Bitcoin Fundamental Briefing, February 2024

CRYPTO RUSH

I do not know how you look at recent BTC rally, guys, but I have some feeling that something “unnatural” is happening. Especially, when you not read some particular news, but just read numerous headline of, say, Bloomberg stream, dedicated to Bitcoin. It reminds the papers hype that you could see in Hollywood movies dedicated to Wall Street.

Despite unstoppable action that have not been seen for a long time – it is just few topics that we could discuss. Recent price pump looks artificial and unnatural, there are many talks started that BTC soon will replace gold, this is best asset in the world and actually you need nothing else. Once Binance has been crushed by the US regulators, punished for 4.3$ Bln and exiled out – Coinbase “unexpectedly” has shown good earnings in last quarter. Just an occasion? I do not think so. All these processes perfectly fits to our long-term view of market consolidation in tight and right hands and control over it. Besides, we see BTC hype as a tool to support US Dollar, which is might be used by US Treasury.

MARKET OVERVIEW

Bitcoin advanced for a fifth straight day, putting the biggest cryptocurrency on track for its biggest monthly gain since October 2021. Bitcoin rose as much as 4.1% to $59,053 on Wednesday. It has risen on all but eight trading days so far in February, rallying 39% for the month.

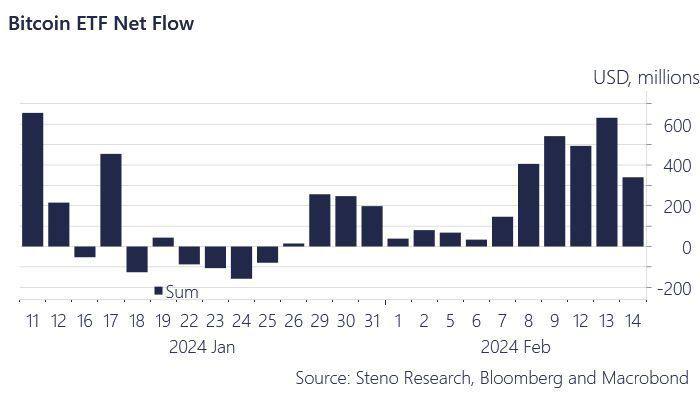

The launch of spot Bitcoin exchange-traded funds in the US in early January has driven a frenzy of buying, overcoming concerns that the Federal Reserve might keep interest rates higher for longer. With Bitcoin’s next “halving” looming in April, optimism among crypto bulls is increasing that the token could soon overtake the record of almost $69,000 it hit in November 2021.

“We’re seeing evidence of elevated interest from both retail and institutional looking to get exposure to digital gold,” said Matthew Sigel, head of digital asset research at VanEck Associates. “History suggests even steeper and more violent rallies are ahead.”

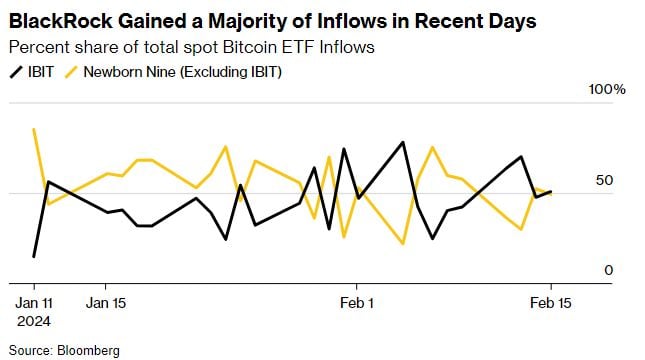

The world’s biggest Bitcoin ETF has reached an inauspicious milestone: an entire month of consecutive outflows. The $24.2 billion Grayscale Bitcoin Trust has seen $7.4 billion exit across 31 trading days as of Monday, Bloomberg data show. GBTC has yet to post a single inflow since it converted into an ETF in mid-January.

GBTC is by far the largest and most actively traded of its peers, its 1.5% management fee means that it’s also the most expensive offering, with the bulk of its peers charging below 0.3%. Additionally, bankrupt estates such as Genesis Global Holdco LLC have been looking to offload their holdings.

“Most of us in the industry expected to see outflows, we all knew it was coming — these long-term holders that were waiting for the fund to finally convert to get out,” said Amrita Nandakumar, president of Vident Asset Management. “Does it go to 60 days? I don’t think so, but then again, I’m surprised to see it got to thirty.”

While GBTC continues to shed assets, the other nine spot Bitcoin ETFs that launched in January are pulling in billions amid the cryptocurrency’s rally. BlackRock and Fidelity are leading the way, attracting about $6 billion and $4 billion a piece, followed by the likes of Ark Invest and Bitwise.

MASSIVE EUPHORIA IS SPREADING AROUND

Open interest (green) in Bitcoin futures reaches its highest level since November 2021

Mom-and-pop investors piling back into crypto markets after a January pause seem to be behind popular cryptocurrencies — including Bitcoin and Ether — rallying to multi-year highs, according to JPMorgan Chase & Co. strategists.

The recent surge in crypto prices appears to be fueled by individual traders making impulsive decisions rather than being driven by institutional investors or market fundamentals, according to JPMorgan analysts.

“Similar to equities, we find that the retail impulse into crypto rebounded in February, thus likely responsible for this month’s strong crypto market rally,” JPMorgan analysts led by Nikolaos Panigirtzoglou wrote in a note on Thursday.

“The revival of the retail impulse in February perhaps reflects the anticipation of three main crypto catalysts over the coming months: the Bitcoin halving event, the next major upgrade of the Ethereum network and the prospect of approval of spot Ethereum ETFs by the SEC in May,” the bank’s strategists wrote. “We believe that the first two catalysts are largely priced in, while for the third catalyst we only see a 50% chance.”

Inflows into newly-approved spot Bitcoin funds were adjusted for as large institutional wallets would otherwise appear larger than they truly are, since they hold funds from retail traders who have recently bought into the new funds, the report noted.

The Ether token is outshining Bitcoin partly on speculation that the next wave of spot US crypto exchange-traded funds will focus on the second-largest digital asset, heralding increased investor demand.

So far this year Ether has climbed 30% versus Bitcoin’s 22% advance, a reverse from 2023 when the biggest digital token set the pace. Ether rose 1.5% to trade near $3,000

While some crypto fans view the funds as a precedent paving the way for Ether ETFs, others are skeptical that officials will accede to them and anticipate further legal drama.

“I expect Ether to continue to outperform Bitcoin in the coming months, at least until April-May when the potential ETF approval looms closer,” said Stefan von Haenisch, head of trading at OSL SG Pte in Singapore.

Von Haenisch added that he’s doubtful US Securities and Exchange Chair Gary Gensler would approve Ether ETFs unless forced to by court decisions.

In the derivatives sector, open interest in CME Group’s Ether futures marketplace is close to a record high. The proportion of Ether being staked has reached an all-time peak of 25%, according to tracker Validator Queue, curbing supply and providing a potential prop for prices.

According to S&P, the SEC will likely approve applications for the issuance of exchange-traded crypto ETFs focused on ether (ETH) in May 2024. The S&P report suggests that the approval of ether-focused ETFs could trigger a redistribution of capital, further increasing the dominance of ETH in the crypto industry.

THE PHANTOM MENACE

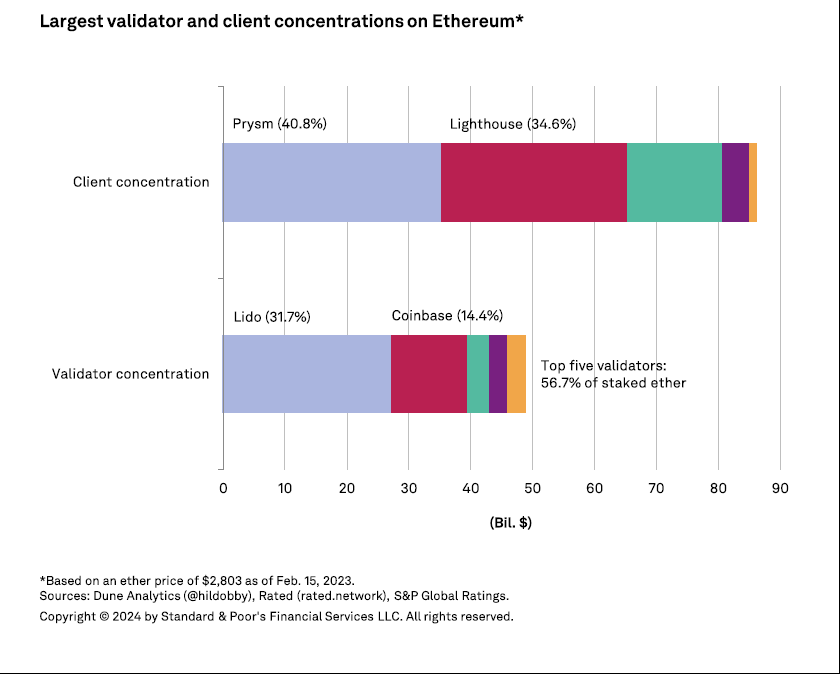

The prospect of a US approval of Ether exchange-traded funds threatens to exacerbate the Ethereum ecosystem’s concentration problem by keeping staked tokens in the hands of a few providers, S&P Global warns.

Such ETFs “could become large enough to change validator concentrations” in the Ethereum network, according to S&P analysts Andrew O’Neill and Alexandre Birry. In turn, that could expose the network to operational risks, such as inactivity resulting from a single point of failure, or malicious collusion.

Coinbase Global Inc. is already the second-largest validator — or provider which validates blocks into a blockchain — in the Ethereum network, controlling about 14% of staked Ether. The top provider, Lido, controls 31.7% of the staked tokens, the analysts wrote, citing Dune Analytics and Rated data.

US institutions issuing Ether-staking ETFs are more likely to pick an institutional digital asset custodian, such as Coinbase, while side-stepping decentralized protocols such as Lido. That represents a growing concentration risk if Coinbase takes a significant share of staked ether, the analysts wrote.

Coinbase is already a staking provider for three of the four largest ether-staking ETFs outside the US, they wrote. For the recently approved Bitcoin ETF, Coinbase was the most popular choice of crypto custodian by issuers. The company safekeeps about 90% of the roughly $37 billion in Bitcoin ETF assets, chief executive officer Brian Armstrong said during an earnings call last week.

US trading venues on average accounted for almost half of bids and asks within 2% of Bitcoin’s mid-price so far this year, a period that straddles the launch of the US spot ETFs, data from research company Kaiko show. In 2023 non-US platforms had the lion’s share of Bitcoin market depth based on this metric.

The impact of the ETFs is already visible. For instance, 57% of Bitcoin trading against the greenback is in US market hours now compared with 48% a year ago, according to Kaiko Senior Analyst Dessislava Aubert.

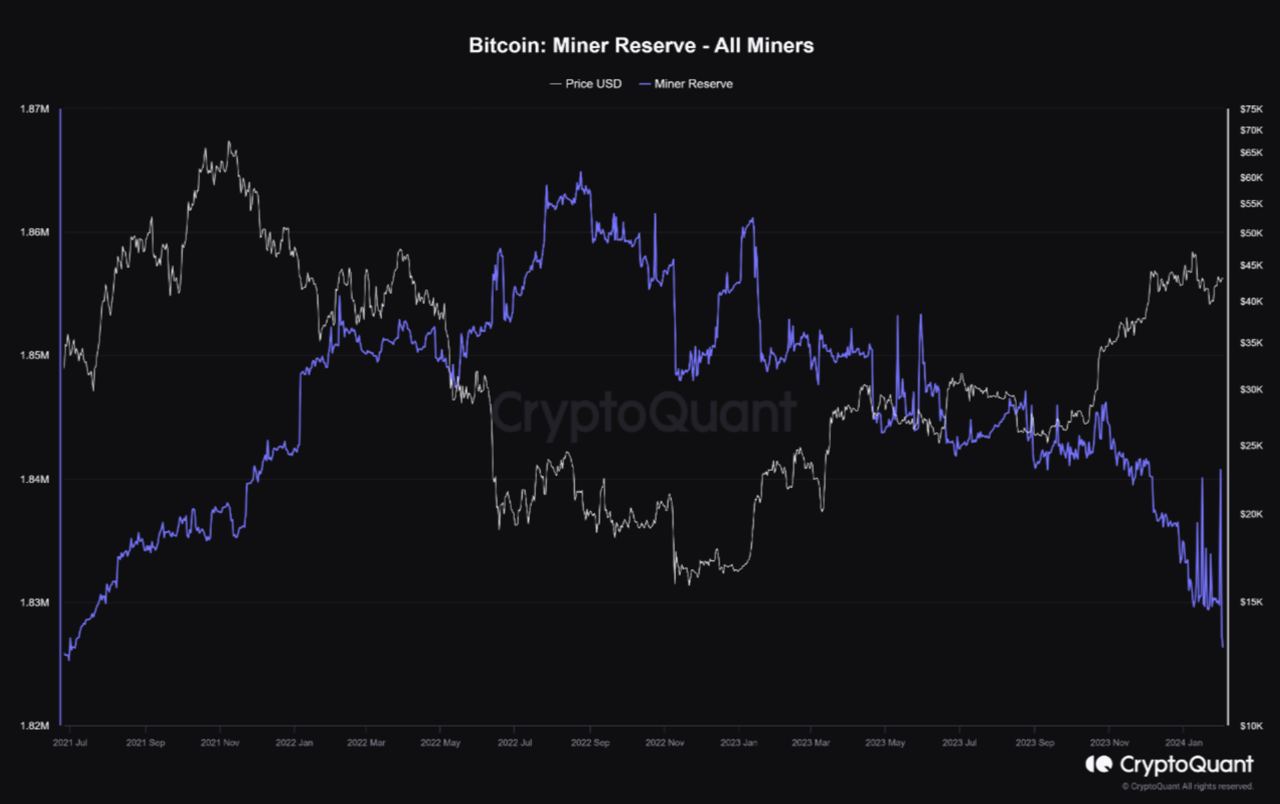

Bitcoin advocates such as MicroStrategy Chairman Michael Saylor and crypto exchange Gemini co-founder Cameron Winklevoss have said pent-up demand from the newly launched funds is at least 10 times as much as the number of new tokens being minted by so-called miners, fueling the more than 20% rally this year in the largest cryptocurrency. However, market data shows there is a plethora of tokens sloshing around.

Miner Reserves Fall to Lowest Level Since July 2021, Quant reports

“In the last two days, miner reserves have fallen by more than 14 thousand BTC, approximately $600 million in reduction.

While the spot Bitcoin ETFs have drawn billions of dollars, a significant share of the inflows are likely from redemptions being recycled from the Grayscale Bitcoin Trust into lower cost rivals, traders said.

Early results had showed BlackRock and Fidelity Investments dominating the emergent sector, but the largest asset manager has since started to emerge as the market leader in recent days. Since launching on Jan. 11, the fund has gained over $5 billion in inflows, about $1.5 billion more than Fidelity’s offering.

UPSIDE TARGETING

Of course, now nobody thinks about catastrophe. Up, up and up and analysts now are competing who set the higher target and provide background for it. We intentionally ignore most absurd targets but provide those that seem more or less possible.

Bitcoin’s sudden rebound to a new high for the year would see it reach the $100,000 threshold by the end of the year as spot ETF flows have slowed significantly and should no longer be a drag.

Bitcoin ETFs Flows Could Propel BTC Prices to $112K This Year: CryptoQuant

Bitcoin prices could touch $112,000 this year if the current trend of inflows related to spot exchange-traded funds (ETFs) continues, on-chain data provider CryptoQuant said Sunday.

“Bitcoin market has seen $9.5B in spot ETF inflows per month, potentially boosting the realized cap by $114B yearly,” Ki said. “Even with $GBTC outflows, a $76B rise could elevate the realized cap from $451B to $527-565B.”

Ki cited a ratio tracking bitcoin’s market capitalization to realized capitalization – a measure of active tokens at thier last traded price – as potentially marking a top for bitcoin at the $104,000 to $112,00 mark. The ratio would reach 3.9 at those prices, a level that has historically marked a price top.

By the end of 2025, the first cryptocurrency may reach a new high of $125,000, and its price fluctuations will become “more stable.” This was stated by Marathon Digital CEO Fred Thiel in Anthony Pompliano’s podcast.

In 2024, the quotes of the first cryptocurrency will reach the $150,000 mark. Tom Lee, co-founder of the Fundstrat analytical firm, expressed this opinion in an interview with CNBC.

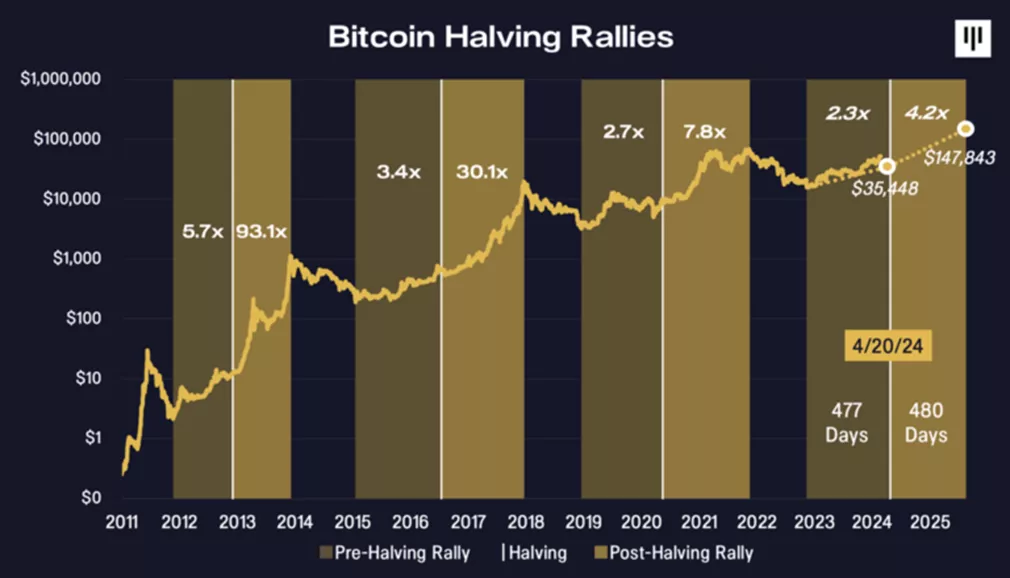

Pantera Capital predicts Bitcoin growth to $147,000 in 2025

Based on previous halving cycles, we can expect the price of bitcoin to decline to $35,448 in April 2024, followed by an increase to $147,000 in 2025. Such forecasts were presented in Pantera Capital.

According to experts, the cryptocurrency market has entered the initial phase of a large bull cycle, which can last 18-24 months.

The goal of $63,000 for bitcoin in March 2024 looks achievable. A similar forecast is contained in the Matrix port report.

After breaking through the $56,000 level, technical analyst and head of Factor LLC Peter Brandt changed his forecast for the exchange rate of the first cryptocurrency in 2025 from $120,000 to $200,000.

The options market is showing that crypto traders are targeting what would be a new record price for Bitcoin after the largest cryptocurrency reached a more than two-year high of $50,000 this week.

The open interest, or number of outstanding contracts, for calls that expire on March 29 with strike prices of $60,000, $65,000 and $75,000 has seen a significant increase, according to data from the largest crypto options exchange Deribit. Bitcoin’s all-time price of almost $69,000 was set in November 2021.

“The strikes traded across the 75-100K region may be more of a bet on this remarking of longer-dated implied volatility than a pure bet on direction, but of course being calls, these profit on an increase in both,” said Chris Newhouse, a DeFi analyst at Cumberland Labs.

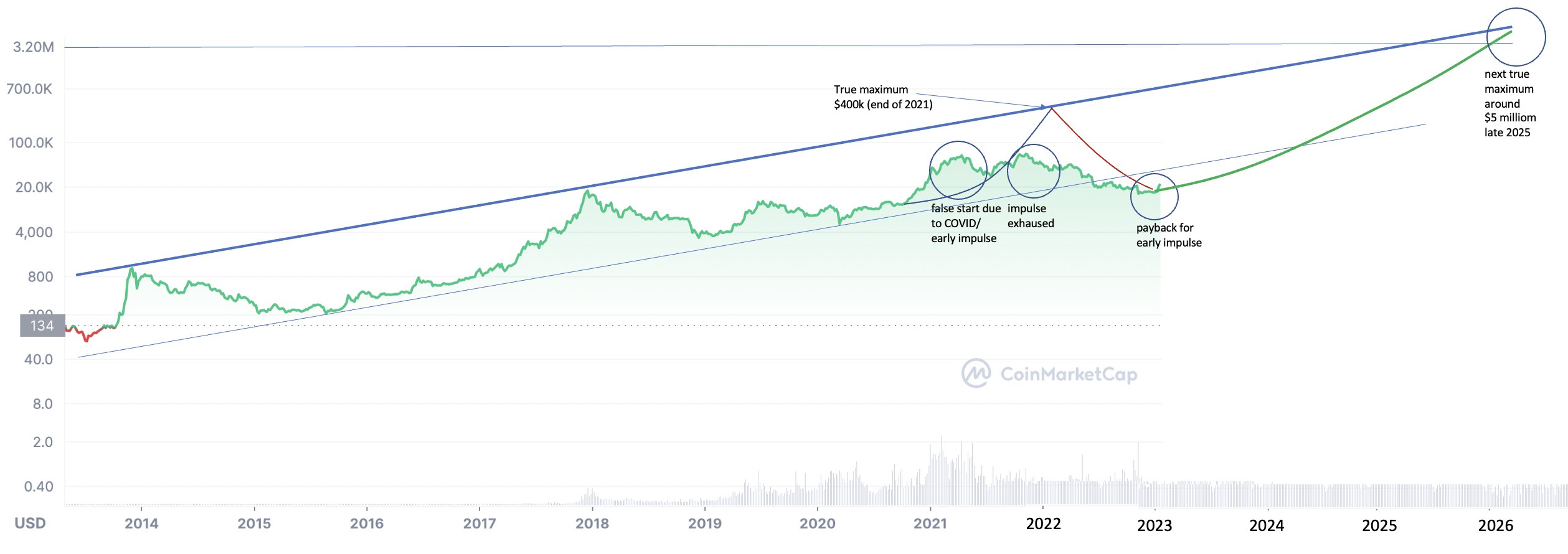

And here is our two cents. Based on technical view, it is easy to estimate near standing upside targets on monthly chart. Definitely they are previous top around 70K and 80-85K of all time upside AB=CD target:

THE VOICE OF COMMON SENSE

It is definitely muted right now. Obviously recent pump has not natural background and is driven not by market common rules. Few months ago we’ve suggested that recent processes that have started in the US – punishing Binance, ETF approvements etc. have absolutely different aim. The US long term has tried to fight against crypto industry, but it was not successful. Now they are trying to lead this sphere and here they have much better results. According to CoinGreko – crypto market of two largest coins BTC and ETF is centralized for 85-90%. In fact totally controlled by the Fed and US Treasury via puppets such as BlackRock &Co.

CoinGecko also noted that the 10 largest bitcoin ETFs occupy a disproportionately large market share of 92.7%. This “top ten” includes five funds from the United States, three European and two Canadian.

We were right about major target of the US. Also we were right on centralization of transactions, depositary services and pricing. Binance has been destroyed not occasionally – all operations gradually flow to Coinbase, US domiciled exchange, the circle is locked.

But what is the major purpose? Everything is logical, it is somehow indecent to inflate the shares further, so it’s time to start dispersing the BTC.

The main thing is that there are no logical explanations for the potential maximum – no multipliers, no dividend yield. Just how fantastic narratives the market will believe in. And anyone could invent its own explanation, trying to provide some background. For example, why this explanation that it could reach $5 Mln per coin is wrong?

You can also come up with some justification that then the capitalization of non-lost coins will be less than 25% of the value of global financial assets, which are just 25-30% overvalued. Or somehow compare it with the global money supply. In general, you can take any arguments, the main thing is to be believed in them.

You can also come up with some justification that then the capitalization of non-lost coins will be less than 25% of the value of global financial assets, which are just 25-30% overvalued. Or somehow compare it with the global money supply. In general, you can take any arguments, the main thing is to be believed in them.

Well, so that everything doesn’t collapse again later, you need to come up with an application. For example, to allow a chunk to pay for cross-border transactions or within countries, and then work and work to ensure that this application is carried out.

Moreover, bank lending began to fail after the 2008 crisis and is clearly lagging behind the historical trend. We need new global instruments (“money-like assets”) to stimulate demand, and preferably ones that do not increase inflation risks in a particular country.

Is it a bubble? No doubts. But this bubble is for longer and hardly explodes immediately. US Banks call for changing depositary rules and ask the Fed to let them keep cryptocurrencies:

it’s unlikely that this bubble will collapse directly in the coming months or years. If this is still a bubble, then it will take a very long time for this bubble to recoup, until the moment when the traditional global financial system is cleared through a long-lasting crisis. And the longer this does not happen, the longer the bubble, if it is a bubble, will exist in the crypto.

The situation is degrading right before our eyes. People start talking about gold replacement by bitcoin, loosing ground. Explaining this by opposite ETF dynamics:

“We anticipate that bitcoin could substitute for gold in some investor portfolios. It may serve a similar role as a hedge against global disorder and financial system dysfunction,” said Jason Benowitz, senior portfolio manager at CI Roosevelt.

“Overall, the crypto industry is maturing and … with more regulatory approval and a new legitimized product, it’s a growing threat to older havens like gold in some regions,” Nicky Shiels, head of metals strategy at MKS PAMP SA said in a note.

And only weak sound of common sense happens from time to time:

Bitcoin is still a pernicious phenomenon with no intrinsic value despite its US approval as an asset for inclusion in Exchange-Traded Funds, two European Central Bank staff members wrote.

The blogpost on Thursday by Ulrich Bindseil, the Frankfurt institution’s market infrastructure and payments director general, and Juergen Schaaf, an adviser, reiterates their long-held view that the digital currency presents risks to both society and the environment.

“For disciples, the formal approval confirms that Bitcoin investments are safe and the preceding rally is proof of an unstoppable triumph,” the officials said. “We disagree with both claims and reiterate that the fair value of Bitcoin is still zero. “Without any cash flow or other returns, the fair value of an asset is zero,” they wrote. “Detached from economic fundamentals every price is equally (im)plausible — a fantastic condition for snake oil salesmen.”

But will this voice of common sense be heard in massive euphoria?

Our conclusion probably should not be too radical and ultimate. In fact, if you make money on BTC – who cares? But, with high level of concentration, we suggest that very soon (or already maybe) it will not be driven by normal market rules. It means that any type of analysis will become useless and trading turns to pure gambling, like it happens now. By our view, BTC and soon ETH are more and more becoming the Fed’s pocket tool to resolve problems in the US economy and on stock market rather than independent asset and market. This is huge argument in favor of gold as the asset for preserving wealth of the last resort.

The Philosophical off topic:

The BTC romantic time is over, everything has turned bad as usual when its grabbed by state and the dream has not come true. You can’t make more land or gold, but you could make a lot of cryptocurrencies, that in fact just a code that could disappear at any moment from any Electricity problems. How the clone of BTC, let’s call it as BTC #2, will differ from original BTC?How many clones of BTC you could make? Numerous. This “unique” feature of BTC only in our heads. When mining of the original BTC will be over, what’s next? “BTC is dead – long live BTC#2” and starts everything from the beginning. This will be absolutely the same, the name and date of mining will be the only difference. How is it differ from money printing? Keep this questions as rhetoric. Would like to pay for this almost 100K? This choice is up to you.

Author Profile

Sive Morten

At the Forex Peace Army, he is known as an author of Forex Military School, which quite unique free forex trading course. We do not know of any other free forex trading education covering such a broad spectrum of forex market concepts in such details while keeping it easy to understand and practically use.

As if that wasn't enough, he is the part of the Shoulders of Giants Program. He shares with his fellow traders at FPA his view and forcast of the Gold Market, Currency Market, and Crypto Market in form of weekly analytics and daily video updates.

* Complete Forex Trading Course by Sive Morten >>

* Sive Morten Forex , Gold , and Crypto Analysis >>

Info

51 Views 0 CommentsComments

Table of Contents

Recent

-

Bitcoin Fundamental Briefing, April 2024 Bitcoin Fundamental Briefing, March 2024 Demystifying Cryptocurrency Nodes: Deep Dive into Polygon Node Ecosystem Strategies for Trading Forex on a Budget Bitcoin Fundamental Briefing, January 2024 Strategic Asset Allocation Techniques for Currency Traders Bitcoin Fundamental Briefing, December 2023 Bitcoin Fundamental Briefing, November 2023