You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

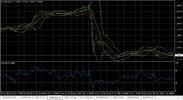

The GBP/USD, good technical round number levels

- Thread starter fxstrategist

- Start date

On Thursday, the Bank of England's Governor Mark Carney said that the uncertainty caused by Brexit, can put pressure on the UK economy for some time. To support it, the British regulator considers to mitigate the monetary policy until the end of the summer. Probably, the Bank of England in the first place will reduce the key interest rate by 25 basis points, and this will decrease the pound below $1.3.

fxstrategist

Corporal

- Messages

- 742

Key levels on the GBPUSD at the moment are the 1.3200 as support and the 1.3532 as resistance along with the 1.3833.

The British pound registered a rise against the US dollar on Monday. After a volatile session, the pound added 35 pips at a closing price of 1.3281. The graphics continue to develop under moving averages, while the index of relative strength remained on neutral territory. If prices continue to rise the pair will head towards resistance at 1.3480. On the downside, we can expect a break of the support at 1.3200.

fxstrategist

Corporal

- Messages

- 742

Who knows how far the GBPUSD may continue dropping, but for now it stalls at the 1.2800 zone. The 1.3200 may act as resistance.

fxstrategist

Corporal

- Messages

- 742

Good bullish bounce on the GBPUSD from the 1.2800 level, the pair may try to visit the 1.3200 level, which could act as resistance.

Similar threads

- Replies

- 0

- Views

- 192

- Replies

- 0

- Views

- 167

- Replies

- 0

- Views

- 221

- Replies

- 0

- Views

- 177