Deltoid88

Master Sergeant

- Messages

- 278

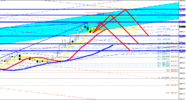

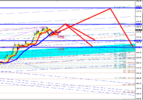

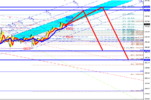

Yes, but about this one. I dont argue your thinking we are in C, although I dont agree because I think wer are in x, but c corrective in 1st of an impulse is shorter than b only in running flat, as far I know..

I see, you meant on that red C wave as part of wave 2. That is completely within rules of waves, and yes, that also was flat, not expanded flat, just flat. There also C wave can be shortest. C wave can not be shortest in ZigZag, but in flat, it can be. In flat wave B must retrace at least 50% of wave A, which was the case as you can see.