Antony_NPBFX

NPBFX Representative (unconfirmed)

- Messages

- 1,094

EUR/USD: the euro develops a corrective impetus 02.02.2022

Good afternoon, dear forum visitors!

NPBFX offers the latest release of analytics on EUR/USD for a better understanding of the current market situation and more efficient trading.

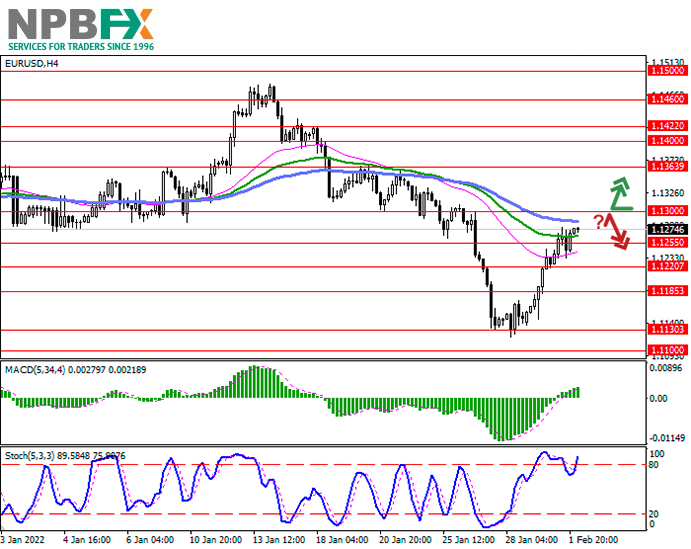

Current trend

The European currency shows weak growth against the US dollar during the Asian session, developing the corrective momentum formed at the beginning of the week and updating the local highs from January 26.

The instrument is moderately supported by the growing interest of investors in risky assets against the backdrop of discussions on the prospects for tightening monetary policy by the US Fed. At the moment, it is not clear whether the US regulator will decide on five or even more interest rate hikes this year, and whether the figure will be adjusted immediately by 50 basis points. The European Central Bank (ECB), in turn, relieved the markets of unnecessary expectations in advance, declaring its readiness to adjust existing parameters, focusing on the epidemiological situation caused by the spread of COVID-19, which is putting significant pressure on the region's economy.

Macroeconomic statistics from Europe published on Tuesday turned out to be moderately optimistic. Investors reacted rather positively to the decline in the Unemployment Rate in Germany from 5.2% to 5.1%, while the Unemployment Change fell by 48K in January after a decrease of 29K a month earlier (expert forecasts assumed a decline of only 6K).

Support and resistance

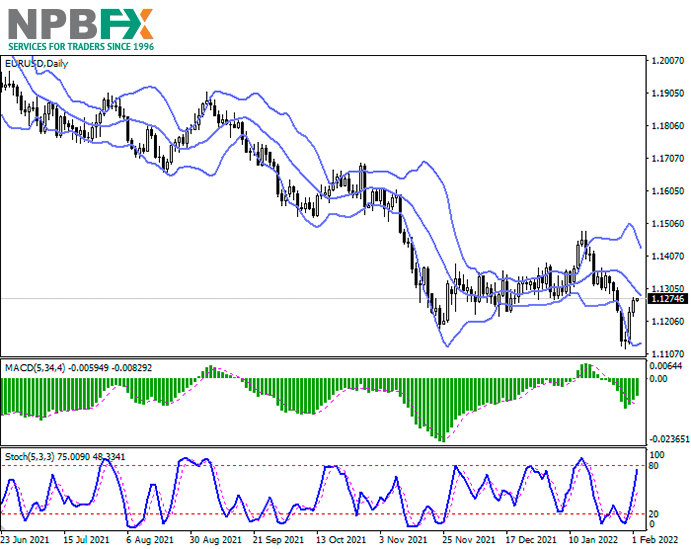

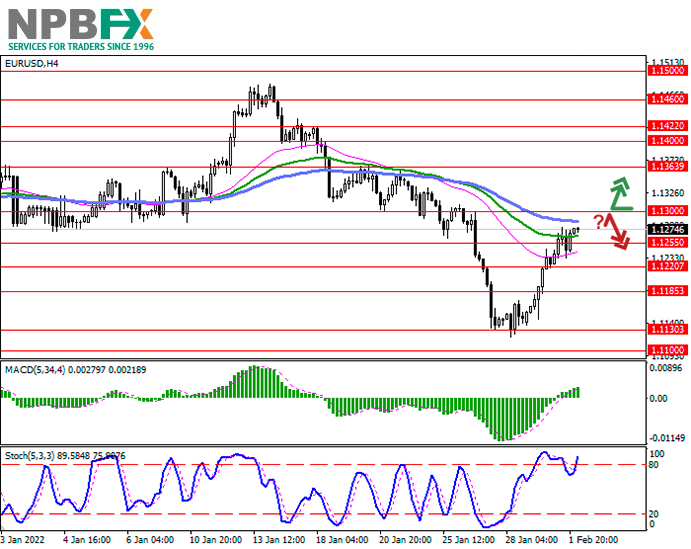

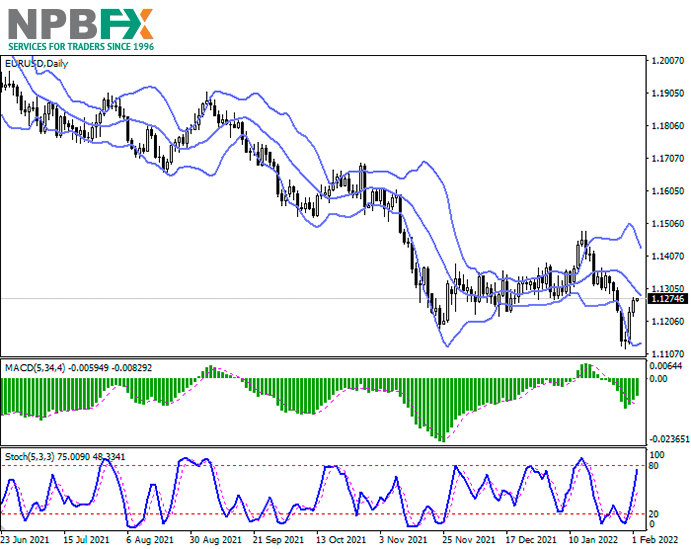

Bollinger Bands on the daily chart show a steady decline. The price range is narrowing, reflecting the emergence of multidirectional trading dynamics in the short term. MACD grows, preserving a stable buy signal (located above the signal line). Stochastic shows an upward direction but is rapidly approaching its highs, which reflects the risks of overbought EUR in the ultra-short term.

Resistance levels: 1.1300, 1.1363, 1.1400, 1.1422.

Support levels: 1.1255, 1.1220, 1.1185, 1.1130.

Trading tips

To open long positions, one can rely on the breakout of 1.1300 with the target at 1.1400. Stop-loss – 1.1255. Implementation time: 2-3 days.

A rebound from 1.1300 as from resistance followed by a breakdown of 1.1255 may become a signal for new sales with the target at 1.1150. Stop-loss – 1.1300.

Use more opportunities of the NPBFX analytical portal: analytics

You can find more actual analytical reviews on other popular currency pairs, metals and CFDs on the NPBFX online portal. Daily analytics with charts, current market prognoses and trading scenarios in the Feed section are available. Get free and unlimited access to the online portal after registering on the official website of NPBFX Company.

If you have any questions about trading instruments, you can always ask an analyst in the online chat on the portal and get a free consultation of an experienced specialist.

Use the current recommendations of analysts on EUR/USD and trade efficiently with NPBFX.

Good afternoon, dear forum visitors!

NPBFX offers the latest release of analytics on EUR/USD for a better understanding of the current market situation and more efficient trading.

Current trend

The European currency shows weak growth against the US dollar during the Asian session, developing the corrective momentum formed at the beginning of the week and updating the local highs from January 26.

The instrument is moderately supported by the growing interest of investors in risky assets against the backdrop of discussions on the prospects for tightening monetary policy by the US Fed. At the moment, it is not clear whether the US regulator will decide on five or even more interest rate hikes this year, and whether the figure will be adjusted immediately by 50 basis points. The European Central Bank (ECB), in turn, relieved the markets of unnecessary expectations in advance, declaring its readiness to adjust existing parameters, focusing on the epidemiological situation caused by the spread of COVID-19, which is putting significant pressure on the region's economy.

Macroeconomic statistics from Europe published on Tuesday turned out to be moderately optimistic. Investors reacted rather positively to the decline in the Unemployment Rate in Germany from 5.2% to 5.1%, while the Unemployment Change fell by 48K in January after a decrease of 29K a month earlier (expert forecasts assumed a decline of only 6K).

Support and resistance

Bollinger Bands on the daily chart show a steady decline. The price range is narrowing, reflecting the emergence of multidirectional trading dynamics in the short term. MACD grows, preserving a stable buy signal (located above the signal line). Stochastic shows an upward direction but is rapidly approaching its highs, which reflects the risks of overbought EUR in the ultra-short term.

Resistance levels: 1.1300, 1.1363, 1.1400, 1.1422.

Support levels: 1.1255, 1.1220, 1.1185, 1.1130.

Trading tips

To open long positions, one can rely on the breakout of 1.1300 with the target at 1.1400. Stop-loss – 1.1255. Implementation time: 2-3 days.

A rebound from 1.1300 as from resistance followed by a breakdown of 1.1255 may become a signal for new sales with the target at 1.1150. Stop-loss – 1.1300.

Use more opportunities of the NPBFX analytical portal: analytics

You can find more actual analytical reviews on other popular currency pairs, metals and CFDs on the NPBFX online portal. Daily analytics with charts, current market prognoses and trading scenarios in the Feed section are available. Get free and unlimited access to the online portal after registering on the official website of NPBFX Company.

If you have any questions about trading instruments, you can always ask an analyst in the online chat on the portal and get a free consultation of an experienced specialist.

Use the current recommendations of analysts on EUR/USD and trade efficiently with NPBFX.