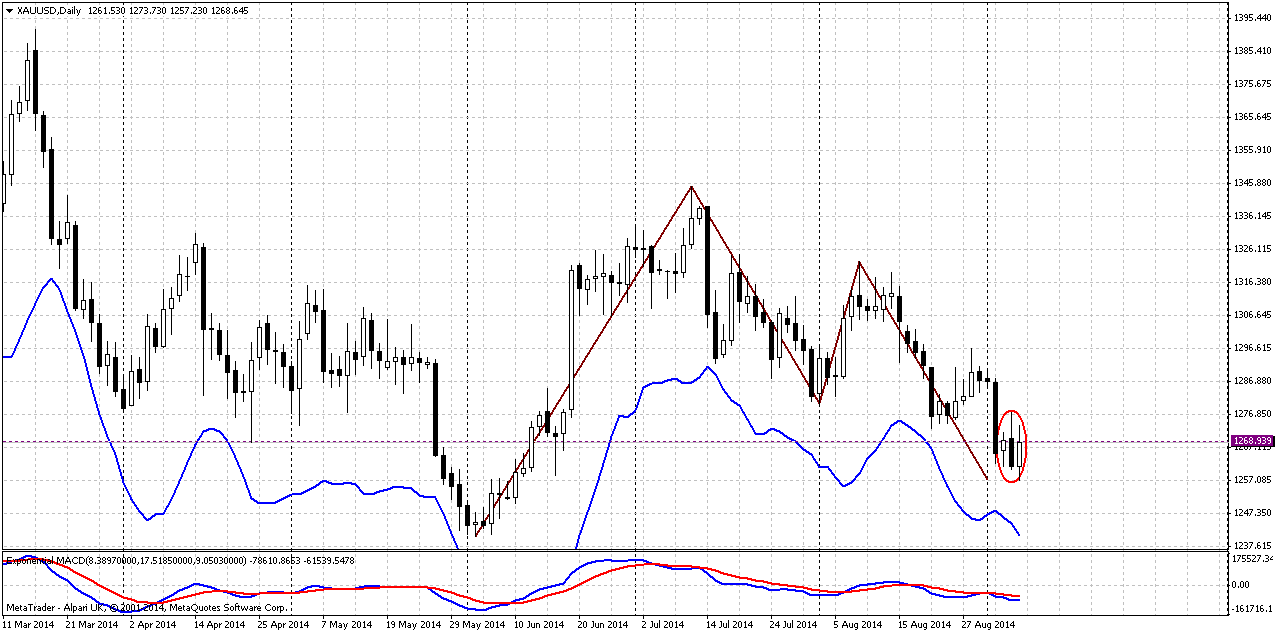

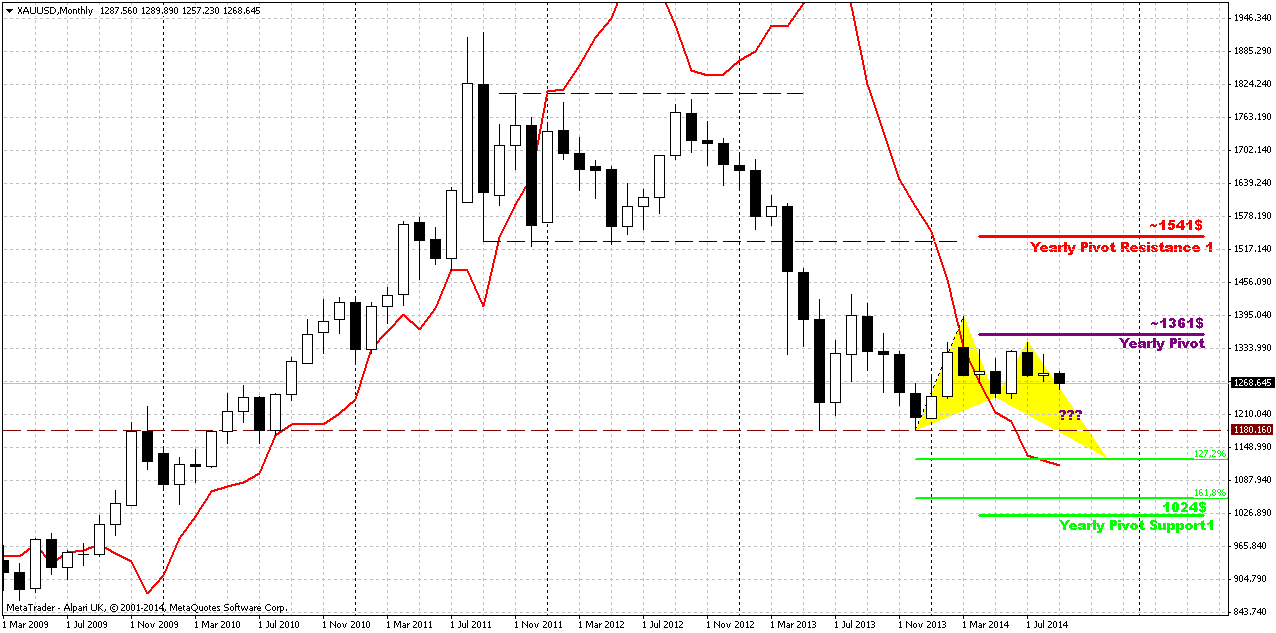

Monthly

Monthly

On recent week although market has closed slightly higher but in general week was in red.

As we’ve mentioned previously price should pass solid distance to change situation drastically. it could change only if market will move above 1400 area and currently we do not see any signs of it. Recent rally that has started in July seems exhausted and looses pace fast. Even coming shift in seasonal trend does not fascinate traders much. Physical demand stands weak, dollar strong, inflation weak and talks around rate hiking also does not add optimism to gold.

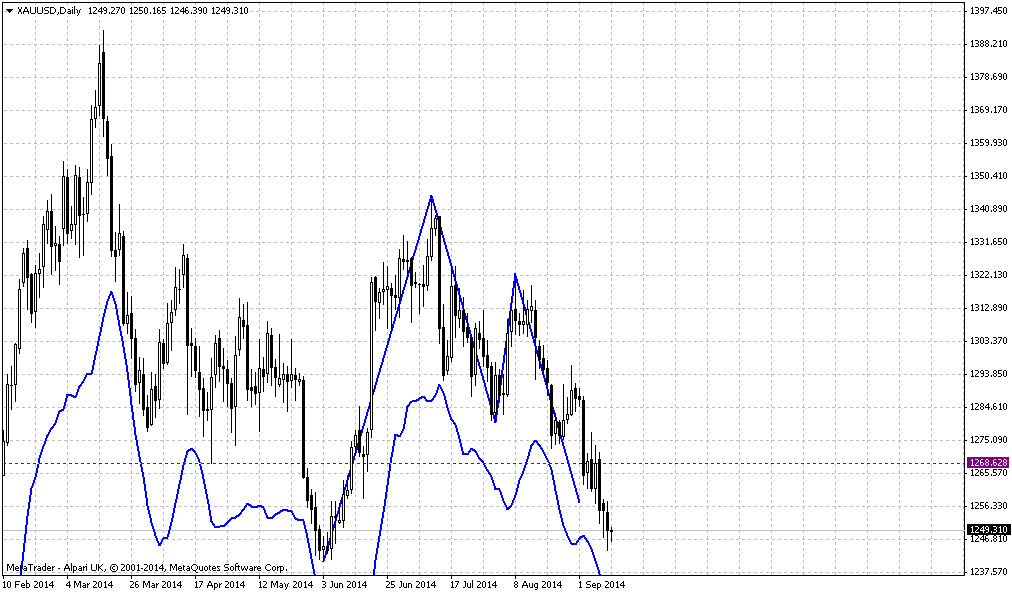

Since currently August mostly is an inside month for July our former analysis is still working. Although investors have not got hawkish hints from Fed and recent NFP data was slightly lower than analysts poll, major factors are still valid - good economy data, that right now is confirmed by US companies earning reports, weak physical demand – all these moments prevent gold appreciation. Recent comments from spot gold traders and CFTC data put more questions rather then answers on degree of support gold by seasonal trend and geopolitical tensions. Technically gold still stands at very important level that at least theoretically could keep chances on upward rebound. If price will fail here – we probably will start to talk about bear trend again. Tendency could take shape of butterfly as I’ve drawn on the chart, especially because it agrees with bearish grabber target.

It is interesting that during recent rally market was not able to re-test Yearly Pivot and later has vanished our bullish weekly grabbers. This moments make difficult to count on upward reversal. Also we suspect that we could get bearish dynamic pressure here. As you can see trend has turned bullish, but gold does not show any upward action. Splash in July has faded fast. Mostly this pattern will depend on action in September-October. Thus, any solid plunge down here and taking 1240 lows will confirm it. In this case butterfly will become a reality. Finally, overall action since the beginning of the year mostly bearish. Take a look – in the beginning of the year market has tested YPP and failed, then continued move down. During recent attempt to move higher – has not even reached YPP again.

That’s being said, situation on the monthly chart does not suggest yet taking long-term positions on gold. Still, fundamental picture is moderately bearish in long-term. Possible sanctions from EU and US could hurt their own economies as well, especially EU. Many analysts already have started to talk about it. It means that economies will start to loose upside momentum and inflation will remain anemic. In such situations investors mostly invest in interest-bear assets, such as bonds. Approximately the same comments we saw for recent 1-2 months from physical gold traders.

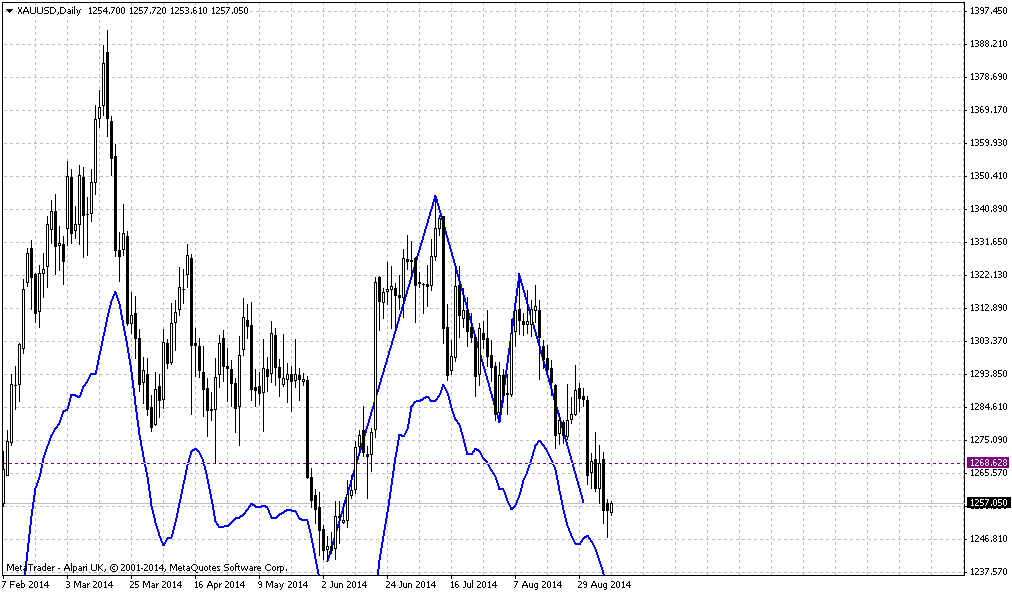

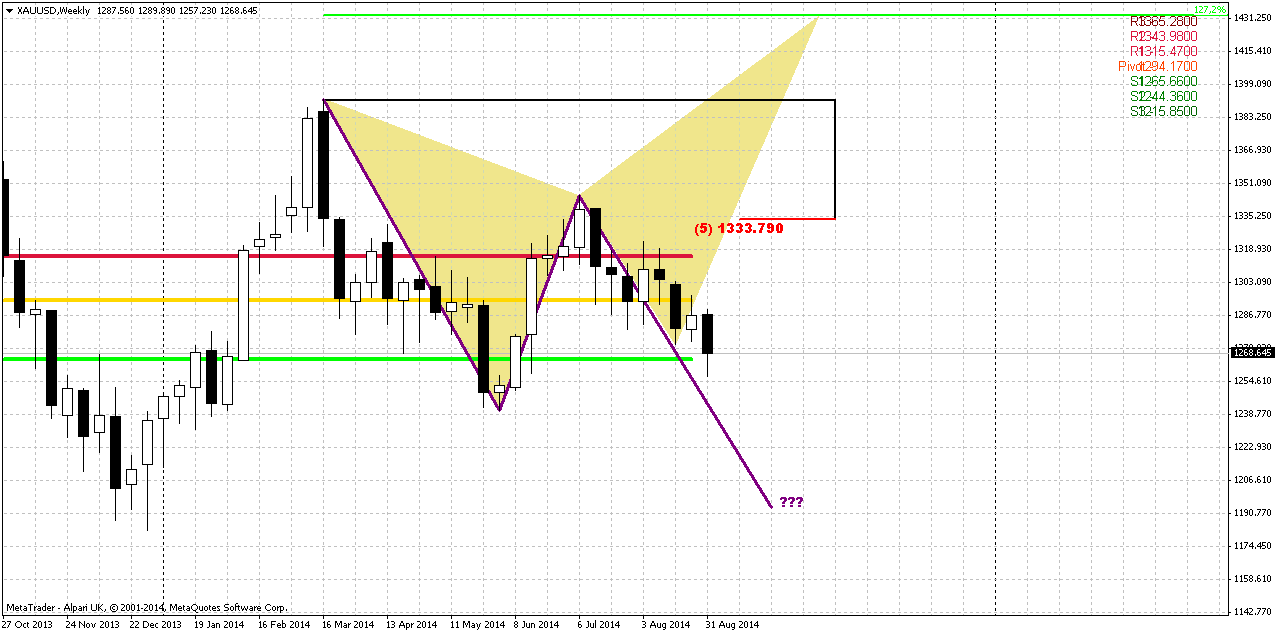

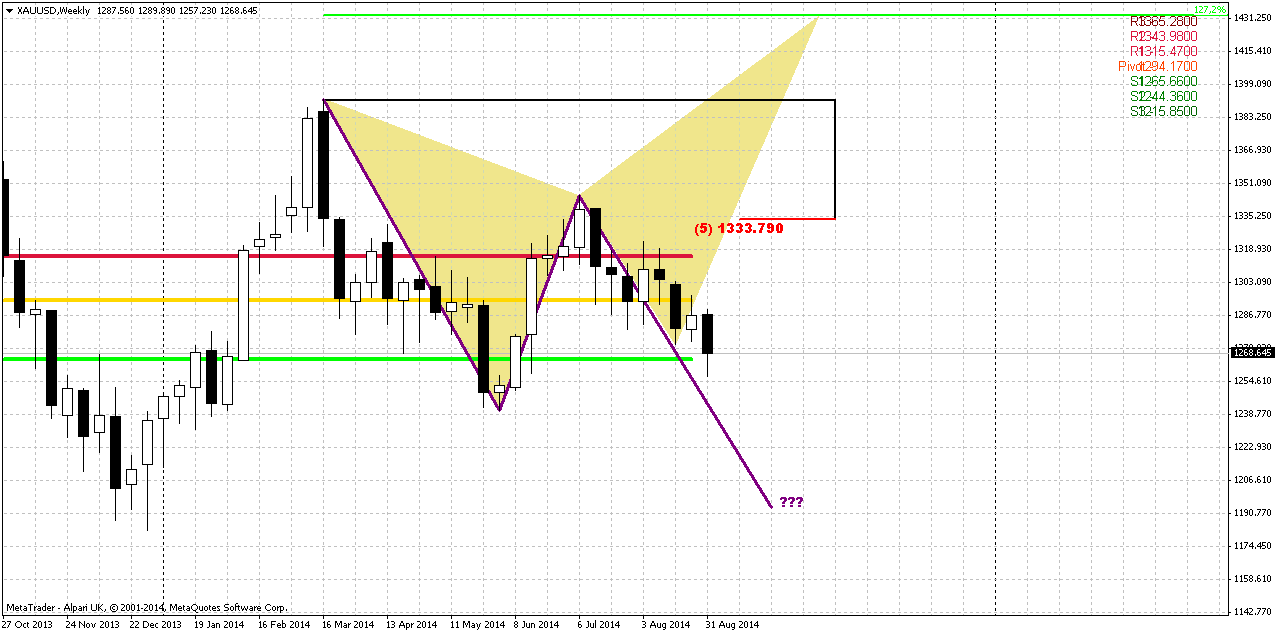

Weekly

On recent week gold has completed logical action and daily AB=CD pattern. AT the same time price has held above MPS1 and at least theoretically still kept chances on upward action. Although theoretical chances on upward action still exist as we’ve said this above and I even put this butterfly on chart, but, to be honest, guys, recent action brings more and more bearish signs.

Let’s follow through recent action:

Upward move from 1240 to 1340 was really nice. This has let reasons to speak about possible break on gold market. At the same time as we’ve mentioned many times – growth mostly was based on geopolitical reasons and had no support from real purchases.

When retracement has started and market has formed three in row bullish grabbers - that was normal - reasonable retracement out from 1333 Fib resistance. Bu later as you can see situation drastically has changed. Bullish trend, price above MPP and three in a row bullish grabbers has shifted to bearish trend, price has closed below MPP and grabbers were vanished.

Bounce up from 1270 two weeks ago mostly reminds some fake rather than real bullish challenge.

Price has closed almost below MPS1, CFTC data declares massive closing of longs and bounce up from 1270 mostly reminds some fake rather than real bullish challenge.

Gathering all this stuff together we come to conclusion that market has small chances to hold around and we should be ready for action to 1240 lows. Yes, some attempts could be made to bounce up due completion of daily AB-CD, geopolitical tensions and poor NFP data, but this is obviously too few to support significant rally.

For weekly chart crucial level will be 1240. Breaking through it will lead to solid consequences, such as – moving below MPS1, erasing of butterfly and solid confirmation of possible downward AB=CD pattern and in perspective monthly butterfly.

Following strictly to DiNapoli method we should search possibility to take short position, because we do not have bullish directional patterns here and trend as on monthly as on weekly stands bearish. Market is not at oversold.

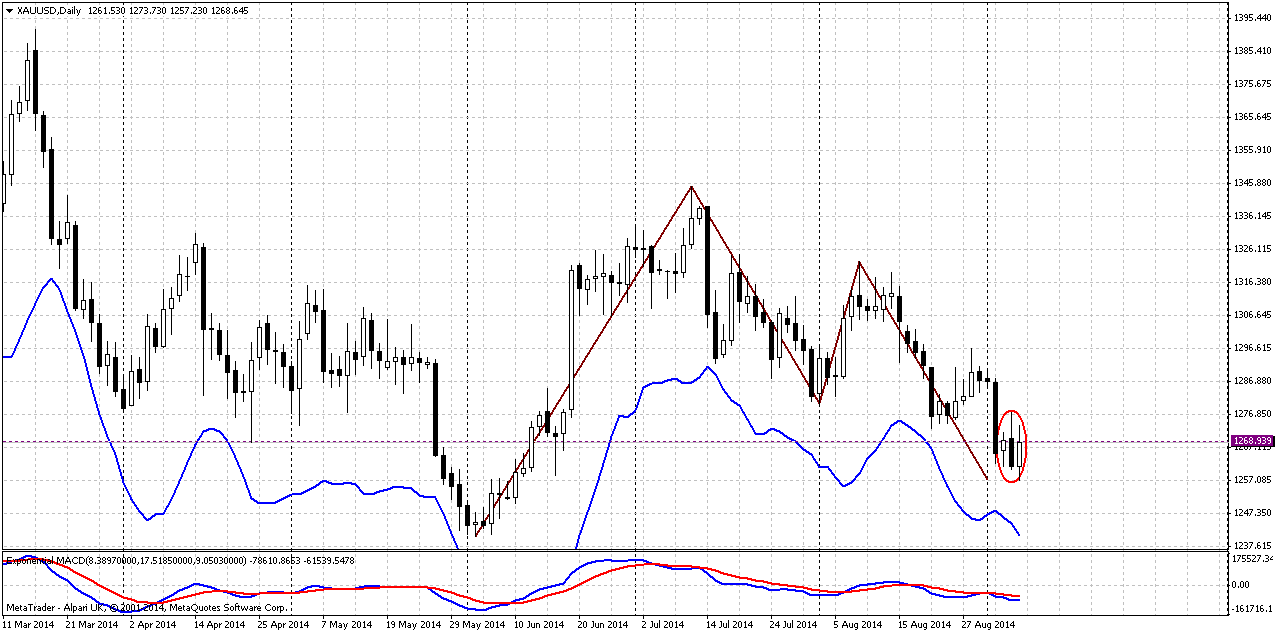

Daily

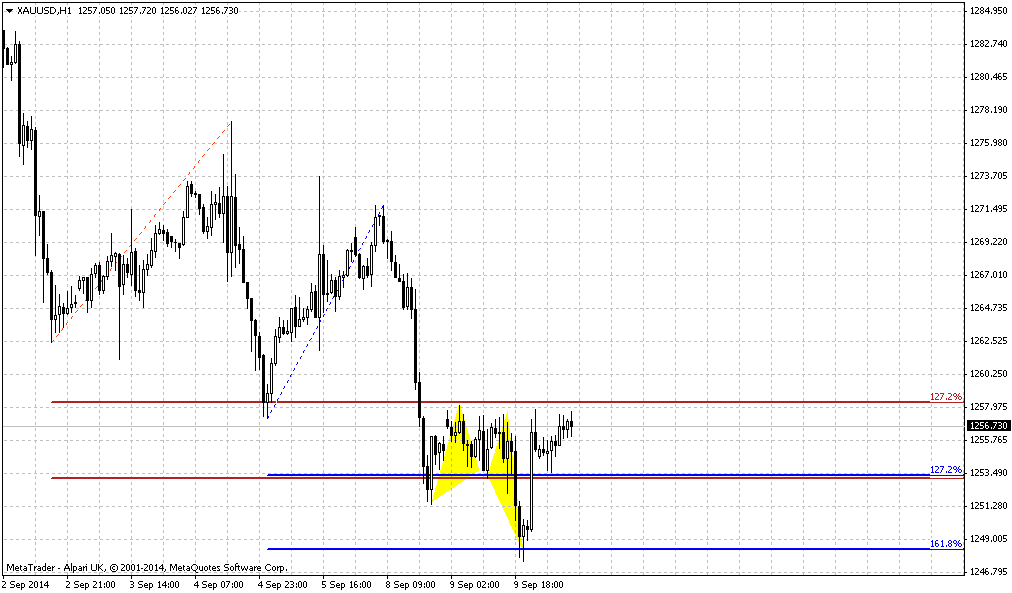

Here is, guys, this “chance” that we’ve mentioned in weekly part. In fact we have Gartley “222” Buy, right? Yes, market has moved slightly lower than bottom of “left shoulder” but this has happened just because of AB=CD target that stands slightly lower. On Friday market has hit it. At the same time downward acceleration right before AB=CD target is a bit worrying sign. Still, on coming week we mostly will deal with this AB-CD pattern and its completion point. If market will form any reversal pattern we could try to ride on retracement up.

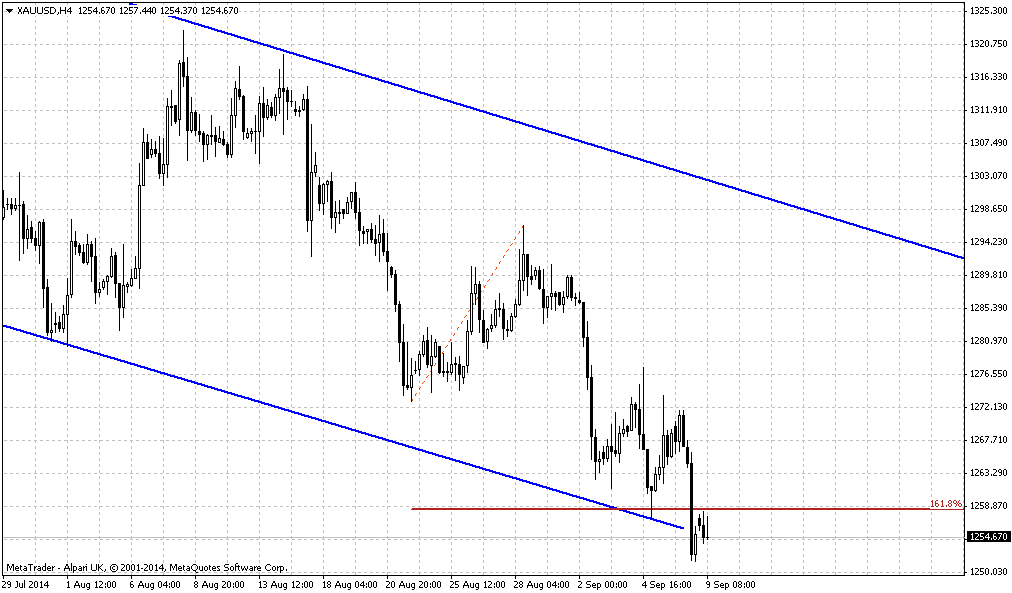

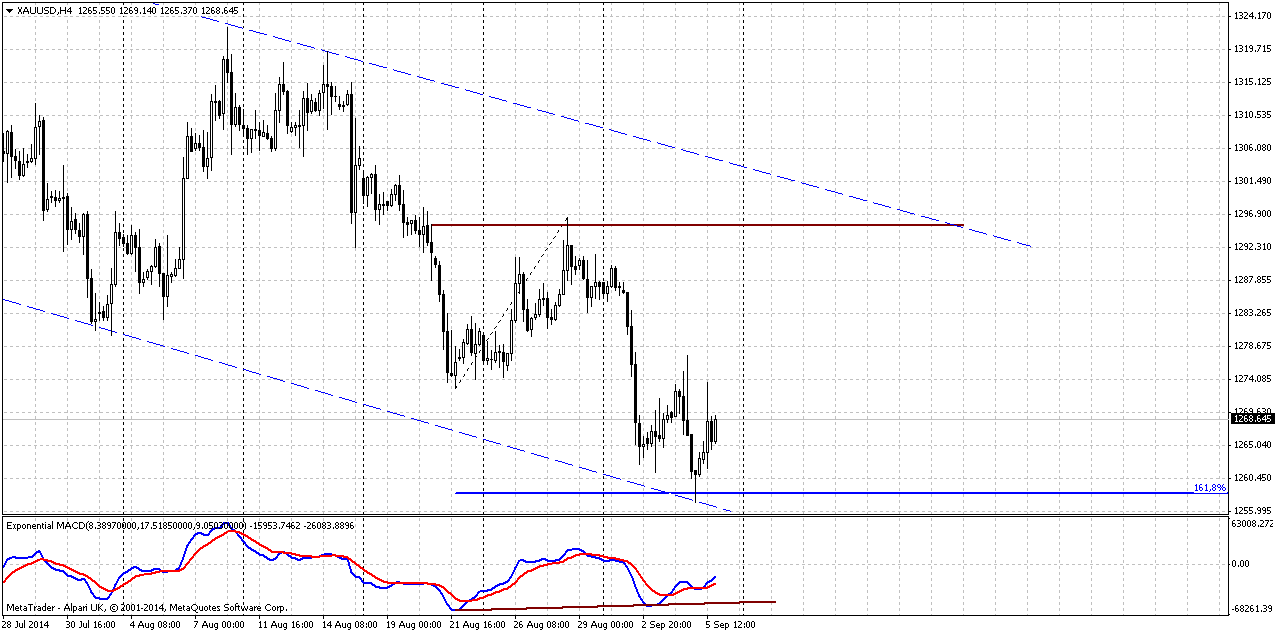

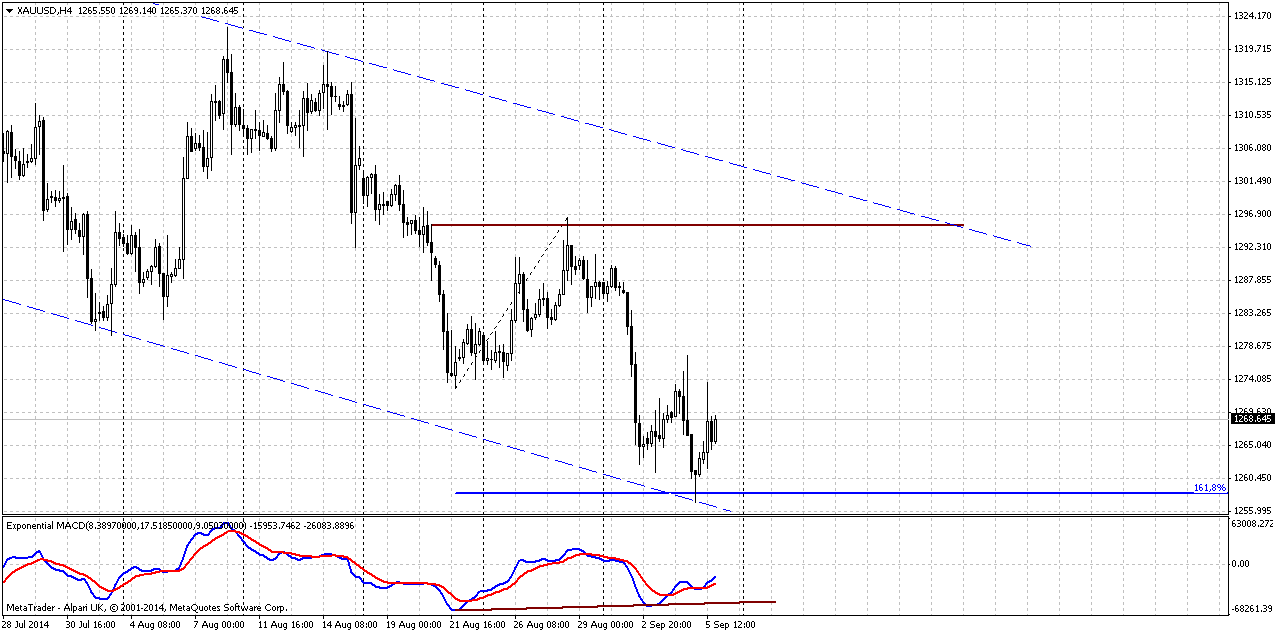

4-hour

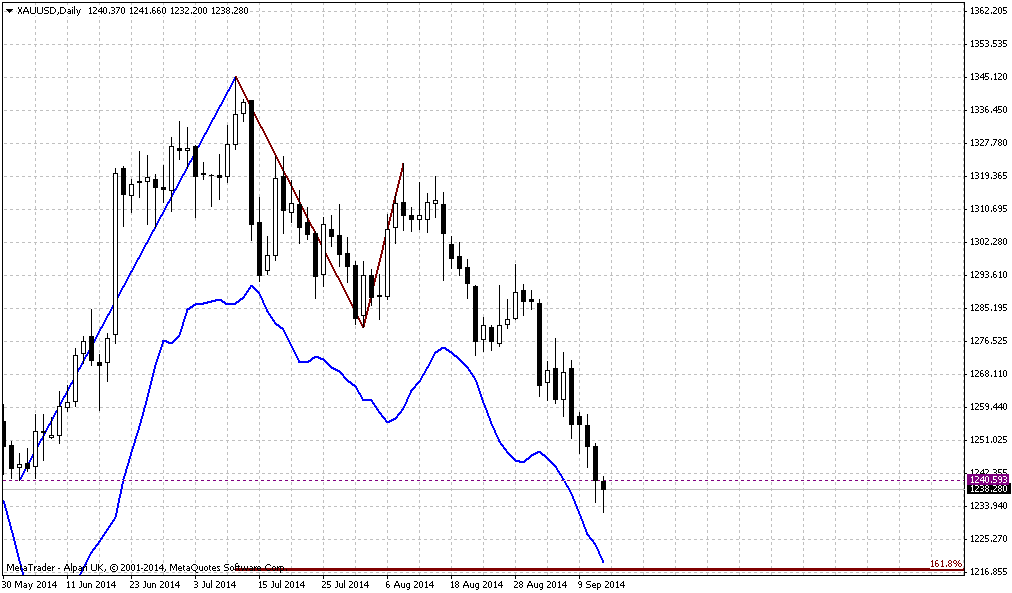

Here market stands in long term downward channel. But compares to previous bottoms – currently situation has changed since price has reached AB=CD target. Current bottom stands precisely at 1.618 of recent retracement up and market theoretically could form reverse H&S pattern. That is what we will be look for on coming week. Also currently it is accompanied by MACD divergence and do not forget that market still holds at MPS1.

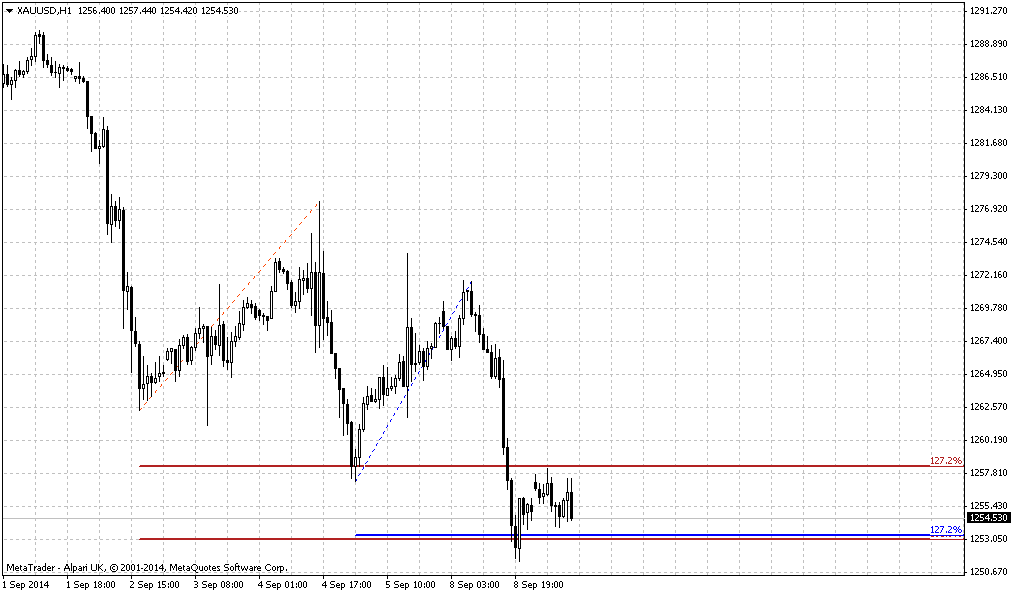

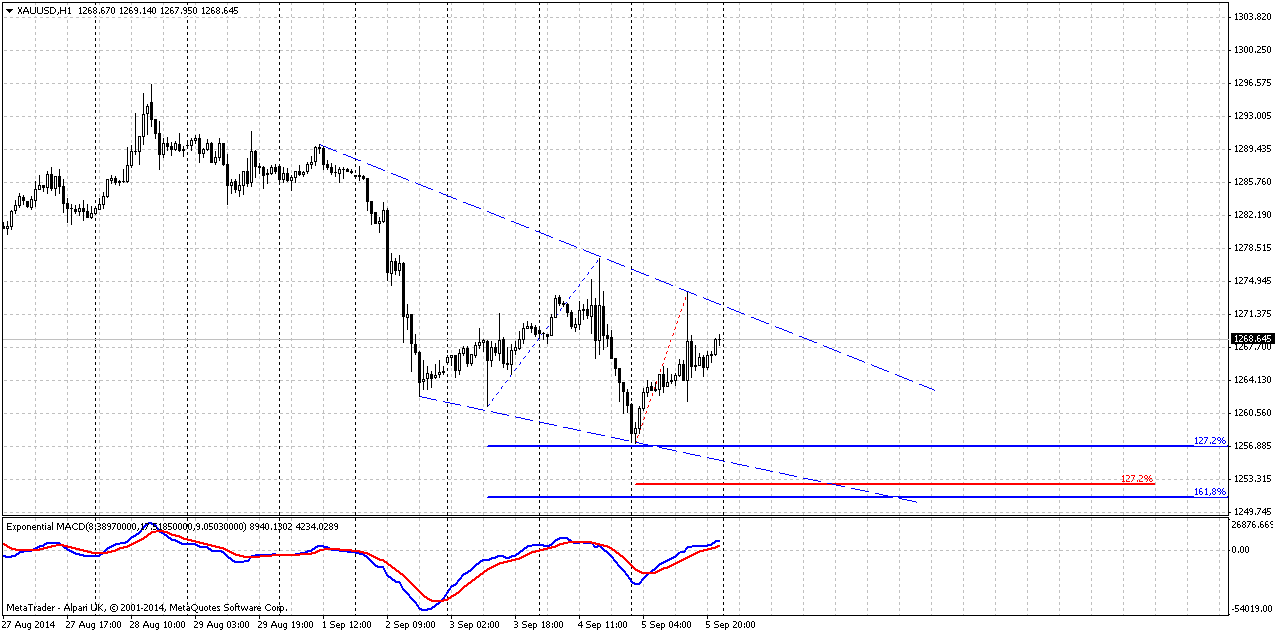

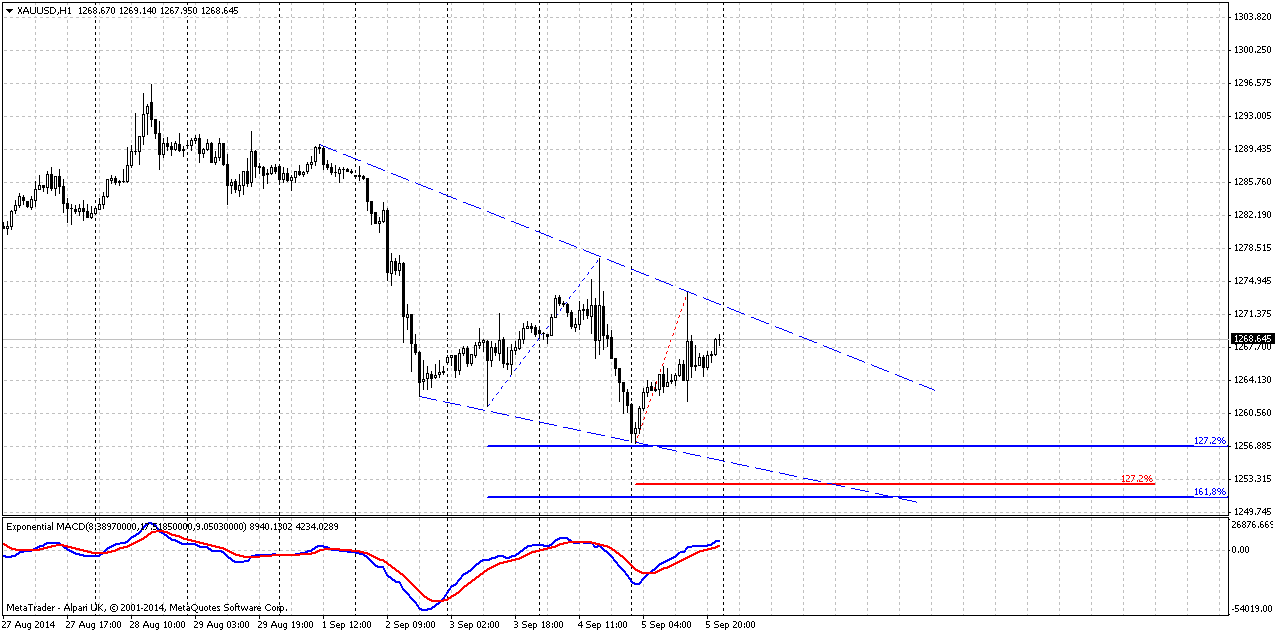

1-hour

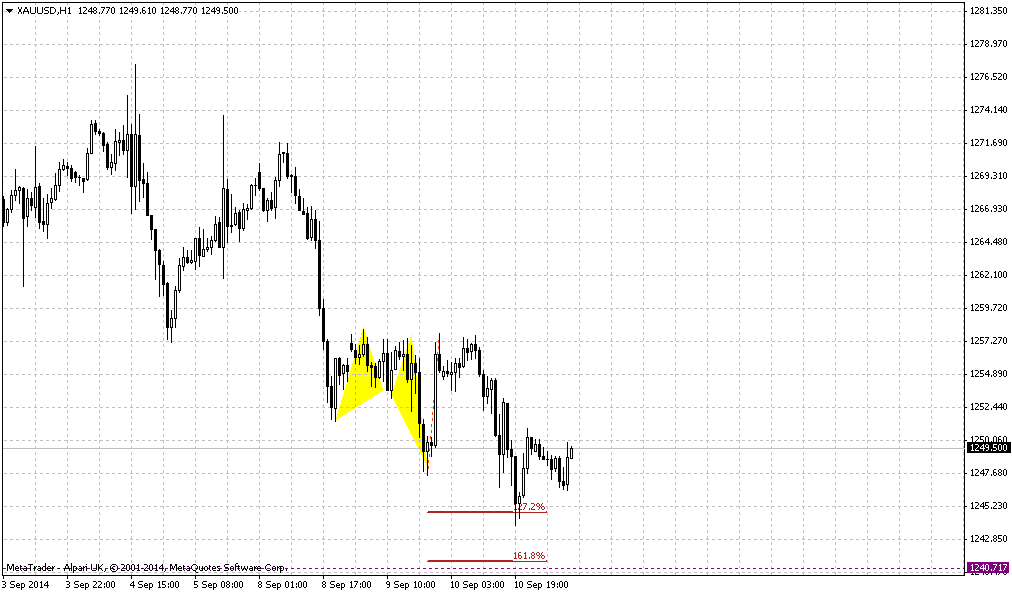

Hourly chart, in turn shows possible scenario of 3-Drive “buy” pattern right at the bottom of the “head”. But, to be honest, guys, I do not see here a lot of reasons for 3-Drive. Market has no target to complete below current levels. If say, market has not touched yet AB=CD target – in this case appearing of 3-Drive could be logical, but right now I’m not sure... Anyway, we need some pattern, mostly on 4-hour chart that could trigger retracement up. Or, conversely we need some action that will tell us that there will not be any retracement.

Conclusion:

Situation on gold market remains sophisticated. Due bearish moments, such as bullish USD sentiment, lack of physical demand, gold has re-established recently downward action. Recent action shows more and more bearish signs as well as fundamental data and overall market sentiment.

In short term some upward retracement could happen mostly technically and due poor NFP data, but hardly it will change situation drastically.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.

Gold prices rose on Friday, recovering from their lowest in nearly three months hit earlier in the session, after disappointing U.S. payrolls data tempered speculation that the Federal Reserve will raise interest rates any time soon.

Bullion pared some gains, however, after Ukraine and rebels agreed a ceasefire, seen as the first step towards ending a conflict in eastern Ukraine that has caused the worst standoff between Moscow and the West since the Cold War ended.

U.S. employers hired the fewest number of workers in eight months in August and more Americans gave up the hunt for jobs, providing a cautious U.S. central bank with more reasons to wait longer before raising interest rates.

"The higher gold prices are reflecting the expectation the Fed will not immediately raise interest rates after the weak job numbers, but the ceasefire deflated safe-haven appetite somewhat," said Alfonso Esparza, senior currency strategist at online forex broker Oanda in Toronto.

In overnight trade, the metal hit $1,256.90, its lowest since June 11. Gold prices posted a 1.6 percent drop for week on economic optimism and as the dollar rallied, marking their third decline in the last four weeks.

The U.S. Labor Department said non-farm payrolls rose 142,000 last month, the smallest increase in eight months. U.S. short-term interest rate futures contracts rose after the report, leading traders to boost bets the Fed will not raise interest rates until the second half of 2015.

In the main physical gold markets, where demand has been soft in recent months, buying picked up slightly. Asian dealers said premiums in China, the top buyer of gold, rose to $4 to $5 an ounce above spot prices, from $3 in the previous session.

However, SPDR Gold Trust, the world's largest gold-backed exchange-traded fund and a good measure of investor sentiment, said its holdings fell 4.78 tonnes to 785.73 tonnes on Thursday - the biggest one-day drop since April 16.

On recent week although market has closed slightly higher but in general week was in red.

As we’ve mentioned previously price should pass solid distance to change situation drastically. it could change only if market will move above 1400 area and currently we do not see any signs of it. Recent rally that has started in July seems exhausted and looses pace fast. Even coming shift in seasonal trend does not fascinate traders much. Physical demand stands weak, dollar strong, inflation weak and talks around rate hiking also does not add optimism to gold.

Since currently August mostly is an inside month for July our former analysis is still working. Although investors have not got hawkish hints from Fed and recent NFP data was slightly lower than analysts poll, major factors are still valid - good economy data, that right now is confirmed by US companies earning reports, weak physical demand – all these moments prevent gold appreciation. Recent comments from spot gold traders and CFTC data put more questions rather then answers on degree of support gold by seasonal trend and geopolitical tensions. Technically gold still stands at very important level that at least theoretically could keep chances on upward rebound. If price will fail here – we probably will start to talk about bear trend again. Tendency could take shape of butterfly as I’ve drawn on the chart, especially because it agrees with bearish grabber target.

It is interesting that during recent rally market was not able to re-test Yearly Pivot and later has vanished our bullish weekly grabbers. This moments make difficult to count on upward reversal. Also we suspect that we could get bearish dynamic pressure here. As you can see trend has turned bullish, but gold does not show any upward action. Splash in July has faded fast. Mostly this pattern will depend on action in September-October. Thus, any solid plunge down here and taking 1240 lows will confirm it. In this case butterfly will become a reality. Finally, overall action since the beginning of the year mostly bearish. Take a look – in the beginning of the year market has tested YPP and failed, then continued move down. During recent attempt to move higher – has not even reached YPP again.

That’s being said, situation on the monthly chart does not suggest yet taking long-term positions on gold. Still, fundamental picture is moderately bearish in long-term. Possible sanctions from EU and US could hurt their own economies as well, especially EU. Many analysts already have started to talk about it. It means that economies will start to loose upside momentum and inflation will remain anemic. In such situations investors mostly invest in interest-bear assets, such as bonds. Approximately the same comments we saw for recent 1-2 months from physical gold traders.

Weekly

On recent week gold has completed logical action and daily AB=CD pattern. AT the same time price has held above MPS1 and at least theoretically still kept chances on upward action. Although theoretical chances on upward action still exist as we’ve said this above and I even put this butterfly on chart, but, to be honest, guys, recent action brings more and more bearish signs.

Let’s follow through recent action:

Upward move from 1240 to 1340 was really nice. This has let reasons to speak about possible break on gold market. At the same time as we’ve mentioned many times – growth mostly was based on geopolitical reasons and had no support from real purchases.

When retracement has started and market has formed three in row bullish grabbers - that was normal - reasonable retracement out from 1333 Fib resistance. Bu later as you can see situation drastically has changed. Bullish trend, price above MPP and three in a row bullish grabbers has shifted to bearish trend, price has closed below MPP and grabbers were vanished.

Bounce up from 1270 two weeks ago mostly reminds some fake rather than real bullish challenge.

Price has closed almost below MPS1, CFTC data declares massive closing of longs and bounce up from 1270 mostly reminds some fake rather than real bullish challenge.

Gathering all this stuff together we come to conclusion that market has small chances to hold around and we should be ready for action to 1240 lows. Yes, some attempts could be made to bounce up due completion of daily AB-CD, geopolitical tensions and poor NFP data, but this is obviously too few to support significant rally.

For weekly chart crucial level will be 1240. Breaking through it will lead to solid consequences, such as – moving below MPS1, erasing of butterfly and solid confirmation of possible downward AB=CD pattern and in perspective monthly butterfly.

Following strictly to DiNapoli method we should search possibility to take short position, because we do not have bullish directional patterns here and trend as on monthly as on weekly stands bearish. Market is not at oversold.

Daily

Here is, guys, this “chance” that we’ve mentioned in weekly part. In fact we have Gartley “222” Buy, right? Yes, market has moved slightly lower than bottom of “left shoulder” but this has happened just because of AB=CD target that stands slightly lower. On Friday market has hit it. At the same time downward acceleration right before AB=CD target is a bit worrying sign. Still, on coming week we mostly will deal with this AB-CD pattern and its completion point. If market will form any reversal pattern we could try to ride on retracement up.

4-hour

Here market stands in long term downward channel. But compares to previous bottoms – currently situation has changed since price has reached AB=CD target. Current bottom stands precisely at 1.618 of recent retracement up and market theoretically could form reverse H&S pattern. That is what we will be look for on coming week. Also currently it is accompanied by MACD divergence and do not forget that market still holds at MPS1.

1-hour

Hourly chart, in turn shows possible scenario of 3-Drive “buy” pattern right at the bottom of the “head”. But, to be honest, guys, I do not see here a lot of reasons for 3-Drive. Market has no target to complete below current levels. If say, market has not touched yet AB=CD target – in this case appearing of 3-Drive could be logical, but right now I’m not sure... Anyway, we need some pattern, mostly on 4-hour chart that could trigger retracement up. Or, conversely we need some action that will tell us that there will not be any retracement.

Conclusion:

Situation on gold market remains sophisticated. Due bearish moments, such as bullish USD sentiment, lack of physical demand, gold has re-established recently downward action. Recent action shows more and more bearish signs as well as fundamental data and overall market sentiment.

In short term some upward retracement could happen mostly technically and due poor NFP data, but hardly it will change situation drastically.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.