Bitcoin fundamentals – September briefing 2019

A Quiet Start – September 2019

September was one of the quietest months of the year, not only in terms of developments but also price volatility. BTC’s chart shows that every week had a smaller trading range than the previous one. Except for the Bakkt launch – a major and much-anticipated event – news reports were few and rather lackluster.

As I write this, Bakkt is trading for the first time.

On a positive note…

Bakkt Starts Trading On ICE

The Intercontinental Exchange (ICE), which owns the institutional investment firm Bakkt, launched officially on September 22 after many delays. Having received all necessary CFTC permissions, Bakkt Bitcoin Daily Futures started trading at a price of $10,115. Clients’ deposits are insured for $125 million, and the initial margin per contract stands around $3,900. An additional floating margin is set in the $400-1,100 range. Bakkt Warehouse accepts BTC trading deposits.

CME Group Launching Bitcoin Options In 2020

Pending regulatory review, Bakkt may have a rival in the first quarter of 2020, when derivatives marketplace CME Group plans to start offering options on its Bitcoin futures contracts. CME will offer cash contracts, unlike ICE, which offers a physically-settled product, meaning that clients receive Bitcoin instead of the cash equivalent.

In its announcement, CME said it aims to provide “additional tools for precision hedging and trading.” According to Tim McCourt, Global Head of Equity Index and Alternative Investment Products:

“Based on increasing client demand and robust growth in our Bitcoin futures markets, we believe the launch of options will provide our clients with additional flexibility to trade and hedge their Bitcoin price risk. These new products are designed to help institutions and professional traders to manage spot market Bitcoin exposure, as well as hedge Bitcoin futures positions in a regulated exchange environment.”

Sberbank And Trafigura Make Deal Using Blockchain

Russian banking giant Sberbank and the multinational commodity trading company Trafigura conducted a pilot blockchain-based transaction for the supply of West Siberian oil. Not a BTC transfer, the transaction involved Sherbank buying receivables owed to Trafigura from a Turkish buyer, thereby reducing transaction costs and simplifying the contract.

While this may not seem like major news, it is a new application of the blockchain in other life spheres such as banking. Of course, blockchain fans have been anticipating this type of application for some time.

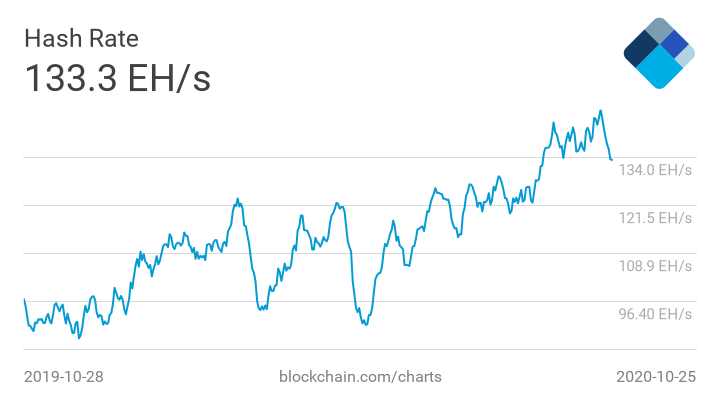

BTC Hash Rate Hits All-Time Record, Reaching 100Mln Th/S

It is widely suggested that hash rate is linked to the price of BTC – the greater the hash rate, the higher the price. Yet, what we have seen in the last 2-3 weeks does not support this view since BTC has been flat for the most part, even dropped slightly, while hash rate hit an all-time high, as you can see in the chart below. What is true, however, is that the more the harsh rate stands, the Bitcoin network becomes safer, and this means a greater diversification of transactions.

Libra “Might Be Unstoppable”

During a lecture released by an online education platform, Changchuan Mu, the new director of China’s Research Institute on Digital Currency, said the following about Facebook’s stablecoin project:

“No countries welcome Libra, but it might be unstoppable anyways. It is very unlikely that one can totally stop people from buying Libra despite rigorous regulations. Even if Facebook is blocked in China, people will use indirect ways to purchase it from abroad once Libra comes out. […] If the U.S. bans Libra legally, then Libra will certainly be stopped.”

On the negative side…

Blockchain And Crypto Deals Down Sharply In 2019

Although BTC’s price has recovered well from last year’s lows, enthusiasm for all things crypto and blockchain pales in comparison to past quarters. So far, in 2019, investors have put approximately $3.38 billion into initial coin offerings and private funding rounds for companies, according to Crunchbase data. At this pace, the total annual investment may end up being a fraction of the $12.86 billion of 2018.

Moreover, this year, $2 billion has been invested in companies tied to crypto and blockchain technology, not including ICOs. That’s on track to come in well below the $4.65 billion total for 2018. You can see more numbers in the following chart:

The data speaks clearly: After the pop of the crypto bubble, blockchain and crypto-related funding is down, but by no means dead. With that said, it is too early to know for certain. Neither the proponents nor the detractors of the blockchain have won their arguments yet.

SEC Chairman Doesn’t See BTC Trading On A Major Exchange Until It Is “Better Regulated”

Bitcoin will have to be better regulated before it can trade on a major exchange, SEC Chairman Jay Clayton said at the Delivering Alpha Conference. He also cautioned investors about the difficulty of “price discovery” when trying to cash in on crypto:

“If [investors] think there’s the same rigor around that price discovery as there is on the Nasdaq or New York Stock Exchange … they are sorely mistaken. We have to get to a place where we can be confident that trading is better regulated.”

Inner Mongolia to Shutdown ‘Illegal’ Bitcoin Miners by October

The autonomous region of Inner Mongolia in northern China is among the most suitable areas for crypto mining due to its cheap electricity, low land prices, cold weather, and a small population. According to local reports, inspections are being carried out in the region. A government spokesperson confirmed to CoinDesk that the plan is to eliminate Bitcoin mining operations by October:

“The move reflects the nationwide phase-out plan on the Bitcoin mining.”

Pending final approval, the intention is to drive out the digital currency mining industry. China started the crackdown before April’s draft proposal by the National Development and Reform Commission (NDRC). NDRC’s position is that mining does not fit into the country’s economic development plan. As part of broader currency controls, trading and possessing cryptocurrencies is illegal in China, even though its use is prevalent on the black market.

Germany: We Cannot Accept Parallel Currencies Such As Libra

On September 17, Reuters reported that German Finance Minister Olaf Scholz said that policymakers could not accept the emergence of parallel currencies such as Facebook’s Libra:

“We cannot accept a parallel currency. You have to reject that clearly.”

The bottom line

While the list of positive news this month is short, there have been some very important moments, namely the Bakkt launch.

We should keep in mind, however, that Bakkt is a double-edged sword: It could trigger either positive market development or disappointment if it does not live up to expectations. Bakkt has been a long-awaited event; a great deal of hope has been placed on it. Investors are watching closely, waiting to see whether the predictions and expectations of BTC’s fans are confirmed or denied.

If no big shifts take place within 1-3 months, the euphoria could turn into confusion, which could negatively impact BTC if the world sees that no institutional money has invigorated the market and that its price lingers at pre-Bakkt levels. With that said, we should not make snap judgments; we should be patient and give the market time to react.

The campaigns against crypto mining in China are a concern because they engender two problems: first, the direct impact of a pause or contraction in mining, and second, the psychological effect when people see governments freely inferring with or halting crypto-related activities.

These were September’s highlights. Let’s wait to see what October has in store.

Author Profile

Sive Morten

At the Forex Peace Army, he is known as an author of Forex Military School, which quite unique free forex trading course. We do not know of any other free forex trading education covering such a broad spectrum of forex market concepts in such details while keeping it easy to understand and practically use.

As if that wasn't enough, he is the part of the Shoulders of Giants Program. He shares with his fellow traders at FPA his view and forcast of the Gold Market, Currency Market, and Crypto Market in form of weekly analytics and daily video updates.

* Complete Forex Trading Course by Sive Morten >>

* Sive Morten Forex , Gold , and Crypto Analysis >>

Info

1452 Views 0 CommentsComments

Table of Contents

Recent

-

The Future of Money: How Bitcoin is Changing Personal Finance Skills Bitcoin Fundamental Briefing, April 2024 Bitcoin Fundamental Briefing, March 2024 Demystifying Cryptocurrency Nodes: Deep Dive into Polygon Node Ecosystem Strategies for Trading Forex on a Budget Bitcoin Fundamental Briefing, February 2024 Bitcoin Fundamental Briefing, January 2024 Strategic Asset Allocation Techniques for Currency Traders